Introduction

Solana and Sui are high-performance L1s routinely compared in 2025’s scalability race. Solana (mainnet 2020) popularized a novel, time-ordered pipeline with Proof of History (PoH) plus a PoS-BFT overlay, and then pushed parallel execution through Sealevel. Sui (mainnet May 2023) rethinks state and execution around objects, pairing an object-centric model with a DAG-backed consensus stack (Mysticeti) that minimizes coordination for independent transactions.

From a builder’s perspective, the trade-offs concentrate around execution models, languages (Rust vs Move), latency/finality, dev tooling, and the shape of each ecosystem. Security is equally critical: teams working in Rust on Solana often require a specialized Rust smart contract audit, while those building in Move on Sui benefit from a targeted Move smart contract audit. If you’re still evaluating scope, start with a comprehensive web3 audit to map protocol, infra and integration risk before chain-specific deep dives.

This piece compares the two with an eye to day-to-day developer impact, what you write, how it runs, how it scales, and how you secure it.

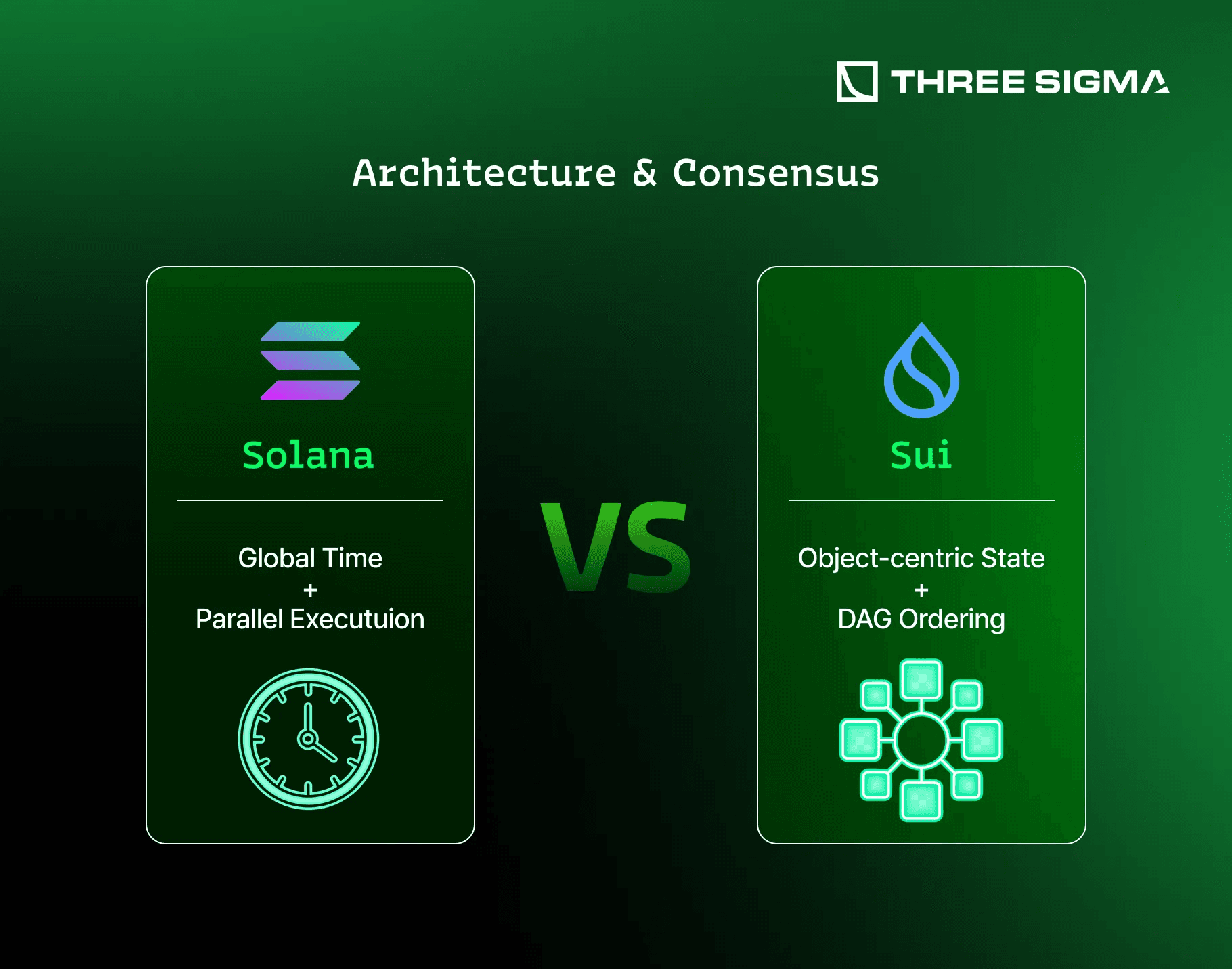

Architecture & Consensus

Solana: Global time + parallel execution

Solana blends PoH (a verifiable clock) with a PoS variant (Tower BFT) to reduce consensus chatter while maintaining BFT safety. PoH provides a globally ordered “tick” that leaders use to sequence entries; Tower BFT overlays voting/finality on top. Sealevel, the runtime, enables parallel execution as long as writable account sets do not overlap; transactions declare read/write accounts up front so the scheduler can run non-overlapping work concurrently. Practically, this yields high throughput with short block times (~400 ms), while economic finality historically sat around ~12–13 seconds. In September 2025, the network approved an “Alpenglow” overhaul targeting ~100–150 ms finality via new components (e.g., Votor for direct voting and Rotor for rapid propagation), a major re-architecture from Tower BFT that aims to make “final” feel instant.

Developer implications.

- Transactions must list all accounts and their mutability; overlapping writable sets serialize, non-overlapping sets run in parallel. This model naturally prevents classic EVM-style reentrancy attacks, but developers still need to lock down CPI surfaces with strict allowlisting and authorization. “Reentrancy-like” issues can still emerge through unsafe CPI patterns, so account choreography and signer validation remain critical.

- The system applies read/write locks during the banking stage; contention shows up as retries/failures when two transactions try to write the same account. Plan for this in UX and retry logic.

Sui: Object-centric state + DAG ordering

