At Three Sigma, we recognize the intricate opportunities within the Web3 space. Based in Lisbon, our team of experts offers premier services in development, security, and economic modeling to drive your project's success. Whether you need precise smart contract audits, a tokenomics audit, or comprehensive blockchain engineering, Three Sigma is your trusted partner. We are not just experts in code, economic auditing, and blockchain engineering, we are passionate about breaking down Web3 concepts to drive clarity and adoption across the industry.

Abstract/tldr;

The ERC-7683 (erc7683) standard, presented in Q2 2024 by Uniswap Labs and Across, establishes a unified framework for intent-based systems to define cross-chain actions precisely, an area where a rigorous mechanism design review helps align incentives and outcomes. Should this standard gain widespread adoption, it could fundamentally alter the dynamics of DEXs, with Uniswap—the DEX with the largest TVL—standing at the epicenter of this seismic shift.

Introduction

Cross-chain swaps still suffer from fragmented liquidity, uneven pricing, and MEV exposure. ERC-7683 (erc7683) proposes a common interface for intent-based execution so solvers can compete on price and reliability across chains, under the same constraints.

As adoption grows (the public intro highlights “70 Protocols Support ERC-7683 and Crosschain Intents”), standardizing payloads, receipts, and settlement flows can shrink price dispersion while improving UX. This article focuses on how ERC-7683 impacts liquidity and what teams should consider before integrating, including whether to conduct a Solidity audit before deployment.

Liquidity remains one of the most crucial challenges facing emerging blockchain networks, particularly within decentralized exchanges (DEXs). Despite significant Total Value Locked (TVL) figures, many networks struggle to maintain adequate liquidity, leading to suboptimal user experiences, higher transaction costs, and, ultimately, hindered growth and adoption. The complexity and costs associated with bridging assets across chains further exacerbate these challenges, often resulting in insufficient incentives for liquidity providers (LPs) an area that benefits from thoughtful points & incentives program design. In this context, the introduction of the ERC-7683 standard by Uniswap Labs and Across presents a potential shift in how cross-chain actions are executed, leveraging intents-based systems that could significantly impact existing liquidity frameworks (for background, our explainer on AMMs, order books, and intents).

High-Level Flow (TL;DR)

- User signs an intent with constraints and desired outcome.

- Solvers fetch the intent and return executable quotes.

- User (or agent) selects a quote; a bundle is prepared.

- Source-chain approval + escrow/commit.

- Cross-chain attestation/verification is produced.

- Destination-chain execution by the selected solver.

- Settlement/rollback based on guards and timeouts.

Architecture Deep-Dive: Actors & Message Flow

- Actors: Intent Submitter, Solver/Relayer, Bridge/Settlement Layer, Destination Executor, Guard/Verifier, Watchers.

- Message flow: Intent creation → quote discovery → bundle formation → source commit → attestation relay → destination execution → post-trade settlement or revert (timeouts, slippage, guard rails).

This research aims to solve the critical question of how the global adoption of the ERC-7683 standard and the subsequent increase in the volume of intents-based protocols might influence the liquidity dynamics within AMM-based DEXs. Specifically, we are interested in exploring whether these protocols, by connecting swappers and fillers without utilizing LPs, could lead to a decrease in the liquidity provided by traditional LPs on platforms like Uniswap. The potential shift away from LPs could disrupt the liquidity flywheel, a foundational concept that drives liquidity provision and trading volume in these decentralized markets.

Our initial set of hypotheses are:

- Transaction costs and bridging complexities deter liquidity provision on new blockchains. High transaction costs and the complexities involved in bridging assets across different blockchains act as significant barriers for LPs, discouraging them from providing liquidity on newer networks.

- Intent-based atomic cross-chain swaps could reduce liquidity on smaller DEXs. By offering a more seamless and potentially less costly alternative to traditional liquidity provision, these swaps may draw volume away from smaller DEXs, reducing the incentives for LPs to contribute to these platforms.

- These swaps may impact the on-chain liquidity of high-cap assets more than long-tail assets. Given the higher trading volumes and the broader availability of high-cap assets, intent-based protocols might affect their liquidity more profoundly, while the impact on long-tail assets, which often rely on on-chain liquidity, could be different.

Our approach was to conduct a comprehensive and systematic analysis of on-chain and intents-based protocol volumes across three different blockchain networks—Ethereum, Arbitrum, and Base. We selected a diverse set of asset pairs, including both high-cap and long-tail assets, to provide a representative view of the trading activity on these blockchains. The analysis involved several key steps: data collection of both on-chain and intents-based volumes, selection of appropriate asset pairs, and a detailed statistical examination through scatter plots, Pearson correlation coefficients, and regression analysis. This methodology allowed us to rigorously test our hypotheses and gain insights into the potential effects of the ERC-7683 standard on the liquidity provision within decentralized finance ecosystems, offering valuable recommendations for stakeholders navigating this evolving landscape.

Key Concepts

This section provides a concise overview of the fundamental ideas essential for understanding the impact of the ERC-7683 standard on liquidity in DEXs. We will briefly introduce Uniswap, intent-based protocols, the liquidity flywheel, the ERC-7683 standard itself, and the challenges related to bridging complexities and transaction costs. These concepts are crucial for grasping the dynamics explored in our research and their potential implications for the future of liquidity provision in decentralized finance.

Uniswap

Uniswap is a DEX protocol that allows users to trade cryptocurrencies directly without relying on an intermediary or central authority. Unlike traditional exchanges, Uniswap utilizes an AMM system where liquidity providers contribute to liquidity pools consisting of pairs of tokens. These pools enable the decentralized trading of tokens based on algorithms that determine the price according to the ratio of tokens in the pool. This mechanism ensures that trades can occur continuously, with prices adjusting automatically based on supply and demand dynamics. Uniswap's innovation lies in its ability to facilitate peer-to-peer trading in a trustless environment, thus reducing counterparty risk and enabling more efficient and accessible financial transactions.

To understand Uniswap, its different products, flows, functionalities, and other aspects, we will break down its versions and components, starting with Uniswap V2.

Uniswap V2

Uniswap V2 is the second version of Uniswap. The main difference between Uniswap V2 and its predecessor is that V2 introduced the ability to trade any ERC-20 token directly with any other ERC-20 token, whereas V1 only allowed trading between ERC-20 tokens and ETH.

Uniswap v2 operates using smart contracts that implement an automated liquidity protocol based on a "constant product formula." This formula ensures that the product of the reserves of two tokens in a liquidity pool remains constant, which is represented mathematically as x * y = k, where x and y are the reserves of the two tokens, and k is a constant.

Uniswap V2 operates through a system of liquidity pools, where each trading pair has its own pool composed of reserves of the two tokens being traded. Liquidity providers (LPs) contribute equal values of both tokens to the pool and, in return, receive liquidity tokens representing their share of the pool. These liquidity tokens can be used to withdraw their portion of the pool, including any fees accumulated.

When a trade occurs on Uniswap, the trader pays a 0.30% fee, which is added to the pool and distributed among LPs. The trade alters the token reserves, and the price adjusts according to the constant product formula, ensuring that the balance is maintained. Uniswap v2 also includes a protocol fee feature designed for future use, which can be toggled on or off. Initially deactivated, this feature, when activated, imposes a 0.05% fee on trades. This fee is directed to a specified address while the remaining 0.25% of trading fees continue to reward liquidity providers.

Prices on Uniswap are determined by the ratio of the two tokens' reserves in the pool. Arbitrageurs play a crucial role in maintaining price alignment with the broader market by taking advantage of price discrepancies until equilibrium is achieved.

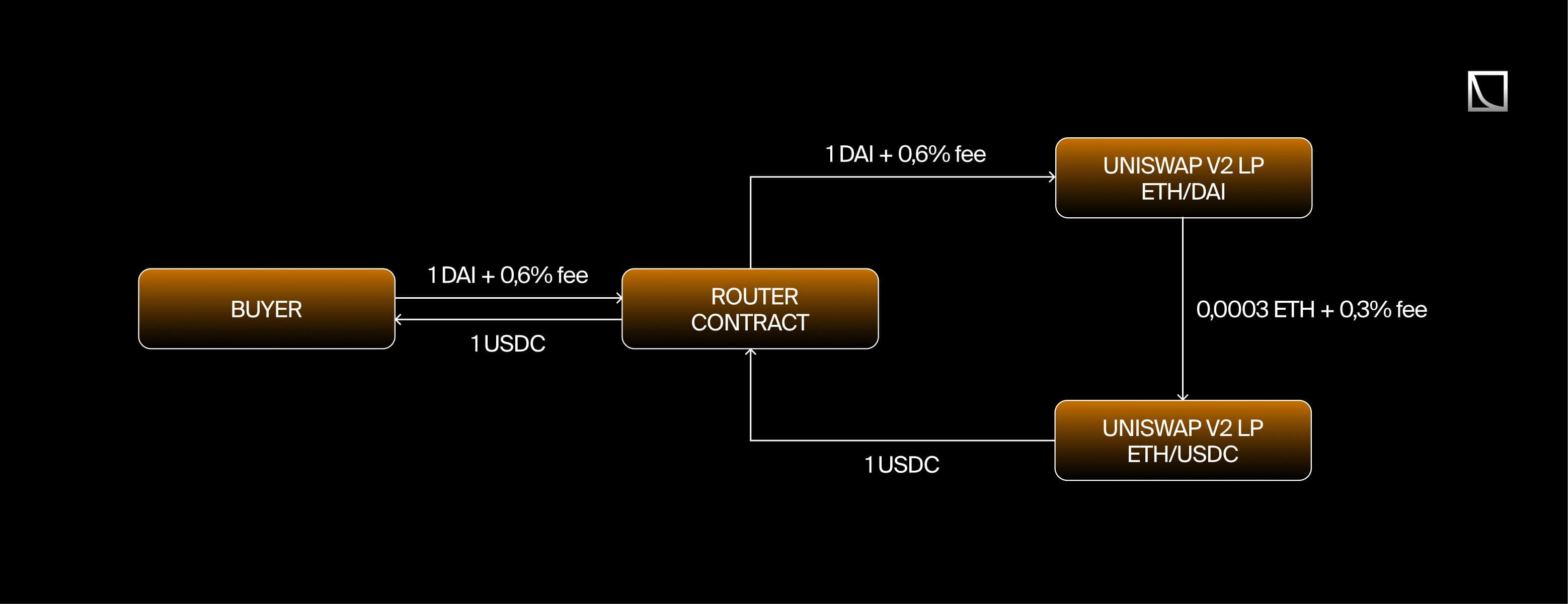

Trades can happen on Uniswap v2 in three ways:

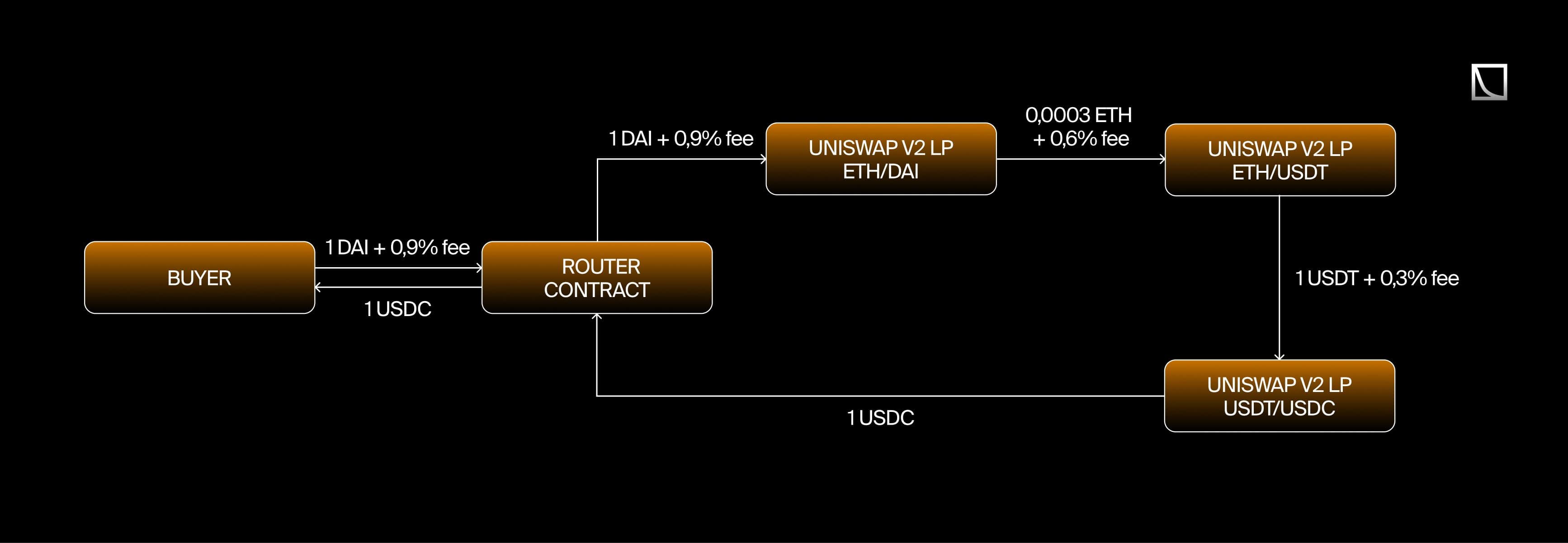

In a direct swap on Uniswap, if the assets you want to trade have their own liquidity pool, the assets are routed through the Router Contract. The assets are then transferred to the LP, where they are swapped. The swapped assets are sent back to the Router Contract and delivered to the buyer, with all fees accrued to the LPs.

When swapping through ETH, if the assets you wish to trade don’t have their own LPs but both have an ETH LP, the buyer's assets are routed through the Router Contract to the ETH LP of the first asset. The assets are then swapped for ETH, which is subsequently sent to the ETH LP of the second asset. This ETH is then swapped for the second asset, which is sent back to the Router Contract and delivered to the buyer. Upon completion of the trade, the fee is distributed pro-rata to all LPs in the pool.

If neither of the assets has its own LP or an ETH LP, the trade follows a custom path. The buyer's assets hop from one LP to another until the route finds the expected output. The fee is distributed pro-rata to all LPs in the pool upon the trade's completion.

Uniswap V2's improvements not only provide better functionality and security but also set the stage for more advanced use cases and integrations within the DeFi ecosystem.

Uniswap V3

Uniswap V3 builds upon the foundations established by its predecessors, Uniswap V1 and V2, by introducing significant enhancements that increase capital efficiency, give LPs more control, and improve the accuracy and convenience of price oracles.

One of the key innovations in Uniswap V3 is concentrated liquidity. Unlike previous versions, where liquidity was distributed uniformly along the constant product curve, V3 allows LPs to concentrate their liquidity within specific price ranges. This targeted approach significantly increases capital efficiency, enabling LPs to earn fees more effectively by providing liquidity where it will be most impactful.

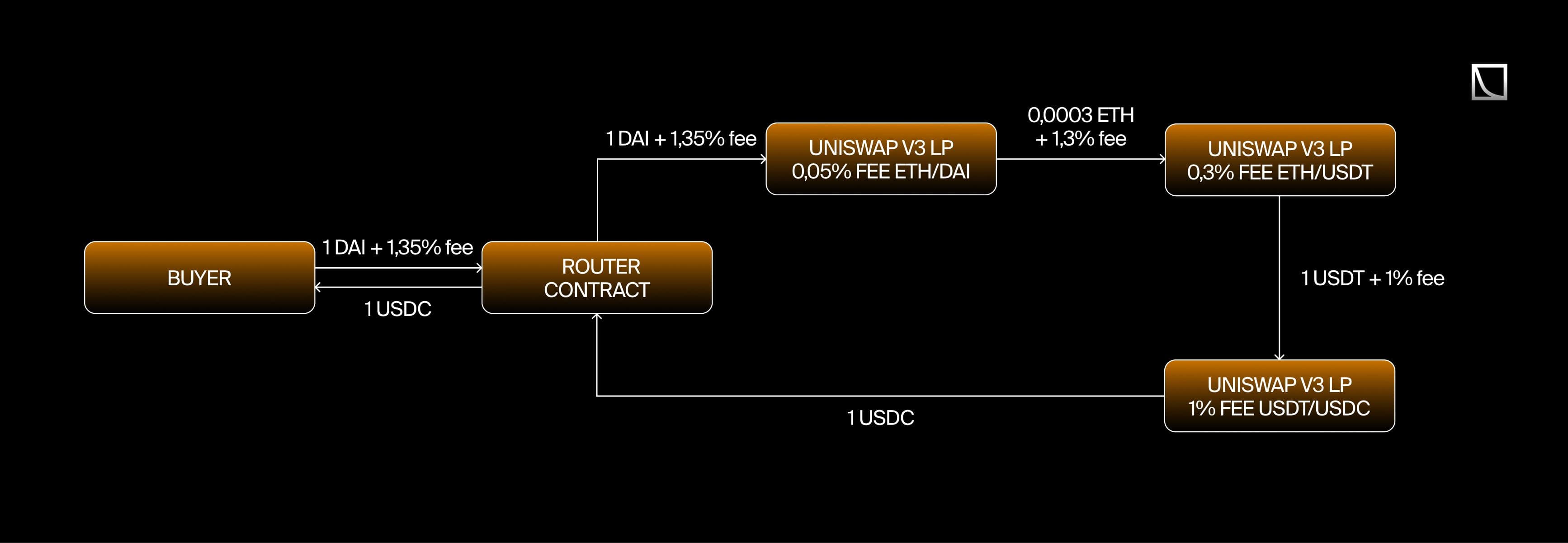

Another important feature is the flexible fee structure introduced in Uniswap V3. While in V2 the swap fee was fixed at 0.30%, V3 allows for multiple fee tiers to be set during pool initialization, including 0.05%, 0.30%, and 1%. This flexibility better accommodates different types of trading pairs, from stablecoins with low volatility to more volatile or less frequently traded tokens. Additionally, v3 retains the protocol fee switch from V2, allowing UNI governance to activate it with the added flexibility of choosing what percentage of fees goes to the protocol.

