1. The Shift Towards Stability in Crypto

Initially, Bitcoin was seen as an alternative to replace traditional money, offering a decentralized, borderless, and censorship-resistant form of currency. However, its high volatility, with significant price fluctuations, its transition into a speculative asset and store of value, and its expensive blockchain transactions made it less suitable for everyday payments and as a stable store of value. This limitation led to the rise of stablecoins, designed to maintain a constant value, typically pegged to the U.S. dollar, offering the stability and efficiency in transactions that Bitcoin cannot provide.

The evolution of the crypto ecosystem reflects a pragmatic shift. While the original ideal was for Bitcoin to replace traditional money, the need for stability has led to the widespread use of stablecoins (often backed by traditional assets) as a backbone of the ecosystem.

These stablecoins act as a bridge between the real-world, traditional financial markets and crypto ecosystem, facilitating adoption by offering stability and utility but also raising questions about the original decentralized ethos. For instance, stablecoins like Tether (USDT) and USD Coin (USDC) are issued by centralized entities, with reserves held in traditional banks, which could be seen as a compromise between mainly ideology and practicality.

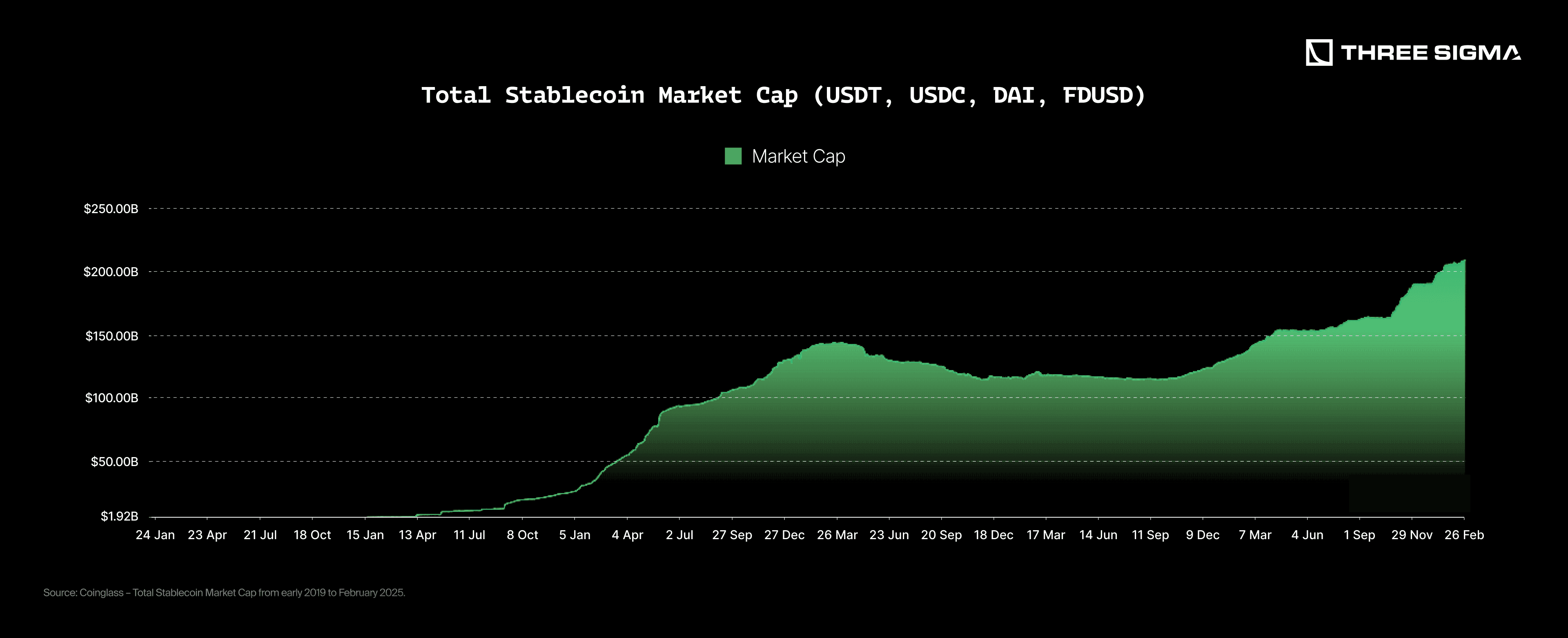

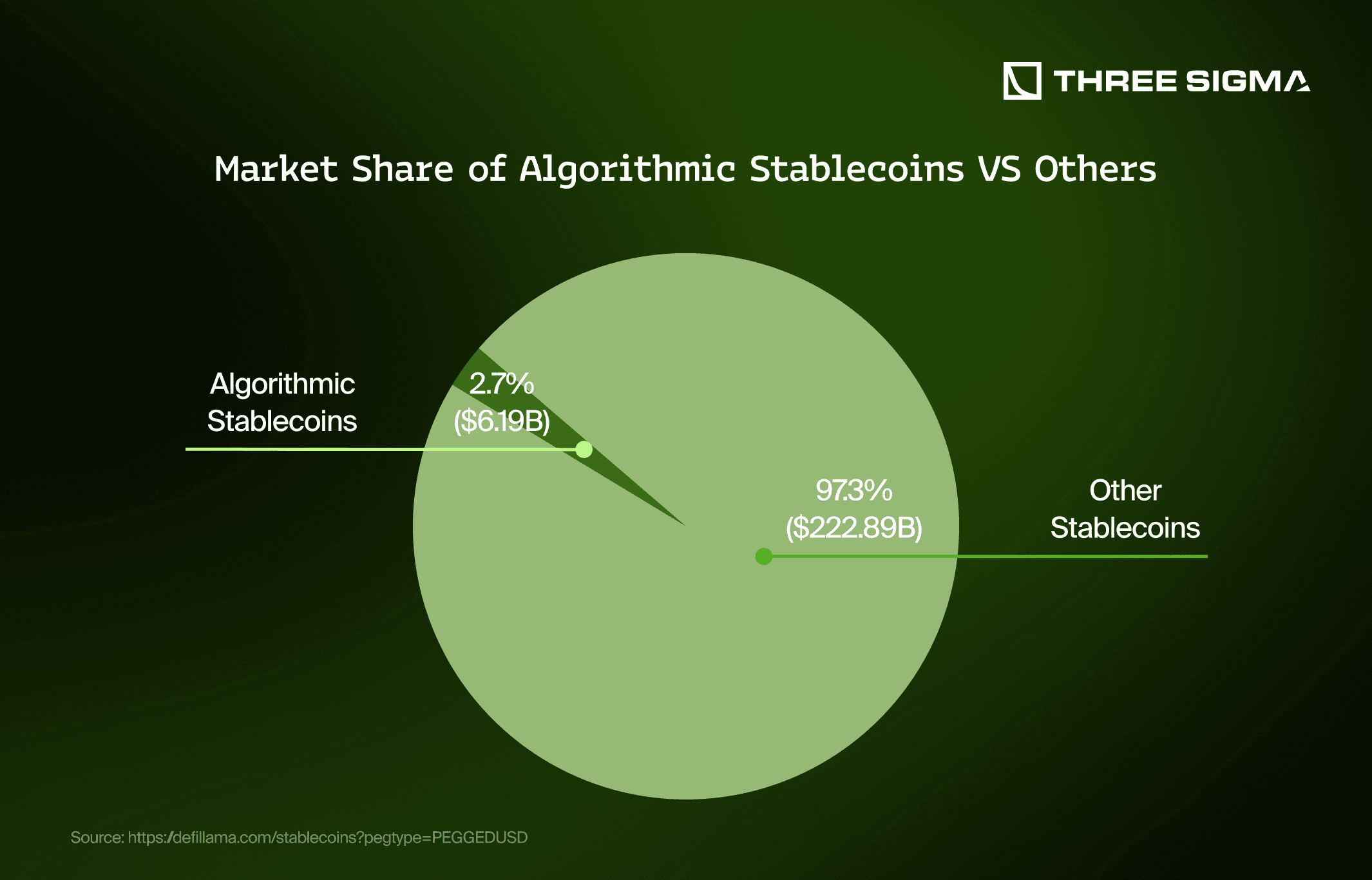

Over the years, the adoption of stablecoins has surged dramatically. In 2017, their market capitalization was under $3 billion, but by March 2025, it has grown to approximately $228 billion. Stablecoins now represent around 8.57% of the total crypto market, serving as a key instrument for trading, cross-border payments and as a safe haven during periods of market volatility. This growth underscores their role as an essential bridge between the real-world,traditional finance markets and the crypto ecosystem. This trend is clearly illustrated in a chart from Coinglass, which tracks the total market capitalization of major stablecoins from early 2019 to the present, showing a steady and significant increase in adoption.

What Are Stablecoins?

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging their price to an external asset, such as a fiat currency (like the US dollar) or a commodity (like gold). For example, Tether (USDT) and USD Coin (USDC) are stablecoins each pegged 1:1 to the U.S. dollar. The purpose of a stablecoin is to offer the benefits of digital currencies (fast, borderless transactions on blockchain) without the extreme volatility seen in coins like Bitcoin.

By holding reserve assets or using other mechanisms, stablecoins aim to keep their price steady, making them more suitable for everyday transactions and as a store of value within the crypto market. In practice, most popular stablecoins achieve stability through collateral (holding equivalent value in reserves for each coin issued).

Stablecoins require clear regulation to ensure their stability and reliability. While the U.S. currently lacks comprehensive federal legislation, it relies on state rules and pending proposals; the EU’s MiCA framework mandates strict reserve and audit standards; Asia exhibits varied regulatory approaches, from strict reserve requirements in Singapore and Hong Kong, bank-issued stablecoins in Japan, to China's broad prohibition of stablecoin activities, reflecting diverse efforts to balance innovation and stability. Nevertheless, the absence of globally unified regulation has not prevented stablecoins from steadily gaining adoption year after year.

Why Are They Emitted?

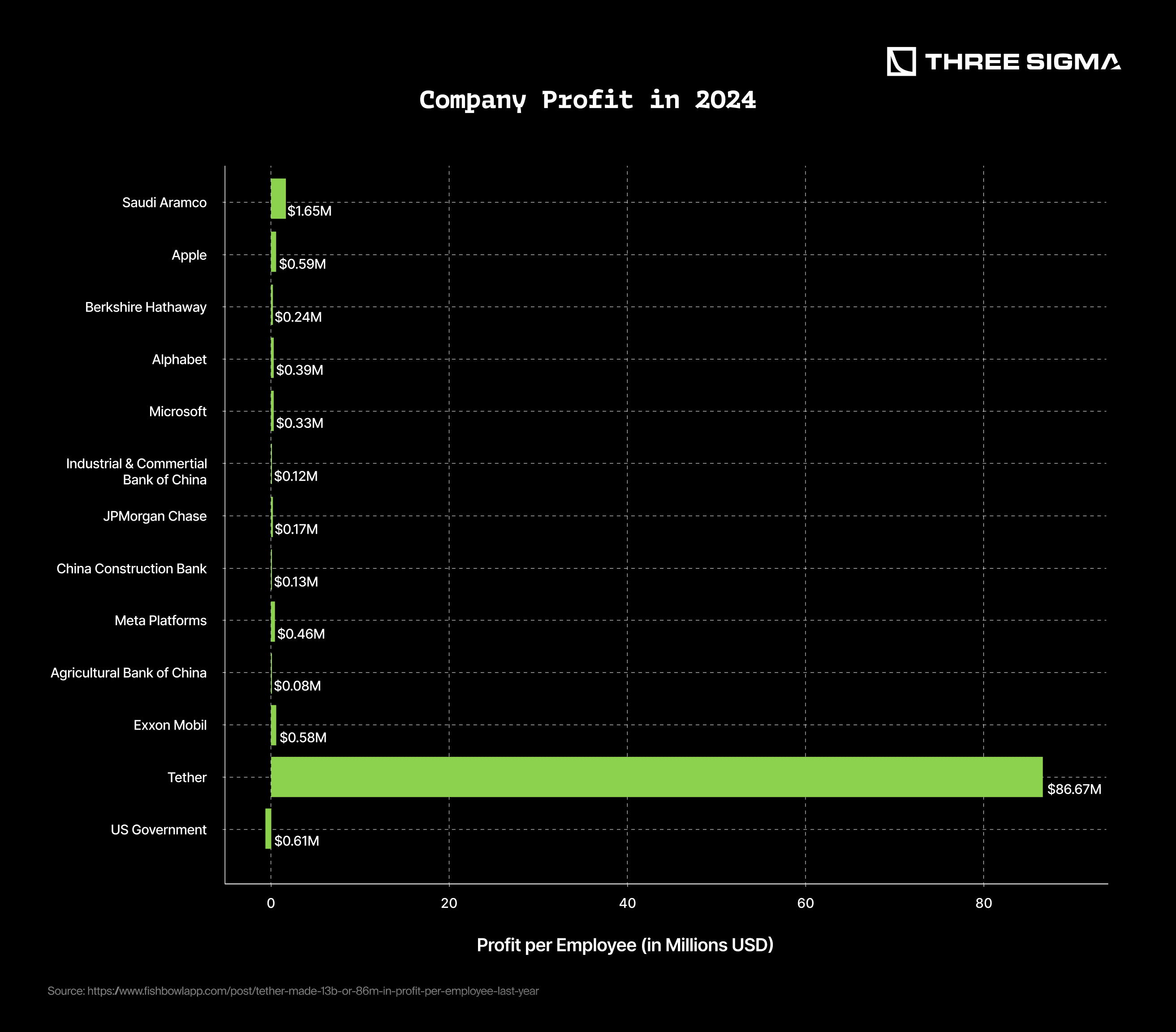

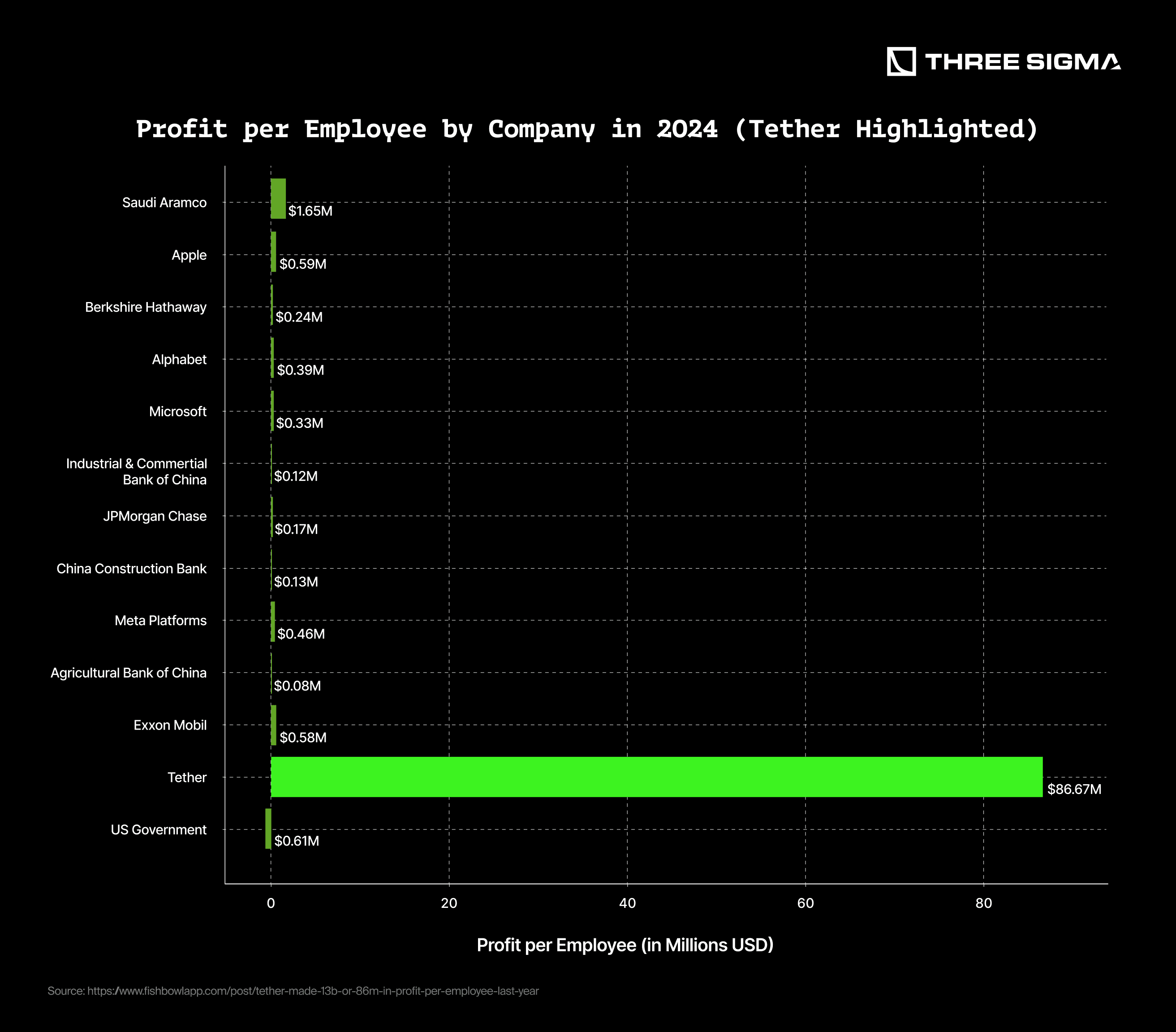

As mentioned earlier, stablecoins emerged primarily to provide users with a reliable digital asset suitable for payments or as a store of value pegged to a major global currency, particularly the USD. However, the underlying reason behind their issuance isn't altruistic; rather, it’s a highly profitable private business opportunity first realized by Tether.

