TL;DR: Real world asset tokenization is converting real assets, like T-bills, property, and private credit, into on-chain tokens that represent verifiable, tradable slices settled by smart contracts.

Introduction

From the inception of cryptocurrencies, widespread adoption has been a defining ambition of the blockchain ecosystem. Whether through governments exploring digital currencies, financial institutions adopting decentralized ledgers, thought leaders advocating for change, or everyday individuals integrating crypto into daily life, the goal is to embed blockchain technology and virtual currencies into society. The vision is a world that is more equitable, transparent, and accessible. Yet, as participants in this evolving space, we often pause to ask:

Are we on the right path to realize this future, especially as real world asset tokenization moves center stage?

Adoption, at its essence, mirrors the trajectory of history’s most transformative innovations. It involves integrating a technology so seamlessly that its complexity becomes invisible to users.

When you query a virtual assistant like Siri or Alexa, you engage with natural language processing and artificial intelligence without a second thought. Similarly, in the 1970s and 1980s, electronic calculators performed complex computations using microprocessors and integrated circuits, then cutting-edge technologies, yet required no technical expertise from users. This invisible integration is the hallmark of successful adoption. By removing barriers to entry, technology becomes intuitive, universally accessible, and simply a tool for use.

In the cryptocurrency space, early efforts focused on building a global payment network, envisioning crypto wallets as a seamless alternative to credit cards. However, a key challenge emerged: many cryptocurrencies, designed as stores of value, discourage spending due to their potential for appreciation. Spending an asset that could grow in value means forgoing future economic potential, prompting a shift toward a more compelling use case: tokenization.

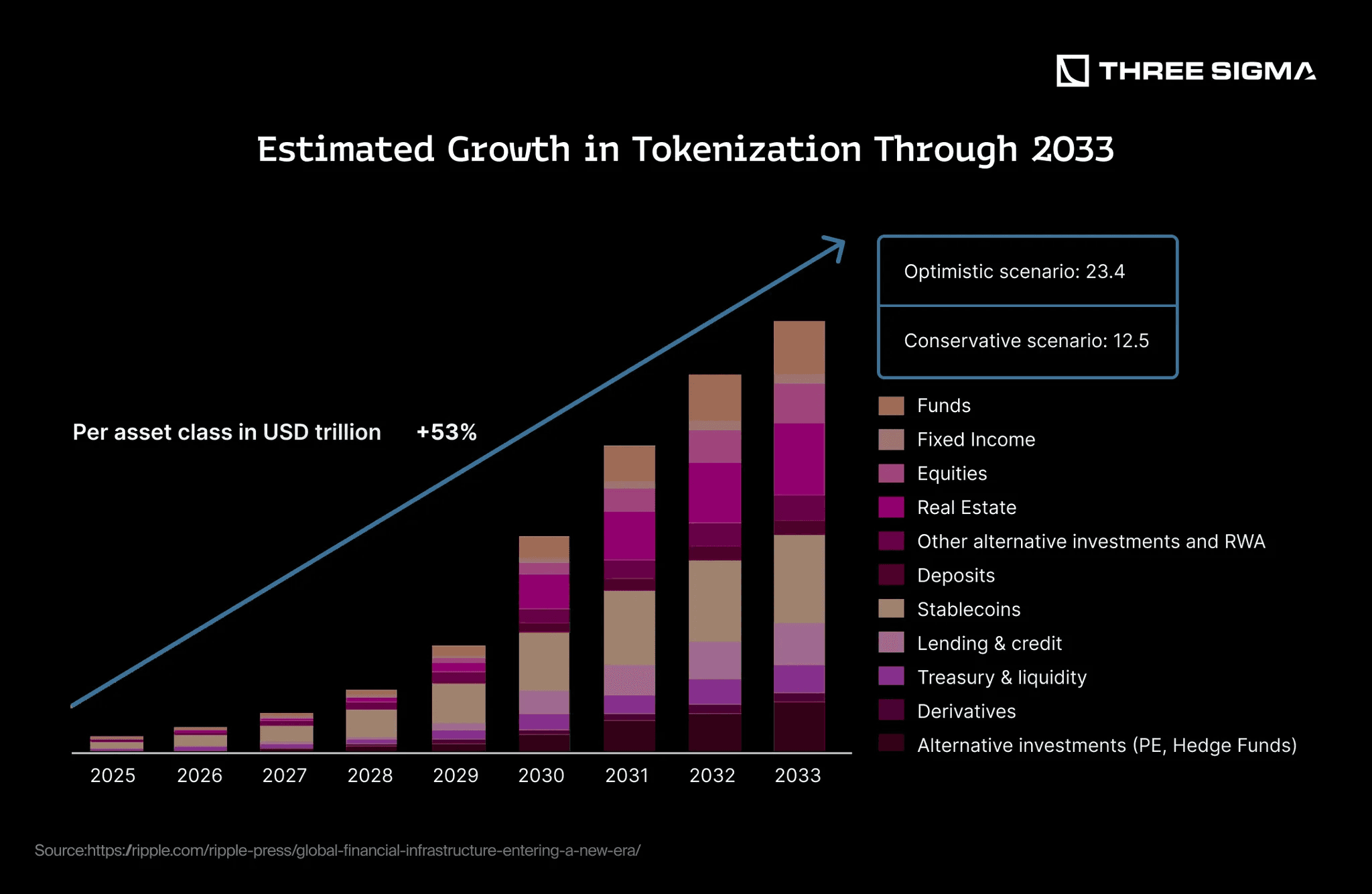

By converting assets into blockchain-based tokens, tokenization enhances liquidity, transferability, and accessibility, redefining how we interact with value. This concept, particularly through real-world assets (RWAs), has ignited widespread discussion and development, positioning it as a cornerstone of decentralized finance (DeFi) and a catalyst for blockchain’s integration into the global economy.

Understanding Real World Asset Tokenization

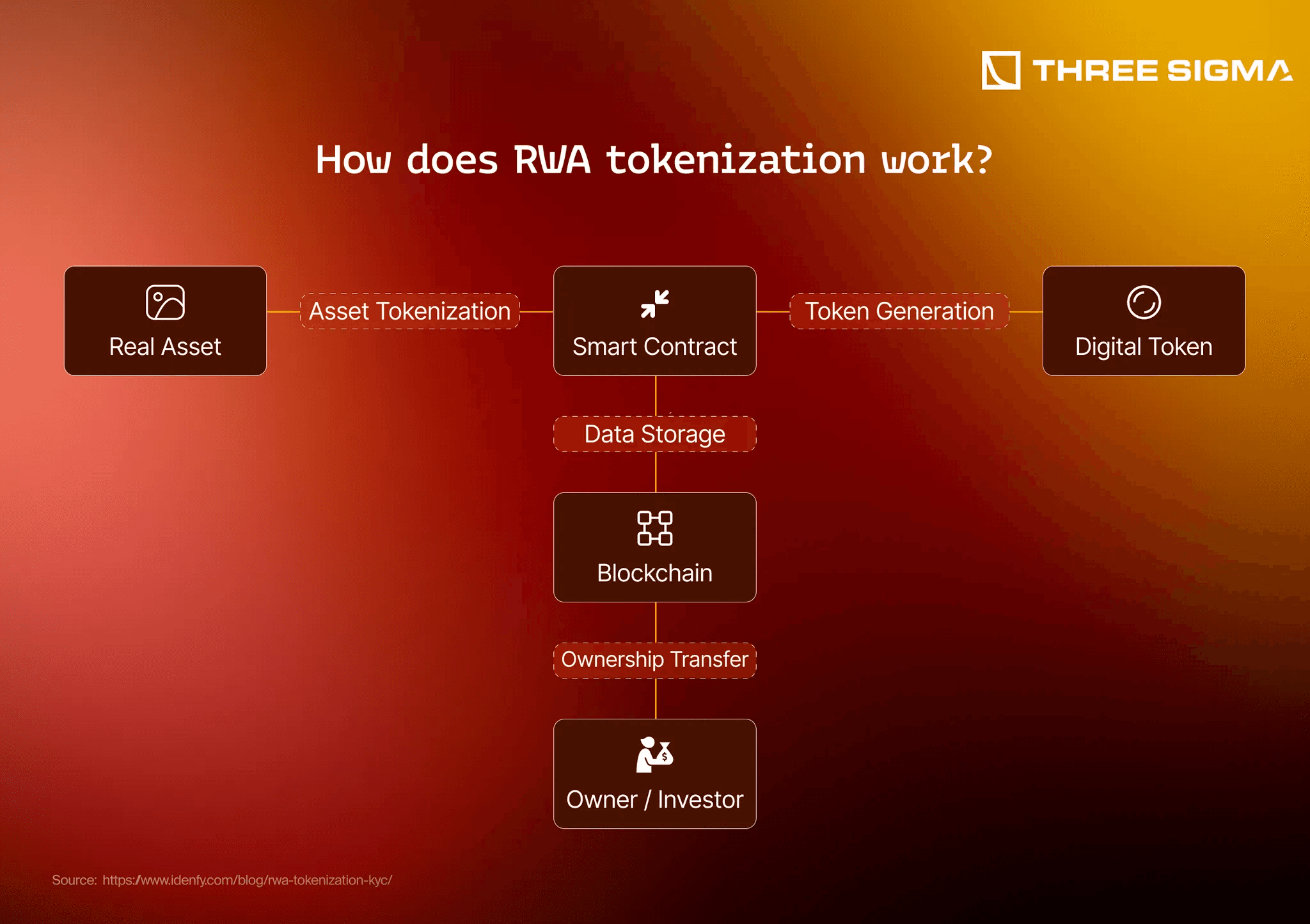

Real world asset tokenization involves converting ownership or rights to a physical or financial asset into blockchain-based tokens.

These tokens, secured by the decentralized, transparent, and immutable properties of blockchain technology, provide verifiable proof of ownership or entitlement, enabling assets to be traded, fractionalized, or transferred with remarkable efficiency.

Unlike traditional assets, which are often slowed by bureaucratic processes, intermediaries, or complex legal frameworks, tokenized real-world assets leverage smart contracts, self-executing programs that automate transactions, enforce agreements, and ensure adherence to predefined rules. Because RWA tokenization often necessitates legal compliance, especially for financial assets requiring large-scale transactions or credit arrangements, these contracts are designed for security and typically undergo rigorous, independent smart contract audits. Participants also complete KYC/AML checks to meet regulatory requirements, safeguarding the ecosystem while aligning with global financial regulations.

By integrating these legal safeguards, tokenization creates a robust framework for managing value, bridging traditional markets with the digital economy and enabling seamless, compliant participation in global financial systems.

How real world asset tokenization works at a glance: custody, issuance, on-chain governance controls, and redemption, with guardrails often defined by a DAO Audit.

Real world asset tokenization increases liquidity and opens access to new investors and entities by converting illiquid assets into tradable digital units, enabling vibrant secondary markets that operate globally and continuously.

Fractional ownership divides a single asset into thousands of tokens, reducing entry barriers and allowing retail investors, smaller institutions, and diverse participants to engage in markets that were once reserved for high-net-worth individuals or large organizations. This broadens participation and lowers barriers for more users. Additionally, the fact that it occurs on the blockchain makes it more transparent and auditable, which builds greater confidence among potential investors in where they invest, further reinforced by the KYC and AML requirements participants must meet. For all these reasons, it could potentially increase investment from TradFi institutions in an on-chain manner. Practically, this is where real world asset tokenization shines: turning illiquid exposure into programmable, transferable claims. To ensure sustainable incentives and fair distribution, teams should undergo a Tokenomics Audit.

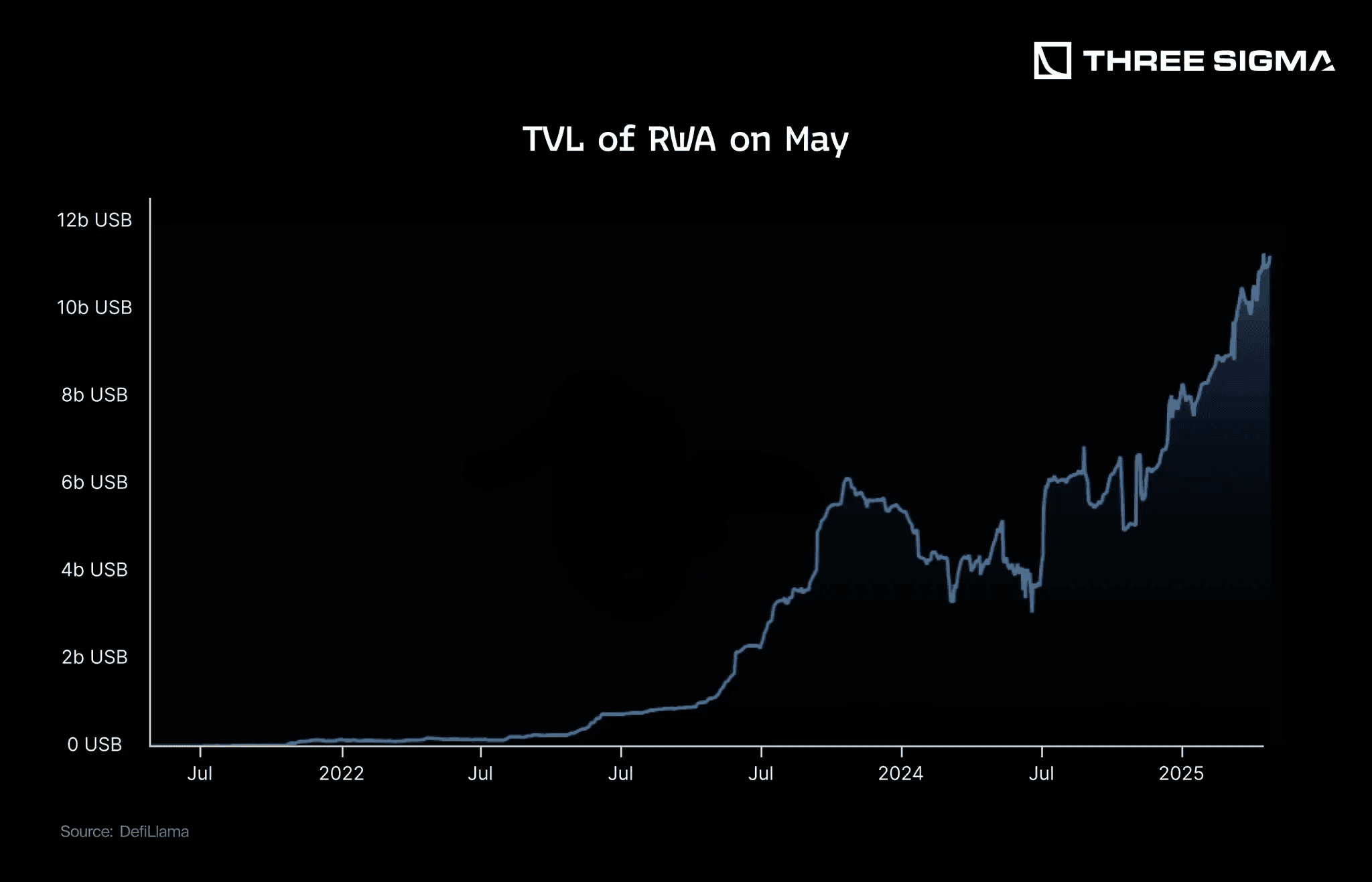

You might be surprised to see how this has fueled RWA growth, as shown in a DeFiLlama chart where TVL soared from near zero in 2021 to 11.5 billion USD by May 2025, driven by leading assets like BlackRock BUIDL, a tokenized money market fund backed by U.S. Treasuries with 2.8 billion USD in TVL, and Ethena’s USDtb, a Treasury-backed stablecoin launched in February 2024, adding over 1.4 billion USD by March 2025.