To address the varying needs of different trading pairs, Uniswap V3 supports multiple pools per pair, each with a distinct swap fee. This structure ensures that trades can be optimized according to their specific requirements, whether they demand high capital efficiency or can tolerate higher fees.

The price oracle in Uniswap V3 has been enhanced for greater accuracy and convenience. The V3 oracle allows users to query recent price accumulator values without the need for specific time checkpoints. Additionally, it tracks the geometric mean of prices instead of the arithmetic mean, offering a more accurate representation of average prices over time.

Another improvement over V2 is the representation of liquidity positions. In Uniswap V3, liquidity positions are represented by NFTs, making them non-fungible. Unlike in v2, where liquidity tokens were fungible and automatically compounded fees, V3 separates fee earnings from liquidity, storing them as individual tokens. This design change reflects the customized liquidity provision feature, giving LPs more personalized control over their positions.

Finally, V3 introduces a time-weighted average liquidity oracle, which provides valuable data on the average liquidity available over time. This data can be particularly useful for external contracts that implement liquidity mining or other strategies.

These features collectively make Uniswap V3 a more versatile and efficient AMM, providing better tools for liquidity providers and traders while maintaining the decentralized and permissionless nature of the protocol.

Uniswap V4

Uniswap V4 introduces a range of significant enhancements and new features that build on the foundations of its predecessors, V2, and V3, with a focus on customizability, gas efficiency, and native ETH support.

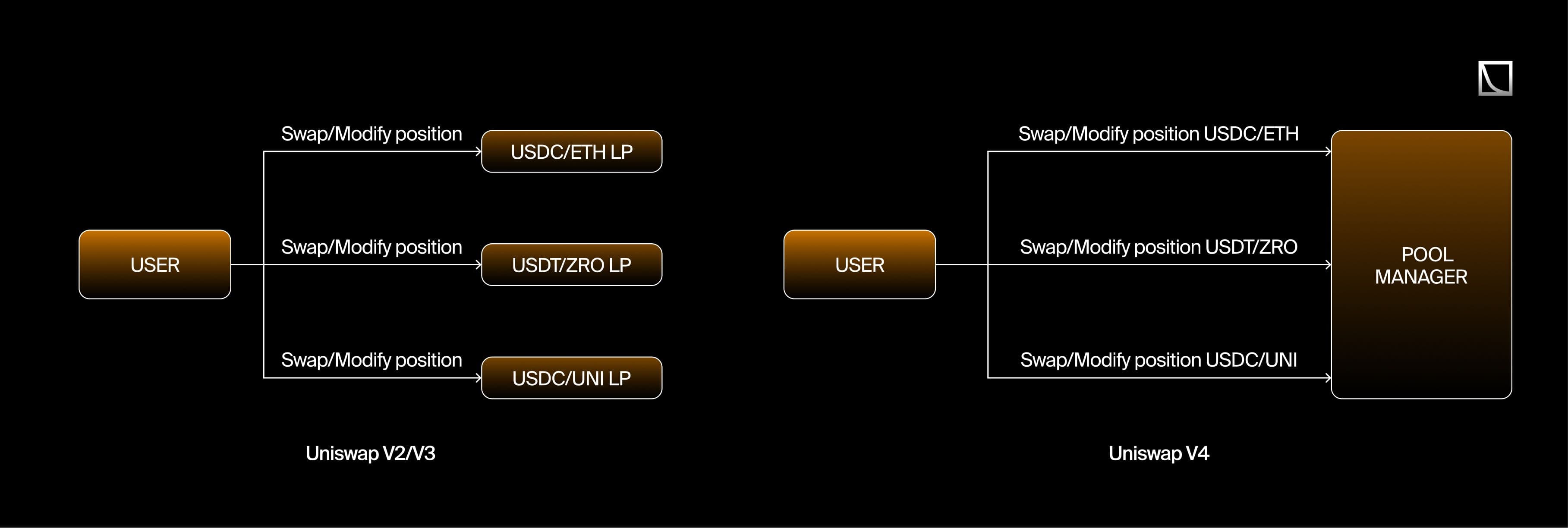

One of the most notable changes in Uniswap V4 is the shift to a singleton contract model. Unlike previous versions that used a factory model to create new pool contracts, V4 manages all pools within a single contract. This approach reduces the cost of pool creation and improves the efficiency of multi-hop trades, making the trading process more streamlined and cost-effective.

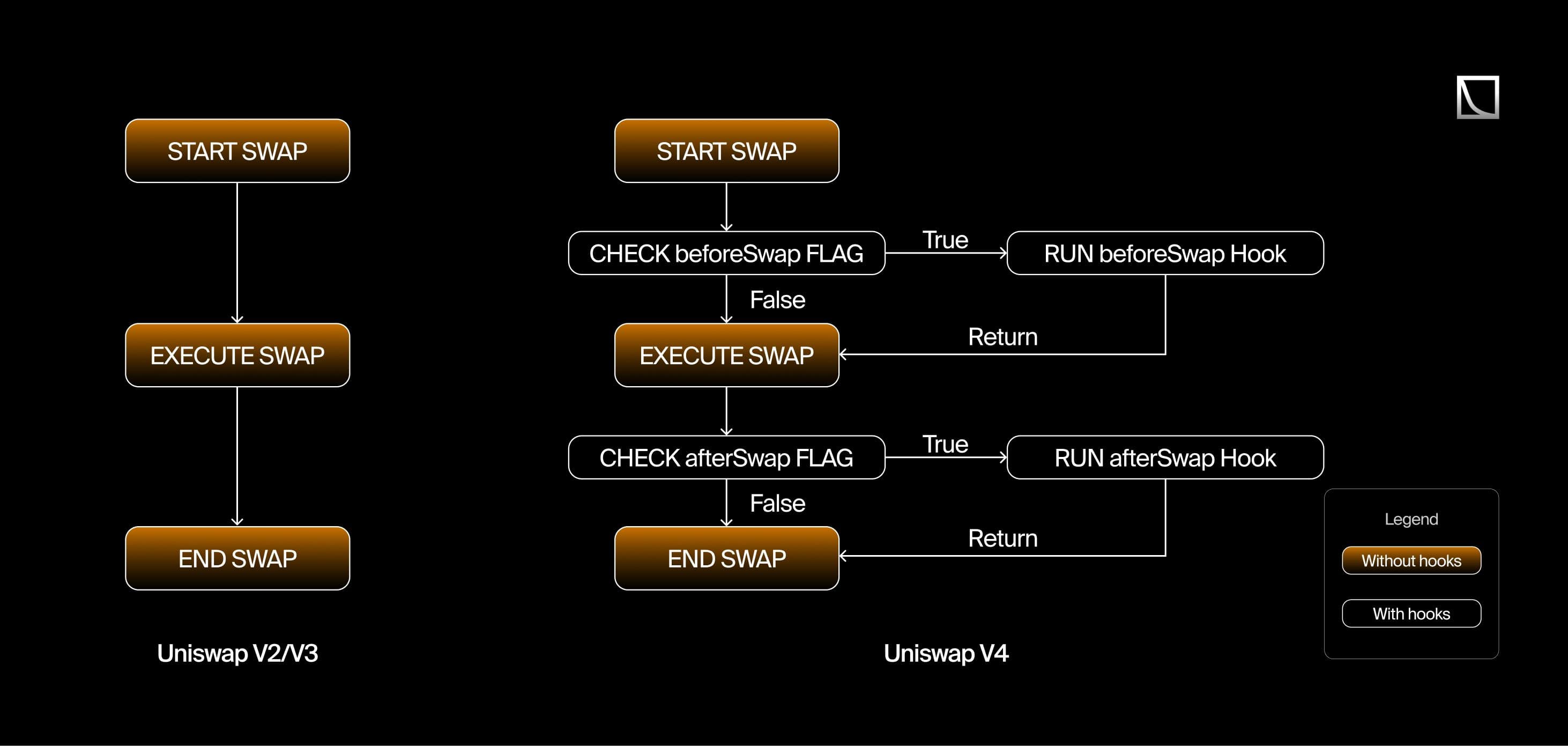

Another major innovation in Uniswap V4 is the introduction of customizable pools with hooks. Hooks are externally deployed contracts that can execute custom logic at specific points in a pool’s lifecycle. This feature allows developers to add functionalities that were previously unattainable without reimplementing the entire protocol. Examples of what can be achieved with hooks include time-weighted average market makers (TWAMM), on-chain limit orders, volatility-based dynamic fees, and custom oracle implementations.

Flash accounting is a new mechanism in Uniswap V4 that ensures no tokens are owed to the pool or the caller by the end of a transaction. This system updates internal balances during operations and only finalizes external transfers at the end of the call. This approach reduces gas costs and simplifies complex operations like atomic swaps and multi-pool interactions, making them more efficient.

Uniswap V4 also reintroduces support for native ETH pairs, addressing the gas costs associated with wrapping and unwrapping ETH. The new singleton and flash accounting mechanisms alleviate previous concerns about liquidity fragmentation and implementation complexity, making it easier and cheaper to trade with native ETH.

Finally, Uniswap V4 includes support for ERC-1155 token accounting. This feature allows for the minting and burning of ERC-1155 tokens within the singleton contract, providing additional token management capabilities. Users can manage tokens more efficiently without frequent ERC-20 transfers, saving gas and streamlining operations for frequent swappers and liquidity providers.

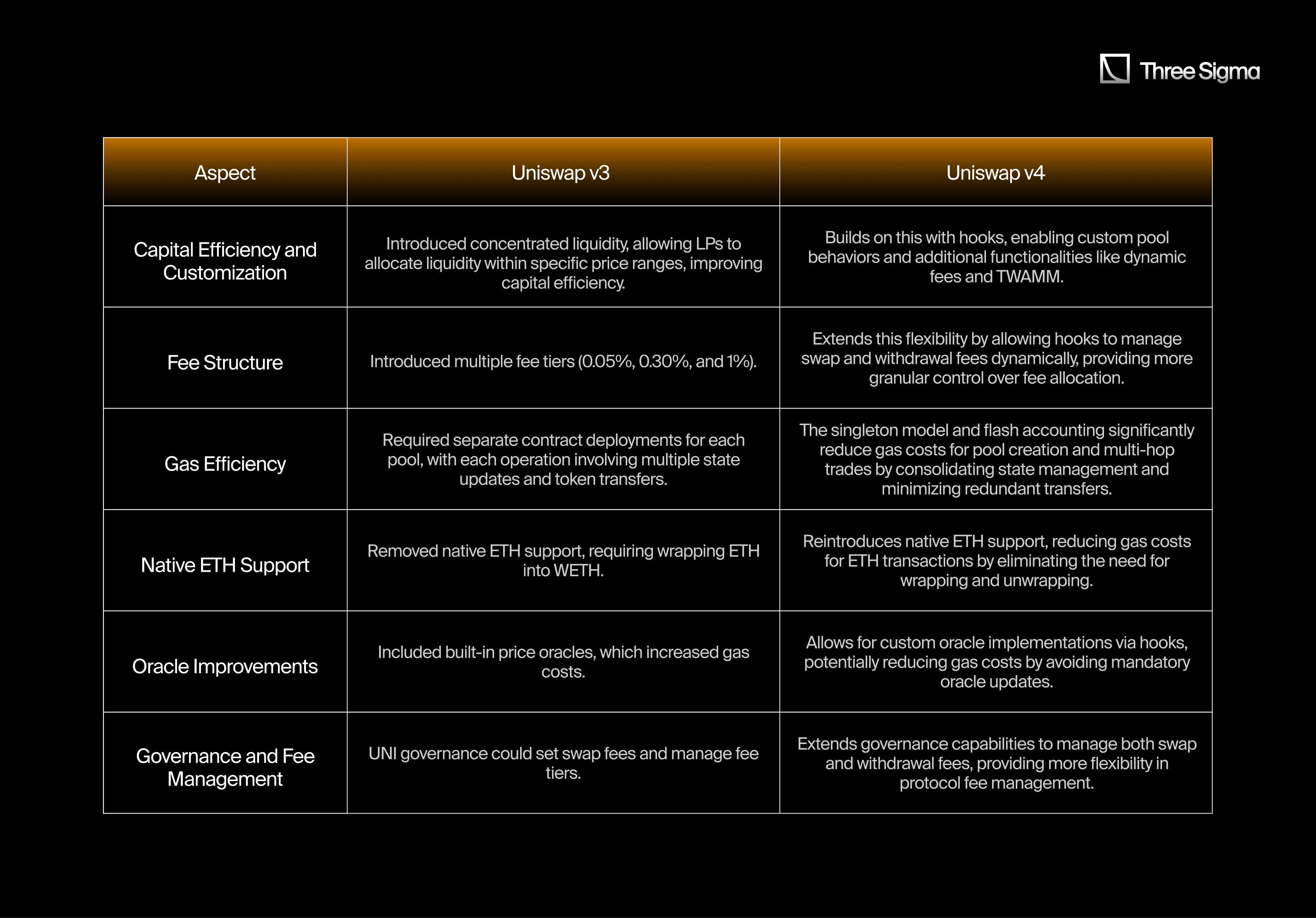

Here’s a breakdown of the improvements of Uniswap V4 over V2 and V3:

Uniswap V4 represents a significant evolution in the Uniswap protocol, introducing customization through hooks, improving gas efficiency with a singleton contract model and flash accounting, and reintroducing support for native ETH. These enhancements build on the innovations of Uniswap v3, offering more flexibility and efficiency for developers, liquidity providers, and traders within the DeFi ecosystem.

UniswapX

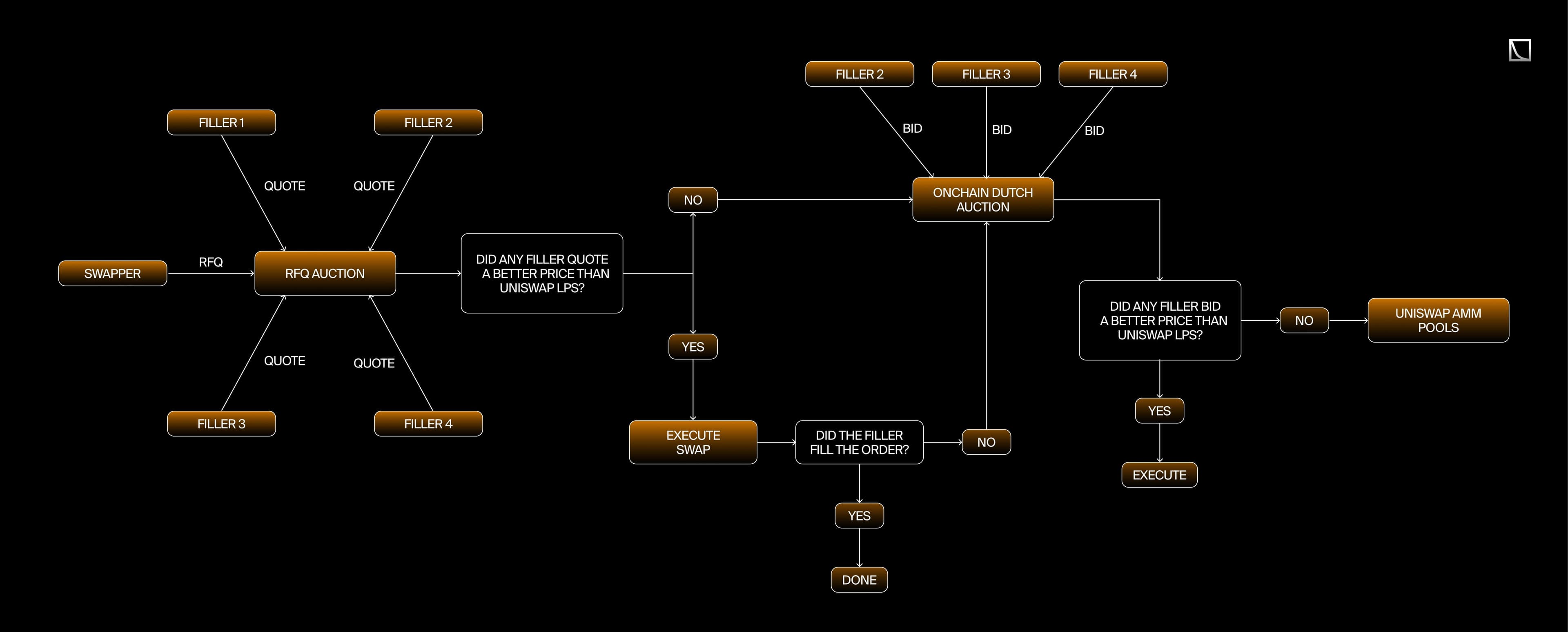

UniswapX is a new protocol introduced by Uniswap that extends its functionality rather than serving as a direct upgrade to previous versions like V1, V2, V3, or V4. It offers several unique features through a Dutch auction-based decentralized trading mechanism, distinguishing it from earlier iterations.

One of the key innovations in UniswapX is its Dutch auction-based trading system. Unlike the constant product market maker model used in previous Uniswap versions, UniswapX employs a Dutch auction mechanism where the price of an order decreases over time. This creates a competitive environment among fillers—agents who execute the orders—to secure the best possible price for swappers. While the user experience of performing a swap remains similar to using Uniswap v2 or v3, in UniswapX, the backend processes involve setting a minimum and maximum number of tokens to receive, based on the slippage set in the UI, as well as determining the transaction deadline.

