Introduction

Points have been an increasingly popular trend among protocols over the years. Popularized by point mania in late 2022 with protocols like Blur, the use of points has now expanded from L1 and L2 solutions to wallets, bridges, and more Degen DeFi projects.

The new liquidity mining reward era is here.

This series of articles aims to provide an overview of the current points space, comparing different programs from protocols across various chains that have gained notoriety among users seeking to participate in airdrops and rewards.

Our focus is on understanding the mechanics and economic incentives behind these systems, rather than promoting them as investment opportunities, to provide a comprehensive understanding of how point programs function and their impact on the broader crypto landscape.

The following 75 protocols were included:

- Ambient Finance, Aspida, Avantis, Avnu, BackPack Wallet, Bedrock, Bitget Wallet, Blast, Blur, ClayStack, Debridge, District One, Drift, Dunes, EigenLayer, Eigenpie, Elixir Network, Ekubo, Etherfi, Ethena, Euclid, Fantasy Top, Friend Tech, GetGrass, Glacier Network, Hyperliquid, InceptionLRT, Init, Insrt, IntentX, Jito, Juice Finance, Jumper Exchange, Kamino, Karak, KelpDAO, KiloEX, Kinza Finance, Linea, Mantle, MarginFi, Mikyway, Mitosis, Mode, Orbiter Finance, Owlto, Parcl, Perpy Finance, Prime Staked ETH, Puffer Finance, Rabby Wallet, Rainbow Wallet, RedBelly, Renzo, Ruby, Scroll, Shuffle, Solend, StakeStone, Stacking Dao, Supra Oracles, Swell, SynFutures, Tensor, Thruster, Velar, Vitruveo, Wasabi, XLink, Yieldnest, Zaros, Zeta, Zest Protocol, ZKBridge

Classification of Points Programs

But before we begin, what is even a point?

Points are incentives rewarded via loyalty programs that became a trend in web3 around late 2022 and early 2023. Projects can give out points for various reasons, whether to gamify their protocol, for governance or voting, to deter airdrop farmers, and more. These points can give you allocations and drop tokens after TGE, but teams still need a smart contract audit before incentives go live, because reward logic becomes a high-value attack surface.

Points tend to be centralized, meaning each protocol disseminates and tracks its point system. These points are often managed off-chain, as they are not recorded on the underlying blockchain layer.

These reward systems surged as an alternative to traditional token airdrops, where projects give tokens to their users as part of marketing campaigns.

Points not only are an evolution of this trend, but even more, the absence of a points system in pre-token protocols can be a factor in why people lose interest in the project, hence the increasing number of protocols implementing them.

Clear examples of this loss of interest can be seen by comparing platforms like Opensea and Blur. Opensea did not implement a point program and didn’t hint at a token, whereas Blur pioneered one of the biggest programs in the space by launching a points campaign with seasons. This strategy gradually attracted more NFT users to Blur, while Opensea remained stagnant.

Users started switching to Blur, which assuredly rewarded their actions, leading to Opensea losing market share.

MetaMask is another example of losing market share due to the absence of any ongoing airdrop program being shared with its community. Competitors like Rainbow and Rabby implemented a points feature, which successfully shifted user bases toward them.

Points are a sensitive aspect to implement, as they have a mixed impact from a community standpoint. Not everyone may favor them, mainly due to past failures in token allocation. However, it is important to recognize the evolution they have brought and how they are consistently evolving, as we will discuss in the upcoming sections.