Tokenized commodities also shine in RWA tokenization narratives, with Tether Gold, a gold-backed stablecoin, at 820 million USD, and Paxos Gold, another gold-backed token, at 775 million USD, together valued at 1.595 billion USD, reflecting the popularity of gold-backed RWAs for stable liquidity.

These entities leverage tokenized assets to create innovative financial products, such as yield-generating pools, collateralized lending markets, or interoperable DeFi instruments, enhancing the ecosystem’s utility. By enabling instant settlement and reducing intermediary costs, tokenization unlocks new economic opportunities, though regulatory clarity and user education remain critical to sustaining its growth and accessibility.

Ownership, Value, and the Role of Blockchain in Real World Asset Tokenization

Tokenization reshapes societal norms around ownership and value while leveraging blockchains and oracles for sophisticated asset management. A key innovation is fractionalization, enabling thousands of stakeholders to co-own an asset through secure tokens, redefining value as liquid, tradable instruments in global trading ecosystems.

Smart contracts automate complex property agreements, eliminating ambiguous clauses, enabling seamless sales, and ensuring new owners inherit consistent responsibilities, fostering efficiency and trust in ownership systems. Conversely, tokenized bonds, issued to individual investors, preserve singular ownership, using blockchain for rapid settlement and automated payments. For EVM-based systems, rigorous Solidity audits help ensure these agreements are implemented safely. Conversely, tokenized bonds, issued to individual investors, preserve singular ownership, using blockchain for rapid settlement and automated payments.

These models spur novel economic structures like tokenized royalties, though fractionalized assets, such as art or heritage properties, may dilute cultural significance, unlike bonds or utility-driven assets, which retain traditional or functional weight. Regulatory frameworks guide asset classification to ensure compliance and prevent misuse, while tokenization enhances economic inclusion by broadening access.

Blockchains, as decentralized ledgers, immutably record ownership via consensus mechanisms like proof-of-stake or proof-of-work, with governance models enabling stakeholder coordination. Scalability solutions, such as sharding or layer-2 protocols, are getting closer to supporting near-instant, low-fee transactions for use cases like cross-border settlements, but they still need to improve. Oracles, centralized or decentralized, extend blockchain immutability by delivering API- or IoT-driven data, such as price feeds or compliance updates, ensuring asset accuracy. Challenges like data tampering, oracle latency, and cross-chain interoperability require cryptographic verification or protocol diversity to sustain reliable 24/7 markets, aligning tokenization’s potential with regulatory and market needs. These concerns are typically addressed through specialized bridge / cross-chain apps audits.

If these advancements come to fruition, blockchain could stand out as the best solution for reshaping financial systems. Its capacity to deliver secure, transparent, and efficient infrastructure for asset tokenization and trading makes it a powerful tool to connect traditional finance with decentralized ecosystems, driving wider adoption and innovation in global markets.

Real World Asset Tokenization vs. Synthetic On-Chain Assets

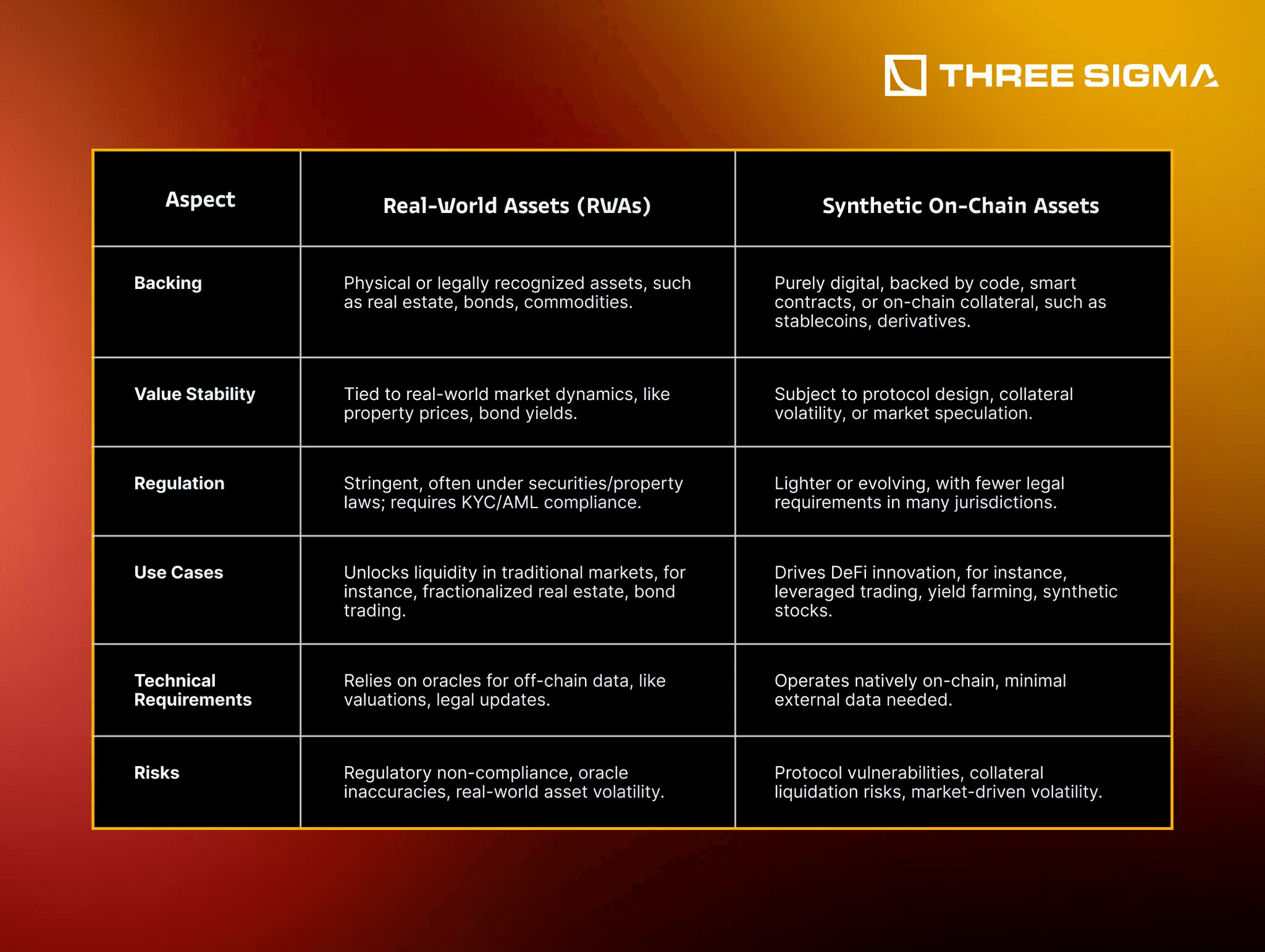

Tokenizing real world assets involves bridging tangible value to the blockchain, fundamentally distinct from creating synthetic on-chain assets. RWAs, such as real estate, bonds, or commodities, are digital tokens representing ownership of physical or legally recognized assets, anchored by real-world value and subject to market dynamics like property prices or bond yields.

These assets require robust legal frameworks, including KYC and AML compliance, as they often fall under securities or property laws, ensuring investor protection and regulatory alignment.

Conversely, synthetic on-chain assets, like algorithmic stablecoins or tokenized derivatives, are purely digital constructs generated within blockchain ecosystems, relying on code, smart contracts, or collateral pools rather than physical backing. Synthetics offer flexibility for DeFi innovations, such as leveraged trading or yield farming, but their value can be volatile, tied to protocol design or market speculation, with lighter regulatory oversight in many jurisdictions. RWAs depend heavily on oracles to fetch off-chain data, such as asset valuations or legal updates, ensuring alignment with real-world conditions, while synthetics operate natively on-chain, requiring minimal external input.

This distinction shapes their roles: real world asset tokenization unlocks liquidity in traditional markets, fostering economic inclusion, while synthetics drive DeFi’s experimental edge, though both must navigate evolving regulatory and technical landscapes to realize their full potential.

RWA in DeFi Today

Once we understand what real world asset tokenization is, how it functions, and its implications for blockchain technology, the first opportunity for crypto users naturally emerges in DeFi. The tokenization of assets represents a vast market that can reposition DeFi at the heart of the crypto narrative by unlocking an enormous amount of liquidity, as we’ve explored earlier. For builders aligning with this opportunity, an end-to-end Economic Audit can validate assumptions before launch.

For builders, the north star is composability: tokenized Treasuries, tokenized real estate, and tokenized commodities that plug cleanly into lending, collateral, and yield markets.

The beauty of having this liquidity on-chain lies in its ability to flow freely across ecosystems. dApps monetize this flow and open new yield opportunities, whether intrinsic to the assets or created by on-chain integrations.

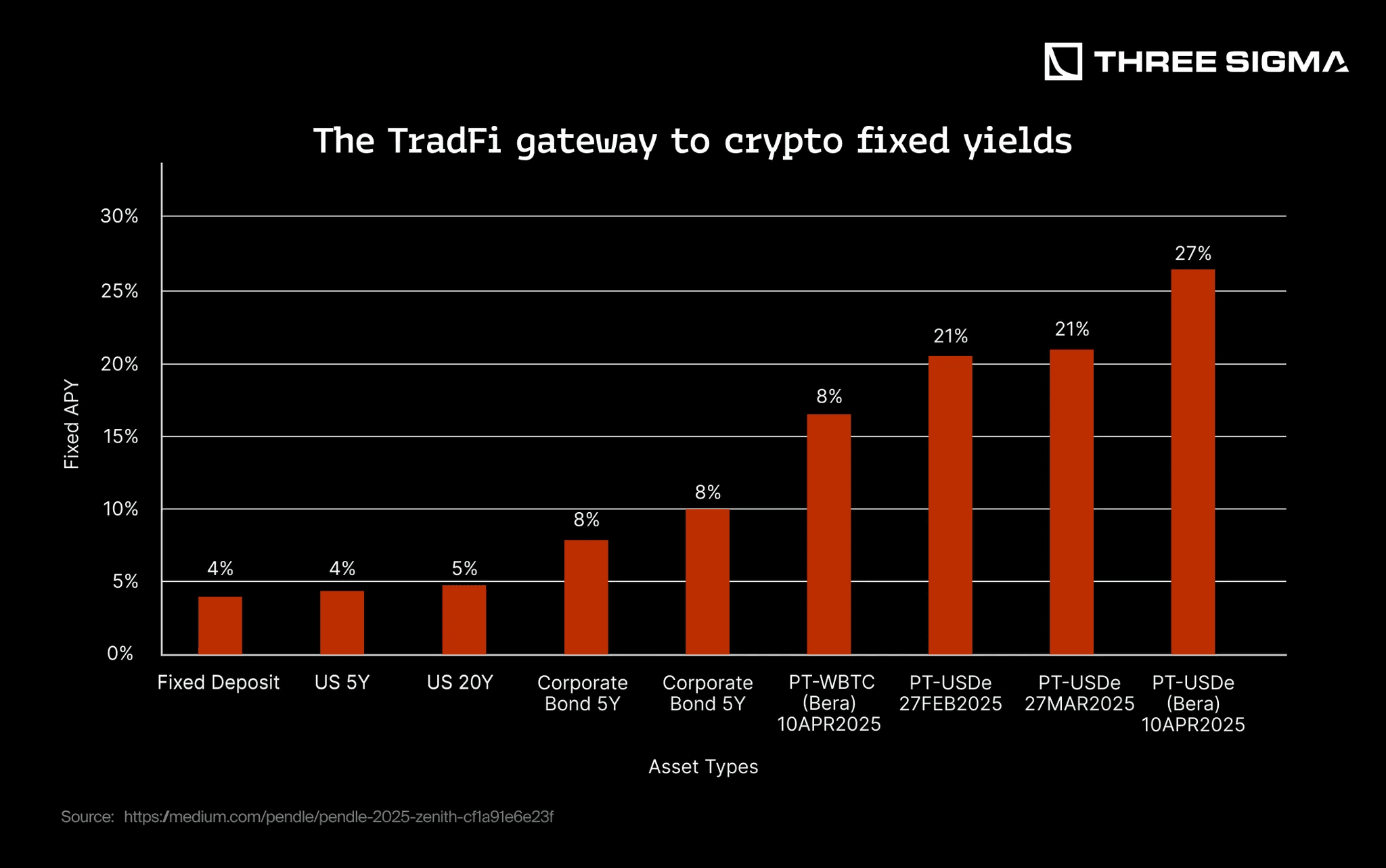

Projects like Centrifuge, Maple, Goldfinch, Ostium, and Pendle are at the forefront of this transformation, collectively managing billions in TVL. Trends in DeFi increasingly center on asset classes like real estate, bonds, and stocks, reflecting growing demand for tangible value in decentralized systems. These platforms deliver strengths like constant and high yields, often exceeding 8% annually, drawing significant institutional interest from traditional finance players seeking diversified exposure. However, challenges persist in most of them: regulatory compliance with KYC/AML and securities laws limits accessibility, and technical risks like smart contract vulnerabilities or oracle inaccuracies pose threats.