Another significant feature of UniswapX is its ability to aggregate liquidity from both on-chain and off-chain sources. Orders are routed through the Uniswap Router, which includes liquidity from LPs in V2, V3, and V4, alongside fillers and quoters. This routing mechanism ensures that the best possible price is offered to swappers, as fillers must provide a better price than what is available from the existing liquidity pools; otherwise, the order is executed through those LPs. This broader liquidity access improves the execution quality for swappers.

UniswapX also introduces gas-free swaps, a feature that enhances user convenience. In this system, swappers do not pay gas fees directly. Instead, fillers cover the gas costs, which are then factored into the execution price of the swap. This means users don't need to maintain a balance of the chain’s native token, simplifying the trading process.

The protocol also internalizes Miner Extractable Value (MEV), returning any surplus generated by an order back to the swappers as price improvement. This approach minimizes the value lost to MEV, a common issue in AMMs where arbitrage opportunities can be exploited by miners and other network participants.

Additionally, UniswapX is designed to support cross-chain swaps, enabling users to trade assets across different blockchains in a single action. This functionality combines swapping and bridging, simplifying the process and reducing the complexities typically associated with cross-chain transactions.

When a user wants to swap with an asset integrated on UniswapX, the flow is as follows:

1. Order Initiation:

- Quote Request: The swapper requests quotes from multiple fillers.

- Quote Responses: Fillers respond with their offers, which include the amount of the output token they are willing to provide in exchange for the input token.

2. Order Signing:

- Selection: The swapper selects the most favorable offer.

- Order Signing: The swapper signs an order specifying the input token, output token, maximum output amount, minimum output amount, and other relevant parameters.

3. Order Fulfillment:

- Filler’s Action: The selected filler can fulfill the order using its own liquidity or route the swapper’s input token through various on-chain liquidity sources.

- Direct Fulfillment: The filler sends the output token to the swapper in exchange for the input token.

4. Order Adjustment if Unfulfilled:

- Fallback Mechanism: If the initial filler fails to fulfill the order, it automatically adjusts to the next best available offer.

- Block Expiry: The order price updates over time, based on the predefined decay function, until it reaches the minimum acceptable value. If nobody fills the order, the swap will be executed through Uniswap AMM pools.

5. Price Improvement and Execution:

- Filler’s Decision: Other fillers may decide to fulfill the order if they can profit by sourcing liquidity from multiple venues.

- Execution: The filler routes the input token through different liquidity platforms, collects the output token, and sends the agreed amount to the swapper, retaining any surplus as profit.

Beyond any activated protocol fee, swappers don’t pay gas directly in UniswapX; fillers cover it and recover costs via price. Effective costs to the user are embedded in the quote (including filler PnL and any protocol fee).

Liquidity-fee flywheel

Finally, to fully grasp the success and dominance of Uniswap in the decentralized exchange market, it's essential to understand the concept of the "liquidity-fee flywheel." This self-reinforcing cycle is a cornerstone of Uniswap's growth, driving its liquidity, trading volume, and overall market presence. Here's a concise breakdown:

- High Liquidity Attracts Traders:

- Liquidity refers to the amount of funds available in Uniswap's pools. The more liquidity there is, the easier and faster it is for traders to execute large transactions without significantly affecting the price.

- When there is high liquidity, traders are more likely to use Uniswap because they can get better prices and execute their trades more efficiently.

2. Trading Volume Generates Fees:

- Every time a trade is made on Uniswap, a small fee is charged. This fee is typically a fraction of a percent of the trade's value.

- These fees are collected and distributed to the LPs who have supplied the funds for the liquidity pools.

- Additionally, a recently implemented fee is charged for using the Uniswap front end or its mobile wallet. This fee, which is 0.25%, does not go to the LPs but to Uniswap Labs.

3. Fees Attract Liquidity Providers:

- Because liquidity providers earn those trading fees, providing liquidity becomes an attractive way to earn passive income.

- As more fees are generated from trading volume, more people are incentivized to add their funds to the liquidity pools to earn a portion of these fees.

4. More Liquidity Attracts More Traders:

- With more people adding liquidity, the pools grow larger. Larger pools mean even better trading conditions for traders.

- This attracts more traders to Uniswap, increasing the trading volume, generating more fees, and continuing the cycle.

Intent-based protocols

To understand this research, it is essential to first grasp the concept of intent-based protocols and their cross-chain solutions, including how they function, the origin of their necessity, and the solutions currently being proposed.

The current blockchain landscape is fragmented, with numerous active blockchains, each containing its own liquidity pools. This fragmentation has created significant challenges for user experience (UX), as users often face complex and cumbersome processes when attempting to move assets across different chains. Initial solutions, such as bridges, were introduced to address these issues. However, these early methods proved inadequate, as they typically required multiple user interactions, were time-consuming, and lacked both cost-effectiveness and security.

In response to these challenges, various solutions have emerged over time to improve UX in cross-chain liquidity transfers. Initially, bridges were the primary method for enabling asset transfers between blockchains. However, this approach led to excessive user interaction, resulting in high friction and user dissatisfaction. To address these shortcomings, newer solutions have been developed that focus on minimizing user input and streamlining the transfer process, thereby enhancing the overall user experience.

One of the more recent advancements in this area is the introduction of the CAKE (Chain Abstraction Key Elements) framework, which outlines key methodologies for achieving chain abstraction and improving user experiences in cross-chain environments. A significant aspect of the CAKE framework is its focus on intent-based cross-chain solutions, which are the central focus of this research.

Intent-based cross-chain solutions are designed to simplify cross-chain transactions by allowing users to specify their desired outcome, or "intent," rather than manually handling each technical step. For instance, a user can indicate their intent to swap tokens from one blockchain to another, and the system will manage the technical complexities in the background. This approach significantly reduces the friction associated with cross-chain transactions, thereby improving the overall user experience.

These protocols operate by requiring each intent to be fulfilled by a counterparty, referred to as solvers or fillers, depending on the protocol. These counterparties are individuals or entities that specialize in offering better prices than AMMs. Solvers compete with one another based on speed and price, typically functioning as specialized market makers. While cross-chain intent-based protocols have gained attention for their efficiency, they are not the only solutions available. Initially, such protocols were developed to provide more efficient pricing within a single blockchain, often operating as DEX aggregators. These aggregators utilize DEXs as liquidity sources and incorporate their own Request for Quote (RFQ) systems, allowing various actors to fulfill orders based on intents. If these actors offer better prices than other liquidity sources, they complete the order and receive a fee as a reward.

A key distinction between intent-based protocols and traditional AMMs lies in their approach to fees. In traditional AMMs, a "liquidity flywheel" effect occurs, where LPs add liquidity in exchange for the fees paid by swappers. As the volume of transactions in a pair increases and generates more fees, there is a greater incentive for LPs to provide liquidity, usually resulting in more available liquidity. In contrast, intent-based protocols involve a different fee structure, where the counterparty is not an LP but an individual or entity. The equivalent of the fee in AMMs is the reward given to solvers or fillers, incentivizing them to maximize efficiency in terms of speed and price. This creates a different type of "liquidity flywheel" in these protocols: as more orders are routed through the RFQ system, more rewards become available, leading to increased competition among solvers or fillers. This competition drives better pricing and execution speed, even if the overall liquidity does not necessarily increase.

Despite the advantages of intent-based solutions, there are significant challenges that need to be addressed, particularly the lack of standardization across different projects. The CAKE framework highlights this issue, noting that each project often develops its own standards. This lack of consistency leads to reduced liquidity, higher costs, and slower transactions, underscoring the need for common standards to ensure the efficiency and effectiveness of intent-based protocols across the DeFi ecosystem.

The ERC-7683 Standard

In response to the growing need for standardization in cross-chain transactions, Uniswap and Across have collaborated to develop the ERC-7683 standard, titled "An Interface for Cross-Chain Trade Execution Systems." The primary goal of this standard is to simplify and enhance the UX for cross-chain asset trading by reducing complexity and ensuring sufficient liquidity and active participation.

The ERC-7683 standard introduces several key features that address these challenges. It defines a standardized data structure called CrossChainOrder, which contains essential information such as the user’s address, the contract address for order settlement, the involved tokens, and the trade deadlines. This standardization of data structures is crucial for enabling smoother and more reliable cross-chain transactions.

Additionally, ERC-7683 outlines a smart contract interface named ISettlementContract, which facilitates the initiation and settlement of orders across various blockchains. This interface ensures interoperability among different cross-chain systems by adhering to a set of common rules, making it easier for diverse platforms to interact seamlessly.

To further enhance interoperability, the standard includes a mechanism that converts specific cross-chain orders into a generic format, referred to as ResolvedCrossChainOrder. This conversion allows different systems to understand and execute orders, even if the details of those orders vary, thereby promoting greater flexibility and compatibility across platforms.

While ERC-7683 provides a general framework, it also allows for customization. Developers can tailor various aspects such as pricing models, fulfillment constraints, and settlement procedures to suit specific needs. This balance between standardization and flexibility makes the standard versatile and adaptable, catering to a wide range of use cases without requiring significant modifications to the underlying framework.

Security and efficiency are further enhanced by the integration of a tool called Permit2 within the ERC-7683 standard. Permit2 streamlines the process of token transfer approvals and order signing, reducing the number of required signatures and tying the token transfer directly to the successful initiation of an order. This integration minimizes friction and simplifies the transaction process, making it more user-friendly and secure.

In terms of implementability, the ERC-7683 standard stands out for its strong focus on interoperability and flexibility. The standardized data structures and interfaces it introduces, such as CrossChainOrder and ISettlementContract, significantly reduce the complexity typically associated with integrating multiple liquidity sources. This standardization facilitates easier adoption by developers and ensures that diverse systems can interact seamlessly, which is critical for widespread implementation. Despite its standardized approach, ERC-7683 allows for customization in areas such as pricing models and settlement procedures. This flexibility ensures that the standard can be adapted to various use cases without requiring significant modifications, thus lowering the barrier to implementation. The inclusion of Permit2 enhances security and simplifies the process of order initiation and execution by reducing the number of required user interactions, minimizing friction, and making the standard easier for both users and developers to adopt.

Compared to other solutions proposed within the CAKE framework, which may involve more complex or fragmented approaches, ERC-7683 offers a more streamlined path to implementation. Alternatives like bridging or multi-step swap mechanisms often require intricate coordination and multiple smart contracts, leading to higher implementation costs and a greater risk of integration issues.

Liquidity Issues

One of the primary challenges faced by blockchains that have not gained sufficient attention is the lack of liquidity in their DEXs. This issue creates a negative feedback loop, opposite to the "liquidity flywheel" effect. Due to the limited liquidity, swaps experience significant slippage, causing traders to prefer networks with higher liquidity. As a result, trading volume tends to decrease over time, leading to lower fees, which in turn disincentivizes LPs from adding liquidity.

Literature Review

The cold-start problem for AMMs on new blockchains has been a significant challenge, often hindering the growth and adoption of these platforms as there is not enough liquidity. A potential solution to this issue is the introduction of atomic cross-chain swaps. First conceptualized by Tier Nolan in 2013, atomic swaps did not see practical implementation until 2017, when SatoshiLite, the founder of Litecoin, successfully executed a cross-chain atomic swap between LTC and BTC using HTLC (A7).

Atomic swaps have been extensively studied from various perspectives, with researchers proposing a range of solutions. These solutions generally fall into the following categories.

Hashed Timelock Contracts (HTLCs)

A type of smart contract designed to ensure secure and conditional asset transfers between parties. By locking assets with a cryptographic hash and setting a deadline, HTLCs enable cross-chain swaps, provided the recipient reveals the correct secret before the deadline.

However, HTLCs are not without their drawbacks. They are vulnerable to front-running attacks, require higher gas fees for setup and execution, and become increasingly complex when multiple orders need to be matched (A9). Dan Robinson has critiqued HTLCs for their susceptibility to "griefing attacks," where malicious actors can intentionally lock up liquidity across multiple channels, causing delays and inefficiencies (A10). Furthermore, HTLCs introduce unnecessary complexity and may grant recipients a "free option" to cancel transactions based on changing conditions, posing risks in multi-asset exchanges (P3).

Arbitrary Message Passing Bridges (AMBs)

Facilitate secure cross-chain token transfers by sending messages to lock and unlock tokens across different blockchains. This method is generally easier to implement and offers enhanced security compared to HTLCs. However, AMBs come with their own set of challenges, including high operational costs due to bridge and gas fees, and the risk of message delivery failures that necessitate retries and additional handling (A9). Some implementations use a centralized server to monitor cross-chain messages and match orders, reducing gas fees and speeding up execution. Yet, this reliance on centralization introduces potential vulnerabilities and conflicts with the decentralized ethos of blockchain technology (A9), a good case for a focused bridge review.

Chain Abstraction

Aims to streamline cross-chain intents and improve the user experience (UX) by establishing a common standard for interactions across different blockchains (A4). The CAKE framework introduces three layers for effective chain abstraction:

- Permission Layer: This layer holds the private key for the user and is responsible for signing messages on their behalf. It supports various types of accounts, including Externally Owned Accounts (EOAs), Account Abstraction wallets, and Policy-based Agents (A4).

- Solver Layer: The solver layer estimates the costs and time required for cross-chain transactions, ensuring they are executed efficiently and reliably across different blockchains. It plays a crucial role in optimizing transaction execution (A4).

- Settlement Layer: This layer ensures the finalization of cross-chain transactions. It involves moving assets to the target chain and completing the transaction securely and efficiently after user approval. The settlement layer is vital for ensuring the integrity and security of cross-chain activities (A4).

The CAKE framework also proposes six independent implementations of Chain Abstraction (A4):

One notable application within this framework is UniswapX, which is framed within the Solver Price Competition solution (A4). Chain abstraction simplifies user interactions with blockchains, allowing them to use any product and asset without the need to manage multiple wallets, bridges, or underlying infrastructure. In simpler terms, users can interact with multiple blockchains seamlessly, without needing to know or care about which specific blockchain they are using, such as Arbitrum or any other (A6).

The CAKE Framework's main contribution is in standardizing cross-chain intents, which simplifies user interactions across blockchains. Minimizing the need for multiple wallets and complex bridging helps to streamline the user experience and supports the development of a more integrated and efficient DeFi ecosystem, potentially aiding the adoption of cross-chain applications.

Intent-Centric

Protocols like SUAVE or Anoma represent a more decentralized approach to matching and executing CoWs. These protocols focus on the intent behind transactions, enabling more seamless and trustless cross-chain swaps. While promising, these solutions are still in development and not yet widely available. Alternatives such as zk or fraud proofs could offer trustless verification of asset deposits across chains, but these are also in the early research or development stages (A9).

For cross-chain interoperability to succeed on a broader scale, there is a growing consensus that a new, universally accepted standard is necessary—one that every network can adopt. This would create a larger market of fillers (entities that fulfill intents) and contribute to greater decentralization within the ecosystem (A3). In response to this need, Uniswap Labs and Across Protocol have developed the ERC-7683 standard, specifically designed to unify intent-based interoperability solutions. Currently under review, this standard aims to provide a cohesive framework that can be widely adopted across various networks, enhancing compatibility and ease of use. More details on this standard can be found on their website ERC-7683 (A3).

One of the key initiatives utilizing this standard is Cross Chain Intents (formerly known as Crosschain UniswapX), which is designed to use the same standard as UniswapX. This ensures smooth integration and interoperability between different intent-based solutions (A3). Intents play a crucial role in addressing several persistent issues in cryptocurrency interactions. For instance, they improve execution quality and help mitigate Maximum Extractable Value (MEV) and other extractive behaviors. Additionally, intents simplify the user experience by abstracting complex tasks, thereby lowering the entry barriers for new users and making the ecosystem more accessible (P2).

However, the rise of solvers—entities responsible for executing these intents—introduces new challenges. Among these are risks related to potential centralization, censorship resistance issues, and continued reliance on off-chain liquidity. There is also the principal-agent problem, where solvers might not act in the best interest of users if not properly regulated (P2). To mitigate these risks, strategies have been proposed, including the development of a common intent standard, the creation of Solver DAOs (Decentralized Autonomous Organizations) for collaborative solving, and the implementation of accountability frameworks to ensure that solvers remain aligned with user interests (P2).

In addition to these emerging protocols, the deBridge stack has also embraced atomic cross-chain intents technology, highlighting its potential for secure and efficient cross-chain transactions (A12). Intent-based Decentralized Exchange (DEX) solutions are particularly promising, offering better pricing compared to traditional Automated Market Maker (AMM) solutions (A13). This is largely due to their ability to aggregate liquidity more effectively and execute trades in a way that maximizes value for users.

While these intent-centric solutions are promising, it's important to note that they are still in development and not yet widely available. Alternatives like zk proofs or fraud proofs, which could offer trustless verification of asset deposits across chains, are also in the early research or development stages (A9). Nonetheless, the ongoing advancements in this area are laying the groundwork for a more decentralized and efficient future for cross-chain transactions.

Uniswap V4 Hooks

To date, only one hook has been developed to specifically address atomic cross-chain swaps: the Crosschain Liquidity Hook. This proposed solution utilizes Axelar to automatically redistribute liquidity across chains, aiming to balance liquidity, increase yields, and reduce slippage, especially on smaller chains.

