Introduction

This is the fourth and final part of our series on DeFi options protocols. This article analyzes liquidity, trading volume, capital efficiency, tokenomics, fees, and structured product performance. It highlights capital rotation cycles and the impact of incentives on trading volume.

In the previous articles, we covered the basics of DeFi options, their market overview, the pricing models used by various protocols, and DeFi options collateralization. If you have not yet read the first, second, and third parts of this options series, it is highly recommended to have a look.

This Options Series takes an in-depth look at the following 33 protocols:

- AEVO, Cally, Cega, DoPeX, Friktion, GammaSwap, Hegic, JonesDAO, Katana, Knox Vaults, Lyra, Oddz, Opium, Opyn, Panoptic, PODS, Polynomial, Polysynth (now Olive), Premia, Primitive, PsyFi, PsyOptions, Ribbon, RYSK, Siren, Smilee, StakeDAO, Synquote, Thales, ThetaNuts, Ntropika, IVX and Zeta.

We considered but excluded 15 other protocols from our analysis because they stopped operating, changed their focus, or had no publicly available information.

- Auctus, Arrows Market, Potion Labs, Buffer Finance, Charm.fi, Dexilion, Everest DAO, Exotic Markets, FinNexus, Kibo Finance, Lien, Phoneix Finance, Risq, Shield, Toros.Finance, Valorem, and Whiteheart. During the writing of this article, Friktion was officially sunset.

Liquidity (Capital Utilization & Volume)

When discussing DeFi protocols, TVL has been widely used as the key metric to analyze the success or failure of a protocol. While that metric can be suited for vault-alike protocols like Yearn or other vault-based protocol, where the TVL is similar to AUM in TradFi, for the options trading protocols, it might not be the best.

Nonetheless, TVL provides a quick overview of where liquidity was flowing in and out. When it is paired with other metrics, such as trading volume, and provided with some context, it can be relevant.

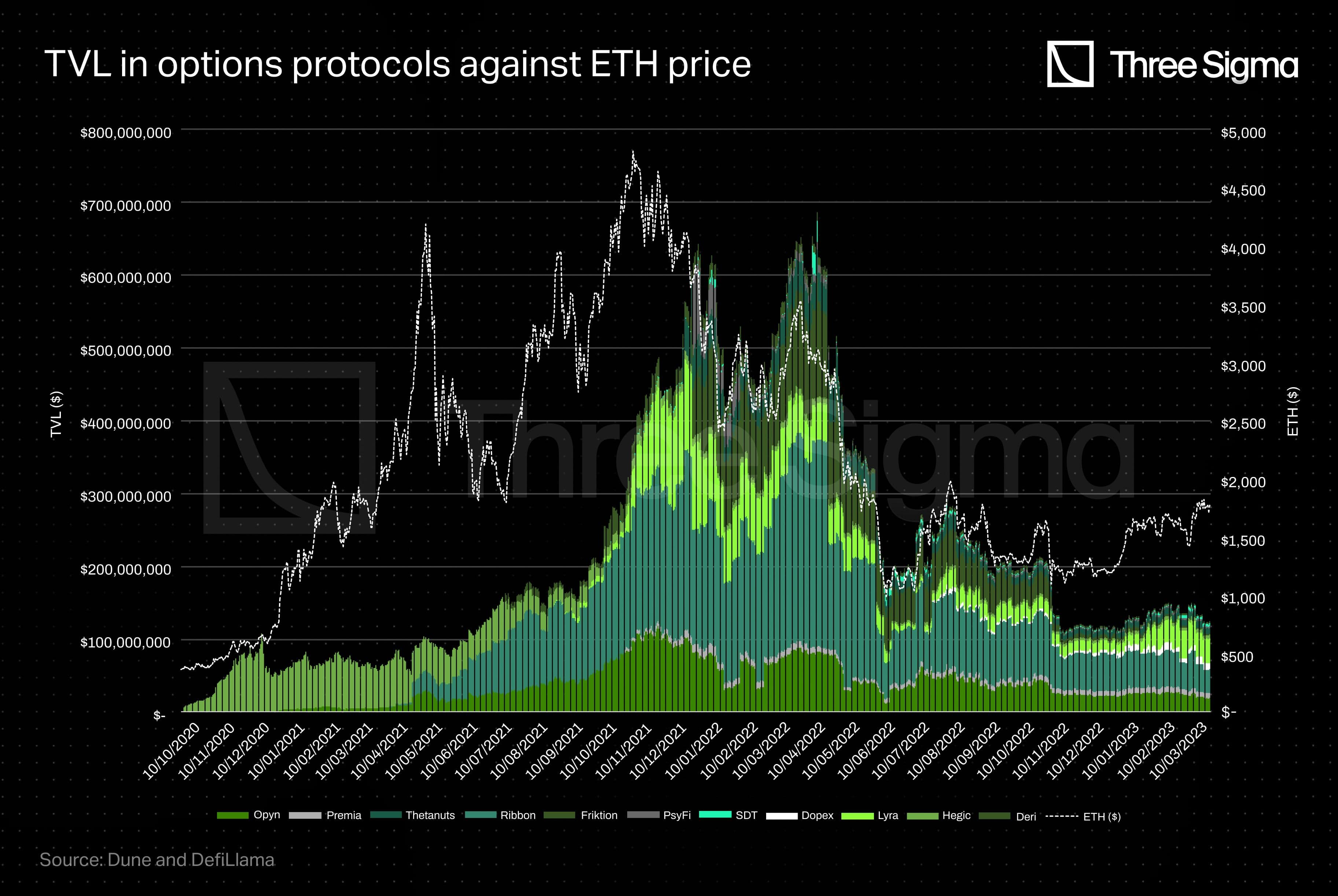

Two notable events that had an impact on the total value locked (TVL) were the launches of Lyra and Ribbon Vaults. These events caused TVL to spike. It is worth noting that during the latter part of the bull run in 2021 and the start of the bear market in 2022, TVL held steady until the Terra Luna crash.

After that, several factors likely contributed to the decline in TVL, such as the negative price action of volatile assets used as collateral, traders leaving due to a lack of upward movement, and reduced volatility in the market.

TVL

Order books

In the specific case of order books, TVL is not a great metric. That is because there isn’t a pool of assets waiting for a trade to appear, it’s rather PvP in nature. In any case, the TVL would be equal to the liquidity locked as collateral plus options premiums waiting to be distributed to the sellers, if not distributed automatically.

Under this context, Opyn has been used as settlement layer for Ribbon, StakeDAO, and others during a long time. For that reason, using TVL as metric, Opyn would be the best order book, even though there’s no liquidity in the order book per se. All options minted are settled on auctions off-chain.

AMMs

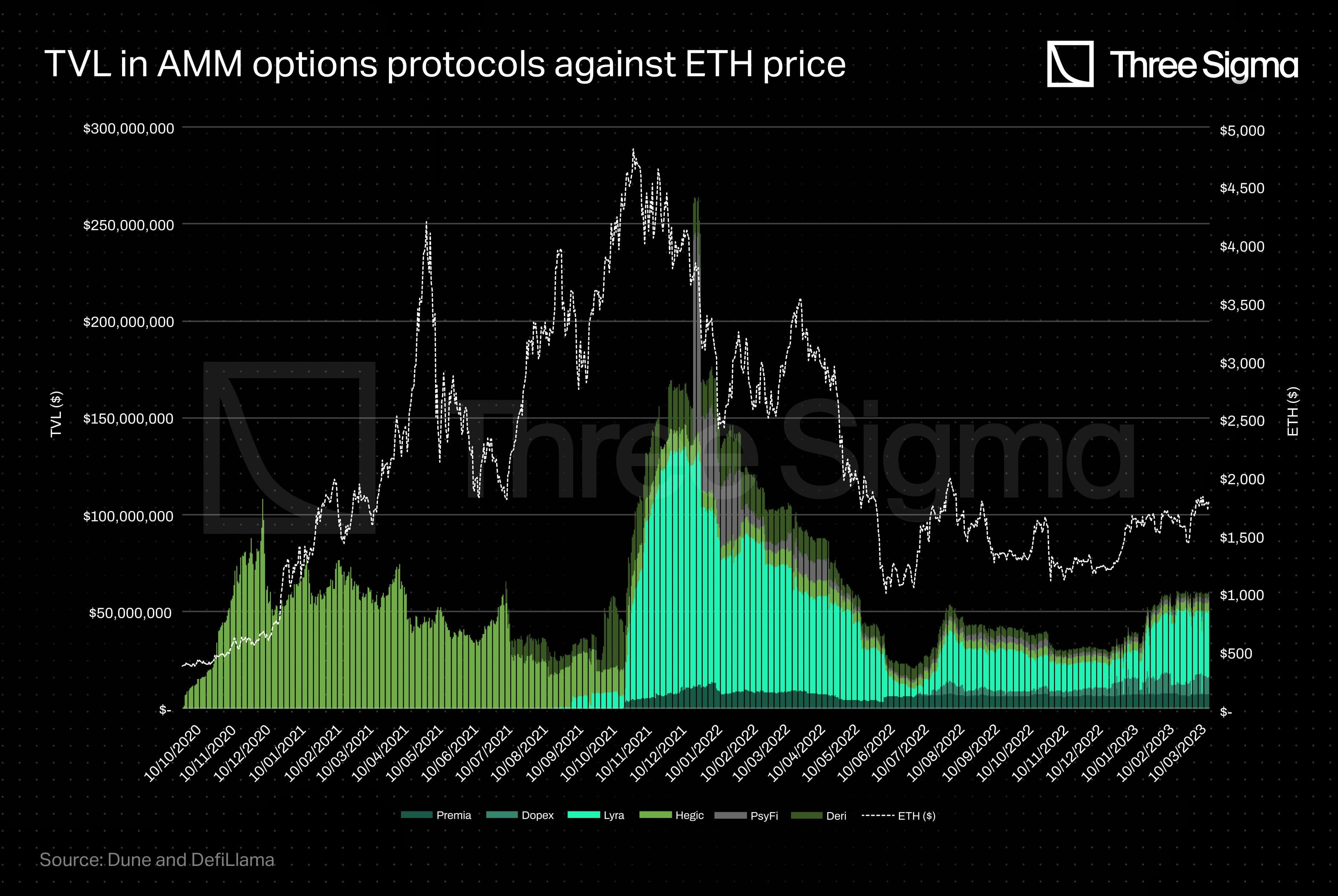

In AMMs the TVL reflects the amount of liquidity awaiting traders to come and use it. In contrast with order books, there are liquidity pools, so that the TVL is not only used as collateral but it is also the available liquidity.

