This article offers a glimpse into our ongoing research on the crypto points program landscape. We examine several protocols on the Solana network, comparing their features to identify successful strategies and areas for improvement.

“Points provide a quantitative answer to the question of how much a user has contributed to the project”, although this statement has almost taken on a meme like status, its essence remains true for a crypto loyalty program. Contrasted with previous systems where users engaged with protocols in anticipation of future rewards through airdrops, points systems distinguish themselves by providing a more tangible notion. While the precise value of a point may not be clear-cut, users can monitor the evolution of their stake based on their interactions.

As Arthur Hayes argues in one of his latest posts, the primary challenge for new web3 projects lies in attracting users, requiring a focused effort in marketing and business development, especially if the project lacks substantial VC funding. Implementing a crypto points program can be an effective marketing strategy, especially as it allows flexibility in adjusting the points to token ratio and incentivizes desired user interactions without being tied to a fixed token emissions schedule.

This approach also appeals to retail users who are cautious of VC unlock schedules, providing them with earlier investment opportunities and potentially better prices. However, the success of a crypto loyalty program hinges on trust between users and the project's founders. While it offers advantages in user engagement and fundraising, the misuse of trust could undermine its effectiveness in the long run.

Let's explore the Solana ecosystem through the lens of five protocols yet to launch their tokens: Zeta, Marginfi, Kamino, Drift, and Parcl and what this means for each crypto points program. As diverse types of protocols, each aims to incentivize various user behaviors. The question arises: how exactly are they achieving this?

Crypto Loyalty Program Transparency

To start off, it's apparent that these protocols vary significantly in terms of the transparency surrounding their crypto points program and in particular their calculation methods.

Zeta has demonstrated a commitment to transparency by providing detailed documentation outlining how each action contributes to a user's Z-score. Their Season 1 program, initiated around the time of Solana Breakpoint 2023 and concluding on December 31st, 2023, focused solely on rewarding takers. However, Season 2, which started on January 10th of this year, introduces Z-score rewards for makers—users placing limit orders—based on feedback received during Season 1. The team noted that users felt pressured to utilize market orders, leading to slippage on Zeta markets in their quest to accumulate points. Moreover, due to the rapid growth of the protocol, liquidity constraints emerged, prompting the decision to incentivize resting maker liquidity. Notably, this transparent approach facilitated the integration of user feedback, driving program evolution.

However, the conversion of the Z-score into points remains unclear at this stage. What we do know is that 10% of the total token supply will be allocated to stakeholders demonstrating a long-term commitment to the protocol, with a notable portion reserved for traders active on the Zeta platform. Individual trader allocations will be determined by two key factors: their Z-score and their demonstrated long-term alignment with the protocol. The impact of the Z-score on token distribution could follow a straightforward approach, directly correlating with Z-score values, or it might employ a tiered system based on specific Z-score thresholds, or potentially a blend of both methodologies. While this aspect introduces some ambiguity into the points system, the team's emphasis on extensive communication and transparency suggests a concerted effort to manage expectations effectively.

Marginfi also provides clear guidelines on how to earn points. However, details such as the program's duration, the conversion of points into tokens, and the proportion of tokens allocated for airdrops to points holders remain undisclosed, which can affect perceived fairness in a crypto loyalty program. The team at Marginfi defends this approach, asserting that providing precise criteria for an airdrop and announcing a snapshot in advance would be detrimental. They argue that such transparency could attract opportunistic capital, potentially diluting the efforts of early supporters who contributed genuinely to the project. Marginfi openly acknowledges that certain aspects of their points program are intentionally concealed to ensure that organic users are not disadvantaged.

Kamino provides a comprehensive explanation of how users can acquire points, with the added perk of being able to witness their points balance increase in real-time within the dApp, enhancing the user experience. These Kamino Points will coincide with multiple rounds of KMNO token drops. The initial Genesis Drop is tentatively scheduled for late Q1 or early Q2 of 2024, although the protocol does not explicitly guarantee this timeline; it aligns with the team's objectives. Upon the Kamino Genesis event, a total of 50,000,000 KMNO tokens will be distributed to OGs (pre-points) on a tiered basis. This OG Allocation constitutes 0.5% of the total supply, contributing to a total Genesis Community Allocation of 7.5%.

Parcl's points program operates in seasonal cycles, with the first season kicking off on December 15, 2023. This program incentivizes both traders and liquidity providers, with slight adjustments to the rates observed between Season 1 and Season 2, which started on January 26th. Season 3 started on March 2nd and this should be the final season before a TGE. However, on March 19th, Parcl introduced a novel addition to the points program: Perpetual Points. This perpetual incentive system is designed to sustainably engage and align liquidity providers, traders, and core community members. Perpetual Points will come into effect following the conclusion of Season 3, featuring periodic distributions of network incentives.

Drift recently initiated its points program, with the inaugural batch distributed on February 2nd, reflecting activity from January 22nd to 31st. This program entails weekly point distributions based on users' interactions with the protocol during the preceding week. However, there is a lack of clarity regarding the methodology used for calculating points. The first week saw the distribution of 2 million points, proportionally divided among users. Future distributions will prioritize trading activities while also rewarding other forms of engagement. Drift has indicated that the precise points calculation methodology will remain undisclosed until the program's conclusion to deter gaming the system and ensure fairness. The program is slated to run for a maximum duration of three months, a duration choice that can materially influence a crypto points program distribution curve.

Actions rewarded

The actions incentivized by a crypto points program differ across protocols. Take Zeta, for example, which not only rewards trading volume but also considers PnL. While the Z-score derived from trading volume follows a direct proportion, PnL is rewarded proportionally, with a multiplier contingent on the trader's daily rank. Although not yet operational, the documentation suggests that ongoing activity will also be recognized, with daily, weekly streaks, or other time-specific engagements factored into the equation.

