Introduction

Tokenomics, or the study of how tokens are created, distributed, and used within blockchain protocols, is a crucial aspect of the cryptocurrency and blockchain space. Tokens play a significant role in the success of many blockchain projects, and understanding the complex dynamics at play is essential for creating a sustainable and thriving ecosystem. In this article, we will explore the supply and demand framework for tokenomics, which allows stakeholders to make informed decisions about creating and distributing tokens in a way that maximizes value and utility while considering the incentives of all participants involved.

We will discuss how the supply of tokens is determined by the total number of tokens and the rate at which they are created or destroyed, while demand is determined by the number of people who want to use or hold the token and the value they assign to it. By examining the factors that influence the balance between supply and demand, we can design better, more useful, and efficient tokenomics. This post has been separated into two parts for easier reading. This first part explains how to match the project's goals with your token and manage the supply side, while the second part will provide an understanding of the mechanisms that drive demand and how to balance both sides of the scale.

If you’re unfamiliar, first read up on the concepts of game theory and supply and demand.

Token design

Designing a token involves outlining, validating, and optimizing it to meet the needs of the protocol and stakeholders. First, determine if a token is needed and if it furthers the protocol's objectives. Then, identify the token's functions and how it captures the protocol's value. Tokenomics design focuses on incentives and mechanisms and this design process is iterative, examining proposed mechanisms and analyzing their impact, often formalized through a tokenomics audit and mechanism design reviews.

Parameterizing the mechanisms is another important task, as competitive fees and expected rewards can make or break the design. Lastly, tokenomics is not only about creating and promoting value and utility but also sustaining it, which safeguards against downward pressures and creates a virtuous cycle. Different frameworks help guide this process and divide tokenomics models into groups, such as deflationary, inflationary, dual-token, and asset-backed models. We, in turn, believe the key framework is the understanding of supply and demand in crypto economics. We will elaborate on this later, and first explain how to bridge the project’s and the token’s goals.

Game theoretical goal setting

Starting with a clear goal is essential for any blockchain project, as it helps identify the key behaviors required for success. For example, a decentralized lending protocol needs participants to deposit liquidity to lend specific assets. Designing a token policy that incentivizes these behaviors can be achieved through game theory. This might influence decisions such as initial distribution, monetary policy, governance, and how it is marketed. The supply and demand framework is necessary after this to ensure a balance in these mechanisms and aid in achieving these goals.

To give a practical example, let’s imagine a scenario where a project is launching a decentralized exchange (DEX) to enable trades between any tokens with the lowest slippage by ensuring deep liquidity. Now, to ensure deep liquidity, there have to be participants depositing funds in the protocol. If the goal is to incentivize users to deposit into the protocol, you can use game theory to build the reward system in such a way that providing liquidity is an optimal strategy for a certain type of user. This is most easily done through the token, by using it as a reward for those who deposit liquidity into the protocol, effectively incentivizing liquidity providing, while planning token distribution so emissions align with long-term adoption and depth. Given this goal and the token’s role in achieving it, it is clear that this cannot be designed with a strict maximum supply that is all initially distributed or locked, because there would be no supply left to be distributed over time. This distribution over time will, however, undoubtedly inflate the token as the supply increases. This is a very common practice nowadays and some projects give out as much as $10m each month in token emissions. Some have been able to reduce this by using other projects’ tokens as incentives. Since all tokens benefit from having more available liquidity, it is rational for projects to want to incentivize liquidity for their own token in a popular DEX. But naturally, if the perceived value of a token fails to grow as emissions grow, the token will lose its value. You have to design it in such a way that the demand will continuously absorb this selling pressure. This can be done through various mechanisms, for example by sharing part of the project’s revenue with token holders, making it a medium of exchange, or associating it with growing, real benefits. These would be a few ways to counterbalance an inflating supply, as more value would be attributed to these over time as the project grows. This is further explored in the upcoming section about demand.

Supply

There are many factors that affect the supply of a token, and these are often set up in advance and codified in the project’s smart contracts, most visibly through token distribution models and unlock schedules. When talking about the supply of a token, one normally differentiates between the initial, maximum, total, and circulating supply. The initial supply refers to the amount of tokens released in the initial launch of a token, which shapes early token distribution and market incentives. Depending on the nature and goal of the protocol, there are different ways to launch the first tokens. The maximum supply is a hard-coded limit on how many tokens will be made in total. As such, it can indicate how much inflation is left. However, it is not mandatory for projects to determine a maximum supply, in which case the token has no supply cap. The total supply is the number of tokens that have already been created subtracted by those that have been burned. This includes tokens that are locked in escrow via staking and unvested tokens held by founders and investors. Naturally, if the token has a maximum supply, the total supply will never exceed it. The circulating supply, in contrast, includes only the tokens currently circulating and not locked. It can be seen as the number of tokens that are immediately available for trade. The circulating supply plus locked tokens sum up to the total supply.