We can broadly observe three periods.

- Hegic was the first options protocol to reach over $100m in TVL, even when ETH was trading at sub $600. However, Hegic faced challenges such as losses for LPs - check these Dune charts for ETH and BTC pools - and a lack of clarity surrounding its operational mechanisms. Despite these issues, alternatives to Hegic were limited during this period.

- Premia, Lyra, and Dopex launched throughout Q4 2021, coinciding with the peak of the previous bull market when ETH prices ranged around $3000 to $4000. The overall TVL was substantially higher, but so was the price of ETH. Additionally, Lyra's TVL experienced a significant boost when its token was launched alongside an incentives program. However, when the incentives ended, the TVL declined along with negative price action.

- Following market turbulence in 2022, particularly after the Terra Luna collapse, TVLs drop 80% in dollar terms and there is a 70% decline in ETH terms from their respective all-time highs.

Our data might not completely match the data from DeFi Llama and other data sources. That is mostly due to what is considered to be the TVL as well as what is included. For example, is governance token staking part of the TVL? Is the staking of LP tokens on AMM to provide liquidity for governance tokens also part of the options TVL? We tend not to consider these.

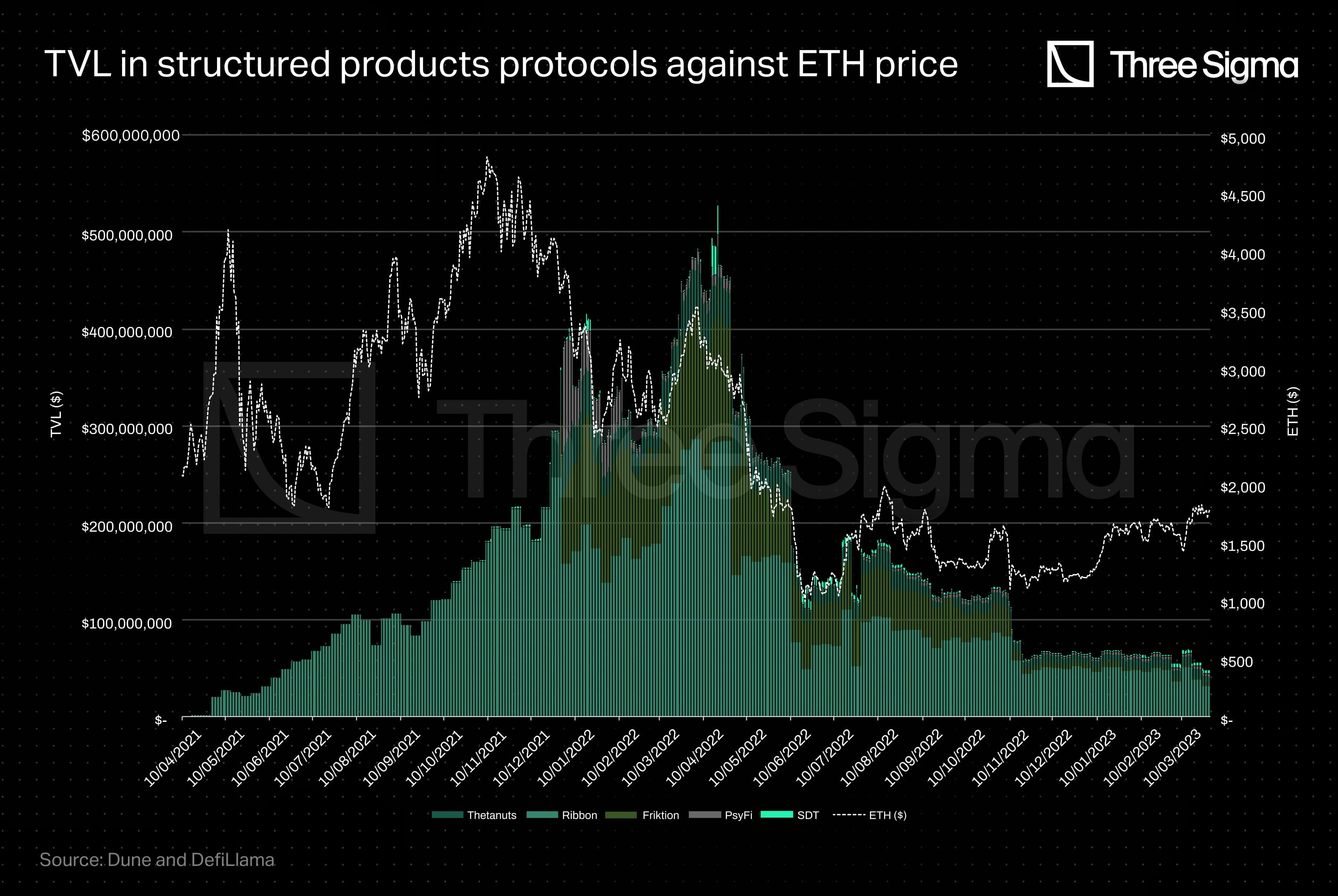

Structured Products

The structured products experienced a notable increase in TVL during the last quarter of 2021 and throughout H1 2022, until the the Terra Luna collapse. The value proposition of earning passive yield on one's preferred cryptocurrency gained substantial traction as many Ribbon copycats were spun out. However, it is crucial to consider the potential downside risk in the event of adverse outcomes. Ribbon, in particular, has predominantly encountered losses as a result of their strategic approach. Further on this topic below.

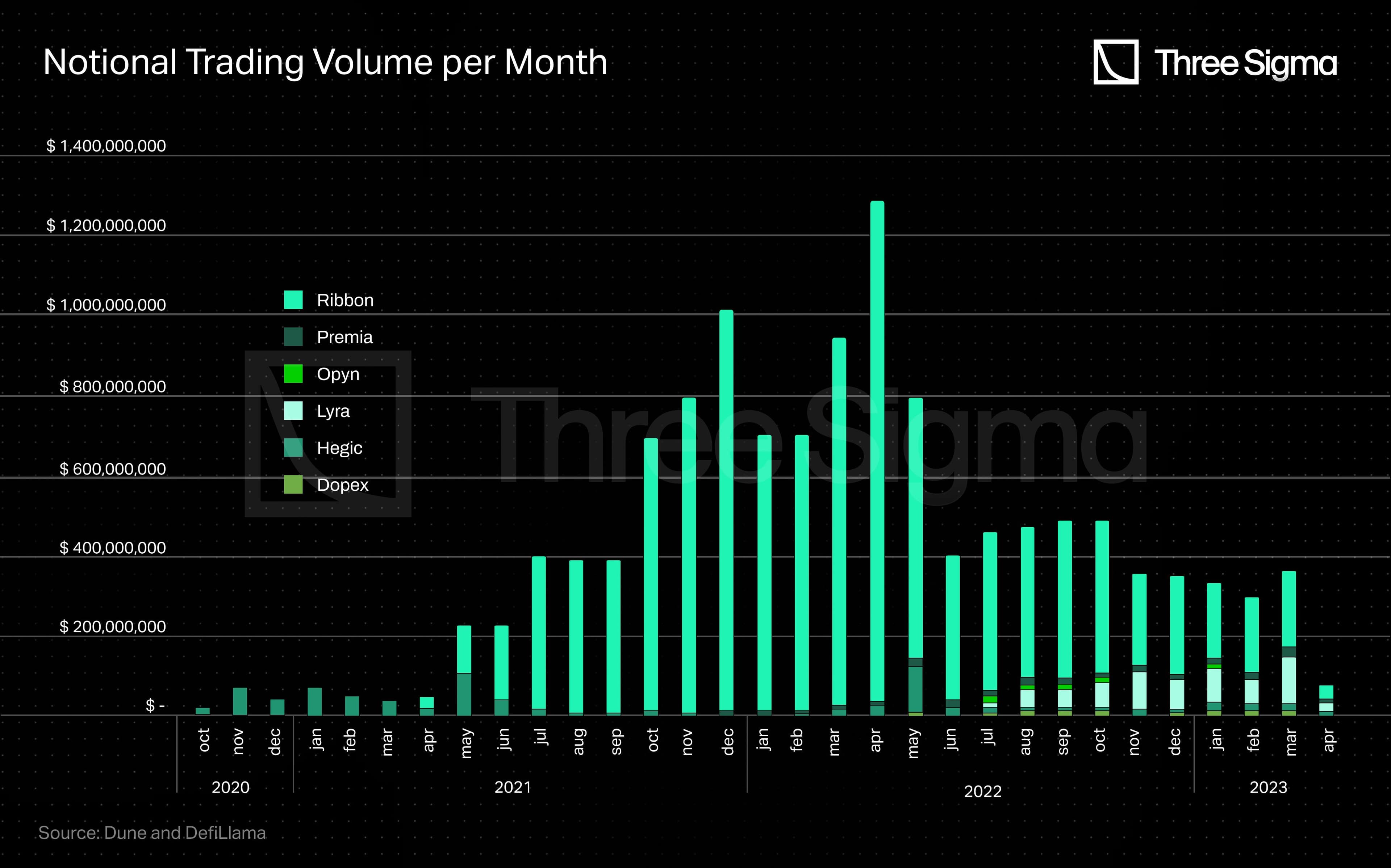

Trading Volume & Capital Efficiency

As previously mentioned, focusing solely on the TVL can be somewhat futile, as it tends to be more of a vanity metric, especially considering the potential liquidity mining incentives provided to LPs. Does it matter if there are hundreds of dollars in liquidity if no one is trading on a platform? Instead, it is more meaningful to compare the trading volume across different platforms.