Sui’s model centers on objects owned by addresses. Transactions explicitly reference the objects they read/mutate. Independent, owned objects execute without global ordering; only shared objects undergo total ordering via consensus. Underneath, Sui uses Narwhal (a DAG mempool for data availability) plus Bullshark ordering; Mysticeti integrates and optimizes these for low latency and high throughput. In public benchmarks around launch, Sui reported sub-second finality (~480 ms) and peak TPS that scaled with validators and non-conflicting workloads (tens to hundreds of thousands of TPS in tests). The design aims to scale horizontally as independent work rises.

Developer implications.

- Think “assets as linear resources.” If a function takes an object, it must use, move, or destroy it, no accidental duplication or forgetting. Independent objects enable concurrency without a global lock.

- Finality is typically sub-second for simple (owned-object) transactions; shared-object paths add a consensus round but still target <1–2 s.

Solana optimizes a single, globally ordered state with fine-grained parallelism; Sui minimizes global ordering, letting independent work commit almost immediately. Solana’s approach simplifies composability under one state; Sui excels at massively parallel, independent state changes.

Execution Model & Programming Languages

Solana: Rust to BPF on Sealevel

Solana programs are typically written in Rust and compiled to BPF (Berkeley Packet Filter). Rust’s ownership/borrowing model removes a swath of memory-safety bugs at compile time; Anchor further abstracts boilerplate (accounts, IDLs). Many Solana failures historically trace to logic/authorization issues or CPI/ordering mistakes, not memory corruption, so rigorous logic checks and property tests remain essential. Because accounts are declared explicitly, parallelism is “opt-in” by design, but developers must reason carefully about account sets, signer checks, PDAs, and CPI flows.

Sui: Move (Sui Move) and resource safety

Move is a resource-oriented language designed for safe asset handling: resources can’t be implicitly copied or dropped unless types declare abilities; ownership and capabilities are explicit. Sui Move extends Move with object ownership (owned vs shared), object IDs/versions, and entry functions that interact with storage safely. Formal verification is first-class: Move Prover exists upstream, and in 2025 Sui’s ecosystem added “Sui Prover” a developer-friendly formal tool used in audits and available open-source.

Move or Rust: implications for correctness and DX

- Rust/Solana: maximal control, mature language ecosystem, steep curve on accounts/CPI/serialization patterns.

- Move/Sui: stronger guardrails on asset safety, intuitive modeling for games/NFTs, and the option to prove key invariants before shipping critical logic.