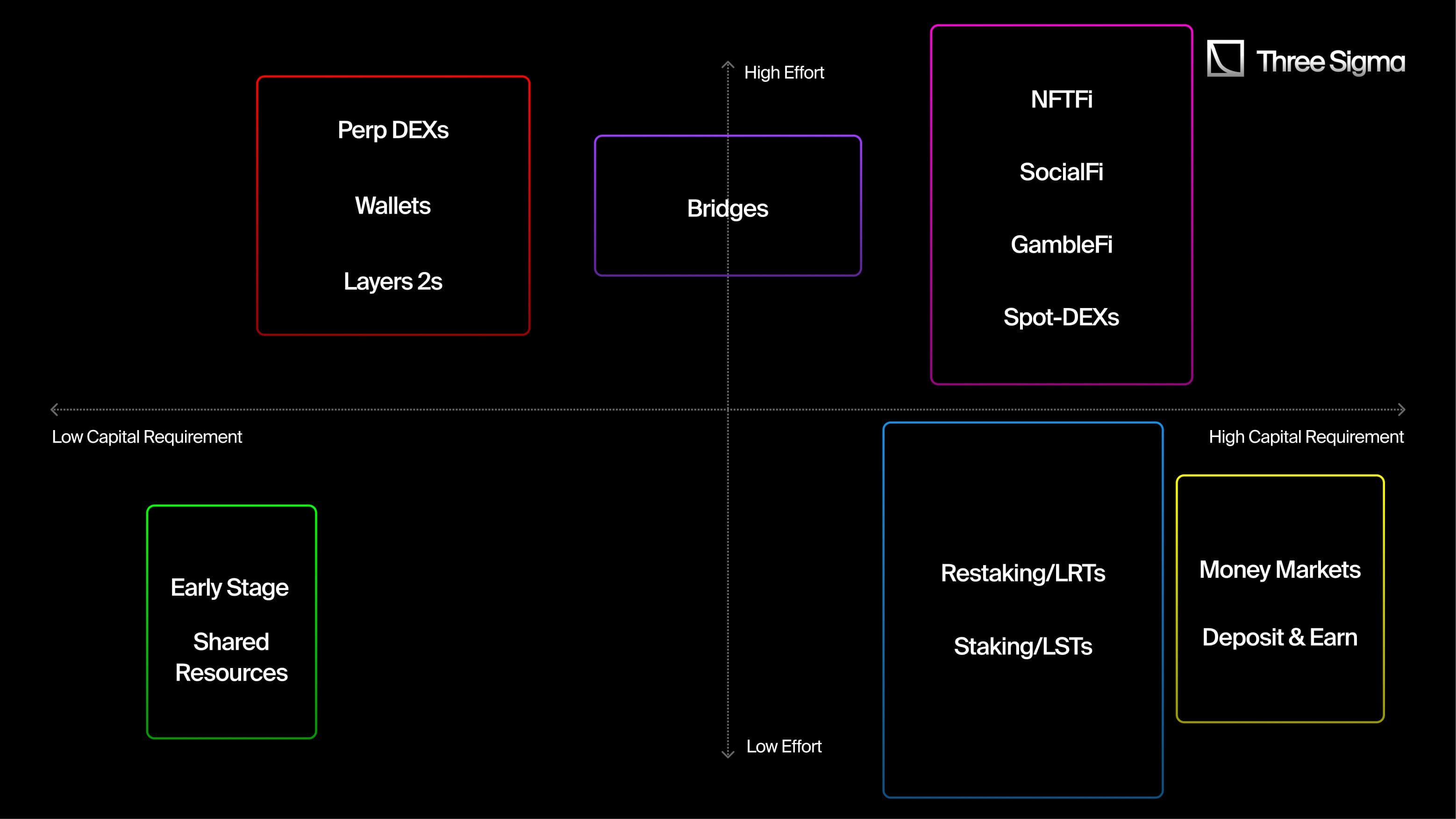

With that in mind, we have developed a broad and simple classification based on the users' perspectives and the requirements they need to meet to be rewarded accordingly.

This is based on two variables.

Capital requirement. Quantity of assets needed from users to be able to participate in the point program without being overwhelmed by whales. It can be found on the X-axis, where:

- Low Capital → There can be a cap on points, so all users have a maximum amount of points they can earn. The rewarding activities offered by the program don't require high capital to accumulate a significant number of points.

- High Capital → There’s no cap on points—The more capital you have the more points you can farm. Also, protocols that fall in this category, tend to reward a broader set of things related to spending money, such as gas fees paid or volume created without leverage or borrows.

User effort. How the effort of a user is rewarded on the activities that will give points. Amount of effort in both time and amount of activities needed to maximize the points allocation for a user. Defined as a bilateral standard, it can be found on the Y-axis, where:

- Low Effort → The rewards are given via lower-effort activities. Simply parking your capital is enough to gain points.

- High Effort → The rewards vary based on several factors that increase the effort required from a user. These factors include the number of point-rewarding activities, periods when specific activities offer bonus points or multipliers, the significance of referrals and social participation, and consistent engagement.

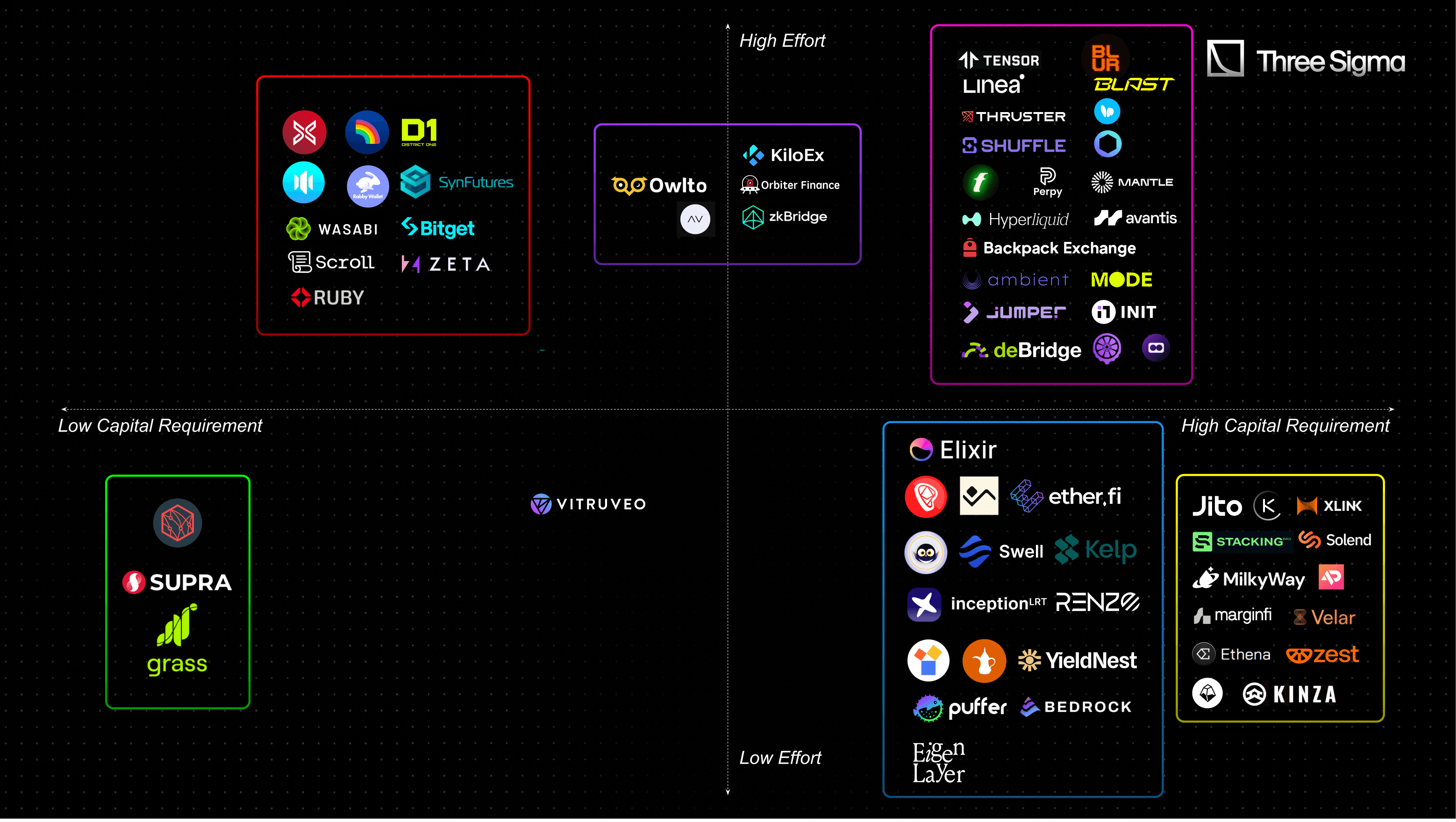

Note. Classification matrix for points programs based on two key criteria: 1) Points capped on a daily/weekly basis. 2) Amount of activities offered (on-chain and off-chain). It is also important to note that within the clusters, different types of protocols will still vary in terms of effort and capital requirements.