Below we explore important factors to understand supply and how it is expected to evolve.

Allocation and Token Distribution

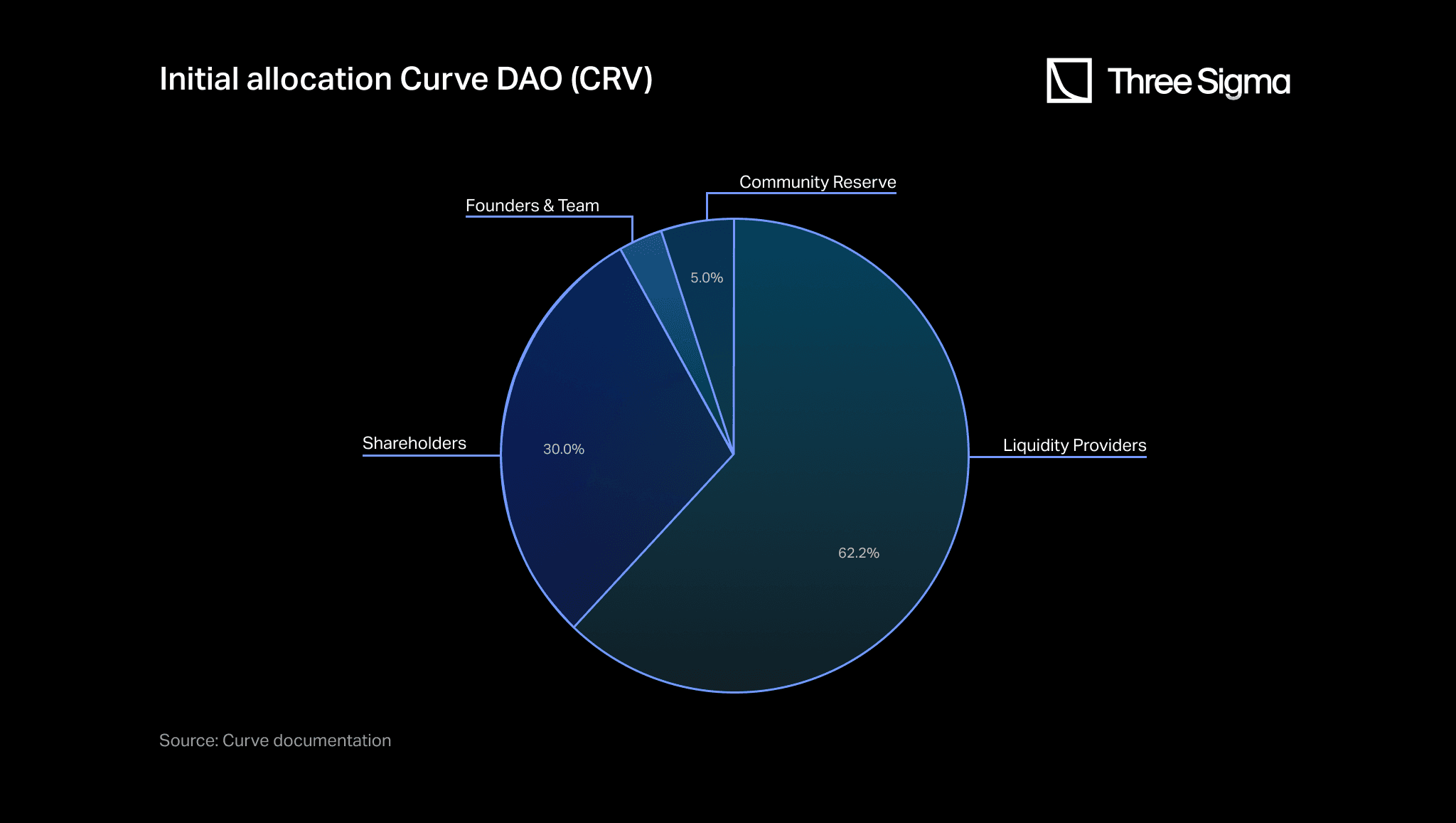

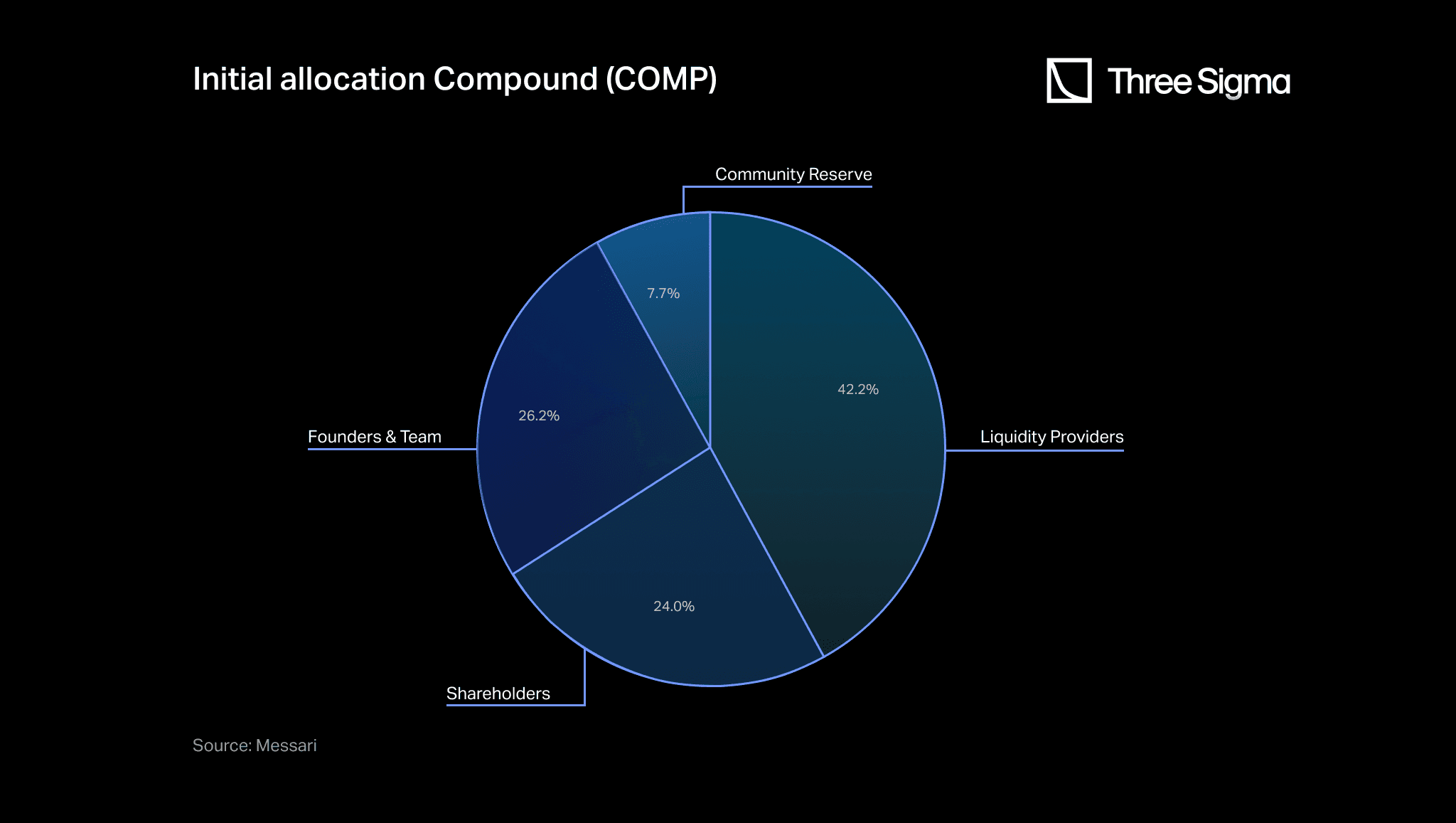

In general we can divide tokens into those that are initially allocated via a fair launch or not, since token distribution at genesis influences concentration and early price dynamics. If you chose a fair launch, the token is created via mining or another community distribution method with no prior allocation, which can result in a strong community. However, it can also be difficult to bootstrap network effects and guarantee a uniform initial distribution. In contrast, the team behind a project can have minted tokens before the public launch, retaining part for team members and investors. Selling tokens to investors allows teams to raise funds for development, although it also creates a large initial imbalance between token holders. The charts below illustrate common initial allocations through the examples COMP and CRV.

A recent paper used agent-based modeling to simulate and analyze how the concentration of governance tokens looked like post several types of fair launches. The results of this study concluded that regardless of the initial allocation, there was always token concentration. It seemed that the fair launch fell short as a mechanism to avoid concentration, as over time, independently of market conditions, the tokens still became concentrated. This is an interesting finding to consider, although it does not mean that an uncareful allocation will not have a negative impact on the token’s price in a short-medium term. There is naturally the risk that the team and investors may later sell large quantities and affect the price. This risk could partly be mitigated with mechanisms such as appropriate vesting schedules.

