Introduction

Within the derivatives space, perpetuals have proven to be far more popular than options, gaining traction across retail and institutional markets. The overall trading volume of BTC-perps has grown from roughly $3 billion per day at the beginning of 2020 to $13 billion by 2023.

This series of articles aims to provide an overview of the current DeFi Perpetuals space and compare different protocols, with a focus on how they work rather than their potential as an investment vehicle.

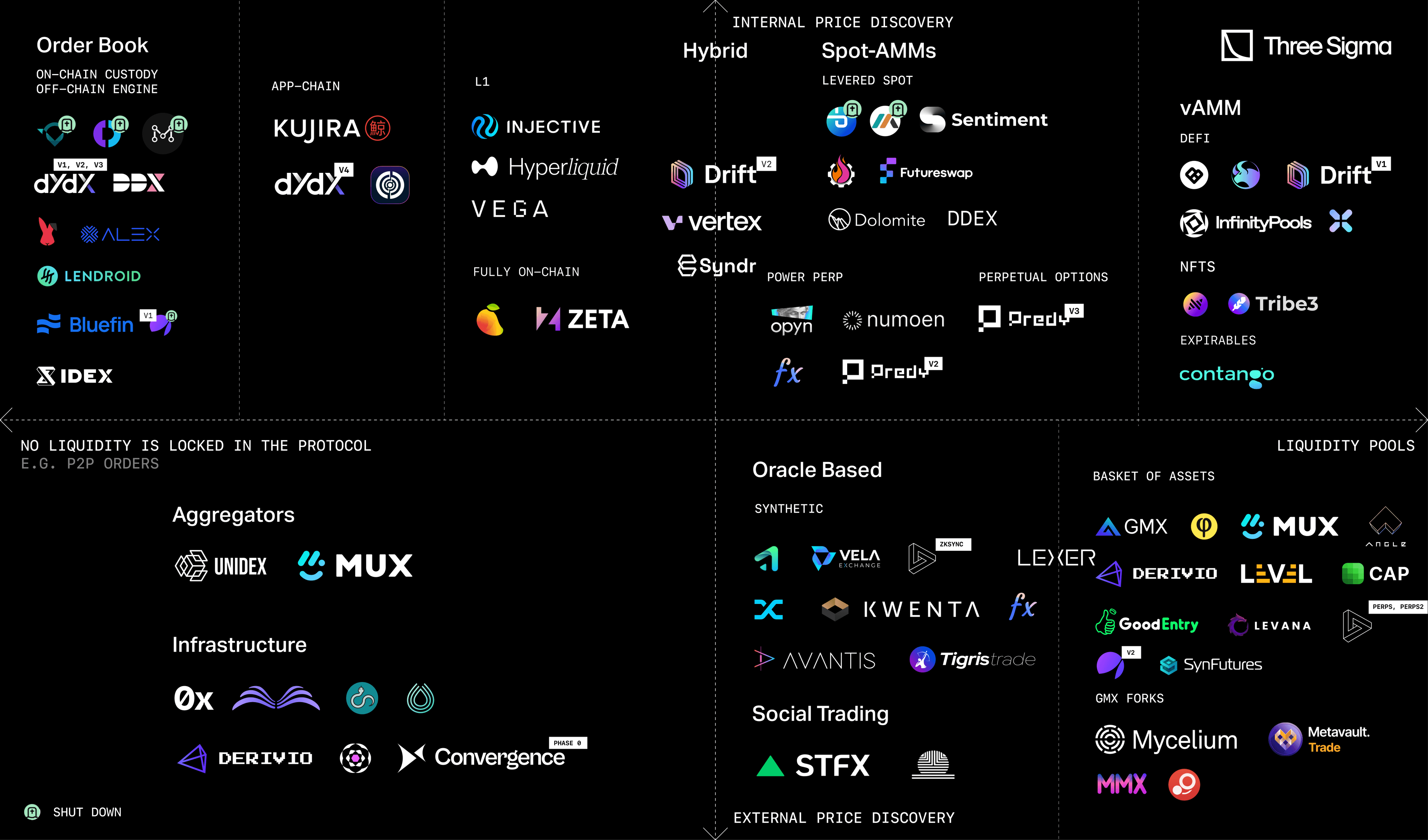

The following 60+ protocols have been considered in this analysis:

0x Protocol, Alex, Angle, Apollo, Avantis, BlueFin, bZx, Cap, Contango, ConvergenceRFQ, DDEX, DDX, Deri, Derivio, Digitex, Dolomite, Drift, dYdX, Futureswap, Gains Network, Gearbox, GMX, GMX Forks, Good Entry, Hubble, Hyperliquid, IDEX, Increment, InfinityPool, Injective, Kujira, Kwenta, Lendroid, Levana, Level, Lexer, Mango, MarketProtocol, MCDEX, Mux, NFTperp, Numoen, OpenBook, Opyn (Squeeth), Perennial, Perpetual Protocol, Perpy, Pika, Polynomial, Predy, RabbitX, RageTrade, Sentiment, Serum, STFX, Syndr, Synfutures Protocol, Synthetix, Tigris Trade, Tribe3, Unidex, Variabl, Vega, Vela, Vertex, Vyper, and Zeta Markets.

In this first article, we will begin with a brief recap of perpetual futures, followed by a broad categorization of the aforementioned protocols. Building upon this categorization, we will delve into the distinctions between these protocols, exploring the trade-offs they make in liquidity provision and contract pricing approaches.

Recap on Perpetuals

In this section, you can find a brief introduction to perpetuals. If you're already familiar with the topic, you can skip this part.

- A futures contract is a legal agreement to buy or sell a particular commodity, asset, or security at a predetermined price at a specified time in the future. Unlike options, there is no optionality. The agreement is binding.

- Perpetuals are a subset of futures without expiration, hence their name. Perpetuals were conceptually introduced in 1992 by Robert Shiller and BitMEX first implemented perpetual contracts in 2016.

Perpetuals are delta-one products, meaning that for every $1 movement in the underlying, the contract price also changes $1. For example, consider that ETH is being traded at $2000. You open a perpetual-long position with a notional value of 1 ETH. After some time, if ETH reaches $2200, the profit would amount to 1 ETH * ($2200 - $2000) = $200 minus trading fees and the funding rate.

This offers traders the ability to speculate on the price movement of assets without worrying about the time horizon. Traders can keep their long or short positions open for as long as they want. The caveat for traders is that they need to pay fees, and in cases where leverage is used, an eye needs to be kept on the health of the position at the risk of liquidation.

In the majority of perpetuals protocols, liquidations are a component of critical importance as the accumulation of bad debt can bankrupt the protocol and/or liquidity providers (LPs). Funding rates or borrowing rates—the nomenclature depends on the protocol—are implemented as a means to foster market efficiency, facilitate arbitrage opportunities, and provide compensation for participants assuming less popular positions to balance the open interest (OI).