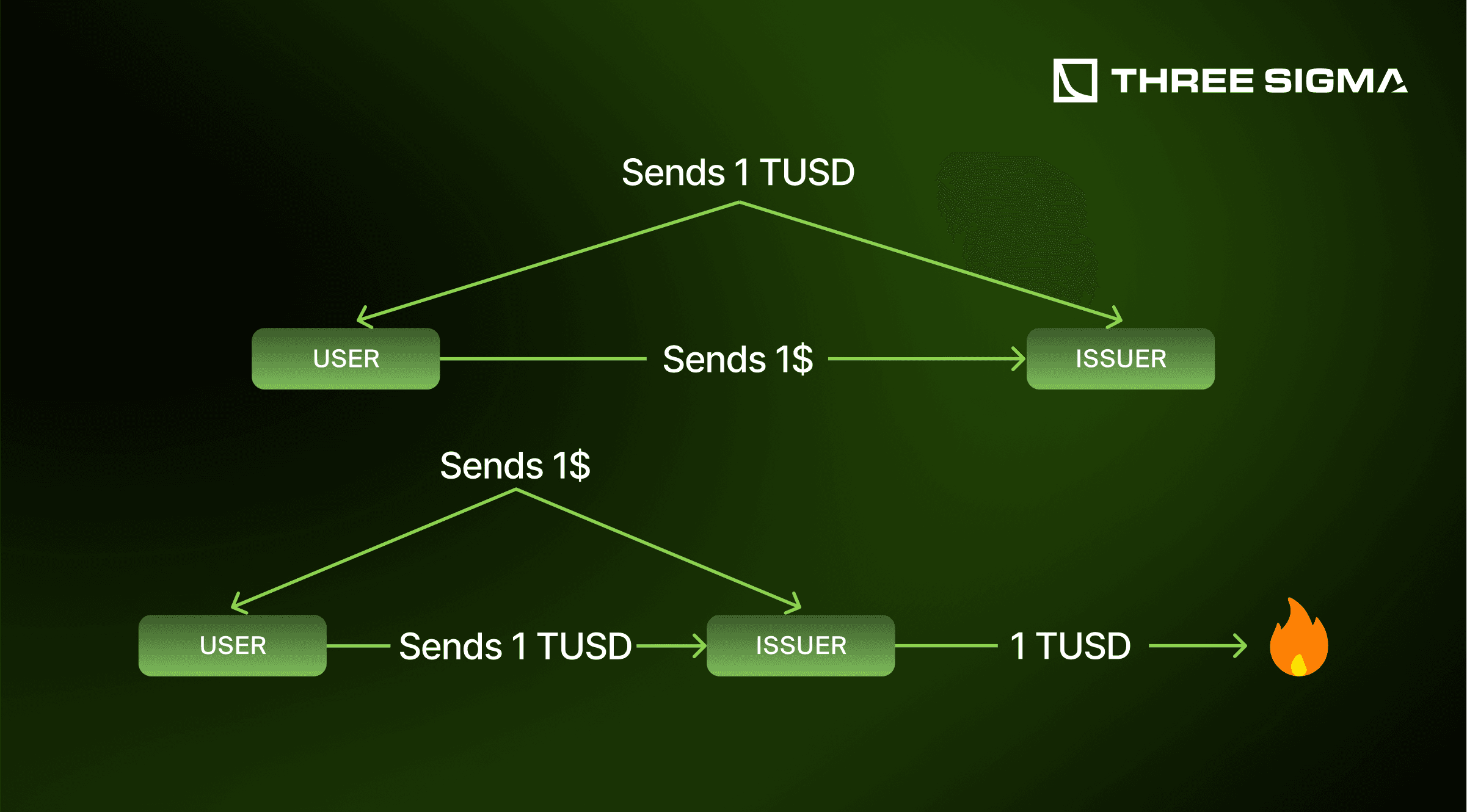

Tether introduced USDT in 2014 as the first stablecoin, establishing what became one of the most profitable businesses ever, especially in terms of profit per employee. Its business model is straightforward: Tether issues 1 USDT for every USD it receives and burns 1 USDT when users redeem their USD. The underlying USD is invested in secure short-term financial instruments, like Treasury bills, and the profits generated from these investments are retained by Tether. Understanding how stablecoins make money is key to grasping their economic impact.

Although the model appears simple, Tether cannot control its primary revenue source, interest rates set by central banks, specifically the Federal Reserve. When interest rates are high, Tether earns substantial profits; when rates are low, profitability declines significantly.

Currently, high-interest rates have been favorable for Tether, but what happens if interest rates decrease again or approach zero? Are algorithmic stablecoins also affected by interest rate fluctuations? Which types of stablecoins might perform better in such economic conditions? These questions will be explored further in this article.This article explores how stablecoin business models adapt to changing macroeconomic conditions.

2. Types of Stablecoins

Before analyzing their performance under different economic conditions, it's important to understand the various types of stablecoins and how they function. Although all stablecoins share the common goal of maintaining a stable value pegged to real-world assets, each type is affected differently by fluctuations in interest rates and broader market conditions. Below, we'll explore the main categories of stablecoins, their mechanisms, and how they react to these economic changes.

Fiat-backed Stablecoins

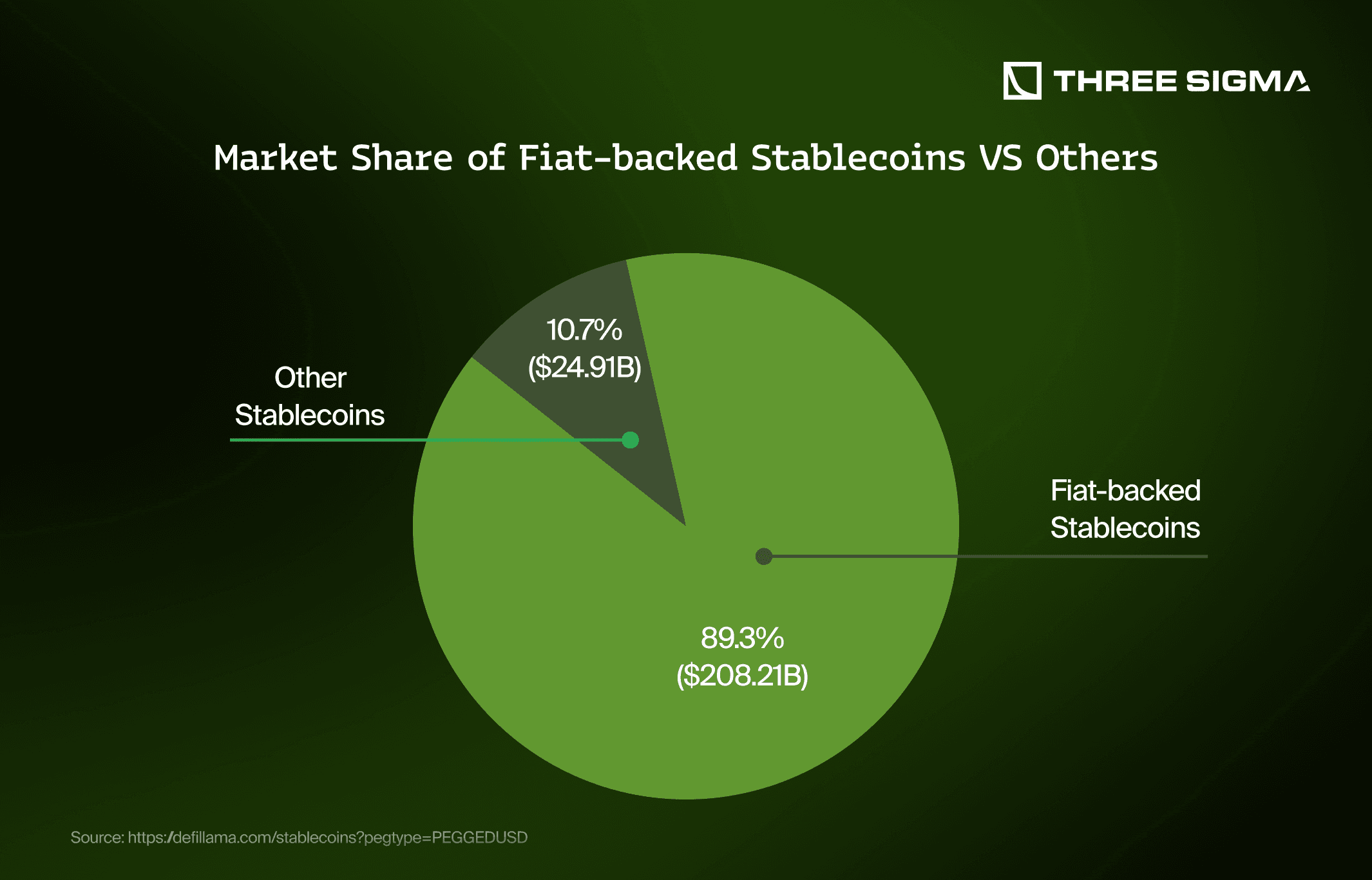

Fiat-backed stablecoins are the most well-known and widely used type of stablecoins, essentially representing tokenized U.S. dollars in a centralized manner.

The mechanism behind these stablecoins is straightforward: for every USD deposited, the issuer mints exactly one tokenized USD. Conversely, when users redeem their tokens, the issuer burns these tokens and returns the corresponding amount in USD.

The profitability of fiat-backed stablecoins emerges primarily behind the scenes. Issuers hold and invest customer deposits in various short-term, secure investment vehicles such as treasury bills, secured loans, cash equivalents, and occasionally more volatile assets like cryptocurrencies (e.g., Bitcoin) or precious metals. The returns from these investments constitute the issuer's primary revenue stream.

However, substantial rewards are accompanied by considerable risks. Regulatory compliance represents one of the major ongoing challenges. Many governments have scrutinized fiat-backed stablecoins under the argument that they effectively issue digital money, thus requiring adherence to strict financial regulations. While most stablecoin issuers have successfully navigated regulatory pressure without severe disruptions, significant challenges occasionally arise. A notable example is Europe's MiCA (Markets in Crypto-Assets) regulation, which recently banned USDT (Tether) from certain markets due to non-compliance with its stringent requirements.

Another prominent risk is the threat of a "depeg." Stablecoin issuers typically keep a substantial portion of their reserves in various investment instruments. Should a large number of customers simultaneously redeem their tokens, issuers may be forced to liquidate these assets rapidly, potentially at a significant loss. This could trigger a bank-run scenario, jeopardizing the issuer's ability to maintain the token’s peg to the USD and potentially leading to bankruptcy.

The most prominent incident highlighting this risk occurred in March 2023 with USDC (Circle). When Silicon Valley Bank (SVB) collapsed, rumors quickly circulated that Circle had significant reserves held by SVB. This raised concerns about Circle's immediate liquidity and its ability to maintain USDC's peg. These fears led to a temporary depeg of USDC. This incident underscored stablecoin reserve risk when holding assets at centralized banks. Fortunately, Circle resolved the situation within a few days, fully restoring confidence and reestablishing the peg.

The two leading fiat-backed stablecoins in the market today are USDT (Tether) and USDC (Circle).

Commodity-backed Stablecoins

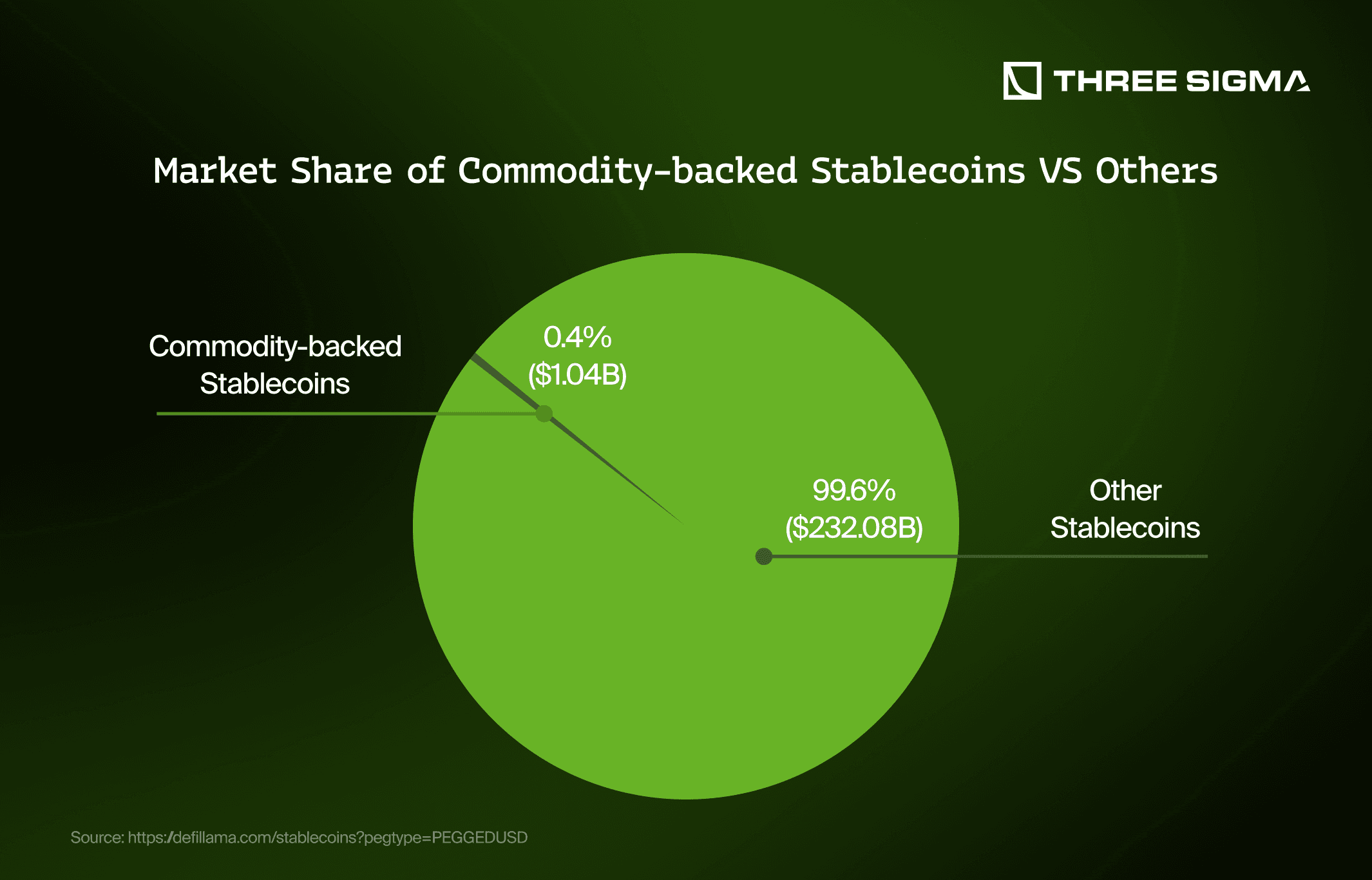

Commodity-backed stablecoins represent an innovative category within the stablecoin ecosystem, offering digital tokens collateralized by tangible physical assets, most commonly precious metals like gold and silver, or commodities like oil and real estate.

The operating mechanism of commodity-backed stablecoins is similar to that of fiat-backed stablecoins: for every unit of the underlying commodity deposited, the issuer mints an equivalent token. Users can typically redeem these tokens for the physical commodity itself or an equivalent cash value, at which point the corresponding tokens are burned.

Revenue generation for issuers of commodity-backed stablecoins primarily involves fees associated with minting (creation) and redeeming (destruction) tokens. For instance, Pax Gold (PAXG) charges small fees for processing token creation and destruction, although Paxos currently does not charge storage fees for gold held in custody. Additionally, issuers may profit through facilitating trades or conversions between the tokenized commodity, USD, and physical commodity forms.

Similarly, Tether Gold (XAUT) generates revenue through fees related to redemption and delivery processes. Users redeeming XAUT tokens for physical gold bars or converting gold to cash through them incur fees, including a 25 basis point charge on the gold price upon redemption, plus delivery costs if physical delivery is chosen. If holders opt to sell their redeemed gold bars in the Swiss market, an additional 25 basis points fee applies.

However, there’s also potential risks here, particularly the volatility inherent in commodity prices, which can threaten the token's peg stability. Regulatory compliance also presents a significant challenge. Commodity-backed stablecoins typically fall under stringent regulatory frameworks, requiring transparent and secure custody arrangements.

Examples of successful commodity-backed stablecoins include Paxos’ Pax Gold (PAXG) and Tether’s Tether Gold (XAUT), both backed by gold reserves, providing investors with accessible digital exposure to commodities.

In summary, commodity-backed stablecoins bridge traditional commodity investments and digital finance, offering investors stability and tangible asset exposure while emphasizing regulatory compliance and transparency.

Crypto-backed Stablecoins

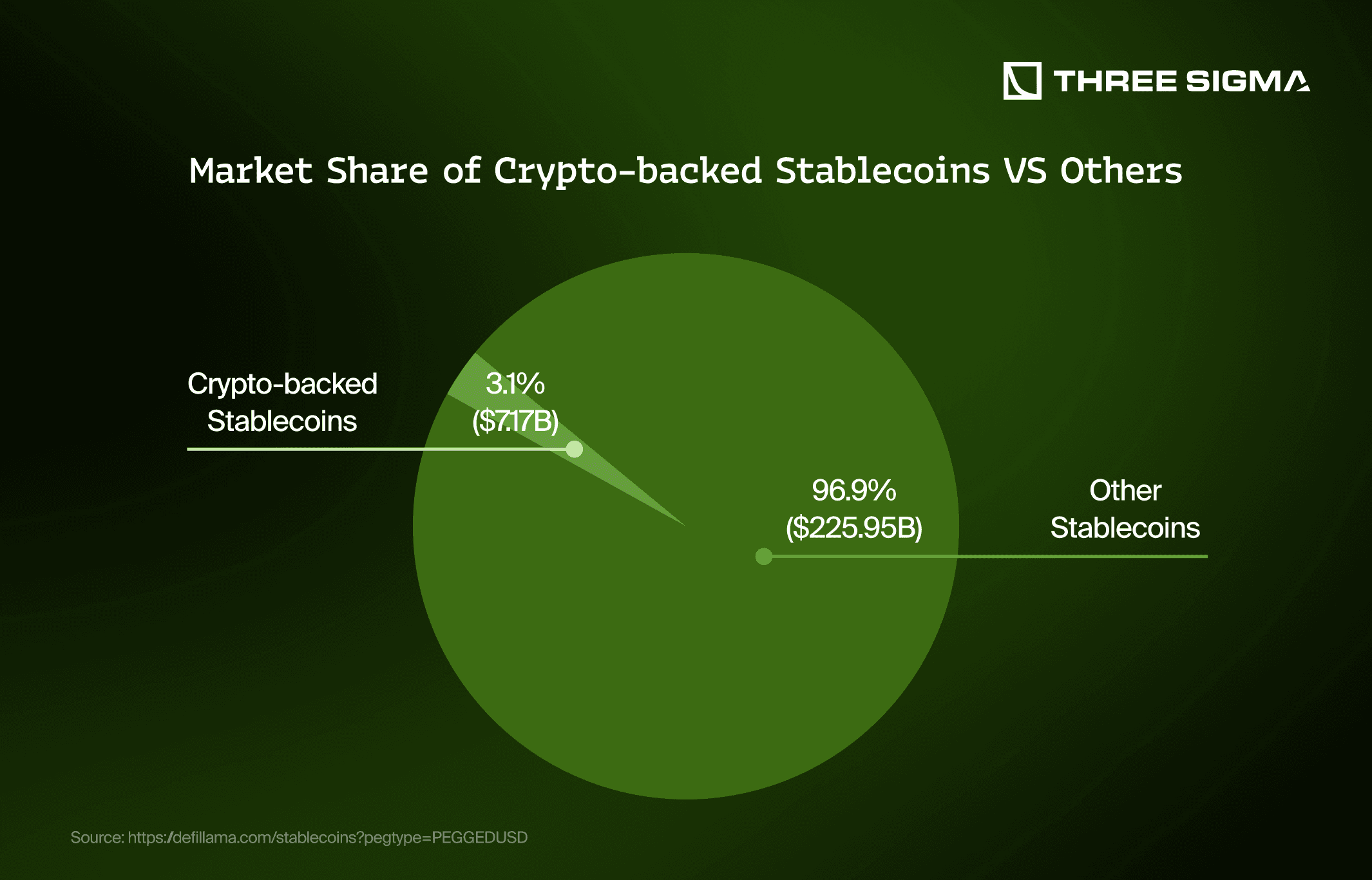

Crypto-backed stablecoins represent a category within the stablecoin landscape that utilizes cryptocurrencies as collateral to maintain a stable value, typically pegged to fiat currencies like the USD. Unlike fiat or commodity-backed stablecoins, these tokens leverage smart contract technology, creating a transparent and autonomous system.

