Introduction

Unraveling the Nature of Extractive Economies

An extractive economy prioritizes short-term profit by aggressively extracting value from participants, often at the expense of long-term sustainability. Such economies exploit users’ financial contributions through mechanisms like high fees, unfavorable tokenomics, or speculative trading environments that yield negative expected value (EV) for most participants.

The statistical outcomes for users in these systems are typically poor, as platforms siphon off significant returns, leaving users with diminishing prospects for profit. This approach erodes trust, reduces user engagement, and ultimately undermines the ecosystem’s viability.

Extractive models thrive on short-term speculation but fail to reinvest sufficiently in users or infrastructure, creating an unsustainable cycle where the majority lose while a few early participants or platform operators benefit disproportionately. The negative EV in these systems is evident in the high failure rate of projects and the prevalence of mechanisms that favor insiders, such as early token dumps or manipulative trading practices.

Extractive platforms often generate substantial revenue, sometimes millions in a short period, while users face consistent losses due to market volatility, structural disadvantages, and varying levels of expertise. For instance, insider-driven activities can skew market dynamics, further disadvantaging retail investors.

Consequently, these characteristics make extractive economies inherently fragile, as they rely on a continuous influx of new users to sustain activity.

Pump.Fun: Driving Fast-Paced Token Creation

Pump.Fun enables rapid token creation and trading, catering to speculative investors. Its revenue model relies heavily on transaction fees and charges tied to token launches, reportedly amassing significant revenue in a short period. However, Pump.Fun’s approach is highly extractive, as it facilitates a flood of speculative tokens, many of which fail or are abandoned, contributing to a negative EV for traders.

The platform’s design encourages high-risk trading, with snipers and insiders often exploiting early trading opportunities, leaving retail users at a disadvantage. Recent updates suggest efforts to redistribute a portion of profits through different mechanisms, but these may not be sufficient to sustain the necessary user influx, given the platform’s aggressive extraction of value.

