At Three Sigma, we recognize the intricate opportunities within the Web3 space. Based in Lisbon, our team of experts offers premier services in development, security, and economic modeling to drive your project's success. Whether you need precise code audits, advanced economic modeling, or comprehensive blockchain engineering, Three Sigma is your trusted partner. Explore our website to learn more.

We are not just experts in code, economic auditing, and blockchain engineering—we are passionate about breaking down Web3 concepts to drive clarity and adoption across the industry.

Introduction

This article provides an overview of the rapidly growing sub sector of cryptocurrencies known as memecoins within the meme coin ecosystem.

These assets have captured significant attention due to their unique ability to create and propagate narratives that generate impressive results for their communities. Memecoins have become major attractors of retail investors into the cryptocurrency market.

This research article aimed to identify the reasons behind the growth of certain narratives and showcase the variables that make memecoins actively generate remarkable outcomes for their communities.

Important variables such as narratives, platforms/infrastructure, teams, and bots were analyzed to provide a general overview of the key areas surrounding the success of a memecoin.

The following 55 memecoins were included:

- Andy, Apu Apustaja, Baby Doge Coin, Basenji, Billy, Boomer, Boop, Book of Meme, BOBO, Boden, Bonk, Brett, Cat in a Dog’s World, Coq Inu, CorgiAI, Daddy, Degen, Dogelon Mars, DogWifHat, Dogecoin, Floki, Giga, Grok, HPOS10I, Kendu Inu, LandWolf, MAGA, Maneki, Memecoin, Michi, Miggles, Milady, MOG, Mother, MUMU, Myro, Neiro, Non-playable coin, PeiPei, Pepe, pepeCoin, Ponke, Popcat, Redo, Retardio, Shiba Inu, Slerf, Snek, SPX6900, Tremp, Toshi, Turbo, WHY, Wojak.

Classification of Memecoins

Memecoins are a type of cryptocurrency often inspired by internet memes, characters, animals, or other cultural phenomena. These coins mainly focus on creating a narrative and community, often without intrinsic value and rarely providing real utility. However, exceptions exist, such as Shiba Inu, which launched its own blockchain, and Bonk Inu, which developed its own trading bot, BONKbot.

Most are supported by enthusiastic online traders and followers, also known as “degens,” and are generally intended to be light-hearted and fun. Memecoins are some of the riskiest assets in crypto, offering very high R/R (risk/reward) for users.

Having started in 2013, the meme coin ecosystem has continued to grow, becoming a significant branch of the crypto ecosystem in 2024. Memecoins were the highest-returning asset category of 2024, with the top 10 tokens by market cap, including those launched in 2024, delivering 1,834% in returns. Analyzing the top 10 coins that existed before 2024 reveals that users who bought them on January 1st still saw an average return of 823%, outperforming any other narrative in crypto.

Historical Context

It all started with Dogecoin. As a fork of Bitcoin created in 2013, this memecoin was a joke based on a Shiba Inu dog meme named Kabosu. Dogecoin remained mostly unknown and traded with low volume for years, until December 20, 2020, when Elon Musk—one of the most famous personalities in both the crypto world and beyond—tweeted in support of Dogecoin and announced that Tesla would accept $DOGE for purchases, causing its price to skyrocket. Underscoring its influence and growth potential, Dogecoin was the first to show how a strong narrative is a key point for a token to have success.

Between 2020 and 2021, memecoins began growing quickly in the cryptocurrency scene. Leading coins like DOGE and SHIB not only established themselves but also paved the way for newer, smaller coins, from derivatives like Baby DogeCoin to other “original” dog coins. Their increasing popularity showcased the charm of the meme market, fueled by speculation, volatility, and enthusiastic communities with the same objective.

Memes could evolve into community-driven movements, with supporters deeply invested in both the meme and the coin. As the first memecoin, $DOGE remains a key indicator of the crypto community’s interest, and despite not reaching its $1 target, its story popularized dogs among crypto as one of the main categories of memecoins, where other coins see Dogecoin as an example of how far a community and its coin can go. To this day, Doge is still one of the strongest narratives to build derivative memecoins around, with a recent example being the token Neiro.

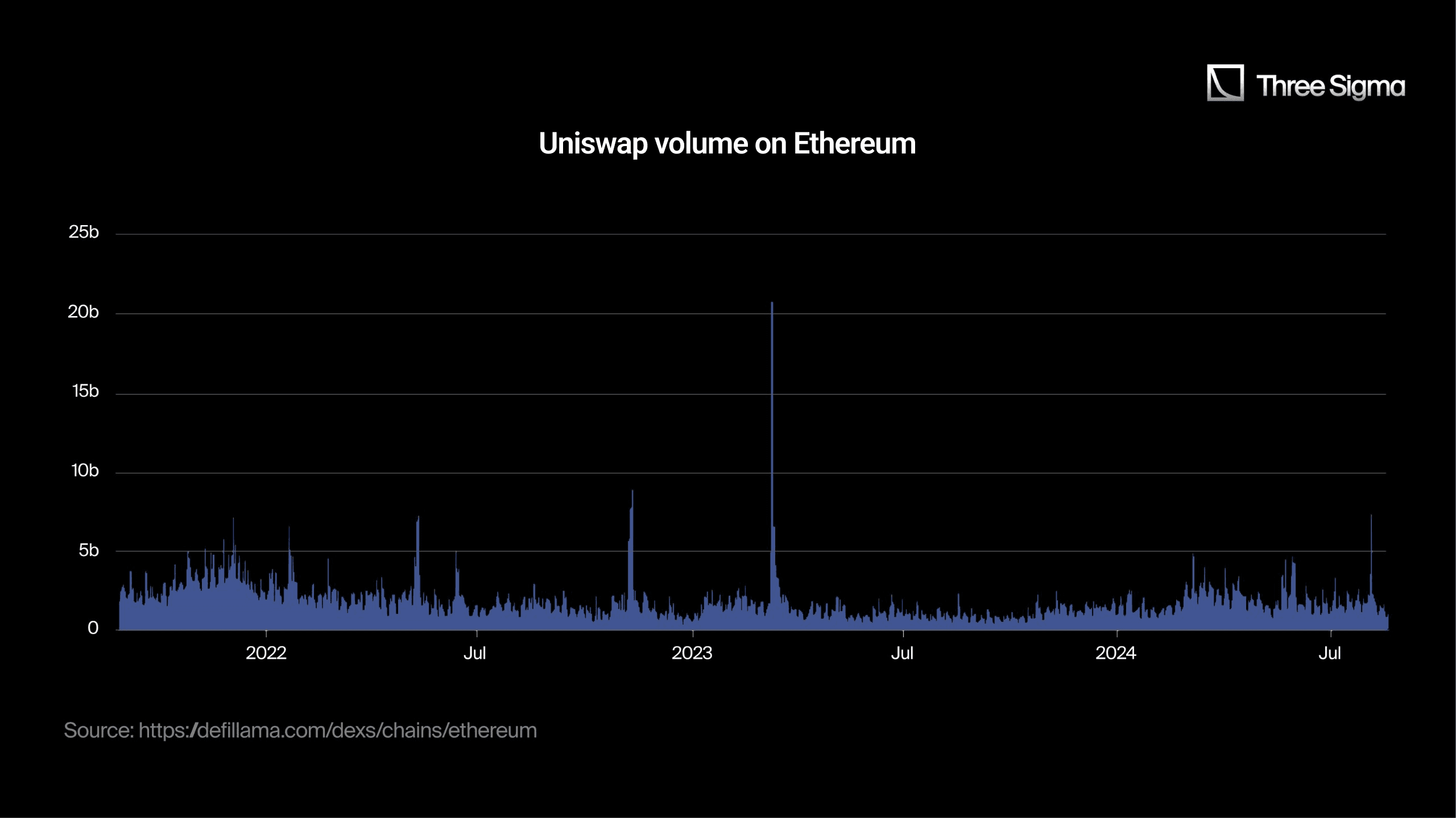

With the run-up of Dogecoin and Shiba Inu in 2020-2021, the Ethereum and Binance Smart Chain networks gained significant attention, setting the stage for their first memecoin season. This period peaked in November 2021, with the Ethereum chain reaching a volume of $20 billion and the Binance Smart Chain reaching $6.5 billion in trading volume.