The fundamental mechanism involves users locking up cryptocurrency assets, usually in excess (over-collateralization), in smart contracts to mint stablecoins. Over-collateralization serves as a safeguard against the volatility of the underlying crypto assets, ensuring that the stablecoin maintains its intended peg. When users redeem these stablecoins, they retrieve their collateralized crypto assets after returning the equivalent amount of stablecoins, subsequently burning the redeemed tokens.

The revenue model for crypto-backed stablecoins typically includes interest rates charged on borrowed stablecoins, liquidation fees from users whose collateral falls below required thresholds, and governance-related mechanisms that incentivize holders and liquidity providers.

DAI (now USDS), issued by MakerDAO (now SKY), exemplifies crypto-backed stablecoins, relying primarily on Ethereum-based assets as collateral. MakerDAO generated revenue through stability fees (interest) charged to users borrowing USDs and liquidation penalties imposed during collateral liquidations. These fees collectively contribute to the stability and operational sustainability of the protocol.

HONEY, the stablecoin issued by Berachain, leverages an array of crypto assets as collateral, primarily USDC and pYUSD at present. HONEY generates revenue from redemption fees; specifically, when users redeem HONEY to retrieve their USDC or pYUSD collateral, Berachain charges a fee of 0.05%.

Even though these stablecoins are classified as crypto-backed, most of them effectively function as "wrapped" versions of fiat-backed stablecoins like USDC. Although initially intended to be fully backed by native crypto assets, the reality is that achieving true stability without heavily relying on fiat-backed stablecoins as collateral has proven challenging.

These assets also carry inherent risks. Volatility in the underlying crypto assets can lead to significant challenges, such as sharp market downturns triggering mass liquidations, potentially destabilizing the peg. Additionally, smart contract vulnerabilities or protocol exploits can pose serious threats to the stability of the entire ecosystem.

In summary, crypto-backed stablecoins like USDs and HONEY bridge decentralized finance and stability, offering users autonomy, transparency, and innovative financial solutions. However, despite their crypto-backed designation, most rely significantly on fiat-backed stablecoins as collateral, necessitating careful risk management practices to maintain resilience.

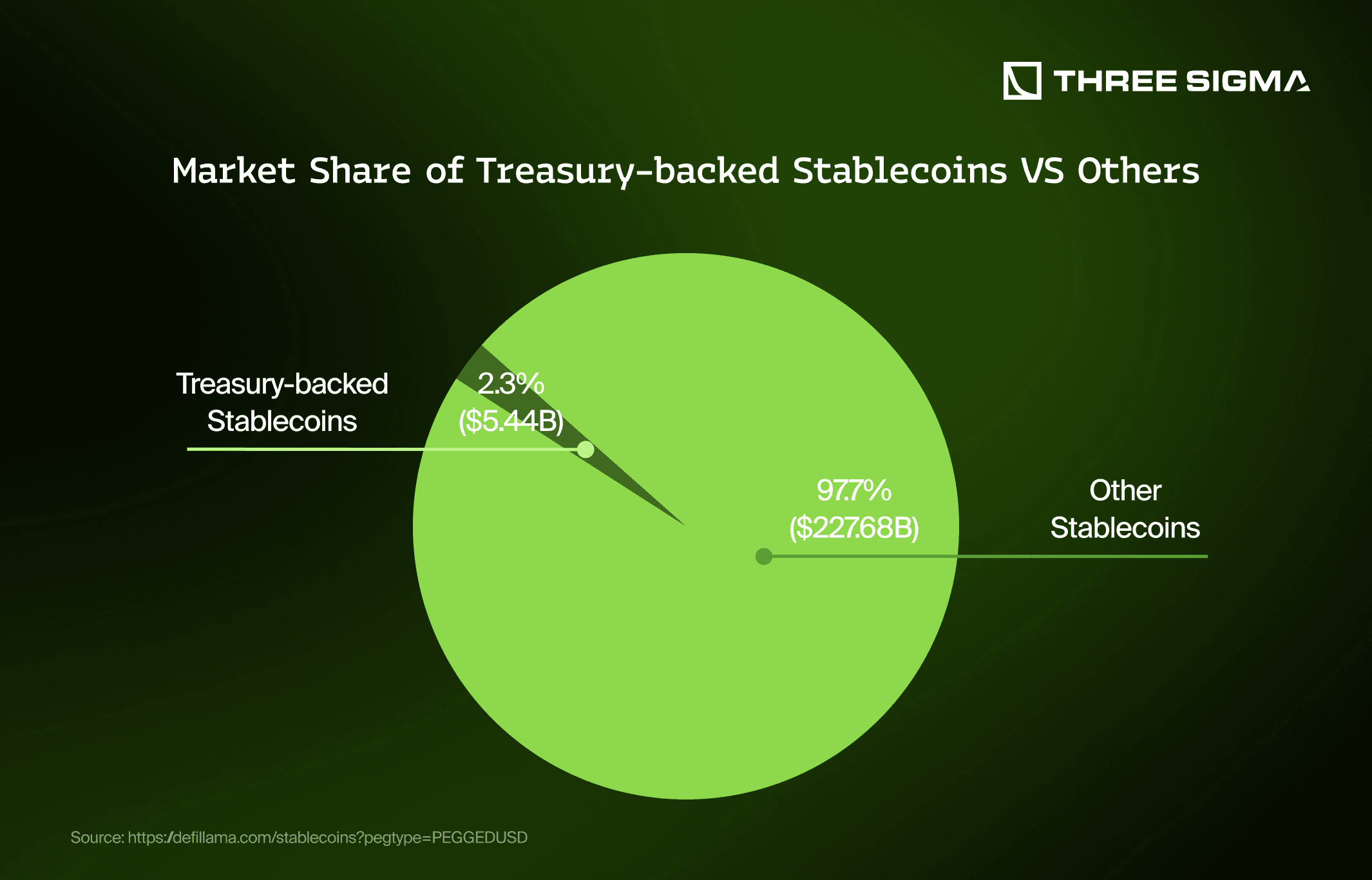

Treasury-backed Stablecoins

Treasury-backed stablecoins are a category of stablecoins primarily backed by government bonds, specifically U.S. Treasuries. These stablecoins aim to maintain a stable value, typically pegged to the U.S. dollar, while also offering yield to holders through the interest earned on the underlying Treasuries. This makes them more like an investment token, combining the stability and confidence of a traditional stablecoin with the added benefit of passive income. Ondo’s USDY (US Dollar Yield Token) is described as a tokenized note secured by short-term US Treasuries and bank demand deposits. It is designed to provide non-US individual and institutional investors with stablecoin-like accessibility while delivering high-quality, US dollar-denominated yield. As mentioned earlier, investors can buy USDY tokens, and the funds are used to purchase US Treasuries and hold some in bank deposits, with the interest passed on to token holders. USDY is a bearing asset, meaning it passively accrues yield as the underlying assets generate interest, increasing the token's value over time.

Hashnote’s USYC (US Yield Coin) is the on-chain representation of Hashnote’s Short Duration Yield Fund (SDYF), which invests in short-term US Treasury Bills and engages in repo and reverse-repo activities. It earns returns aligned with the short-term risk-free rate while leveraging the speed, transparency, and composability of tokenization, and minimizing protocol, custody, regulatory, and credit risks. Investors can mint or redeem USYC on the same day (T+0) or the next (T+1) into USDC or PYUSD, with atomic and instant minting directly on the blockchain. Like USDY, USYC is a bearing asset, passively accruing yield as the underlying assets generate interest.

Treasury-backed stablecoins carry risks despite their stability and yield. Regulatory risk arises from changing global policies, as these assets often target non-US investors to avoid certain regulations. Custodial risk involves trusting issuers to securely manage the underlying assets. Liquidity risk could affect redemption during volatile markets, while counterparty risk stems from reliance on repo participants. Lastly, macro-economic risks, like shifting interest rates, can impact yields. These assets are part of a growing category often referred to as Treasury-backed crypto.

Algorithmic Stablecoins

Algorithmic stablecoins are a category of stable assets that rely on economic mechanisms and market incentives rather than full collateralization with traditional assets like fiat or Treasuries. These models have historically sought to maintain a peg through supply and demand adjustments, though they have often faced challenges in extreme market conditions. The fundamental issue lies in their dependence on sustained market confidence and functional incentive structures, which can break down during periods of severe stress.

USDe, issued by Ethena, represents a new iteration of algorithmic-like stablecoins, employing a hybrid model. It maintains stability through a delta-neutral hedging mechanism, where it holds crypto assets such as BTC and ETH as collateral while simultaneously taking short positions in derivatives markets. This setup offsets the price volatility of the underlying assets, ensuring a stable USD value. USDe is fully collateralized at a 1:1 ratio, making it more capital-efficient than overcollateralized stablecoins. Additionally, Ethena incorporates liquid stablecoins like USDC and USDT into its reserves to enhance liquidity and improve the efficiency of its hedging strategies.

Despite these innovations, algorithmic stablecoins remain exposed to significant risks. Market instability, extreme volatility, or liquidity crises can disrupt the mechanisms that sustain the peg. The reliance on derivatives introduces counterparty and execution risks, making the system vulnerable to external shocks. While newer models like USDe attempt to mitigate these challenges through structured hedging and diversified reserves, their long-term resilience will ultimately depend on liquidity availability and their ability to function effectively in adverse market conditions.

3. Main stablecoins right now

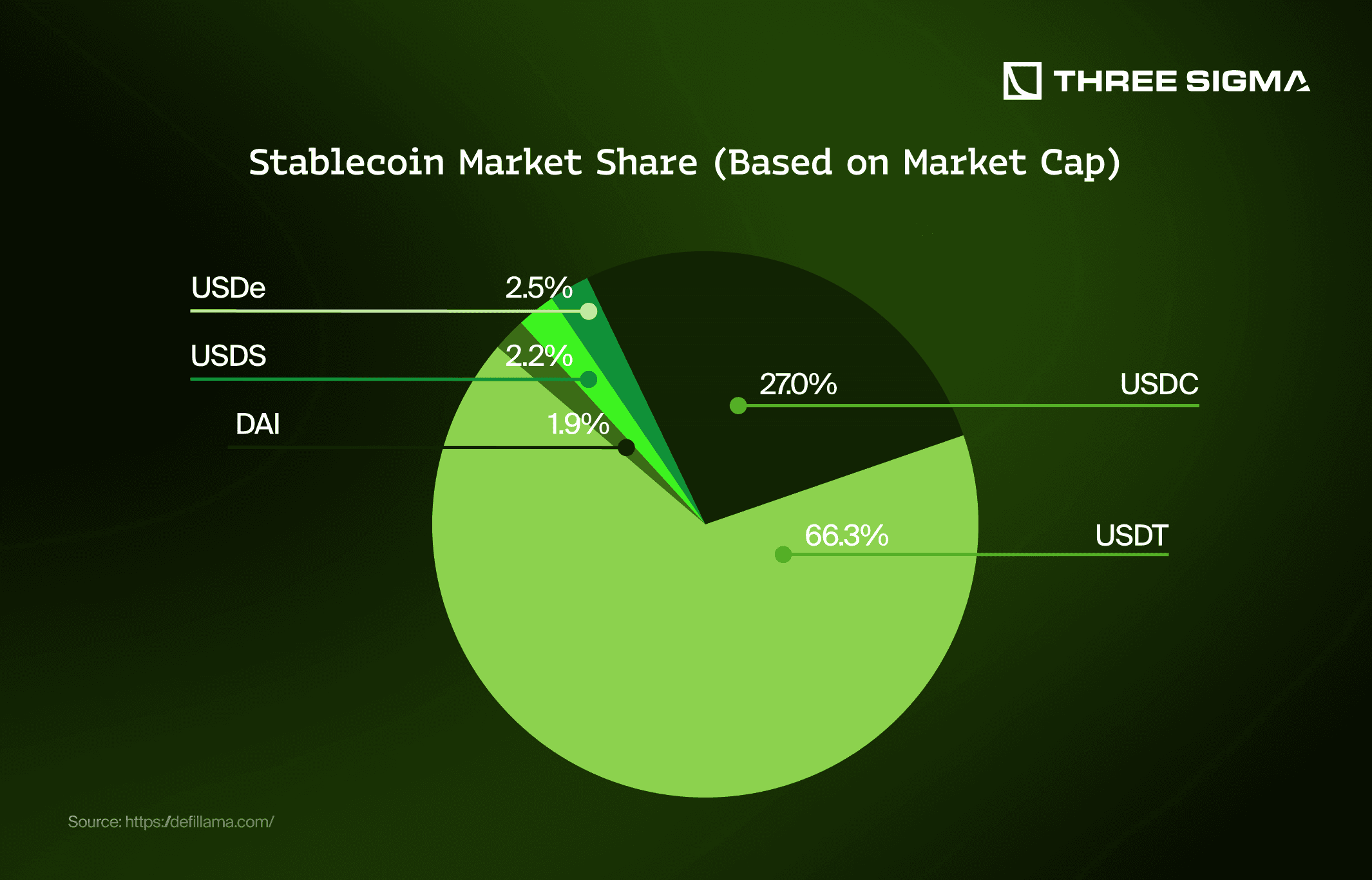

When discussing stablecoins, USDT and USDC naturally emerge as the dominant players, both functioning as centralized pillars of liquidity within the crypto market. They share a common structure: both are issued by centralized entities, fully backed by fiat reserves, and widely integrated across exchanges and financial platforms. USDT, issued by Tether, holds the largest market share and is known for its deep liquidity and widespread adoption, particularly in high-volume trading environments. USDC, issued by Circle, has positioned itself as a more regulatory-compliant alternative, often favored by institutions and entities seeking transparency. Despite minor differences, their role remains the same, providing a stable, trusted digital dollar that powers much of the crypto ecosystem. On the other side, USDS, DAI, and USDe represent the decentralized counterbalance to fiat-backed stablecoins, yet their degree of decentralization varies. DAI and USDS are fundamentally linked, both emerging from MakerDAO, now rebranded as Sky, with USDS positioned as the evolution of DAI within Sky’s long-term roadmap. However, DAI was historically more decentralized, maintaining its peg through overcollateralized crypto reserves, while USDS reflects Maker’s shift towards a more structured and strategic model under Sky, integrating a broader vision that leans towards efficiency rather than pure decentralization. Meanwhile, USDe stands as another major decentralized stablecoin competitor, though with a distinct approach. Unlike Maker’s model, which relied on overcollateralization and governance mechanisms, USDe introduces a yield-generating structure, leveraging its backing assets to provide additional returns to holders.

USDT

When discussing stablecoins, USDT naturally emerges as a dominant player, functioning as a centralized pillar of liquidity within the crypto market. Issued by Tether, USDT holds the largest market share and is renowned for its deep liquidity and widespread adoption, especially in high-volume trading environments. It provides a stable and trusted digital dollar that powers much of the crypto ecosystem, acting as the primary medium for trading pairs, arbitrage opportunities, and cross-exchange liquidity provisioning. Its widespread acceptance has solidified its role in both centralized and decentralized finance sectors.