Let’s take a look at some of the current top protocols in the DeFi ecosystem and explore their key characteristics and what their purposes are.

Top RWA Protocols in the DeFi Ecosystem

Centrifuge

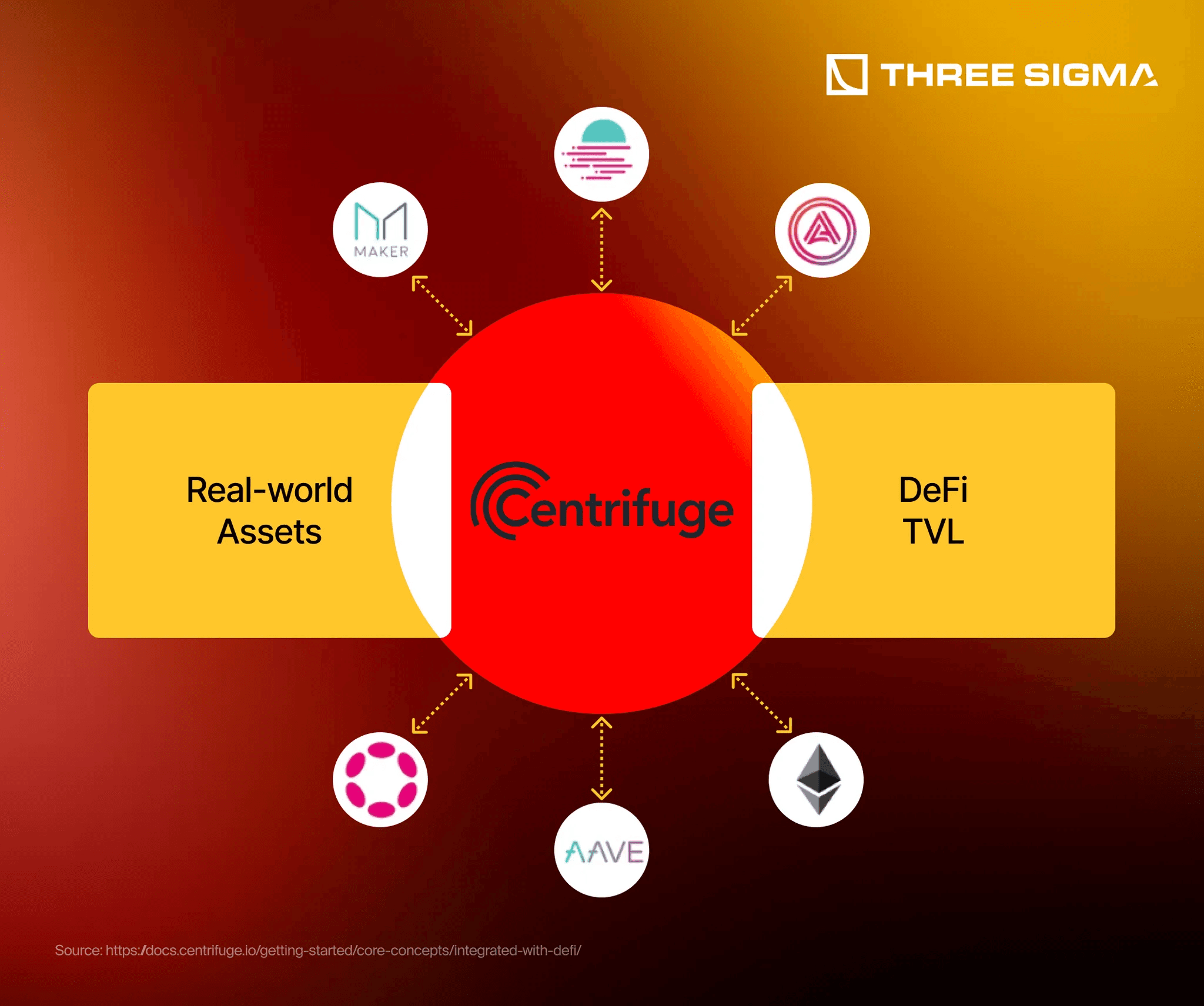

Centrifuge has solidified its position by bridging tokenized real-world assets with decentralized ecosystems, focusing on structured credit to empower small and medium-sized enterprises. Since its founding in 2017, Centrifuge tokenizes assets like invoices, mortgages, and royalties, unlocking liquidity for businesses often excluded from traditional finance due to high borrowing costs. By May 2025, it had facilitated over $700 million in asset financing, demonstrating its pivotal role in expanding DeFi’s reach with tangible value.

Centrifuge operates on the Centrifuge Chain, a proof-of-stake blockchain built on Polkadot’s Substrate framework for speed and low fees, with a bridge to Ethereum for broader liquidity. Asset originators convert RWAs into privacy-enabled NFTs, which are collateralized in Centrifuge’s lending dApp. Investors fund these pools, receiving DROP or TIN tokens with varying risk and yield profiles, such as fixed yields for DROP or higher variable returns for TIN, providing capital to businesses in exchange for interest. These tokens go beyond simple receipts. TIN and DROP define risk, yield, and payout priority, giving investors active roles in the credit structure. They can sometimes be integrated or traded, but mainly function within Centrifuge’s ecosystem.

The process starts with originators minting NFTs on the Centrifuge Chain, linking assets to off-chain legal documents while keeping sensitive data private. These NFTs are locked in dApp pools, which Centrifuge enhances with liquidity pools for direct integration with any EVM-based blockchain and protocol listed, minimizing effort by creating a standard investment layer. Investors provide stablecoins like USDS, and borrowers repay with interest via a special purpose vehicle, with transparency ensured through real-time monitoring and governance by CFG token holders voting on pool onboarding and risk parameters.

Centrifuge generates revenue through transaction fees on the Centrifuge Chain, paid in CFG tokens, which also enable staking and governance. Originators pay to tokenize assets and create pools, while investors face fees for accessing yields.

Centrifuge’s +$700 million in financing and more than 1600 assets tokenized highlights its impact, with partnerships like SKY and Aave enabling tokenized RWAs to serve as collateral for stablecoin borrowing or yield generation, fostering financial inclusion for underserved markets. It reduces borrowing costs for SMEs, often facing 15% interest rates in traditional systems.

But this access comes with tradeoffs. Some Centrifuge pools have experienced defaults, reminding us that tokenizing credit does not eliminate underlying risks. Not all originators manage risk well, and decentralized investors may lack tools to fully assess creditworthiness, especially in opaque or early-stage pools.

Maple/Syrup

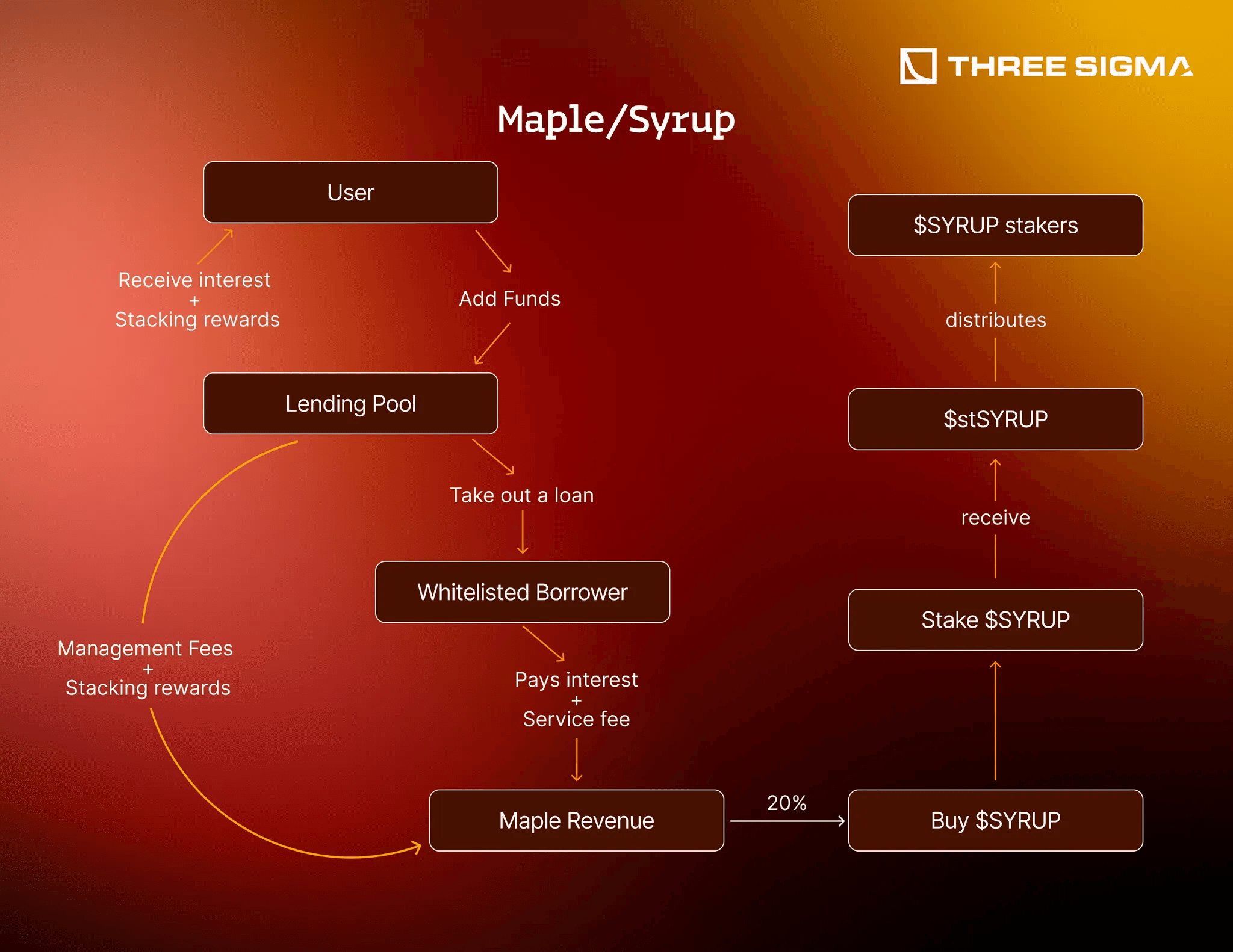

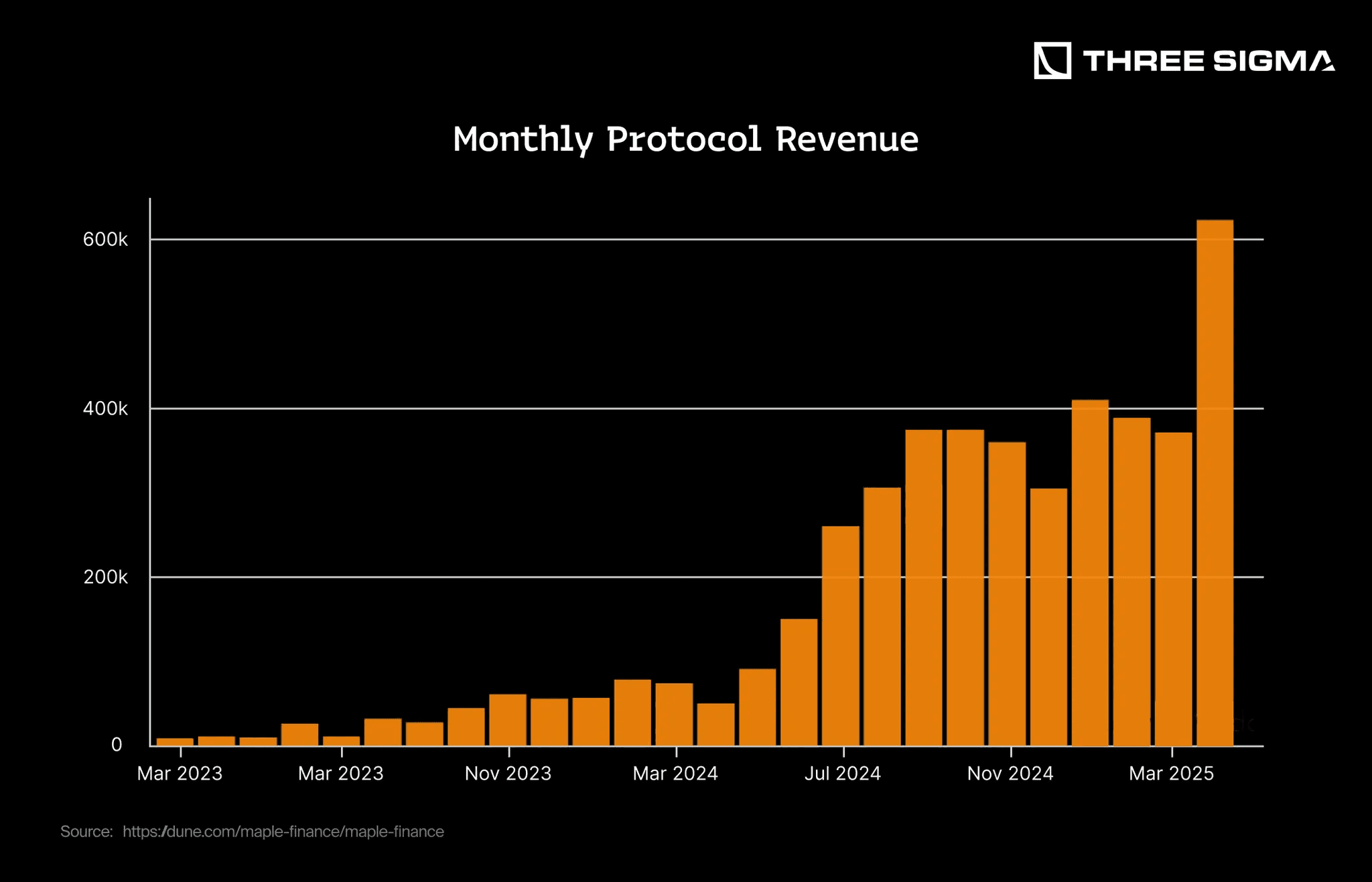

It’s fascinating to see how Maple has carved out a significant role in DeFi through RWA tokenization of credit and Treasury exposure. It focuses on undercollateralized lending for borrowers such as hedge funds and crypto firms while offering investors access to stable yields. Since its inception in 2019, Maple has tokenized credit assets, including real-world assets through its Syrup platform. This opens the door to traditional financial returns within a decentralized environment. Earlier versions of the protocol, particularly Maple v1, struggled with risk management and suffered high-profile defaults. The transition to Maple v2 brought stronger controls and greater transparency, reflecting lessons learned. As of May 28, 2025, Maple has facilitated over $7 billion in loans and manages over $1.9 billion in assets. SyrupUSDC now acts as the receipt token and is usable within protocols such as Morpho, which is curated by Gauntlet and MEV Capital. With a market size of $88 million in early June, the protocol shows signs of increasing resilience and deeper DeFi integration.