These peak volumes were largely driven by the increased activity in memecoin trading.

The Degen Money Influx from the memecoin season also brought attention to other types of assets. By the beginning of 2022, the focus (mainly on ETH) shifted to their newer token standard, ERC-721 (known as NFTs), leading to another “bubble”.

Bear Market and the Surge of Ethereum Memes

After experiencing a significant NFT bull run, Ethereum was titled as the top chain for Degen activity, with hopes from the community that the NFT mania would make a comeback.

During the bear market, as liquidity became scarce and NFTs demanded high trading volume while remaining illiquid assets, their prices plummeted sharply, with the community envisioning a weak future—at least during that period.

Despite facing the peak of the crypto bear market, Ethereum still had the infrastructure and community needed for a new wave of degen tradeable assets to emerge.

During the beginning of 2023, ERC-20s began gaining significant attention again as they were a cheaper and more fragmented asset to trade for degens, as well as an easier asset to deploy for developers and creators.

During harsh market periods, memecoins required less capital from users and could be quickly traded back into ETH. Not only did ERC-20 tokens offer these advantages compared to ERC-721 tokens, but the low usage of the Ethereum chain during that time made transaction fees acceptable for most of the community, with average gas prices around 20 gwei in January 2023, compared to 120 gwei from the previous year. This gathered all of the attention to the Ethereum chain—a trend that would shift once the bull market returned.

During this time, particularly from March to May 2023, Ethereum experienced a surge in memecoin activity, marking the start of a memecoin season. Many of today's most popular memecoins were created during this period, with $PEPE leading the charge. Launched in April 2023, it quickly became one of the most prominent memecoins ever.

Bull Market and the Solana Takeover

As the market rallied, memecoins gained even more momentum and visibility. With the influx of users trading Ethereum memes, network fees rose up to $50 per swap - driving most retail traders away. There was a need for a chain that supported such a high number of transactions without compromising swap fees. Solana quickly emerged as the preferred choice, thanks to its growing ecosystem, community, and lower barriers for traders. A major driver of this adoption was PumpFun, which leveraged Raydium as its underlying DEX. PumpFun’s innovative approach, along with its derivatives, spurred rapid memecoin adoption on Solana. This momentum was further fueled by Solana's resurgence after its post-FTX slump, with the platform gaining renewed mindshare following the announcement of several major airdrops like Jupiter and Jito.

The graph below shows the quick takeover starting on November 2023.

Solana became home to most of the leading memecoins of this cycle, such as Dogwifhat, Bonk, and PopCat. In a short period of time, trading volume shifted to the chain, and the number of memecoins with a market cap above $1 million on Solana surpassed those on Ethereum.

With the growth of memecoins, the infrastructure that was once Ethereum dominated began migrating to Solana. Various trading bots for users emerged, and MEV strategies became increasingly prevalent in the meme coin ecosystem.

Where is the meme coin ecosystem headed in the future?

In the past four years, the development of more sophisticated L1 and L2 ecosystems has been notable, with some carving out unique spaces for the meme coin ecosystem.

Base is a prime example of what BNB represented in 2021. Backed by Coinbase, one of the largest companies in the crypto space, Base has become an easy option for onboarding new users, naturally attracting the attention of memecoin creators as well.

Additionally, TRON has been appearing in statistics, with renewed interest after Justin Sun began endorsing these assets on his chain.

While L2s like Base have been thriving, others like Arbitrum remain less relevant in the memecoin sector, despite efforts like Memecoin Funds to onboard more users. Designed primarily for DeFi, Arbitrum's focus has remained there, limiting its appeal to the memecoin community.

The memecoin sector continues to grow, leaving room for more innovation. The recent development of L1s like Berachain and Monad, particularly after the rise of Base, positions them as potential strong ecosystems for memecoins.

Although these upcoming chains haven’t launched yet, community engagement is already growing, suggesting they could develop strong memecoin ecosystems.