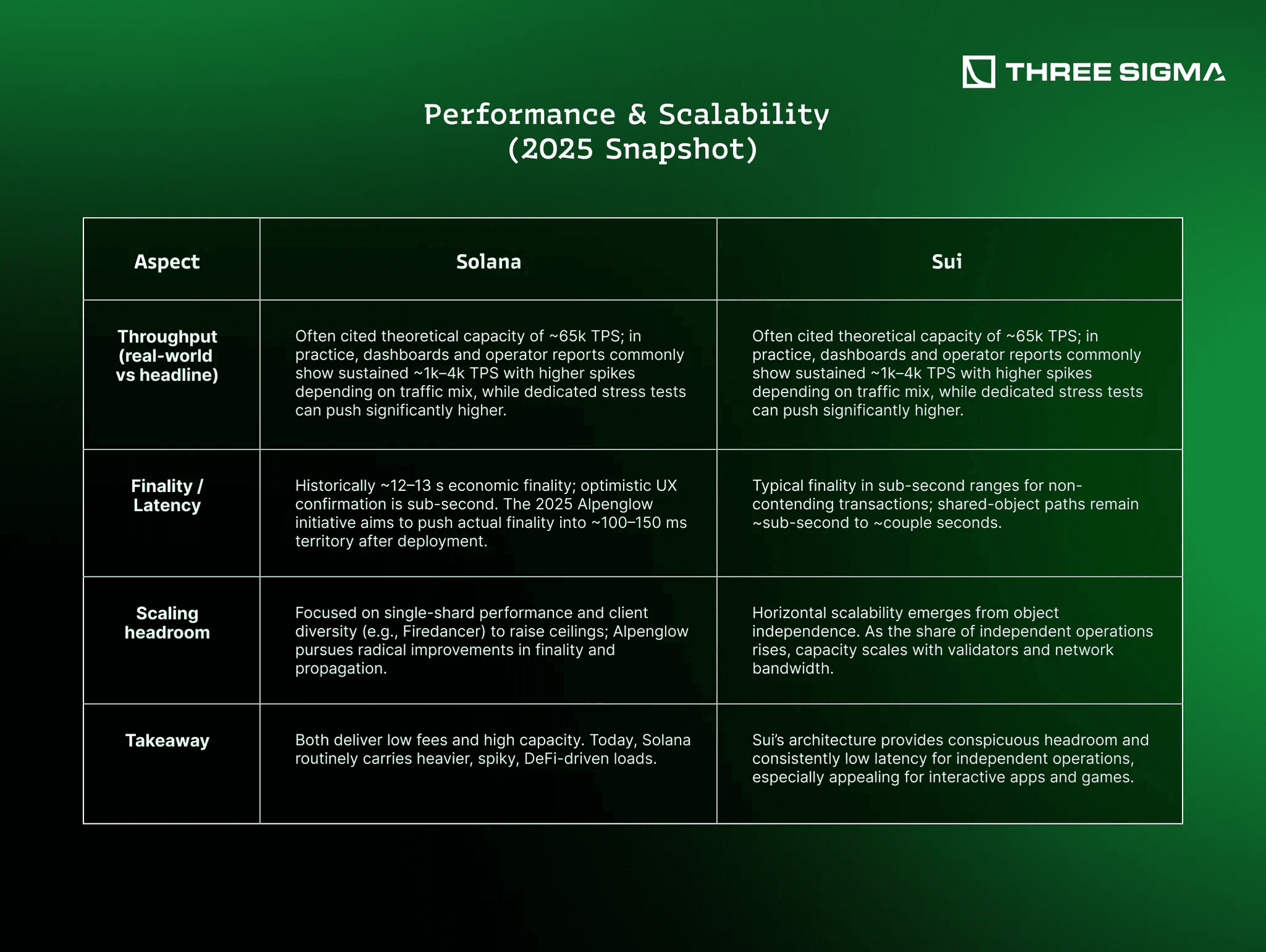

Performance & Scalability (2025 Snapshot)

Developer Experience, Tooling & Data

Solana DevX.

- Mature ecosystem around Anchor, test validator, and a large body of examples/tutorials.

- Parallelism and account choreography remain the core mental models to master.

- Strong third-party indexers/RPCs and data services (Helius, Triton, etc.).

Sui DevX.

- Move’s resource model simplifies asset correctness; Sui CLI, SDKs (TS/Rust), and Move Playground lower the barrier to entry.

- Formal methods are more accessible: Move Prover and Sui Prover enable specs for safety properties (e.g., non-drainable pools, conservation) and machine-checked proofs.