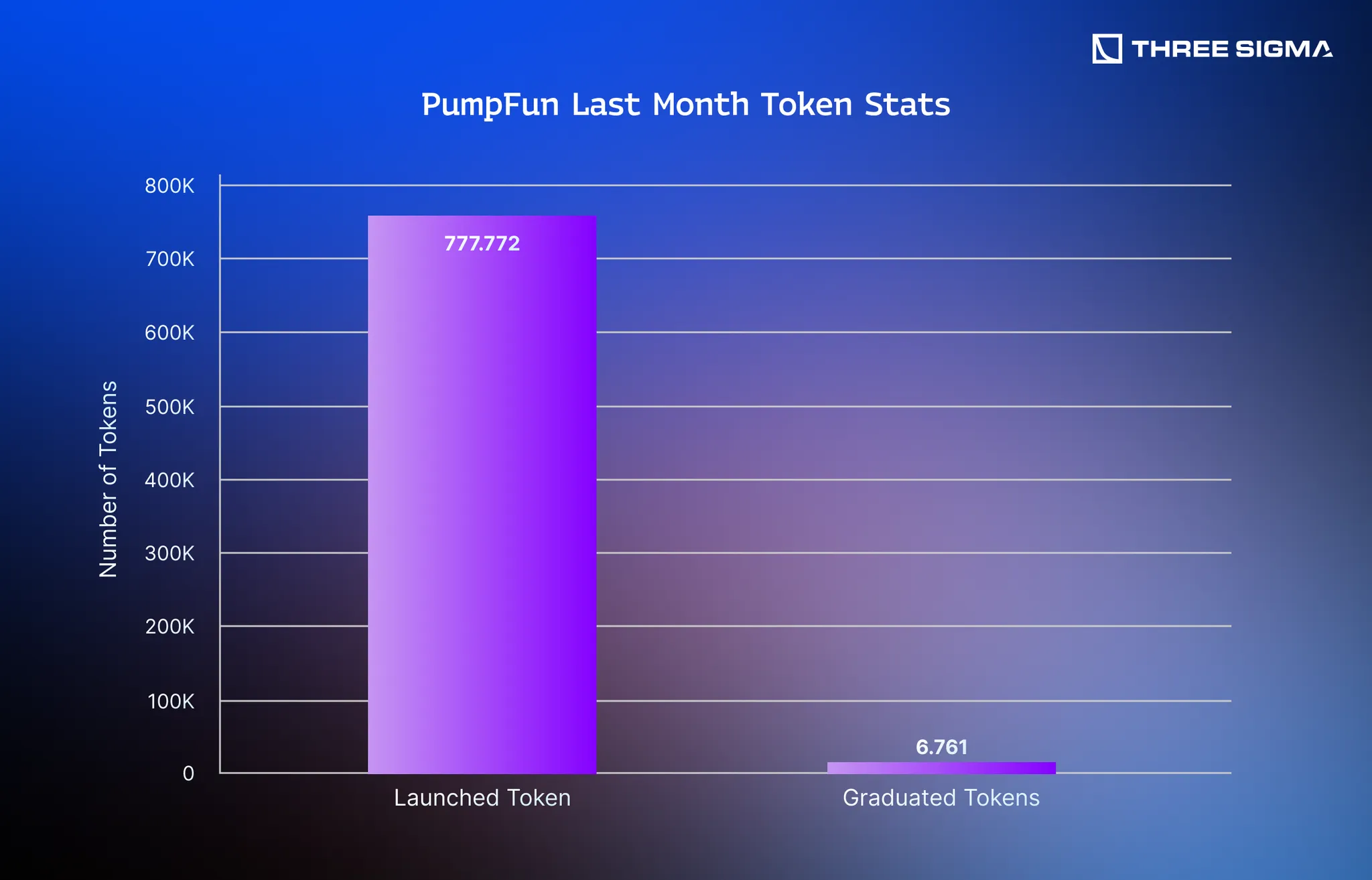

The platform’s structure encourages rapid token launches, often without rigorous vetting, leading to a high incidence of “rug pulls,” where developers abandon projects after raising funds. Recent data indicates that less than 1% of tokens on Pump.Fun have graduated in the last month, underscoring the speculative and risky nature of its ecosystem.

This low graduation rate reflects the platform’s focus on volume over quality, prioritizing revenue generation over user success. Such practices reinforce the extractive nature of Pump.Fun, as the platform benefits from transaction fees regardless of individual project outcomes.

LetsBonk: Community Focus with Limited Impact

Bonk, another Solana-based platform, operates in the token launch space but pursues a less aggressive approach compared to Pump.Fun. Bonk’s revenue model "centers" on community-driven tokenomics, with a focus on rewarding holders through mechanisms like staking rewards. Bonk generates revenue through transaction fees and token-related activities. It allocates a portion of its profits to encourage user participation.

While still extractive, given the speculative nature of its ecosystem and the negative EV for many traders, Bonk’s model is less predatory. Its reward structures aim to distribute value more equitably among holders, though these efforts may not fully offset the inherent risks of speculative trading, as statistical outcomes for users remain unfavorable due to structural challenges.