Methodology

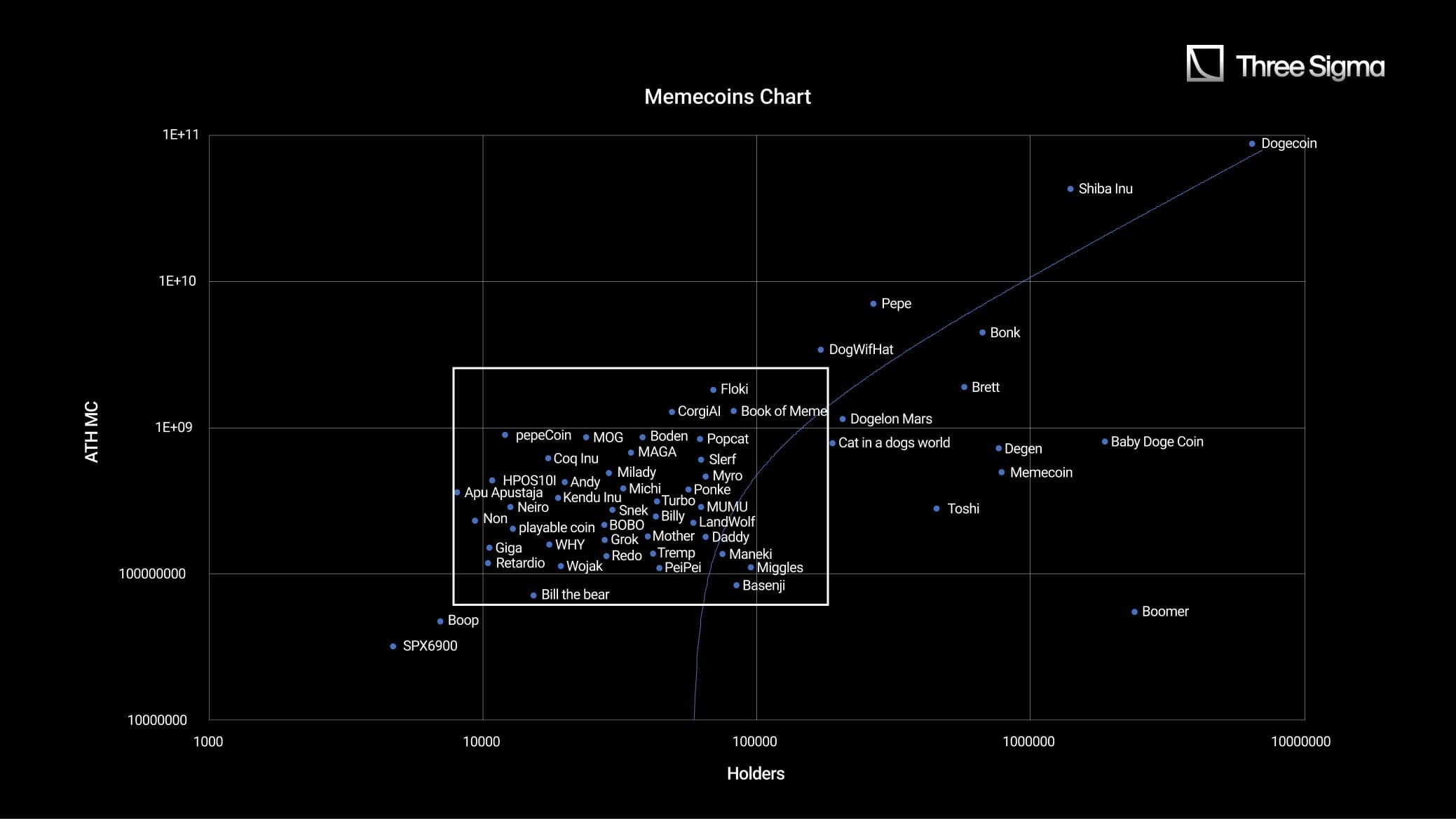

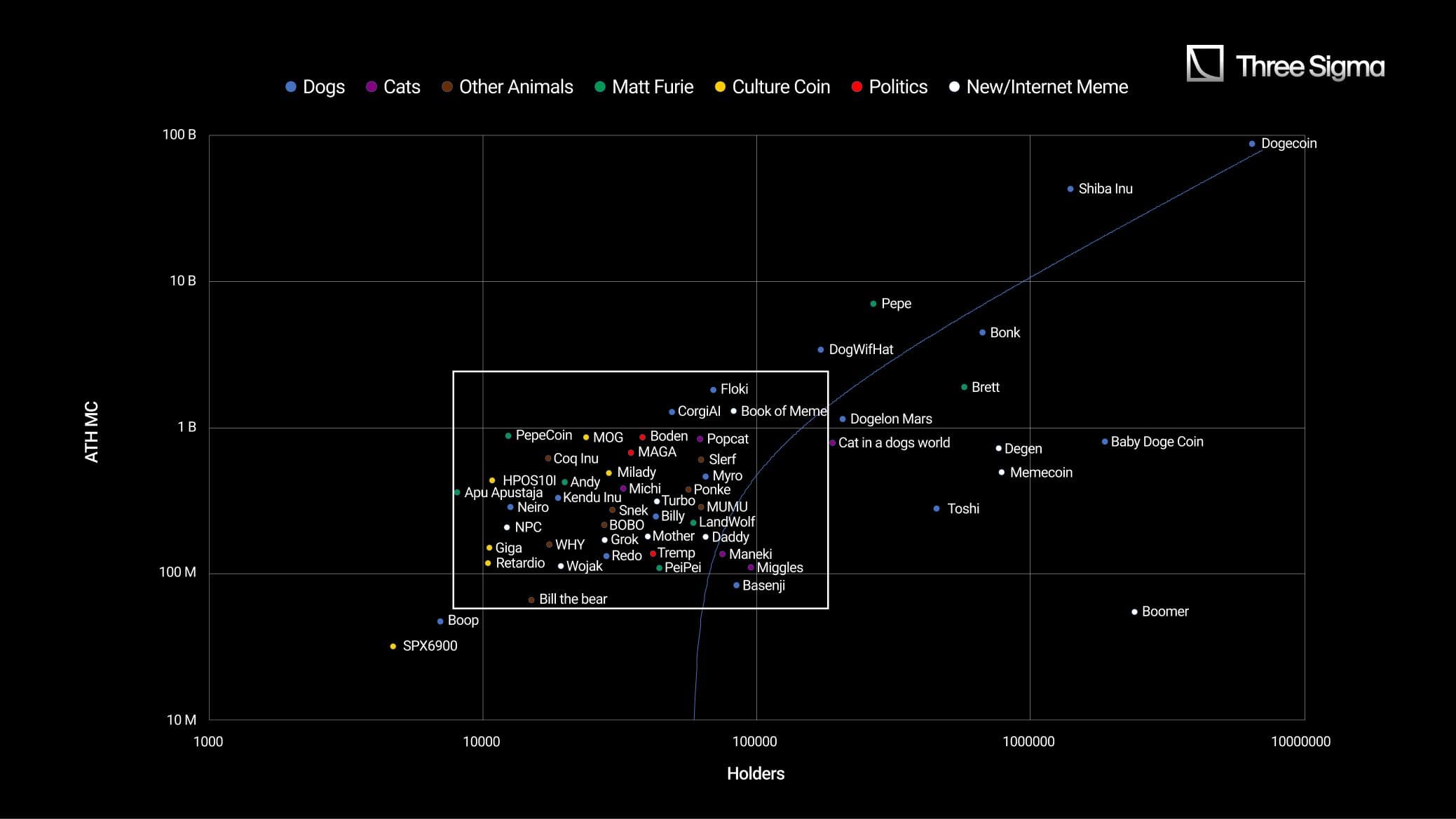

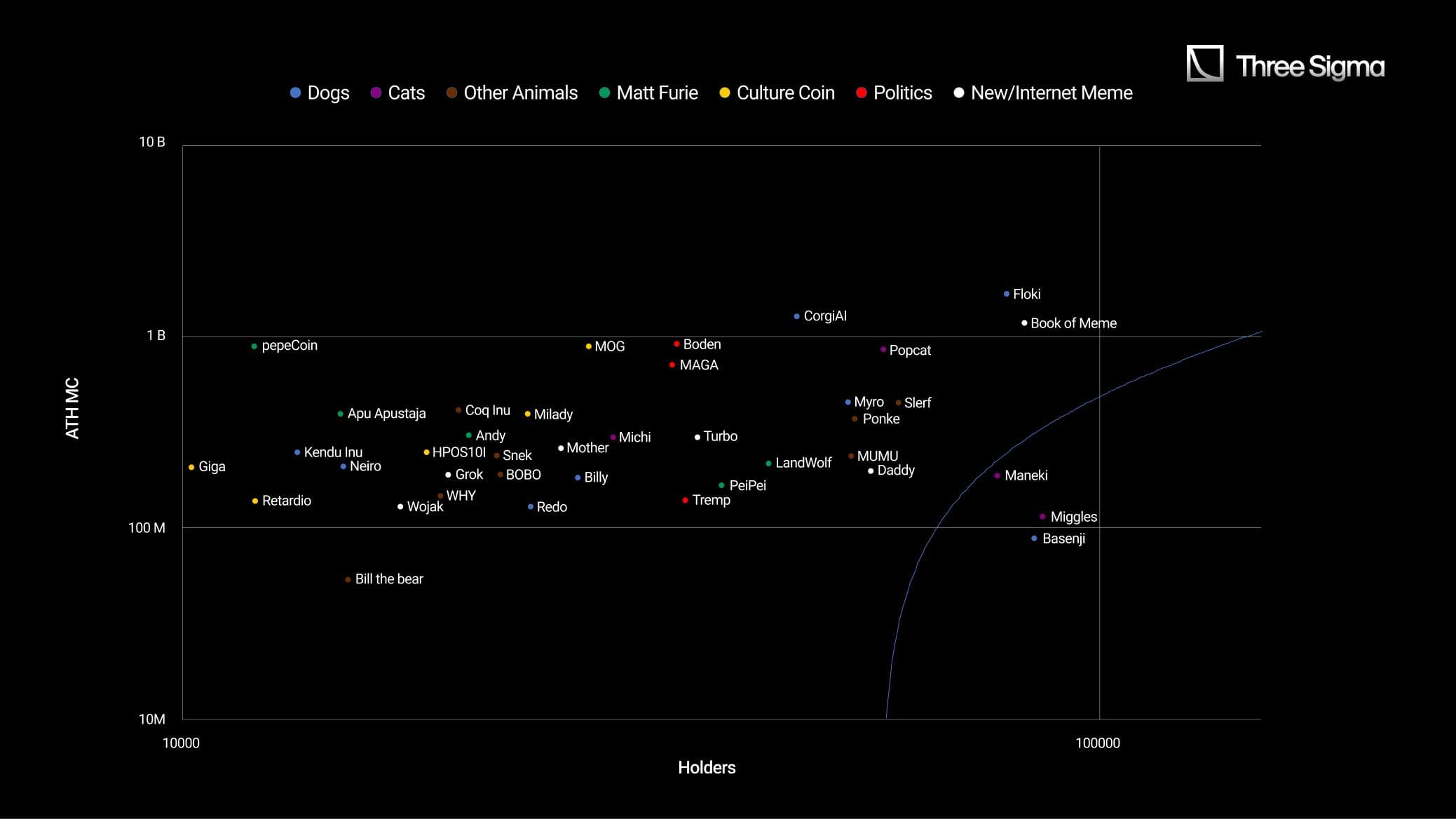

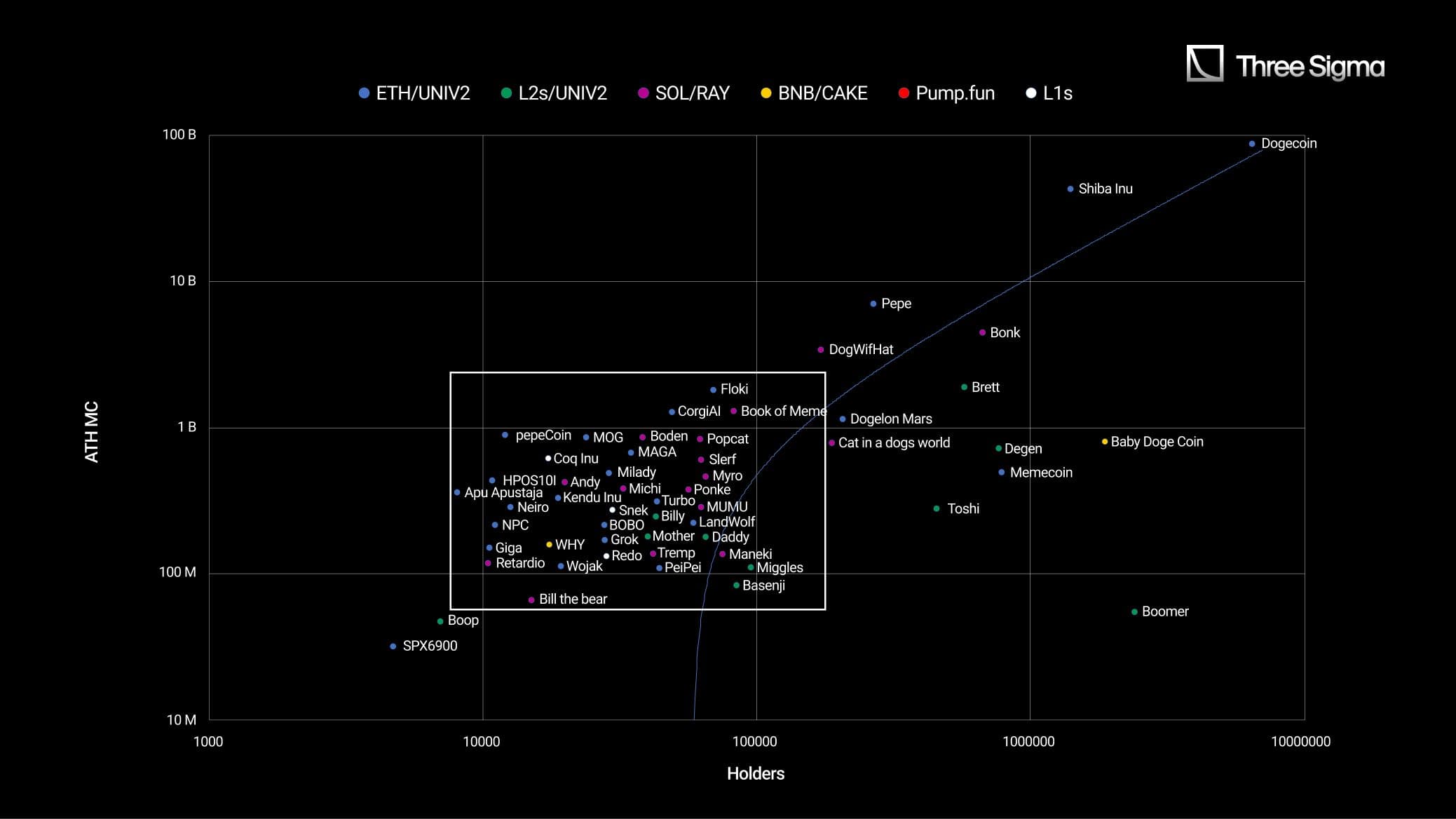

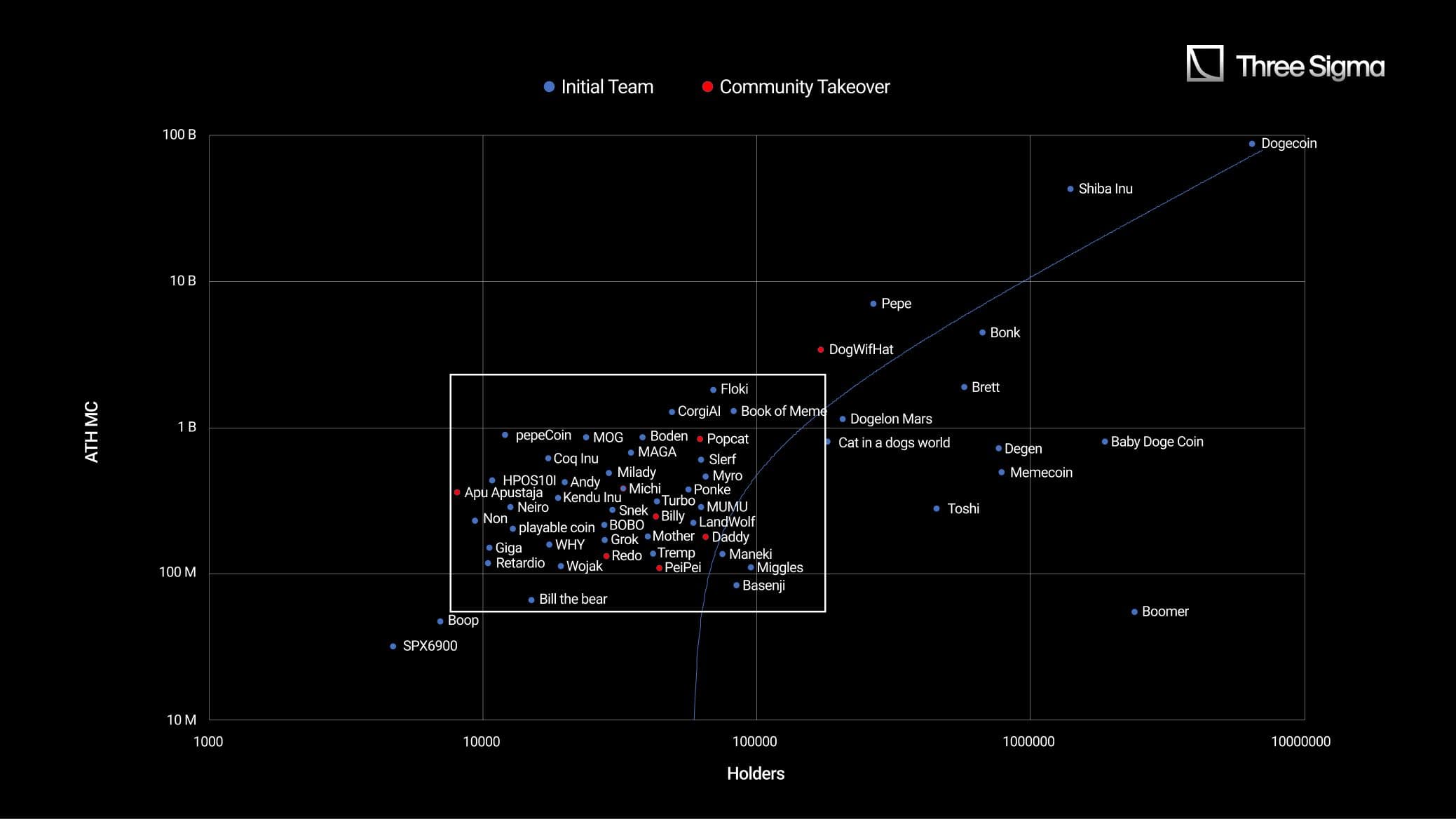

To enhance the clarity of our research, we’ve created a chart that highlights key similarities among the discussed memecoins. This chart categorizes top protocols based on two key variables:

- All-Time High Market Cap → Related to the highest market cap ever achieved by the memecoin, not accounting for any inflation or deflation mechanisms.

- Users onboarded → Related to the number of holders of the memecoin (found via Blockchain Explorers).

Note: Due to the nature of memecoins, there is a real possibility that some of them may become obsolete in the future. Therefore, the identification was focused on ATH, reflecting the success trajectory of each token.

Holder Count

The holder count is a harder variable to consider, as several factors complicate the accurate determination of the actual number of genuine users holding a memecoin. The main challenges include various types of automated bots that can manipulate holder counts and the tendency for real users to distribute their tokens across multiple wallets for different reasons. For example, whales might split their holdings to avoid alarming the community, while users may spread tokens across wallets to artificially boost the holder count.

It is important to consider these factors when analyzing holder data, as they may not fully reflect true user engagement. However, their impact is usually minimal and does not significantly affect the validity of the research.

What memecoin projects can we find on the chart below?