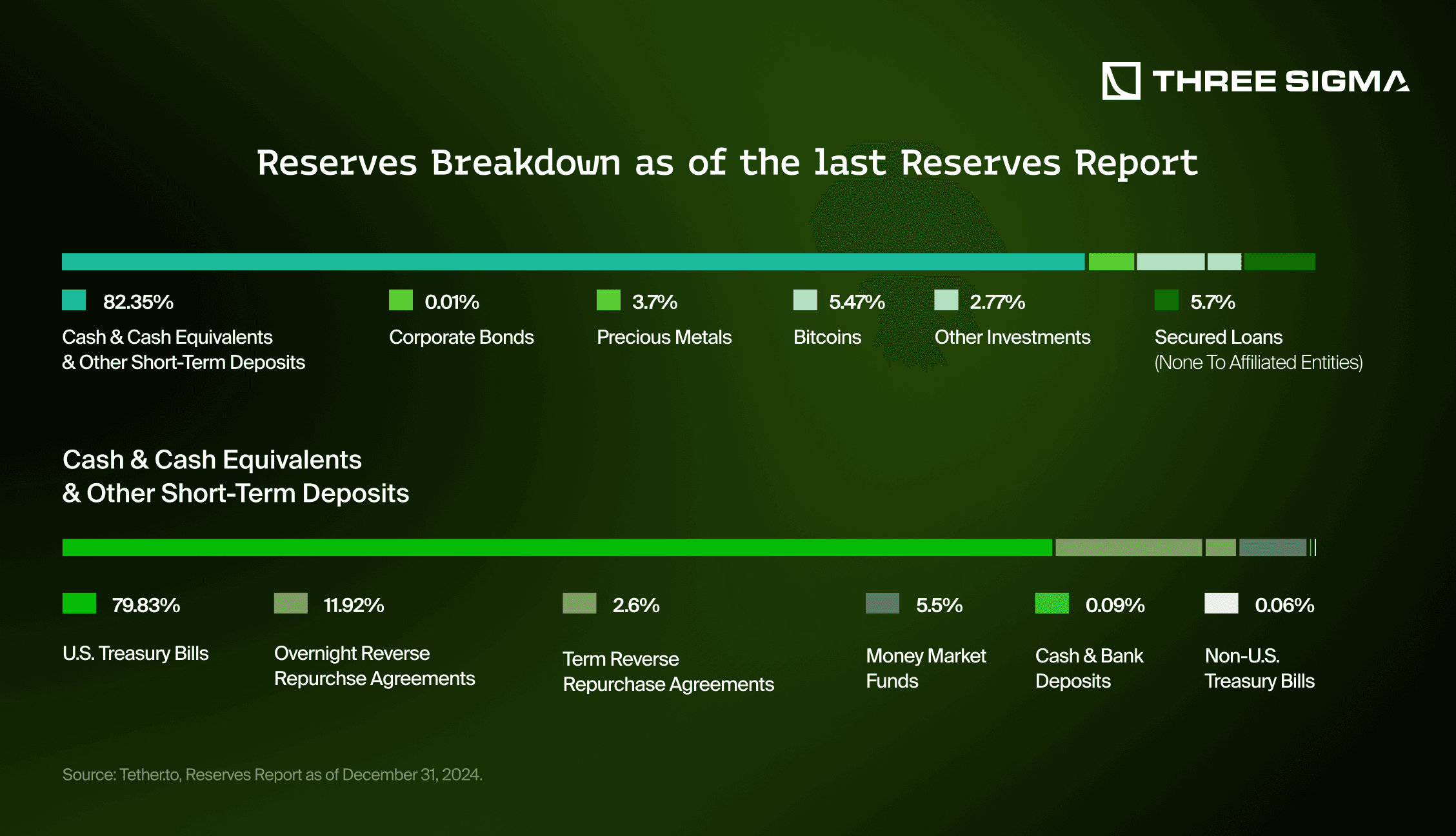

Tether generates revenue predominantly through the management of its substantial reserve assets that back each issued USDT token. These reserves primarily consist of cash equivalents such as U.S. Treasury bills, commercial paper, short-term deposits, money market instruments, and corporate bonds. By strategically allocating these reserves, Tether accrues interest and investment returns, significantly contributing to its income.

Additionally, Tether occasionally engages in short-term lending and financial instruments, further diversifying and enhancing its revenue streams. Fees generated through token issuance, redemption processes, and transaction fees across various blockchain platforms supplement these primary revenue streams.

Here’s its latest Reserves Report, clearly illustrating that over 80% of their treasury consists of Cash, Cash Equivalents, and Other Short-Term Deposits—of which approximately 80% is specifically invested in Treasury Bills:

Essentially, Tether’s revenue heavily depends on interest rates established by central banks, particularly the U.S. Federal Reserve, since the majority of its reserves accrue value directly tied to these rates. Higher interest rates substantially boost the returns Tether earns from its reserves, whereas lower rates significantly diminish its income potential.

Importantly, unlike certain other stablecoins, all revenue generated by Tether is retained by the issuer itself, with none distributed to USDT token holders. This contrasts with yield-generating stablecoins, where returns are shared directly with holders, highlighting a key difference in the stablecoin business models.

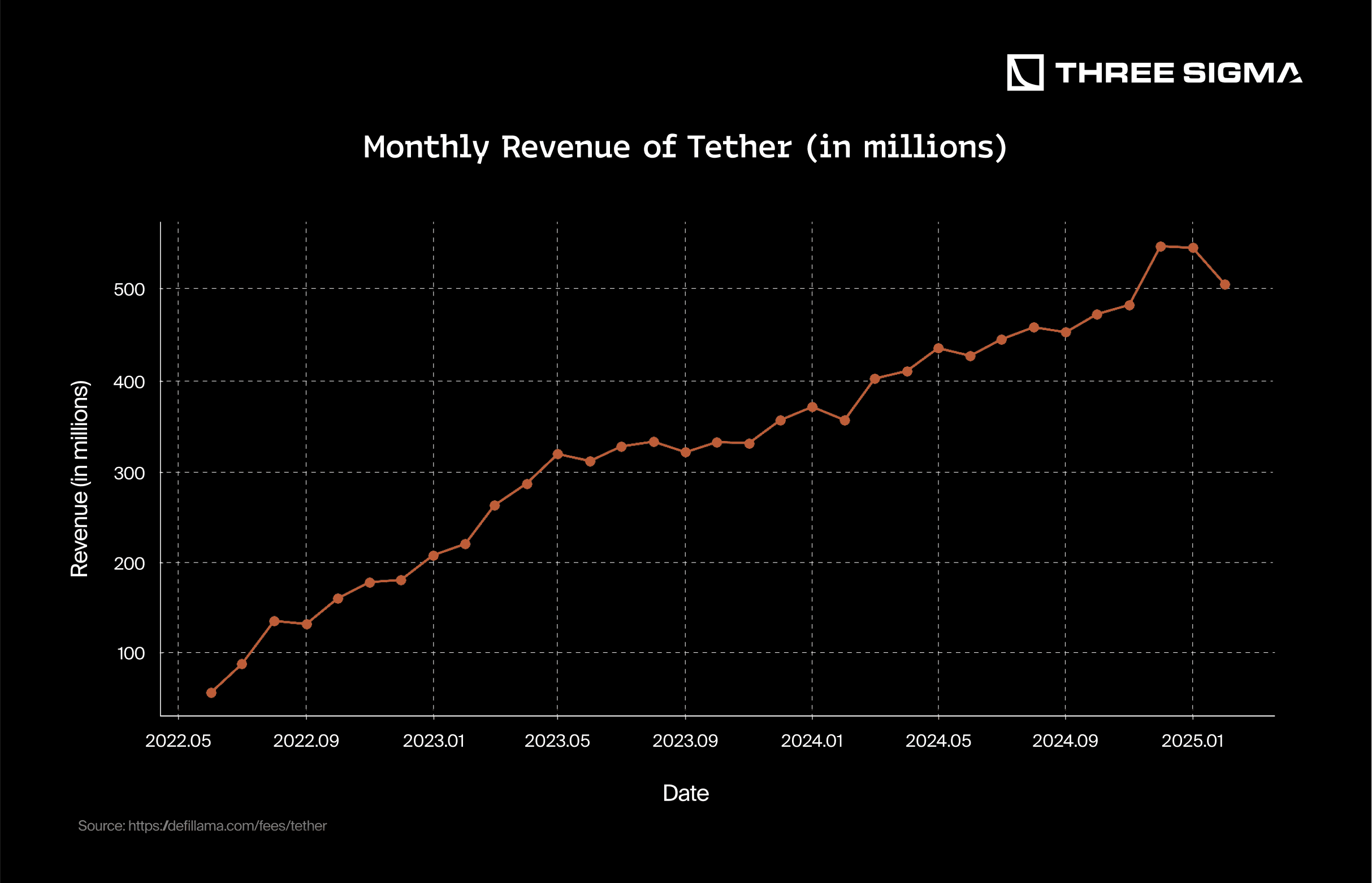

Historical Revenue Trends

Historically, Tether’s revenue trajectory has closely mirrored global interest rate trends. During extended periods of low interest rates such as from 2019 through early 2022 Tether generated modest revenue growth, primarily due to its reliance on conservative investment strategies that yielded limited returns.

However, beginning in mid-2022, as central banks aggressively raised interest rates to combat inflation, Tether’s revenue grew substantially. From June 2022 to early 2025, monthly revenue increased nearly tenfold, underscoring the high sensitivity of Tether’s income streams to macroeconomic shifts and monetary policy decisions. This trend highlights the effectiveness of Tether’s revenue model during rising rate environments.

That said, revenue is not solely dependent on interest rates. Even in a scenario where rates decline, Tether may still see revenue growth if the supply of USDT expands significantly. A larger supply translates into more assets under management, which can offset lower yields and sustain or even increase overall earnings.

USDC

USDC, issued by Circle, is among the most trusted centralized stablecoins in the market. Known for its regulatory alignment and transparency, it is widely used across DeFi, institutional payments, and cross-chain applications. Its presence on multiple blockchains enhances its composability and ecosystem reach.

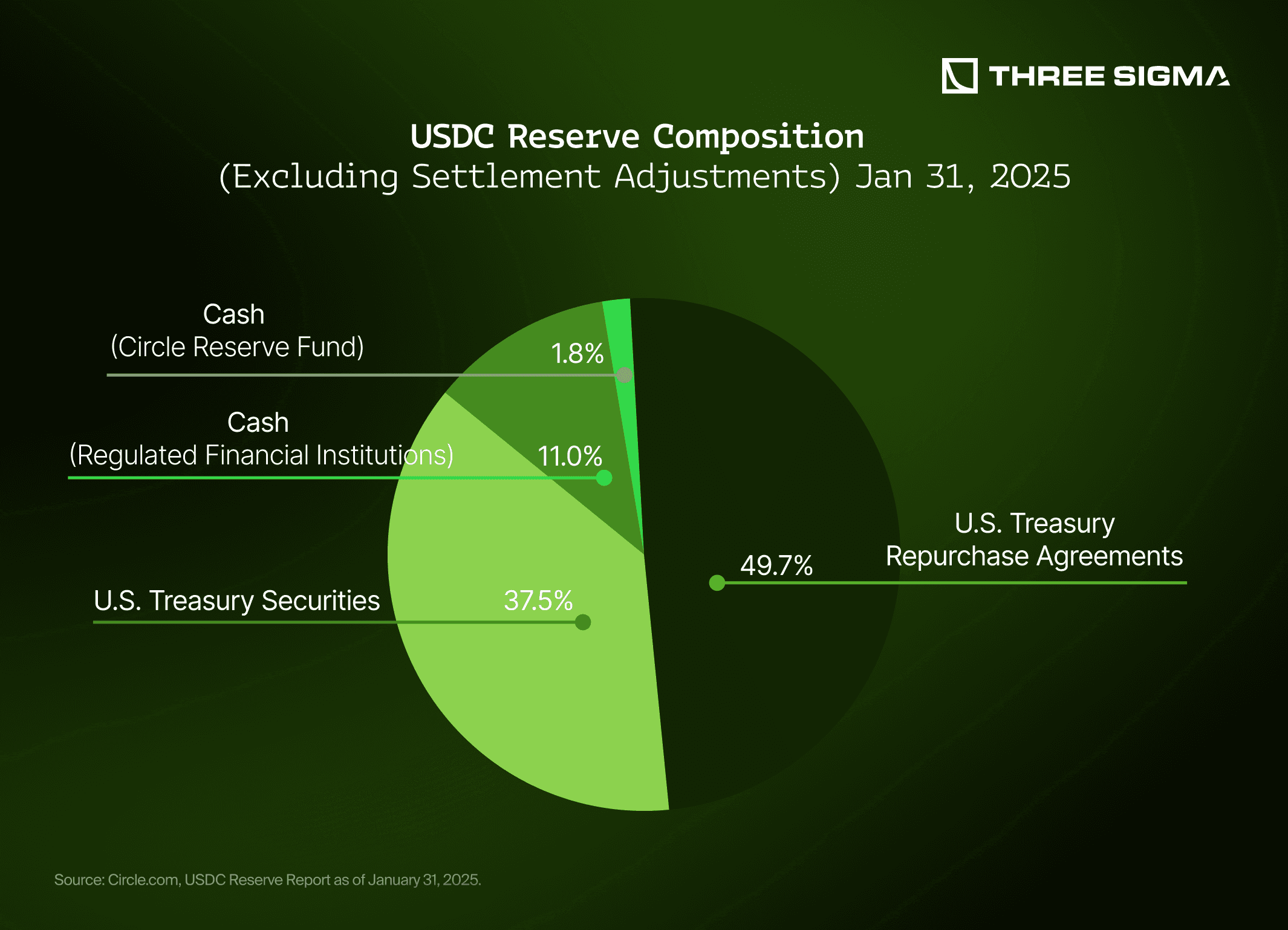

A key differentiator for USDC is Circle’s rigorous reserve structure and public disclosures. As of January 31, 2025, USDC had over $53.2 billion in circulation, backed by $53.28 billion in reserves, fully attested by independent accountants. These reserves are split between:

- The Circle Reserve Fund: a government money market fund holding $47.26 billion in U.S. Treasury securities and repurchase agreements.

- Segregated bank accounts: holding an additional $6.02 billion with regulated financial institutions.

Circle earns revenue by managing these reserves, capitalizing primarily on interest from U.S. Treasuries and overnight lending arrangements. Although structurally similar to Tether’s model, Circle distinguishes itself through its fund setup, owning 100% of the Reserve Fund equity on behalf of USDC holders. This not only provides clearer regulatory separation but may also enable more nuanced product integrations in the future.

Unlike decentralized alternatives, USDC does not distribute yield directly to users. Instead, revenue remains with the issuer, prioritizing simplicity, compliance, and capital preservation.

Historical Revenue Trends

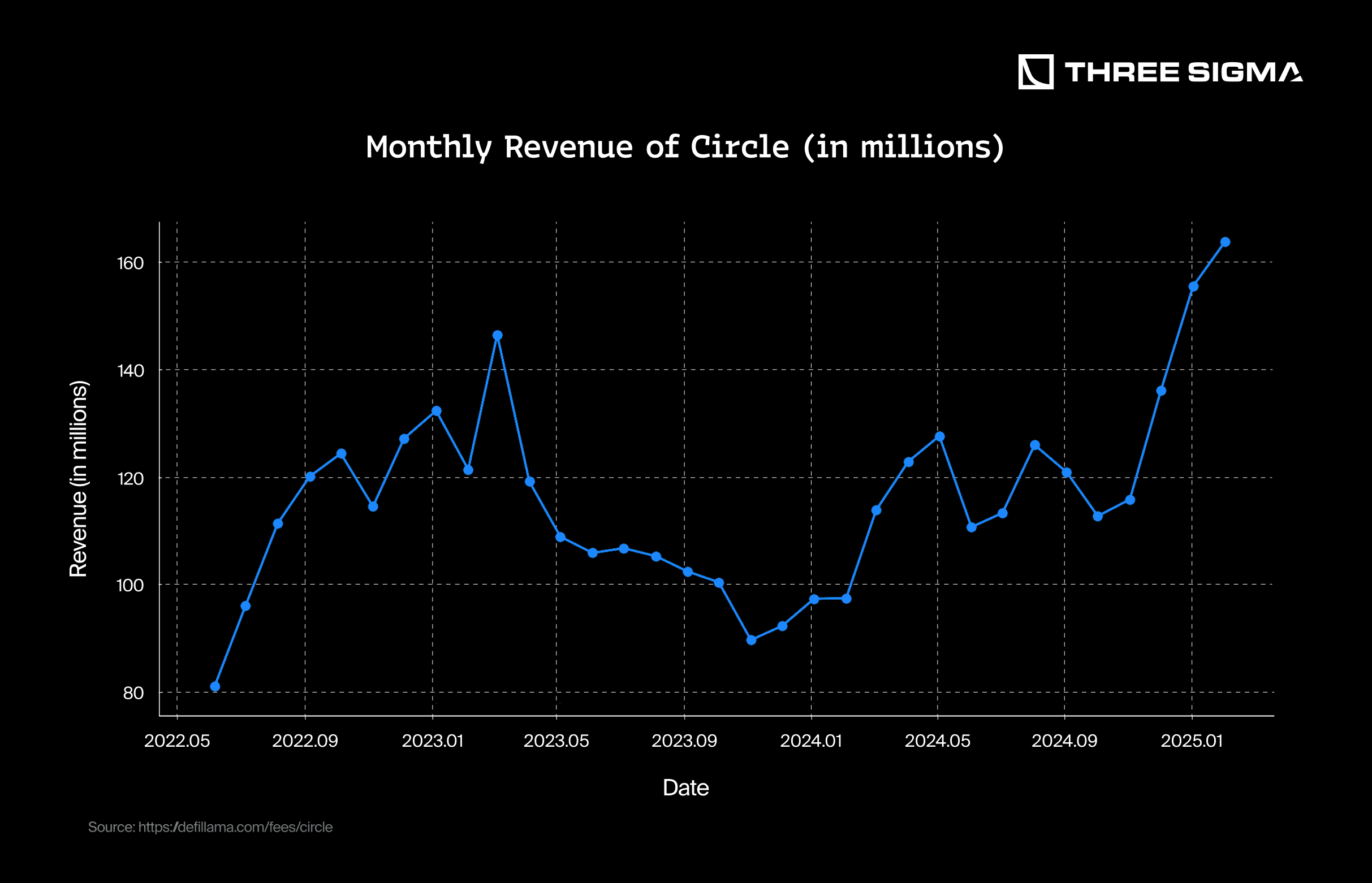

Circle’s revenue trajectory has closely followed the broader interest rate environment, given its conservative investment profile focused on short-term government debt.

Revenue grew consistently through 2022 as the U.S. Federal Reserve raised rates, reaching a high point of $146.5 million in March 2023. However, later that year saw mounting pressure from competing stablecoins, blockchain reliability issues (notably on Solana), and reputational turbulence tied to banking partners, contributing to a gradual decline. By late 2023, monthly revenue had dropped below $90 million.

Recovery followed in 2024, helped by reduced redemptions, a rebound in crypto activity, and the continued high-rate environment. Revenues returned to pre-dip levels, hitting $126 million in August, and closing the year strong. In February 2025, Circle posted its highest monthly revenue on record: $163.7 million.

This trend highlights USDC’s resilience and the strong link between stablecoin revenue models and monetary policy. Circle’s consistent recovery underscores its ability to navigate market cycles while maintaining user trust and liquidity dominance.