- 2025 added a GraphQL RPC and General-purpose Indexer (beta), giving structured queries, a checkpoint-driven data pipeline, and an alternative to JSON-RPC for higher-level data access.

Docs & learning curve.

- Rust is widely known but Solana-specific patterns (PDAs, CUs, CPI, account limits) take time to internalize.

- Move is newer but intentionally small; resource types and abilities map well to on-chain assets, which many devs find intuitive.

Ecosystems in 2025

Solana has a large, battle-tested DeFi and NFT stack, robust liquidity (with order-book and AMM venues), broad wallet support, and heavy daily use. Reports in 2025 show Solana commanding the lion’s share of DEX transactions and sustained growth in developers and protocol revenue, evidence of deep product-market fit for high-throughput finance.

Sui has grown rapidly in gaming, dynamic NFTs, and interactive apps, domains that benefit from object-centric state and instant-ish confirmations. Infrastructure matured with native USDC, expanding SDKs, and formal tooling; the community invests in grants and hackathons, and the data stack upgrade (GraphQL + Indexer) tightens the developer loop for analytics and UX.

Interoperability & multi-chain reality. Bridges and shared wallets lower switching costs; in practice many teams deploy components where they fit best, e.g., a Solana DeFi leg for liquidity and a Sui gameplay loop for real-time responsiveness.

Security: Typical Pitfalls & Audit Focus

In the sui vs solana debate, real risk lives at the intersection of execution model and whether you build in move or rust. Solana’s Sealevel execution shifts the primary risks away from memory safety and into account choreography: signer and ownership validation, CPI target allowlisting, PDA seed discipline, compute-unit headroom, and contention under read/write locks. Rust’s borrow checker eliminates many memory bugs, but most incidents stem from logic and authorization flaws rather than memory corruption; our write-up in Rust Memory Safety on Solana explains why correctness still hinges on design.

Sui’s object-centric model and Move’s resource semantics prevent asset duplication and accidental drops, but developers can still leak capabilities, overexpose entry functions, or misclassify objects as shared, expanding concurrency and trust unexpectedly. Good security practice begins with modeling object lifecycles, abilities (key, store, drop, copy), and friend visibility, then proving the invariants that matter.

What we recommend:

- Threat modeling aligned to the chain. On Solana, assume attackers control account lists and CPI surfaces; enforce canonical bumps, strict program-ID checks, idempotent retries, and explicit arithmetic guards. On Sui, keep objects owned unless sharing is essential, constrain capability flow, and verify state transitions against a spec.

- Prove and test invariants. Move teams can bring specs into CI using the Prover; conservation, authorization, and state-machine guards should be machine-checked before mainnet. Solana teams should add property tests around CPI ordering, failure paths, and precision, and prefer checked math over wrapping behavior.

- Secure upgrade and operations. Protect upgrade authorities with multisigs and timelocks, pre-audit migrations, and monitor post-deploy; exploits move at the speed of finality on both chains.

- Audit the whole product surface. Many losses start in wallets and UIs. Pair protocol reviews with hardening of the client and integrations.

If you’re building on Sui, see our scope and methodology in Move & Sui Audits. For Solana and Rust programs, review focus areas and deliverables in Rust/Solana Audits.

A significant share of Web3 losses don’t originate in smart contracts but in the user interface layer, wallets, dApps, and integrations. That’s why dApp & Frontend Audits are critical for securing the full attack surface.

Choosing Where to Build

Pick Solana when:

- You need deep DeFi composability, order-books, or integrations that already live on Solana.

- You want Rust’s ecosystem and are comfortable modeling around account sets, CPIs, and read/write locks.

- You plan to leverage emerging advancements like Alpenglow’s finality gains as they land.

Pick Sui when:

- Your app has many independent, fast asset mutations, game state, inventories, evolving NFTs, where sub-second finality and object isolation improve UX.

- You want the safety ergonomics of Move (resource types, abilities) and the option to prove invariants for critical code.

- You value predictable fees and storage rebates to keep long-lived state economical.

Practical Tips for Teams

Design for parallelism.

- Solana: minimize overlapping writable accounts; batch reads; segment hot accounts; consider PDA sharding patterns; target lower CPI counts.

- Sui: keep objects owned where feasible; promote to shared only when necessary; model object lifecycles explicitly.

Prove what matters.

- Write Move specs for conservation, invariant bounds, and authorization; run (Sui) Prover in CI.

- For Solana, add property/invariant tests and differential testing around CPI sequences and error surfaces.

