Introduction

In this third article we will look at option collateralization, specifically the margin and liquidation engines of the protocols that allow leverage option trading in DeFi. We will also explore the concept of “working collateral” and the path towards more capital-efficient options collateralization. Finally, we will analyse the trade-offs of some of the protocols' delta-hedging strategies.

If you have not yet read our the first and second parts of this options series, it is highly recommended to have a look at DeFi Options and Pricing Models and Tokenomics.

Collateralization - Margin & Liquidations

Options contracts are collateralized to ensure that option sellers have the financial capacity to meet their obligations if buyers choose to exercise the option.

Margin — Leverage

Options protocols, similar to DeFi borrowing and lending markets, initially required fully collateralized options. This meant that an option contract had to be fully backed by either the underlying asset or stablecoins, with an additional capital buffer. Later, users were able to trade options with less than the full underlying asset deposited as collateral through margin trading. There are two main approaches to do this:

- Partially collateralized options: Users post less collateral than the amount required to cover the option's liabilities. This approach allows users to trade with less capital upfront, but it carries a higher risk as they may need to add more collateral if the value of the underlying asset changes significantly. This is done by Opyn, Zeta, Lyra, Rysk (given it’s built on Opyn) and Panoptic.

- Borrowing capital: Users borrow capital to match the option's liabilities, which allow users to trade with leverage and involves paying back the borrowed capital with interest.

The following step was to put the collateralizing capital to work. While collateral is typically used for hedging, it can also be used to generate additional returns or reduce losses by lending it through an overcollateralized protocol. This is similar to traditional financial option exchanges using 3M T-Bills to pay option writers a few basis points.