Classification of Perpetual Protocols

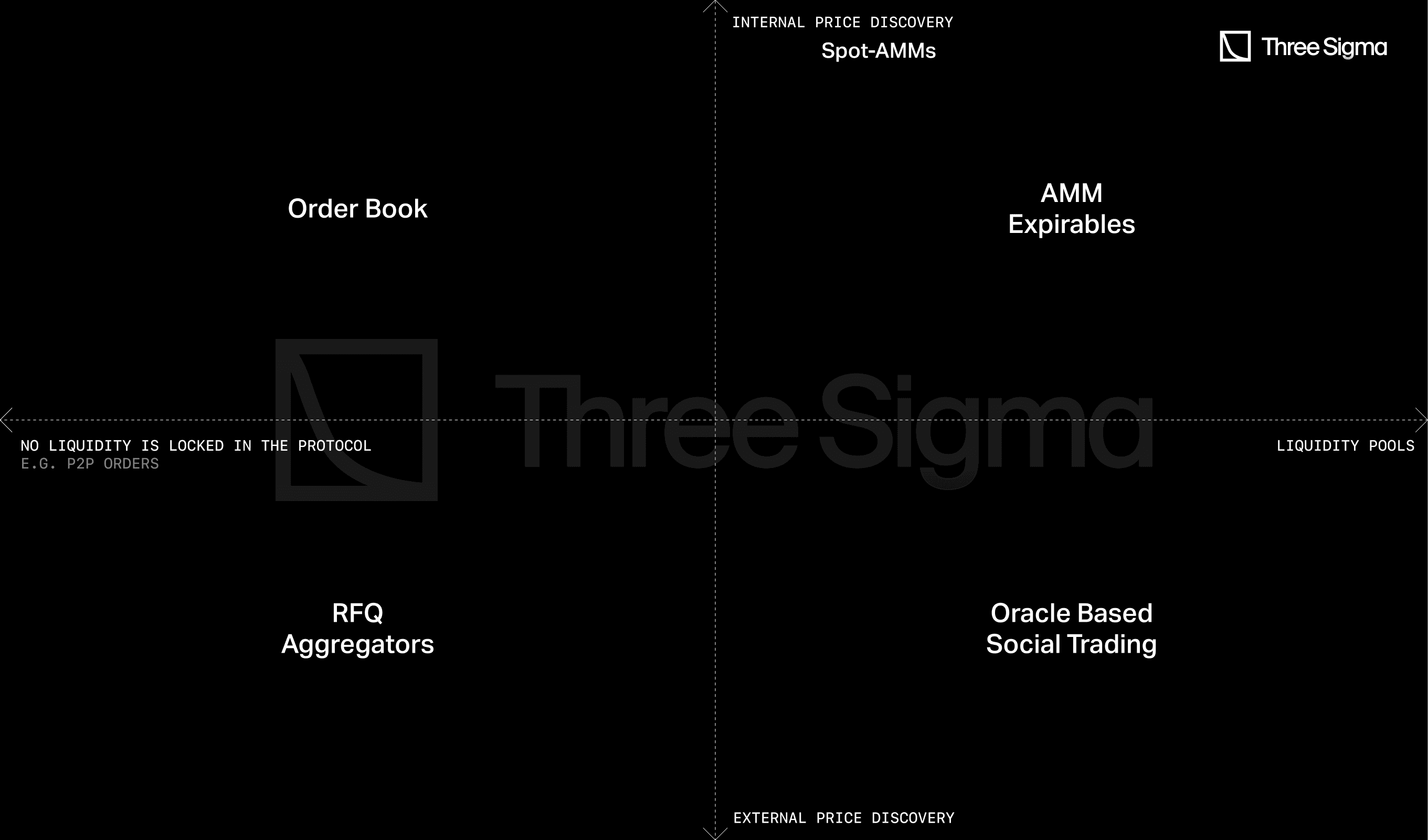

A very broad classification can be done based on two main variables.

- Does the protocol need to have liquidity locked into it? Think of it as: are there liquidity pools, or is it completely peer-to-peer (P2P)?

- Does the protocol have a direct impact on the market, thus leading to or impacting the price discovery of the underlying or contract? Or is the protocol using an oracle to retrieve the fair prices of the assets?

Based on that, we can lay out this basic—probably simplistic—categorization.

Classification matrix for perpetual protocols based on two key criteria: 1) External Price Discovery vs Internal (Oracles vs Oracleless) and 2) No liquidity is locked vs Liquidity Pools (P2P vs P2Pool)

Source. Own creation.

We will use this grouping by type of Liquidity Provision and Pricing Mechanism later in the Protocol Breakdown section of the article to dive deeper into the different ways protocols offer perpetual contracts.

Order Book

In this section, we can find the following protocols:

- Alex, Apollo, Blue Fin (former Firefly Exchange), DDX, Digitex, dYdX, Hubble, Hyperliquid, IDEX, Injective, Kujira, Lendroid, Mango, Market Protocol, RabbitX, Variabl, Vega, and Zeta.

AMM Based

In this section, we can find the following protocols:

AMMs

- Leveraged Spot: bZx, DDEX, Dolomite, Futureswap, MCDEX

- Leveraged Accounts: Gearbox, Sentiment

- Power Perpetuals: Deri, Numoen, Opyn (Squeeth), Polynomial, and Predy v2.

- Perpetual Options: Predy v3.

Virtual AMMs

- Drift, Increment, InfinityPools, NFTperp, Perpetual Protocol, Rage Trade, and Tribe3.