Within Marginfi, users can accumulate points by borrowing, lending, or referring new users, mechanics typical of a crypto points program designed to deepen retention. Point accrual is calculated on a daily basis, meaning that increased lending activity results in higher point earnings. Furthermore, the duration of lending correlates with greater point accumulation. To underscore borrowing's significance as a pivotal driver of success for a lending protocol, Marginfi allocates four times as many points for borrowing compared to lending activities.

Kamino's crypto points program implements varying rates and boosts for different types of assets and strategies, which can be validated with a tokenomics audit to ensure incentives align with protocol health, including collateral assets, debt assets, combinations of collateral and debt, liquidity vaults, and automated strategies like Long/Short & Leveraged Staking (Multiply). While activities such as lending, borrowing, or providing liquidity in the vault typically earn users one point per dollar per day, certain actions, such as lending specific sets of assets, receive a boost. Additionally, all positions held from Kamino's launch in August 2022 until the Kamino Lend beta launch on October 20th, 2023, have been rewarded with double points per day for their deposits over that period, as a gesture of appreciation to early users (prior to the implementation of the points system).

Season 1 traders in Parcl earned one point per day for every dollar of open interest, while liquidity providers earned 3 per dollar deposited into the pool. Season 2 changed the points rates to 4 Points per dollar of LP per day and 2 points per dollar of open interest. Season 2 also introduced a consistency snapshot to initiate a points boost for the most loyal Parcl traders, LPs, and eligible HOA holders (highest boost!). Season 3 promised more appreciation for consistent and loyal behavior. Parcl increase the total of points with 5 points per dollar of LP per day and 2.5 points per dollar of open interest. Additionally, 50,000 Points for each successful liquidation facilitated for technically skilled users and new Points boost structure with new boost tiers.

In Parcl's Season 1, traders earned one point per day for every dollar of open interest, while liquidity providers received three points per dollar deposited into the pool. In Season 2, the points rates were adjusted to four points per dollar of LP per day and two points per dollar of open interest. Furthermore, Season 2 introduced a consistency snapshot, initiating a points boost for the most dedicated Parcl traders, LPs, and eligible HOA holders. Season 3 promised increased recognition for consistent and loyal behavior. Total points were increased to five points per dollar of LP per day and 2.5 points per dollar of open interest. Additionally, users skilled in liquidation were awarded 50,000 points for each successful liquidation, along with a new points boost structure featuring new boost tiers.

Although there isn’t a lot of information on Drifts system, the first points drop rewarded traders, MMs and DLP stakers for their activity between Jan 22-31. Future points drops will reward other activity. Each week, trading on some selected markets earn boosted points. As an example, at the time of writing there is a 5x boost on SOL perp and spot trading and a 2x boost for W perp trading.

Partnerships

An interesting aspect of these programs lies in the collaborations between protocols, particularly with NFT collections, a frequent pattern in crypto loyalty program design.

In Zeta, engaging in a NFT partner week or a bonus week on a specific asset can result in a substantial boost of up to 6x your Z-Score. Holders of these NFT collections enjoy special benefits throughout the season, enhancing their Z-Score earning potential. They receive Z-Pass cNFTs through airdrops, which, when burned, provide a 2x boost to their Z-Score for the following 7 days. Furthermore, each community within these collections hosts its own "Community Week," granting holders a 2x boost on Z-Score generated during that period. Zeta Cards utilize compression on Solana to introduce an innovative incentive program, unique to the Solana ecosystem, a notable differentiator for a crypto points program. The Z-Pass Season 2 collection features a 10K collection comprising 5 different Zeta Explorer types, each offering various rarity levels and boost benefits when utilized on Zeta during Season 2 of Z-Score.In Season 2, Zeta has also partnered with Pyth and Backpack wallet. Users staking more than 1000 $PYTH receive a 10% boost to their Z-Score, while the same boost is extended to users utilizing Backpack to connect to Zeta.

Marginfi recently introduced partnerships as a means to earn or boost points, notably with the recent addition of a 5% points boost for Bagpack wallet users.

Kamino's documentation hints at the capability to provide boosts for activities beyond its platform, such as actions taken on other Solana protocols or assets held in your wallet, although specific details are yet to be disclosed.

Users who utilize a wallet on the Parcl Platform containing at least one HOA NFT will receive bonus points. Holding one NFT grants a 20% points boost, while each additional NFT adds an extra 5% boost.

Socials and referrals

Social engagement, including activities such as interacting on social media and making referrals, is often a standard inclusion in a crypto loyalty program.

Recently, Zeta rolled out a referrals program during the second season of their points initiative. Users can now distribute their unique affiliate link to earn 10% of their referees' trading fees and 10% of their Z-score. Referred users are also incentivized to utilize an affiliate link, as it grants them a permanent 10% boost on their own Z-score.

In Marginfi, a referring user receives 10% of the points earned by the users they refer. Moreover, referring users also earn 10% of the 10% earned by any user they refer who subsequently refers other users. This cascades down the referral tree as more users continue to refer others.

Kamino has mentioned that referrals will be available soon.

Parcl recently introduced its referral program to complement the points system. By inviting others, you can earn 10% of the points accumulated by each referred user. Furthermore, users who are referred receive a permanent 5% boost to their points.

While Drift has maintained a referral program for a long time, it appears to operate independently from their crypto points program. Referrers earn 15% of the fees generated by users they refer to Drift, and the referred user receives a 5% discount on their fees.

Measures against Washtrading and Sybil attacks

Although all protocols acknowledge the significance of addressing wash trading and sybil attacks, there is a lack of clarity regarding the specific measures that will be implemented to mitigate these issues, an area where an ecosystem risk assessment is valuable.

Kamino specifies certain limitations on farming, including restrictions on points earned by positions exclusively composed of LSTs on both the collateral and debt sides, as well as positions consisting solely of stablecoins on both sides, standard guardrails for a crypto loyalty program.

Parcl explicitly addresses self-referrals, emphasizing that they are prohibited, and points earned from such activities are subject to potentially being revoked. Additionally, Parcl provides a process on Discord for users who wish to voluntarily disclose self-referrals, thereby minimizing the risk of penalties.