Maple primarily operates on Ethereum, with expansions to Solana and Base for broader accessibility, leveraging smart contracts to manage lending pools. Borrowers create pools to access capital, while investors deposit stablecoins like USDC to earn yields. Syrup, launched in 2023, enhances this by integrating tokenized RWAs such as Treasury-backed stablecoins, offering secure yield opportunities through audited smart contracts and risk tranching. Recent integrations include Coinbase, enabling users to buy, sell, and store SyrupUSDC seamlessly, which boosts accessibility.

Borrowers get in touch with Maple’s pool delegates, experienced credit managers who underwrite loans and set terms, ensuring compliance with KYC/AML standards. Loans are tokenized as smart contracts, with Syrup enabling RWA integration by linking to assets like tokenized Treasuries. Investors fund these pools, earning interest as borrowers repay, with transparency maintained through on-chain data and governance by token holders. Maple BTC Yield, recently introduced, unlocks Bitcoin’s potential by allowing BTC holders to earn yields through Syrup’s lending infrastructure.

Maple’s revenue comes from two main sources: management fees, a portion of the interest paid by borrowers retained by the protocol for facilitating loan origination and service fees paid by borrowers as part of their total borrowing cost, typically 1–2% establishment and ongoing performance fees, shared between pool delegates and the protocol. Starting in Q1 2025, 20% of this fee revenue will be used to buy back SYRUP tokens from the market, distributed to stakers from April 2025 onward. This enhances incentives for farming drips, a reward token in the Syrup lending platform, convertible to SYRUP, encouraging institutional and user staking.

Maple’s $3.4 billion in loans and $1 billion TVL by early 2025 highlight its impact, with Syrup enabling DeFi protocols like Aave and Morpho to tap into RWA yields, fostering institutional adoption. Bitwise’s first DeFi allocation with Maple underscores its appeal to tradfi players, and the $50 million investment by SKY in SyrupUSDC bolsters Maple's growth economically and in trust among DeFi players.

Ostium

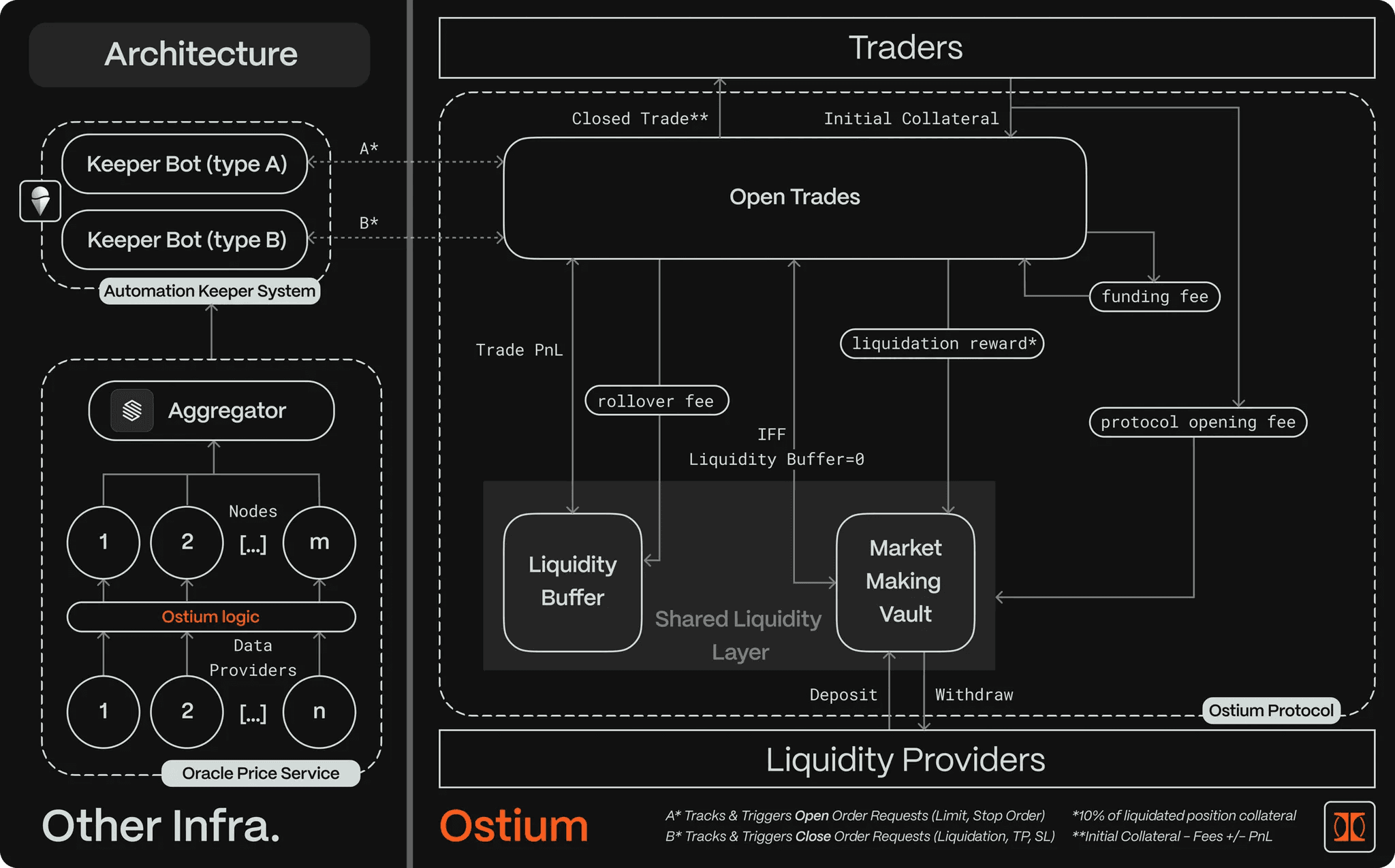

Ostium has carved a unique niche in DeFi by enabling synthetic price exposure to real-world assets through perpetual futures, bringing traditional markets on-chain. Ostium allows traders to long or short assets like gold, oil, S&P 500, and forex pairs with up to 200x leverage directly from a crypto wallet. Unlike tokenized real-world assets, Ostium’s assets are synthetic, relying on oracle price feeds rather than physical backing, which eliminates custody and redemption complexities. By April 2025, Ostium had reached $5.8 billion in trading volume, +$60 million in TVL and $2.4 million in revenue, reflecting its growing traction in the DeFi ecosystem.

Ostium operates on Arbitrum, using a shared liquidity layer with a liquidity buffer and market-making vault, similar to GMX’s model. This setup ensures efficient trades with zero slippage at oracle prices, supported by high-speed oracles like Stork for real-time pricing. Traders deposit stablecoins, and the protocol facilitates peer-to-pool market making. Fees generated from trading activity ($411,000 in a week from $938 million in volume during April 2025) are shared between liquidity providers and the platform. Ostium’s impact is evident in its ability to democratize access to global macro markets, with RWA volumes outpacing crypto by 4x during periods of macroeconomic volatility.

Pendle

If you're in the space, for sure you know about Pendle’s ascent as a DeFi powerhouse, initially carving its niche by tokenizing and trading future yields, and now setting its sights on a transformative future with real world asset tokenization. Since launching in 2021, Pendle has excelled at splitting yield-bearing tokens into Principal Tokens (PT) for fixed returns and Yield Tokens (YT) for speculative gains, amassing a TVL of $3.28 billion by May 2025.

The protocol knows the best is yet to come, leveraging RWAs to bridge traditional finance with DeFi, starting with integrations like Sky Savings Rate (formerly DAI Savings Rate) and Anzen Finance’s sUSDz on Base, which allow users to trade yields from Treasury-backed stablecoins directly on-chain.

Pendle currently operates across major EVM chains, using its AMM to enable trading of RWA yields, such as those from tokenized Treasuries or stablecoins, with over $4 billion in trading volume by April 2025. The process involves wrapping RWA yield-bearing tokens into a standardized format (SY tokens), splitting them into PT and YT, which lets investors lock in fixed returns or speculate on future yields like Treasury interest, all while mitigating impermanent loss through its tailored AMM design. Pendle generates revenue through trading fees, shared with liquidity providers, while the PENDLE token facilitates staking and governance, supported by a $3.7 million funding round in 2021, ensuring growth as it expands RWA offerings.

Looking ahead, Pendle’s 2025 roadmap, dubbed Zenith, outlines ambitious plans, including expanding to Solana, Hyperliquid, and TON, introducing a KYC-friendly Citadel for TradFi capital, and launching a Sharia-compliant Citadel for Islamic finance, alongside Boros, a platform for fixed funding rate trading of perpetuals. These initiatives aim to unlock billion-dollar RWA markets, enhancing composability with DeFi protocols for collateral use and cross-chain strategies.

RWA trends

Real world asset tokenization is a reality, and as observed in the market, narrative, and dApps, it’s fully present today. When discussing tokenization, as we’ve seen earlier, the leading asset type by market capitalization is tokens generating yields through U.S. interest rates essentially tokens representing a stake in a U.S. Treasury bill fund that delivers returns based on the underlying T-Bill interest, distributed via smart contracts.

Within tokenized Treasuries, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) stands out as the primary asset in this category, with a TVL of $2.8 billion by May 2025, and is widely used in DeFi lending protocols like Aave, where investors deposit BUIDL to earn yields or use it as collateral, creating opportunities for leveraged strategies and enhancing liquidity within decentralized ecosystems.

Another RWA category gaining significant attention for its recent appreciation and long-standing stability is gold-backed stablecoins like XAUt and PAXG, representing a troy ounce of gold stored in London (PAXG) and Switzerland (XAUt), with a combined value of $1.26 billion in May 2025, offering reliability during economic volatility.

These stablecoins are integrated into lending protocols like Maple, where they serve as collateral for borrowing, enabling users to access liquidity without selling their gold-backed holdings, thus fostering new yield opportunities.

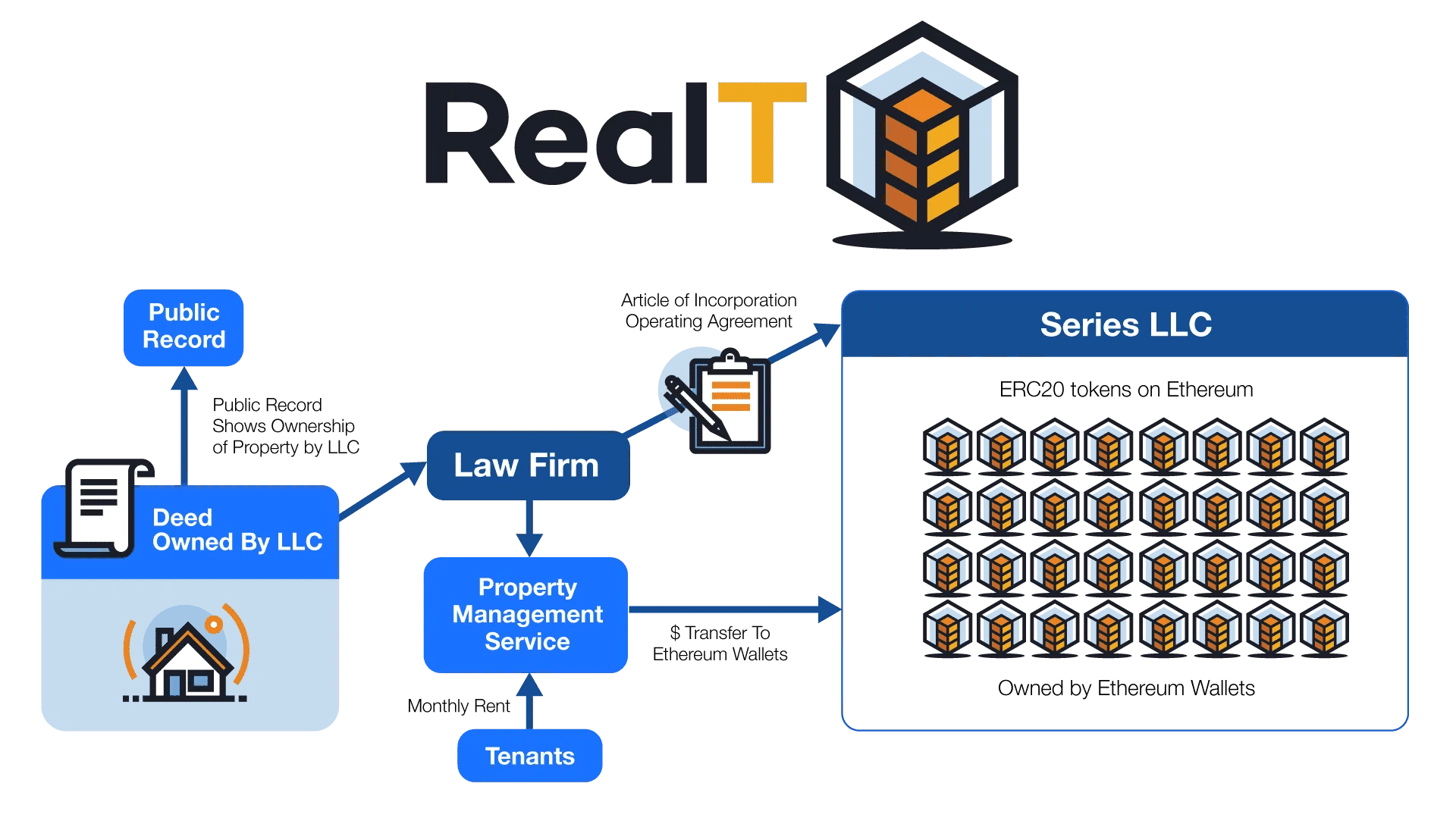

Tokenized real estate is also on the rise, enabling fractional ownership of properties through platforms like RealT and Propy, which have tokenized assets worth $500 million, democratizing access to real estate investments.