Animals

- Dog: Dogecoin, Shiba Inu, DogWifHat, Bonk, Floki, Boop, Redo, Billy, Baby Doge Coin, Myro, Dogelon Mars, CorgiAI, Kendu Inu, Neiro, Basenji

- Cat: Popcat, Michi, Maneki, Cat in a Dogs World, Toshi, Miggles

- Frog: Pepe, Apu Apustaja, PeiPei

- Bear: Bill the bear, BOBO

- Other: Ponke, Coq Inu, Slerf, WHY, Snek, MUMU

Matt Furie inspired

Pepe, Brett, Andy, LandWolf, PepeCoin

Politics

- MAGA, Boden, Tremp

Personalities/Celebs

- Mother, Daddy

Culture Coins

- Retardio, Milady, MOG, HPOS10I, Giga, SPX6900

Memecoins without specific Background

- Book of Meme, Memecoin, Degen, Non-playable coin, Wojak, Boomer, Turbo, Grok

Meme Coin Ecosystem Overview

The overview of the market is:

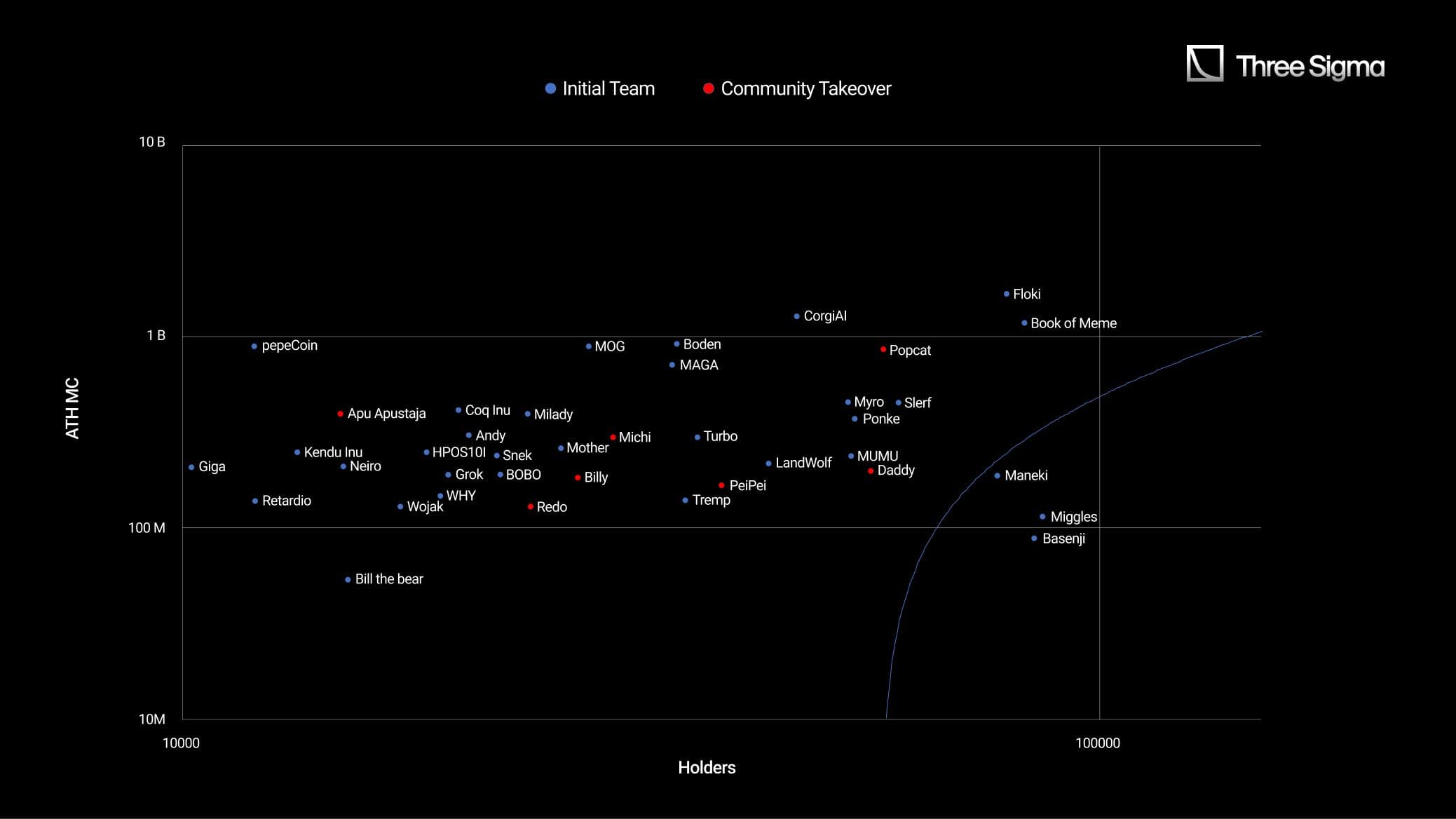

Note: The rectangular frame within the chart will be zoomed in and displayed as a new image in the charts below.

The importance of a Narrative

While memecoins are a narrative of the cryptocurrency ecosystem, it's important to recognize that they also have their sub-categories/narratives.

For a memecoin to be successful, it typically depends on a well thought out plan from a team that has studied variables like supply distribution and incentives, decisions that benefit from an independent Tokenomics Audit. However, one crucial variable that can influence the future of a memecoin—and even propel a memecoin without solid plans or known teams—is the narrative of the token itself.

The narrative of a token explains why it was created and what it represents. Narratives are prevalent in the meme coin ecosystem, and it is up to the community to determine which narratives are valuable enough to make a token worth investing in.

When examining narratives, there are several examples of how one can emerge:

- A derivative of a famous token or derivative of a token that recently experienced a significant price increase - $NEIRO

- A token supported by influential personalities - $MOTHER

- A token that followed a momentary trend in the meme market - $SLERF

- A first mover meme - $BITCOIN

The most famous narratives in 2024 have been:

- Dog coins: Since the most prominent memecoins have always been related to dogs, this narrative has always been considered strong. Recently, several tokens have emerged following this narrative, such as Myro, Billy, Toshi, Neiro, and Bonk.

- Cat coins: The year 2024 was characterized by the idea that, although dogs remained a strong narrative, another animal should start gaining success. The cat was chosen, with various cat memes achieving success that year. Examples include PopCat, Michi, and Maneki.

- Culture coins: Culture coins aren't tied to a specific animal or personality but reflect phenomena that the community enjoys and wants to identify with. These coins are more "edgy" and foster strong cultures that the community adopts and endorses. A characteristic of culture coins is the relationship between a strong community and an "edgy" narrative that not everyone may like, which results in coins with fewer but more dedicated holders. Culture coins try to install their culture into the crypto community. Examples include MOG, HPOS10I, and GIGA.

- Animals: Animal tokens typically follow the idea that the community is very fond of this type of memecoin, so developers look for other animals that can create compelling narratives.

- Matt furie/boys club: Matt Furie, an artist, gained great notoriety in the world of memecoins after $PEPE, a meme based on his creation, achieved significant success between 2023 and 2024. Following this, several other characters drawn by him, which are part of the so-called “Boys Club,” were created. Many of these memecoins also performed well in the market, demonstrating the strong narrative driven by PEPE. Examples include Andy, LandWolf, and Brett.

- Influencers: Emerging as a flash narrative in June 2024, driven by a malicious developer with numerous connections, memecoins endorsed by influencers began appearing daily. Various personalities from different fields created their memecoins, and many of these did not amount to more than farms. However, some exceptions managed to maintain relevance and remain significant in the market, such as MOTHER and DADDY.

Narratives are extremely relevant in memecoins, and if one is strong enough, much of the hard work from a team can be minimized, as the asset will already possess something inherently special in the eyes of the community. Real examples of tokens that initially found success due to their narrative include:

- Neiro ($NEIRO): This token emerged following the dog narrative, specifically relating to being a parent of Doge. It took two days for $NEIRO to gain momentum, as those initial days were characterized by competition from many different deployments on various chains to decide which would be the official Neiro coin. Once it was established as the chosen one, it reached a market cap of $300 million within seven days.