THORChain

ThorChain is often misunderstood as an atomic swap solution and relies on liquidity pools rather than true atomic swaps. It swaps assets like ETH for BTC by first converting ETH to RUNE and then RUNE to BTC, exposing the process to potential risks from liquidity pool vulnerabilities. (A7)

Key Factors Influencing Adoption in the DeFi Ecosystem

While the ERC-7683 standard addresses cross-chain interoperability challenges such as the lack of liquidity on new blockchains. Its implementation and adoption success or failure will depend on various factors within the existing DeFi ecosystem. These factors, which have been observed in the current landscape of decentralized exchanges and liquidity provision, will influence the effectiveness and uptake of any new standard. Key considerations include

- Gas fees significantly impact liquidity provision and trading behavior across different blockchain environments. On scaling solutions like Arbitrum and Polygon, lower gas fees enable more frequent position updates in Uniswap V3, resulting in enhanced liquidity concentration around market prices. This concentration benefits small traders by reducing slippage and lowering execution costs (P14). Conversely, larger traders and liquidity providers (LPs) tend to favor Ethereum's mainnet, despite higher fees, due to its superior security and deeper liquidity pools (P14).

- LP behavior exhibits notable patterns. The majority of LPs demonstrate a cautious approach, typically investing in a single pool. Over 70% of providers invest in only one pool, indicating a conservative strategy that persists even as the number of LPs increases over time (P15). Liquidity migration between pools is primarily driven by external incentives, such as liquidity mining rewards, rather than regular market fluctuations (P15). Returns vary significantly across different pool types. Stablecoin pools offer near risk-free returns, primarily from transaction fees. Normal pools involving major cryptocurrencies like ETH and BTC experience fluctuating returns due to price volatility. Exotic pools, characterized by highly volatile tokens, often result in substantial losses (P15).

- Market fragmentation, particularly with varying fee levels, proves beneficial to the overall ecosystem. It encourages greater LP participation and fosters competition, especially in low-fee pools (P17). This fragmentation contributes to improved market quality by accommodating diverse LP needs. High gas prices exert a substantial influence on liquidity distribution, often shifting liquidity from low-fee to high-fee pools (P17).

- Layer 2 solutions offer both benefits and challenges. Lower gas fees on L2s facilitate more efficient liquidity use and improved returns for LPs through more frequent position rebalancing (P18). However, challenges persist, including centralized sequencers and liquidity fragmentation across different L2s. The process of bridging funds between L2s and the mainnet remains costly and time-consuming (P18).

- Uniswap's evolution reflects the changing landscape of blockchain scalability. While Uniswap V3 was optimized for Ethereum mainnet, the forthcoming Uniswap V4 could leverage cheaper chains to implement more complex hooks and enhance user experience, particularly on L2s (P18). This adaptation highlights the ongoing efforts to balance efficiency, cost-effectiveness, and user accessibility in decentralized exchange protocols.

- Trader behavior. Trader behavior is predominantly influenced by the "think time" or characteristic time, which is one of the most critical predictors of user satisfaction. Following this, the task completion rate and "click time" or offset time also play significant roles. To enhance user satisfaction, it is essential to minimize both the time traders spend deliberating and the time they spend clicking through tasks. (P19)

Conclusions and Implications

Previous research supports our hypothesis that atomic cross-chain swaps can address the cold-start problem for AMMs on new blockchains. While atomic swaps offer a potential solution by enabling asset transfers from established chains to new ones (A4, A7), existing solutions like HTLCs and AMBs have limitations such as complexity, high costs, and centralization risks (A9, A10, A17).

Our research should focus on overcoming these limitations. By exploring intent-centric protocols and standards like ERC-7683, we can develop more user-friendly and decentralized atomic swap solutions (A3, A12, A13). Prioritizing user experience, reducing costs, and addressing centralization risks are key areas to explore (P2). Additionally, analyzing factors like gas fees, LP behavior, and trader behavior will help us design solutions that align with user needs and the broader DeFi ecosystem (P14, P15, P17, P18, P19).

Methodology

To test our hypotheses, we conducted a thorough analysis of on-chain volume alongside the volume of intent-based protocols across three distinct asset pairs on three different blockchains. The primary objective was to determine whether an increase in the volume of intent-based protocols correlates with a corresponding decrease in on-chain volume for these asset pairs. Such a decrease could potentially trigger a reduction in on-chain liquidity because the liquidity flywheel could be affected.

While it might seem logical to consider the entire spectrum of off-chain volume, encompassing all transactions conducted off-chain, including those on CEXs and intent-based protocols, this study deliberately narrows its focus to the volume originating from intent-based protocols. The rationale behind this focus lies in the specific user market we are examining: on-chain users who interact with DEX, whether intent-based or traditional, as opposed to off-chain users who exclusively operate within CEXs.

Our analysis was carried out in a systematic manner, comprising four key steps designed to ensure a comprehensive evaluation of the selected blockchains and asset pairs. This approach allowed us to rigorously test the hypothesis and provide insights into the interplay between on-chain and intent-based protocol volumes.

Step 1: Blockchain Selection

The first step in our methodology involved the selection of the most suitable blockchains for the case study. We initiated this process by acquiring inflow and outflow data from deBridge, focusing on a cumulative 180-day period. The data was extracted using the query found at https://dune.com/queries/3971774. With this data, we compiled a list of the top 10 blockchains based on their cumulative inflow and outflow volumes.

Next, we identified the blockchains that met the following criteria: sufficient cumulative 180-day volume on deBridge, and no ongoing airdrop activities. From this analysis, three blockchains were selected: Ethereum, Arbitrum, and Base. Ethereum was chosen due to its ranking as the second-highest in inflow and outflow volume, making it a strong base-layer blockchain. Arbitrum, which ranked fifth, was selected for its consolidated position as an alternative layer without an ongoing airdrop. Base, ranked fourth, was chosen as a non-consolidated alternative layer, also without an ongoing airdrop (at least publicly).

Step 2: deBridge Data Collection (180 Days)

In the second step, we focused on collecting the necessary deBridge data for our analysis. Specifically, we gathered the cumulative inflow and outflow volumes over 180 days for all exchanged asset pairs on the selected blockchains. The data was obtained through the following queries: for Ethereum, the query is available at https://dune.com/queries/3971932; for Arbitrum, at https://dune.com/queries/4000142; and for Base, at https://dune.com/queries/4008397.

Once the data was collected, we identified the top exchanged asset pairs on each blockchain, categorizing them based on their characteristics. We selected one pair that is highly liquid and consolidated, another that is less consolidated, and a third pair that is not listed on CEXs.

The selected pairs for this analysis were as follows:

Following this, we retrieved both the cumulative and daily inflow and outflow volumes for these selected asset pairs on the chosen blockchains.

Step 3: On-chain and Off-chain Data Collection (180 Days)

The third step involved collecting both on-chain and off-chain data of those pairs of assets over the same 180-day period. Initially, we identified the main DEXs and intent-based DEXs on the chosen blockchains.

For the on-chain data, we collected cumulative and daily trading volumes using the following queries: for Ethereum at https://dune.com/queries/4001734; for Arbitrum at https://dune.com/queries/4001769; and Base at https://dune.com/queries/4001799. Similarly, for off-chain data, we retrieved cumulative and daily volumes using the following queries: for Ethereum at https://dune.com/queries/4001750; for Arbitrum at https://dune.com/queries/4001827; and Base at https://dune.com/queries/4001814.

Step 4: Analysis

The final step involved a comprehensive analysis of the on-chain and off-chain volumes for the selected asset pairs. Our primary objective was to determine whether there was a correlation between increases in off-chain volume and decreases in on-chain volume for each asset pair.

The analysis proceeded as follows. First, we applied logarithmic transformations to the on-chain volume, off-chain volume, and active address data to address skewness and stabilize variance. Then, we employed Ordinary Least Squares (OLS) regression models to analyze the relationship between on-chain volume (the dependent variable) and two independent variables: off-chain volume and active addresses. These models were separately applied to each token pair on each blockchain.

We assessed the statistical significance of the off-chain volume's impact on an on-chain volume using p-values, considering a threshold of p < 0.05 to indicate significance. Additionally, Pearson correlation coefficients were calculated to assess the strength of the linear relationship between on-chain and off-chain volumes. To visualize these relationships, regression plots were generated, which included the Pearson correlation coefficients.

In our time series analysis, we examined the relationships between on-chain volume, off-chain volume, and active addresses over time. We applied the Augmented Dickey-Fuller (ADF) test to ensure the stationarity of the time series data. Subsequently, a Vector AutoRegression (VAR) model was utilized to explore the interdependencies among these variables. The optimal lag selection for the VAR model was determined based on the AIC coefficient, with the number of lags chosen according to the lag showing the lowest coefficient among the 15 lags analyzed. This approach provides a robust framework to explore the interdependencies among the variables.

Granger causality tests, both normal and inverse, were conducted to determine whether off-chain volume could predict on-chain volume, or vice versa, indicating potential causality.

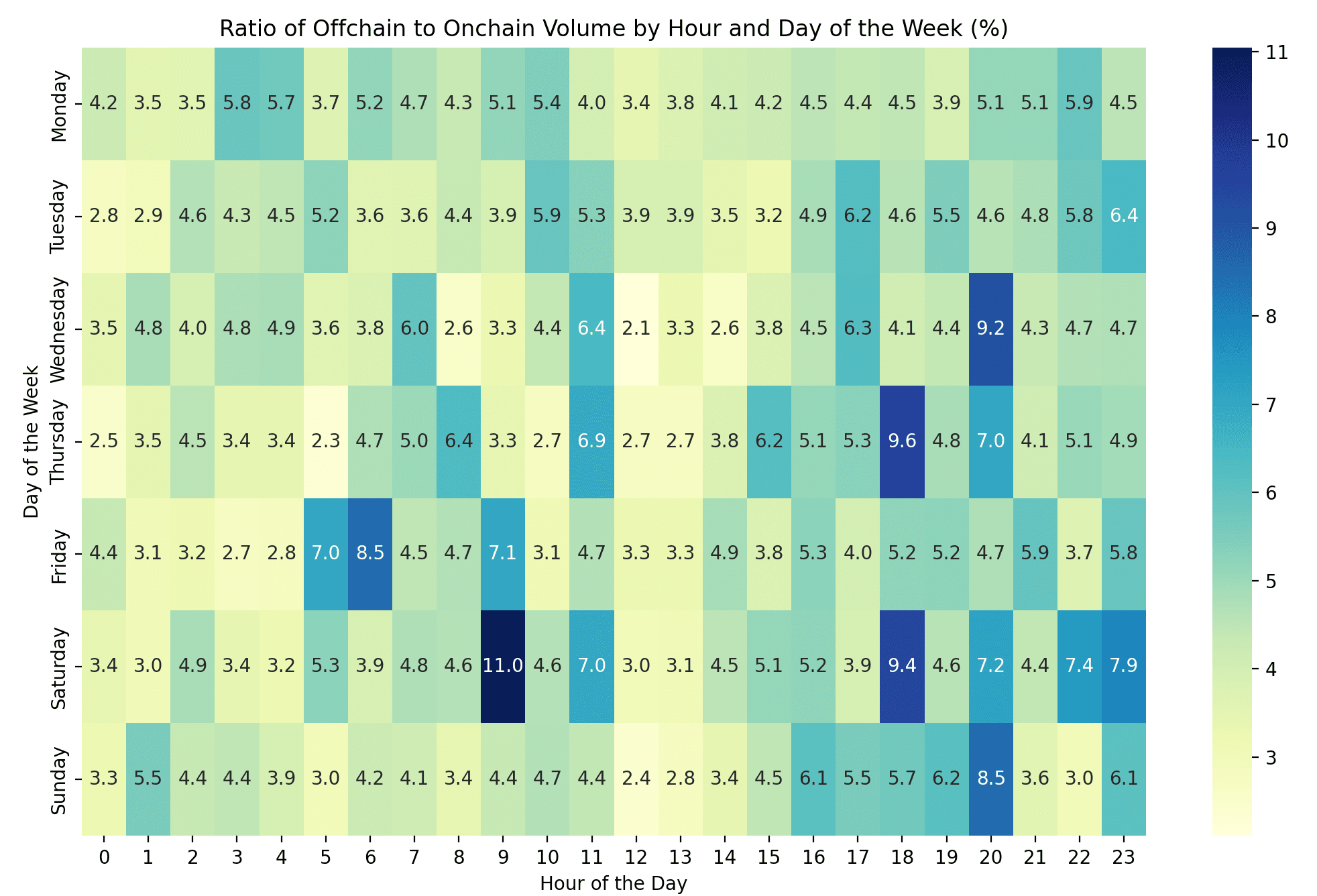

Finally, we performed a solvers analysis, creating a heatmap to compare the activity (as a ratio of off-chain volume to on-chain volume) of the solvers based on the hour and day. This comprehensive approach allowed us to test the hypothesis that an increase in off-chain volume is statistically associated with a decrease in on-chain volume for the selected asset pairs. Furthermore, we examined the activity of fillers and compared their volume to the on-chain volume to assess whether intent-based protocols are a practical and effective solution in this context.

Empirical Results

This section presents the findings of our analysis, examining the impact of intent-based protocols on on-chain liquidity across different blockchains and asset pairs. By systematically testing our hypotheses and exploring key variables, we uncover significant insights into the relationship between off-chain and on-chain activity. The results highlight variations in the effects depending on the blockchain (Ethereum, Arbitrum, Base) and asset pair studied, offering valuable data for understanding how the rise of intent-based protocols could reshape liquidity dynamics on decentralized exchanges.

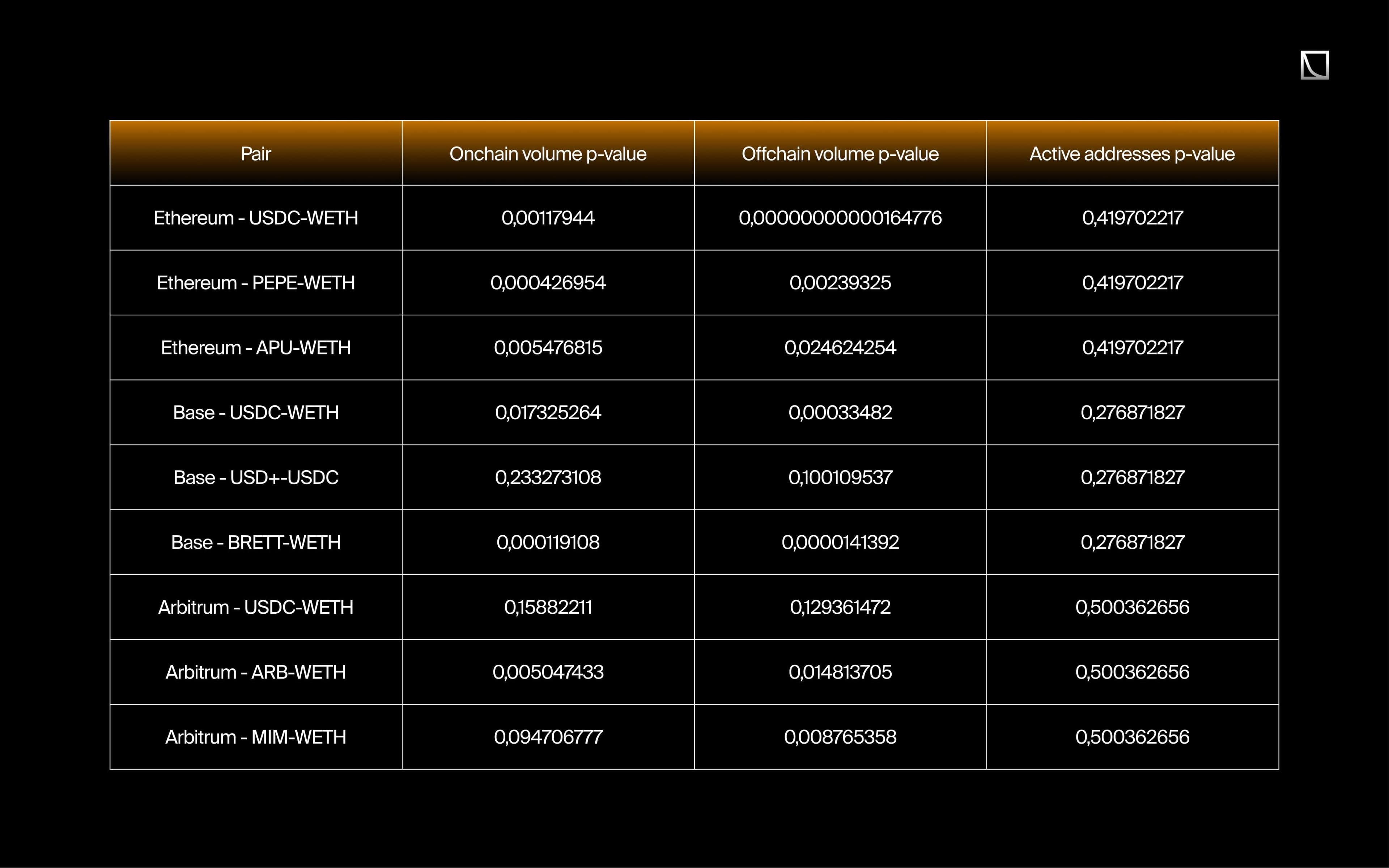

The numerical results obtained from the first 4 steps of the data analysis are summarized in the following table:

Pearson coefficient and its p-values

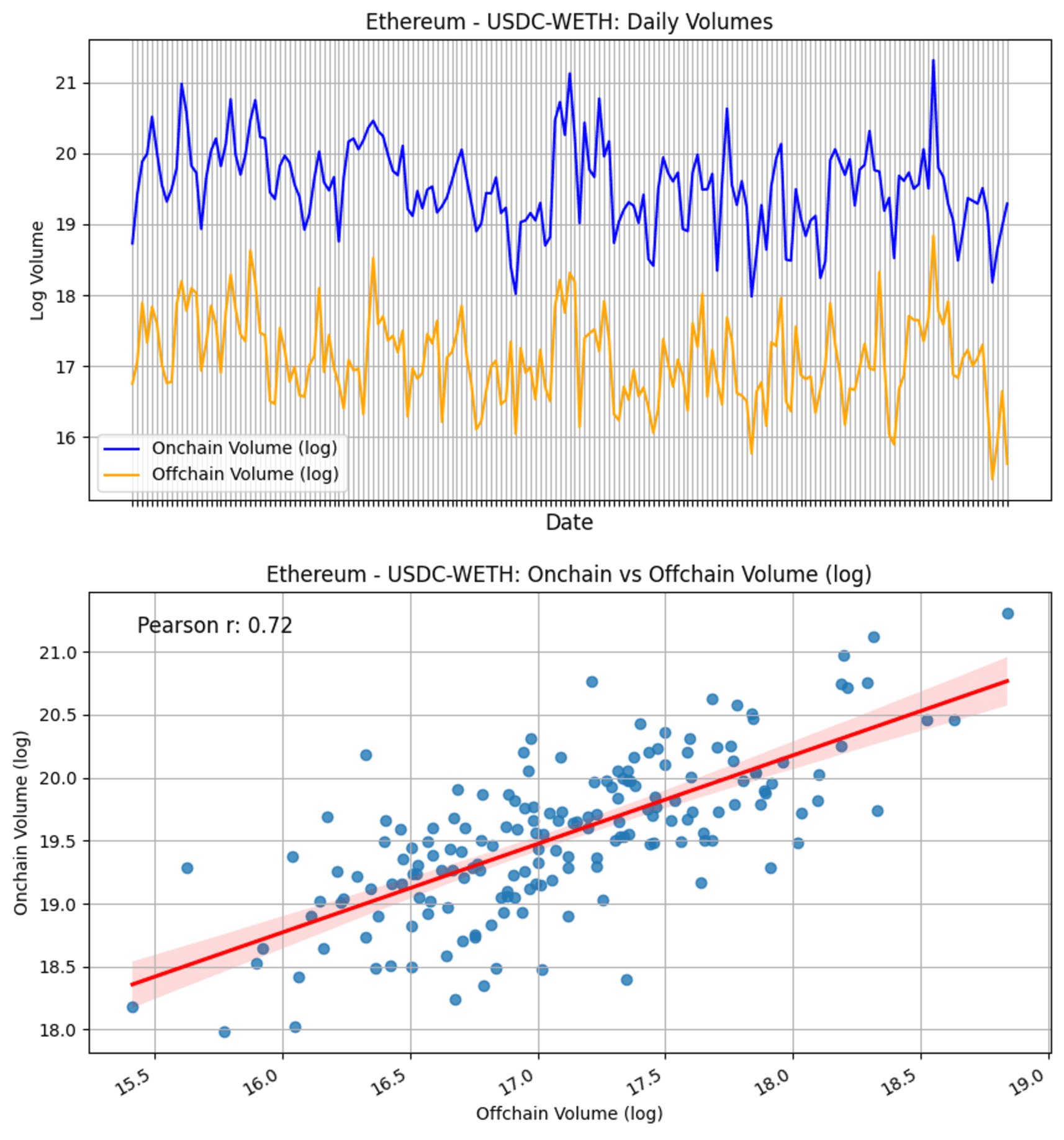

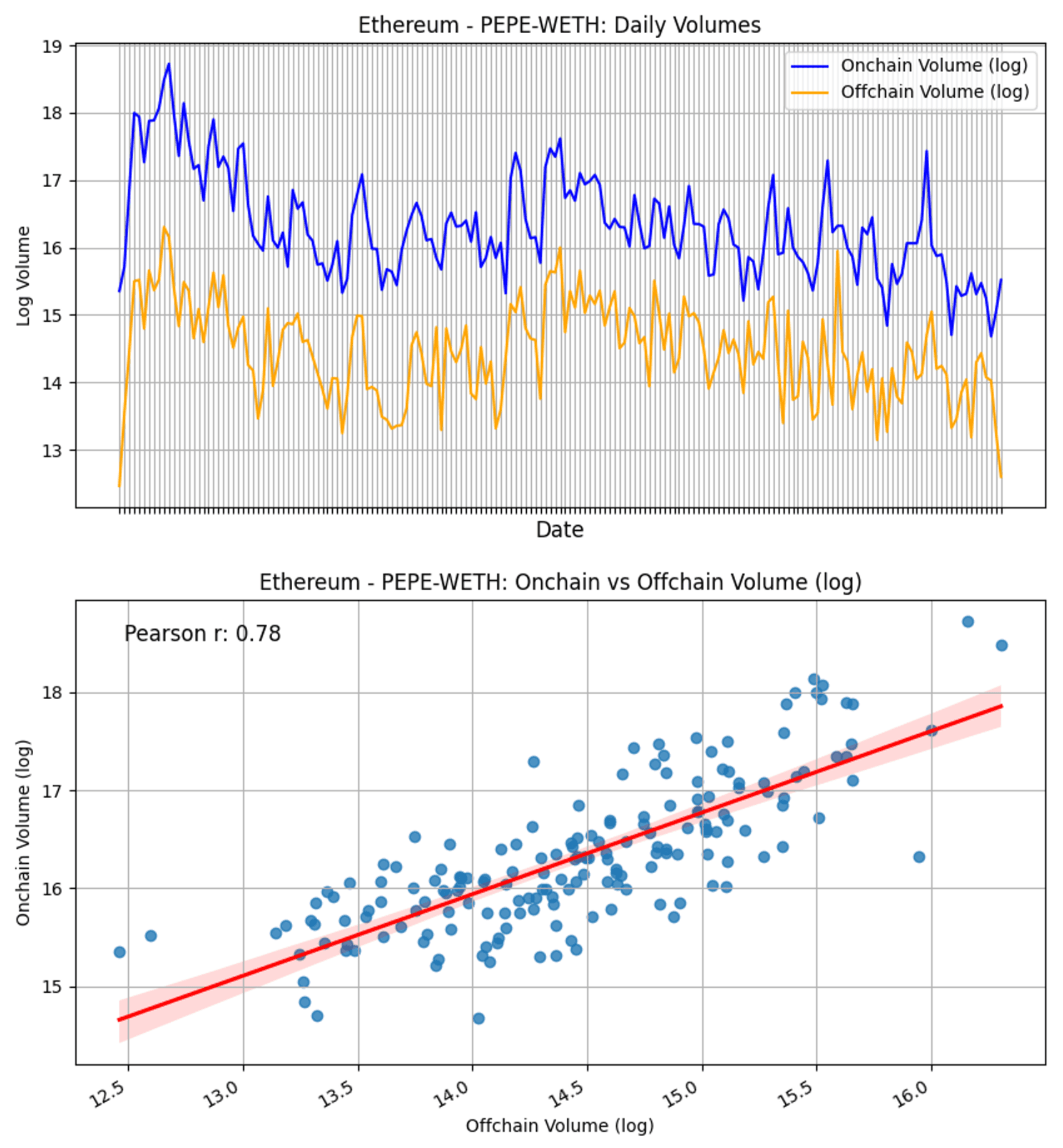

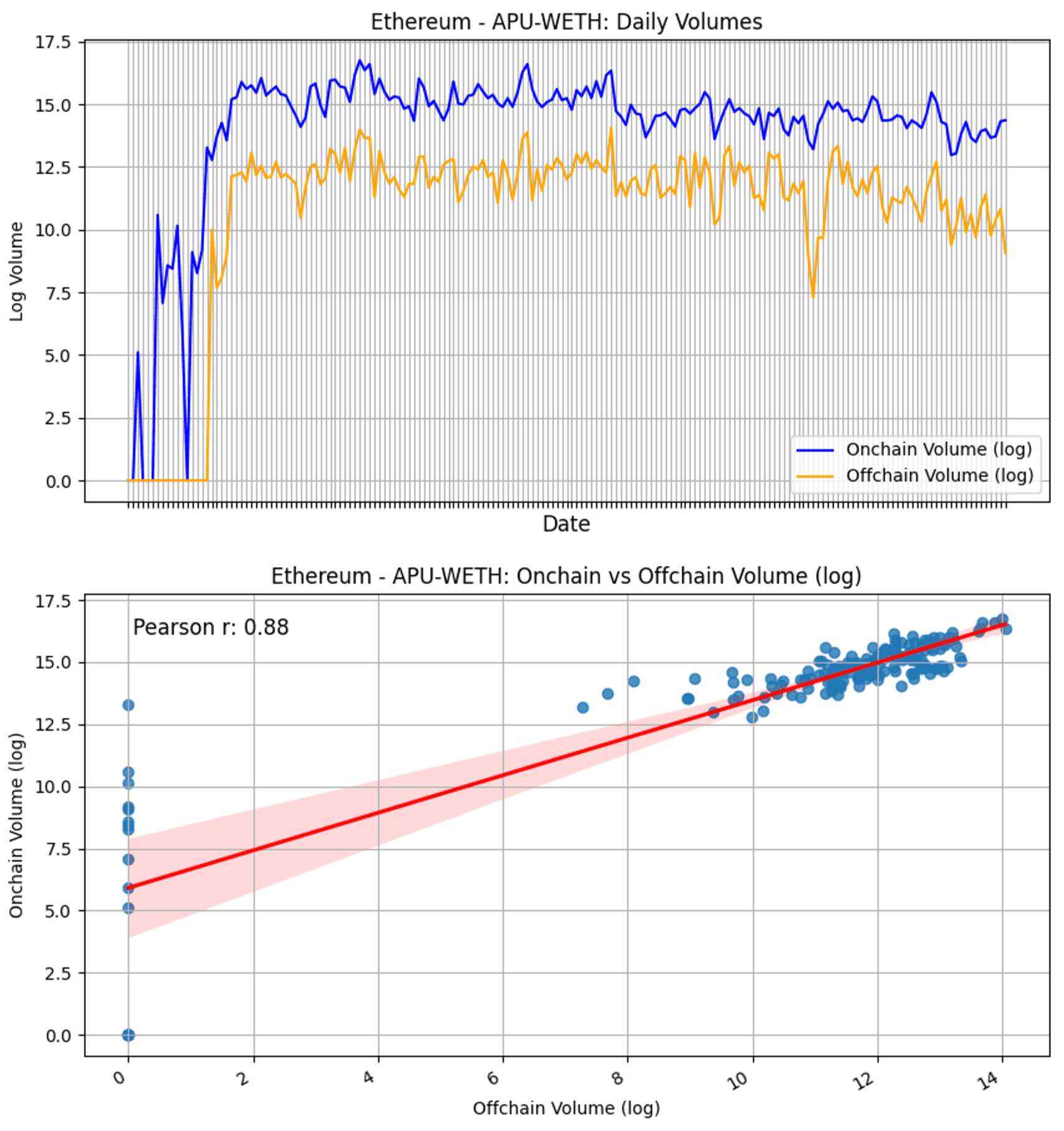

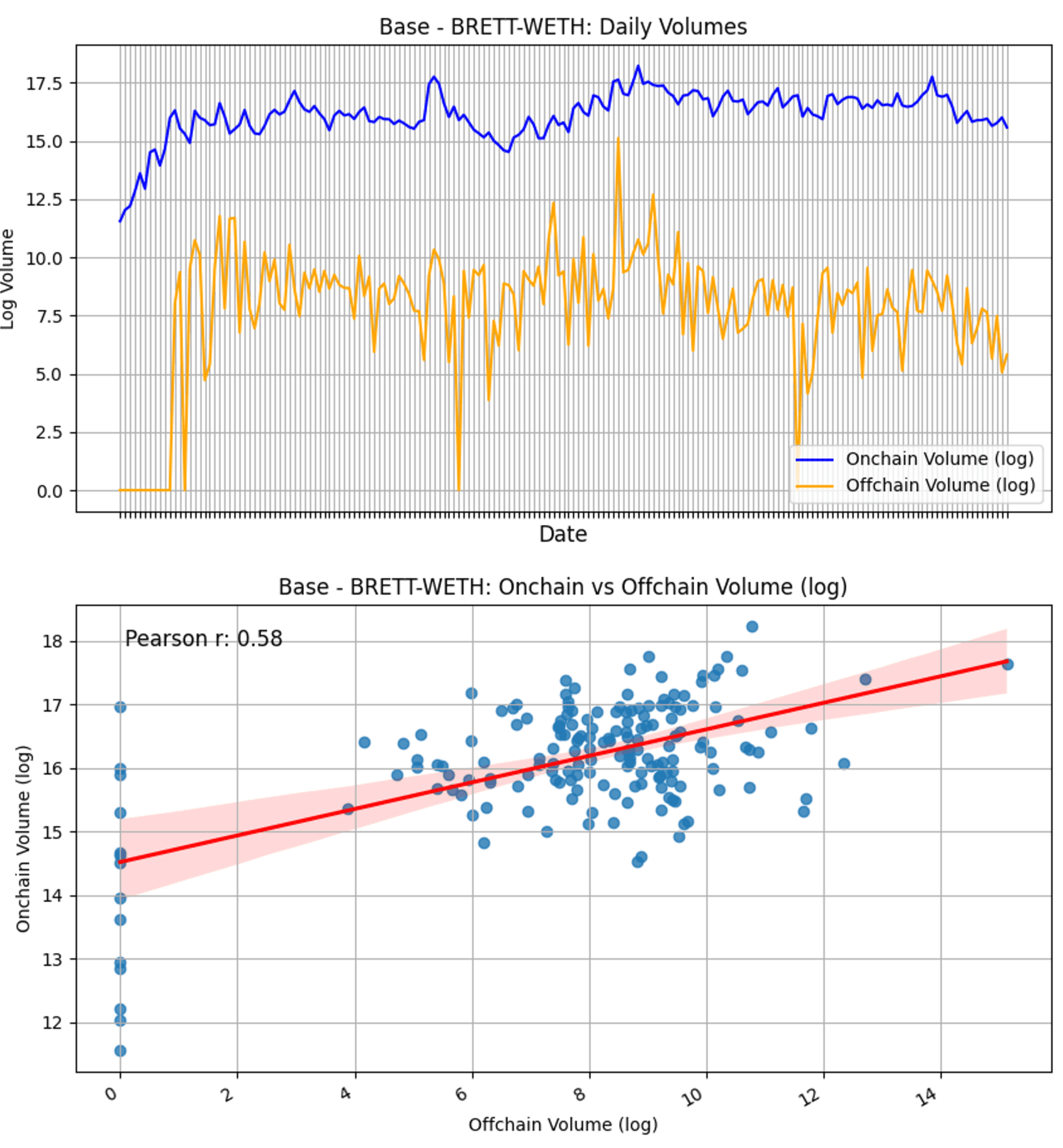

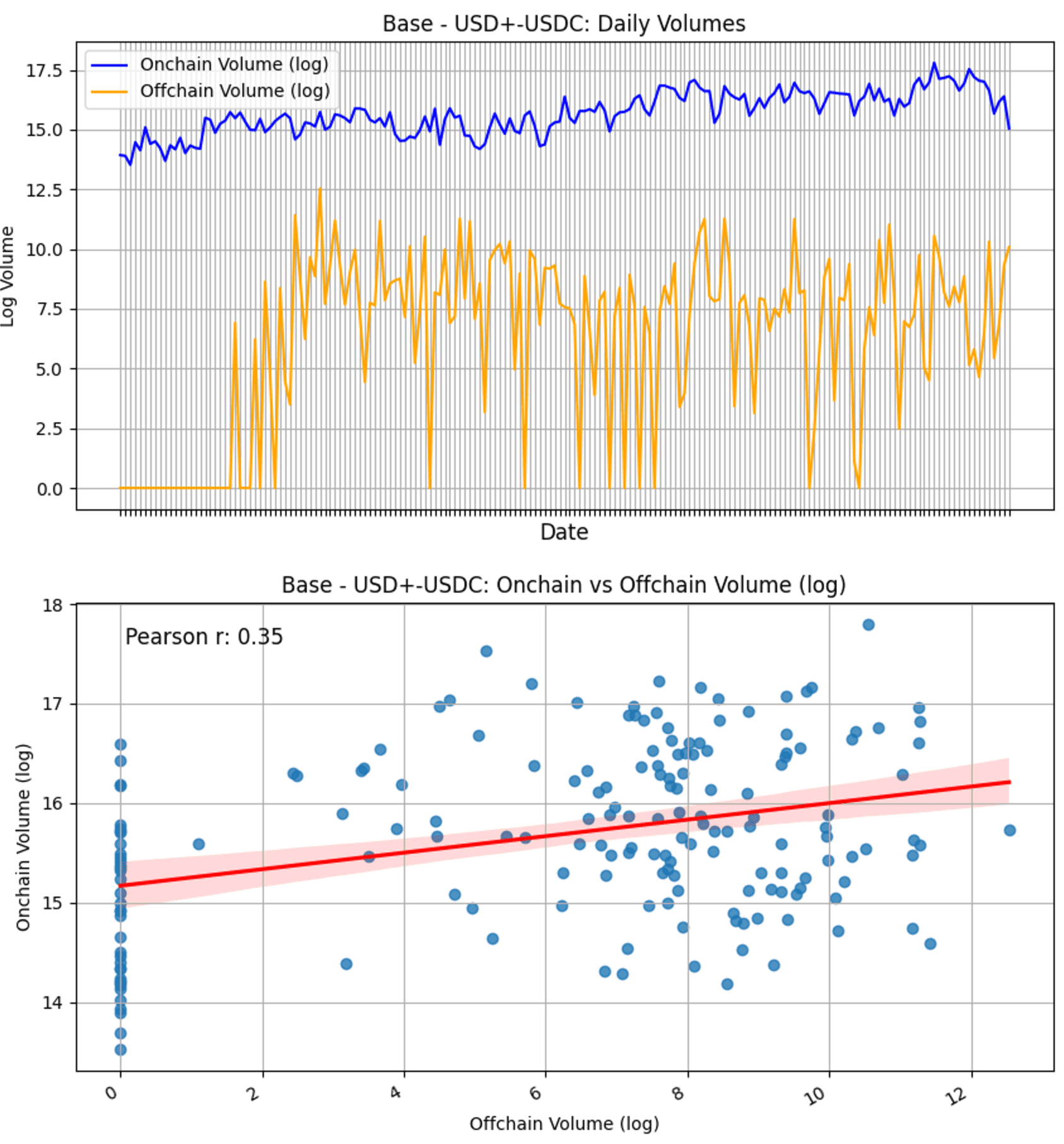

To provide further context, we have included the charts for each of the analyzed asset pairs below:

Daily volumes and regression plot of USDC-WETH on Ethereum

Daily volumes and regression plot of PEPE-WETH on Ethereum

Daily volumes and regression plot of APU-WETH on Ethereum

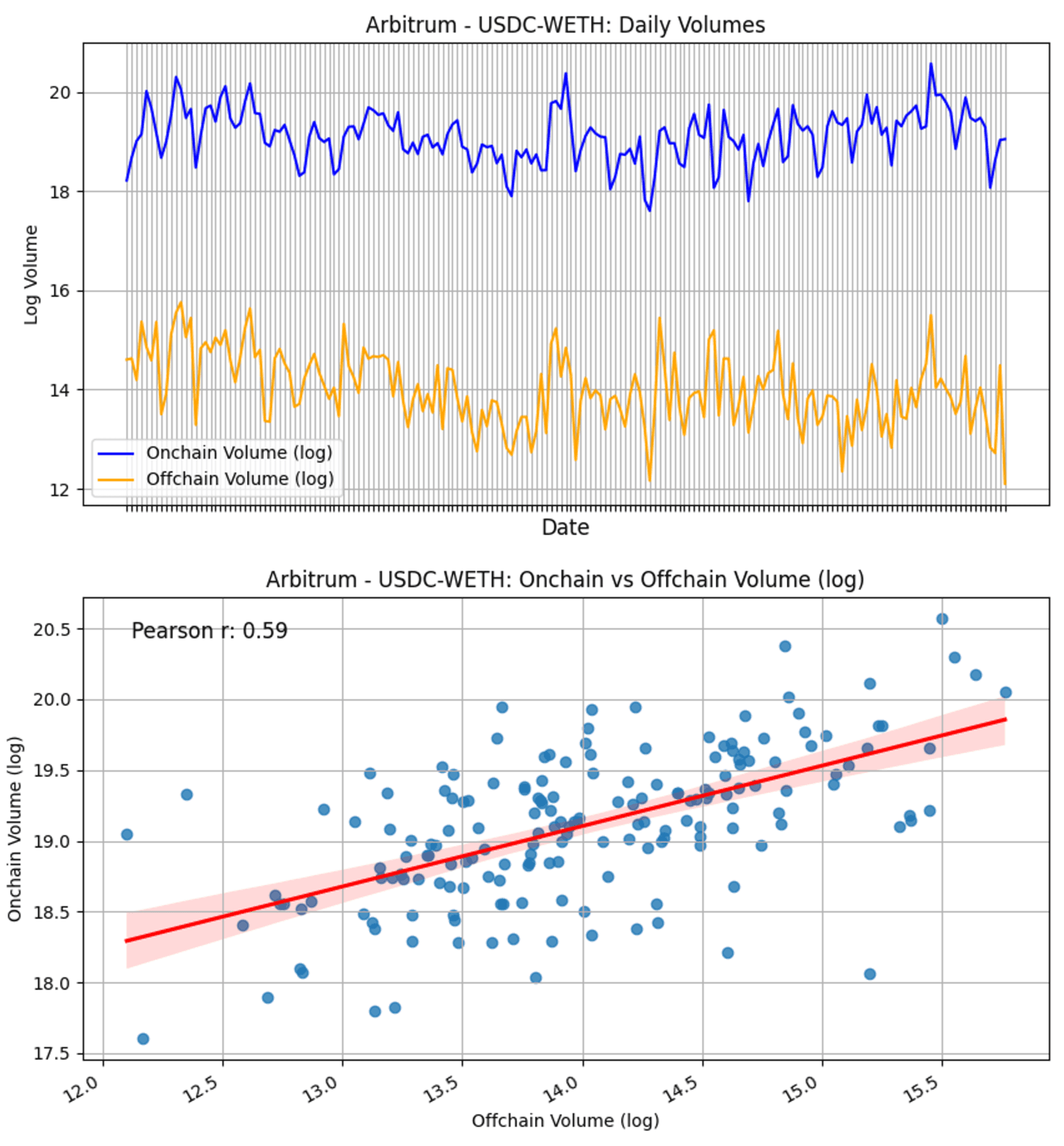

Daily volumes and regression plot of USDC-WETH on Arbitrum

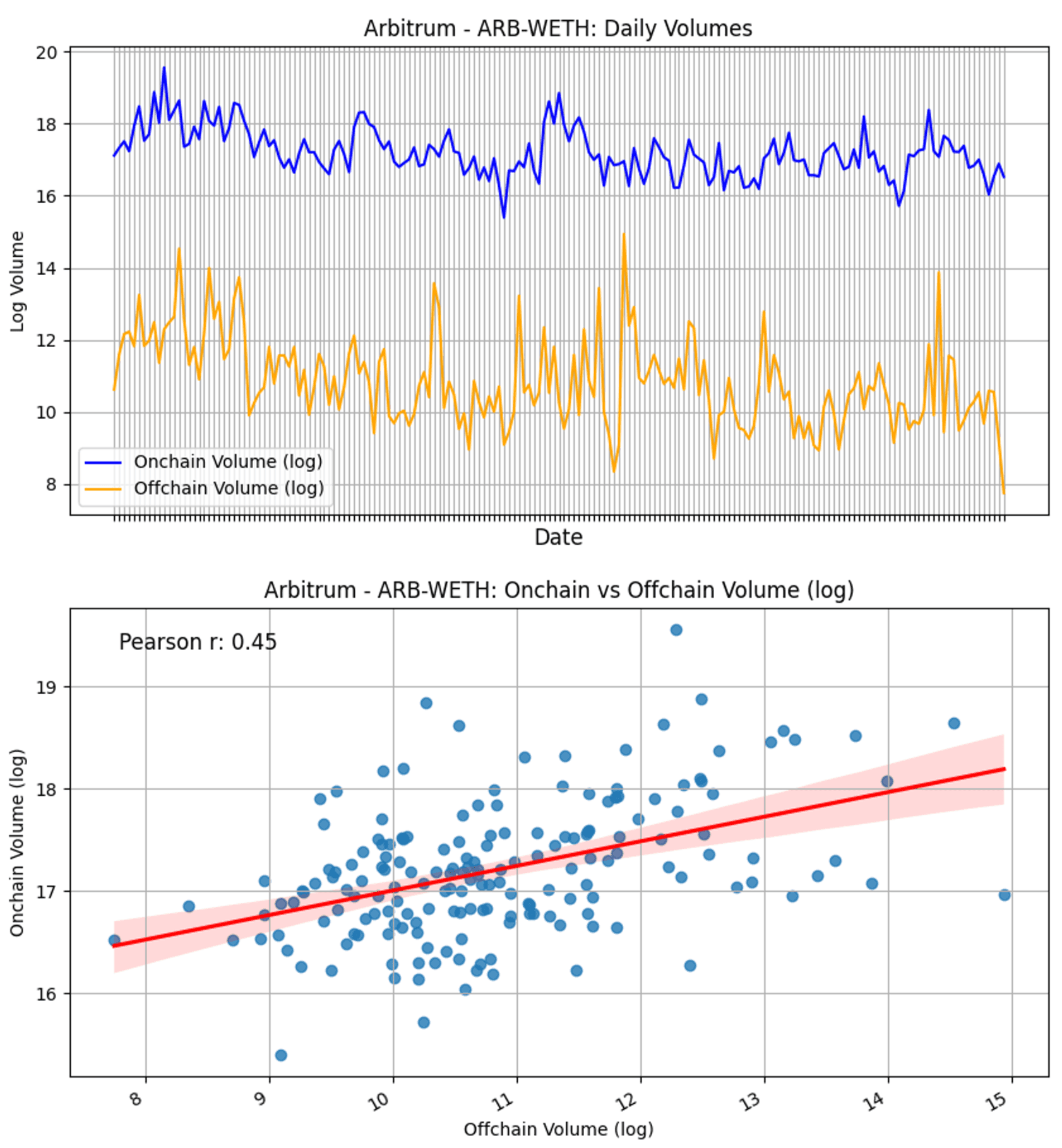

Daily volumes and regression plot of ARB-WETH on Arbitrum

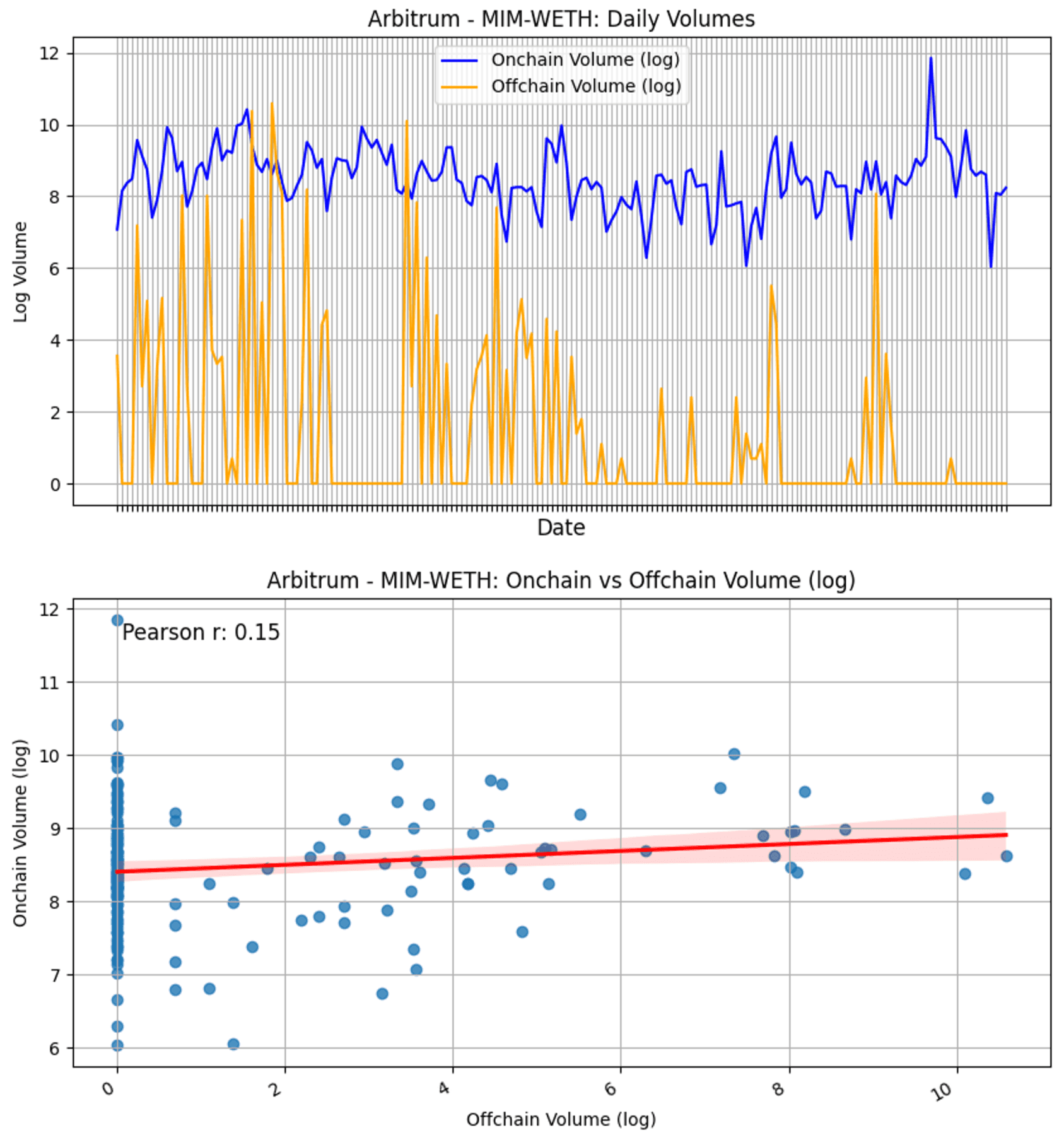

Daily volumes and regression plot of MIM-WETH on Arbitrum

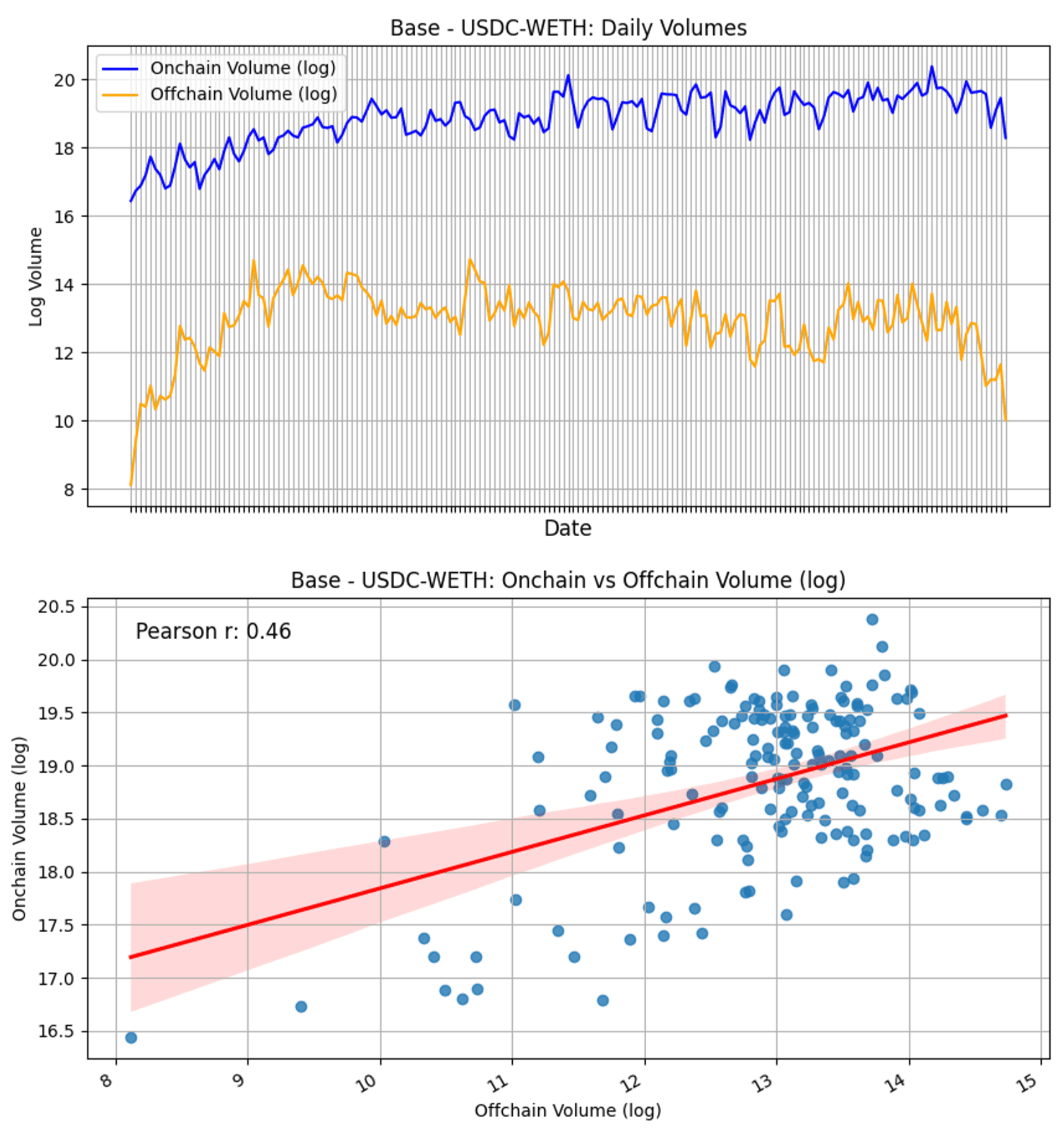

Daily volumes and regression plot of USDC-WETH on Base

Daily volumes and regression plot of BRETT-WETH on Base

Daily volumes and regression plot of USD+-USDC on Base

It is observed that for all pairs, there is a significant positive correlation, except those that are purely onchain (USD+-USDC and MIM-WETH). Additionally, this correlation is significantly stronger on Ethereum than on Arbitrum and Base.