Order Books

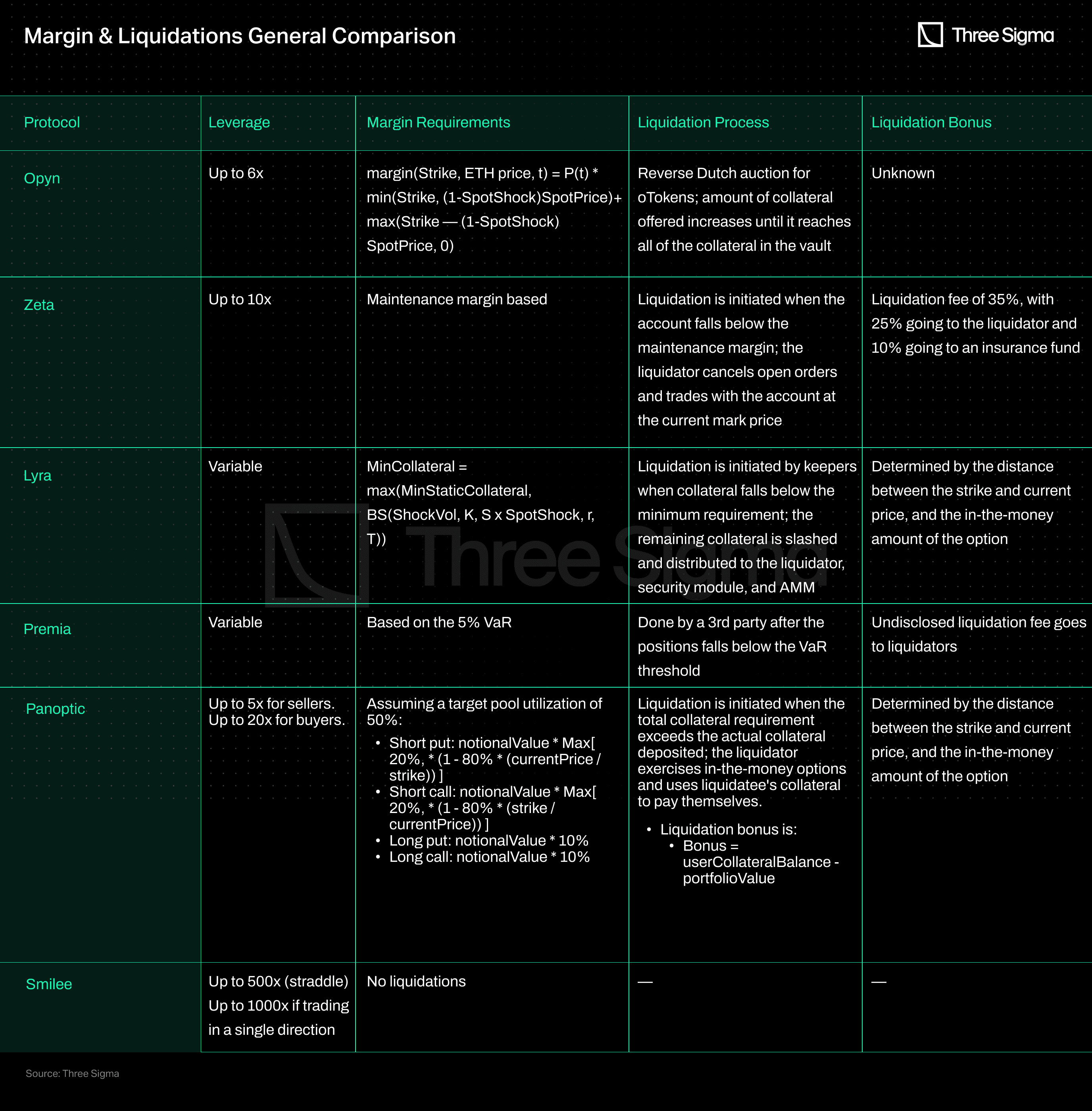

In terms of leverage, Zeta offers up to 10x leverage, while Opyn's leverage is unconfirmed but is reported to be up to 6x.

In terms of margin requirements, Opyn's margin requirement is calculated using a complex formula that takes into account the strike price, the current spot price of the underlying asset (ETH), and the time remaining until the option expires, ensuring that the margin requirement is adjusted for market conditions and never goes negative, without assuming that the spot price will remain constant over the life of the option. On the other hand, Zeta operates on a maintenance margin basis, requiring traders to deposit collateral with the platform before opening a position and maintain a minimum amount of collateral in their account after opening the position.

For PsyOption, there is no information available on their margin requirements as it is currently being worked on (10.03.2023), and no planned release date has been announced.

AMMs

Lyra, Premia, and Rysk are all AMMs options trading platforms that have different ways of calculating margin requirements and handling leverage. Lyra and Premia both adjust their margin requirements based on market conditions and volatility, while Rysk uses the Opyn margin engine as a basis for its margin requirements.

Lyra calculates the minimum collateral required based on a combination of the Black-Scholes model, minimum static collateral, volatility, and spot price shock. It does not have a fixed maximum leverage value. The minimum collateral requirement is calculated using a formula that adjusts for market conditions and includes a minimum quote collateral and a minimum base collateral. This model can making it difficult to determine the maximum leverage limit, as users would need to solve the BS model first to then calculate the collateral.