What projects can we find in each cluster on the chart above?

DEXs

The two types of DEXs are positioned on opposite sides of the X-axis due to differences such as the artificial volume created through leverage and the different presence of caps on points.

Bridges

Degen

Infrastructure

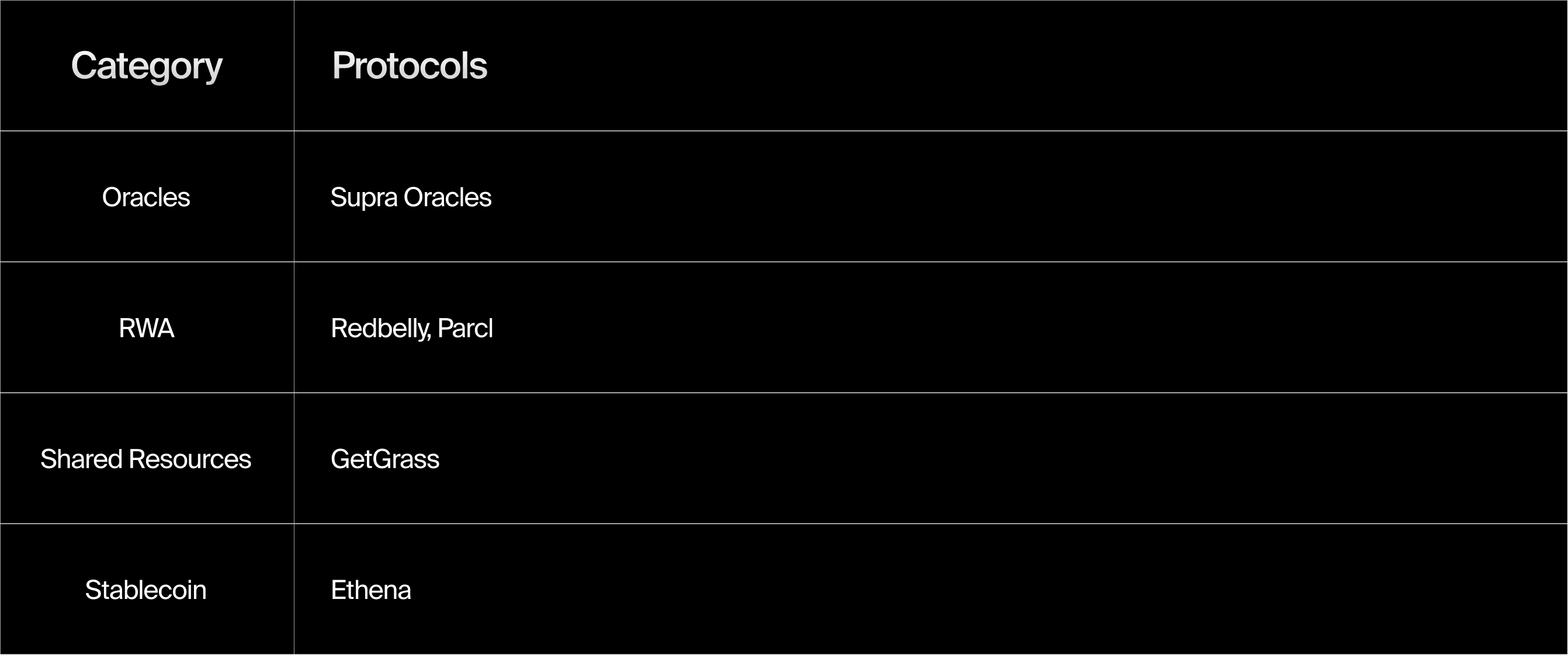

Infrastructure protocols are a vast part of the blockchain ecosystem, and their point programs are spread across different categories, depending on the specific focus of their infrastructure and their unique needs.

Wallet

Except for Backpack Wallet, which has a program focused on trading volume, most wallets fall into the clusters requiring low capital and high effort from the user.

Money Markets

Staking

Base Layer

Both L1s and L2s are distributed along the X-axis, with some prioritizing volume and others focusing on social engagement and referrals.

Ecosystem Overview of Points Programs

Note: Outliers seen outside the clusters represent programs that do not adhere closely enough to the X and Y axes to be inside a cluster. These have been measured as outliers, yet they usually fit well into their closest clusters.

It is also important to note that point programs differ significantly in the transparency of their protocols, particularly concerning the quantitative aspects of point allocations. Therefore, we will provide a general overview of specific programs, highlighting what they reward the most and what is most important in each category.

Pink Cluster

This section refers to the protocols that were found to require the highest amounts of effort and capital for point accumulation. The main types of protocols found here are NFT marketplaces, Social Apps, and L2 DEXs.

Degen

Degen protocols, known for their high R/R structures, have leveraged point programs to incentivize user engagement and participation. The three primary types of Degen protocols that utilize these point programs are NFTFi, SocialFi, and GambleFi.

NFTFi protocols were among the first to popularize points. As pioneers, their point programs were not optimally refined for maximum accessibility compared to more recent programs, yet they were a huge success. Among the key learnings from their programs is the notable impact of multiple seasons on TVL, user engagement, acquisition, and retention.

