Introduction to Liquid Staking and Restaking

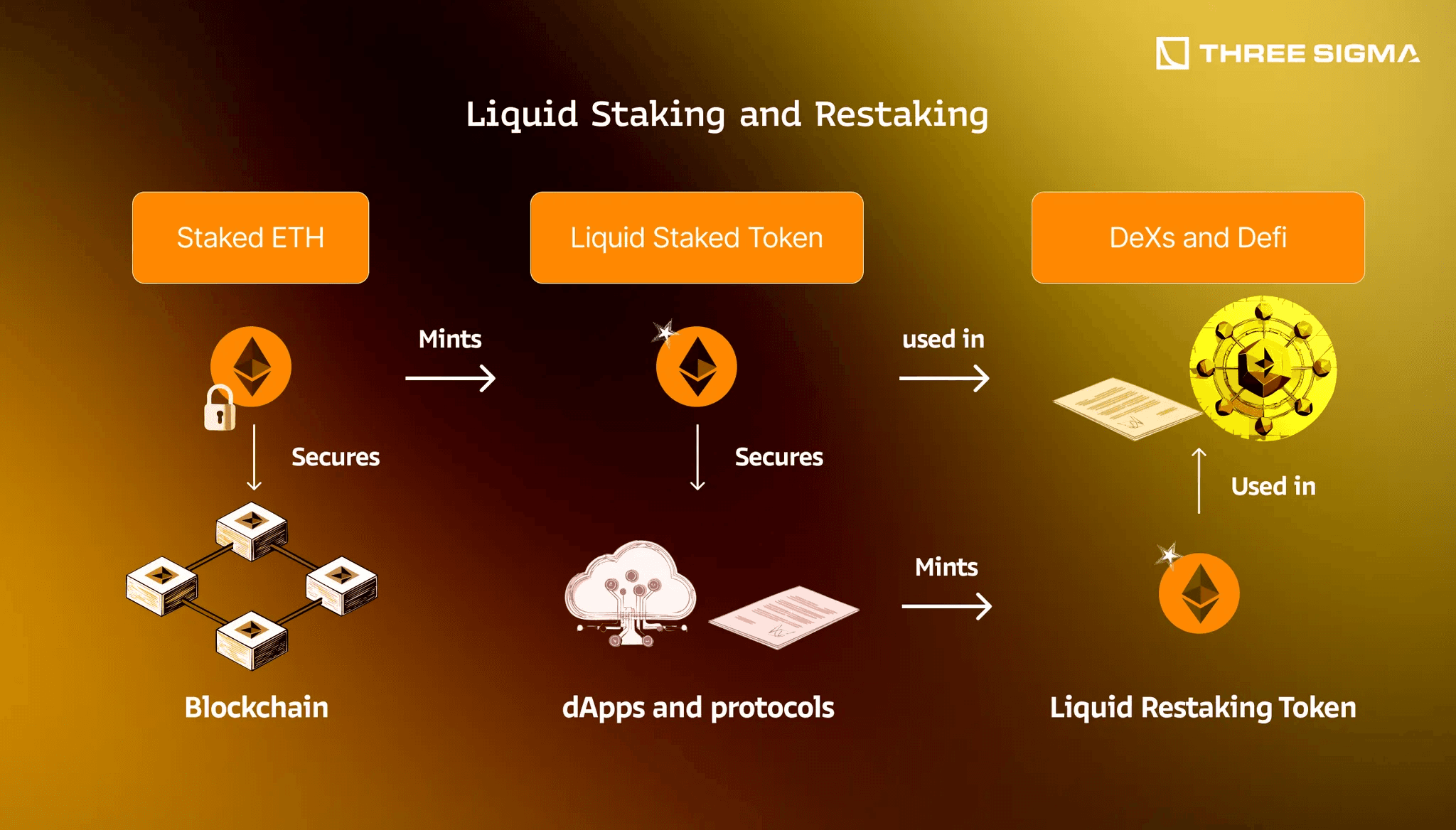

Liquid staking and liquid restaking are innovations that enhance capital efficiency in Proof of Stake networks. In liquid staking, users stake their tokens (e.g. ETH) but receive a derivative token representing the staked asset, often called liquid staking tokens (LSTs). This derivative remains liquid, it can be traded or used in DeFi while the original stake still earns rewards. By contrast, liquid restaking protocols allow staked assets to be reused across multiple systems. The same staked tokens (or their LSTs) are “restaked” to secure additional services or networks on top of the base blockchain. Liquid Restaking Tokens (LRTs) combine both concepts: they are tokenized representations of a restaked position, allowing a user’s staked asset to secure multiple protocols at once while remaining liquid and tradable.