While Predy and InfinityPools are both building “Perpetual Options” or perpetuals using concentrated liquidity from an AMM, please note that they are implementing it in different ways, hence they’re in different categories. In our previous series on DeFi options, we covered various protocols that were building on this same concept but are more focused on offering options-alike experience, like Gamma Swap, Panoptic, or Smilee.

Oracle Based

In this section, we can find the following protocols:

Synthetic Liquidity

- Avantis, Gains Network, Deri, Synthetix (Kwenta, Polynomial, etc.), Tigris Trade, and Vela.

Basket of Assets

- Angle, Apollo V2, Cap, Deri, Derivio, GMX and its forks, Good Entry, Levana, Level, Lexer, Mux, Pika, and Synfutures Protocol.

Others

These protocols do not necessarily fit in the categories above and/or are better included in an exclusive category. As such, they were listed here for completion purposes, but the rest of this article will focus on the categories mentioned above.

Aggregators

In this section, we can find the following protocols:

- UniDEX and MUX.

Similar to spot aggregators like 1inch, Matcha, or DeFillamaSwap. These protocols compare fees and prices across perpetual venues to open the trade in the most favorable venue.

Social Trading <> Copy Trading

In this section, we can find the following protocols:

- Perpy and SFTX.

They let users copy-trade each other on other platforms. For example, a trader would place trades on GMX and other users would copy the same trades.

Infrastructure

Protocols that allow other protocols to build on top of them.

- 0x, Serum, OpenBook allow for protocols to launch order book platforms.

- Vyper, Derivio, Perennial, and Convergence RFQ have a bit more case-specific solutions. In general, they can be seen as a base layer upon which other protocols can build their own markets.

To briefly build on RFQ. RFQ stands for Request for Quote, where typically a traders request quotes and market makers respond with offers for that specific instrument/asset/quantity/etc.

Expirables

Contango offers expirables. That is neither perpetual—since obviously they expire—nor forwards. Contango doesn’t have an order book or liquidity pools. When a position is opened, Contango borrows on the fixed-rate market, swaps on the spot market, and then lends back on the fixed-rate market. Trading pairs based on the assets available at fixed-rate money markets like Yield or Notional. At maturity, the contract can either be settled in cash or physically delivered. More can be read about it here.

Market Analysis of Perpetual Protocols

The overview of the market is:

Aggregated DeFi Perpetuals Landscape

Source. Own Creation.

It is important to acknowledge that our research is subject to survivorship bias. Nonetheless, we have focused on including the aforementioned protocols despite their varying levels of success.

Before we dive deeper into the different archetypes of protocols doing perpetuals, two important considerations related to on-chain derivatives are regulatory uncertainty and the historical pre-DeFi landscape.

Regulatory uncertainty surrounds on-chain derivatives. They have faced regulatory challenges that have impacted the market. Two significant cases can be brought up to highlight this.

- Digitex, December 2017. Encountered regulatory scrutiny when it was sued by the Commodity Futures Trading Commission (CFTC) for operating an illegal commodities futures trading platform. Link.

- bZx or bZeroX (Fulcrum Trade), June 2019. The history of bZx is more convoluted than Digitex. In part as it got rekt 4 times (Link). The protocol was managed by Ooki DAO. The CFTC charged the founders and the Ooki DAO for offering illegal off-exchange digital asset trading. Link.

Pre-DeFi Summer 2020, not a lot was happening on-chain and some of the ones that were working before this didn't get to see the light at the end of the tunnel.

- VariabL, Q4 2017. Last update on the blog on Q2-2018. VariabL was a Derivatives Trading Platform built on Ethereum by ConsenSys. More information can be found here.

- Market Protocol. Last update on Twitter on December 2019.

Order Book

The goal of an order book is to fully allow P2P on-chain trading. The main issue, however, is that most popular blockchains are not suited to having a fully on-chain order book.

Therefore, different solutions are adopted.

1) Add parts of the system off-chain. Mostly the matching engine, as it is the most resource-intensive (computationally expensive) component for an order book.

2) Fully on-chain. Move to an alt layer, like Solana, where, in exchange for less security in the underlying blockchain, the throughput is higher. Updates in the order book can happen every block, or every half a second.