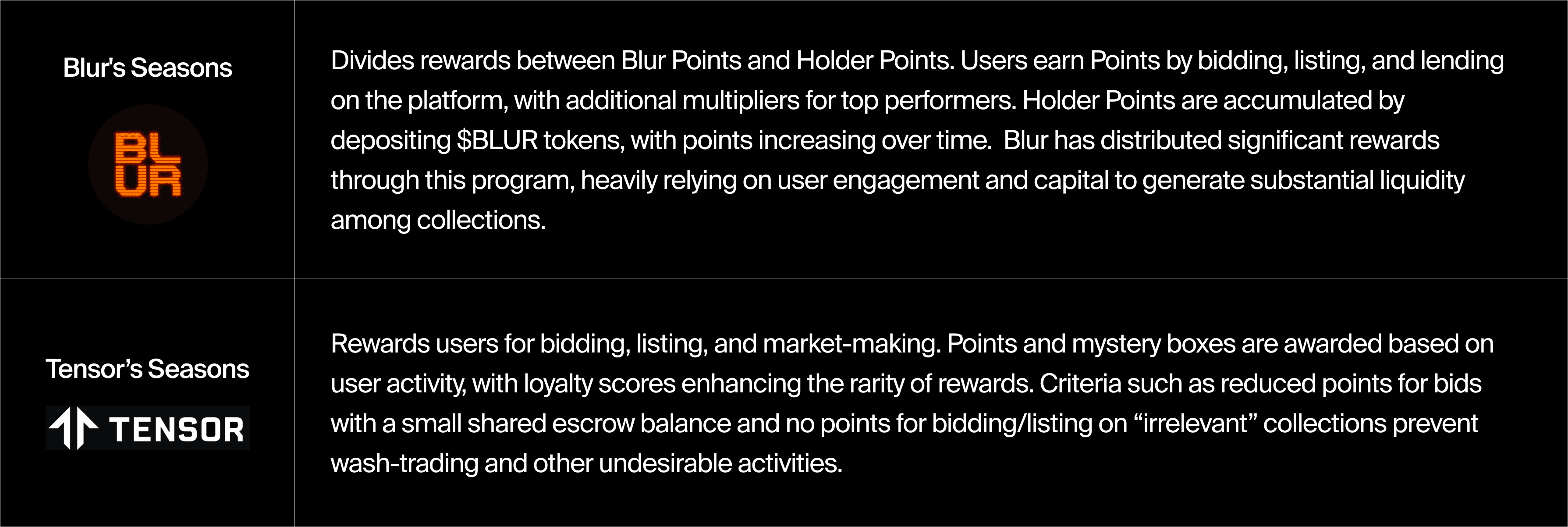

Blur and Tensor were among the first to introduce gamified point programs aimed at incentivizing trading volume. These protocols, like most in the cluster, reward users based on their trading volumes and liquidity provision, emphasizing high trading volumes that require existing user capital.

The implementation of seasons doesn't mean that each season is completely different; normally, the activities remain the same. Instead, it helps protocols distribute tokens in a more organized and phased manner, allowing each phase to adapt to different requirements from the previous one.

The seasonal structures demonstrated how programs can significantly boost user participation and asset allocation within the platforms.

This sub-group employs an exponential criterion for point distribution. Points are continuously earned and accumulated based on user engagement and activities throughout the season. Boosts are determined by a 24-hour leaderboard, implying that early-point farmers can be easily diluted as other participants increase their bidding activity and scale rankings.

In summary, the key changes on both Blur and Tensor included introducing new mechanisms to enhance user engagement and ensure fairness. Blur introduced lending points, integrated with the Blast protocol, hid the points counter to prevent abuse, and strengthened anti-fraud measures. Tensor, on the other hand, hid the points counter, introduced price locks, ensured equal daily distribution of points, and also enhanced anti-fraud measures to maintain a fair and competitive environment.

Building on the principles of NFTFi protocols, SocialFi platforms integrate the asset trading aspect of marketplaces with social interaction. These protocols reward users for engagement and holding/trading collections, mirroring some of the strategies of their NFTFi predecessors.

SocialFi protocols tend to link the social activity of users to the platform to be able to scan and reward social participation.

These SocialFi protocols tend to require less capital from users than NFTfi protocols. They focus on rewarding social-related activities with linear distributions and are less aggressive on metrics that require capital, such as Blur's trading volume, making them more accessible and engaging for a broader range of users. These platforms monetize social interactions, making their point programs distinct yet rooted in the principles of NFT collection interaction.

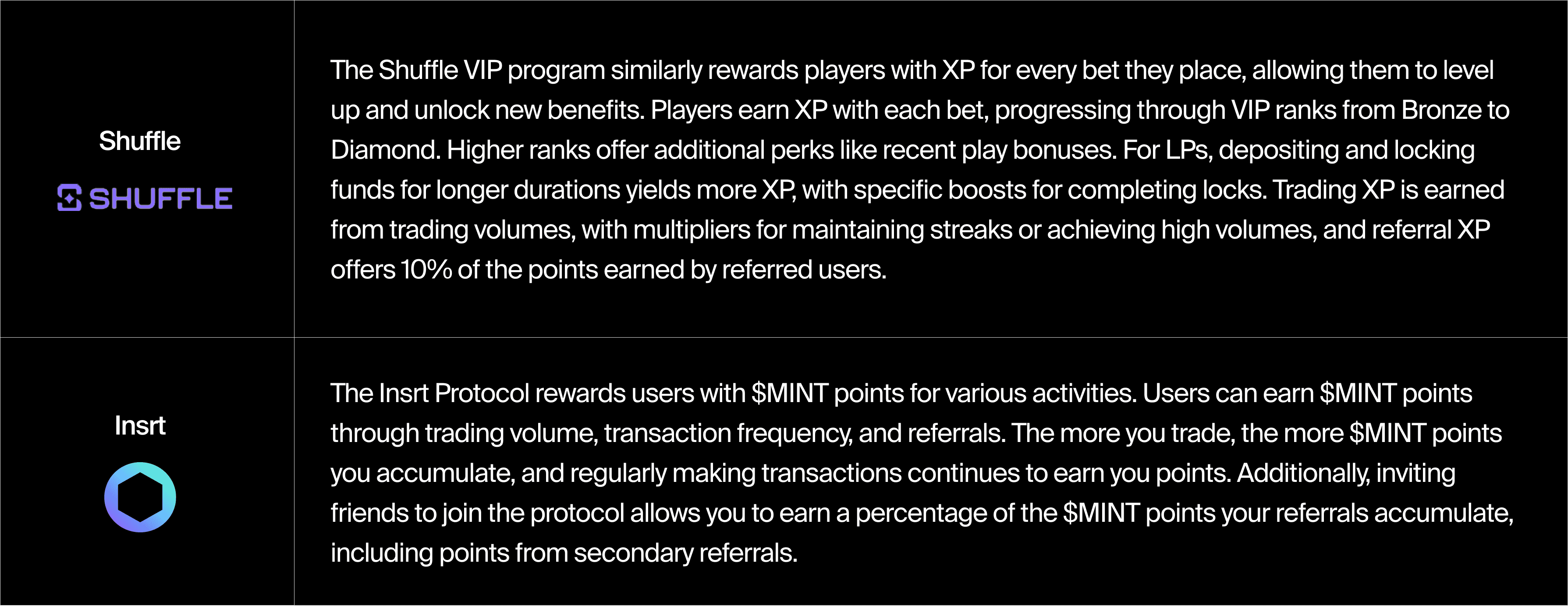

Transitioning from the social-driven engagement of SocialFi protocols, GambleFi protocols integrate simpler programs than NFTfi protocols, offering users the chance to earn points and rewards through simple bets. These platforms can require lower capital but high effort, rewarding consistent participation and strategic engagement, or focusing on the amount of money being bet.