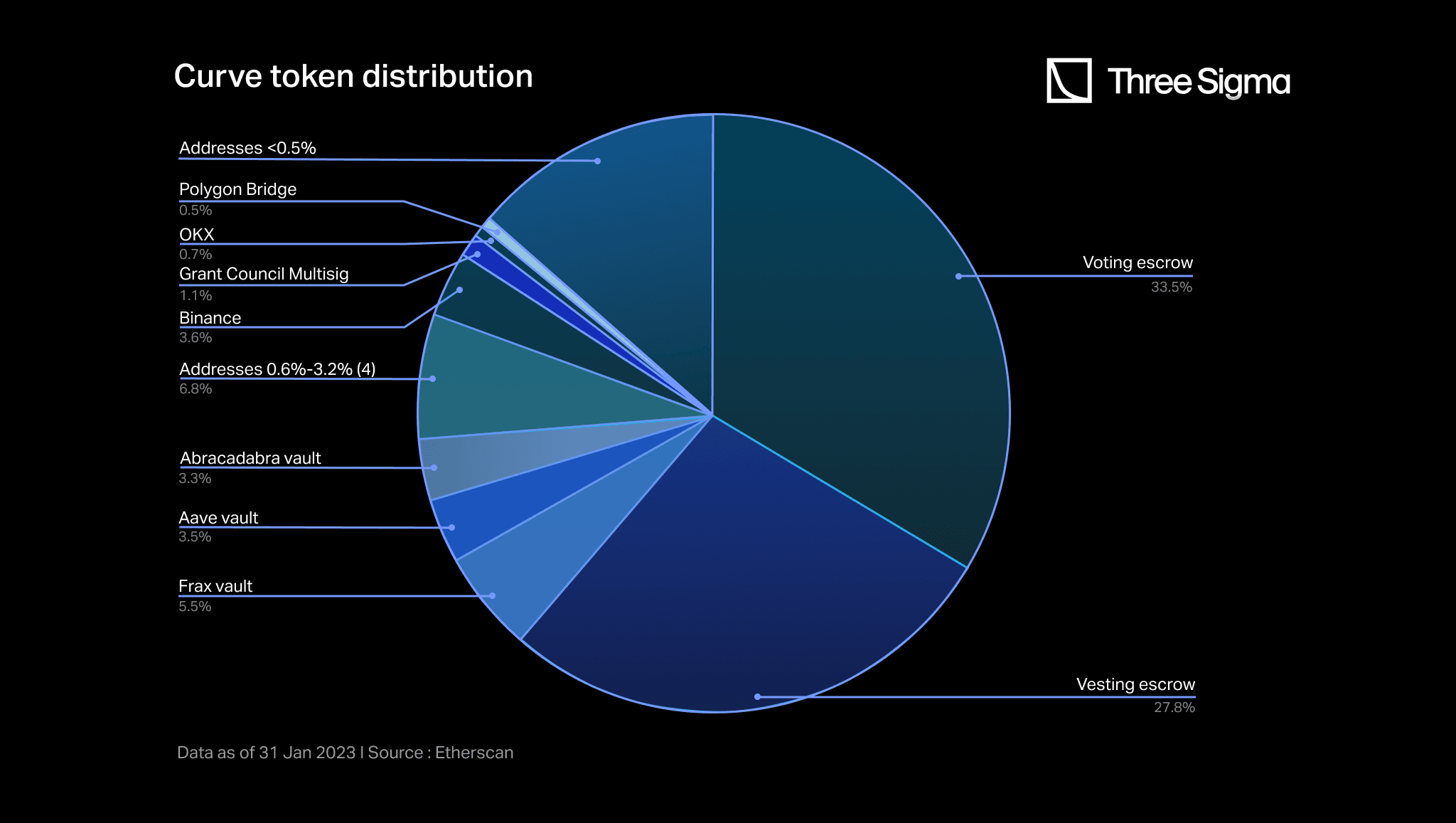

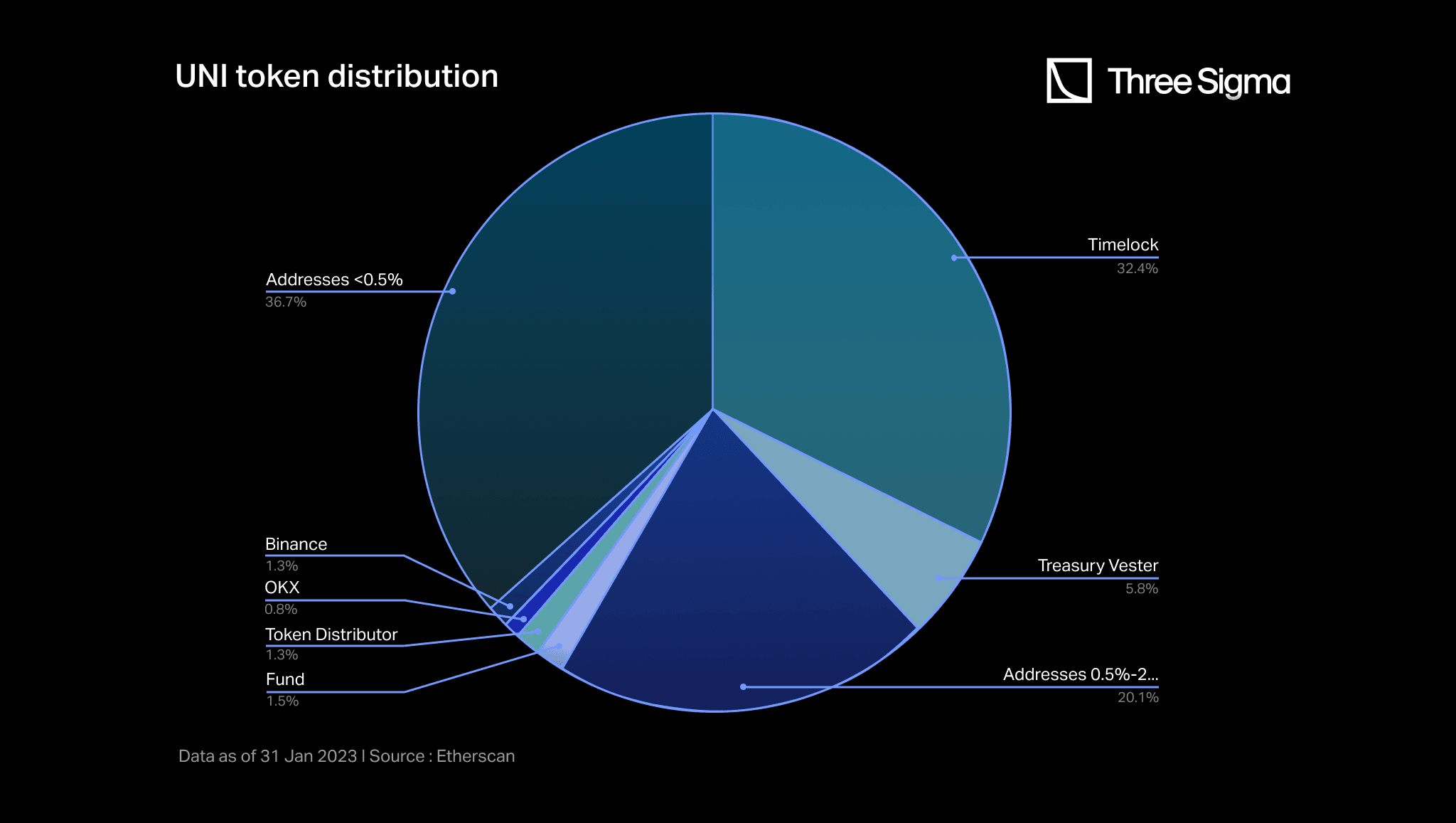

The token’s distribution refers to an analysis of who currently holds the token and in what quantity, with the goal of understanding the level of dispersion of the token, a critical part of token distribution monitoring over time. Regardless of the initial allocation, you should monitor this closely, as the presence of a few large holders can bring about the risk that they could sell and cause a decrease in price. To encourage widespread token distribution, you may employ various tactics, such as setting a per person limit for an ICO or distributing the token through airdrops to ensure broad ownership. However, these tactics are also not fail-proof, and sybil attacks have been extensively used to take advantage of them. The charts below show the token distribution of CRV and UNI. A larger part of UNI (37%) is distributed amongst addresses who hold less than 0.5% of the total supply, when compared to CRV (14%). However, most CRV is locked in voting or vesting escrow (61%), which decreases the risk of large sales.

Vesting

Vesting is the process of locking and distributing purchased tokens within a given timeframe, known as the vesting period. There is usually an initial durational lock called the cliff before tokens begin to be distributed in accordance with the specified vesting schedule, which can lock tokens typically for up to a year before they start vesting. You can choose between different types of vesting schedules, for example the distribution of tokens in equal parts within a certain period of time is known as linear vesting. The time period can be days, weeks, months or even years. The distribution of tokens in random parts within a variety of time periods is known as twisted vesting. For example, let’s say 600,000 tokens need to be vested for advisors. Under linear vesting, 50,000 tokens can be released monthly, completing the entire vesting within a year. If a 6 months cliff is added, an advisor will receive 50,000 tokens every month for consecutive 12 months, starting from the 6th month. But in twisted vesting, 25% of 600,000 tokens can be released monthly for the first 3 months and then 75% of tokens can be released followed by a 6 months cliff. By looking at current projects, you could say the norm of vesting schedules is to have tokens locked for a few months, usually between six months to a year, and then unlocking linearly for a time period between one and three years.