- Baby Doge Coin ($BabyDoge): This token surged in 2021 during a period of mania for creating "baby" versions of famous memecoins. There couldn’t be a stronger narrative than Baby Doge, and as expected, this memecoin was one of the few to reach multiple billions in market cap.

- Mother ($MOTHER): Following a trend that began on June 24 of celebrity memecoins, $MOTHER, the token of the singer Iggy Azalea, achieved a market cap of $220 million in its first week.

While narratives can drive a token's success, they can also lead to decline when the narrative loses momentum. Real examples of this include:

- Jeo Boden ($BODEN): Known as the only political coin to reach a $1 billion market cap, Boden had a strong narrative of being the president’s token during its launch. However, as time passed and confidence in Biden waned in real life, this was reflected in $Boden's weakening narrative, causing the token to plummet by more than 95% in just a few months, now sitting at a $10M market cap.

- Donald Tremp ($TREMP): Similar to Boden, which shared the same narrative and was leading, Tremp, the token representing Trump, also faced the downfall of political coins, plummeting 90% from its peak.

It is important to note that although these tokens have declined and cooled off, it is not impossible for their narratives to recover, with the tokens following suit. The opposite is also true—narratives that are extremely strong during one period can lose momentum, which is reflected in the memecoins that adopted that narrative.

Memecoin Launchpads & Infrastructure

The process of creating memecoins has never been so easy.

When we talk about the Ethereum network, smart contracts developed by experienced individuals have always been preferred because they offer greater flexibility and control. This flexibility allows teams to manage many processes at their own pace, such as creating liquidity pools on UNIv2/UNIv3, renouncing contracts, and locking LP tokens.

However, this same flexibility can also introduce risks, as it opens the door to malicious actions, such as rug pulls, fee manipulation, or contract clogging, highlighting the importance of analytic tools like TokenSniffer in simplifying the audit process for users.

“Clogging” happens when the developer sends a portion of the token supply to the contract itself. The contract's transfer function is modified to include an additional swap. Whenever a user makes a transaction, the contract simultaneously sells a small percentage of its own tokens, without the user's knowledge. This hidden sell is bundled with the user's transaction, making it difficult for most users to notice.

Below is an example of how a clogging function can be integrated into the transfer function of a memecoin contract:

Examples of memecoins that initially clogged their contract are BITCOIN, with 15% of the total supply reserved to the contract, and TRUMP, clogging 20% of the total supply.

Given the flexibility of ERC-20s, while launchpads on the chain surged, Ethereum has yet to see the need for the creation of these launchpad platforms, which is completely opposite when we talk about Solana.

Solana, having its SPL token standard, never had the flexibility provided by ERC-20s. For the creation of memecoins on the network, it would be enough to mint tokens and add them to liquidity pools in DEXs like Raydium.

To further protect users and align incentives, Meteora introduced a new tool for developers to launch pools with instantaneous burned LP, ensuring that they could no longer withdraw liquidity, while retaining the authority to collect fees generated by trading in perpetuity.

Also recognizing the growth of memecoin activity on Solana and how simple and inexpensive this process was, the platform PumpFun emerged in January 2024. For just 0.02 SOL, anyone could upload an image, assign a ticker, name it, and add social links to launch a virtual liquidity pool, pre-seeded with a synthetic $5,000 of liquidity. This dynamic quickly gained success, driven by the platform's first-mover advantage and accessibility.

Competitors like Moonshot from the Dexscreener team surged offering more perks like free DEX updates, but they still struggle to compete with PumpFun and haven't produced any notable memecoins.

PumpFun has dominated blockchain metrics in recent times, outpacing competitors in many key metrics, such as:

Deployments: Throughout 2024 and peaking in August, PumpFun tokens saw a significant rise in deployments, regularly outperforming traditional methods. At its peak, the platform had 200% more deployments than conventional approaches, showing a strong preference for PumpFun's simplicity.

Revenue Generation: PumpFun has also led in revenue, consistently ranking as the most profitable protocol. On August 14, it set a new record, generating $5.3 million in just 24 hours, surpassing the combined revenue of the next 24 top-earning protocols.

Following the hype of launchpads brought by PumpFun, other companies began creating similar solutions on different blockchains, such as MoonMaker from Spectral Labs, which greatly facilitates the deployment of memecoins on the Base network. Even so, there has not been rapid adoption of these platforms, and no major memecoins have emerged.

To this day, traditional methods have typically brought the most famous memecoins to life, possibly due to the greater control these methods provide.

- On EVM networks, all the major memecoins come from custom contracts and deployments on UNIv2 and UNIv3 pools, such as BITCOIN, TRUMP, and PEPE on Ethereum, and BRETT and $TOSHI on Base.

- On Solana, traditional methods of minting and adding liquidity on DEXs like Raydium have also been more successful, with tokens like WIF, MANEKI, and $MEW emerging that way.

- PumpFun has only recently begun producing successful memecoins, with BILLY and MOTHER being some of the best examples.

Strong Team vs Strong Community

Successful memecoins are rarely created overnight. For a token to succeed, it is necessary for a team to manage its full development, ranging from supply management, social media, and community to marketing and KOLs.

Today, these teams are primarily made up of complete teams that, from the beginning, have a clear vision of what they want to achieve and where they want to take their project. With few exceptions, memecoins are typically either managed by a team or part of a Community Takeover. Let’s explore both scenarios:

Community Takeovers, also known as CTOs, occur when the original developers of a project abandon it through exit scams or rug pulls, leaving with investor funds for a quick buck or due to loss of interest or disagreements among the team.

This situation is common in smaller memecoins projects, as they have nothing solidified and it’s easier for a developer to leave without making too much “noise”. In response to "rug pulls," the community often takes the initiative to continue the project by re-organizing a new team through social media and forums.

The number of CTOs has grown significantly since Solana became a focus, as SPL tokens offer fewer opportunities for scams and avoid issues like contracts still being controlled by the previous team.

CTOs typically begin by reuniting active members of the project and taking control of crucial assets such as the project's media accounts, websites, and content. They also oversee marketing efforts and coordinate actions to sustain the project.

The community sets up new decision-making structures, often led by experienced groups known as "Cabals," who employ successful strategies. Volunteers with relevant skills and expertise collaborate to maintain and improve the project's ecosystem.

The holder count in community takeovers is often relatively low, which might be related to the strong community that forms around these projects. While fewer new holders may be onboarded due to skepticism about a community's ability to push a project to success, those who do believe in the community's strength often continue to invest over time.

This creates organic growth in every aspect of the memecoin, as dedicated believers contribute to the project's ongoing development and sustainability. Despite these challenges, these takeovers demonstrate the resilience and creativity of crypto communities in overcoming obstacles and driving projects forward.

Notable examples of successful community takeovers are Wif, Apu, Redo, and Billy, which all experienced a revival when community members took control following the original team's departure. Some of the Characteristics found in these types of Memecoins are:

- Public Wallets for Donations: Especially during the initial phases of CTOs, wallets known as “marketing wallets” are created by trusted CTO team members. These wallets allow the community to donate and support endeavors that require capital.

- Decentralized decision-making processes: CTOs take their journey in a more decentralized way. Teams usually not only expect more from the community, but they also give the community more power in decisions and opinions for the future of the project. Valuable community members can be promoted to team positions as well.