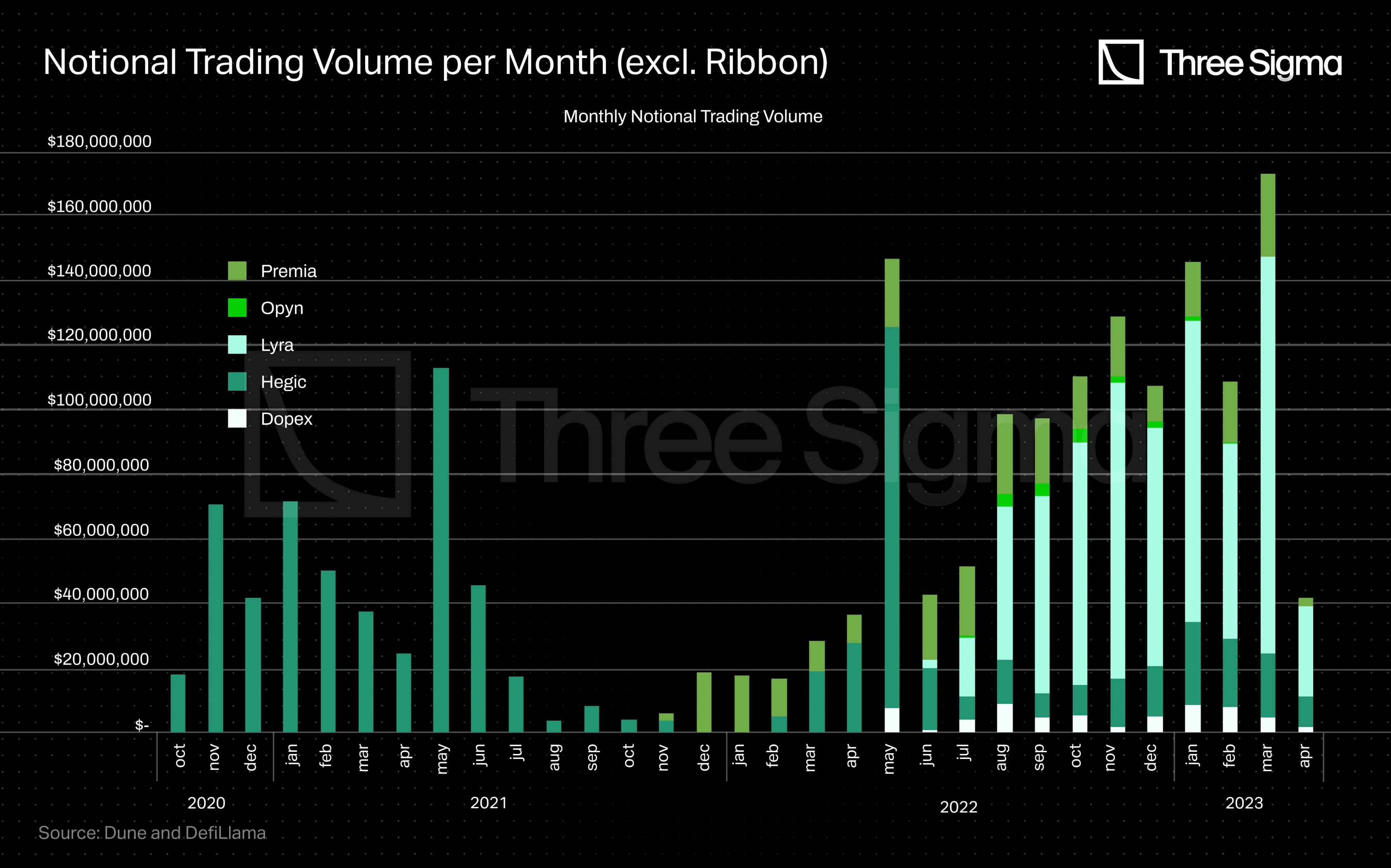

Excluding Ribbon to have a clearer comparison.

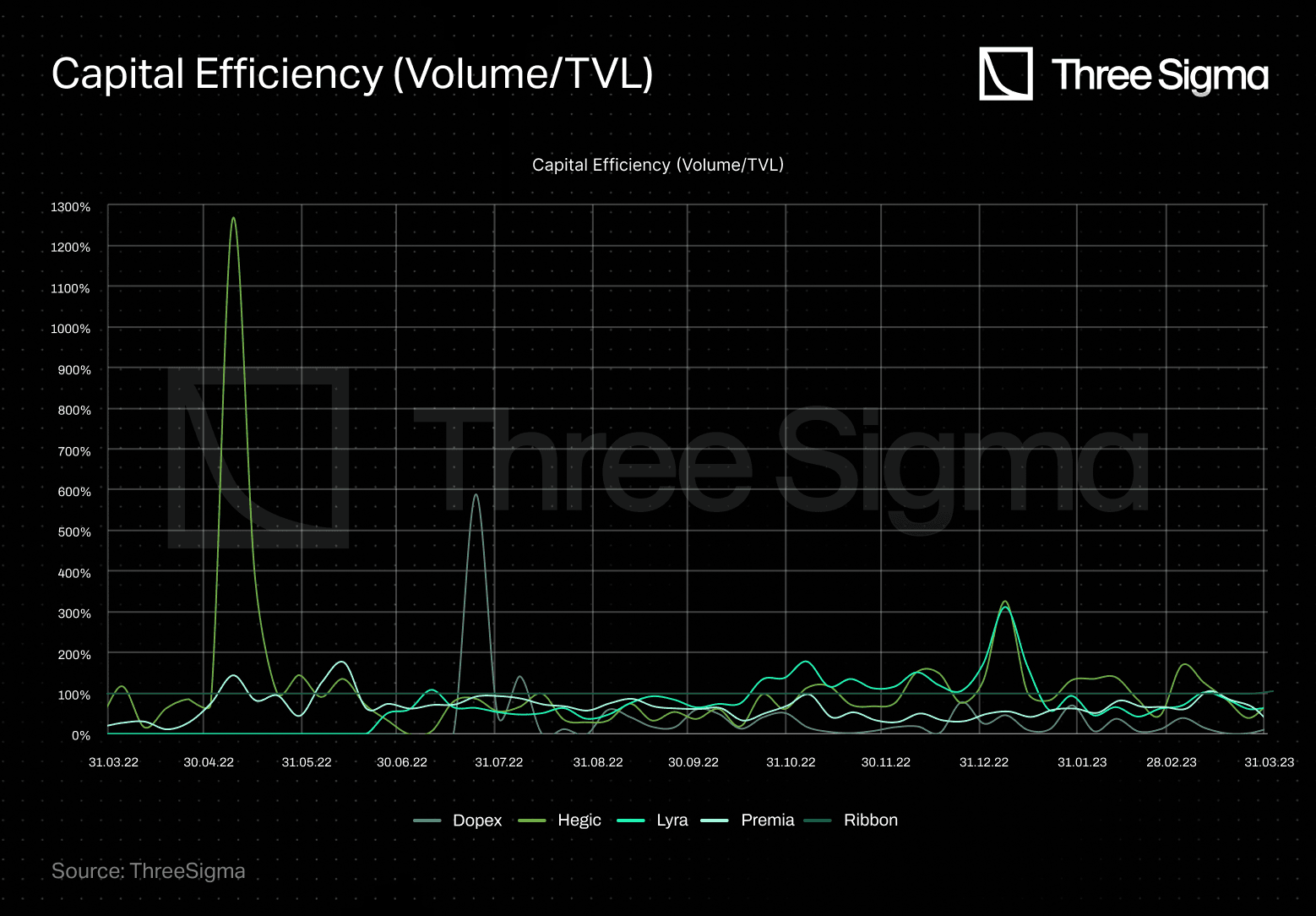

Recognizing that TVL represents liquidity, it is more insightful to assess the "capital efficiency" of these platforms, specifically through the volume-to-TVL ratio. This ratio examines the relationship between the trading volume and the TVL. Why is this important? It allows one to compare the trading volumes, taking into account how much liquidity is sitting in the protocols. It also allows one to interpret how much trading volume $1 in liquidity facilitates over the span of 7 days.

Below, we’ve represented Dopex, Hegic, Lyra, Premia, and Ribbon.

Note: The chart utilizes the notional traded volume over a 7-day period relative to the TVL at the beginning of that week. Therefore, even if the ratio exceeds 100%, it does not necessarily imply that trades were undercollateralized; it indicates a high utilization of the available liquidity. Source: Dune and DefiLlama