USDS/DAI (SKY)

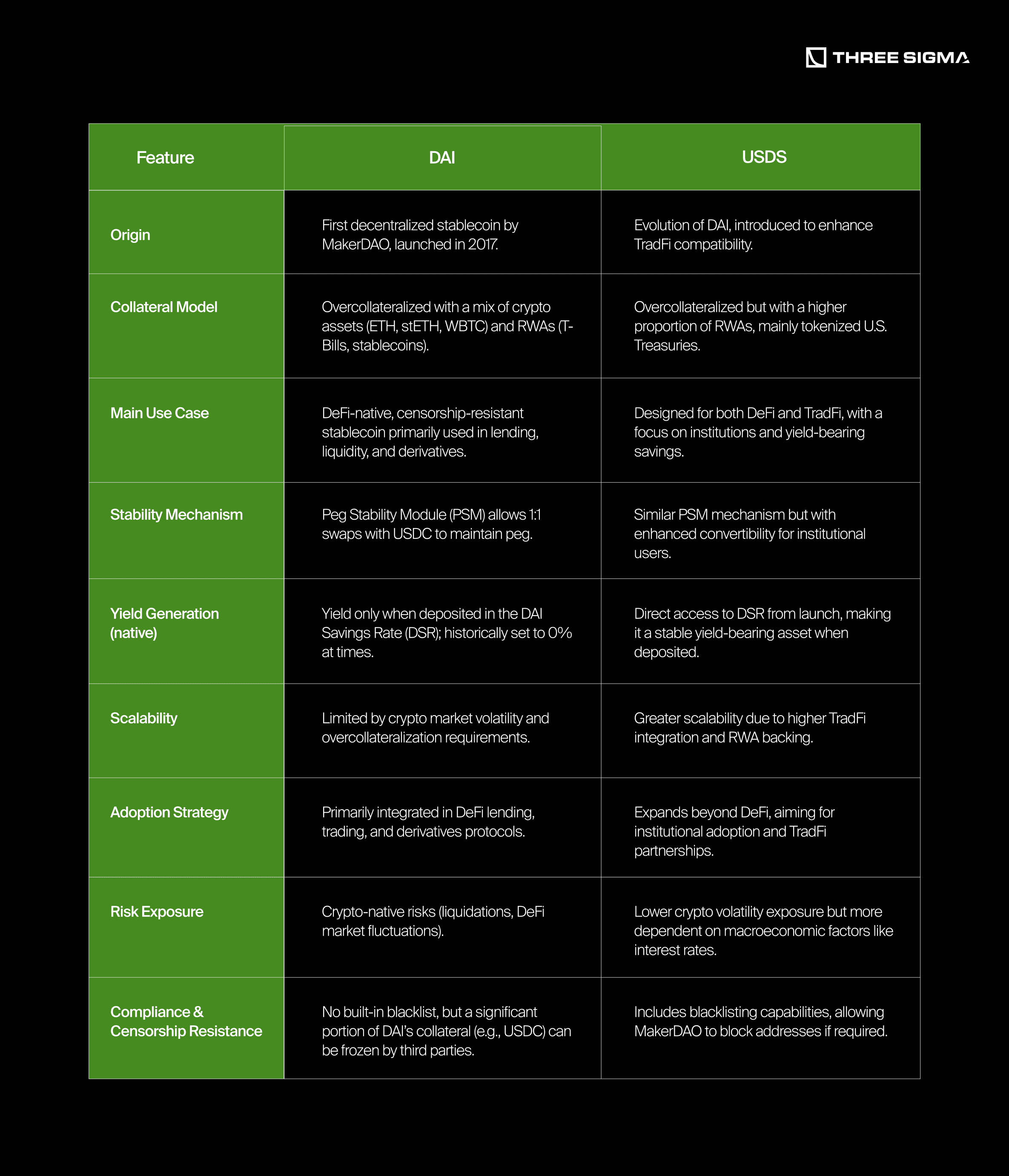

USDS is the current evolution of DAI, the first major decentralized stablecoin issued by MakerDAO, designed to provide censorship-resistant alternatives to traditional fiat-backed assets. While both belong to the Maker ecosystem, they have structural differences in their collateral models and target use cases.

DAI is an overcollateralized stablecoin backed by a mix of cryptocurrencies, real-world assets (RWAs), and stablecoins. It is minted through Maker Vaults, where users deposit collateral such as ETH, stETH, or USDC, ensuring it remains fully backed. This design makes DAI highly resilient but limits its scalability.

USDS, on the other hand, represents MakerDAO's evolution toward a more TradFi-compatible stablecoin. While still overcollateralized, USDS incorporates a structured reserve approach that includes tokenized short-term U.S. Treasury bills. This aligns it with institutional demand, positioning it as a competitor to stablecoins like USDT and USDC while maintaining MakerDAO’s decentralized governance model.

The transition from DAI to USDS reflects a shift toward broader institutional adoption. While DAI started as a crypto-native stablecoin backed primarily by decentralized assets, USDS optimizes its collateral structure by incorporating a larger share of RWAs, particularly U.S. Treasury bills. Additionally, USDS enhances stability through direct convertibility mechanisms, making it easier to maintain its peg to the dollar. Unlike DAI’s early reliance on external DeFi incentives, USDS was designed from the outset to offer a built-in yield via the DSR, making it more attractive in both DeFi and TradFi environments. This structure aligns with real-world asset (RWA) yield DeFi strategies gaining traction in 2025.

Transparency is foundational to the design of the Sky ecosystem, not as a mechanism to maintain the peg itself, but as a prerequisite for trust, institutional participation, and responsible capital allocation. In an environment where protocols manage billions in assets, users and institutions alike demand visibility into where those funds are held, how they are used, and what backs the system.

That’s why Sky provides public, real-time dashboards that offer a clear breakdown of USDS backing, diversification, and revenue. But transparency alone doesn’t stabilize a currency, the peg is maintained through overcollateralization, risk-managed asset allocation, and protocol-level mechanisms.

USDS is always backed by more collateral than is issued. As of now, it maintains a total collateral base of over $10.8B for a supply of ~$8.3B, ensuring a substantial buffer to absorb market volatility or redemptions. The collateral is diversified across several key sources:

- Stablecoins (54.8%): Primarily via LitePSM, a peg-stabilizing module that allows for 1:1 swaps between DAI and USDC to support the USDS peg.

- Spark (24.7%): Sky’s lending and liquidity protocol, which mints USDS against high-quality, interest-generating collateral.

- Cash RWA (9.7%): Fully held in BlockTower Andromeda, a strategy investing in short-term U.S. Treasuries, offering low-risk, real-world yield.

- Core (9%): Sky’s overcollateralized vault system, where users mint USDS against assets like ETH and stETH under strict collateralization thresholds.

Together, these mechanisms ensure that USDS remains stable, overcollateralized, and backed by a blend of liquid, productive assets, while transparency guarantees that all of this can be verified by anyone at any time.

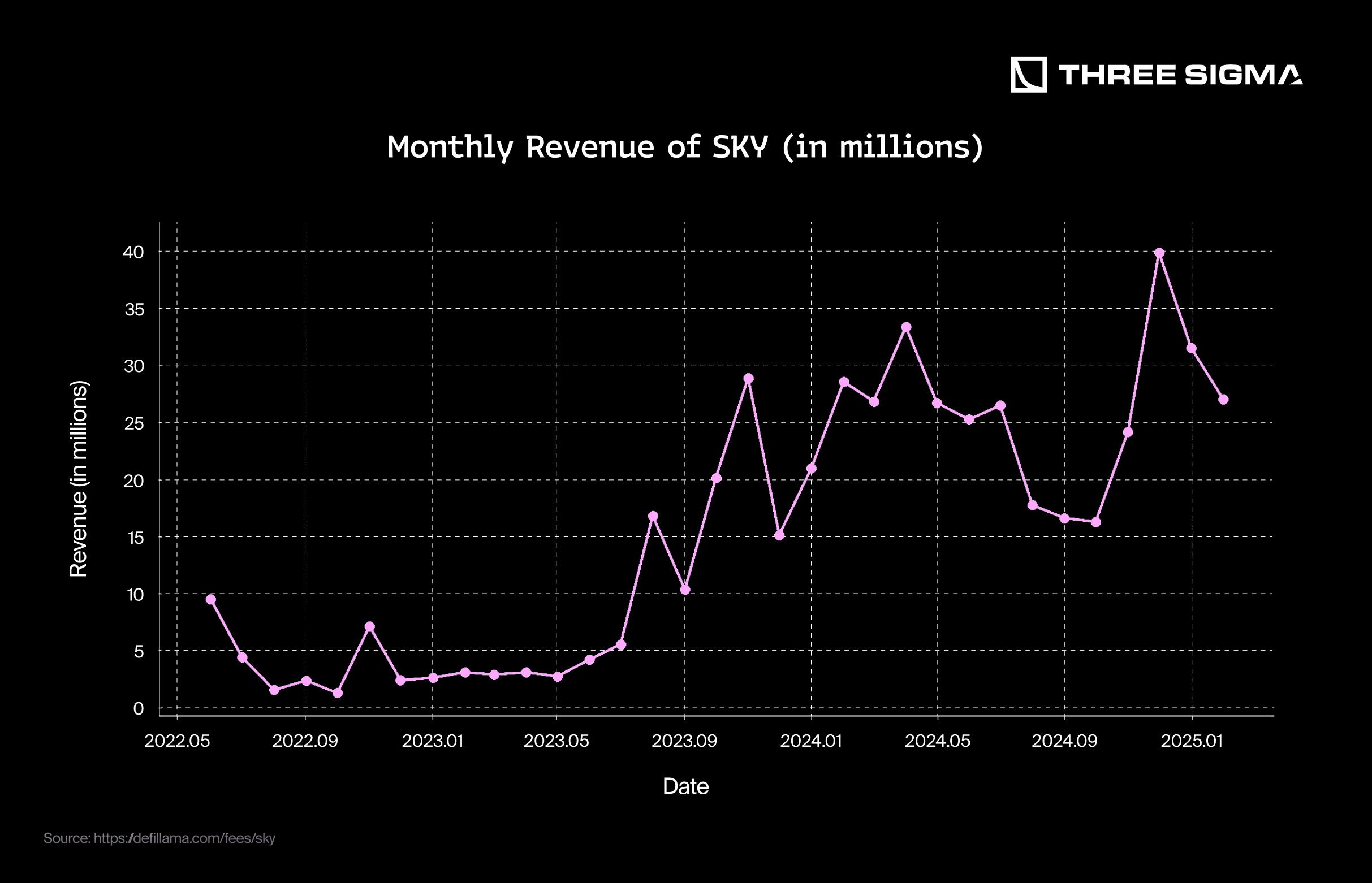

Historical Revenue Trends

The chart above illustrates the cumulative revenue generated by the Sky protocol from mid-2022 to early 2025. While revenue grew steadily in the early months, a noticeable acceleration began in late 2023, coinciding with expanded DeFi integrations, increased USDS adoption, and deeper exposure to real-world assets such as short-term U.S. Treasuries, right when interest rates started to spike. By early 2025, cumulative revenue since then had surpassed $500 million, reflecting Sky’s ability to scale sustainably while capturing yield across both crypto-native and institutional strategies.

USDe

USDe is a delta-neutral synthetic dollarUSDe is a delta-neutral stablecoin that uses a synthetic dollar structure maintained through perpetual futures, developed by Ethena Labs. Unlike traditional stablecoins backed by fiat reserves or overcollateralized crypto assets, USDe maintains its peg to the U.S. dollar through an automated hedging strategy. This makes it fully-backed, scalable, and censorship-resistant. Ethena also offers sUSDe, a yield-bearing version of USDe, which earns rewards from liquid staking assets and funding rate arbitrage in futures markets.

Since its public launch in early 2024, Ethena has rapidly expanded, reaching a $6 billion supply within ten months, making USDe the third-largest USD-denominated asset in crypto. It has also become a fundamental component in DeFi, with integrations across major protocols like Pendle, Morpho, and Aave, where its adoption has fueled significant growth. Beyond DeFi, USDe has penetrated CeFi, now integrated as margin collateral on approximately 60% of centralized exchanges, surpassing USDC balances on Bybit in less than a month.

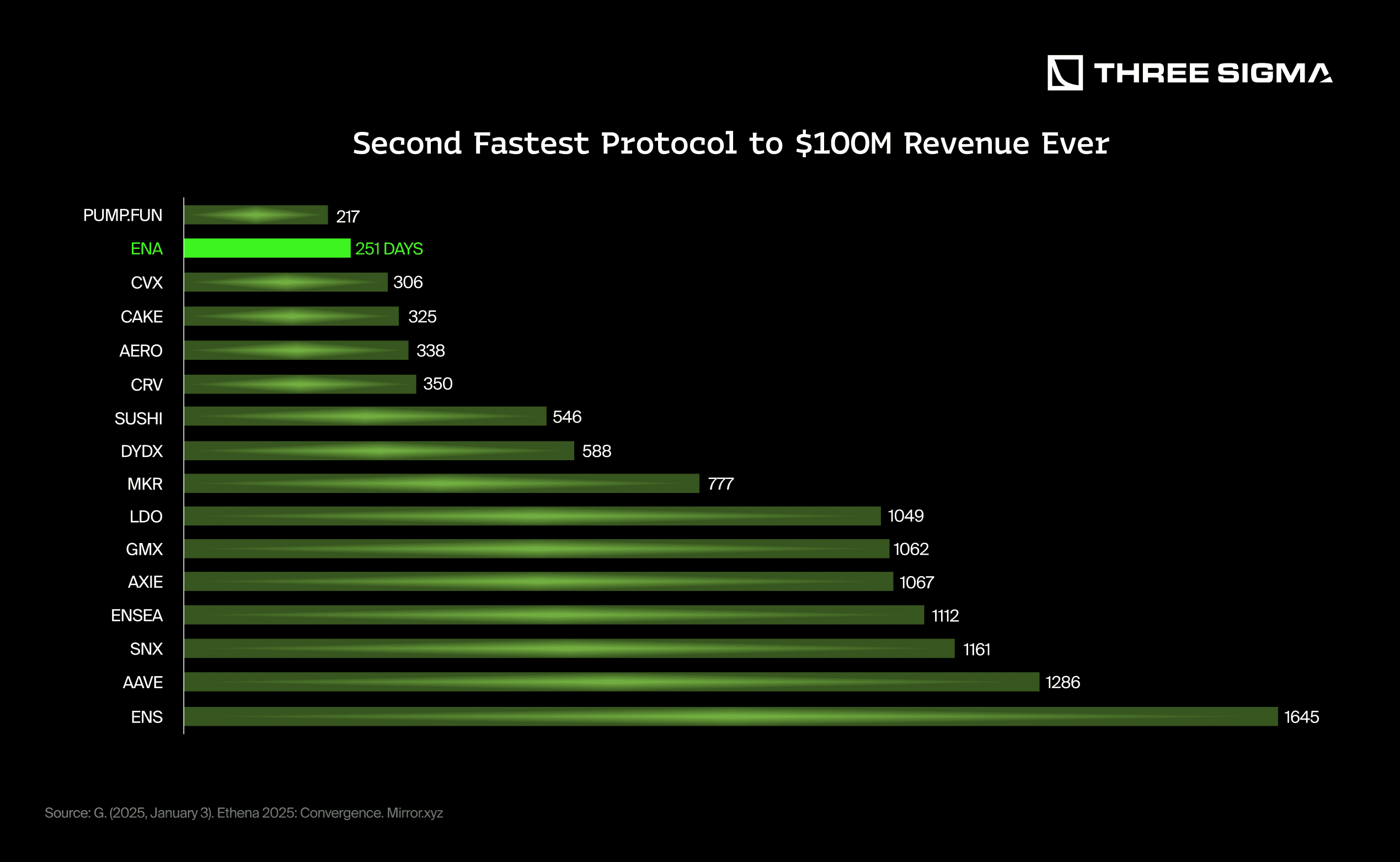

If we dive into revenue, Ethena is far from lagging behind, becoming the second-fastest dApp in history (only behind Pump.fun) to reach $100M in revenue, achieving this milestone in just 251 days. In 2024, Ethena has emerged as the dominant force in DeFi, it accounts for over 50% of Pendle’s TVL, approximately 30% of Morpho’s TVL is linked to Ethena-related assets, and it became the fastest-growing new asset on Aave, reaching $1.2B in deposits in just three weeks.

Ethena’s next phase is defined by Convergence, which is the merging of DeFi, CeFi, and TradFi through USDe. With the introduction of iUSDe, a wrapped version of sUSDe designed for institutional adoption, Ethena aims to provide a high-yield, crypto-native dollar product tailored to asset managers, private credit funds, and exchange-traded products. By aligning capital flows and interest rates across financial systems, Ethena is positioning USDe as a cornerstone of the evolving digital dollar landscape.

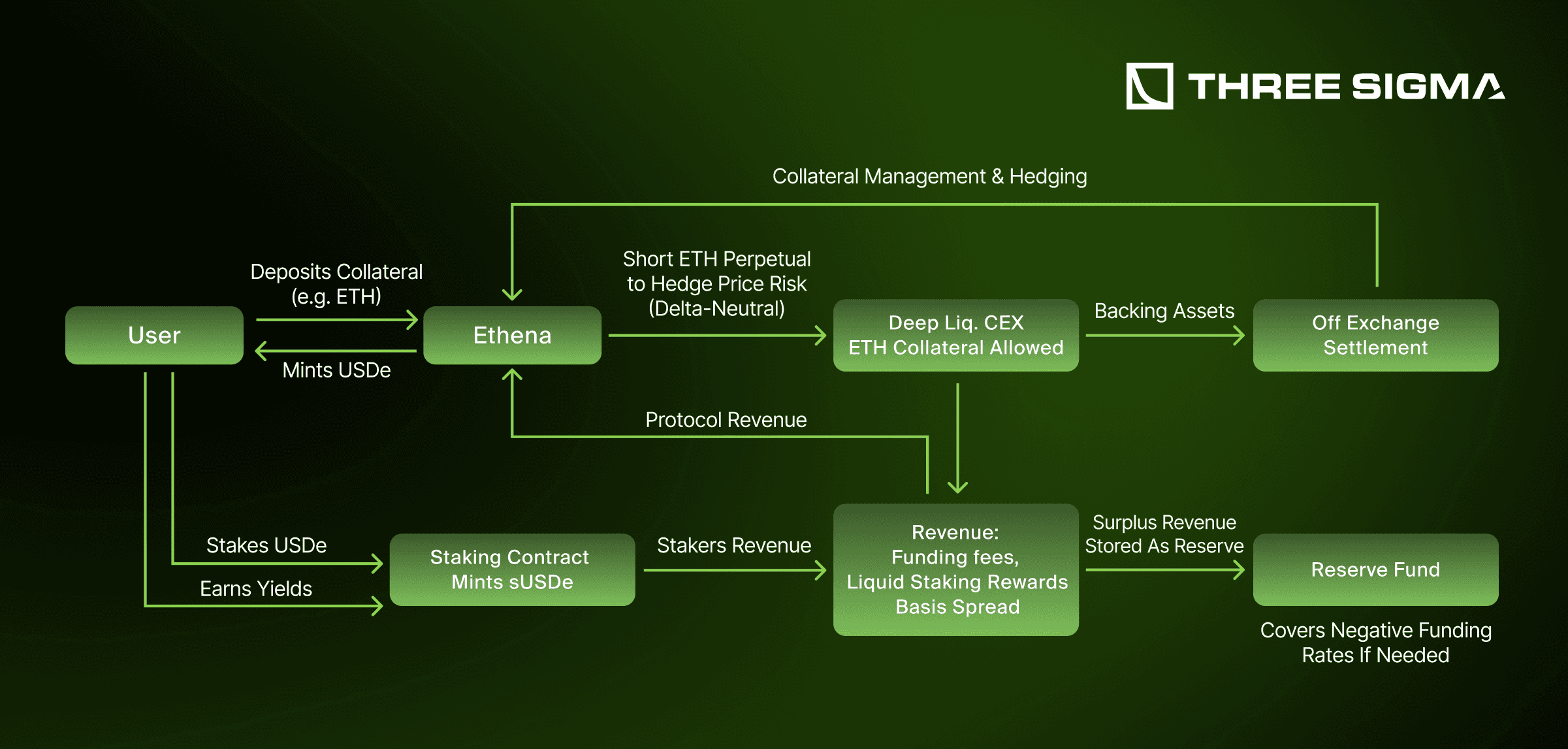

How USDe Works?