ADF tests

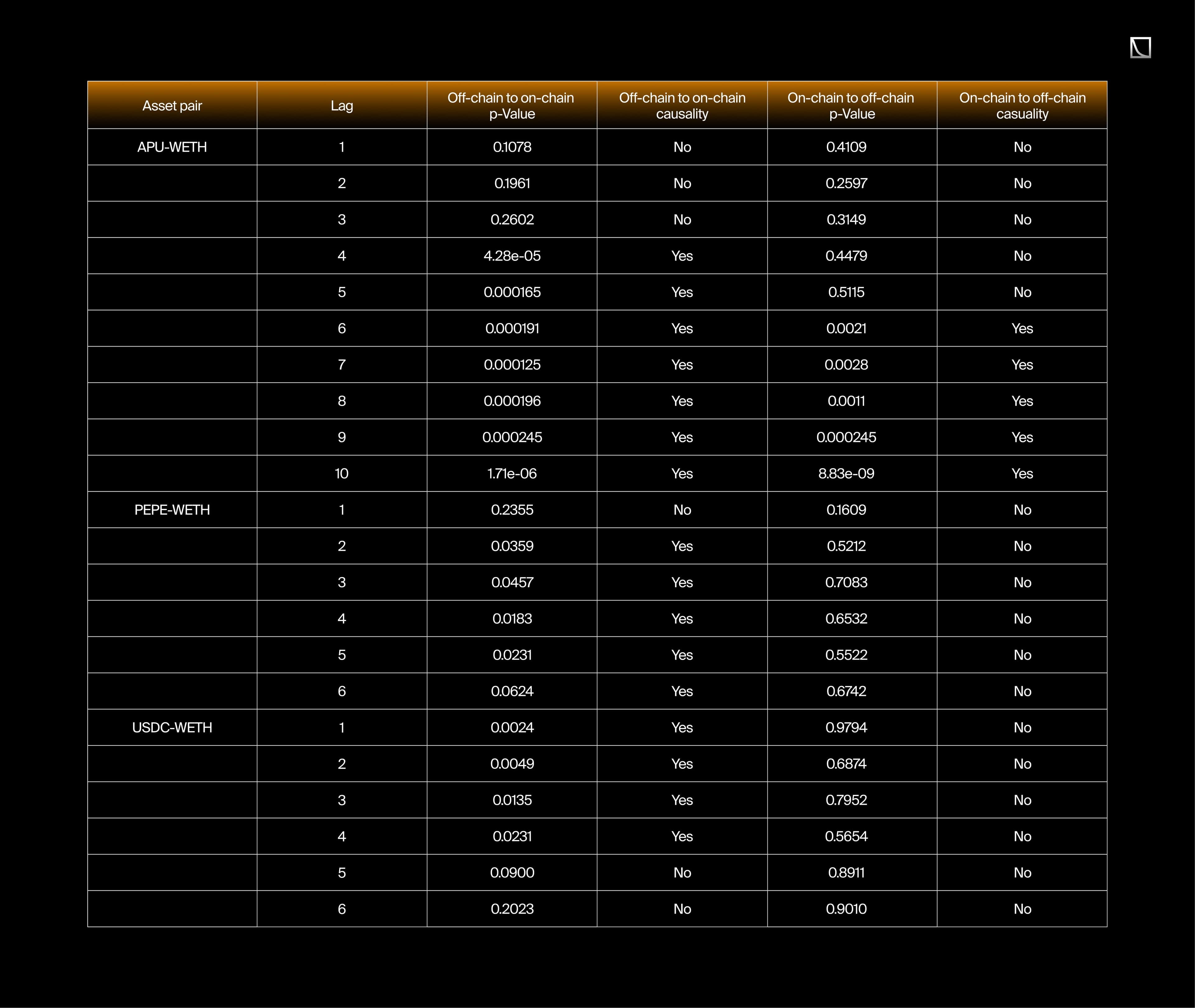

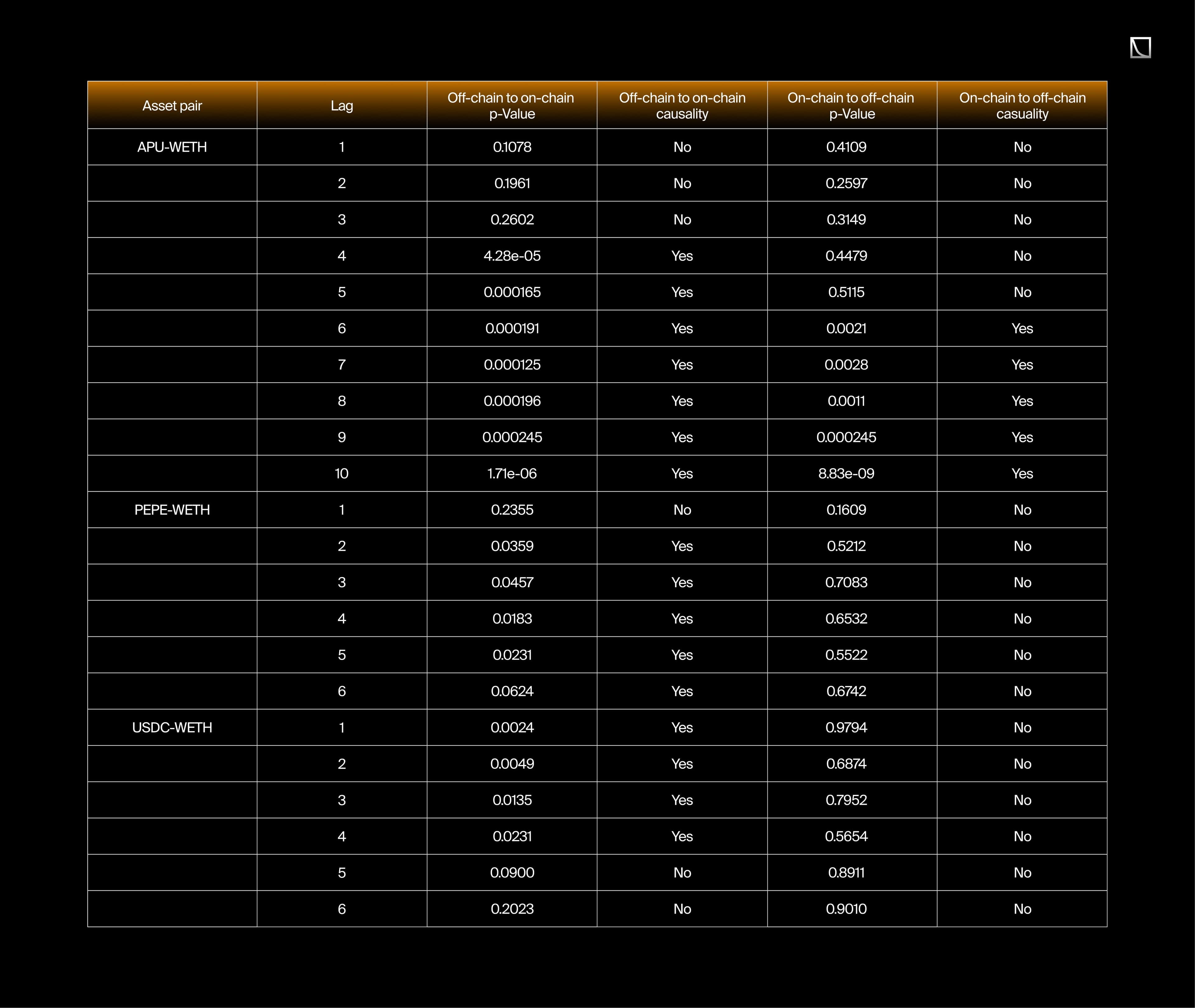

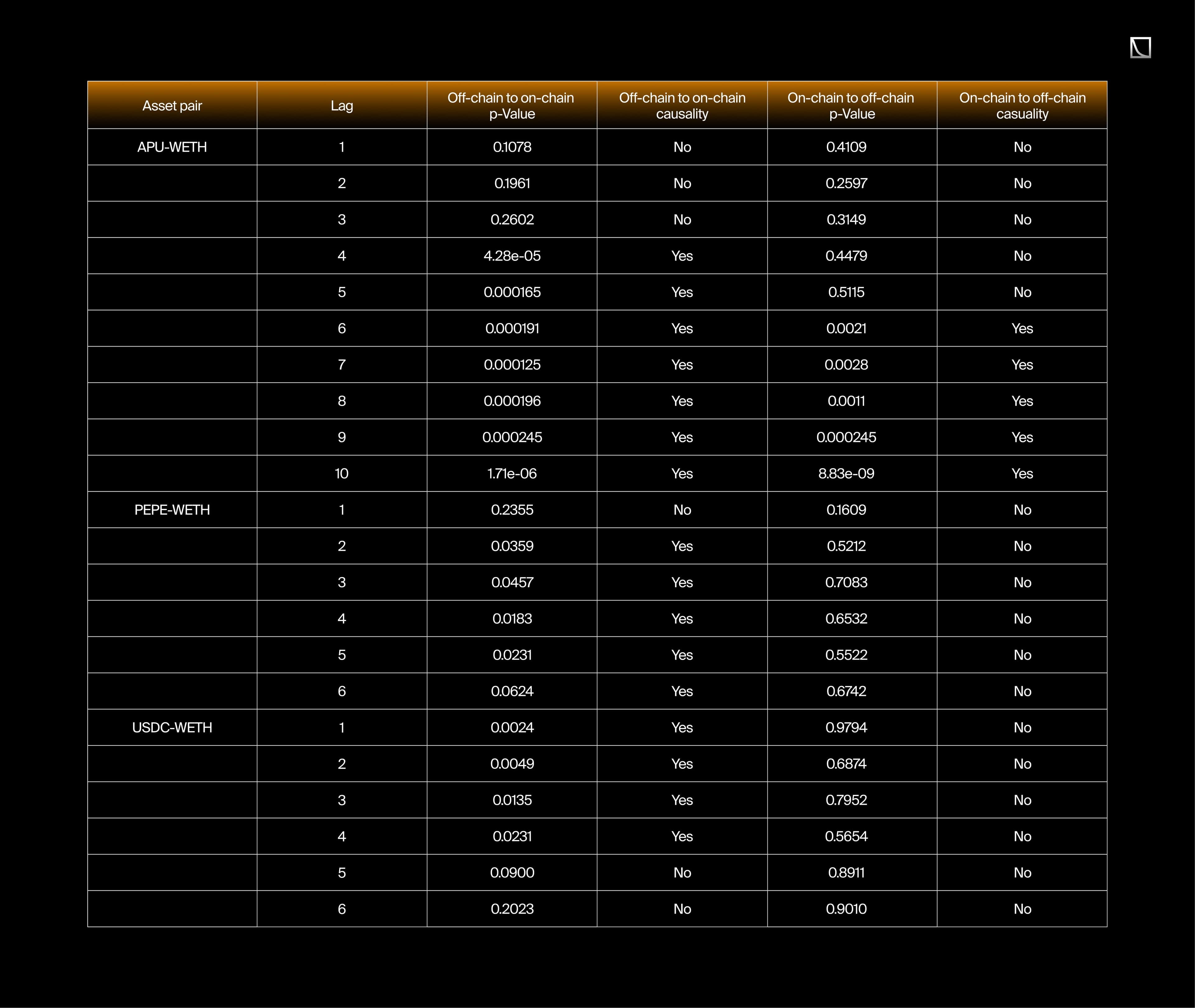

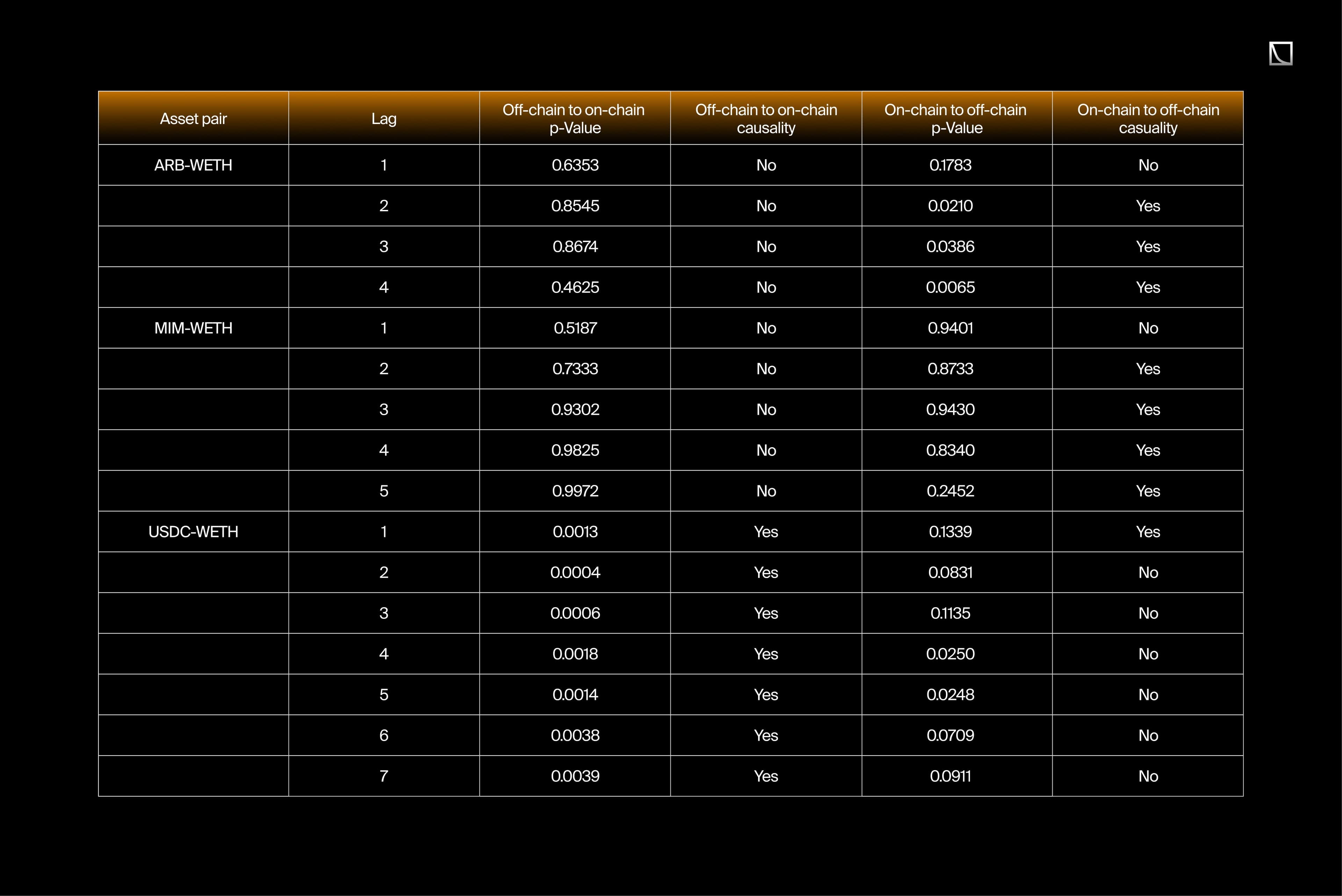

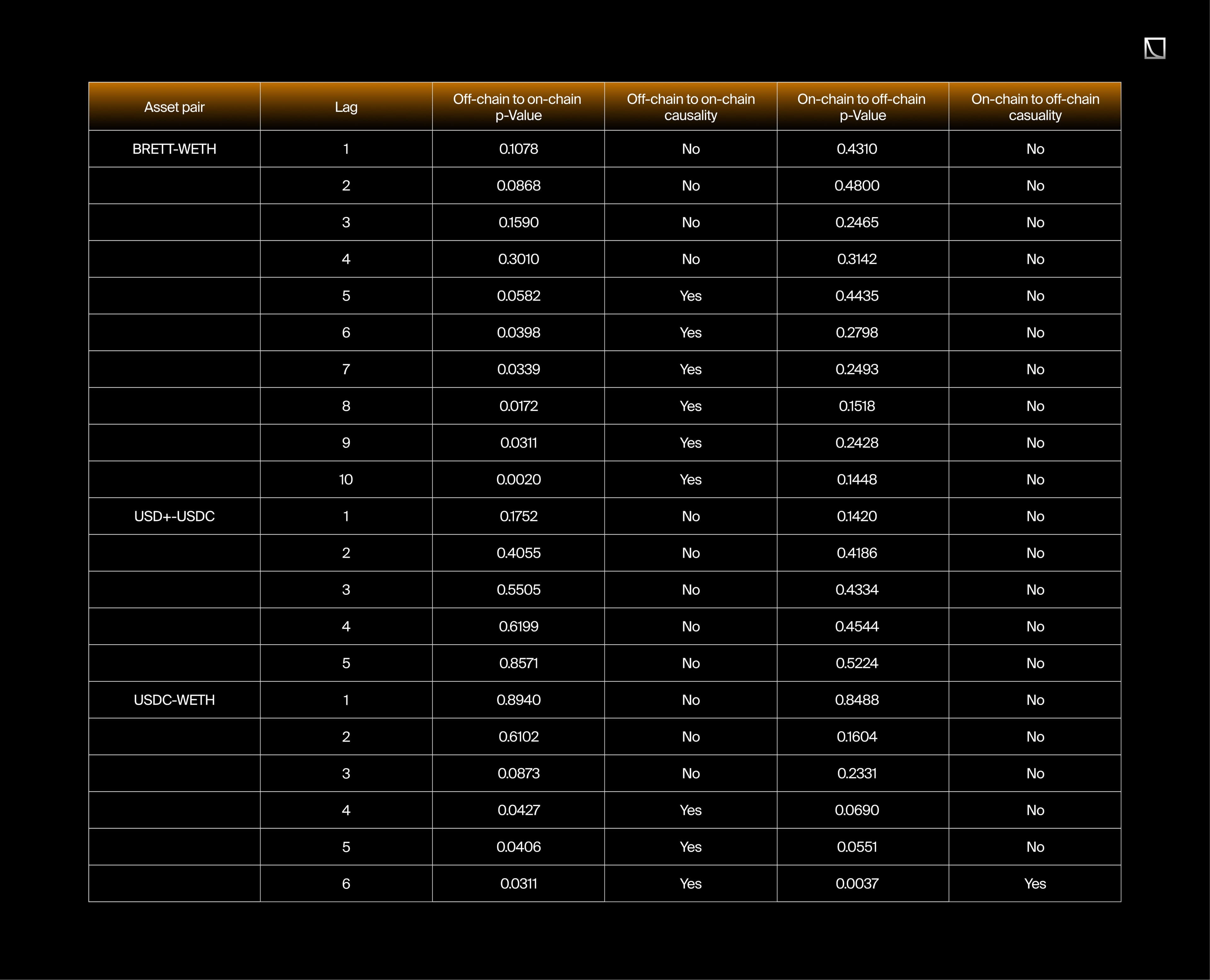

The numerical results from the Granger Test indicate that the outcomes vary across different asset pairs, depending on the lags analyzed. This data is summarized in the following tables:

Granger Test Results for Ethereum

Granger Test Results for Arbitrum

Granger Test Results for Base

The Granger causality tests reveal a significant predictive relationship between off-chain volume and on-chain volume, and vice versa for some assets, with p-values indicating potential strong causality. This suggests that movements in one volume type can reliably predict movements in the other, highlighting a dynamic interaction between on-chain and off-chain activities.