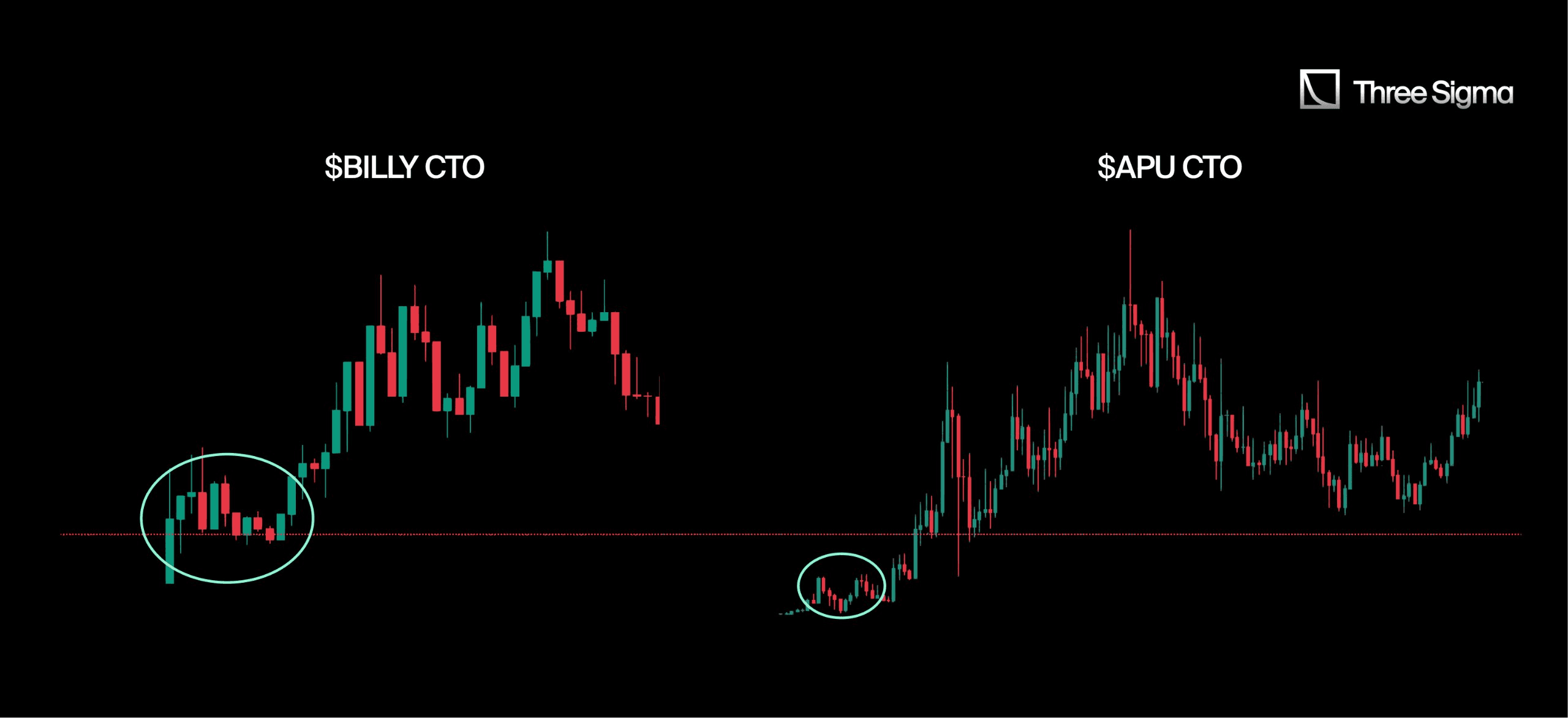

- Graph Patterns of Community Building: While all memecoins have different chart patterns, Community Takeovers (CTOs) sometimes exhibit similarities in their graphs. Consider the examples of two famous CTOs, BILLY and APU. In both cases, the original team abandoned the project, leading to significant drops in the chart. At that point, a CTO begins to form, with the CTO team planning the next steps and the community working to maintain support levels. After several days of planning and organizing, successful CTOs can often be observed moving out of the accumulation zone and starting their rallies.

Despite recent success stories, CTOs still make up a small part of the memecoin ecosystem. They face challenges like organizing without central leadership, limited technical expertise, and lack of funding for development and marketing. Additionally, convincing exchanges and investors to back a community-run project can be tough due to concerns about legitimacy and long-term sustainability.

These difficulties don’t necessarily mean CTOs can’t be very successful. CTO teams tend to like to push the Animal narrative, leveraging the popularity of these memes to gain traction and attract supporters. Yet there seem to be “market resistances” that limit CTOs, such as the 250-400M market cap ranges, which tend to be the TOPs.

On the opposite side of community-led memecoins that rally after a team’s departure, there are cases where a serious and experienced team is responsible for driving the memecoin's success from the very beginning. These teams typically require significant initial investments to cover various aspects such as exchange listings, marketing, and market-making. Team-led memecoins often inspire confidence within the community from the start, leading to a larger number of holders compared to CTO projects, as more users are encouraged to join early on. Some of the characteristics found in Memecoins led by these teams are:

- Fast reach to KOLs: Stong teams have KOLs that have been onboarded since the beginning. They get paid with criptocurrencies + supply of the token to support it throughout specified periods.

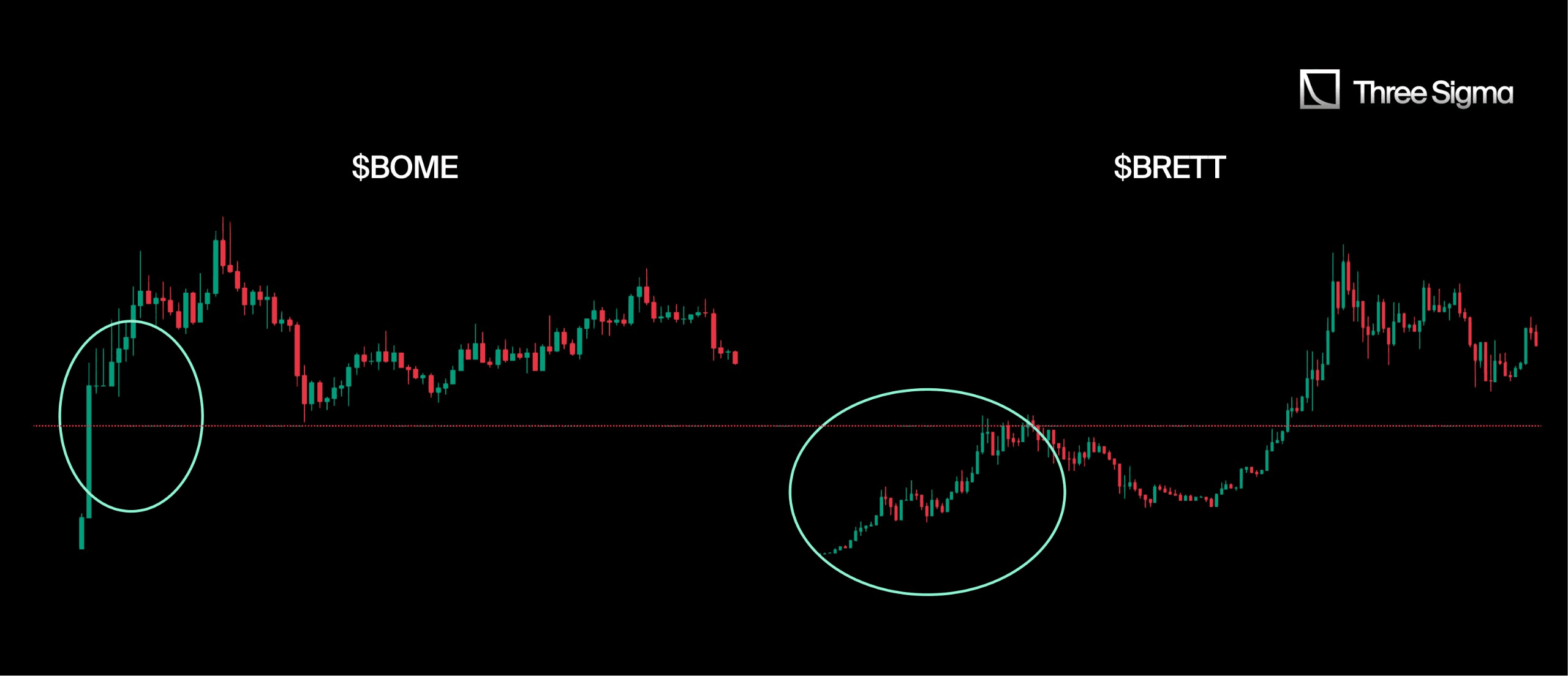

- Fast CEX listings: These teams often have CEX listings pre-scheduled, not just on any exchanges, but on tier-one CEXs. This can happen within the first few days of the token's launch. For example, $BOME was listed on Binance within its first three days.

- Connections with Whales and Market Makers: Many of these teams reach out to whales to help hold the floor and periodically drive prices up, or to market makers to use their liquidity provision services.