Premia, on the other hand, uses a Minimum Margin (M*) system to determine the point of liquidation for a position. M* is a dynamic threshold value calculated using a time-scaled, log-normal, 5% value-at-risk (VaR) for a single-tail that admits the option market’s current implied volatility as an input value. The Minimum Margin is not a static value and updates according to the market conditions. VaR is a statistical method used to quantify potential loss with a given probability over a set time period. As days to expiration, implied volatility, and/or moneyness increase, the Minimum Margin requirement also increases. The Initial Margin Requirement (M0) is 150% of the position's Minimum Margin at the time the position is created, and a borrower can add capital manually or use automated software to prevent liquidation. Collateral Value (ν) and Minimum Margin for a position are both derived from the current market price of the option, and a position can be liquidated if ν drops below M*.

Deri has transitioned from its V2 to V3 margin system, which is the current version. The new margin system is based on greek calculations. Specifically, Deri utilizes delta and gamma to assess how the option value fluctuates in response to changes in the underlying asset's price. Consequently, the margin system operates as follows: traders are obligated to post δC (or δP) as margin for call (or put) positions, considering a specific risk scenario, such as δS/S = 5%.

Rysk will leverage the existing Opyn margin engine but with an improvement to the liquidation system for increased simplicity (undisclosed). Further information about Rysk's margin requirements is not available at this time.