Tokenomics

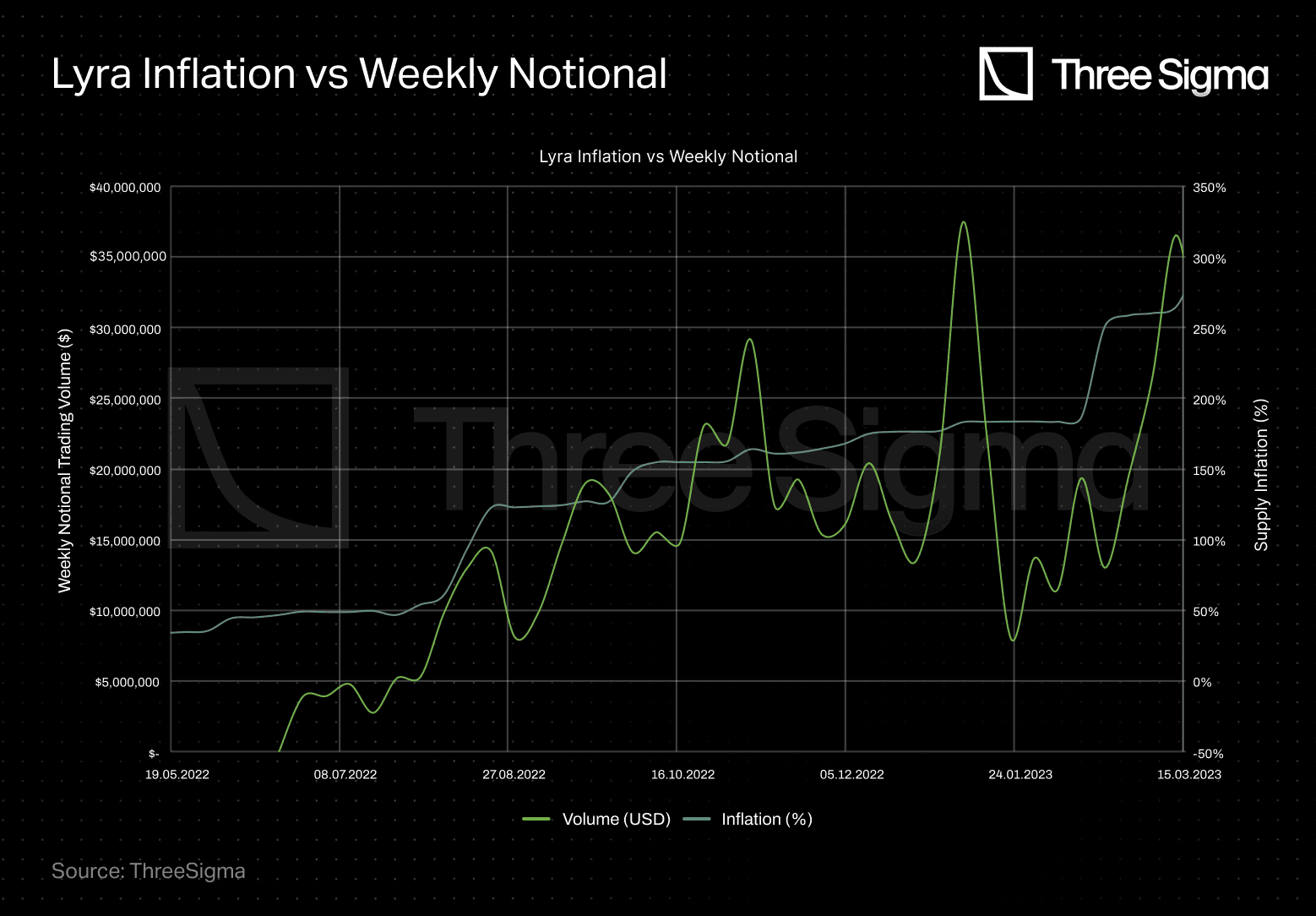

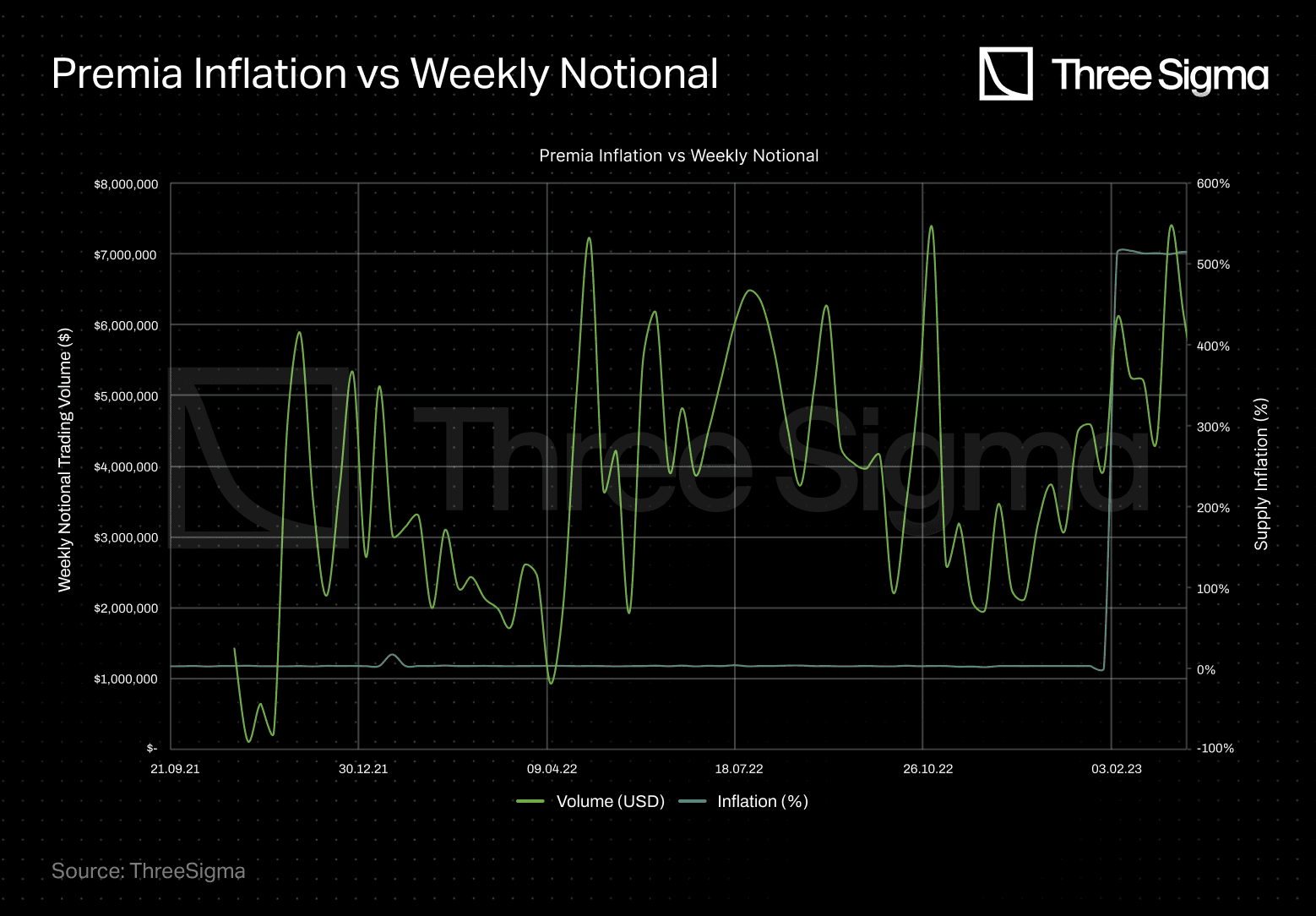

To what extent was the trading volume incentivized by these protocols with tokens? For example, on Lyra there were LYRA rewards and OP rewards/airdrops. It becomes challenging to determine and pinpoint the precise impact. It is evident that there was a shift in user behavior following the occurrence of the OP airdrop, resulting in a decline in trading activities on Lyra. Similarly, the occurrence of the ARB airdrop led to a decrease in trading on Premia.