USDe maintains stability through a delta-neutral hedging strategy, ensuring its value remains unaffected by market fluctuations. When a user mints USDe, Ethena receives collateral, which can include ETH, BTC, LSTs, USDT, USDC, and SOL. To neutralize price risk, Ethena opens a short position in perpetual futures for the same asset received as collateral. For example: If the collateral is ETH, Ethena shorts ETH perpetual futures.

This ensures that any price movement in the collateral is offset by the corresponding futures position. If the collateral increases in value, the short position incurs losses but is balanced by the higher collateral value. Conversely, if the collateral price drops, the short position gains, compensating for the collateral’s depreciation. This mechanism keeps USDe stable regardless of market fluctuations.

Unlike other synthetic stablecoins, Ethena does not use additional leverage beyond what derivatives exchanges naturally apply when valuing collateral. This minimizes liquidation risks, ensuring that every short position is fully backed 1:1 by assets.

To enhance security, backing assets remain onchain and are custodied via an off-exchange settlement system to mitigate counterparty risks. Ethena never fully transfers control of assets to derivatives platforms but uses them solely for margining its short hedging positions, ensuring decentralized and transparent asset management.

Ethena generates revenue by capturing a portion of the yield derived from its delta-neutral strategy. This includes:

- Funding rate arbitrage: Ethena profits when perpetual futures funding rates are positive.

- Liquid staking rewards: Collateralized LSTs generate staking yield, of which a portion is retained by Ethena.

- Basis spread profits: Ethena benefits from inefficiencies between spot and futures markets.

- Protocol fees: A share of the total returns is directed to the Reserve Fund and protocol treasury, ensuring long-term sustainability.

While USDe’s delta-neutral strategy minimizes exposure to price fluctuations, it is still vulnerable to funding rate volatility, market dislocations, and counterparty risk. If funding rates turn negative for an extended period, Ethena’s Reserve Fund absorbs the losses, but prolonged negative rates could pressure the system. Liquidity crises or extreme volatility may cause temporary peg deviations if spot and futures markets diverge. Additionally, reliance on centralized exchanges for hedging introduces counterparty risk, though Ethena mitigates this by keeping assets onchain in off-exchange settlements.

Historical Revenue Trends

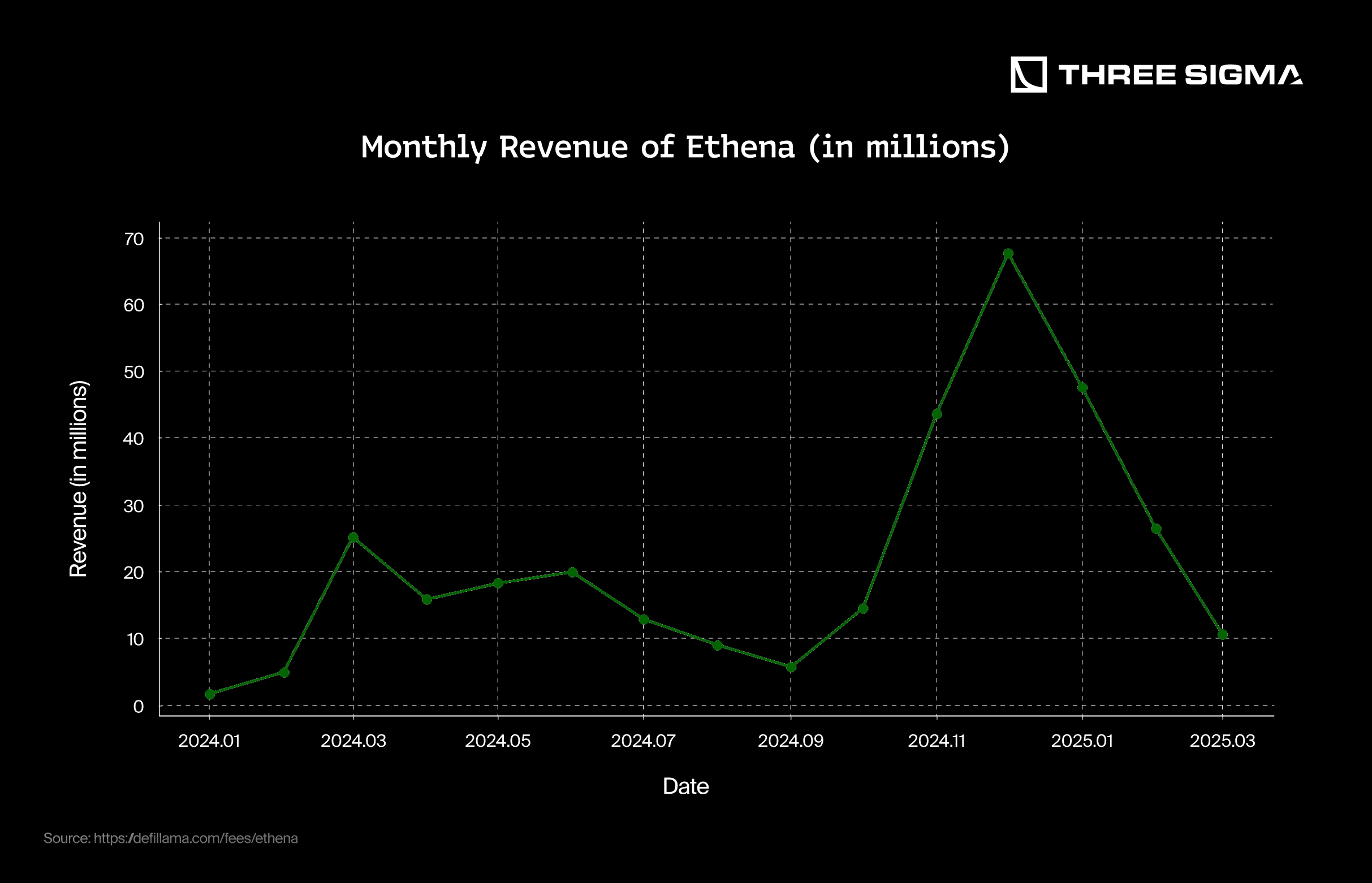

Ethena opened to the public on February 19, 2024, allowing users to mint USDe by depositing stablecoins and stake it as sUSDe to earn yield. In under a year, the protocol generated over $320 million in cumulative revenue, one of the fastest monetization curves in DeFi history.

The steady climb in revenue during the first half of 2024 reflects consistent growth in USDe supply and adoption across DeFi and CeFi platforms. However, the sharp acceleration starting around October 2024 coincides with:

- The integration of USDe and sUSDe into major lending markets like Aave and Morpho.

- The surge in funding rate arbitrage opportunities due to increased market volatility.

- And the rollout of new institutional products such as iUSDe, expanding Ethena’s reach into TradFi.

By Q1 2025, cumulative protocol revenue surpassed $300 million, positioning Ethena among the top revenue-generating protocols in crypto, despite having launched less than 15 months earlier. This rapid growth signals strong market demand and validates the sustainability of USDe’s delta-neutral model.

However, after peaking in late 2024, monthly revenue saw a sharp decline throughout Q1 2025. This drop correlates with a cooling in funding rate arbitrage opportunities, as perpetual futures funding normalized across major exchanges. With lower volatility and more neutral funding environments, one of Ethena’s primary revenue streams temporarily weakened, highlighting the model’s sensitivity to market conditions.

4. Interest rates vs Revenue correlation

The interest rate impact on stablecoins is one of the most defining factors in their revenue performance. As we have seen previously, stablecoins generate revenue through various mechanisms, including interest-bearing reserves, market arbitrage, and other yield-generating strategies. Since many stablecoins hold assets that respond to changes in interest rates, their revenue potential is often affected by macroeconomic conditions.

To better understand this relationship, we have adjusted revenue by dividing it by supply. This normalization allows for a more accurate comparison, as a higher stablecoin supply naturally leads to greater potential revenue generation. By focusing on revenue per unit of supply, we can isolate the direct impact of interest rate fluctuations on stablecoin profitability.

USDT

In-depth chart analysis vividly illustrates the positive correlation between Tether’s revenue and fluctuations in interest rates. Historical graphs plotting Tether’s quarterly revenue alongside interest rate changes demonstrate clear synchronization, highlighting near-immediate revenue responses to rate adjustments.

These visual representations effectively underscore Tether’s revenue sensitivity to interest rate environments, providing predictive insights into potential future performance scenarios. They emphasize the importance of proactive financial and reserve management strategies to mitigate revenue risks associated with volatile or declining interest rate cycles.

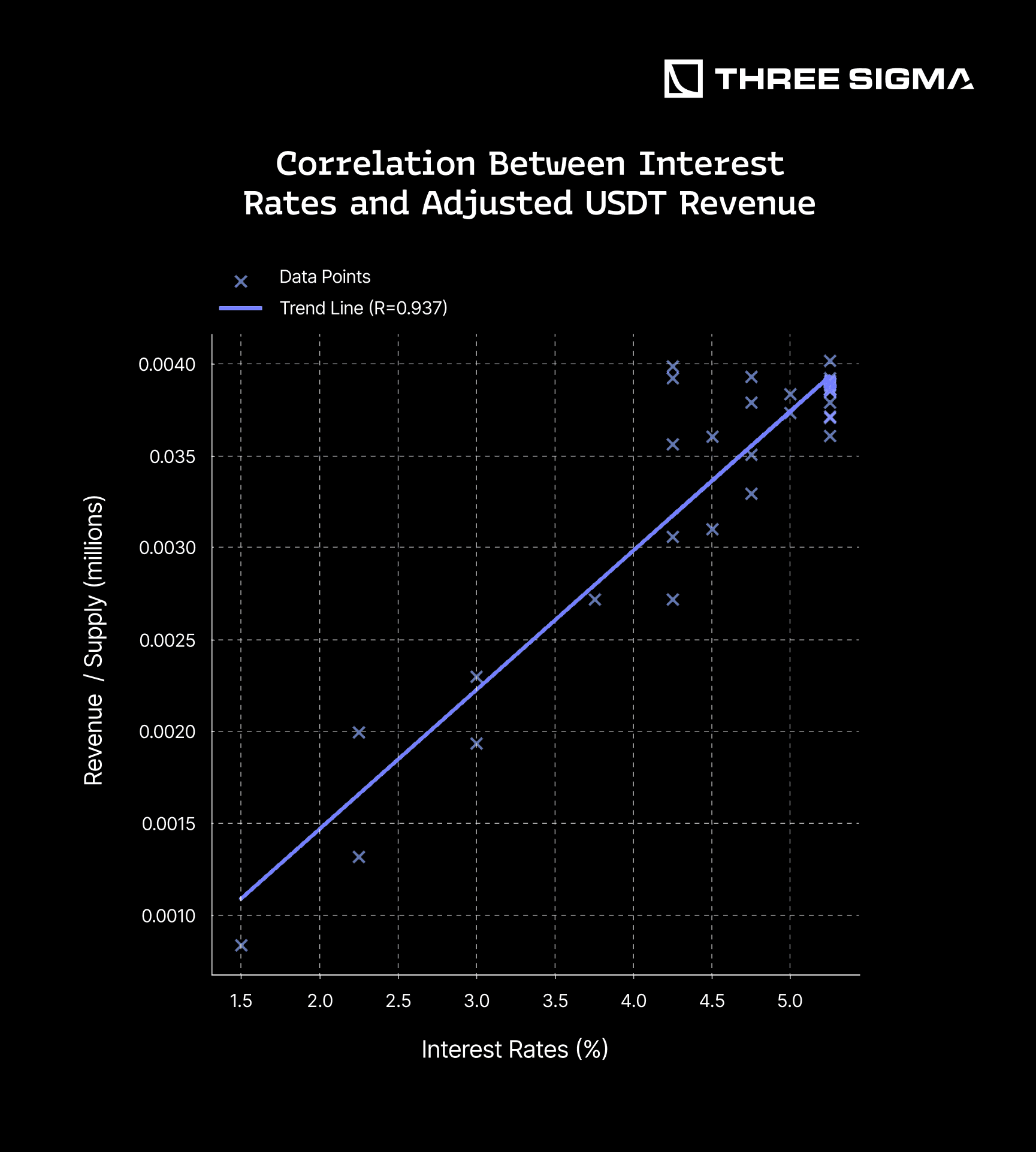

The graphs below show the correlation between interest rates and adjusted stablecoin revenue. Each chart illustrates how revenue per unit of stablecoin supply (y-axis) changes in relation to interest rates (x-axis).

The graph further highlights a strong positive correlation (R = 0.937) between interest rates and USDT’s adjusted revenue per supply. This indicates that as interest rates increase, USDT's revenue per unit of supply rises, reflecting the benefits of USDT's investments in U.S. Treasury bonds. As rates increase, these bonds generate higher yields, directly impacting USDT’s overall revenue.

This correlation highlights how USDT effectively manages its reserve assets to benefit from evolving economic conditions, particularly in high-yield environments. It reflects USDT’s adaptive financial strategy and its positioning to perform well as interest rates rise, strengthening both its economic stability and its role as a reliable digital asset. As previously mentioned, a 100% correlation is not possible since 80% of reserves are held in cash and Treasury bills, of which 80% is specifically allocated to T-bills.

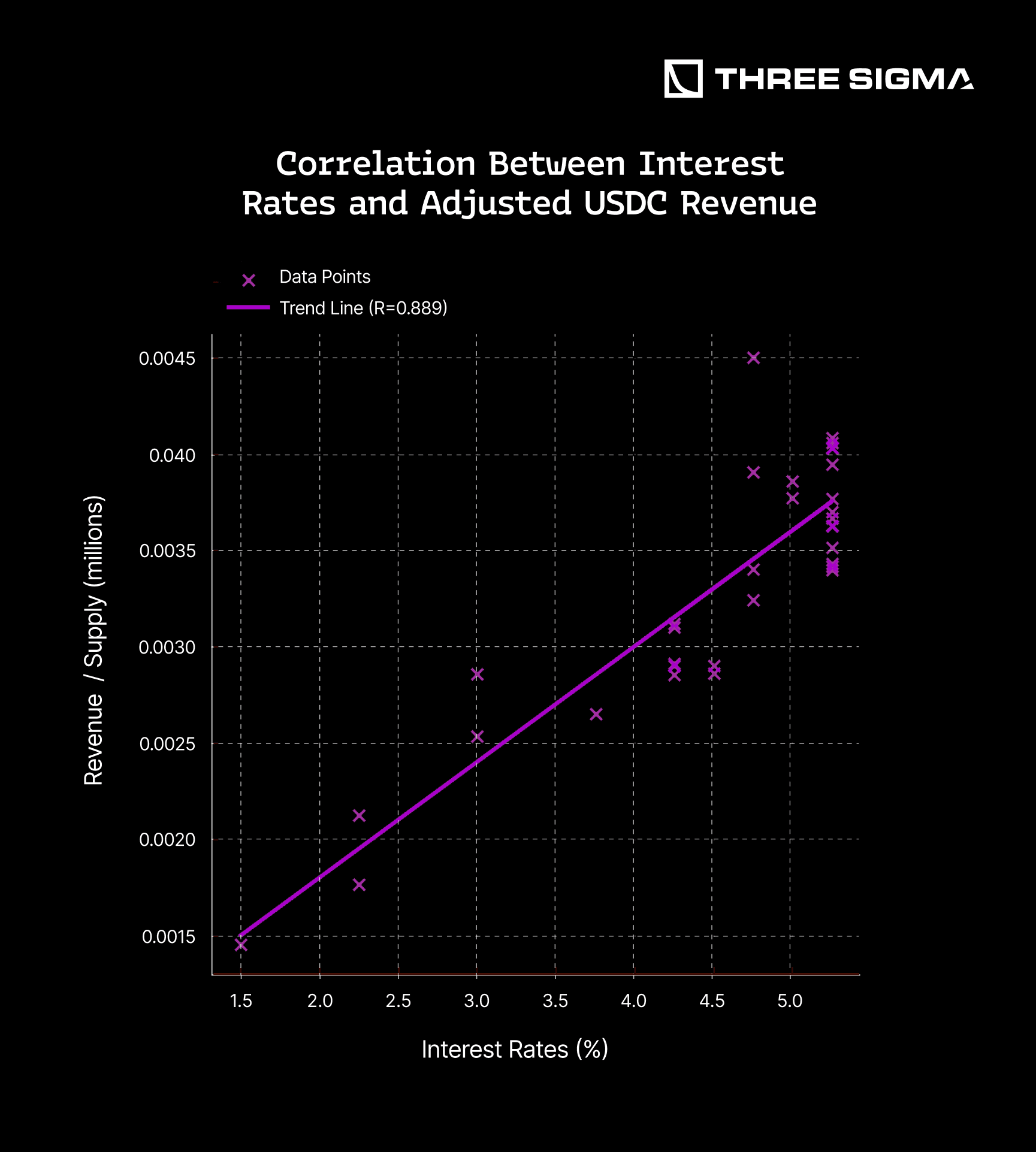

USDC

USDC’s economic strength lies in strategic reserve management. As interest rates rise, USDC benefits from its significant holdings in U.S. Treasury securities, which offer higher returns. With 75-80% of its reserves in Treasuries, USDC not only maintains stability but also generates additional revenue as bond yields increase. This direct exposure to rate fluctuations allows USDC to capitalize on rising interest rate environments, reinforcing its position as a yield-generating stablecoin.