Structured Products

As of February 2023, structured products do not use leverage. This is either a deliberate decision or part of their design, as they execute strategies on behalf of their users.

AMM Powered

Panoptic and Smilee use two different margin systems for options trading.

Panoptic calculate’s the minimum amount of collateral that users need to deposit based on various factors, such as notional value, market price of the underlying asset, and strike price. The margin requirement for each option is calculated differently based on its type (OTM Put, OTM Call, OTM Covered Call, ITM) and takes into consideration the notional size of the option, the initial collateral ratio, the current price, and the strike price.

For example, if a user sells an OTM put option, the buying power requirement will increase as the price decreases below the strike price. The buying power requirement is always higher than the in-the-money amount (or the amount of funds necessary to cover the option). On the other hand, for a short call option, the buying power requirement can exceed the notional value, but users can deposit additional collateral to reduce it.

On the other hand, for a short call option, the buying power requirement can exceed the notional value if users sell (naked) calls that aren’t back by the risky asset, but users can deposit additional collateral to reduce it.

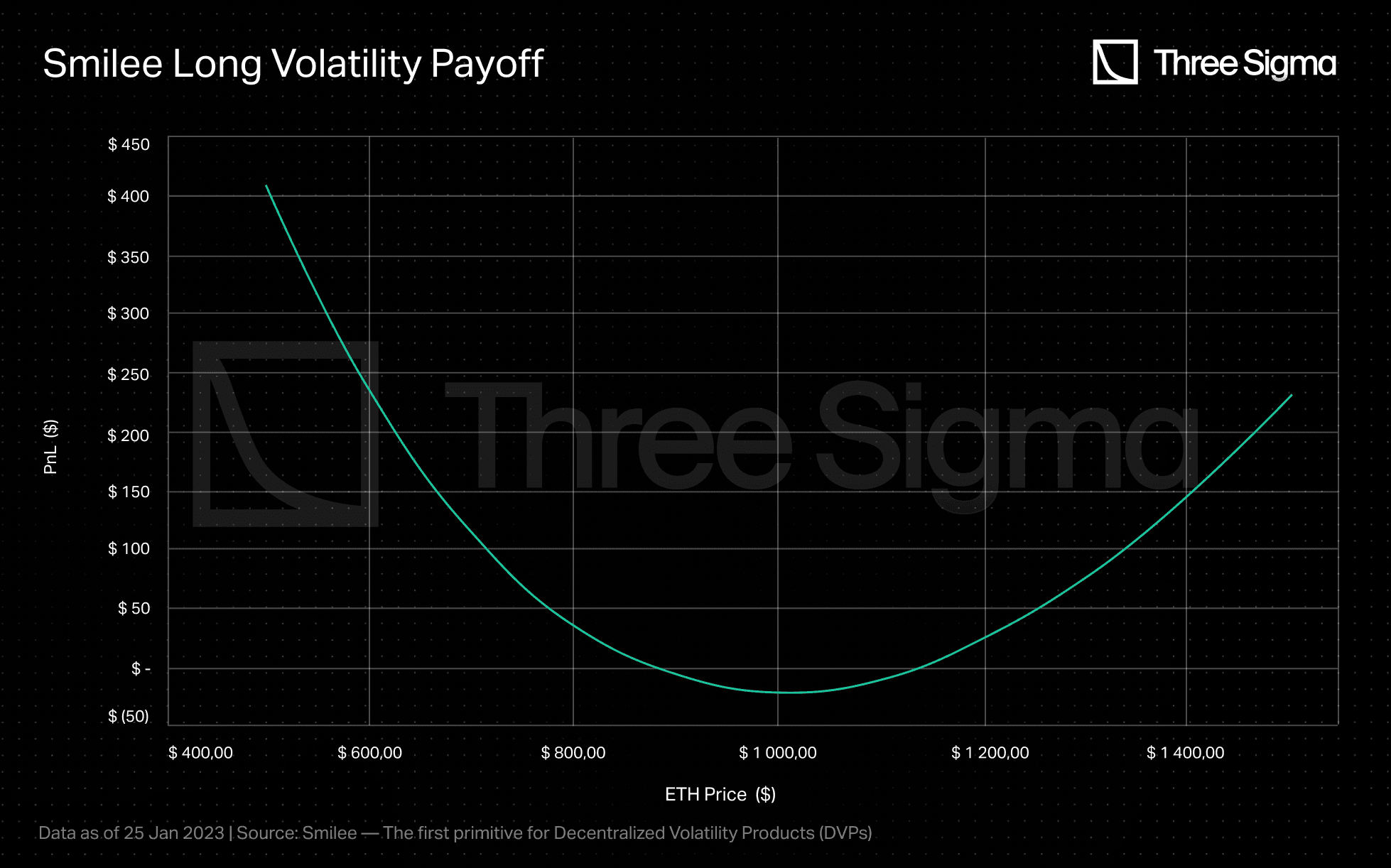

On the other hand, Smilee's margin system uses leverage to allow traders to trade options with less capital. The leverage is calculated based on the inverse of the weekly APY earned by options sellers as:

where the Premium is the weekly APY earned by options sellers. For example, if the APY of the short volatility vault is 10%, the Premium would be:

The resulting leverage would be calculated as:

From a trader's perspective, this means that they would pay a premium of 20 USDC to enter into a position with a notional value of 10,000 USDC, which allows them to trade with less capital. The system is fully collateralized as long volatility traders are synthetically borrowing liquidity from short volatility liquidity providers.