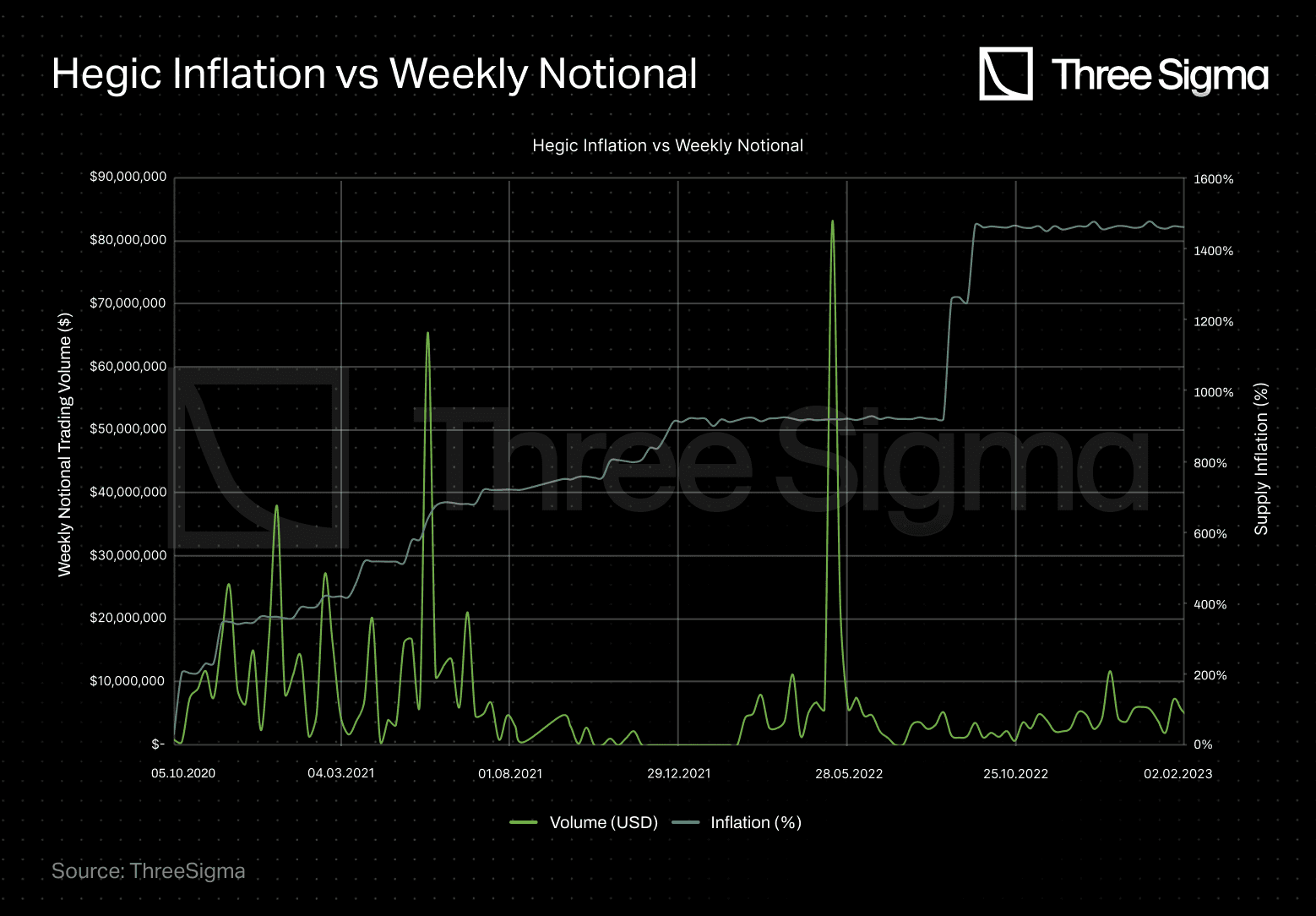

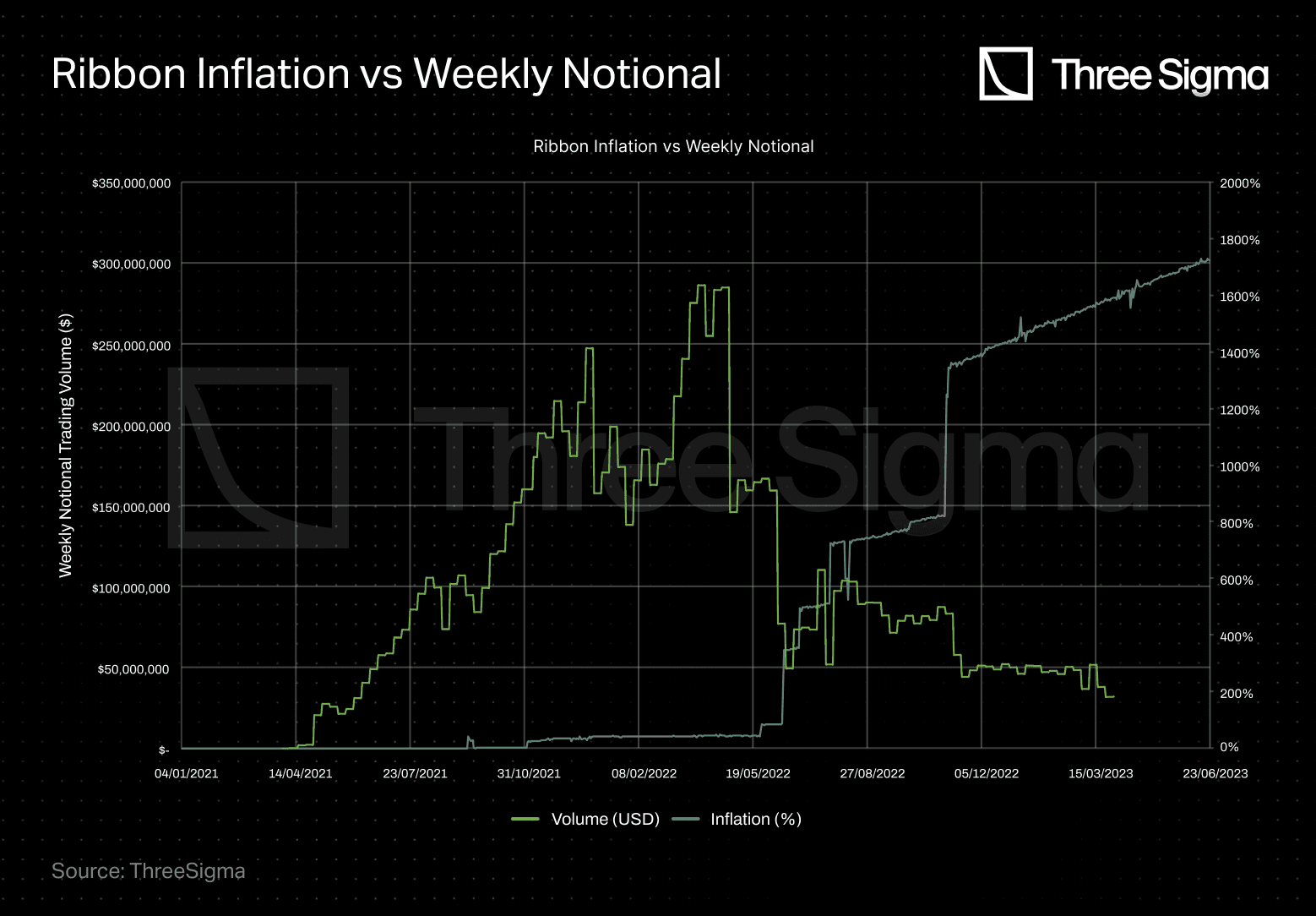

Nevertheless, we can conduct an analysis by comparing token inflation with trading volume to establish a correlation, even though imperfect - we are not analyzing if there were traders who were both long and short solely to farm the rewards -, between the quantity of tokens distributed through incentive campaigns and the trading volumes observed on the protocols.

Below, it can be observed that there is a moderate correlation between token inflation and trading volume in the cases of Lyra and Ribbon. However, such a correlation is not evident in the case of Hegic. Furthermore, Premia shows no correlation due to the absence of emissions. It is important to repeat and acknowledge that this analysis does not account for potential L2 airdrop farmers on OP or ARB, which could introduce additional dynamics to the observed trends.

Fees

Fees are a critical component for traders as they directly impact their profit and loss (PnL). To understand fees, we must take a step back and comprehend why they exist. They are necessary because protocols need revenue. The main drivers for this are:

- Generated as a percentage of trading volume, premiums, collateral, or other sources.

- Protocols that operate as their own market makers generate revenue from premiums earned by selling options.

- For protocols that operate with 3rd party market makers, they can earn revenue through PFOF (payment for order flow), which is a practice where market makers pay brokers to execute trades on behalf of their clients, allowing market makers to earn from the spread.

However, it's important to remain skeptical of the assumption that revenue generated by the protocols is equivalent to the premiums generated by being short on volatility.

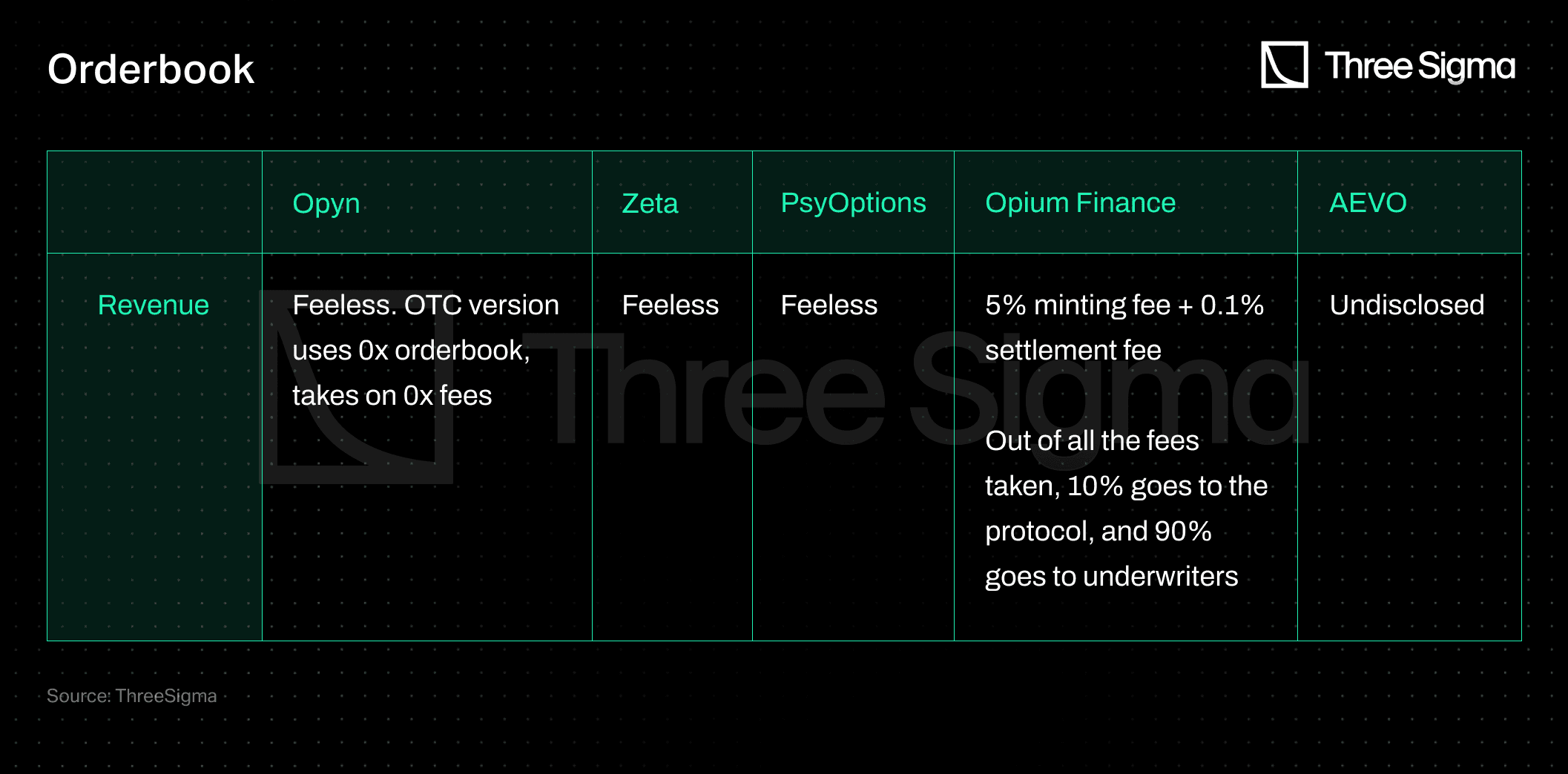

One notable difference is the presence or absence of fees. The majority of order books, like Opyn and Zeta, are "feeless" and do not charge any fees for their services. Others, like Opium Finance, have a fixed fee structure with a 5% minting fee and a 0.1% settlement fee.

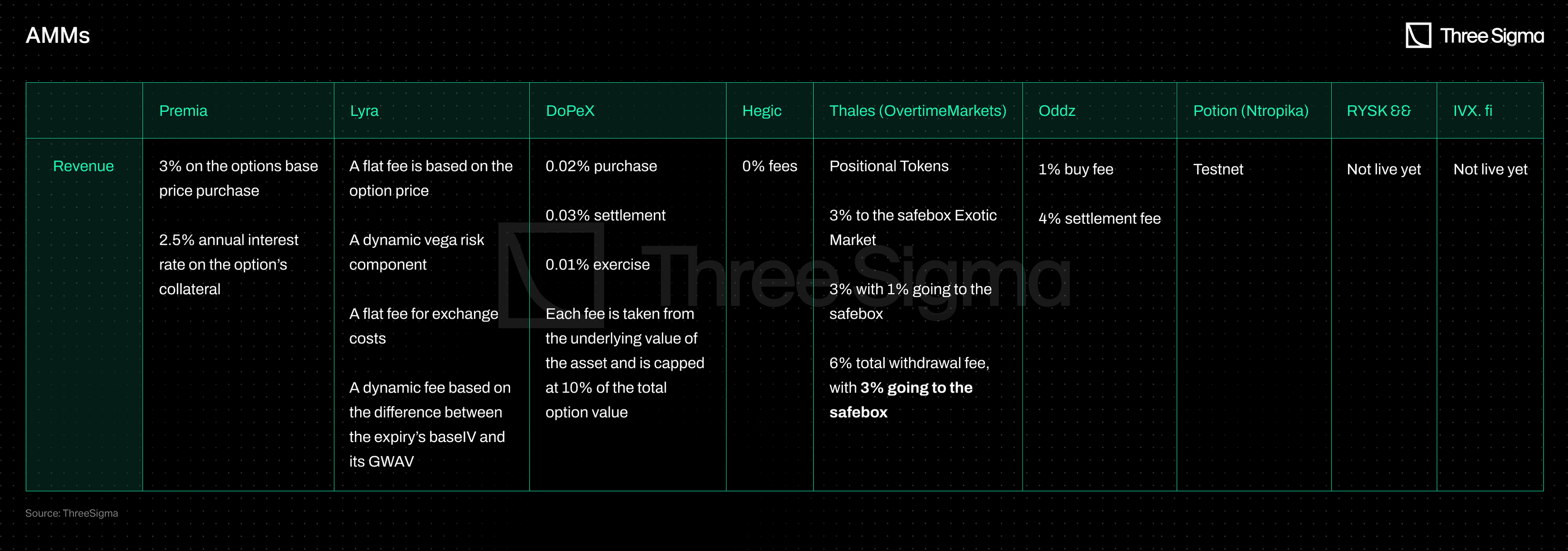

For AMMs, there is a feeless platform, like Hegic, or DoPeX that has low fees. Protocols offer a flat fee that is easy to understand for their users, with the exception of Lyra which has dynamic fees.