Crypto Points Program Effects

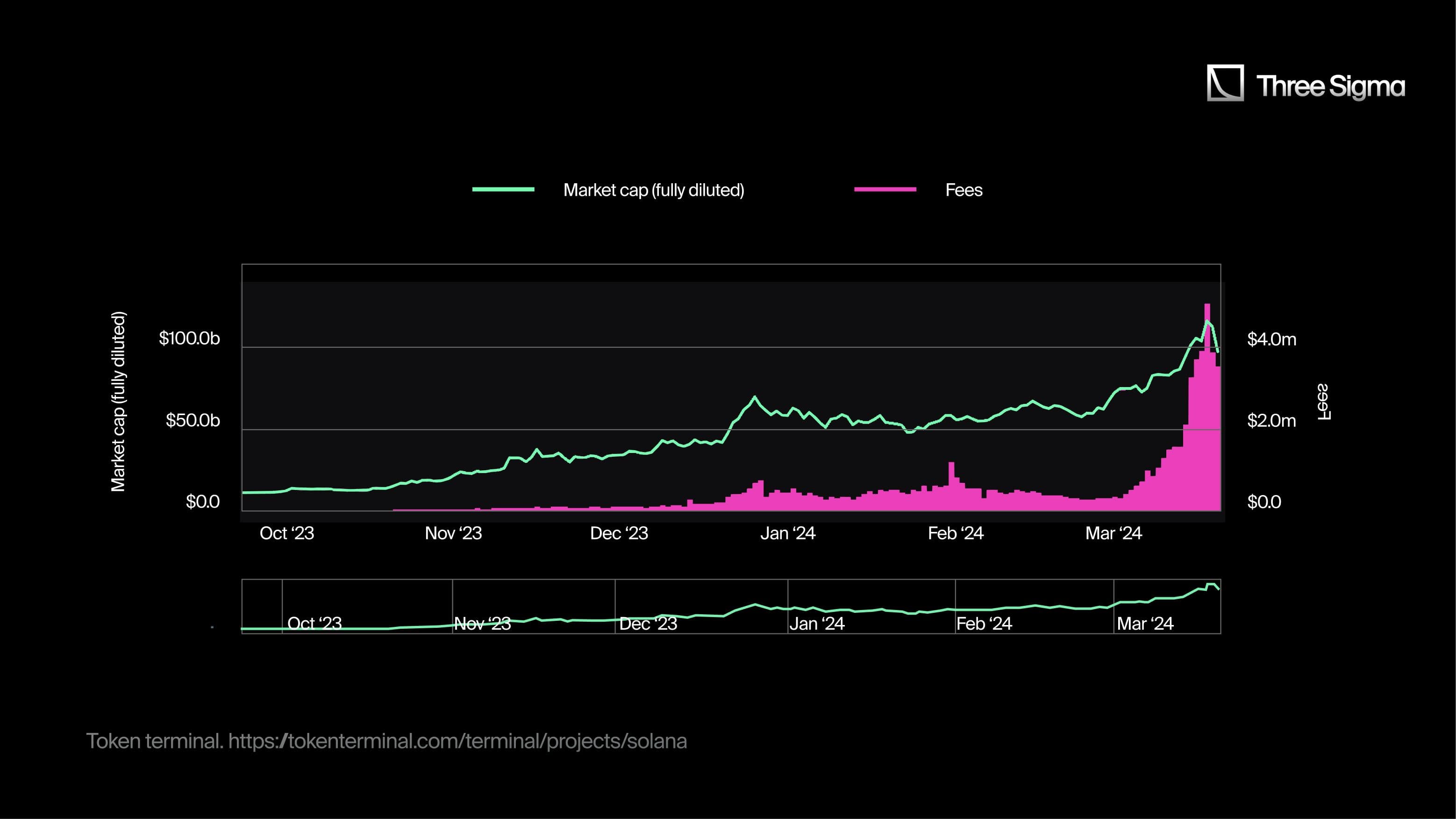

In assessing the impact of a crypto points program on protocol metrics, it's essential to contextualize within the broader market to filter out external trends. The market has been on an upward trend for several months, attracting increased user participation, trading volume, and TVL. Notably, the Solana ecosystem has experienced significant growth during this period.