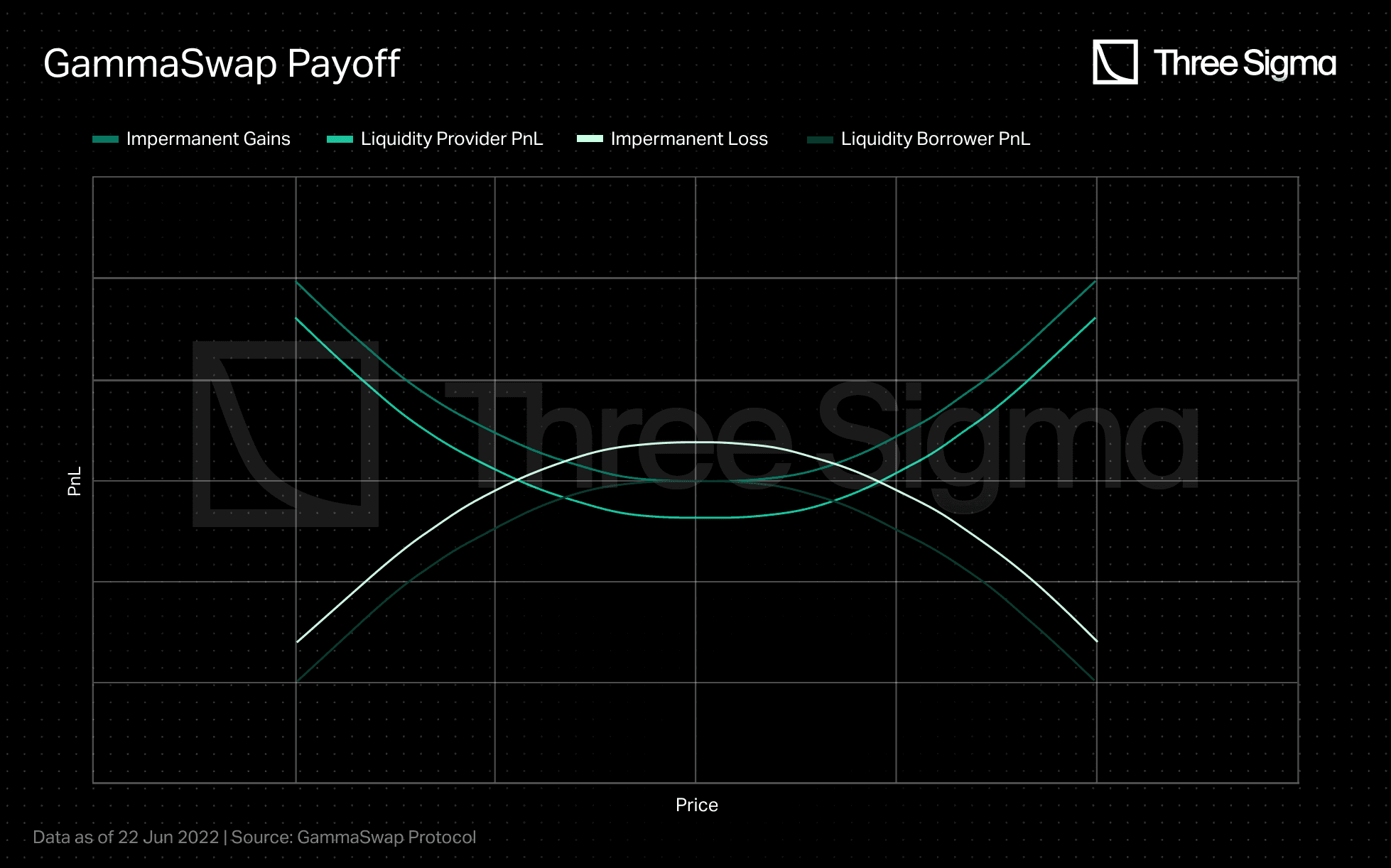

Additionally, while GammaSwap does not offer leverage, it does offer a convex payoff on its product. A convex product can be seen as similar to accessing leverage as it can amplify the gains or losses. As shown below.

Source: https://medium.com/gammaswap-labs/gammaswap-protocol-6a4430e4b0ad

Liquidations

Margin is a trading mechanism that involves borrowing funds to invest in an asset. However, if the value of the underlying asset drops below a certain threshold, a liquidation mechanism is activated to sell the collateral and pay off the borrowed funds. This helps prevent bad debt and ensures that users maintain a positive balance.

Different protocols have different liquidation systems in place to handle these scenarios.

Opyn

Opyn uses a virtual reverse Dutch auction to liquidate its vaults, offering a small amount of collateral in exchange for all of the oTokens, increasing the amount of collateral offered in each subsequent bid until the oTokens are repaid or the vault reaches a state of insolvency. The rate at which the bid price increases is determined by the liquidation method, which is set to increase the bid price by a fixed amount (e.g. $5) for each block. The efficiency of this mechanism allows for a fast and fair liquidation of vaults, with the objective of minimizing losses for the vault owners. Additionally, the mechanism also incentivizes early redemption of the oTokens, as the longer, the auction process continues, the higher the collateral offered in each bid becomes.

Zeta

Zeta allows for full or partial liquidation of an account's collateral, with a two-step process to handle liquidation:

- The first step is to cancel any open orders on the account, which frees up collateral if possible and helps to bring the account balance back up to the required maintenance margin.

- If the account balance remains below the required margin, the liquidator will start the liquidation process by trading with the account at the current market price. This is done in order to raise enough funds to meet the account's collateral requirement. A liquidation fee is set at 35%, with 25% going to the liquidator and 10% to the platform's insurance fund.

The insurance fund is made up of platform fees, liquidation fees, and an initial seed amount, and acts as a buffer against losses. If the insurance fund is not enough to cover the losses, the losses are shared among all users on the platform. In conclusion, Zeta has a well-structured liquidation process in place to handle situations where an account's collateral falls below the required margin. The platform balances the interests of the liquidator, the platform, and its users by allocating a portion of the liquidation fee to the insurance fund and ensuring that losses are shared among all users if necessary.

Lyra

Lyra allows keepers to initiate a liquidation process if an account's collateral value falls below the minimum requirement. When liquidation is triggered, the liquidatee is forced to buy back their option. The liquidation process starts by slashing the remaining collateral in the liquidatee's account by a flat percentage (currently set at 5%), with a portion going to the liquidator as a fee and the rest being distributed to the security module and the AMM.

Once the liquidation process is complete, the liquidatee's account will be closed, and they will no longer be able to trade on the Lyra platform. This helps to prevent any further risks to the platform and its users.