GambleFi protocols typically employ varied distribution methods to incentivize participation and maintain user engagement. Most platforms, like Insrt Protocol and Shuffle VIP, linearly distribute points based on user activities, ensuring that both early and late participants are rewarded equitably for their efforts.

Spot-DEXs

In this section, we identified DEXs on L2 solutions such as Blast, Starknet, and Arbitrum, which all follow similar strategies. Generally, DEXs have stricter capital requirements compared to derivatives protocols.

The protocols reward trading activities, which include metrics such as the number of transactions, frequency, volume generated, and fees paid. The DEXs analyzed did not have caps for points, making their programs more friendly for individuals with high capital.

For example, if a DEX plans to airdrop $2 million worth of tokens and initially users earn 1,000 points a day. One week later, a user with an outsized amount of capital starts farming, quickly diluting the rewards for smaller traders. As more high-capital users enter, the rewards for smaller traders are further diluted, even if they remain actively trading.

DEXs can take different approaches to rewarding their users, focusing either on LPs, traders, or equally rewarding both. Some examples of this are:

For protocols sourcing liquidity from external sources, which do not rely on LPs, like Jumper Exchange, points are awarded based on the volume traders generate and the frequency of their trades.

Additionally, DEXs emphasize other aspects, such as user social engagement, to encourage active participation across multiple dimensions.

DEXs such as Jumper, Velar, Ambient, and Thruster, tend to implement programs that distribute points linearly. This means points are distributed consistently to early and late participants based on their actions, ensuring predictable accumulation without multipliers.

Common Characteristics and Analysis

Protocols in this cluster focus on rewarding active participation and, most importantly, the amount of capital being handled in their protocol.

Protocols in the Degen sector leverage gamification through leaderboards, rankings, and innovative reward structures to incentivize users to contribute with consistent and high-volume trades.

Another practice in this area, especially in the Degen sector (specifically NFTFi and SocialFi), is filtering collections that get rewarded points to prevent wash-trading. For example, trading small rather unknown collections will often give fewer points or no points at all. The emphasis on high capital requirements is a conscious and strategic decision, targeting users who can deploy significant amounts of capital and maintain active participation.

However, as seen during the era of Blur farming, this strategy can heavily favor whales, who will be responsible for most of the volume. This, in turn, reduces the interest from smaller capital users.

Blue Cluster

Continuing with the protocols that reward higher capital, staking-related protocols present themselves as a lower-effort solution that still values what the Pink cluster requires: capital.

Three main types of protocols emerge in this staking context: Staking/LSTs, ReStaking/LRTs, and some Liquidity Provision protocols.

Staking/LSTs

Staking protocols like Milkyway, Jito, Aspida, and Stakestone significantly benefit from what supports the protocol the most: simple deposits.

While many staking protocols, such as Jito and Aspida, cater to whales by having no caps on points, others like Stakestone implement daily caps, which helps achieve a more equitable distribution of point allocations.

Stakestone's approach benefits a broader audience by preventing the accumulation of unfair amounts of points and encouraging early deposits rather than waiting until just before the snapshot to deposit large sums and earn substantial points quickly. On the downside, the addition of caps might limit volume and capital inflow.

An aspect of liquid staking protocols, which is now being introduced in restaking point programs, is how they manage their LSTs for extra rewards.

Regarding the distribution of points, LST point programs exhibit exponential distributions. Without implementing caps, users can join and deposit any amount of capital, quickly diluting the shares of points held by early depositors who once had significant participation.

These staking protocols demonstrate a clear pattern in which actions are being rewarded, yet they implement varied strategies in allocation, caps for deposits/points, and timeframes for rewards. Each protocol balances the needs of its user base, optimizing for both equitable distribution and capital inflow.

Restaking/LRTs

Restaking, introduced by Eigenlayer, along with the addition of LRT protocols, can offer even more rewards than LST protocols. Depositing into restaking protocols grants points from both the LRT programs and the base restaking layer program. This model, now being adopted by competitors like Karak, is generally advantageous for users who can stake a significant amount of capital early, as they will accumulate more points over time, gaining multipliers and extra rewards along the way.

For many protocols, the strategy is very simple. More stake assets + more time = more points.

With the surge of liquid restaking, protocols have had the opportunity to capitalize on the influx of users and create their point systems, generating opportunities that incentivize continuous participation. Eigenlayer employing this method leveraged liquid restaking protocols to create point programs where users earn both Eigenlayer points and LRT points.

All these protocols have also embraced the trend of creating seasons for farming. Eigenlayer and EtherFi are clear examples, both being in Season 2 with structures similar to the first season, aiming to maintain high engagement on their platforms. The results have been positive, as demonstrated by EtherFi’s increasing TVL even after the first airdrop on March 18th.

LRT programs are typically categorized under exponential distributions. Points are usually measured by the time-integrated amount staked in units of ETH*hours. Early stakers accumulate more points over time, benefiting from multipliers and additional rewards, yet, as more users join and TVL increases, the total issuance of points grows, diminishing the relative share for early participants.

Common Characteristics and Analysis

Protocols in the Blue cluster are among the most friendly protocols for whales to participate in due to their simplicity and the rewards based on the amount deposited. It’s no surprise that Justin Sun, just days before the EtherFi snapshot, deposited $480M into the protocol receiving 6% of the total airdrop.

These programs utilize advantages inherent to the protocol mechanisms and are mirrored in the programs to help users with more reward opportunities.

An example is the use of LSTs and LRTs for other DeFi activities, which has proven to significantly increase rewards, with multipliers and boosts always available for users engaging in such activities.