Token terminal. https://tokenterminal.com/terminal/projects/solana

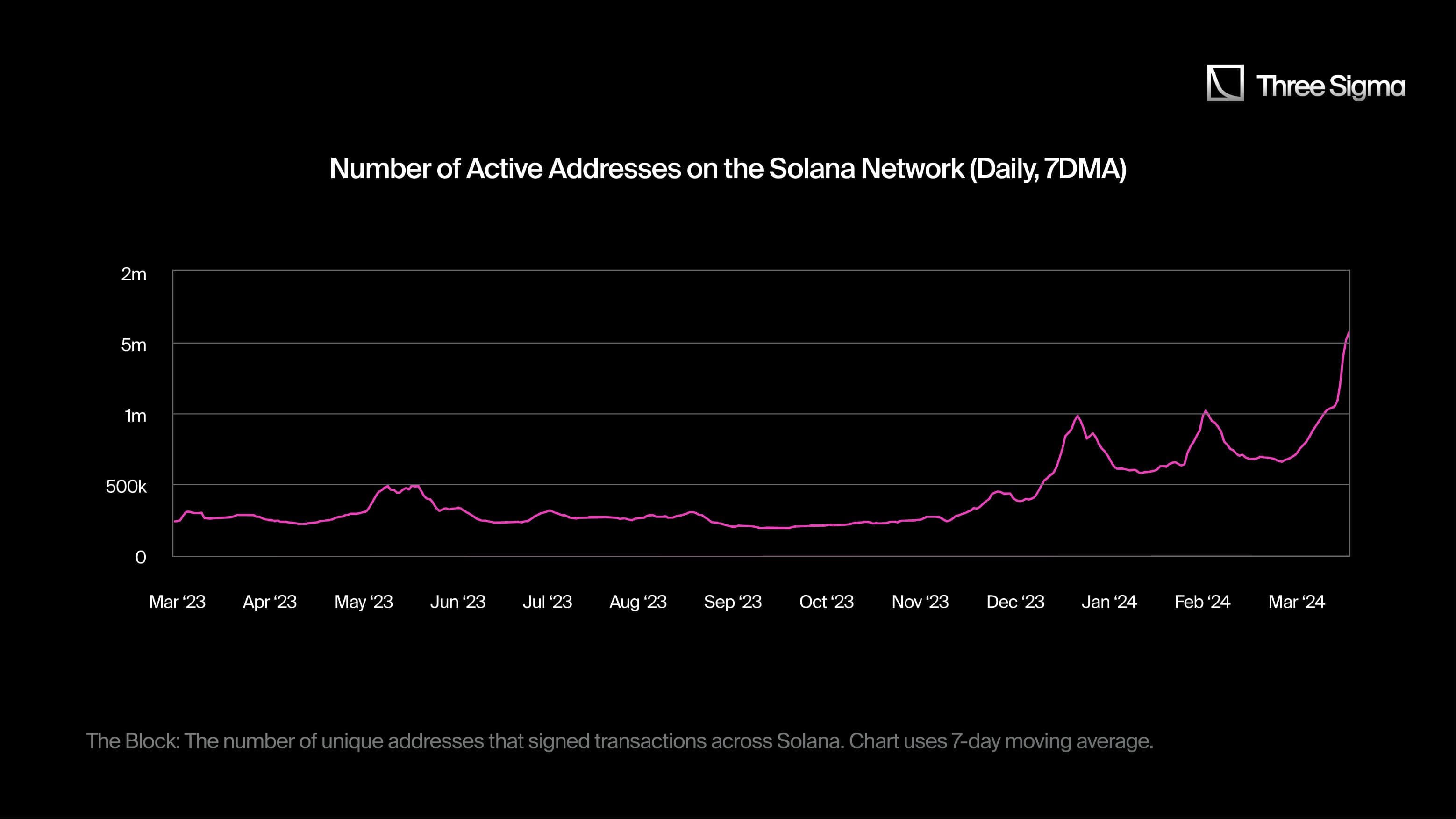

The Jito airdrop also contributed to a surge in Solana's metrics, highlighting the profitability of pursuing airdrops. Announced on November 25th, 2023, the airdrop claim window opened on December 7th, 2023. Users with a minimum of 100 points received a distribution of 80 million JTO tokens. Following Jito's TGE, the number of active addresses on Solana more than doubled in the subsequent two weeks, rising from approximately 413k on December 7th to around 981k on December 21st.

The Block: The number of unique addresses that signed transactions across Solana. Chart uses 7-day moving average.

In the broader context, all five protocols benefited from increased attention, leading to a substantial rise in TVL, strengthening the case for rigorous points and incentives program design and independent economic audit validation. However, what differences can we see?