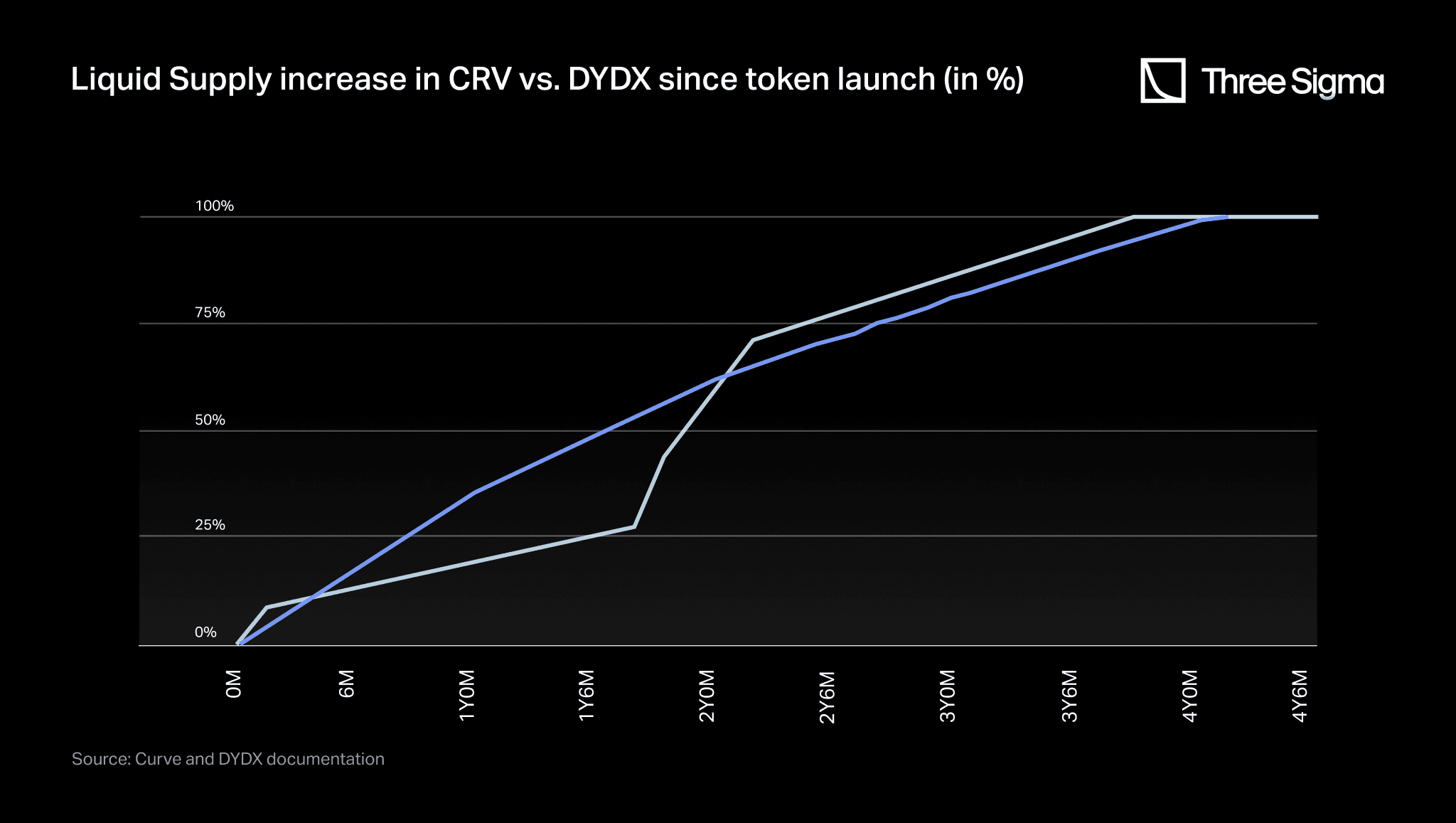

If team members and investors have a gradual vesting schedule, the risk of sudden price movements can be mitigated. On the other hand, short vesting schedules with large cliffs may cause an abrupt increase in supply, increasing the amount of tokens to be sold, which can lead to a consequent decrease in price. There are a few important choices when you consider vesting. These choices might be influenced by various factors, including the type of project, the maximum token supply and the emission schedule planned for the token. After considering the cliff, you must decide what part of the tokens is unlocked and how the next unlocks will look like. Some projects choose a constant vesting, while others go for batch like unlocks with set intervals. While it is mostly intuitive how each kind of vesting can affect the price differently, there are other factors that should be considered in conjunction with this, which we cover in our DeFi audit guide for teams designing sustainable systems. For instance, one study that compared schedules concluded that larger initial unlocks have less negative price impact than smaller initial unlocks, most likely because teams and VCs have less incentive to sell in the beginning of a project’s lifespan. The goal is naturally to find a vesting schedule that produces the least negative price impact on vesting dates and lowest token volatility over the vesting period. The chart below illustrates how different vesting schedules can look like, considering the liquid supply increase in CRV to DYDX. While CRV employed linear vesting, DYDX uses batch unlocks.