Red Cluster

For a protocol to require low capital and high effort, which is the case for protocols in the red cluster, the platform must provide users with tools to either turn small amounts of capital into larger sums through leverage, thereby competing with higher capital individuals or to bet on strategies unrelated to on-chain activities.

Protocols in the red cluster include a variety of platforms, ranging from L2s to Perp-DEXs to Wallets.

Layer 2s:

The point mechanisms in L2s often reward users for various activities within and for their chain. These activities range from bridging assets to their network and engaging with protocols within their ecosystem to emphasizing referrals and social activities. The effectiveness of these programs depends heavily on the current state of development of the protocol and the diversity of users they aim to attract. This encourages network activity while providing ample opportunities for people with lower capital to participate.

- Ruby is an example of an L2 with lower capital requirements. Its program rewards users solely for promoting the L2 on social media platforms, a strategy that has been part of many past airdrops.

- Linea, on the other hand, recently introduced a 6-month/6-season program that requires users to bridge assets and engage in on-chain activities such as trading and providing liquidity. The program also implements caps on rewards for specific activities, such as trading, based on the amount of fees paid.

L2s have very different types of distribution, which coincides with their overall spread in the chart. Most of them use linear distributions, like Ruby and Glacier Network. Linea is an exception, having implemented a decay distribution where each month 10% fewer points are distributed.

Another unique aspect of points in Base Layers is how they can leverage dual point programs from both the chain and its ecosystem protocols.

- Blast is a recent notable example, implementing a dual point system where users earn both standard points and Blast Gold. Blast Gold was designed to incentivize capital movement into its DApps. Users earn Gold by participating in specific protocols selected by Blast to receive Gold allocations, and it’s up to those protocols to decide how Blast Gold is distributed. If a protocol that is part of the Gold program also has a point program, users can farm three different types of points through single actions.

While most L2 protocols focus on higher effort and low capital requirements from users, some, like Blast and Linea, stand out with higher capital requirements due to their extensive incentive structures. This contrasts with simpler programs like Ruby and Glacier Network, which reward actions less related to capital usage.

Additionally, there has been a growing trend of rewarding "off-chain" activities. Developers contributing to GitHub, participating in community discussions, and engaging in other off-chain activities are increasingly being recognized and rewarded by these chains.

Perp-DEXs:

Perpetual DEXs are a DEX category that allows users to trade perpetual futures with leverage. These platforms typically have lower capital requirements compared to spot-DEXs because they enable users to leverage assets to achieve higher trading volumes. These programs are particularly attractive for smaller traders looking to maximize their impact.

The reward mechanisms of these programs are designed to encourage active trading, liquidity provision, and user engagement. Common strategies to gamify the program include creating trading competitions and rankings based on PnL, which grants boosts to top performers. Platforms like Zaros, Intentx, and Wasabi all offer boosts based on PnLs.

To prevent whales from accumulating points excessively, some Perp DEXs implement measures such as weekly caps on points or higher allocations for riskier traders. These rules benefit a wider userbase, as leverage trading can generate large artificial volumes with relatively small capital if done well. Examples of protocols using these strategies are:

Liquidity provision is also crucial for Perp-DEXs. Protocols like Avantis and Drift reward liquidity providers to a higher percentage than low-leverage traders.

Perp DEXs offer various incentive mechanisms to actively engage users. By incentivizing leveraging, implementing point caps, and rewarding liquidity provision, these platforms create programs that support both small traders and larger participants in the ecosystem. This makes Perp DEXs a dynamic and accessible option in the DeFi landscape.

There is a predominance of a decaying distribution of points among Perp DEXs, which reward early participants more heavily and reduce points allocation over time. Additionally, exponential distributions are also common, as seen in protocols like IntentX and Wasabi, which incentivize latecomers and high-risk takers with point boosts.

Wallets

A newer trend has emerged where wallet providers implement distinct point programs to incentivize their adoption. These programs address features the community has long awaited from leading wallet providers like Metamask and Coinbase.

Wallets, being foundational in crypto, offer varied ways to distribute points. Besides connecting users to DApps, they often include functionalities such as staking or swapping, which can earn points. Wallets reward users based on their activity and loyalty, including holding assets, performing transactions, and engaging with features. Referrals are also a crucial component of these programs.

Each wallet implements its point program uniquely to attract and retain users. Yet, most use a decay/logarithmic distribution, rewarding early adopters and high-value activities initially, with diminishing returns over time. Rainbow Points and Rabby Points follow this model. Exceptions include Bitget Wallet's linear distribution with daily caps and Backpack Points' exponential rewards for specific DApps and leaderboard rankings.

Wallets are essential in the crypto ecosystem, and by adding incentives, they create a more engaging experience for newcomers.

Rainbow Wallet and Rabby Wallet promote broader engagement through diverse activities, while Bitget Wallet maintains balance with clear daily caps. Backpack Wallet stands out with its high capital requirements and speculative rewards, encouraging significant user interaction with its ecosystem and partner DApps.

Common Characteristics and Analysis:

The red cluster has some differences. Wallets and L2s differ significantly from perp-DEXs in how users can earn points.

L2s and wallets have programs that focus on a higher number of activities being done repeatedly by users. They offer the greatest variety of options for users, often including not only on-chain interactions with DApps but also tasks on social media, smart contract deployments, and other off-chain tasks. They can also create specific multi-tier point programs for their ecosystem, rewarding protocols within it, as is the case with Blast Gold.

In this way, the protocols that participate in this dynamic see their engagement automatically increase and can leverage this to create their own programs to further incentivize users and compete with those that already have their own program plus the L2 program.

It is no coincidence that a large number of protocols in Blast started their point programs alongside the launch of Blast Gold.

Perp-DEXs manage to enter this cluster by enabling leverage, which reduces the need for large initial capital to generate volume. Moreover, the risk taken, including the amount of leverage, will proportionally increase the number of points earned. This, along with some programs that include weekly caps, allows for a more equal distribution among users.

Yellow Cluster

The yellow cluster consists of protocols that primarily account for the number of dollars being deposited, meaning usually very low effort is required. Protocols in this category may require varying degrees of effort. For example, money market protocols often demand more active participation, while others are entirely based on a “deposit and earn” model.

This second type of protocol is not exclusive to one category—lending-focused protocols, traditional staking, and LP-focused protocols can be included, depending on the specific requirements of their programs. For facilitation, they will be called “deposit & earn” programs.