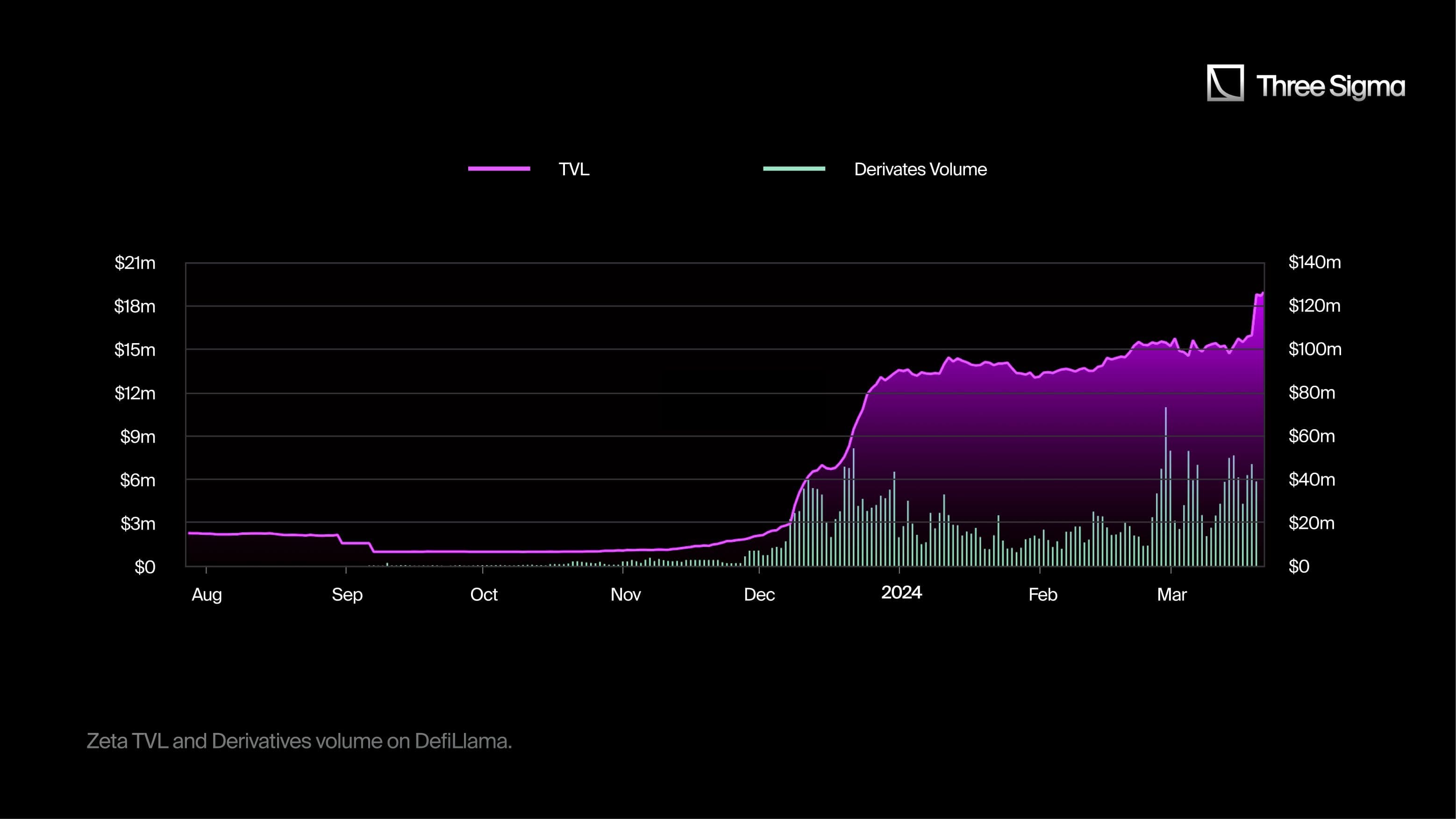

Zeta's TVL initially experienced gradual growth, starting at nearly $1 million in October and early November, reaching $2.8 million by December 7th. Subsequently, there was a sharp surge, doubling the TVL in under a week to $6.5 million by December 13th. This was followed by another rapid increase, with the TVL soaring by 100% to $13.3 million by December 31st. Throughout the early months of the following year, the TVL remained relatively stable, ranging between $13 million and $14 million. Correspondingly, trading volume surged during periods of accelerated TVL growth, a common response to aggressive crypto points program boosts. The surge after December 7th is likely attributed to the market debut of JTO. At that point, Zeta had already initiated Season 1 of its points program, positioning itself to attract users seeking similar opportunities within the Solana ecosystem. Overall, there was approximately a 417% increase in TVL, rising from around $3 million to approximately $15.5 million during this rally. Interestingly, on March 20th, there was a noticeable TVL surge, likely triggered by the introduction of the referral system on that day.

Zeta TVL and Derivatives volume on DefiLlama.

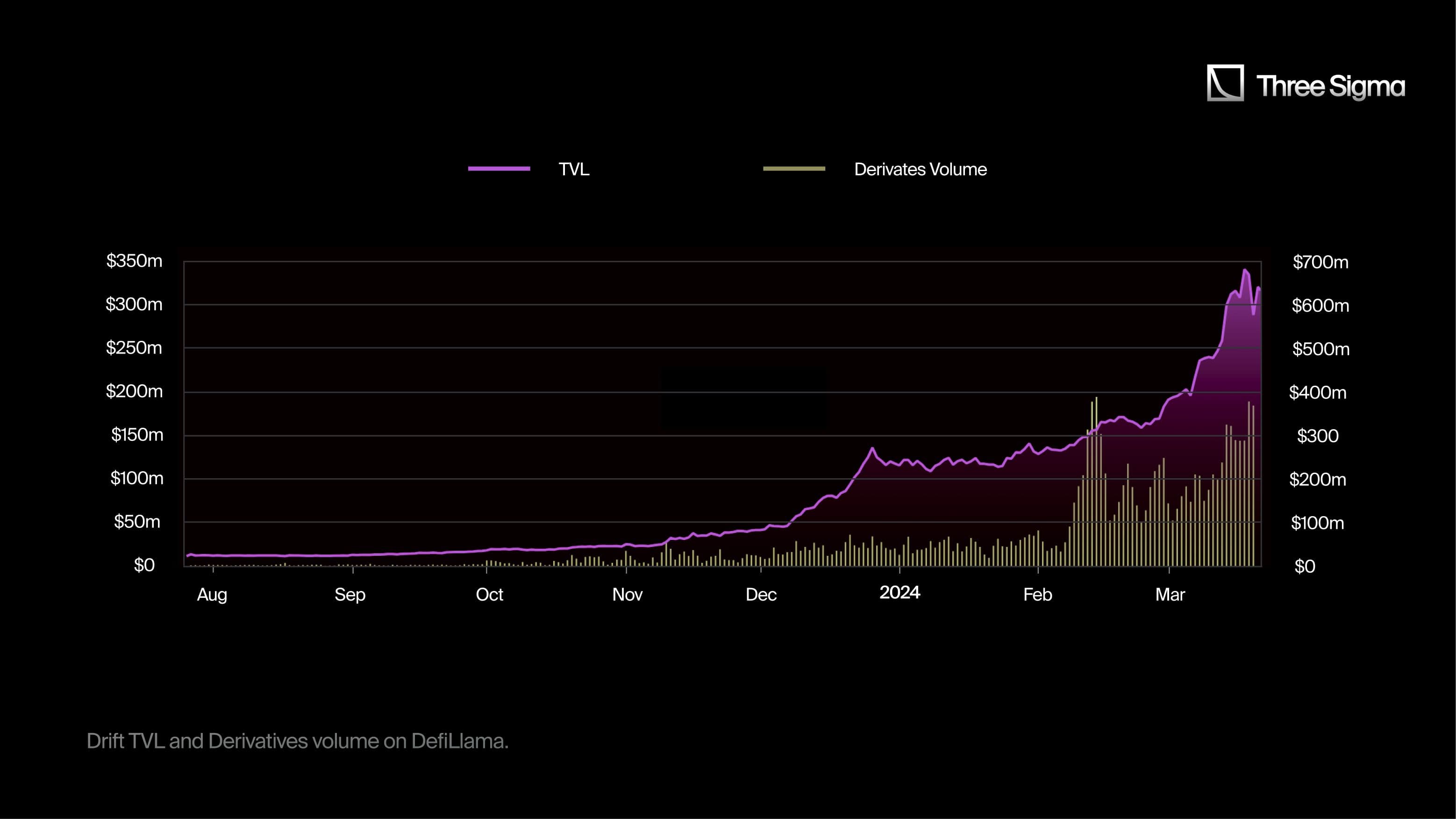

Drift's trajectory follows a similar pattern, albeit with a more gradual TVL chart, reinforcing how design choices in a crypto loyalty program shape participation. On December 26th, Drift's TVL reached a local peak of $135.8 million, soaring from around $22 million before November—an impressive 517% surge. Interestingly, despite the rapid growth in TVL, the release of Jito's airdrop did not appear to have a significant impact. It's noteworthy that Drift's points program only started at the end of January, suggesting that the pre-existing surge was driven by a combination of organic protocol expansion, heightened market activity, particularly within Solana, and anticipation of eventual retroactive points. The onset of February sparked renewed interest, evidenced by the surge in trading volume on the platform. Derivatives volume on Drift surged from $132 million on February 2nd to $388 million on February 14th, more than tripling within a span of two weeks. Subsequently, both TVL and trading volume continued to climb steadily. Despite Drift's lack of clear guidelines on how user activity contributes to their points accumulation, users now witness their allocations increase weekly, with the program set to conclude no later than April.