For other assets, the relationship only implies correlation in one direction—either from off-chain to on-chain or from on-chain to off-chain. For less liquid asset pairs, the correlation is confirmed to be insignificant.

Lastly, we also analyzed the solvers' typical working hours and compared their volume with on-chain volume to assess whether, in practice, the solution based on them is effective and whether they are active at all times of the day.

In the heatmap, it can be observed that despite solvers being primarily institutions or market makers, their activity does not decrease significantly at any time during the week and is even higher during periods of reduced volume, such as weekend nights.

Discussion

Based on the analysis, the relationship between off-chain volume and on-chain volume varies depending on the specific blockchain, token pairs, and the type of pair of assets (traded on CEX+DEX vs traded only on DEX):

- USDC-WETH: The analysis shows a significant positive correlation between off-chain and on-chain volumes (coefficient = 0.698, p-value < 0.001). This suggests that an increase in off-chain trading volume is associated with a notable increase in on-chain volume. VAR model results indicate a strong predictive relationship from off-chain to on-chain volume, with Granger causality tests confirming this bidirectional influence. This pair’s high liquidity across CEX and DEX platforms underscores the robustness of this relationship, suggesting that off-chain activity might drive or reflect similar trends in on-chain transactions.

- PEPE-WETH and APU-WETH: Both pairs exhibit strong positive correlations, with coefficients of 0.828 and 0.756, respectively, and very low p-values. The VAR analysis for these pairs also indicates a significant influence of off-chain volume on on-chain activity, particularly for PEPE-WETH, where Granger causality tests suggest that off-chain volume significantly predicts on-chain volume. These findings imply that even for less prominent pairs, off-chain volume is a strong predictor of on-chain activity.

Base

- USDC-WETH: The positive but smaller coefficient (0.186, p-value < 0.001) suggests a weaker yet significant relationship between off-chain and on-chain volumes. VAR analysis for this pair shows that while there is a positive correlation, the predictive power is weaker compared to Ethereum. The differences might stem from variations in market maturity, liquidity, or infrastructure. Granger causality tests did not find a strong causal relationship, indicating that the interaction between these volumes might be more complex on Base.

- USD+-USDC: This pair shows an insignificant and slightly negative relationship between off-chain and on-chain volumes (coefficient = -0.011, p-value = 0.433). The results suggest that for USD+-USDC, off-chain activity may not be a reliable predictor of on-chain volume and vice versa.

- BRETT-WETH: Although less traded than USDC-WETH, BRETT-WETH still shows a positive correlation (coefficient = 0.152, p-value < 0.001). The VAR analysis suggests that off-chain volumes can moderately predict on-chain activity even for smaller pairs on Base, although the relationship is not as robust as in more liquid pairs.

Arbitrum

- USDC-WETH: The relationship between off-chain and on-chain volumes is moderate but significant (coefficient = 0.404, p-value < 0.001). However, the ADF tests indicate that the time series for on-chain volume, off-chain volume, and active addresses are not stationary, which raises concerns about the validity of the VAR model and Granger causality tests applied in this context. Although the VAR model suggests that off-chain volume influences on-chain volume, this relationship may be less robust due to the non-stationarity of the data. The Granger causality tests confirm some degree of influence, highlighting the interconnectedness of off-chain and on-chain activities even in less mature ecosystems like Arbitrum. However, these results should be interpreted with caution, given the potential for spurious relationships caused by the underlying trends in the non-stationary data. Further preprocessing or alternative modeling approaches may be necessary to obtain more reliable insights.

- ARB-WETH: The effect is weaker (coefficient = 0.173, p-value < 0.001) but still significant, indicating that off-chain activity influences on-chain volume, though the impact is smaller compared to more liquid pairs. The VAR analysis also supports this finding, showing a moderate influence of off-chain volume on on-chain activity.

- MIM-WETH: This pair shows the weakest relationship (coefficient = 0.022, p-value = 0.337), with the VAR model and Granger causality tests indicating a lack of significant interaction between off-chain and on-chain volumes. The results suggest that for MIM-WETH, off-chain activity may not be a reliable predictor of on-chain volume and vice versa.

Comparative Insights Across Blockchains

- Ethereum as a Benchmark: Ethereum remains the blockchain where off-chain volume most strongly affects on-chain activity. The robustness of these relationships, particularly for USDC-WETH, makes Ethereum an essential benchmark for understanding the dynamics between off-chain and on-chain trading. These insights could inform strategies as other blockchains evolve and develop their market structures.

- Divergence in Lower Liquidity Networks: The results from Base and Arbitrum highlight that the relationship between off-chain and on-chain volumes can vary significantly depending on each blockchain's liquidity and trading environment. On these blockchains, off-chain activity’s influence on on-chain volumes is less pronounced, possibly due to differences in market infrastructure or liquidity provision strategies.

Although our initial hypotheses suggested that intent-based protocols might negatively impact on-chain liquidity, our findings indicate a positive correlation across most pairs and blockchains. A key reason could be that this off-chain volume (generated by solvers) remains very low, about 4.63% of on-chain volume, failing to reach the critical threshold needed to significantly affect APY in liquidity pools.

Furthermore, the strength of this relationship varies significantly. The effect is more pronounced in highly liquid pairs (such as USDC-WETH on Ethereum) and diminishes in pairs primarily traded on DEXs or with lower liquidity. This could suggest that solvers are not interested in filling orders from DEX-only tokens. Our main hypothesis suggests that this is because these tokens can’t be arbitraged through CEXs, making it difficult to offer better quotes than the price provided by an AMM LP. However, this is just a hypothesis and should be investigated further to obtain conclusive data.

Regarding the time series of all the aggregated data, its analysis, supported by the ADF tests, confirms that most key variables are stationary, ensuring that the relationships observed are reliable and not driven by underlying trends.

The VAR model analysis, considering the most significant lags (ranging from 1 to 10 across different pairs), reveals that past values of on-chain and off-chain volumes do indeed influence current volumes over time. However, the complexity and interaction within these markets are highly dependent on the specific asset pair and blockchain, with varying degrees of impact observed across different lags.

Granger causality tests show a mixed picture of the relationships between off-chain and on-chain volumes. For some pairs, there is a strong bidirectional relationship, indicating that off-chain and on-chain activities are closely interlinked, each influencing the other. However, for other pairs, the relationship is weaker or even insignificant, suggesting that the dynamics between off-chain and on-chain activities can vary widely depending on the specific context.

Regarding solver activity, although they fill less volume on weekends, a comparison with on-chain volume shows that they fill orders every day at every hour, indicating that intent-based protocols are currently a good alternative to AMM-based DEXs.

Cross-chain intents open doors for new liquidity layers. New risks in execution, settlement and timing. Our DeFi Ecosystem Strategic RD service helps you design and audit intent-based workflows that are secure, efficient, and chain-agnostic.

Conclusions

We formulated three hypotheses before conducting this research:

1. Transaction costs and bridging complexities deter liquidity provision on new blockchains.

True: Studies suggest that trader behavior is predominantly influenced by “think time” (in this case, the time a user spends thinking about how to bridge funds), one of the most critical predictors of user satisfaction. In addition, the task completion rate and “click time” (or offset time) also play significant roles. Transaction costs and bridging complexities compel users to deliberate on the fastest, safest, and cheapest way to bridge funds for adding liquidity, leading to longer thinking times and decreased user satisfaction. This results in fewer users choosing to bridge funds to new blockchains.

These are not the only factors driving this behavior; incentives and lower security on new blockchains are also relevant reasons users may avoid bridging funds and providing liquidity.

2. Intent-based atomic cross-chain swaps could reduce liquidity on smaller DEXs.

Partially False: The data analysis suggests that while intent-based atomic cross-chain swaps were hypothesized to reduce liquidity on smaller DEXs, this is not entirely the case. Instead, there is a positive correlation between off-chain and on-chain volumes, indicating that off-chain activity can enhance on-chain liquidity because of the liquidity flywheel (more volume leads to more fees, leading to more liquidity). This suggests that rather than diminishing liquidity on DEXs, the off-chain volume may complement and support on-chain trading activity across different assets and blockchains.

3. These swaps may negatively impact the on-chain liquidity of high-cap assets more than that of long-tail assets.

It is important to remember that correlation does not imply causation. While the results analyzed through the Granger causality tests suggest that these correlations might reflect a causal relationship, this evidence alone is insufficient to confirm causality. The Granger test indicates potential predictability between variables, but it cannot account for all possible external factors or underlying mechanisms driving these relationships. Therefore, while the findings provide strong indications of a causal link, further investigation, and additional methods would be necessary to establish causality.

ERC-7683 standardizes how intents are expressed, quoted, and settled across chains. By letting solvers compete under the same constraints and by emitting verifiable receipts it can compress spreads, raise effective depth, and smooth UX across fragmented liquidity. The payoff, however, depends on disciplined implementation.

Key takeaways

- Standardization: common payloads, receipts, and settlement flows reduce integration cost and ambiguity.

- Solver competition: more routes under shared constraints → tighter price dispersion and better realized execution.

- Guardrails first: medianized oracles, explicit expiries/nonces, domain separation (per-chain binding), fee caps, and circuit breakers.

- Robust accounting: idempotent settlement, partial-fill handling, replay resistance, and clear failure modes (timeouts, stale quotes).

- Decision boundary: prefer single-chain execution when cross-chain complexity adds more risk/latency than price improvement.

What to watch (operational KPIs)

- Spread improvement vs baseline (bps).

- Fill rate and partial-fill share.

- End-to-end latency vs expiry; revert/failure rate.

- Slippage vs quoted price; realized fees vs caps.

- Solver competition per intent (quotes received, win rates).

- Adoption momentum (wallets/routers/chains) and spec/version changes.

Bottom line

ERC-7683 can meaningfully unify fragmented liquidity—provided teams pair integration with strong safeguards and measurement. Start with guarded markets, instrument observability, publish receipts, and iterate as adoption grows.

Reach out to Three Sigma, and let our team of seasoned professionals guide you confidently through the Web3 landscape. Our expertise in smart contract security, economic modeling, and blockchain engineering, we will help you secure your project's future.

Contact us today and turn your Web3 vision into reality!

FAQ

What is ERC-7683 and why does it matter?

ERC-7683 (erc7683) standardizes how intents are expressed, quoted, and settled across chains. With shared payloads and receipts, solvers can compete under the same constraints, improving execution quality and unifying fragmented liquidity.

How is ERC-7683 different from bridges or HTLCs?

Bridges/HTLCs move assets with bespoke flows. ERC-7683 defines a common, constraint-bound intent format and settlement receipts, enabling quote competition, partial fills, and safer fallback paths across many venues without one-off integrations.

Who are the key actors in an ERC-7683 flow?

Intent submitter (user/app), solver/router (finds route), executor (submits txs), settlement/bridge layer (verification/finality), and guards/relayers (proofs, receipts). Each role is measurable and replaceable, reducing vendor lock-in.

How do solvers compete and how are quotes made trustworthy?

Solvers return executable quotes bounded by the signed intent (min-out/max-in, expiry, fee caps). Trust comes from constraints, on-chain receipts, and guardrails like nonces, domain separation, and revert conditions when bounds aren’t met.

What are the main risks and how do we mitigate them?

Oracle drift, MEV reordering, relay/finality lag, partial-fill griefing, replay across domains, and fee abuse. Mitigate with medianized oracles, private/guarded submission, explicit expiries and nonces, domain separation, min fill sizes, fee caps, and circuit breakers.

How does ERC-7683 prevent replay attacks?

By binding nonces, expiries, and a signing domain (chain/version) into the payload. Intents are valid only within that scope; attempts to replay on other domains or after expiry revert.

When should we not use ERC-7683?

For simple single-chain swaps with tight native liquidity, hard real-time latency needs, restrictive compliance zones, or exotic state changes solvers can’t validate or hedge. If complexity outweighs price improvement, keep it simple.

How does ERC-7683 interact with UniswapX and other intent systems?

It complements them by defining shared payload/receipt semantics. Wallets, routers, and aggregators can interoperate more easily, while preserving competition among solvers and execution venues.

Acknowledgements

We would like to extend our sincere gratitude to @IrishLatte_19 for their invaluable assistance in conducting the queries that made this research possible. Additionally, we're deeply grateful to Anthias Labs for their supervision and guidance throughout the course of this work, which was instrumental in shaping its direction and conclusions.

References

- “Cross Chain Hook.” EthGlobal, https://ethglobal.com/showcase/univ4-cclp-hook-zd3st, https://docs.google.com/presentation/d/1C1lLhoYYmpsEEC-JGbzujo_J7OndEnWInum2RjecHco/edit#slide=id.g282a24d9684_0_11.

- A3 “Uniswap Labs and Across Propose Standard for Cross-chain Intents.” Uniswap Blog, https://blog.uniswap.org/uniswap-labs-and-across-propose-standard-for-cross-chain-intents.

- A4 “CAKE (Chain Abstraction Key Elements) Framework.” Frontier Tech, https://frontier.tech/the-cake-framework.

- A6 Chain Abstraction list - By Nairolf, https://x.com/0xNairolf/status/1792887694764233128

- A7 Atomic Swaps: The Practicality of Vitalik Buterin's Advice - By Defi Ignas

- A9 “Cross Chain Cow-swap — August 2023.” ETH Research, https://ethresear.ch/t/cross-chain-cowswap/16319/2.

- A10 Robinson, Dan. “Why HTLCs are Harmful.” What Bitcoin Did, April 2019, https://www.whatbitcoindid.com/podcast/dan-robinson-on-why-htlcs-are-harmful, https://www.youtube.com/watch?v=qUAyW4pdooA.

- A12 “deBridge Documentation.” deBridge, https://docs.debridge.finance/.

- A13 Solver-based DEX dashboard, https://slayer-dashboard-frontend.vercel.app/

- “Atomic Cross-Chain Swaps.” arXiv, May 2018, https://arxiv.org/pdf/1801.09515.

- P2 “Redefining Blockchain Interactions: The Crucial Role of Solvers in an Intent-Focussed Future.” Perridon Ventures, 2024, https://perridonventures.xyz/publications/redefining-blockchain-interactions-the-crucial-role-of-solvers-in-an-Intent-focussed-future.

- P3 “Atomic Cross-Chain Exchanges of Shared Assets.” arXiv, February 2022, https://arxiv.org/pdf/2202.12855.

- “A Multi-Party, Multi-Blockchain Atomic Swap Protocol with Universal Adaptor Secret.” arXiv, June 2024, https://arxiv.org/pdf/2406.16822.

- “R-SWAP: Relay based atomic cross-chain swap protocol.” Cryptology ePrint Archive, 2021, https://eprint.iacr.org/2021/621.pdf.

- P14 “Blockchain Scaling and Liquidity Concentration on Decentralized Exchanges.” arXiv, 2023, https://arxiv.org/pdf/2306.17742.

- P15 “Behavior of Liquidity Providers in Decentralized Exchanges.” arXiv, 2021, https://arxiv.org/pdf/2105.13822.

- “The Need for Fees at a DEX: How Increases in Fees Can Increase DEX Trading Volume.” American Finance Association, 2022, https://afajof.org/management/viewp.php?n=43204#:~:text=Importantly%2C DEXs acquire inventory by,return from financing DEX inventory.

- P17 “Fragmentation and Optimal Liquidity Supply on Decentralized Exchanges.” arXiv, 2024, https://arxiv.org/pdf/2307.13772.

- P18 “Layer 2 be or Layer not 2 be: Scaling on Uniswap V3.” arXiv, 2024, https://arxiv.org/pdf/2403.09494.

- P19 “Predicting Post-Task User Satisfaction With Weibull Analysis of Task Completion Times.” Journal of Usability Studies, 2017, https://uxpajournal.org/user-satisfaction-weibull-task-times/.

- “Chain Abstraction Landscape.” https://newsletter.asxn.xyz/p/chain-abstraction-landscape.

- “Uniswap v2 Whitepaper.” https://uniswap.org/whitepaper.pdf.

- “Uniswap v3 Whitepaper.” https://uniswap.org/whitepaper-v3.pdf.

- “Uniswap v4 Whitepaper.” https://github.com/Uniswap/v4-core/blob/main/docs/whitepaper-v4.pdf.

- “UniswapX Whitepaper.” https://uniswap.org/whitepaper-uniswapx.pdf.

- “How Does UniswapX Work?” https://support.uniswap.org/hc/en-us/articles/17542712707725-How-does-UniswapX-work.

Economic Security Lead

Pablo holds a Master's in management, having focused in finance, and with a thesis on DeFi, demonstrating his knowledge and expertise in this field. He has extensive experience in research and analysis of DeFi protocols, having worked as an analyst at Siemens and a DeFi researcher at Deep Tech Ventures. His background in finance, research and analysis skills are a valuable addition to our team.