Premia

Premia's liquidation system is not automatic, and positions must be liquidated by a third party. Anyone can liquidate an at-risk position and collect a fee derived from the size of the position. Upon liquidation, ownership of the position is transferred to the Reserve Fund, and any remaining collateral is forfeited as a liquidation fee.

Borrowers have the option to add margin to prevent liquidation, and the system reduces the risk of price manipulation and insolvency. Automated software is available for monitoring and liquidating user positions, and the code will be open sourced for third party liquidators to participate and compete for fees.

Deri

Deri Protocol confidently adopts an account-level cross-margin framework for the margin requirement. This means that the total required margin is calculated against all open positions by one account within a trading pool - either if everlasting options, perpetuals, or power perpetuals are used - and is used to compare with the dynamic effective balance of the account.

Liquidators are required to stake DERI in the privileger pool with a staked amount no less than the average.

Panoptic

On Panoptic, if the collateral deposited by an account is lower than the total collateral requirement, the account is considered insolvent and may be subject to liquidation. The liquidation process is initiated by a liquidity provider, known as the liquidator, who closes all options from the user’s account and uses part of the remaining collateral balance to pay themselves

The liquidator receives a liquidation bonus based on the difference between the current market price and the strike price of the option, as well as the in-the-money amount of the option. However, if the current market price falls below the strike price minus the collateral requirement, the liquidator's bonus will be equal to zero.

The protocol compensates the liquidator for any losses incurred, and the liquidator does not incur any losses themselves. This incentivizes liquidity providers to participate in the liquidation process and helps ensure the stability of the protocol.

Smilee

Smilee is able to offer high leverage trades (500x leverage trades or 1000x if traded in only one direction) without liquidations by using virtual liquidity pools and the small premium paid for large notional values. Smilee enforces a cap on total platform exposure by limiting the exposure that the short volatility vault has to the long volatility vault. This ensures that the short volatility vault can pay the impermanent gains under all scenarios. For instance, if the short volatility vault earned a 10% APY through the premium paid by the long volatility vault, and had $10,000, it would earn roughly $20 per week, allowing for a 500x leverage. However, if there is a +485% price movement within a week's timespan, the short volatility vault may not be able to pay the impermanent loss to the long volatility vault.

A General Comparison

Working Collateral & Hedging

This section covers working collateral and hedging. Before diving into these concepts, let’s review what they mean:

- Working Collateral: The collateral used in options trading that can earn yield or be redeployed to unlock further capital efficiency for LPs. In traditional finance, collateral is invested in low-risk, liquid instruments such as T-Bills.

- Hedging: A risk management used to offset or reduce the risk of loss from an existing position by taking a position in a financial instrument that is opposite to the original position. This can be done using derivatives such as futures contracts, options, or swaps. Therefore, the end goal is to reduce the level of risk associated with providing liquidity to an AMM.

Working Collateral

DoPeX and StakeDAO are two DeFi protocols that provide, or provided, the ability to use working collateral. DoPeX by letting options to be underwritten by 2CRV, and through its Atlantics product. StakeDAO by allowing the redeposit of the vault’s funds into Curve.

Dopex

In DoPeX v1, the funds are typically kept in the vault until the options reach maturity. The only options that earn yield are puts written with 2CRV, which are invested in the Curve platform. The Atlantis product, on the other hand, allows option buyers to borrow the collateral from the vault added by the option writer. This allows for a few key benefits:

- Option writers can earn extra yield as buyers borrow collateral

- Option buyers can use the funds locked by the option writers

However, buyers will not have direct access to the funds; rather, the funds will be integrated and used by other DeFi applications (smart contracts). When capital is borrowed from the pool, a funding fee is charged that is inversely proportional to the amount of capital remaining in the Atlantic option pool and is capped by a maximum set by governance, ranging from 5% to 20% per year.

The premiums for Atlantics options are based on Black-Scholes pricing, with implied volatility (IV) calculated as the realized volatility (RV) at a premium. This is due to the capital efficiency offered by the pool's remaining options supply and the time to expiration. There will be a limit set for the premium, known as the maximum multiplier. Atlantic put options are expected to be more expensive than SSOV (Single-sided Option Vault), but Atlantic call options will be less expensive. This is due to the fact that one put options in the SSOV are out of the money, whereas Atlantic will be at the money.