- High supply percentage: While it doesn’t happen so often, some teams can gather high amounts of supply for them, leaving a smaller percentage to the pool and creating the so called “supply control”, which has both positives and downsides.

- Graph pattern: When a memecoin has been planned by an experienced team, the launches will follow as expected, performing extremely well even at the very beginning of its journey. Amongst many examples, BOME and BRETT showcase how in short periods of time their tokens ran to millions/billions in market capitalization.

The Bots Status Quo

Alongside the evolution of crypto and the memecoin market, bots have begun gaining popularity in throughout the memecoin space. For many memecoin creators, various bots are highly advantageous for maintaining control over certain aspects of a token, such as supply, and boosting key metrics like volume.

Many memecoins teams avoid discussing their use of these bots, but it is well known that many projects utilize them. The undisclosed use of bots, especially by malicious actors, can lead to serious issues such as market manipulation, fraud, and the erosion of trust.

Due to the increase in Solanas memecoin activity, bots became something even more acessible due to the low transaction fees.

There are diverse types of bots that can be used to improve the manipulate results of an asset. Below we’ll cover some of the most famous and explain what they do with examples:

Market making Bots

Market making bots are automated systems used by market-making firms to provide buy and sell orders on exchanges, helping to create a stable and liquid market where assets can be traded efficiently. These bots help narrow the spread between bid and ask prices, facilitating price discovery while ensuring high volumes and stabilizing prices, effectively shaping the charts.

Teams often partner with these market making firms to leverage their algorithmic trading capabilities, helping with price discovery and liquidity management, practices that should be balanced with OpSec Audit controls.

We analyzed 8 market-making firms and their involvement in the memecoin ecosystem; here are the results:

- High Memecoin Involvement: 12.5% (1) of the market-making firms had high involvement, supporting over five memecoins, including NEIRO, PEPE, MEME, PEPECOIN, MOG, COQ, BENJI, TRUMP, SHIB, and DEGEN. Their extensive participation played a key role in liquidity and price stability across a broad range of memecoins.

- Moderate Memecoin Involvement: 50% (4) of the firms had moderate involvement, providing services for three to five memecoins, such as PEPECOIN, LADYS, and $MEME. Though not as heavily involved, these firms maintained a significant presence in the memecoin market, contributing to liquidity and price discovery.

- Low Memecoin Involvement: 37.5% (3) of the firms had low exposure, supporting one or two tokens at most, including SHIB and PEPE. Their focus was primarily on more established digital assets, with limited participation in the memecoin space.

Sniping Bots

Sniper bots are automated trading tools designed to instantly buy tokens as they enter the Liquidity Pools, making them particularly popular in the memecoin trading space given the number of deploys and volatility of these assets.

Sniper bots are highly effective at securing a large portion of the token supply during the initial trading phase of a memecoin, a recurring risk pattern across the meme coin ecosystem. After acquiring the tokens, it's common practice to distribute them across multiple wallets, each holding 1% or less of the total supply. This strategy creates the appearance of a well-distributed token supply and helps to mitigate negative perceptions from bubble maps, which are widely used to analyze token distributions. Some memecoins that have experienced LP sniping include:

- $BRETT is a prime example, where the team was responsible for sniping over 80% of the token supply at launch. Despite this, the token went on to become one of the best performers of the year.

- $POPCAT, $MANEKI, and $MEW are other examples of heavily sniped memecoins, allegedly by team members for supply control measures.

- $SOAR was launched with a $20 million market cap, and this time sniper bots from users managed to generate $1.36 million in unrealized PnL by investing just $67 across nine different wallets. In contrast, the creators of SOAR only realized $310,000 in unrealized PnL.

Examples of sniping bots include Maestro Bot and Banana Gun. The accuracy of snipes often depends on factors like bribes, gas optimization, and the bot's latency in reacting to on-chain events.

Volume Bots

Unlike market making bots, volume bots are designed to generate artificial trading volume in memecoins, which may require Incident and Emergency Response planning when abuse impacts users. High-volume tokens look more tradeable in the eyes of users (as low volume can signal a lack of interest) and also for meeting criteria such as minimum volume requirements for exchange listings. For a volume bot to operate, capital must be allocated to it, allowing it to run transactions until the capital is depleted or a specific condition is met.

Some examples of volume bots are:

- Fatality Rank: This Solana volume bot operates by being funded with Solana and generating recurring transactions, typically in a pattern of 2 buys followed by 1 sell of the same value. As fees are paid, the size of the buys and sells gradually decreases until the bot runs out of capital and can no longer continue its volume generation.

- Orbit MM: Offers several packages, each with different levels of intensity in terms of wallet numbers and transaction frequency. These bots operate for a set period, burning Solana to cover trading fees and generate volume. The platform also provides "MicroBots" to increase the appearance of organic transactions.

- BumpIt: A bot specifically designed for Pump.Fun. Its purpose is to execute frequent small buys, referred to as "micro-buys," which helps keep a memecoin consistently visible on the launchpad’s main screen. This activity is known as "bumping".

Conclusion

This research aimed to offer a clearer understanding of the key factors in the meme coin ecosystem and the variables that can impact success or failure.

Some of the aspects highlighted in this research were the potential role variables like narratives and the more recent integration of bots can play in the success of memecoins.

Narratives became crucial in shaping whether a token thrives or fails. In 2024, dog-themed memecoins continued dominating as the most successful memecoins, but there was also room for other narratives to emerge, such as Cat tokens and Culture Coins.

Alongside this, the use of bots has been actively and increasingly employed by many memecoins, contributing to their success, many times undisclosedly. More and more, there appears to be a link between the strength of some memecoins and their strategic use of bots to enhance market activity.

By combining narratives, bots (if needed), and other factors explored in this research and beyond, teams can propel memecoins to remarkable heights within the crypto community.

Memecoins today have become assets that, even if their popularity declines, will continue to exist by adapting themselves to new demands. Therefore, it is necessary to keep evolving the infrastructure and the culture behind them to minimize the bad reputation memecoins are known for.

Platforms like PumpFun have gained popularity for this very reason. Although they cannot prevent bad actors, they brought new infra that significantly democratized the process and reduced the possibilities of altering liquidity pools.

The meme coin ecosystem is far more complex than it seems. Many actors exploit the complexities tied to these assets and the high risk reward ratios to launch low quality projects and scam retail users. This is evident in the data, with 97% of memecoins failing and the majority of traders losing money on these assets.

The culture behind these assets still needs improvement to address the current flaws within the ecosystem. Developers must prioritize quality over quantity and focus on nurturing communities rather than quickly abandoning their projects. Likewise, the community must become more discerning, taking the time to research where to invest rather than succumbing to the allure of high potential rewards, ignoring red flags and blindly following the crowd by placing trust in vague sayings like "believing in the community”.

Reach out to Three Sigma, and let our team of seasoned professionals guide you confidently through the Web3 landscape. Our expertise in smart contract security, economic modeling, and blockchain engineering, we will help you secure your project's future.

Contact us today and turn your Web3 vision into reality!

References

Docs of mentioned protocols:

Andy, Apu Apustaja, Baby Doge Coin, Basenji, Billy, Boomer, Boop, Book of Meme, BOBO, Boden, Bonk, Brett, Cat in a dogs world, Coq Inu, CorgiAI, Daddy, Degen, Dogelon Mars, DogWifHat, DOG, Dogecoin, Floki, Giga, Grok, HPOS10I, Kendu Inu, LandWolf, MAGA, Maneki, Memecoin, Michi, Miggles, Milady, MOG, Mother, MUMU, Myro, Neiro, Non-playable coin, PeiPei, Pepe, pepeCoin, Ponke, Popcat, Redo, Retardio, Shiba Inu, Slerf, Snek, SPX6900, Tremp, Toshi, Turbo, WHY, Wojak.

Economic Security Lead

Pablo holds a Master's in management, having focused in finance, and with a thesis on DeFi, demonstrating his knowledge and expertise in this field. He has extensive experience in research and analysis of DeFi protocols, having worked as an analyst at Siemens and a DeFi researcher at Deep Tech Ventures. His background in finance, research and analysis skills are a valuable addition to our team.