Drift TVL and Derivatives volume on DefiLlama.

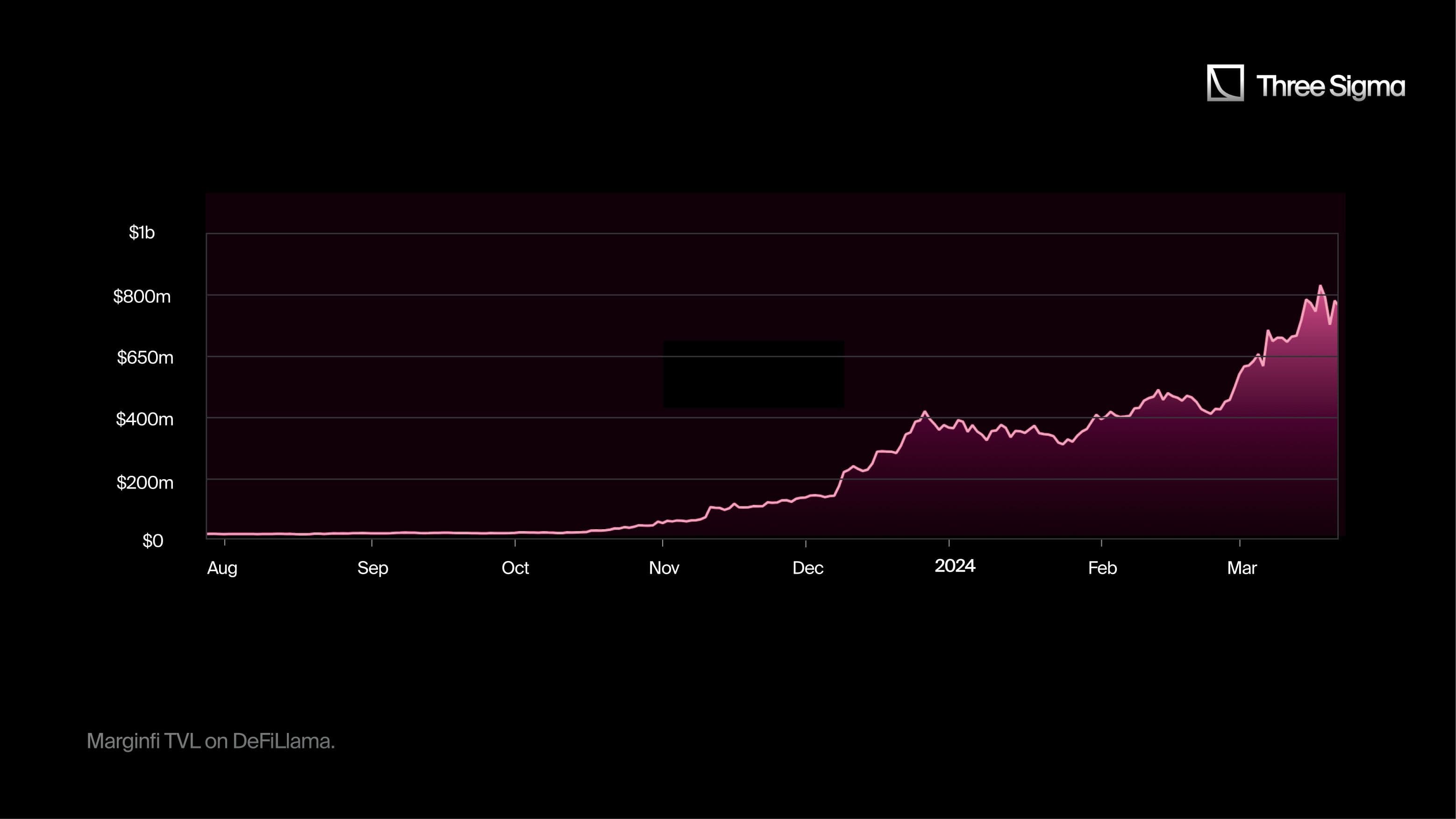

Marginfi experienced a TVL growth pattern similar to Drift, albeit less pronounced. User deposits into the platform began before November, leading to a doubling of TVL from around $25 million at the start of October to approximately $55 million by November 1st. Like Drift, December 26th marked a local TVL peak for Marginfi, reaching $430.7 million—an impressive 683% increase since November. In this context, while we aim to isolate the effect of the points program, it's crucial to acknowledge Marginfi's adeptness at capitalizing on attention. The platform swiftly opened deposits for new tokens, such as JTO, listed on the day of its launch. Following a hiatus in its TVL rally in January, deposits began to accumulate again from January 26th onward. Notably, Marginfi initiated its points program much earlier, in July 2023. This serves as compelling evidence that points alone do not attract attention; rather, a thriving ecosystem, market attention, and product-market fit are the true catalysts behind its success.

Marginfi TVL on DeFiLlama.