After having thought about all these factors that you can control, you have to keep in mind that all designs will also be affected by exogenous factors. The way early investors deal with the token, market sentiment, and the latest narrative are a few examples of factors that are difficult to measure but important to consider. This leads us to the concepts of market capitalization (market cap) and fully diluted valuation (FDV). The market cap of a crypto asset is its price multiplied by the amount of tokens that are currently in circulation. FDV is another valuation metric, which multiplies the price by the total amount of tokens that will ever exist. This naturally means that the market cap of a token will always be smaller than or equal to its FDV. Market cap can be thought of as an indication of demand in dollar terms (or in another currency the token was priced in). Changes in demand directly impact the price at which participants are willing to buy the token. FDV, however, increases in the same proportion when demand increases, ignoring the amount of tokens that is locked. It is perfectly possible that some token holders would rather sell than hold, but cannot exercise this as their tokens are locked. It is therefore more of a measure of supply. As a project gains traction and the token attracts more demand, it can easily exceed investors’ initial investment by twenty, fifty, hundred or more times. Take the example of a project that raises a round at a $50m valuation by selling 1% of tokens at the price of $0.01. Let’s say investors have their allocation locked for one year and in the meantime an airdrop puts 1% of the total supply in circulation. With only 1% of the tokens in circulation in a few months the market cap is at $5m, which in turn means that FDV is at $500m. This has raised the valuation by 10 times, which means tokens are now worth $0.10 and that investors are up 10 times since their initial investment. As the project keeps growing and token demand rises, the price increases 20 times, making token price $2, market cap $100m, and FDV $10b. Seed investors are up 200 times and it is very likely that investors are happy selling at a much lower price, given their initial cost. This begs the question: can investors really not capitalize on this growth while their tokens are locked? In fact they can, in over-the-counter (OTC) markets. Professional investors can trade locked tokens through legal contracts, which means they can sell their locked tokens with a discount and still make a large profit. Of course the tokens remain locked and the new buyer cannot sell them. Locked tokens can trade hands a few times, raising the price at which the last buyer can actually make a profit once they are vested. For this reason, when tokens are finally unlocked, investors’ margins can have decreased a lot. Investors might not sell upon an unlock. In turn this lack of action at a supposedly negative event can be seen as disproportionally positive - the general public will see this as “if even early investors do not want to get rid of their tokens, they must be worth more than current price”. This event effectively just removed an unknown, possibly negative, price reaction, leaving holders more confident. This should illustrate how everything is nuanced, even when looking at a seemingly direct economical relation of supply and price. Naturally, most unlocks do result in token selling, particularly when there is no OTC market or demand for the particular token. Before determining how the supply will look, when designing a token, keep in mind that the size the project is expected to grow to and the demand that you estimate to capture are enough to keep the FDV when the total supply is unlocked. You don't want to be forced to chase after enough demand just to maintain the token value.

Emissions schedule / Monetary policy

Many protocols have a built-in mechanism for increasing the circulating supply, which is often referred to as inflation or emissions. You can do this to incentivize and reward activity such as validation and liquidity providing, but ensure emissions and token distribution cadence fit sustainable crypto economics validated by economic audits. The emissions rate can vary depending on the design of the protocol and can be either fixed or variable. This can be referred to as the mint rate, which is the rate at which new tokens are created. This rate helps determine future inflation of the token. If a token has no maximum supply, you can mint new tokens endlessly, while a token with a maximum supply will have a mint rate for the duration of time between their initial launch and the moment they achieve maximum supply of tokens in the ecosystem.

Additionally, you may also employ mechanisms to counter emissions and reduce the circulating supply, such as token burning or staking, supported by staking design review to keep incentives aligned. Staking requires locking tokens in a smart contract in exchange for benefits such as a share of protocol revenue or the ability to participate in community governance. Token burning is when tokens are removed from circulation permanently and can be based on factors such as fees, price, or timing. The rate at which tokens are destroyed is referred to as the burn rate. Whenever a project finds it appropriate, they may choose to burn a portion of tokens to decrease the supply and benefit token holders through positive price movement. A protocol may also burn tokens or increase burn rate to counter a previous inflationary nature of the token economy.

While in a centralized ecosystem mint and burn rates are decided by the central authority, in a decentralized ecosystem these are often decided by on-chain governance votes utilizing governance tokens held by users.