Money Markets

Money Markets, which specialize in borrowing and lending activities, play a crucial role in providing liquidity to ensure smooth trading operations. These protocols typically reward users for their participation in lending, borrowing, and liquidity provision activities, with various schemes to enhance user engagement and capital flow. Users earn points based on the amount they lend or borrow. The most rewarded activity depends on protocol priorities. However, borrowing often offers higher rewards to stimulate liquidity demand.

Borrowing is often more rewarding than lending because it creates demand for liquidity, which is crucial for the functioning of money markets. By incentivizing borrowing, protocols can ensure a steady flow of capital and maintain higher levels of liquidity.

The duration that a user holds their position is also very important and counts, adding multipliers/boosts for long-term participation. This incentivizes users to maintain their positions for longer periods, contributing to the stability and liquidity of the market.

Money markets have diverse distribution types, reflecting their varied approaches to reward users. Most protocols employ linear distributions, providing consistent rewards based on user activities. However, some protocols (like Solend) employ different strategies, such as exponential distributions that reward users even at a later stage or linear distributions with variations to adapt to different user engagement strategies.

These reward mechanisms ensure continuous engagement and sustainability within money market protocols.

Deposit & Earn

These point programs are from protocols that focus solely on rewarding LPs and simple deposits. They require relatively less effort compared to other categories in the blue cluster and typically involve one of the highest amounts of capital to earn as many points as LRTs provide, for example. From the protocols we analyzed, there are no daily caps on points, allowing for unlimited accumulation of rewards based on the amount of liquidity provided.

These point programs focus on the capital that users can allocate to liquidity pools. The protocols proportionally reward users for the amount of liquidity they provide, ensuring that larger stakes receive higher rewards. Here are some examples of protocols with point programs focused on LPing and their current initiatives:

Common Characteristics and Analysis

While both the Blue and Yellow clusters require similar effort, the Yellow cluster stands out because its programs are easier to farm. This is because most Yellow cluster protocols do not reward users with reusable assets for their deposits, unlike those in the Blue cluster.

Consequently, users won’t be able to perform additional activities permitted by LSTs and LRTs, such as using them in other protocols to earn higher amounts of points.

Capital requirements are also higher, as the same amount of capital cannot be reused to earn more points.

Purple Cluster

For the most part, bridges are included in the purple cluster, where the effort of performing recurring activities is often more significant than the capital itself. Owlto, for example, adds a 1.5x multiplier for users with 100+ transactions, meaning that a user who completes 200 transactions totaling 1 million in volume will receive more points than a user with 10 transactions of the same volume.

The way rewards are distributed by these bridges can vary significantly. Common reward metrics include the number of transactions made, fees paid, and transaction volume.

Bridges generally have less risk of capital fluctuation compared to DEXs. This makes them appealing to conservative users who want to join points programs without dealing with trading volatility. As a result, more people can participate in bridge points programs.

Users can leverage the advantage of bridging low-cost chains to bridge back and forth their assets with nearly zero gas fees. Therefore, the primary costs involved are the platform fees, which may not be as daunting as one might assume if the user looks for low-fee bridges. Examples of programs from bridges include:

Bridges are simple to farm as the tasks are easy. However, this simplicity leads to increased competition due to the increased use of bots and the low Sybil resistance available to counter these methods. Users should choose the best bridge to farm based on variables such as whether the bridge rewards points per transaction, which benefits users with lower capital, or based on fees and volume, which is more advantageous for users with higher capital.

Owlto and Orbiter are good options for lower capital users, while Xlink and Debridge are better suited for those with higher capital.

Each bridge implements its point program uniquely to attract and retain users, yet the programs focus on linear distributions, rewarding both early and late participants equally based solely on their activities.

By leveraging these strategies, bridge providers aim to build loyal user bases, increase engagement, and create vibrant ecosystems around their platforms.

Green Cluster

There's a notable scarcity of protocols that require neither capital nor effort from users.