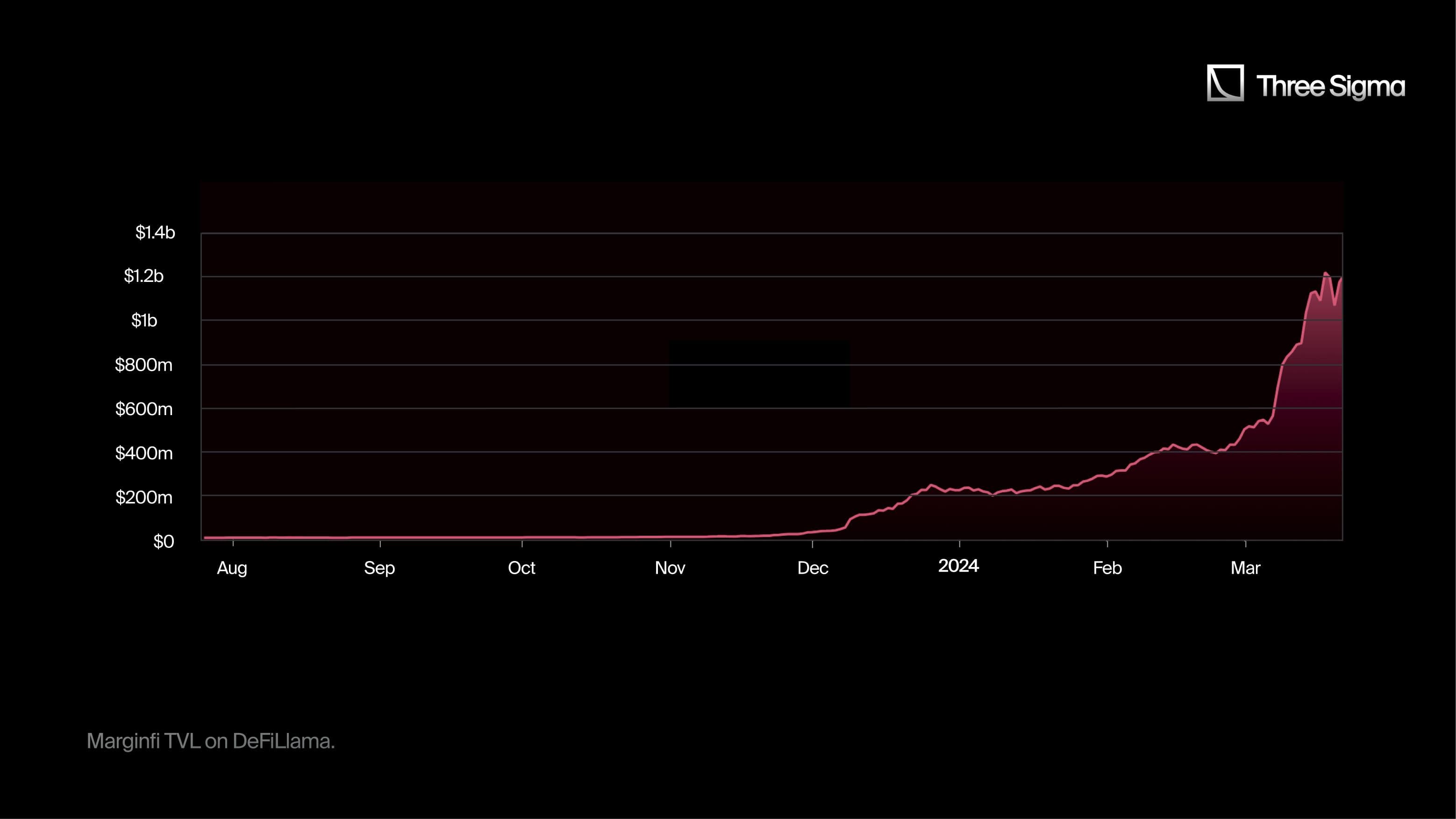

Kamino also had a similar TVL increase, albeit starting later. In the beginning of November there was only around $12m in the platform and this amount increased steadily to $48m by December 7th, the day of the JTO airdrop. This event seems accelerated the deposit rate, so that TVL reached a local top of $248m also on December 26th. From November 1st this represented an increase of around 1967%. After a somewhat stable month, TVL started increasing again at the end of January, likely also motivated by the announcement of points, now counting with around $430m in the platform. In fact, Kamino only announced their points program on January 19th and even though the platform has had remarkable growth since then, it seems to still have had a positive impact with an increase of 73% since the local top on December 26th. Although the continued increase in popularity during February was impressive, March proved to be even more. In particular, on March 6th Drift had around $527m TVL and this value jumped to $692m on March 8th, a 31% increase in TVL in just 2 days. This was probably due to the announcement on X, stating that the snapshot for Season 1 will be taken on 31st of January. This wasn’t really news, because as described above, Kamino had always stated the first season would last 3 months and culminate on the airdrop. However, it clearly served as a reminder to those who didn’t try the platform yet. During the following days this sparked some attention and discussions on X as well as prompted some more announcements on airdrop and points mechanics by the team, further fuelling newcomers’ attention. This ultimately resulted in an impressive $1.2b TVL by March 18th.

Kamino TVL on DeFiLlama.