Finally, tokenized private credit assets are gaining traction, with protocols we discussed earlier, like Centrifuge, financing over $761 million in loans for businesses in emerging markets by tokenizing invoices and mortgages, allowing DeFi investors to earn yields from real-world credit while opening new opportunities for global investors, despite regulatory and technical challenges that demand constant innovation.

It’s striking to see how RWAs in DeFi deliver high yields, a major strength that attracts both retail and institutional investors seeking stable returns in a volatile crypto market. Treasury-backed tokens like BUIDL, with a $2.8 billion TVL, offer annualized yields often exceeding 5%, driven by U.S. T-Bill interest rates, while Goldfinch Prime targets 9–12% returns through diversified private credit pools, as seen in its partnerships with managers like Ares and Apollo. Protocols like Maple and Centrifuge further enhance this appeal, with Maple’s Syrup platform yielding up to 8% on Treasury-backed stablecoins and Centrifuge providing uncorrelated returns via tokenized invoices and mortgages, averaging 7% for investors.

These high yields, often outpacing traditional fixed-income markets, make RWAs a compelling option, especially as DeFi lending protocols like Aave and Spark integrate these assets, enabling users to compound returns through staking or leveraged strategies, amplifying their attractiveness, A thorough Staking Design Review helps ensure these strategies remain sustainable and secure.

Institutional interest in RWAs is another powerful strength, with traditional finance giants increasingly embracing DeFi’s potential, and recent weeks have brought even more momentum.

Just in early May 2025, Franklin Templeton announced a strategic integration with Pendle, allocating $30 million to its tokenized Treasury yield pools, aiming to leverage Pendle’s yield-splitting mechanism for institutional clients, following the footsteps of earlier adopters like BlackRock and Bitwise. Additionally, Ostium’s synthetic RWA perpetuals platform saw a new partnership with Citadel Securities, providing liquidity for forex and commodity trades, further bridging TradFi and DeFi.

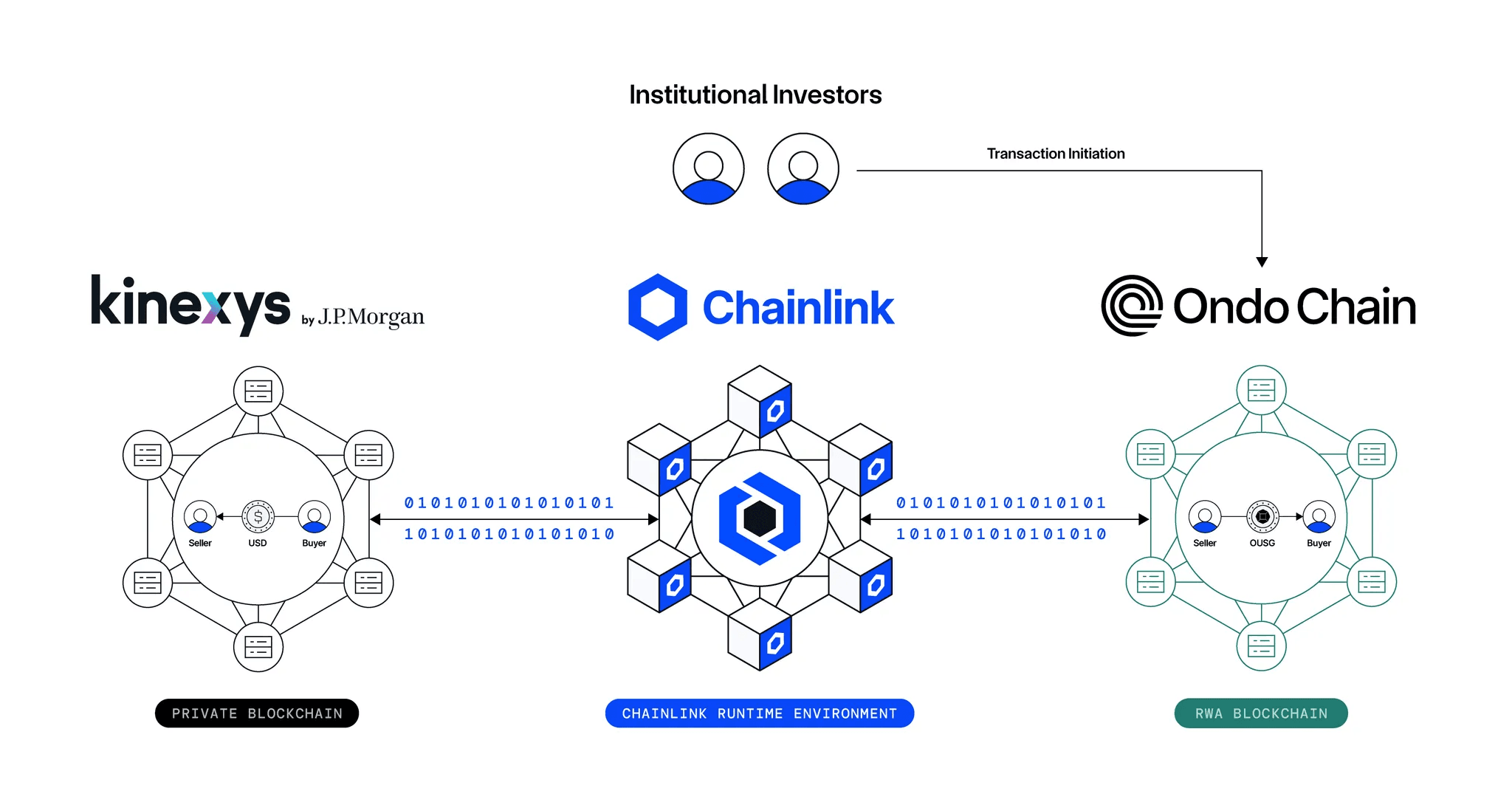

On May 14, 2025, J.P. Morgan completed a landmark cross-chain transaction, settling Ondo Finance’s Short-Term U.S. Government Treasuries Fund (OUSG) on the Ondo Chain testnet, using Kinexys Digital Payments for the payment leg and Chainlink’s cross-chain orchestration to ensure secure, atomic settlement, a step that highlights the scalability of bank payment rails for tokenized asset markets.

With all this, we can see that TradFi is genuinely interested in entering DeFi, signaling a transformative shift in how traditional finance engages with decentralized ecosystems.

Challenges: Regulation, Tech Risks, User Trust

While RWAs bring significant strengths to DeFi, the journey toward widespread adoption is not without significant hurdles, starting with the complex landscape of regulation. Scaling real world asset tokenization safely hinges on credible neutrality in oracles, verifiable reserves, and clear recourse in off-chain legal wrappers.

Governments and financial authorities worldwide are still grappling with how to classify and oversee tokenized assets, particularly those tied to real-world value like Treasury-backed tokens or private credit pools.

On May 12, 2025, the SEC held a pivotal roundtable titled “Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet,” involving major financial players like BlackRock, Fidelity, and Nasdaq, to discuss integrating RWAs into traditional finance and building a regulatory framework for Web3. This discussion underscores the ongoing struggle to classify tokenized assets, with debates over whether they should be treated as securities, potentially requiring stringent compliance measures that could restrict access for retail investors. The lack of uniform global regulations further complicates cross-border transactions, as protocols must navigate varying legal landscapes.

Beyond regulation, technical risks and user trust present notable challenges that could hinder RWA adoption if not addressed properly. Advancements in AI-driven risk analysis, observed in early 2025, seek to enhance real-time asset valuation and market forecasting, yet doubts linger about their reliability, particularly for assets reliant on external data feeds.

For example, inconsistencies in oracle updates can cause pricing errors, which may shake investor confidence in DeFi platforms. Additionally, the complexity of tokenized ecosystems often overwhelms the average investor, who may find fractional ownership or smart contract risks difficult to grasp. To tackle this, educational efforts are gaining momentum, with platforms like Plume focusing on user-friendly interfaces and transparent reporting to foster trust, an essential step for ensuring RWAs can succeed in DeFi’s dynamic and new environment.

Where RWA Can Take DeFi

RWAs are reshaping DeFi by unlocking economic opportunities that make illiquid assets accessible to smaller investors through fractional ownership, opening up markets that were once out of reach for the average person.

This not only boosts liquidity across ecosystems but also allows investors to diversify their portfolios, bringing tangible, physical assets onto the blockchain with the security of regulated platforms ensuring trust and compliance.

These opportunities are already unfolding across several domains. From collectibles and luxury goods to multimillion-dollar artworks and real estate, tokenization is unlocking new levels of access, liquidity, and participation. Let’s take a closer look at how this plays out across different asset classes.

Looking deeper into these investments, we see how assets once considered too pricey for most become affordable for many, letting anyone diversify their on-chain portfolio beyond just digital assets into physical ones.

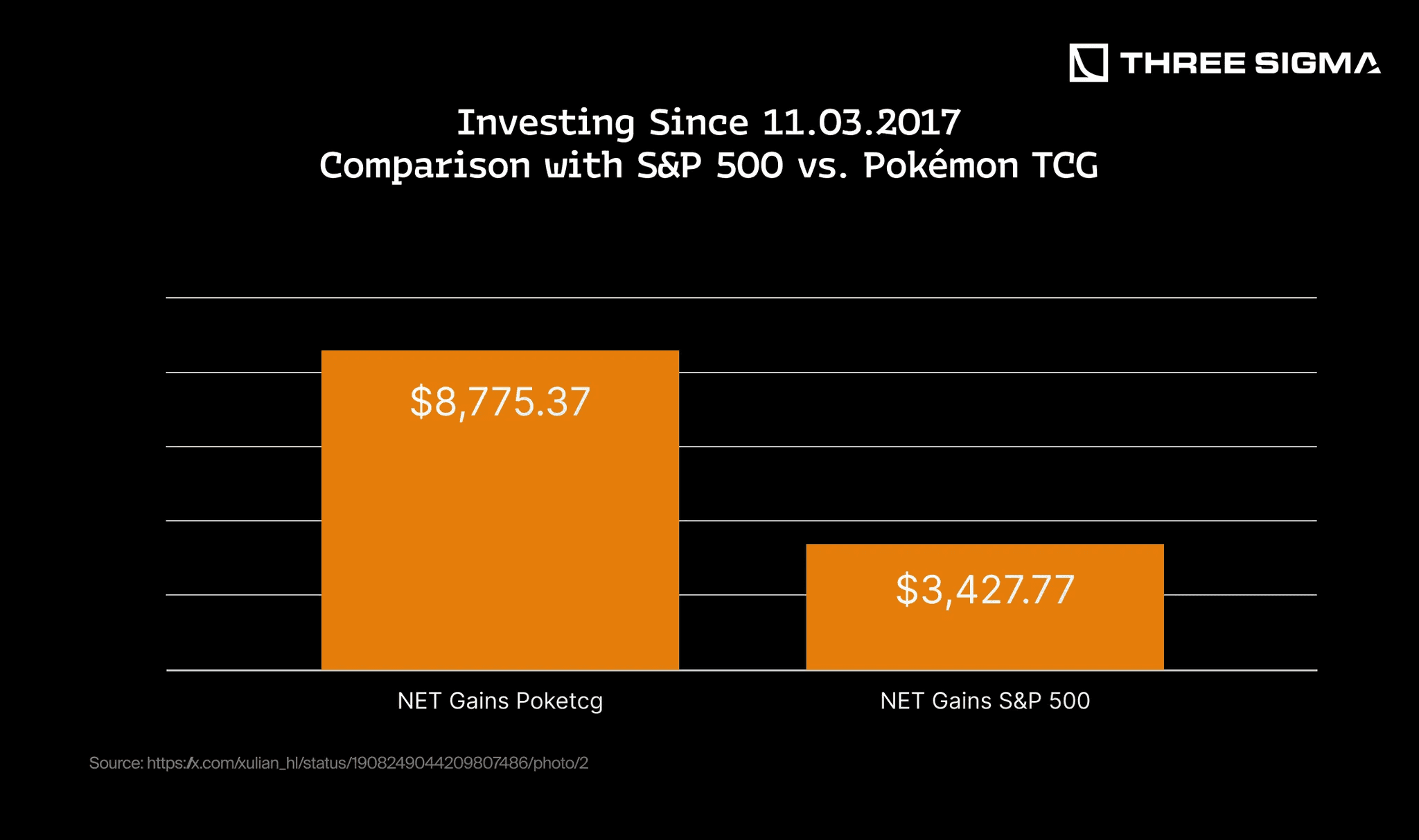

The past few years have seen a surge in physical collectibles like luxury watches, limited-edition sneakers, and rare trading cards, such as Pokémon or Magic: The Gathering sets, with platforms like Courtyard and Collector Crypt. You can buy tokens representing these cards, burn them to receive the physical item, or hold them for future appreciation in their marketplaces. This opens up the possibility of investing in collectible RWAs with a much lower monetary entry barrier compared to other assets like watches or other high-end collectibles.