The trend line shows a strong positive correlation (R = 0.889), indicating that as interest rates increase, USDC revenue per supply rises accordingly. This aligns with expectations, as USDC, like other reserve-backed stablecoins, earns yield from higher-yielding assets such as U.S. Treasury bonds.

This correlation highlights USDC’s ability to optimize its reserves and adapt to changing economic conditions. It also underscores how reserve-backed stablecoins can leverage rising interest rates to enhance yield generation, further solidifying their role in the digital asset ecosystem.

This correlation, while strong (R = 0.889), is lower than USDT’s due to differences in reserve composition. USDT maintains a larger portion of its reserves (roughly 80%) in short-term U.S. Treasury bills, which are highly sensitive to interest rate changes. In contrast, USDC’s reserves are more diversified, with only 37.5% in Treasury securities and nearly 50% in repurchase agreements, which don’t respond as directly to rate shifts. This diversified approach enhances liquidity and stability, but it slightly dilutes the direct impact of rate hikes on yield, resulting in a weaker correlation. In summary, a direct USDT vs USDC revenue comparison highlights the effects of reserve composition and yield strategy.

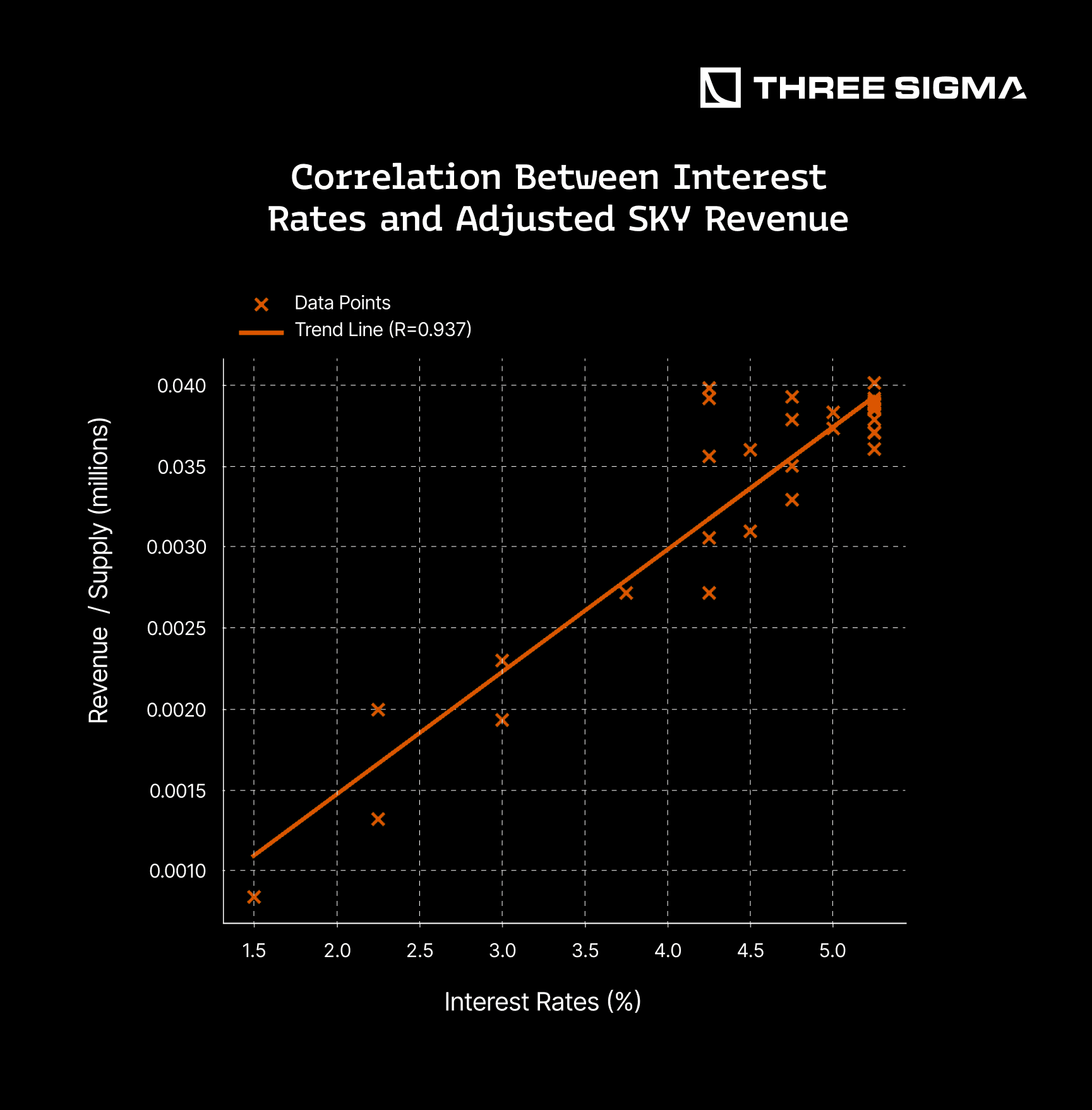

SKY (DAI/USDs)

SKY's economic strength lies in strategic reserve management. As interest rates rise, SKY stablecoins (USDS and DAI) benefit from their exposure to yield-bearing assets.

Unlike USDC and USDT, which have traditionally been backed by institutional reserves, DAI historically relied on crypto-collateralized assets such as ETH. However, in October 2022, MakerDAO began allocating a significant portion of DAI’s reserves into U.S. Treasuries and other real-world assets (RWAs) to capture higher yields. By July 2023, over 65% of DAI’s reserves were tied to RWAs, making its revenue more sensitive to interest rate movements. This shift aligns DAI's behavior more closely with institutional stablecoins, benefiting directly from rising interest rates.

As expected, this shift in DAI’s reserve composition results in a strong positive correlation (R = 0.937) between interest rates and SKY stablecoin revenue per supply. The data confirms that higher interest rates contribute to increased revenue generation, reinforcing the idea that SKY stablecoins now behave similarly to yield-optimized institutional stablecoins.

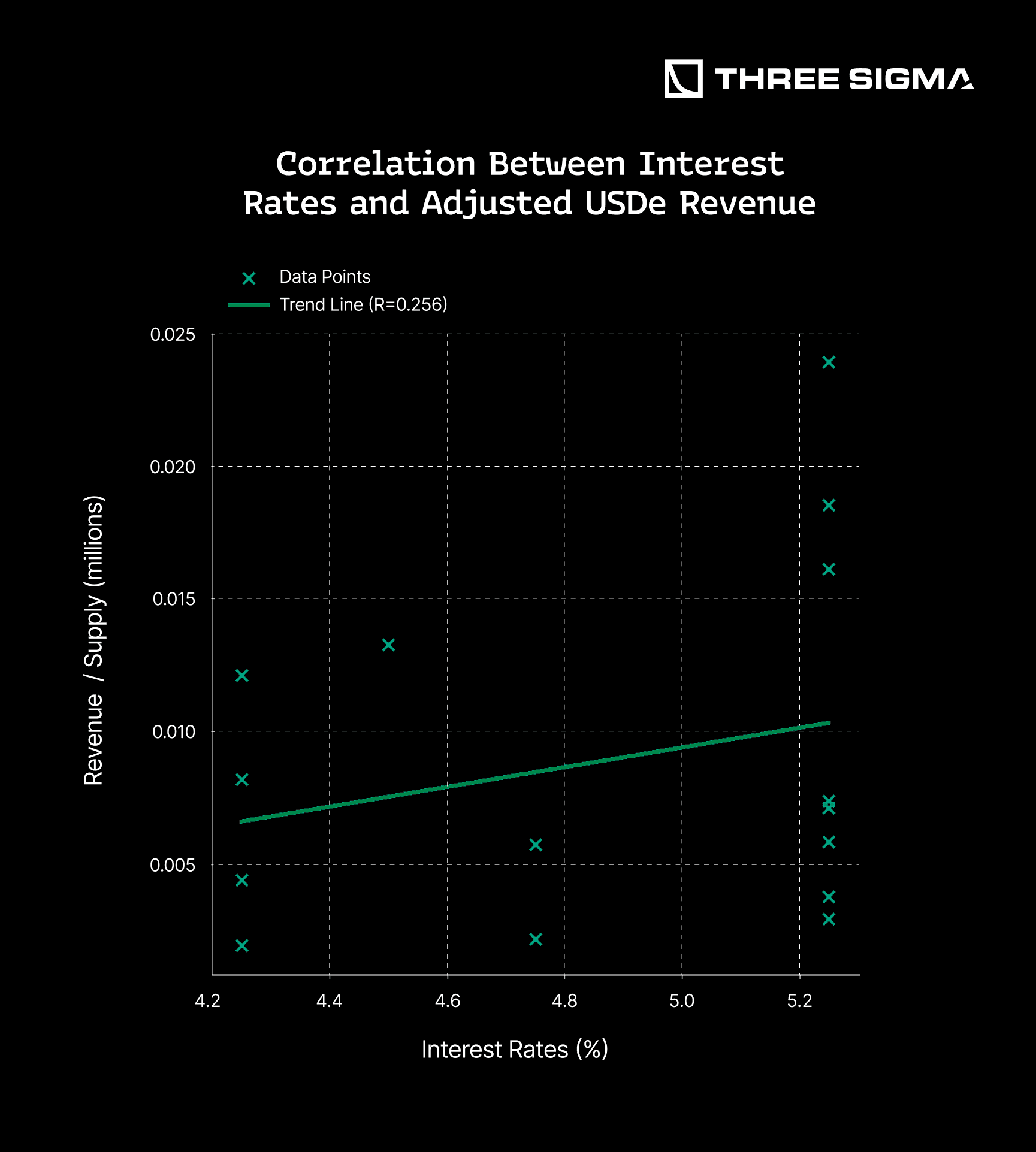

USDe

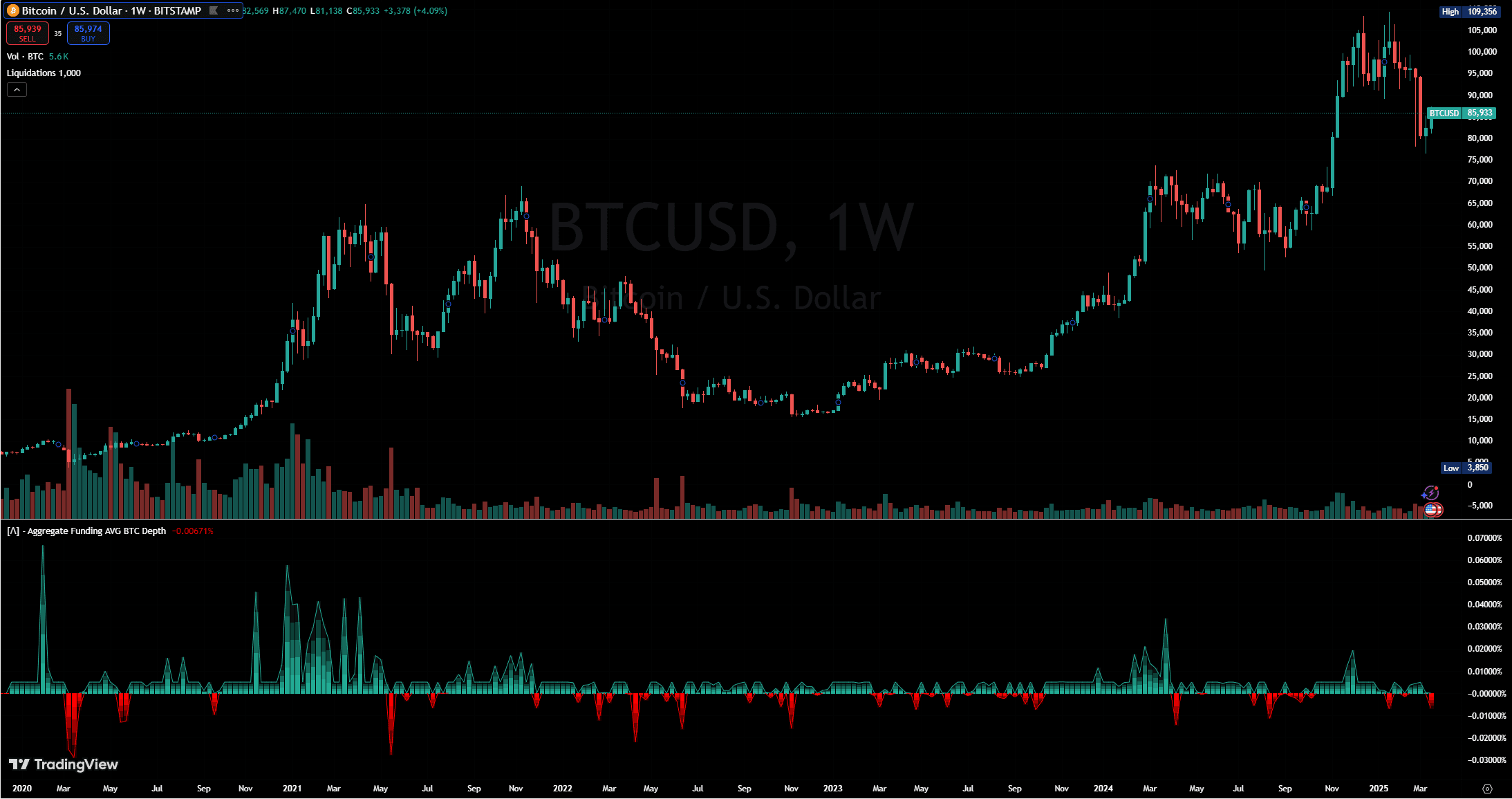

USDe’s revenue model is mostly based on funding rate arbitrage in perpetual futures markets rather than traditional interest-bearing assets like U.S. Treasuries. As we have seen, its delta-neutral strategy involves holding short positions in perpetual futures, benefiting from the fees paid by long traders when there is an imbalance in open interest.

When demand for long positions increases, funding rates rise, making it more expensive to hold long positions while providing a yield opportunity for short traders, including USDe. However, this revenue model is less directly influenced by traditional interest rate movements and instead depends on market volatility, trader positioning, and overall leverage demand in the crypto market.

The trend line shows a weak positive correlation (R = 0.256), suggesting that while higher interest rates may have some impact on USDe’s revenue, the relationship is not particularly strong.

This aligns with expectations, as USDe’s revenue model is primarily driven by perpetual futures market conditions rather than interest rate movements. Funding rates and leverage demand play a far more significant role in revenue generation than traditional rate hikes.

This correlation highlights how USDe’s yield depends on trader behavior rather than direct exposure to real-world interest rates. While lower interest rates can encourage greater risk-taking and leverage in crypto markets, USDe’s profitability remains tied to funding rate imbalances in perpetual futures trading.

5.Impact of Rates Dropping to 0%

Interest Rates

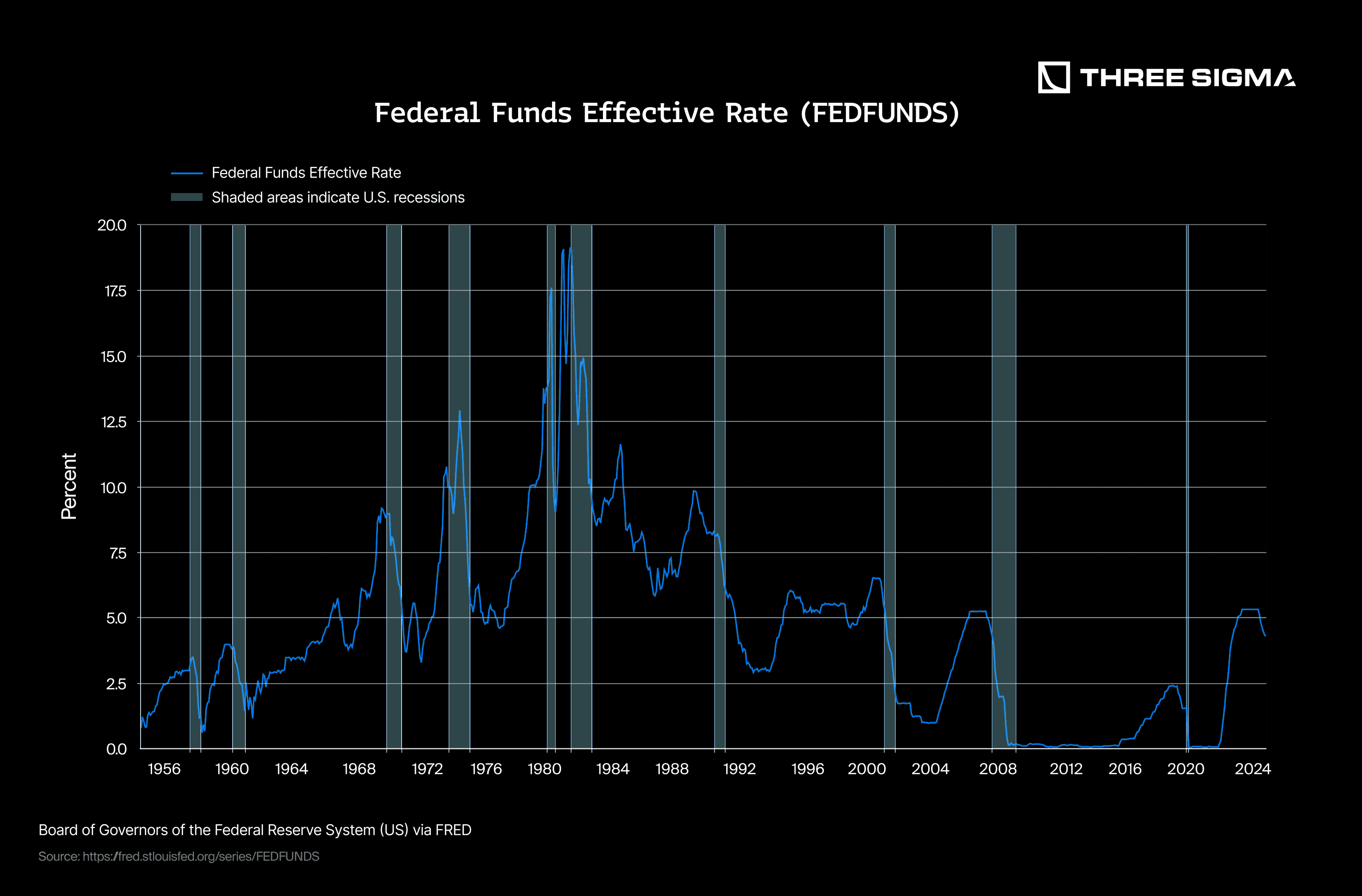

Interest rates represent the cost of borrowing money or, conversely, the compensation received for lending or depositing funds. Central banks, such as the U.S. Federal Reserve, set baseline interest rates (e.g., the Federal Funds Rate) to manage economic growth, control inflation, and stabilize financial systems. Lower interest rates typically encourage borrowing, stimulating economic activity but potentially fueling inflation. Conversely, higher rates discourage borrowing, slowing economic expansion but helping curb inflationary pressures. Historically, rates have fluctuated dramatically in response to economic cycles and crises, ranging from near-zero during economic downturns (e.g., 2008 Financial Crisis, COVID-19 pandemic) to significant hikes during periods of inflation (e.g., post-pandemic 2022-2024). Interest rate fluctuations directly influence yields on Treasury bills (T-Bills) and bonds, making them crucial for stablecoin issuers whose revenue heavily depends on returns from these investments.