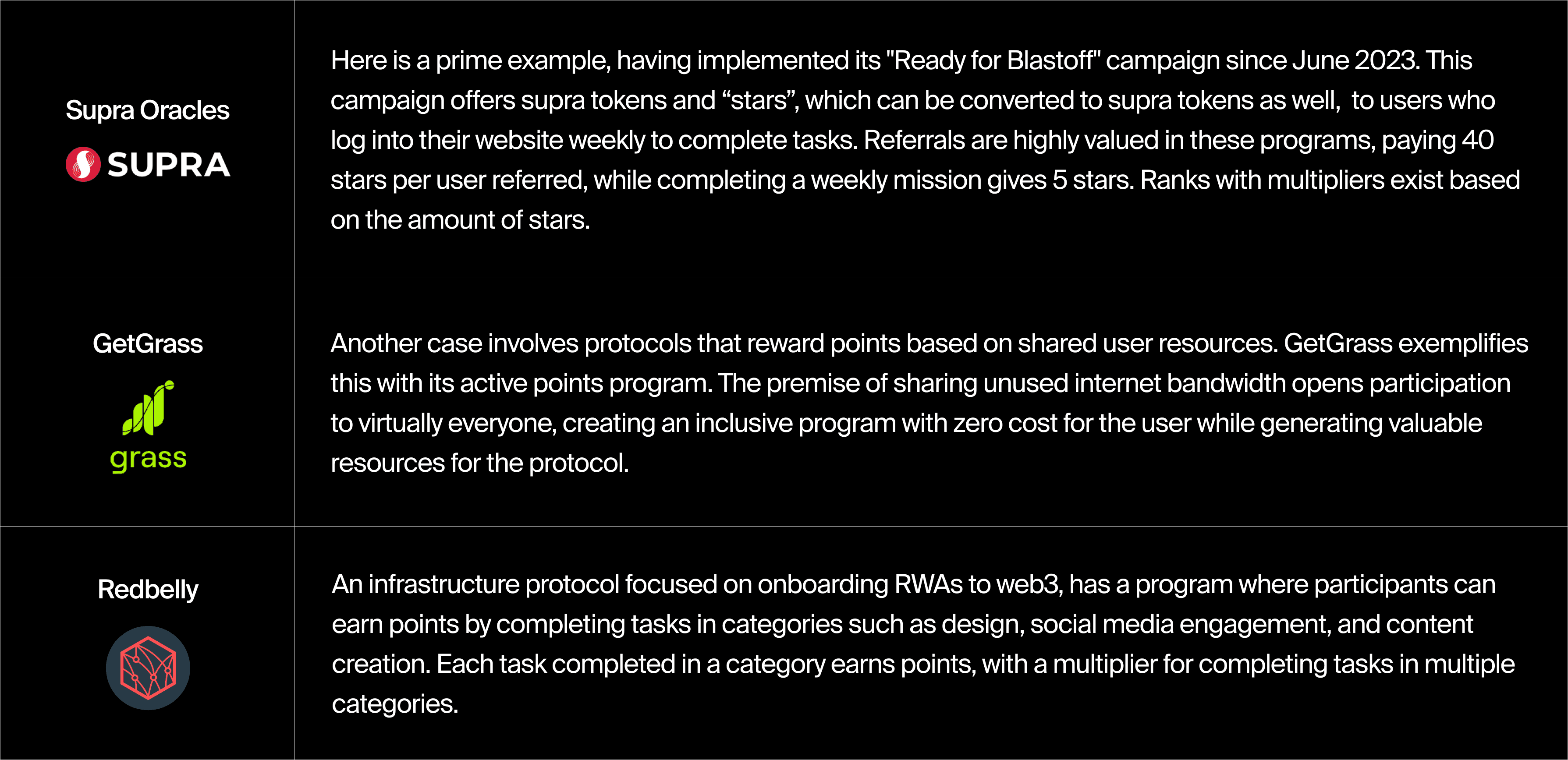

For a protocol to reward points without requiring significant capital or effort from users, the program needs to focus either on social activities or tasks, which can be seen as an "old school" way to farm airdrops. Or on utilizing resources that users can share, such as internet bandwidth and computing power.

Protocols that fit this category will often do these programs during their initial phases when there are no ready developments for user activities. They use recurrent tasks and social activities to maintain high engagement throughout the development phase.

The green cluster focuses on a linear distribution of points, sometimes with decay functions to help users that have been performing activities for the longest time and have been more loyal.

These strategies have proven to be very effective and have been widely used in the past to keep user engagement high while developments continue in the background. By leveraging social activities and user-shared resources, protocols can maintain momentum and interest even before fully launching their primary features.

For users and farmers, these examples show that it is not always necessary to invest capital to participate in airdrop farming activities. The main effort here is the time spent doing tasks.

Points programs can attract users or incentivize mercenaries. Our DeFi Ecosystem Strategic RD service helps you balance fairness, sybil resistance, and sustainable growth in any incentive design.

Conclusion

In this article, we have provided a broad overview of the point programs market, including many of the major categories of protocols that are helping to evolve the economic incentive landscape of blockchains. For this report, we examined over 70 different protocols.

It is safe to say that point programs have evolved into more transparent and seasonal mechanisms, attempting to correct past mistakes such as the lack of clarity regarding rewards, the encouragement of wash trading behaviors, and the high entry barriers for users.

The charts above reveal a significant imbalance in protocol distribution. The majority of protocols are concentrated in areas that reward higher capital and effort, likely due to the incentive structure prioritizing increased liquidity and overall platform activity

Liquidity is crucial across many different protocols. Providing liquidity is often more rewarding as it directly contributes to a healthier ecosystem. By ensuring sufficient liquidity, LPing facilitates smoother trading, lower transaction costs, and attracts more users. While trading generates fees and volume for the protocol, it primarily benefits the platform rather than the overall ecosystem stability.

Referrals are also a strong feature among most protocols, offering rewards that are valuable to consider. People with strong social engagement can benefit from this and avoid some of the effort and capital typically needed to be part of these programs. It is also notable that protocols, depending on various factors, will decide whether they want their protocol to have a gamified experience or not.

While users have mixed opinions on point programs and whether they are the best way to conduct airdrops, the adoption of point programs by protocols is still in full force. Many of the protocols mentioned above started their programs in Q2 2024, with approximately 40% of the programs either starting or having a new season begin during this period.

From a user standpoint, selecting the right protocol to farm is extremely important. Key factors to consider include how early you are to the program, your available capital, and the amount of time you can dedicate to participating.

From a protocol standpoint, implementing a point program should be carefully planned to retain and strengthen the user base of the project. This can be achieved by studying variables such as creating multi-season systems, implementing caps for a more equitable distribution of points, and rewarding loyal users with boosts and multipliers.

This research was intended to guide users in understanding the various types of loyalty programs that different protocols have been implementing, while also providing protocols with technical data on the current landscape of crypto point programs. It aims to facilitate your journey in finding strategic places to spend effort and capital for the best possible outcome.

References

Docs of mentioned protocols: Ambient Finance, Aspida, Avantis, Avnu, BackPack Wallet, Bedrock, Bitget Wallet, Blast, Blur, ClayStack, Debridge, District One, Drift, Dunes, EigenLayer, Eigenpie, Elixir Network, Ekubo, Etherfi, Ethena, Euclid, Fantasy Top, Friend Tech, GetGrass, Glacier Network, Hyperliquid, InceptionLRT, Init, Insrt, IntentX, Jito, Juice Finance, Jumper Exchange, Kamino, Karak, KelpDAO, KiloEX, Kinza Finance, Linea, Mantle, MarginFi, Mikyway, Mitosis, Mode, Orbiter Finance, Owlto, Parcl, Perpy Finance, Prime Staked ETH, Puffer Finance, Rabby Wallet, Rainbow Wallet, RedBelly, Renzo, Ruby, Scroll, Shuffle, Solend, StakeStone, Stacking Dao, Supra Oracles, Swell, SynFutures, Tensor, Thruster, Velar, Vitruveo, Wasabi, XLink, Yieldnest, Zaros, Zeta, Zest Protocol, ZKBridge

Economic Security Lead

Pablo holds a Master's in management, having focused in finance, and with a thesis on DeFi, demonstrating his knowledge and expertise in this field. He has extensive experience in research and analysis of DeFi protocols, having worked as an analyst at Siemens and a DeFi researcher at Deep Tech Ventures. His background in finance, research and analysis skills are a valuable addition to our team.