While collectibles lower the entry barrier for retail participation, tokenization is also opening up traditionally exclusive markets. One of the clearest examples is the world of fine art, where fractional ownership is reshaping who gets to invest.

When it comes to art, we’re talking about a pricier world where only big investors typically play, plus the challenge of even accessing recognizable works, often sold through exclusive auctions or high-quality networking.

That’s where dApps like Masterworks shine, founded in 2017 and now serving over a million users globally, from first-time investors to seasoned collectors looking to build a diversified portfolio. They let you buy shares in multimillion-dollar pieces by artists like Basquiat, Picasso, and Banksy, creating a liquid trading market so your investment stays accessible, offering exposure to high-value art that can appreciate over time while you trade shares as needed.

Yet perhaps no sector illustrates tokenization’s disruptive potential more clearly than real estate. Here, the barriers to entry are traditionally even higher, and the implications for both investors and communities are especially profound.

Arguably the biggest innovation with the most potential for adoption is real estate tokenization, transforming how we invest in property by making it accessible, efficient, and truly global.

RealT enables fractional ownership of U.S. rental properties, where you can buy tokens for as little as $50 to earn passive income from rent, with properties ranging from single-family homes in Detroit to apartment units in Miami, all managed by RealT’s team to handle tenant relations, maintenance, and rent collection, ensuring consistent returns for investors. RealT’s platform operates on Ethereum, tokenizing each property as a unique LLC, with tokens representing equity shares that pay out rental dividends monthly, attracting a diverse investor base from young professionals to retirees seeking steady income without the hassle of direct property management.

Parcl takes a different approach, offering a decentralized platform to speculate on global real estate price movements using city-specific indexes, letting you bet on housing trends in cities like New York, Tokyo, or Miami without ever owning property. Built on Solana for low-cost, high-speed transactions, Parcl uses Chainlink oracles to track real-time price data, allowing investors to trade synthetic assets tied to real estate indexes, such as a Miami residential index, with leverage options up to 10x, catering to both retail traders and institutional funds. This shift creates a new layer of market participation, where data-driven investors can capitalize on real estate trends without the overhead of ownership, potentially amplifying price discovery and encouraging more responsive urban development strategies as investment flows influence city planning and growth.

But tokenization’s impact isn’t just economic. Beyond investment returns, these technologies are also driving new forms of financial inclusion and community development.

These yields appeal to a broad spectrum of investors, from cautious retirees seeking steady income to hedge funds looking for diversification, offering a buffer during crypto downturns. Over time, this stability could attract more institutional capital to these dApps, fostering a more mature DeFi ecosystem less dependent on speculative cycles and accelerating broader financial integration.

RWA as a Social Benefit

Beyond their economic impact, RWAs bring profound social benefits to DeFi, reshaping how we think about wealth and access in a world often divided by financial barriers. By enabling fractional ownership, RWAs empower small investors to participate in markets previously reserved for the elite, fostering financial inclusion that challenges traditional notions of economic privilege. Imagine a young artist in a developing country owning a piece of a luxury apartment in Paris or a share of a rare artwork, gaining access to wealth-building opportunities that were once unimaginable given his birth place.

This democratization of investment isn’t just about money, it’s about rewriting the social contract, giving people a stake in global markets and a sense of agency in their financial futures, which can ripple into broader societal empowerment by bridging gaps between the haves and have-nots, potentially reducing inequality over time.

Tokenized RWAs are enabling global capital to support local community projects.

In Southeast Asia, platforms like SUSI Partners and British International Investment are using tokenization to fund solar, wind, and hydropower plants, making renewable energy investment accessible to smaller investors.

In Brazil, SolarShare lets individuals buy NFT-based shares of solar panels, earning USDT rewards while financing off-grid energy in rural areas. Meanwhile, community housing initiatives like FICA (Fundo Imobiliário Comunitário para Aluguel) crowdfund tokenized real estate to offer affordable rental housing in São Paulo, promoting non-speculative urban living.

These projects highlight how RWAs bring financial inclusion to underserved regions while supporting environmental and social goals.

New In Town: Intellectual Property

The tokenization of intellectual property (IP) is evolving from royalties and patents into something much broader: turning IP itself into a composable, on-chain primitive. Projects like Story Protocol are pioneering this shift by building infrastructure for IP registration, licensing, and monetization directly on-chain. Unlike traditional tokenized assets, Story Protocol aims to create a universal IP layer where creators can register their work (stories, characters, universes), define usage rights, and allow others to build upon them, all governed by smart contracts.

This model enables programmable IP licensing, where derivative works automatically share revenue with the original creators, tracked transparently on-chain. For example, a game developer could use a character from a registered IP, and every in-game sale would trigger a smart contract distributing royalties upstream. This reduces friction, legal overhead, and enables permissionless creativity while ensuring fair attribution and payment.

Philosophically, IP on-chain with protocols like Story reflects a deeper shift towards open-source creativity. It challenges legacy IP frameworks, which are often exclusionary and litigious, by proposing a networked approach to ownership. Here, value comes from people creating together and remixing ideas, not from keeping rights locked away. It’s similar to how DeFi builds financial systems where everyone can participate, without middlemen.

For DeFi, this opens new asset classes and revenue streams. IP-backed tokens can be staked, used as collateral, or fractionalized for community funding. Liquidity pools for licensed IP derivatives could emerge, blurring the lines between cultural and financial assets. This composability turns IP into a living financial primitive, evolving as more creators and users contribute.

The Chaos of Tokenizing Everything

The promise of RWAs is rooted in access, efficiency, and the ability to share value across previously closed-off markets. But this same logic, when applied without limits, begins to reveal its contradictions. The line between empowerment and excess becomes increasingly thin as the scope of tokenization expands. What starts as inclusion can easily turn into distortion.

A world where everything is tokenized is often portrayed as a revolution. Imagine a future where your house, your car, even your favorite coffee mug exists as a digital token on a blockchain, tradable in global markets. The idea of democratizing investment and giving anyone, anywhere, access to wealth-building opportunities is undeniably appealing. It feels like the ultimate financial equalizer.

However, reality tends to be far messier than these clean, futuristic visions.

Tokenizing everything risks fueling speculative frenzies where hype, not value, dictates price. Picture a ten-dollar coffee mug skyrocketing to one thousand because a viral TikTok declared it the next big flex. We've seen this movie before. The NFT mania of 2022 was a preview of how fast irrational exuberance can inflate bubbles, only to leave latecomers holding the bag when the hype fades.

No one is suggesting your childhood teddy bear will end up on OpenSea. But tokenizing vast swaths of assets like real estate, collectibles, and intellectual property blurs the line between what's tradable and what's sacred. The scale could amplify market chaos. Systems would be flooded with newly liquid assets, destabilizing the human need for meaning and connection.

Ownership itself could become deeply confusing. Imagine your home fragmented into a thousand tokens, each owned by different investors spread across the world. Every decision, from repairs to selling, becomes a negotiation among people with conflicting interests. Managing shared ownership at this scale could lead to constant disputes, delays, and legal grey areas.

Something as personal as your house turns into a bureaucratic battleground. In many cases, it is the company managing the property that has the final say on what happens. But what if a single user gradually acquires 51% of the tokens? Would that person suddenly gain full control over your home? Tokenization opens the door to these power dynamics, where majority shareholders can impose decisions that override the interests of all others, regardless of emotional or personal ties to the asset.

Conflicts over tokenized assets would not stop at property decisions. As more assets become fractionalized, disputes over governance, voting rights, usage policies, and exit strategies will only increase. Competing token holders may push for incompatible outcomes, turning what should be straightforward decisions into prolonged battles. These tensions add another layer of instability, making even simple assets vulnerable to internal gridlock and external manipulation.

Beyond these social frictions, the technology that enables tokenization is not infallible. Protocols can fail. Smart contracts might contain vulnerabilities or be exploited. If a critical platform were to collapse, the impact would extend beyond digital assets. Real-world properties and investments, tied to those failing tokens, could suffer sudden and devastating losses. Market crashes triggered by protocol failures would blindside investors who believed they were buying into a stable system.

This is not just a market problem. Tokenized assets become prime targets for manipulation. Bad actors pump and dump prices in global, always-on blockchain markets. Retail investors get burned and whales walk away richer. We saw this in the meme mania of 2024, where privileged groups engineered hype cycles. Everyday participants were left exposed when the music stopped.

Tokenizing personal assets on public ledgers also erodes privacy. Every transaction is traceable. Every financial detail becomes a potential target. In a hyper-transparent world, personal security turns into a luxury. More insidiously, commodifying everything chips away at emotional bonds. Family heirlooms become just another tokenized asset. Sentimental value is reduced to market price. The ties connecting us to our histories weaken.

This transactional culture deepens systemic inequality. Those with resources dominate token markets. Smaller players stay perpetually behind. Philosophically, it forces a hard question. What does ownership mean when nothing is truly yours? Just a token on a ledger, passed around by strangers. Money already runs the world. Tokenizing everything could make it even worse. The dream of access might simply replace old forms of exclusion with newer, colder, more chaotic ones.

What DeFi Needs to Get Tokenized Assets Right

But beyond the philosophical concerns, the harsh reality of DeFi reveals even deeper challenges when trying to tokenize everything.

Most DeFi protocols today rely on a fragile stack of smart contracts, oracles, and governance mechanisms that are still experimental by traditional financial standards. The assumption that these systems can suddenly absorb trillions in real-world assets is, at best, premature. Technical exploits, oracle failures, or liquidity shocks can cause massive disruptions even in relatively small ecosystems. Now imagine this applied to tokenized real estate, credit markets, or sovereign debt.

Recent years have shown that even well-audited platforms are not immune. Hacks, contract misconfigurations, and governance attacks continue to plague DeFi at a worrying pace. These are not isolated incidents but symptoms of a still-maturing ecosystem. If protocols like Maple or Centrifuge are to scale their recent partnerships with institutions such as Cantor Fitzgerald, BlockTower, or Janus Henderson, and hope to attract even larger and more risk-averse players, they must grapple with risks that go beyond volatility. They need to ensure asset integrity, legal enforceability, and operational resilience at a level that no DeFi-native protocol has fully achieved yet.

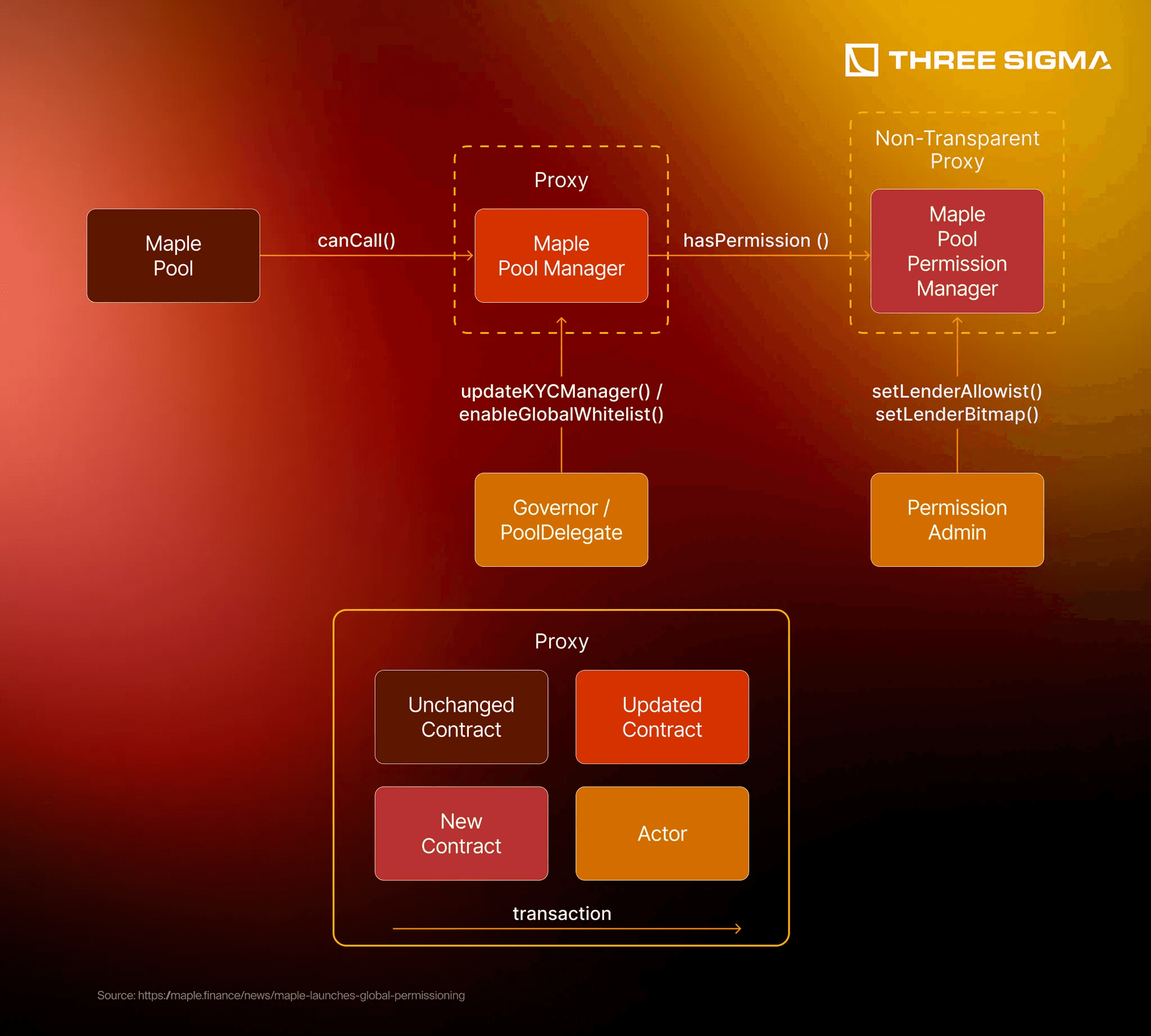

Maple, for exemple, is taking steps toward institutional readiness through its Global Permissioning system. The architecture separates permission logic into dedicated contracts like the Pool Permission Manager, which controls lender access to each pool. Key actors such as the Pool Delegate and Permission Admin can update KYC policies or allowlists without altering core pool logic. This modular design aims to meet compliance standards while maintaining DeFi composability, though it remains an evolving experiment.