Plan for contention & retries.

- Solana: account locks cause contention; implement idempotent flows and clean retries.

- Sui: be explicit about object versions; handle concurrent attempts on shared objects.

Instrument and index early.

- On Sui, evaluate the GraphQL RPC + Indexer beta for structured, low-friction queries.

- On Solana, pick an indexer/RPC that fits your query patterns and volumes.

Secure upgrade paths.

- Document and restrict upgrade authorities; deploy timelocks/multisigs; pre-authorize only essential capabilities.

Conclusion

Solana and Sui represent two coherent answers to the same question: how to run a global, permissionless computer at web scale. Solana optimizes a single global state with time-ordered execution and aggressive parallelism; Sui eliminates unnecessary global ordering by modeling assets as objects and committing independent work almost immediately. In 2025, Solana anchors the heaviest DeFi/NFT flows and is rolling out a significant consensus shift (Alpenglow) to compress true finality toward human-imperceptible times. Sui, meanwhile, has matured its developer stack (including formal verification and GraphQL-based data access) and continues to show that object-centric state is a natural fit for interactive, asset-heavy apps.

For developers, the choice should map to workload shape and team strengths. If the app leans on deep composability and existing liquidity, Solana is the obvious home. If the app demands ultra-low latency on many independent state updates, games, rich NFTs, social objects, Sui’s model is compelling. Many teams will do both.

As these ecosystems mature, security reviews remain essential. Understanding how to evaluate providers and align audits with the platform’s execution model is covered in What Is a Smart Contract Audit & How to Choose the Right Security Partner, which outlines the criteria that matter when securing applications across different blockchain architectures.

Frequently Asked Questions (FAQ)

1. Why is Sui better than Solana?

Sui focuses on an object-centric model with fine-grained ownership and DAG-based ordering. This allows independent transactions to finalize almost instantly without requiring global sequencing, which can lead to better scalability for applications with many independent state changes.

2. Can Sui be the next Solana?

Sui has the potential to become a major high-performance chain thanks to its Move language and DAG-based execution. However, Solana already has a large developer base, liquidity, and ecosystem, making it less about “replacement” and more about whether Sui can carve out a complementary niche.

3. Is Sui a Solana killer?

Rather than a “killer,” Sui offers a different execution philosophy. Solana optimizes a single global state with parallel execution, while Sui minimizes global ordering to maximize concurrency. Both approaches can coexist depending on application needs.

4. Will Sui overtake Sol?

Sui could surpass Solana in specific verticals like gaming, NFTs, or apps that benefit from massive concurrency. Solana’s broader ecosystem and market position, however, make an outright overtake challenging in the short term.

5. What makes Solana unique compared to Sui?

Solana leverages Proof of History (PoH) and Sealevel parallel runtime. Its globally ordered state simplifies composability and cross-program interactions, which is attractive for DeFi protocols and complex financial primitives.

6. Why does Sui use Move instead of Rust?

Move enforces resource safety at the language level—assets can’t be duplicated or lost by mistake. This model maps directly to on-chain assets and provides strong invariants for developers, reducing common classes of bugs.

7. How do Solana and Sui differ in finality?

- Solana: ~400 ms block times, with ~12–13 s historical finality (targeting 100–150 ms with Alpenglow upgrades).

- Sui: Typically sub-second finality for owned-object transactions; shared-object paths still finalize in under 1–2 s.

8. Which ecosystem has better developer tooling?

- Solana: Mature with Anchor, a test validator, and strong third-party data/indexing services.

- Sui: Newer but with accessible SDKs, Move Playground, formal verification tools (Move Prover, Sui Prover), and GraphQL RPC.

9. What are the main security pitfalls for each chain?

- Solana: Account choreography mistakes (signer checks, PDAs, CPI allowlisting).

- Sui: Misclassifying objects (owned vs shared), leaking capabilities, or exposing entry functions.

10. Should I build my next app on Sui or Solana?

It depends on the use case:

- Choose Solana if you need composability, liquidity, and a mature DeFi ecosystem.

- Choose Sui if your app benefits from independent state changes, resource safety, or massive concurrency (e.g., games, NFT-heavy apps).

Security Researcher

Simeon is a blockchain security researcher with experience auditing smart contracts and evaluating complex protocol designs. He applies systematic research, precise vulnerability analysis, and deep domain knowledge to ensure robust and reliable codebases. His expertise in EVM ecosystems enhances the team’s technical capabilities.