Atlantics Option vaults will primarily focus on puts, but some calls may also be offered. The exact product offer has not yet been disclosed, and implementation will be done on a case-by-case basis. In some cases, buyers may need to supply collateral to be able to borrow the funds, but this has not been the case with Atlantic Straddles.

StakeDAO

StakeDAO allows users to deposit either stablecoins or 3CRV. If stablecoins were deposited, StakeDAO converts the funds to the right ratio to invest in a passive strategy, which involves depositing in Curve and then staking at Convex. The receipt token received from Convex is then used as collateral on Opyn. However, this approach has been deprecated in the transition from V1 vaults to V2 vaults. The removal of the underlying working collateral has two key benefits:

- Eliminating the risk of IL if the user is LP’ing stETH-ETH through StakeDAO, and withdraws their funds at the wrong time

- Simplifying the deposit and withdrawal process, as there is no need to unstake from Convex and Curve

Conclusions

In traditional finance, when someone uses collateral to secure a loan, the collateral is usually invested in low-risk, highly liquid investments. However, in DeFi, options protocols that allow users to earn returns on their collateral must be careful when considering the risks of investing in specific assets, especially the liquidity of these assets and potential contagion effects during market downturns, as well as the capital efficiency of their investment strategy.

Beyond the lack of low-risk highly liquid investments, adding working collateral to DeFi protocols can make deposits and withdrawals more gas-intensive for users, given the need to convert and/or stake assets. Additionally, assuming protocols let users deposit and withdraw during a 24-hour window, it would imply they need to track when each user staked to have proper accountability. For example, if two users deposit at different times within a 24-hour period, they may not be entitled to the same yield depending on when they deposited.

Hedging

Liquidity provision in AMMs involves passively providing liquidity to a market by buying and selling options at any time. For users, this is great, since there’s always liquidity available to buy or sell the options, on the other hand, this creates inventory risk, which can arise if the price of the assets moves against the AMM and result in losses for the LPs. To manage this risk, AMMs typically hedge their positions through delta hedging, which involves holding additional assets, option contracts, or using perpetual futures to offset their exposure. Additionally, volatility impacts an option's price (called gamma), which can be hedged by holding additional options contracts that offset each other.

Imagine a scenario where a large number of call options are being held in a position. To protect against potential losses due to an unexpected drop in price within the next 24 to 48 hours, one possibility is to add a small put-option position as an offset. Another option might be to sell a carefully chosen number of call options at a different strike price.

However, hedging options can have its own risks, such as the possibility of losing the hedge and not being protected against losses. Additionally, the capital used for hedging could be used to increase the liquidity of the AMM, resulting in more liquidity and trades and, ultimately, more fees.

Two case studies are provided to illustrate the different approaches to hedging: Lyra and Risk.

Lyra

The example of Lyra hedging through Synthetix shows that delta hedging can be inefficient, as it requires a high collateral ratio (at least 350%) and a significant amount of locked capital, making the delta hedge tremendously capital-inefficient.

Let’s assume the following scenario:

- The LP provides sUSD to the options pool

- The AMM sells an ATM sETH call with a delta of -Δ0.5, resulting in an AMM exposure of -Δ0.5

- The trader fully collateralizes the call with 1 sETH adding a delta exposure of +Δ1.0, and the delta exposure of the AMM increases to +Δ0.5.

- To hedge this +Δ0.5 exposure, the AMM shorts 0.5 sETH (-Δ0.5) on Synthetix

Assuming a collateral ratio of 400% on Synthetix, since the minimum is 350%, the cost of hedging one ETH call requires 2 full sETH exposures (1 long and 1 short).

If ETH is worth $2000, locking it requires $16,000 (due to the 400% collateral ratio, for 1 long and 1 short). The premium must also be paid in sUSD, and assuming a premium of $100, $400 must be locked to mint the 100 sUSD, bringing the total locked amount on Synthetix to $16,400.