Liquid Staking Tokens (LSTs)

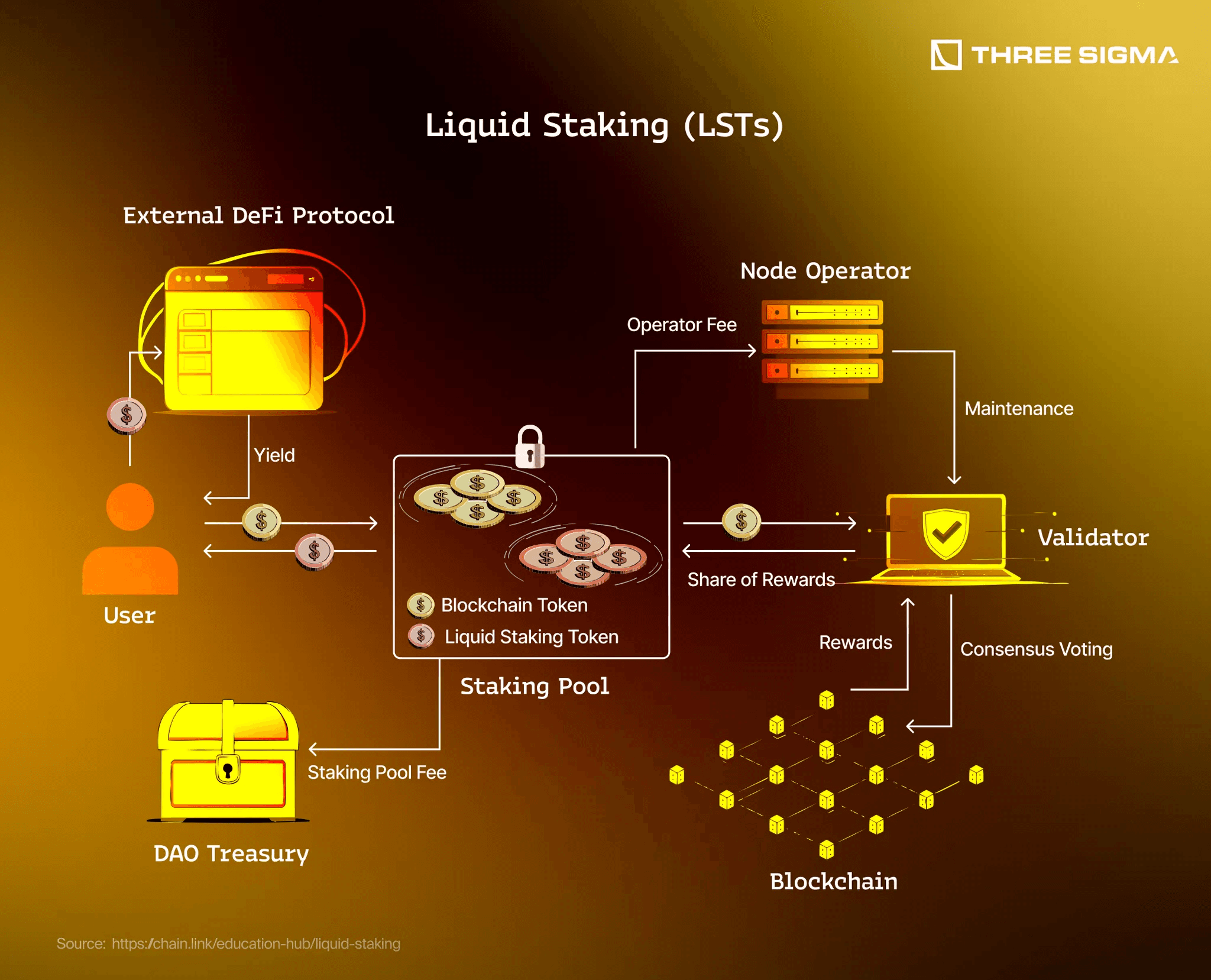

Liquid Staking Tokens (LSTs) In traditional liquid staking, when you stake (lock up) assets on a network, you receive an LST (liquid staking derivative) that represents your claim on the staked assets and any rewards. For example, staking ETH via Lido yields stETH, an ERC-20 token reflecting your staked ETH. LSTs solve the liquidity problem of staking: instead of waiting through lock-up periods, users can move and utilize the derivative token freely in other DeFi protocols. This boosts capital efficiency, your asset secures the network and can earn yield elsewhere simultaneously. However, the LST’s value can drift from the underlying asset (e.g. stETH trading slightly below ETH during extreme market conditions), introducing some market risk. Liquid staking platforms (like Lido, Rocket Pool, etc.) also handle the validator operations and technical complexity for the user, in exchange for a fee. The main benefit is flexibility of staked value without sacrificing staking rewards.

Restaking and Liquid Restaking Tokens (LRTs)

What is liquid restaking?

Liquid Restaking takes things a step further by using the same staked asset to secure multiple protocols or services beyond the original chain. A prime example is Ethereum’s EigenLayer protocol, which lets users opt-in to restake either their native staked ETH or liquid staking tokens (like stETH, rETH, etc.) to secure new projects known as Actively Validated Services (AVS). When users restake, they can earn additional rewards from those services. Liquid Restaking Tokens (LRTs) are derivative tokens representing a restaked position. Essentially, an LRT is an IOU (I owe you) or voucher that proves you’ve deposited your staked asset into a liquid restaking protocol. Because it’s tokenized, the LRT can be transferred or integrated into other DeFi activities for even more composability. This means capital doesn’t sit idle, your stake can secure multiple platforms and the LRT can be traded, used as collateral, supplied to liquidity pools, etc., enabling layered yield strategies.

Key Differences - LST vs LRT

Liquid staking derivatives like LSTs and liquid restaking tokens (LRTs) share the goal of increasing liquidity and yield on staked assets, but they operate at different layers of the ecosystem:

- Scope of Security: With an LST, your stake secures one blockchain (e.g. Ethereum for stETH). With an LRT, your stake’s security is extended to multiple protocols or networks (e.g. securing oracles, bridges, new chains via restaking). This broadens the impact of each staked ETH, potentially securing many services at once.