For example, BNB adopts coin burning to remove coins from circulation and reduce the total supply of its token. With 200 million BNB pre-mined, BNB’s total supply was 157,903,320 as of January 2023. BNB will burn more coins until 50% of the total supply is destroyed, which means BNB’s total supply will be reduced to 100 million BNB. Previously, these burns were periodic, based on the BNB trading volume on the Binance exchange, but it often happened that these buys were frontrun. A new burning mechanism was introduced through the BEP-95 in November 2021, adding a real-time burning mechanism to the BNB Chain. The smart contract automatically burns a portion of the gas fees collected by validators from each block. As more people use the BNB Chain, more BNB will be burned, effectively accelerating the burning process. As BEP-95 is solely dependent on the BNB Chain network, it will continue to burn BNB even after the 100 million burn target has been reached. Binance also introduced the auto burn to replace the quarterly burn, which is a mechanism that will automatically adjust the amount of BNB to be burned based on the price and the number of blocks generated on the BNB Chain during the quarter. Once the total circulating supply of BNB falls below 100 million, the BNB Auto-Burn will stop. This illustrates how different burn mechanisms can be and how you should choose them according to the project’s needs and ecosystem.

Remarks on the supply side

It will always come back to the behaviors that you want to incentivize and the equilibrium between supply and demand. Even though a lower supply can generally make a token's value increase, supply-side tokenomics is not always about taking tokens out of circulation. Instead, it should focus on meeting demand to support and improve protocol goals. For example for a protocol that is trying to grow activity, a token with a rapidly deflating supply could cause token holders to only hold, anticipating a price increase. The protocol would be incentivizing behavior detrimental to its goal. Protocols such as proof-of-stake blockchains intentionally inflate their currencies in part to encourage network validators to join and decentralize the network.

Therefore, the best supply-side tokenomics is the one that seeks to match its demand. Generally, a token that has a large percentage of its maximum supply already circulating, with steady and predictable inflation to encourage usage, a fair launch or pre-mine with a gradual and lengthy vesting schedule, a high allocation for community ownership, and a well-diversified distribution with no overly large holders, is well-positioned to steadily absorb demand as it grows over time.

Read part 2 of this article to understand the mechanisms that drive the demand for a token and how to balance both sides of the scale.

The way tokens enter circulation impacts everything from staking behavior to market cap. Our DeFi Ecosystem Strategic RD service helps teams design emissions schedules, vesting flows, and liquidity programs that support long-term sustainability.

Sources & References

- Rosic, A. (2020). What is Cryptocurrency Game Theory: A Basic introduction. Retrieved fromhttps://blockgeeks.com/guides/cryptocurrency-game-theory/

- Fernando, J. (2023). Law of Supply and Demand in Economics: How It Works. Retrieved from https://www.investopedia.com/terms/l/law-of-supply-demand.asp

- Supply and demand. Retrieved from https://www.britannica.com/topic/supply-and-demand

- Fernandez, J., Barbereau, T. and Papageorgiou, O. (2022). Agent-based Model of Initial Token Allocations: Evaluating Wealth Concentration in Fair Launches. https://doi.org/10.48550/arXiv.2208.10271

- Stephanian, L. (2022). Optimal vesting structure. Retrieved from https://unlockscalendar.substack.com/p/optimal-vesting-structure

- Shahzad, I. (2022). Token Vesting: The Complete Guide to Creating Vesting in Tokenomics. Retrieved from https://medium.com/coinmonks/token-vesting-the-complete-guide-to-creating-vesting-in-tokenomics-bf211b999f2f

- Cobie. (2021). On the meme of market caps & unlocks. Retrieved from https://cobie.substack.com/p/on-the-meme-of-market-caps-and-unlocks?utm_source=%2Fsearch%2Fbullish%2520unlock&utm_medium=reader2

- What Is BNB Auto-Burn? (2022). Retrieved from https://academy.binance.com/en/articles/what-is-bnb-auto-burn

Economic Modeler

Carolina is a data analyst with a Master’s degree in analysis and engineering of big data and a background in mathematics applied to economics and management. She has experience working on optimization problems, leveraging statistics to produce simulations and extract valuable insights. She joined Three Sigma with a continued passion for finding knowledge in data and an interest in improving the blockchain industry by contributing to its sustainable development. Outside of work, Carolina enjoys traveling and immersing herself in foreign environments.

Economic Modeler

Joana has a Master’s degree in finance and a background in mathematics applied to economics and management. She has spent the past three years working at a private equity company, becoming familiar with traditional finance concepts and honing her analytical skills. The opportunity to blend her mathematical expertise with her finance background is what initially sparked her interest in the blockchain field. Joana joined Three Sigma with a strong eagerness to make a valuable contribution to the world of decentralized finance, which she excitedly believes has great potential. In her free time, Joana enjoys traveling and engaging in sports.