Another often-overlooked vulnerability lies in liquidity fragmentation. Tokenizing assets creates new markets, but liquidity doesn’t magically appear. Without sufficient market depth and participants, many tokenized assets will trade in illiquid pools, leading to violent price swings at the slightest sell-off. Unlike crypto-native assets where traders accept volatility, real-world investors will not tolerate such instability for assets like real estate or fixed income.

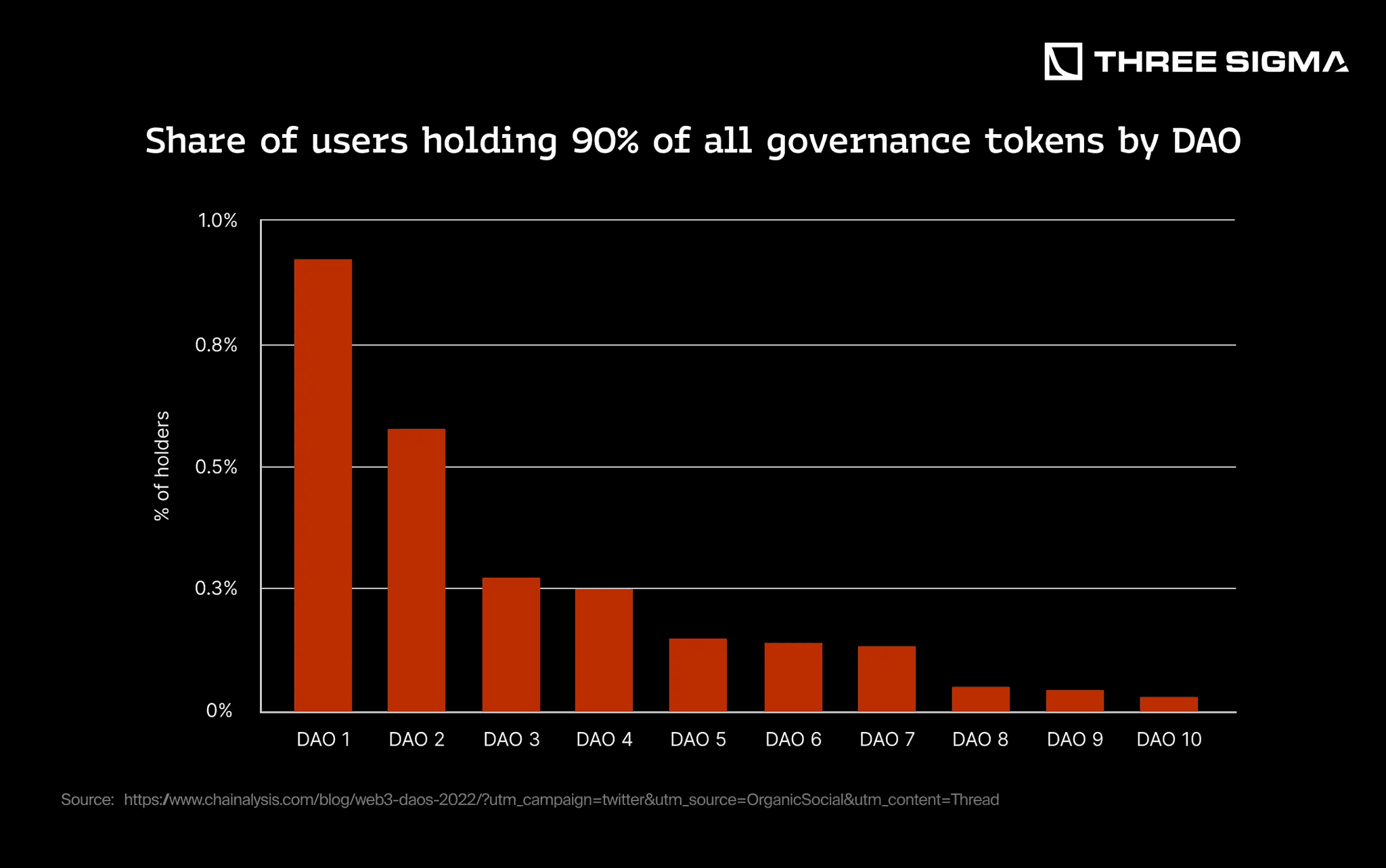

Moreover, the governance structures of DeFi projects remain dangerously centralized in many cases. Token holders might vote on proposals, but participation is low, and influence often lies with a handful of whales or project insiders. In a world where tokenized assets represent legal claims over physical goods or financial contracts, this concentration of power becomes not just a philosophical issue, but a direct threat to asset security and fair market dynamics. Majority token holders could, intentionally or not, steer protocols in directions that disadvantage smaller investors or even compromise the underlying asset's value.

All of this unfolds in an environment where regulatory clarity is still lagging. While high-profile institutions like BlackRock and Franklin Templeton can operate within compliant, controlled environments, most DeFi-native tokenization efforts are pushing into legal gray zones. The more these protocols attempt to tokenize real-world assets without robust legal structures, the greater the risk of sudden enforcement actions, asset freezes, or delistings.

In the rush to bring everything on-chain, DeFi risks overextending itself. Tokenizing everything might sound like the logical next step, but without solving liquidity, governance, technological, and legal challenges, this expansion could easily turn into a liability. If the industry's foundational structures are not solidified, mass tokenization won't democratize finance, it will create fragile, fragmented markets prone to manipulation, systemic failures, and loss of trust. The chaos wouldn’t be philosophical. It would be very real.

Avoid Chaos, Embrace a Tokenized Future

Technical Fixes in Real World Asset Tokenization

RWA platforms are rapidly iterating on technical designs to prevent disorder and build trust. One area of intense focus has been governance models: new frameworks aim to align incentives and manage risk as RWA protocols scale. In this context, we'll explore four foundational pillars shaping the future of RWAs.

New types of governance

Maple Finance in 2024 introduced a revamped governance token SYRUP to unite its ecosystem and balance different user bases. The SYRUP model underpins two segments: a KYC-restricted institutional lending arm and an open DeFi platform. Doing this allows Maple to maintain rigorous risk management for real-world borrowers while still offering permissionless access to yield in DeFi. This dual approach illustrates how governance is evolving to blend traditional oversight with decentralized participation.

Likewise, Centrifuge’s DAO has added expert committees like a Treasury Advisory Group to oversee financial risk and transparency. By injecting professional expertise into on-chain governance, such models aim to avoid the chaos of unfettered markets by enforcing prudent standards even as lending and securitization move on-chain.

Infrastructure and data transparency

Ensuring that on-chain tokens faithfully represent off-chain assets requires robust reporting mechanisms. In 2024, RWA projects began integrating specialized oracles to provide real-time verification of asset values and conditions. For instance, Centrifuge partnered with oracle provider Chronicle Labs to implement a dedicated “RWA Oracle” for its tokenized funds. This allowed real-time monitoring of a fund’s net asset value and even its off-chain holdings (such as bonds or loans held by a custodian) in a verifiable on-chain manner.

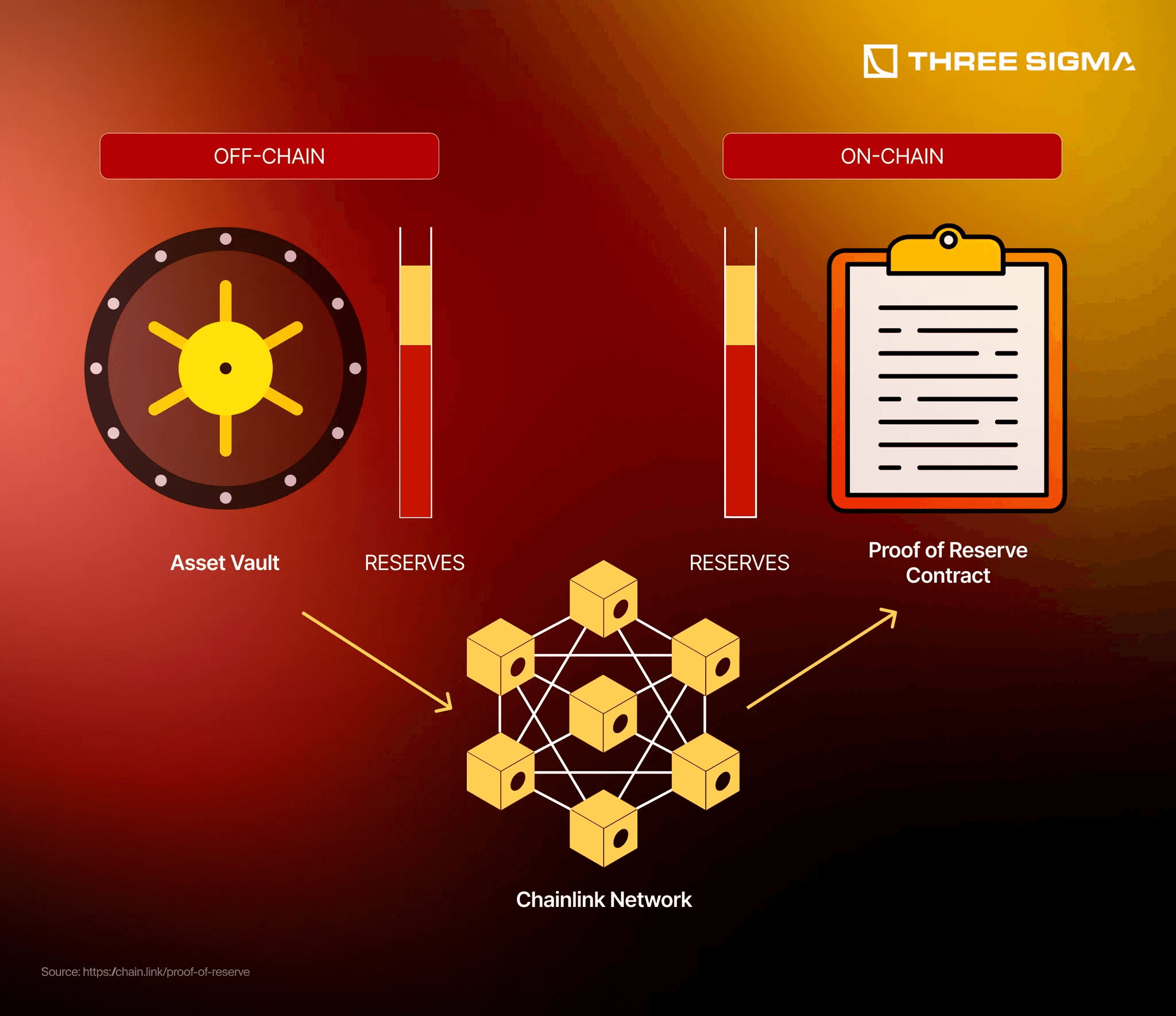

Such transparency tech is critical; it gives investors confidence that a token’s value is backed by actual assets, with continuously updated data rather than sporadic disclosures. Chainlink’s oracle network works similarly. Its Proof of Reserve feeds and upcoming standards are being used to automatically audit that tokens (from stablecoins to commodity-backed assets) remain fully collateralized. In short, by leveraging decentralized oracles and audit nodes, RWA platforms can avoid information asymmetry and fraud, creating a more orderly market with less reliance on blind trust.

Privacy and security

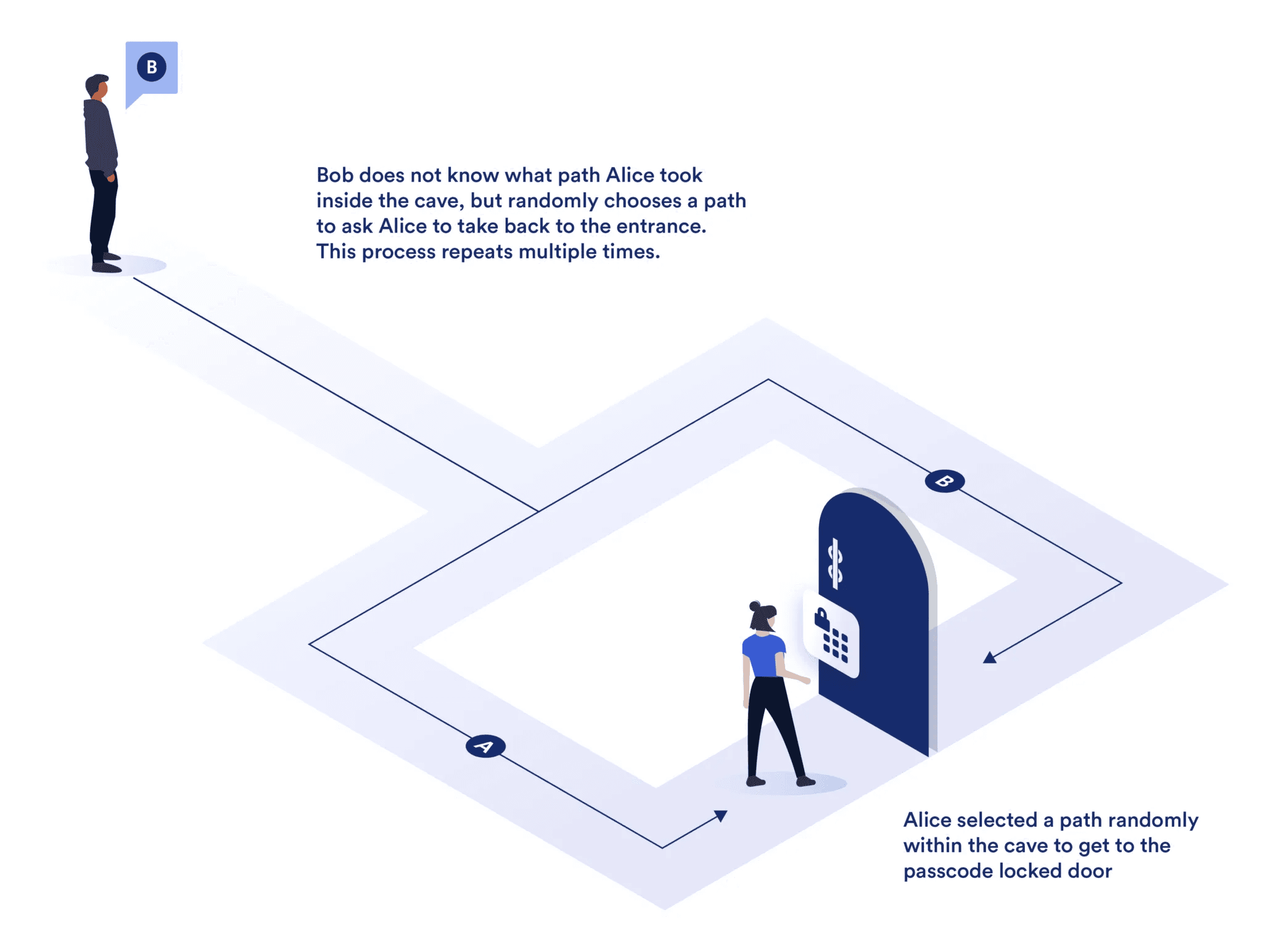

Unlike purely on-chain crypto assets, tokenized real-world assets often involve sensitive off-chain information, identities, legal contracts, and private financial data, which, if exposed, could deter participants or violate regulations. In response, projects are adopting privacy-preserving technologies to reconcile transparency with confidentiality. Zero-knowledge (zk) proofs and permissioned access controls are being built into RWA protocols so that, for example, an investor’s accreditation status or a borrower’s credit score can be verified on-chain without revealing the underlying personal data.