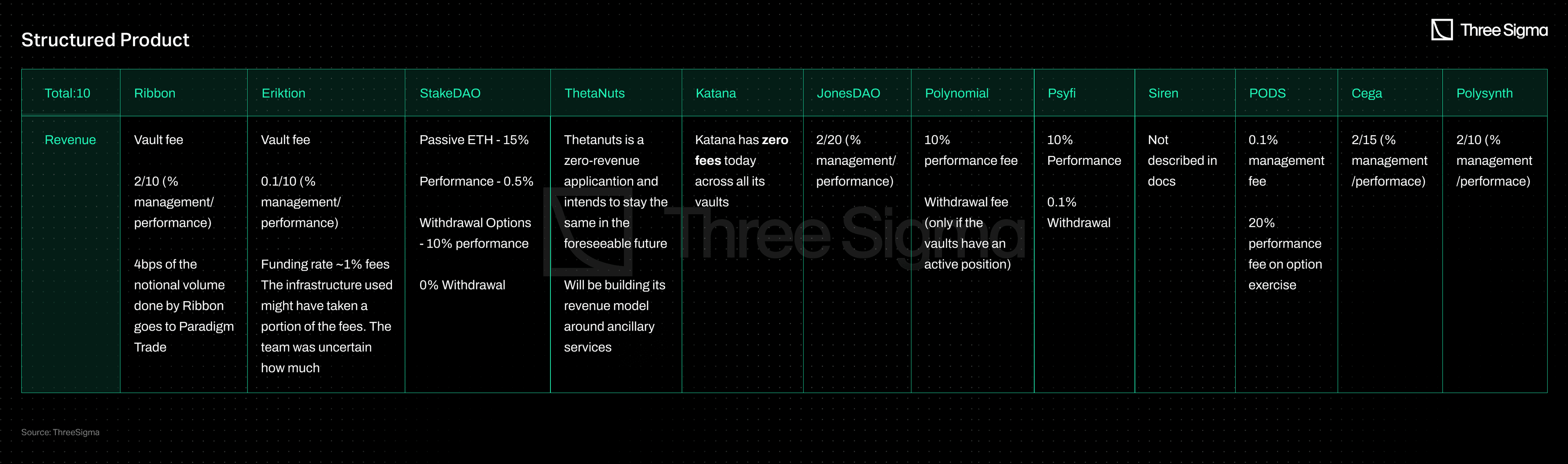

Regarding structured products, as most of them are built on top of order books, they are feeless. Usually, these products follow a look-alike hedge fund fee structure, where they take an initial management fee and a further performance fee. Some protocols, instead of taking an upfront management fee, take a withdrawal fee.

Orderbook:

AMMs:

Structured Product:

AMM Powered:

Both GammaSwap and Smilee have not yet disclosed their fee structures. Panoptic charges a flat 10 bps fee; which is paid both by buyers and sellers to Panoptic LPs.

Structured Product Performance

While the goal of this report is to provide a comparison of how the different protocols on DeFi options work, it is also important to comment on the performance of the different structured vaults given that they attracted a substantial inflow of funds during 2021 and 2022.

The two most prevalent strategies employed are covered calls and put selling:

- Covered calls involve writing (selling) call options on an underlying that the seller already owns, with the goal of generating additional income from the underlying through the option premium. The call option loses money when the price of assets rises, while holding the underlying does the opposite.

- Put selling involves writing (selling) put options with the goal of generating income from the option premium. The strategy loses money when the prices of the assets collapse.

Overall, these protocols can be seen as selling volatility, as the optimal outcome is for the call or put option to expire out-of-the-money (OTM) while the underlying asset remains stable. For instance, in the case of a covered call scenario, if ETH experiences a 30% increase within a week, the option expires in-the-money (ITM), resulting in the short side paying the long side. As a result, an initial holding of 100 ETH reduces to 90 ETH, but the underlying asset value has risen by 30%.

Furthermore, it has become common for DOVs (including Ribbon, among others) to face front-running issues, as observed by @OssaCapital (here):

- 30.09.2022, call options with a strike of 21.5k:

- Deribit OB Price 0.003-0.0035 ETH

- Paradigm GRFQ 0.0028-0.0034 ETH

- Execution Price 0.0027 ETH

In this particular case, a market maker could have bought on the auction the options at 0.0027 ETH and could have sold them intraday between 0.0028 and 0.0035, netting around 4% to 30% return.