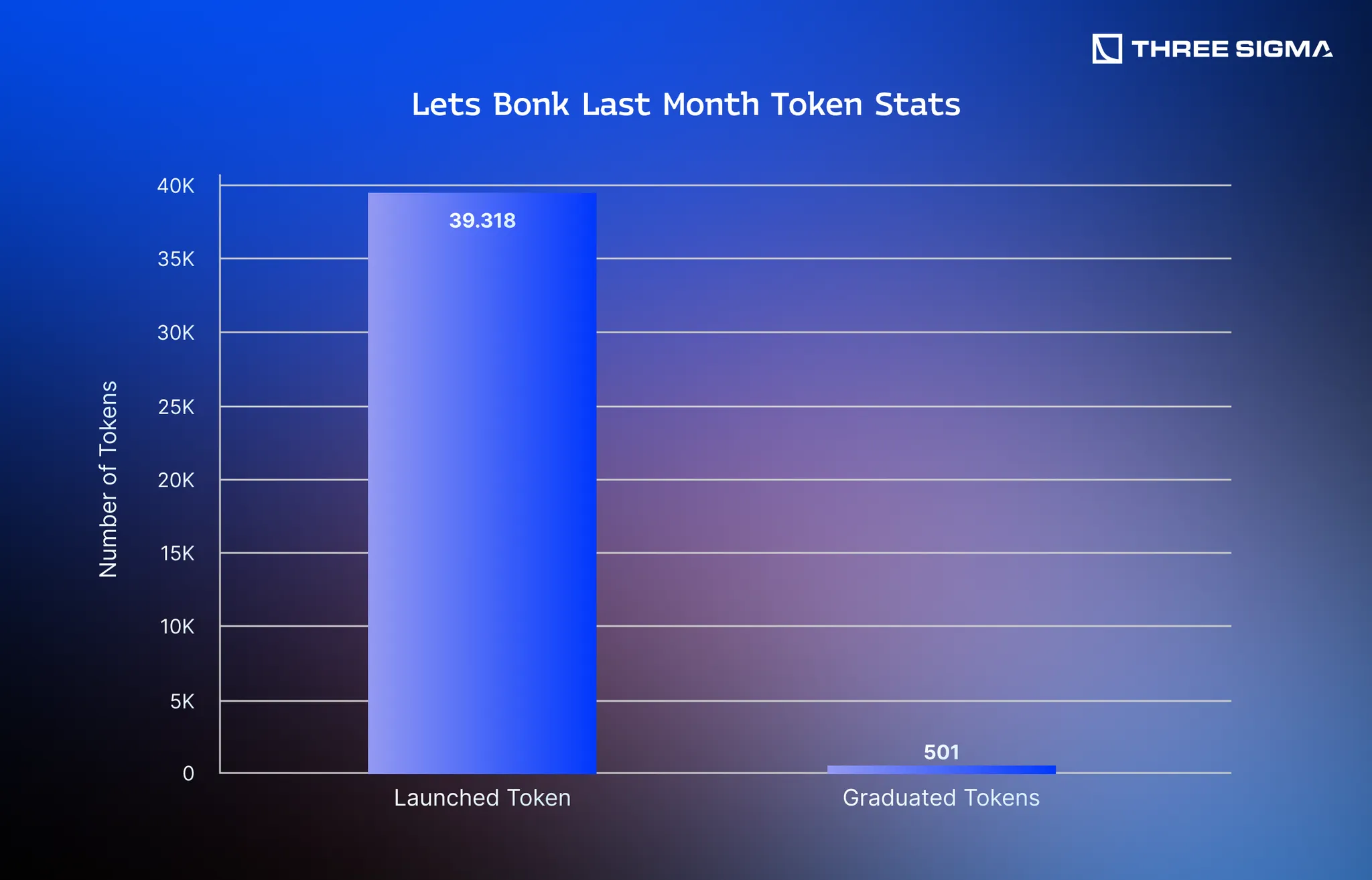

In the case of Bonk, 1.27% of tokens have graduated in the last month, a marginally better rate than Pump.Fun, though still indicative of a challenging environment for users. As Bonk experiences exponential growth, the platform is likely to attract an increasing number of token launches, including those from scammers who exploit trending sectors to mislead users.

This influx of projects, many of which may lack legitimacy, is expected to worsen the token graduation rate, as the ecosystem becomes saturated with speculative tokens. While Bonk’s focus on rewarding holders may mitigate some risks, the speculative nature of its environment continues to pose significant challenges for users seeking sustainable returns.

Conclusion

The focus should not be on pitting platforms like Pump.Fun and Bonk against each other but on fostering ecosystems that prioritize fairness, transparency, and sustainability for the majority of users. Both platforms, while differing in their approaches, operate within extractive frameworks that yield negative EV for many participants.

Bonk’s efforts to reward holders through some mechanisms represent a step toward a more equitable model, but to achieve long-term viability, DeFi platforms must move beyond extractive models that rely on insider advantages or relentless user influx. Instead, they should cultivate environments where skill, strategic decision-making, and expertise drive financial success, rather than access to privileged information or developer connections.

This shift requires robust tokenomics and mechanisms to mitigate scams and rug pulls, which erode user trust. By prioritizing user-centric practices, such as equitable reward distribution and enhanced project vetting, DeFi ecosystems can foster sustainable growth, ensuring that participants are rewarded for their contributions rather than exploited for short-term platform gains.