A notable development in late 2024 was Chainlink’s introduction of privacy features into its Cross-Chain Interoperability Protocol (CCIP) used for tokenized assets. This allows institutions to define conditions under which authorized parties can verify certain data (e.g., that an off-chain asset exists or a user passed KYC) while keeping that data encrypted and hidden from the public. Such innovations use cryptography to prevent the “chaos” of either total opacity or total exposure: they enable compliance with laws (like verifying investor identity, or ensuring a real asset backs a token) without putting sensitive information on public view.

Liquidity design

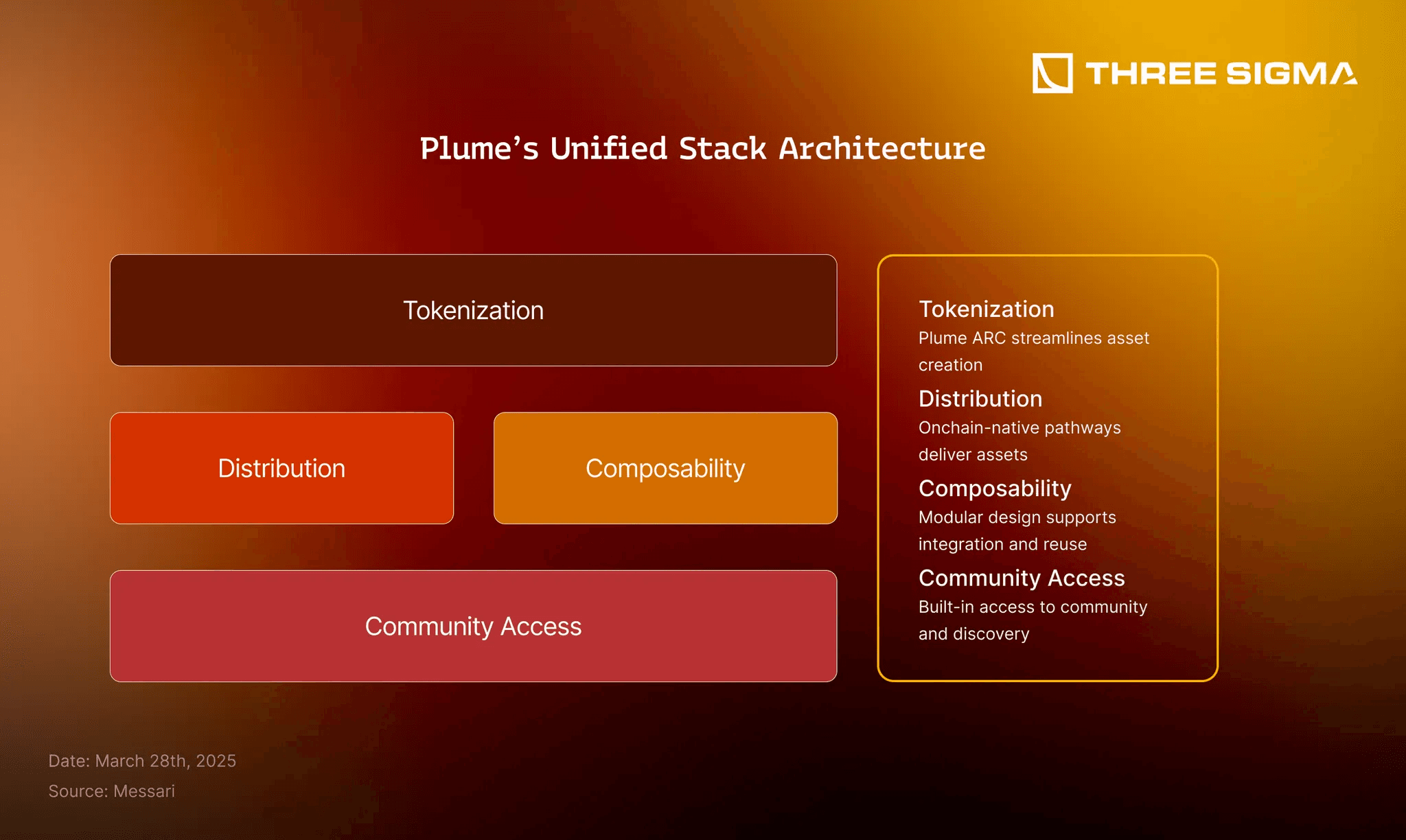

Finally, the last pillar is liquidity design for real world asset tokenization. RWAs have seen major improvements in DeFi, avoiding the fragmentation and dryness that plagued early efforts. A tokenized asset is only as useful as the markets around it, if no one can easily trade or use it in DeFi, it remains illiquid and “stuck.” To counter this, newer RWA protocols emphasize integration and composability from day one.

Plume Network illustrates a new approach: instead of just tokenizing real-world assets and leaving them siloed, it’s building a full blockchain and DeFi ecosystem around RWA tokens to ensure immediate utility. Inspired by stablecoins, the idea is that tokenized assets should natively serve crypto use cases, plugging into dApps and driving organic liquidity. This means designing RWA tokens to be DeFi-ready from day one, usable as collateral, tradable on DEXs, or yield-bearing without extra integration work.

Even though progress is underway, there are already dApps and RWAs that can be used today. Centrifuge, for example, partnered with Base Network and the Morpho protocol in 2024 to create an institutional lending market for tokenized U.S. Treasury bills. This allowed RWA tokens to be borrowed against and traded on a major Layer 2, with one-click onboarding for verified institutions. Morpho also adopted syrupUSDC, the receipt token users receive when they lend USDC on the platform.

The end goal is for a tokenized bond or loan to have a fluid market and price discovery process similar to a regular token. While market-making for low-volume real assets remains a challenge, improvements in market design such as tranching and AMM integration, along with increased connectivity between traditional finance and DeFi, are steadily enhancing liquidity.

Taken together, these four pillars show how the RWA ecosystem is moving from experimentation to maturity. Through a combination of technical and structural innovations, ranging from adaptive governance and real-time data infrastructure to privacy safeguards and integrated liquidity design, platforms are tackling the core challenges of tokenizing real-world assets. As these solutions evolve and interconnect, they are laying the groundwork for a more resilient, transparent, and scalable future for RWAs.

The Dilemma of Tokenizing Essential Goods

As real world asset tokenization moves beyond financial assets into resources like food and water, it poses a dilemma. Tokenizing essential goods promises improvements in access and distribution. For example, tokenizing crops lets farmers reach global markets directly, which can stabilize prices and send surplus food to areas in need. Similarly, tokenized water rights can create transparent marketplaces for more equitable water allocation. With careful design, tokenization might democratize control over vital goods, leveling the field for smaller stakeholders.

However, financializing basic needs also raises ethical and practical concerns. Critics warn that turning essentials into tradable assets could invite unchecked commodification. As noted by the UN Special Rapporteur on the human rights to safe drinking water and sanitation, “Water is already under extreme threat from a growing population, increasing demands and grave pollution from agriculture and mining industry in the context of worsening impact of climate change. I am very concerned that water is now being treated as gold, oil and other commodities that are traded on Wall Street futures market.”

Unfettered tokenization could let profit outweigh people, as wealthy actors hoard food or water tokens, driving up prices and deepening inequality. This risk underscores calls for strong regulation and ethical guardrails before tokenizing essentials.

Tokenization could lead to two contrasting futures.

- Balanced scenario, society embraces tokenization cautiously and thoughtfully: Public infrastructure and basic goods might be tokenized under strict regulations to ensure public benefit. For instance, a city could issue tokens to fund a water project or public transit, accompanied by rules that guarantee affordable access for all. In this model, essential tokens include safeguards such as usage caps, subsidies, or oversight through public governance, ensuring that efficiency gains do not come at the expense of basic rights. In such a future, blockchain markets promote transparency and inclusion, while public institutions protect equity and uphold ethical standards. Researchers note that realizing this outcome requires collaboration among technologists, policymakers, and communities to design legal frameworks that capture tokenization’s benefits without compromising public goods.

- Over-financialized world, tokenization expands into every aspect of life without restraint: In this scenario, everything becomes a token on the open market, including water, shelter, and even personal identity. Crucial resources could fall under the control of those who hold the largest number of tokens, turning public goods into instruments of private wealth. First we need to ask if the ability to tokenize something necessarily means it should be tokenized. If every part of life is reduced to a financial asset, the boundary between innovation and ethical failure becomes increasingly blurred. Cultural heritage might be broken into ownership shares, and personal data treated as a commodity. When technology advances faster than ethics, monetary value could replace meaning, and human dignity may be lost in the process.

These scenarios underscore the need for balance. The future of tokenization depends on society’s ability to draw boundaries with care. The question is whether we will use tokens to strengthen public welfare or allow them to reshape basic necessities according to market forces. The outcome will depend on how we regulate, and where we choose to place limits. Not everything is black and white, but failing to act with intention could blur the line between innovation and exploitation.

Where Real World Asset Tokenization Leads

The promise of real world asset tokenization is clear. Turning physical assets into digital tokens unlocks liquidity, broadens access to financial tools, and allows decentralized applications to connect more effectively with the real economy. Illiquid assets become tradable, services reach more users, and composability between real and digital systems improves. These changes hint at a more open, efficient, and innovative financial landscape.

This is no longer a distant vision. Protocols like Maple, Centrifuge, and Pendle are combining real-world backing with on-chain infrastructure. Features like audited contracts, risk tranching, on-chain reporting, and institutional partnerships show growing maturity. Tokenized Treasury bills, privacy-enhanced KYC, and smoother capital flows demonstrate that RWA tokenization is already functioning in real markets.

Still, this progress comes with real challenges. Tokenizing everything risks reducing meaning to market price. Speculative bubbles can form as hype overtakes value. Technical failures in smart contracts or blockchains could cascade across platforms, causing widespread damage. Governance remains fragile in many systems, with misaligned incentives and concentrated voting power often undermining protocol stability.

Moving forward will require more than just innovation. There must be clear boundaries around what should and should not be tokenized. Not every asset belongs on-chain. Regulation must evolve to offer investor protection and market oversight without blocking growth. And most importantly, the DeFi ecosystem must keep improving its security, risk tools, and incentive design to ensure that tokenization delivers on its promise without becoming a liability.

From a practical standpoint, one way to guard against RWA tokenization pitfalls is through rigorous third-party oversight. Specialized auditors like Three Sigma have emerged to help DeFi protocols model risk properly, build robust mechanisms, improve tokenomics, and plan for long-term sustainability. By stress-testing economic designs and challenging optimistic assumptions, the Three Sigma team can identify vulnerabilities early, enabling project teams to refine their models and avoid chaotic outcomes when scaling up. Explore our approach and examples of Case Studies and Audit Reports and get a quote for a Smart contract audit.

In short, real world asset tokenization can either extend access or entrench power; outcomes depend on design choices, governance, and enforcement.

Ultimately, tokenization is not just a tool. It is a force that can either concentrate power or redistribute it, depending on how we wield it. It can build transparent, inclusive markets or unleash speculative chaos at unprecedented scale. What makes it powerful also makes it dangerous.

As DeFi stretches to wrap the real world in code, the challenge is no longer just technical. It is moral, political, and economic. Whether tokenization becomes a foundation for broader prosperity or just another engine of inequality will depend on the boundaries we set, and the courage to enforce them before it’s too late.

FAQ

What is real world asset tokenization?

It’s the process of converting legal rights to real-world assets (e.g., T-bills, property, private credit) into on-chain tokens that represent verifiable, tradable ownership or claims.

How does do RWA’s work, end to end?

Custody/valuation → legal wrapper (SPV/trust) → token issuance → on-chain controls (KYC/allowlists, transfer rules) → secondary markets → redemption/burn.

Why do it?

Liquidity, fractional access, faster settlement, and DeFi composability (use as collateral or to route yield).

What are the biggest risks of RWA tokenization?

Regulatory classification, oracle errors, smart-contract bugs, governance capture, and thin liquidity, audits reduce (not eliminate) code risk.

How should teams ship safely?

Use reputable custody/legal structures, real-time reporting, and independent reviews, start with a Smart Contract Audit.