Historical interest rates

The most critical interest rates to monitor are those set by the U.S. Federal Reserve, specifically the Federal Funds Rate, due to the global dominance of the U.S. dollar as the primary reserve currency and its extensive influence on international financial markets. Changes in U.S. rates significantly impact global economic activity, currency valuations, investment flows, and borrowing costs worldwide, making them a crucial benchmark for global financial stability.

The historical chart clearly illustrates several major rate cycles, including the record-high rates of the early 1980s to combat inflation, followed by a steady decline into the low-rate environment of the past two decades. The 2008 financial crisis notably forced rates to nearly zero to stimulate economic recovery.

Specifically, during the last interest rate cycle (2010-2020), the Federal Reserve maintained historically low rates (near 0%) for an extended period, gradually raising them between 2015 and 2018 as the economy recovered. However, the emergence of the COVID-19 pandemic in early 2020 triggered another aggressive cut back to near-zero levels, aiming to counteract economic slowdown, ensure liquidity, and stabilize financial markets.

Comparison of the correlation interest rates vs revenue for each one of the researched stablecoins

As we've already discussed, certain stablecoins have revenue models that are heavily dependent on interest rates, while others have structures that isolate them from these fluctuations.

The provided data clearly confirms this distinction. USDT, USDC, and SKY all demonstrate high correlations (R ~0.89–0.94), which underlines their significant dependency on prevailing interest rates. Their revenue largely originates from traditional investments such as Treasury securities, making them particularly susceptible in scenarios where interest rates approach zero, severely impacting their profitability.

In sharp contrast, USDe shows a notably weaker correlation (R = 0.256), reflecting its fundamentally different approach to revenue generation. Instead of relying on conventional, rate-sensitive assets, USDe's income streams are primarily derived from crypto-native mechanisms such as perpetual futures funding rate arbitrage and staking yields.

In summary, this data strongly indicates that fiat-backed and treasury-backed stablecoins (such as USDT, USDC, and SKY) face considerable risks in low-interest environments. Conversely, algorithmic stablecoins like USDe, with their alternative revenue strategies, demonstrate greater resilience and could even serve as strategic diversifiers within a portfolio, providing relative stability when interest rates decline.

0% interest rates scenario

In a scenario where interest rates return to 0%, the impact on stablecoins varies significantly based on their underlying revenue models and asset allocations:

Tether

Given that USDT primarily generates revenue through traditional financial assets like Treasury bills, a drop to 0% interest rates would severely diminish their revenue streams, heavily impacting profitability. However, Tether’s strategic diversification into alternative investments, including cryptocurrencies (BTC, ETH) and precious metals, could partially mitigate this effect. Nevertheless, these alternative assets introduce increased volatility and risk, and might not fully compensate for lost interest revenue, potentially weakening its overall market position.

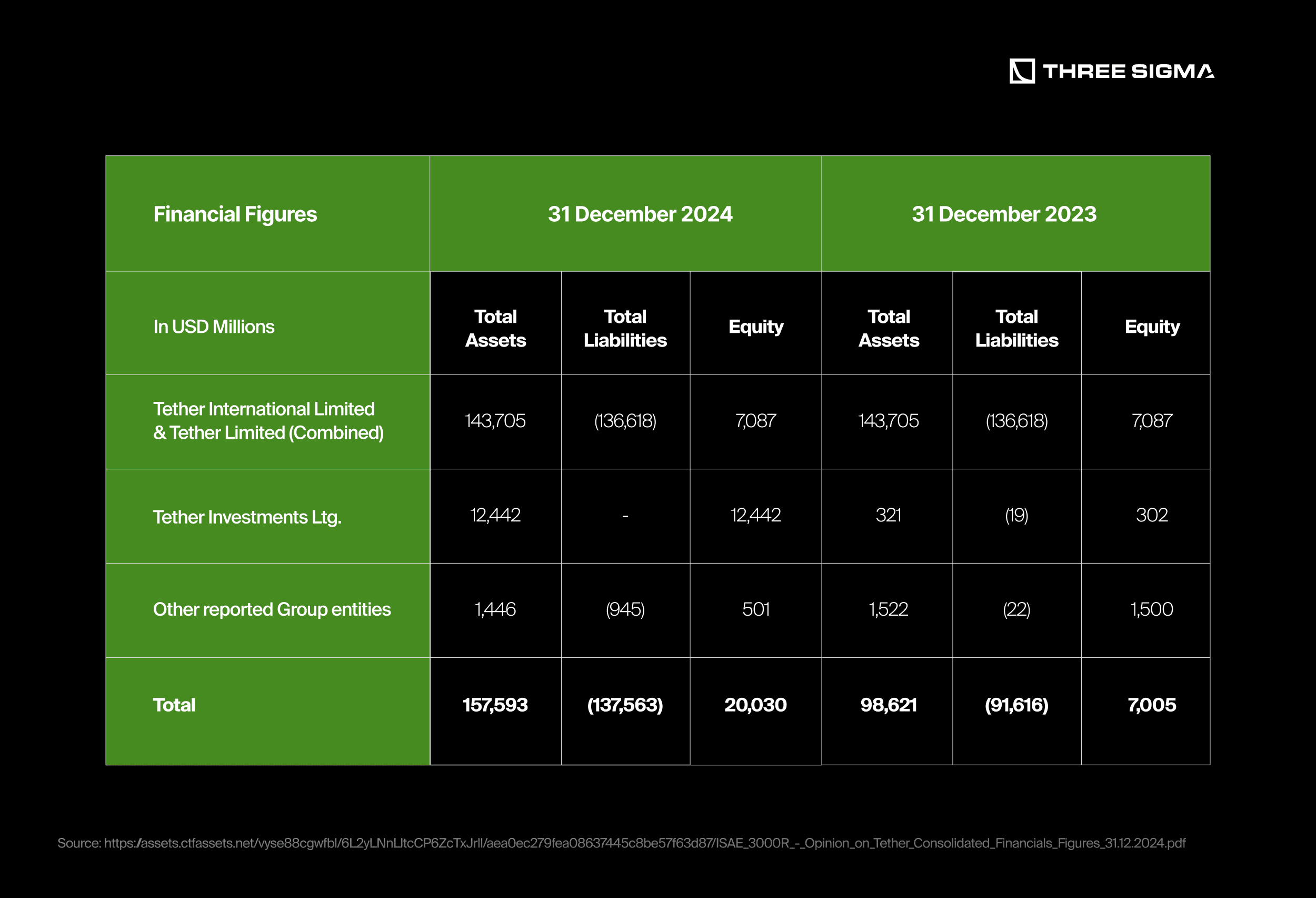

In 2024, Tether maintained exceptionally low operational expenses, driven by a lean structure of fewer than 50 employees, minimal administrative overhead, and negligible issuance and redemption costs for USDT tokens since fees collected generally covered these transactional expenses. Legal and regulatory expenses were modest, with no significant fines incurred during the year, contrasting previous settlements such as the $18.5 million fine paid to the NY Attorney General in 2021.

Financially, Tether ended 2024 with robust reserves, holding approximately $7.1 billion in excess reserves over and above its obligations to USDT holders, alongside a total equity of around $20 billion. Given its conservative annual operating expenses (likely under $100 million), Tether could sustain operations for more than 70 years even if future revenue dropped entirely to zero highlighting its exceptional financial stability and virtually indefinite runway.

Circle

Circle recently filed an S-1 registration statement with the U.S. Securities and Exchange Commission, signaling its intention to go public on the New York Stock Exchange under the ticker symbol “CRCL.”

In 2024, Circle reported total revenue of approximately $1.68 billion, a 16% increase from $1.45 billion in 2023. Notably, more than 99% of this revenue came from reserve income—primarily interest earned on assets backing USDC. The company’s net income from continuing operations was around $156 million in 2024, down significantly from approximately $268 million the previous year, largely due to increased operating and distribution expenses.

Operating expenses for 2024 totaled about $492 million, with significant allocations to compensation ($263 million), general and administrative costs ($137 million), IT infrastructure ($27 million), depreciation and amortization (approximately $51 million), marketing ($17 million), and losses on digital assets ($4 million). Additionally, Circle incurred roughly $1.01 billion in distribution and transaction costs, with approximately $908 million paid to Coinbase, its primary distribution partner.

As of December 31, 2024, Circle held $751 million in cash and cash equivalents, as well as an additional $294 million in other liquid investments, bringing total available liquidity to approximately $1.045 billion. When estimating the company’s financial runway in a zero-revenue scenario, it’s important to distinguish between these two categories:

- The $751 million in cash and cash equivalents represents highly liquid, immediately accessible funds—ideal for a conservative runway estimate. Based solely on this, and assuming current annual operating expenses of $492 million, Circle would have a financial runway of around 18 months.

- Including the full $1.045 billion in total liquidity (cash plus other liquid assets), and assuming those additional assets are readily accessible and not restricted, the runway could extend to approximately 25 months.

The more conservative approach focuses only on cash equivalents to avoid relying on potentially less liquid or encumbered assets. However, if Circle can tap into the broader liquidity pool without issue, it would have more flexibility.

In a prolonged zero-interest-rate environment, Circle’s heavy reliance on interest income from reserves could significantly impact its revenue streams. Without effective diversification into alternative revenue sources, the company’s profitability might be adversely affected, potentially necessitating strategic adjustments such as revising fee structures or exploring new investment avenues.

SKY

In a 0% interest rate environment, Sky Protocol (formerly MakerDAO) would indeed face significant challenges, particularly concerning its revenue streams and financial sustainability. The protocol's reliance on U.S. Treasuries, ETH staking rewards, and DeFi revenues means that a complete absence of interest could substantially impact its income.

Revenue Streams Under Pressure:

- Stability Fees and Borrowing Demand: With reduced borrowing demand, stability fees from DAI loans would likely decline. This decrease, coupled with diminished yields from U.S. Treasuries and other bonds, could strain the protocol's financial health.

- DeFi Funding Fees: In a low-rate environment, traders may be less inclined to engage in leveraged positions, leading to a reduction in funding fees from DeFi activities.

Historically, Sky Protocol has demonstrated adaptability to low-rate environments by adjusting parameters like the Sky Savings Rate (SSR). For instance, the SSR was recently reduced to 4.5%, effective from March 24, 2025, to align with current market conditions.

Sky Protocol's total treasury is valued at approximately $220 million, comprised of:

- $101M in DAI – Stable

- $82.2M in SKY tokens – Volatile

- $36.4M in MKR tokens – Volatile

- $243K in stkAAVE – Volatile

- $470K in ENS – Volatile

The total value of $220M combines both liquid assets like DAI and volatile tokens like SKY and MKR, which could fluctuate depending on market conditions. The liquid assets are the most readily available for the protocol's operational needs, while the volatile tokens represent a more strategic asset class, subject to market volatility.

The runway is the amount of time Sky Protocol can continue to operate without generating new revenue, based on its current treasury and annual operational expenses. The protocol’s estimated annual operational expenses are ≈$35M. Here’s how the runway is calculated:

- If considering only liquid assets (DAI): Runway = $101M ÷ $35M = 2.89 years

- If considering the total treasury at current prices (liquid + volatile assets): Runway = $220M ÷ $35M = 6.29 years

Sky Protocol's financial sustainability in a 0% interest rate scenario heavily depends on the value of its volatile assets like SKY and MKR tokens, which could fluctuate and impact the total runway. However, based on the DAI system surplus alone, Sky Protocol can sustain operations for approximately 2.89 years without generating additional revenue. Including the entire treasury (liquid and volatile assets), Sky could sustain operations for approximately 6.29 years, assuming no other major disruptions or changes in the market.

As a protocol that has historically demonstrated adaptability, Sky Protocol can adjust its fee structure and make strategic shifts in its asset allocations to weather a prolonged low-interest-rate environment.

Ethena

If the Federal Reserve lowers interest rates to 0%, several factors can influence USDe’s ability to sustain and even increase its yield. Lower interest rates reduce the cost of borrowing, making leverage more attractive for traders and investors. In traditional markets, this tends to push capital into riskier assets, as lower returns in fixed-income instruments encourage investors to seek higher yields elsewhere. The same dynamic applies to the crypto market, a lower-rate environment often results in an influx of capital into cryptocurrencies like Bitcoin and Ethereum.

With more liquidity available, traders are more inclined to take leveraged long positions on crypto assets, expecting continued price appreciation. This creates an imbalance in perpetual futures markets, where demand for long positions surpasses demand for shorts. As a result, funding rates increase, making it more expensive for traders to hold long positions while benefiting those who are short, such as the USDe strategy does.

Yet, this benefit is not without its potential risks. If interest rates remain low for a prolonged period, the yield generated by USDe might eventually stabilize or even decrease as market participants adjust their strategies to the new normal. This adjustment could manifest in various forms, such as reduced leverage or changing trading tactics. Moreover, while a low-rate environment initially supports USDe’s yield generation through its exposure to perpetual funding rates, the prolonged stability of these conditions could incentivize a shift in investor behavior, shifting away from the assets that currently generate the highest yield.

From a protocol-level perspective, Ethena is financially well-positioned. The project has raised over $120 million through venture funding and token sales, and maintains a reserve fund currently holding around $61 million, verifiable on-chain via wallet 0x2b5ab59163a6e93b4486f6055d33ca4a115dd4d5. This reserve acts as a buffer during negative yield environments and supports the stability of USDe. Ethena also operates with a lean team, with estimated annual operating expenses between $2M-$5M, giving the project a multi-year runway even if protocol revenues were to shrink significantly.

In conclusion, while a low interest rate environment presents a unique opportunity for USDe to remain attractive in the short term, its long-term sustainability depends on continued market activity and volatility. That said, Ethena’s strong treasury position and low burn rate offer a solid financial cushion, ensuring that the protocol can weather prolonged low-yield periods without compromising its core stability.

6. Conclusions

The stablecoin landscape is intricately tied to macroeconomic dynamics, particularly interest rates. As this analysis demonstrates, the performance and sustainability of each stablecoin model diverge significantly in a scenario where interest rates drop to 0%.

- Most Exposed: USDC, which relies almost entirely on returns from U.S. Treasuries, would face the steepest revenue decline. Without meaningful diversification its business model becomes structurally fragile in prolonged low-rate environments. High operational costs and a relatively limited treasury reserve further constrain Circle’s long-term runway.

- Significantly Impacted but More Resilient: USDT and SKY would also see considerable revenue compression due to their reliance on interest-bearing assets. However, both benefit from buffers.

- Tether (USDT) holds a large treasury surplus, minimal operating expenses, and some exposure to diversified investments (e.g., Bitcoin, gold), granting it an extended financial runway even under zero-interest conditions.

- SKY (USDS/DAI) is similarly exposed to falling yields. However, it maintains a blend of revenue sources via DeFi-native mechanisms such as protocol fees, crypto collateral liquidations, and smart contract lending, which provide operational flexibility. Additionally, the protocol can fall back on governance token sales to cover expenses if needed, as evidenced in past cycles.

- Least Impacted / Most Adaptable: Ethena (USDe) Stands out with its crypto-native, market-driven revenue model, which does not rely on interest-bearing instruments. Instead, Ethena captures value from perpetual futures funding rates, staking rewards, and market inefficiencies. In a 0% interest rate world, USDe could even benefit from increased leverage and speculation, making it one of the few stablecoins positioned to thrive when others contract. That said, in the long run, a prolonged low-interest environment can lead to neutral or bearish market conditions, which may reduce Ethena’s profitability. In fact, during periods where funding rates turn strongly negative for shorts, the protocol could even face temporary losses.

This comparative analysis highlights a key insight: revenue diversification is no longer optional, it is essential. In a world where interest rates may return to historical lows, stablecoin issuers overly reliant on traditional finance instruments risk significant profitability declines. Protocols with flexible, crypto-native revenue engines, especially those like USDe, may not only weather the storm but emerge stronger.

Ultimately, sustainability in the stablecoin market will be dictated not just by peg stability or adoption, but by resilience across economic regimes. Those who adapt whether through product innovation, diversified collateral, or yield mechanisms will define the next generation of digital dollars.

As a final note, it’s worth pointing out that both Circle and Tether may already be preparing for a world of lower interest revenues. Each is actively building or contributing to its own blockchain infrastructure: Circle with Cortex and Tether with Plasma. These efforts seem aimed at diversifying their service offerings and potentially opening up new revenue streams beyond treasury yield.

Additionally, Circle’s IPO announcement came just as we were wrapping up our research. The details disclosed align closely with the vulnerabilities and strategic directions we identified, particularly the need to diversify and scale through new ventures. The IPO could represent both a liquidity event and a pivot toward a more service and infrastructure-oriented business model.

And finally, one can only speculate whether Circle has one more card up its sleeve. Could it be quietly positioning itself to become the official issuer of a digital USD? While no formal announcements confirm this, such a move would certainly align with its regulatory-first approach and U.S. partnerships. Who knows.