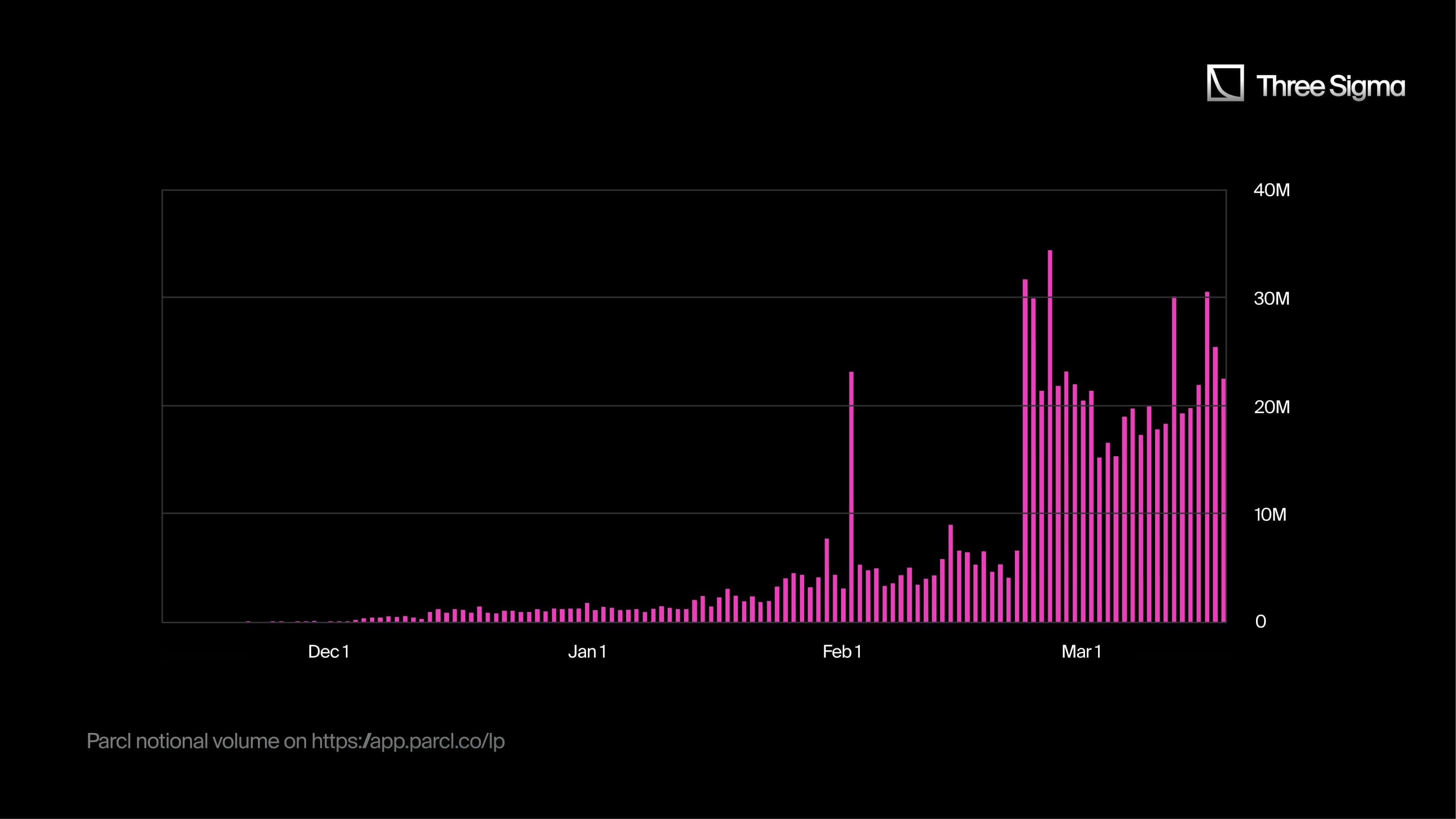

Parcl stands out as a unique project, offering real estate price trading to its users. There seems to be an error in DefiLlama's TVL depiction, with some weeks not being properly accounted for. Despite this, when considering Parcl's notional volume below, it becomes evident how the project has benefited from similar growth dynamics observed in the other protocols mentioned here. While users were already earning points for their activity, the comprehensive display of points was announced to go live on December 15th. Since then, the volume has steadily increased, with noticeable spikes in activity. Particularly striking is the surge from $6.6 million on February 25th to $31.5 million the following day, coinciding with Aevo's announcement of PARCL pre-launch futures.

Parcl notional volume on https://app.parcl.co/lp

Points, boosts, and multipliers seem simple, but their long-term impact often isn’t. Our DeFi Ecosystem Strategic RD service helps you analyze behavioral incentives, sybil resistance, and economic sustainability in every reward structure.

Key Takeaways

Many protocols are currently discussing partnerships with other projects, and while referrals are expected to contribute points in the future, specific details are currently lacking. However, this trend is anticipated to have a net positive impact on the space, as users recognize the benefits of engaging with multiple projects within the ecosystem.

The majority of programs operate in seasonal cycles, leveraging each season as an opportunity for learning and adaptation. For example, Kamino outlines that each season will have varying durations, new mechanics, unique airdrop schedules, and different allocations. Zeta successfully adjusted its approach to accommodate increased liquidity needs. Flexibility is crucial for projects, given that points can unpredictably impact a protocol's metrics or lead to sudden growth surges.

An interesting observation is that the market situation appears to hold greater significance than the points program itself. Drift and Marginfi, for instance, exhibit nearly identical TVL charts despite launching their points programs at different times. Although Drift does not provide a description of how to earn points, while Marginfi does, this disparity seems to have little effect on TVL. Nonetheless, the active presence of a points program, along with marketing efforts such as weekly drops, carries significant weight, as evidenced by Drift's increased volume following its initial announcement.

Even for projects with less apparent product-market fit like Parcl, the anticipation of a token significantly boosts metrics and fosters adoption. The positive impact of referrals is noteworthy, as seen with Zeta's TVL boost upon introducing this mechanic.

As the end of points programs approaches, protocols become more vocal about their plans to further engage users. Parcl introduces Perpetual Points, while Kamino prepares for upcoming seasons, offering tailored strategies to maintain user engagement.

Overall, there seems to be a consensus among most projects to prioritize clarity and transparency, while also retaining flexibility. Effective marketing also plays a pivotal role in project success. However, attributing metric boosts solely to new mechanics in the points system can be challenging, as these boosts are often influenced by marketing efforts aimed at spreading awareness.

Economic Modeler

Carolina is a data analyst with a Master’s degree in analysis and engineering of big data and a background in mathematics applied to economics and management. She has experience working on optimization problems, leveraging statistics to produce simulations and extract valuable insights. She joined Three Sigma with a continued passion for finding knowledge in data and an interest in improving the blockchain industry by contributing to its sustainable development. Outside of work, Carolina enjoys traveling and immersing herself in foreign environments.