In this example, the inefficiency of hedging in terms of capital usage is highlighted. Given the lack of liquidity in DeFi options markets, it is important to consider whether it is worth for LPs to hedge their inventory risk. Hedging is based on the general assumption that the potential losses from inventory can be greater than the premiums earned from selling options with that capital. Despite its capital inefficiency, hedging is thought to be a better option for LPs than selling options.

Deri

In Deri's unique case, the hedging process may not be as straightforward due to the fact that the LPs are counterparties to not only options, but also perpetuals, power perpetuals, and gamma swaps. However, it is important to note that the DPMM (Deri Proactive Market Making) efficiently prices the derivatives, whether they be options or perpetuals, taking into account the current state of the system. This means that longing when everyone else is already long could result in significant expenses. The same principle applies conversely.

Rysk

Rysk hedges by selling in the opposite direction of the contract. Going back to the example above where the LPs provides USDC to the options pools and the AMMs sells an ATM ETH call with a delta of -Δ0.5 and where the trader fully collateralizes the call with 1 ETH, adding a delta exposure of +Δ1.0, and the delta exposure of the AMM increases to +Δ0.5.

To hedge this +Δ0.5 exposure, the AMM could:

- Short 0.5 ETH (-Δ0.5) on a perpetual exchange like GMX

- Buy an ATM put with a delta of -Δ0.5.

- To passively buy an ATM put, the AMM would need to sell an ATM put to a trader and increase the premium for the put to incentivize this.

However, this approach has its additional risks:

- Liquidity risk: The need for traders to take the other side of the trade

- Premium costs: The need to make the price attractive enough while still being competitive

- Volatility risk: While being delta-neutral, the AMM would still be subject to volatility risks.

Collateralization defines the risk boundaries of every options protocol and most get it wrong.Our Smart Contract Audit service analyzes vault logic, margin flows, and liquidation triggers to protect LPs and users without overengineering the system.

Conclusions

The introduction of margin and liquidations in options trading protocols can offer users greater flexibility and potentially higher returns, but it also comes with additional risks and complexity:

- Users need to manage their collateral and margin levels carefully to avoid liquidation

- Protocol creators must design and implement margin and liquidation processes to ensure the stability and security of the protocol

The few protocols that allow for margin trading have distinct designs for their margin requirements and liquidation processes. Leverage trading carries additional risks and requires well-defined liquidation and margin requirements to mitigate these risks, both for users and protocols. In particular, the lack of transparency or predictability in liquidation processes can discourage users from participating in the platform. Therefore, it is important for options trading protocols to carefully consider their margin requirements and liquidation processes to foster a stable and user-friendly trading environment.

The use of working collateral is common in traditional finance but few DeFi protocols adopt this approach due to the associated risks. Protocols must weigh the risk of redeploying the capital, for example, on other DeFi protocols such as AAVE, Compound, or Euler, against potential risks such as having a high utilization rate, collateral that cannot be redeemed, a third party protocol that is compromised and funds are lost, centralization of the decision-making process of where and which assets are redeployed, etc. Similarly, using collateral to hedge also involves similar risks and reduces the liquidity available for trading in options protocols.

Similarly, using collateral to hedge also involves similar risks and reduces the liquidity available for trading in options protocols. Additionally, it reduces the liquidity available for trading in options protocols and assumes that the losses reduced by hedging are greater than the fees generated from said liquidity.

In conclusion, options trading protocols must carefully consider their margin requirements and liquidation processes to provide a stable and user-friendly trading environment for users, while weighing the risks and benefits of working collateral and collateral hedging.

Sources & References

- Opyn Liquidations 1.https://medium.com/opyn/opyn-partial-collateralization-how-to-trade-partially-collateralized-defi-options-3e23e8a201e#fb3b

- Opyn Liquidations 2. https://medium.com/opyn/partially-collateralized-options-now-in-defi-b9d223eb3f4d

- Documentation & Discords of the protocols included in the analysis.

Economic Security Lead

Pablo holds a Master's in management, having focused in finance, and with a thesis on DeFi, demonstrating his knowledge and expertise in this field. He has extensive experience in research and analysis of DeFi protocols, having worked as an analyst at Siemens and a DeFi researcher at Deep Tech Ventures. His background in finance, research and analysis skills are a valuable addition to our team.