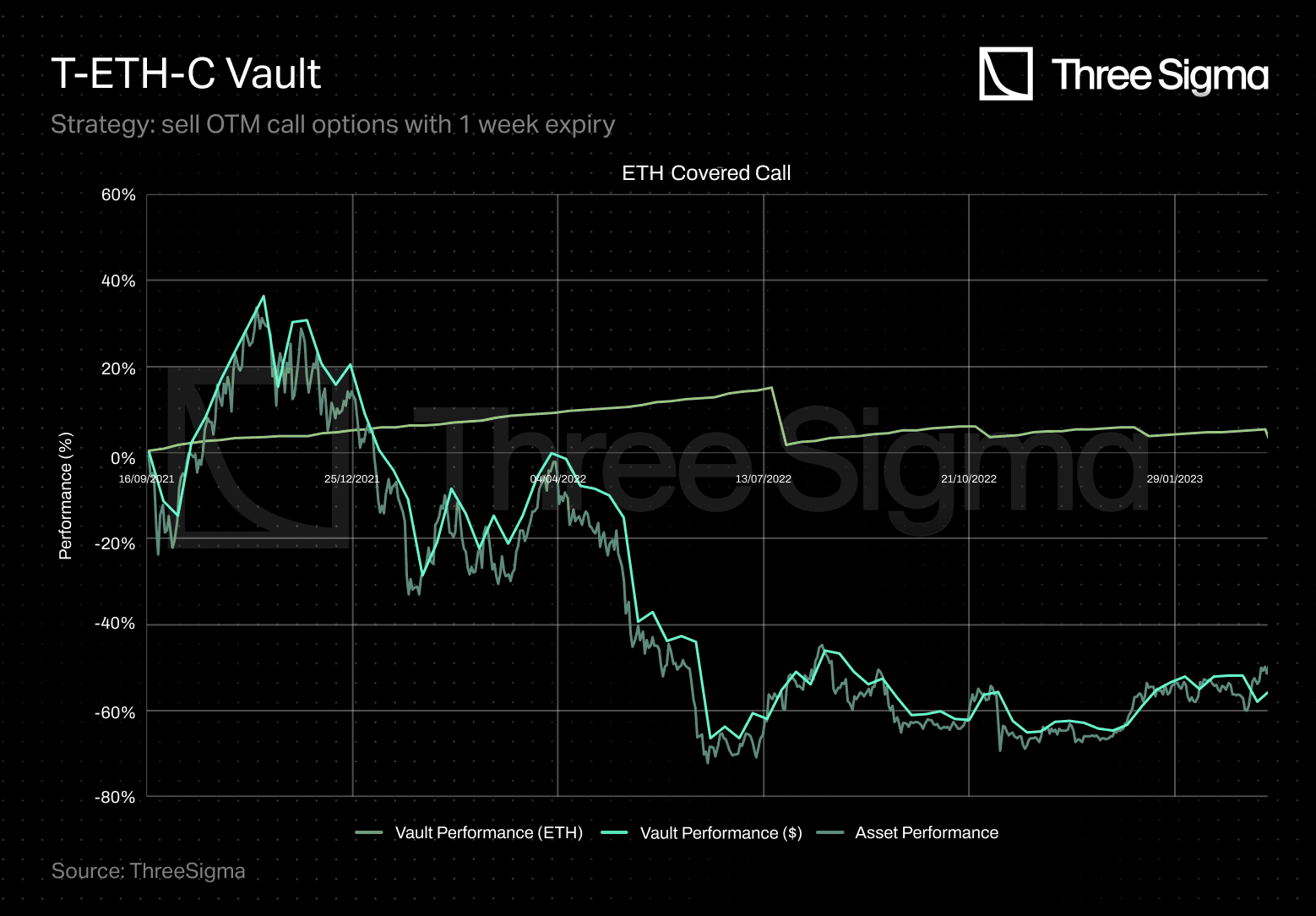

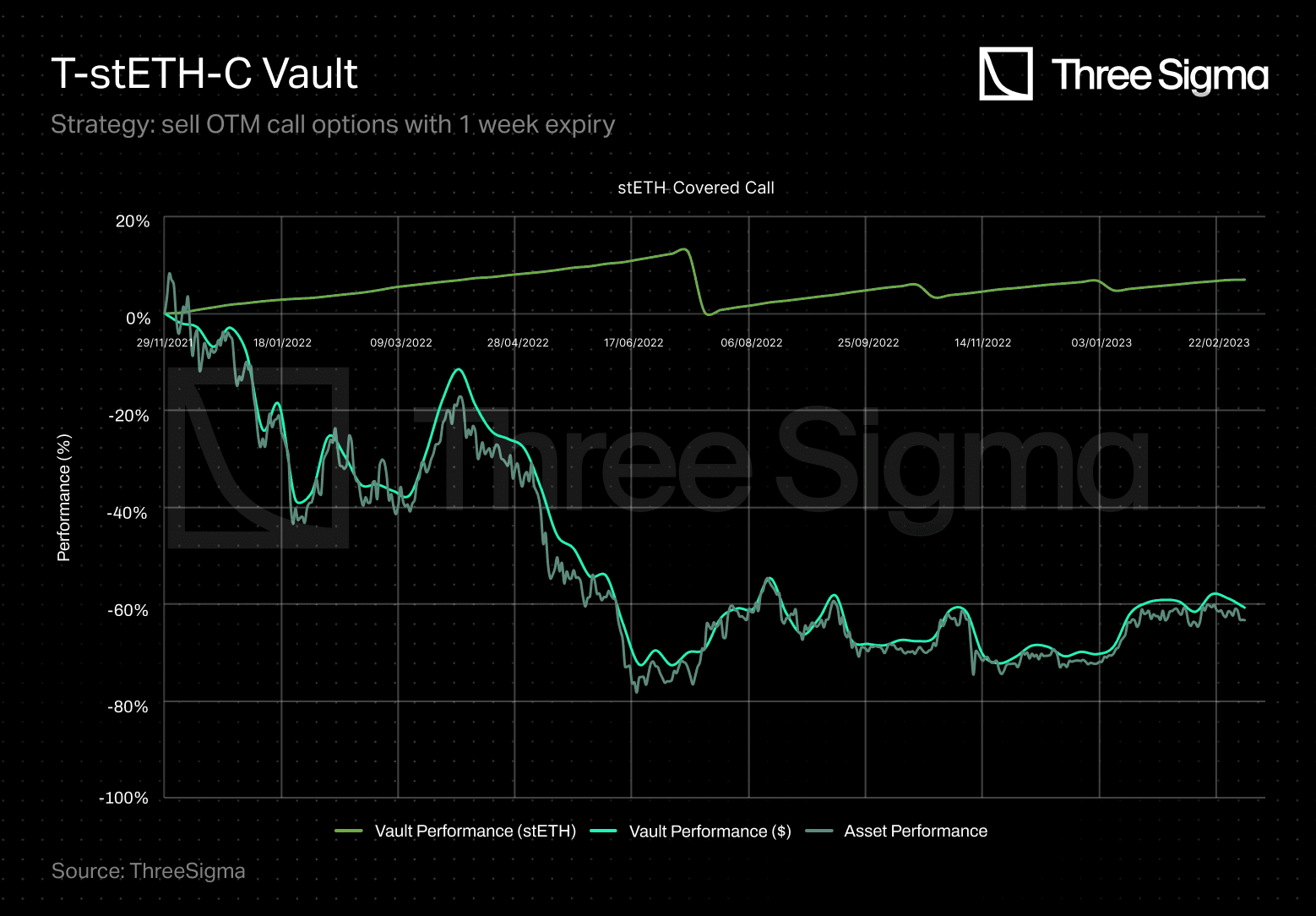

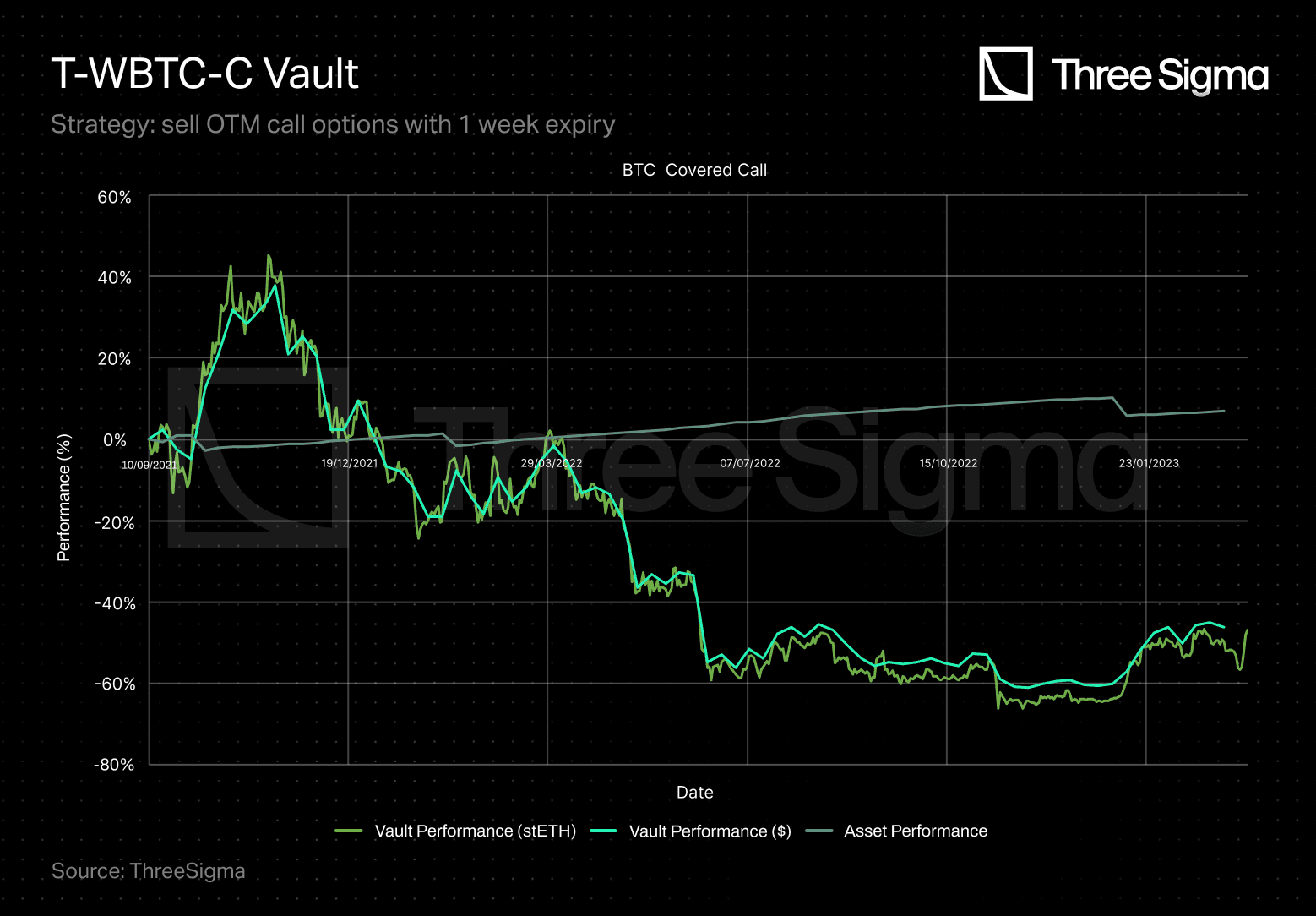

This section presents an analysis of the performance of Ribbon Finance vaults, aiming to provide valuable insights into the dynamics of DOVs. Ribbon Finance is utilized as an illustrative example, given its position as one of the pioneering and largest DOVs in the market. It is important to note that the intention of this analysis is not to overly emphasize any negative aspects of Ribbon Finance but rather to utilize publicly available data to objectively examine the performance and outcomes of their vaults.

Out of the six vaults showcased below, five have underperformed in USD terms. That is, if investors had held plain dollars, they’d have outperformed the vaults. It is important to note that these results are influenced by the price trajectory of the underlying assets, which, as also highlighted, has been poor since the inception of the vaults. However, upon closer examination of the asset-denominated performance, a more balanced distribution emerges, with an even mix of winners and losers.

T-ETH-C VAULT:

- Strategy: sell OTM call options with 1-week expiry

T-stETH-C VAULT:

- Strategy: sell OTM call options with 1-week expiry

T-WBTC-C VAULT:

- Strategy: sell OTM call options with 1-week expiry

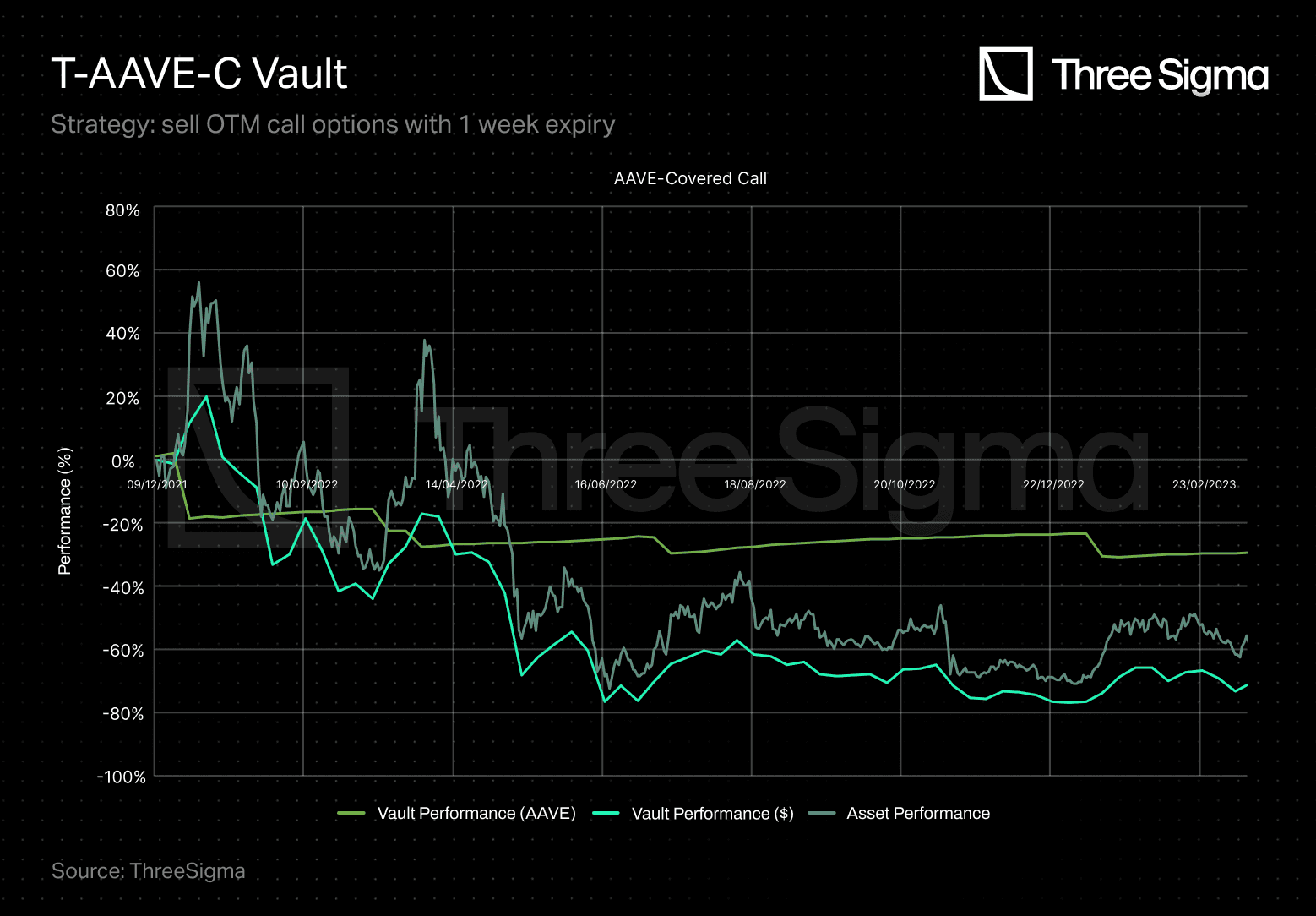

T-AAVE-C VAULT:

- Strategy: sell OTM call options with 1-week expiry

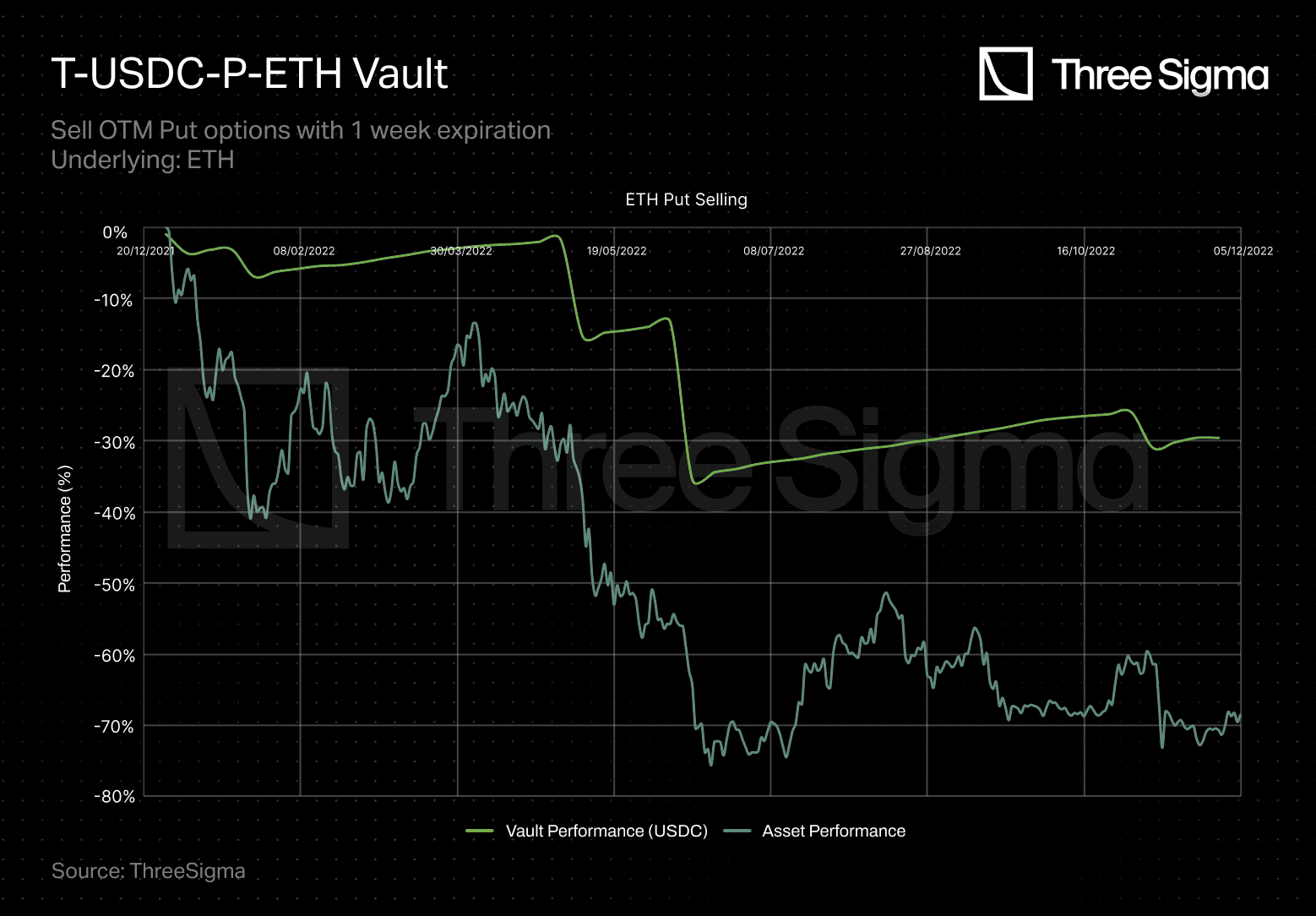

T-USDC-P-ETH Vault:

- Sell OTM Put options with 1-week expiration

- Underlying: ETH

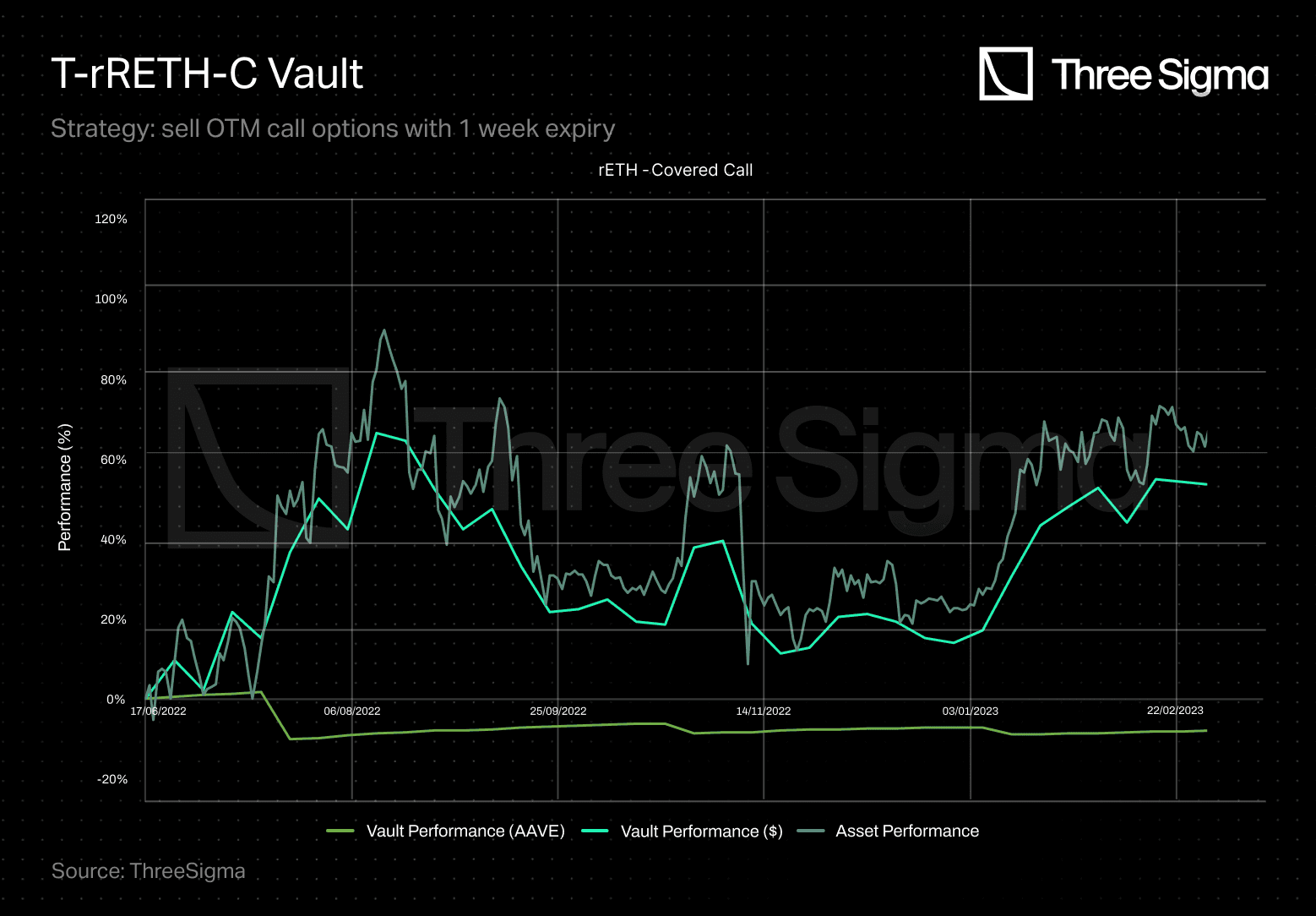

T-rRETH-C VAULT:

- Strategy: sell OTM call options with 1-week expiry

From AMMs to order books, options protocols must balance risk, reward, and reactivity. Our DeFi Ecosystem Strategic RD service reviews pricing functions, settlement logic, and liquidity incentives to keep your LPs secure and engaged.

Final Thoughts & Conclusions

The analysis reveals distinct cycles of capital rotation through the TVL. The progression can be observed through three stages, namely Hegic, followed by Ribbon/Lyra, and culminating in what can be termed the "Death of the Vol" phase. Each stage represents a significant shift in capital allocation and market dynamics.

When assessing trading volume, drawing definitive conclusions becomes challenging due to the influence of incentives that tend to distort the overall picture. Traders may strategically engage in long positions on one platform and simultaneously initiate short positions on another platform - between centralized and decentralized exchanges - targeting the same strike and maturity. In such cases, the profitability of the trade itself may be nonexistent, but the attractiveness lies in the token incentives, which add a layer of complexity to evaluating trading volume dynamics.

Capital efficiency exhibits a similar pattern to trading volume, with notable dependencies. Surprisingly, there are very few instances where the 7-day volume exceeds the TVL within AMMs. This suggests potential opportunities for improving capital efficiency and optimizing the utilization of available liquidity.

When considering fees, it is worth questioning whether traders operating on-chain truly prioritize fees. Given the nature of on-chain trading and its inherent gas fees and intricacies, the relative fee structure may not be a primary concern. However, it is noteworthy that order book infrastructures typically impose no fees, while AMMs adopt varying fee structures. Meanwhile, structured products, often built on top of order books, benefit from the absence of fees while following a fee model reminiscent of hedge funds, involving an initial management fee and a performance fee.

DOVs have exhibited mixed performance, primarily seen through very negative returns in USD terms, since their inception. Percentage-wise, profitable vaults show modest gains at around +6%, while loss-bearing vaults experience substantial downturns.

Economic Security Lead

Pablo holds a Master's in management, having focused in finance, and with a thesis on DeFi, demonstrating his knowledge and expertise in this field. He has extensive experience in research and analysis of DeFi protocols, having worked as an analyst at Siemens and a DeFi researcher at Deep Tech Ventures. His background in finance, research and analysis skills are a valuable addition to our team.