- Liquidity and Tradability: Both LSTs and LRTs are liquid representations of staked assets. However, a basic LST is backed by a single staking contract and usually has a relatively straightforward redemption (e.g. 1 stETH roughly equals 1 ETH). An LRT might represent a more complex position across layers. Some early restaking setups lacked direct unstaking, users would have to sell the LRT on market if they wanted out. Ensuring redemption or unstaking mechanisms for LRTs is an evolving challenge; without it, an LRT could trade below the underlying value in low-liquidity markets.

- Reward Sources: An LST yields the base network’s staking rewards. An LRT yields those plus additional rewards from each integrated protocol (the AVSs). In theory, restakers can “stack” rewards from multiple sources for higher total yield. The flip side is they also assume additional slashing or failure risks from those sources.

- Complexity and Risk: Liquid staking simplifies staking for users (no need to run a validator) and adds minimal extra risk beyond smart contract risk and slight price divergence. Restaking is more complex: your stake is subject to the risks of every protocol you opt into. LRT holders face compound risk, if any one service misbehaves (or its smart contract is exploited), your restaked stake could be partially slashed or its token value affected. We will explore these risks in Part 3. In short, LSTs offer liquidity for single staking, whereas LRTs leverage that liquidity to amplify yield and security across many platforms, at the cost of additional complexity.

Conclusion

Liquid restaking builds on liquid staking’s success by unlocking new uses for staked assets. We’ve defined LRTs as tokenized restaked assets that allow stakers to compound utility and rewards across multiple protocols. This innovation addresses the “opportunity cost” of staking by reusing collateral for multiple purposes. However, it also introduces new dynamics and risks beyond standard liquid staking derivatives. In Part 2, we will dive into how one might implement an LRT protocol in practice, using EigenLayer’s architecture as a case study to understand the smart contract design behind liquid restaking. For deeper insights into DeFi audits and design, explore our tokenomics audit and staking design review services.

Security Researcher

Simeon is a blockchain security researcher with experience auditing smart contracts and evaluating complex protocol designs. He applies systematic research, precise vulnerability analysis, and deep domain knowledge to ensure robust and reliable codebases. His expertise in EVM ecosystems enhances the team’s technical capabilities.