3) Become your own layer. There are two ways of doing this: by becoming an app-chain building on the OP stack or Cosmos or by building your standalone L1 from scratch. We’re not going to reinvent the wheel. Read this article to better understand the trade-offs.

Each of them has pros and cons. For example, moving parts of the application off-chain introduces trust assumptions. Deploying on a less secure layer in exchange for faster throughput and less decentralization on the underlying chain. App chains can offer protocols to capture MEV at the expense of having more permissioned settings and adding a layer of friction.

AMMs

In contrast with order books, where orders are settled P2P, AMMs need liquidity to be locked within the protocol in liquidity pools. The key difference between AMMs and vAMMs is that AMMs need real liquidity, while the liquidity for vAMMs comes directly from a vault sitting outside of the vAMM, therefore not necessarily needing the existence of LPs.

Spot-AMMs

In this context, while AMMs are not perpetual futures, they are included as they allow traders to have a Delta=1 exposure to the underlying with leverage via borrowing funds.

However, there are some advantages to this type of protocol.

AMMs like Uniswap, provide the flexibility to trade a wide range of assets as long as there is a liquid market available. In turn, this allows traders to access assets on leverage that may not be eligible on other perpetual futures protocols. Additionally, using liquidity already contained in spot-AMMs ensures continuous liquidity to match buy and sell orders, which in turn helps with the price discovery of the asset.

Nonetheless, there are some trade-offs. In order to allow traders to get access to this leverage, it is necessary to incentivize lenders to deposit with attractive yields and/or rewards. Additionally, while we mention that by using spot markets, potentially all assets can be traded, there also needs to be—to an extent—a permissioned system in order to avoid users losing lenders’ funds on honeypots, rugs, etc.

It follows that since LPs are not direct counterparties of traders, they avoid the risk of insolvency. Yet this comes at the trade-off of becoming a lender for traders and taking credit risk.

Regarding power perpetuals, they were introduced by Paradigm in 2021. Opyn (SQUEETH) was the first team to implement them. In short, they have a n^x payoff, for example, ETH².

vAMMs

The vAMMs provide a decoupled market structure, facilitating independent price discovery from the underlying spot price. This can lead to discrepancies between the futures price and the spot price of the asset, which can lead to arbitrage opportunities. On the other hand, what is the real price of the perpetual contract?

Another challenge for vAMMs is liquidity. The lack of deep liquidity can trigger unexpected or undesirable price movements when opening/closing positions.

The vAMM model relies on liquidating positions and maintaining a balanced open interest to keep the mark price close to the spot price. However, this creates inherent imbalances and skews that grow over time, particularly during market meltdowns or extreme market movements.

Oracle-Based

In very broad terms, oracle-based protocols can be defined as protocols in which there’s a liquidity pool that acts as a counterparty for trades. In contrast with AMMs, there’s no price discovery within the protocols themselves, as an oracle is used to price the underlying asset from other venues.

We can find two archetypes of oracle-based perps.

- Synthetic Liquidity. A single asset serves as the foundation for all trading markets. By using an oracle, LPs can become the counterparty to all those markets.

- Basket of Assets. A basket of assets is used as a counterparty. That is, in a hypothetical BTC/USDC, BTC collateralizes longs, and USDC the shorts. More assets can be added, but this is the general rationale.

Synthetic. They have the advantage that, given that a single asset is the counterparty, there are no real restrictions on what markets can be added or not. As long as there’s a sufficiently reliable oracle. This allows protocols to be more flexible with the markets that are added. However, this makes it riskier for LPs, as they are taking exposures to certain assets that are not possible to hedge on-chain. For example, being a counterparty for gold or USD/JPY. On the bright side, there’s no unexpected impermanent loss, assuming that a basket of assets would keep a 50%-dollar-balance in the pool, giving a similar impermanent loss profile to Uniswap V2.

An advantage offered by the protocols using a basket of assets to LPs is a more rigid setting, which can be advantageous for risk management (volatile assets back longs and stable shorts, so even if there are wild price movements, the system remains collateralized). This comes at the expense of traders, who do not have that many markets to trade in. For example, in GMX v1 you can only trade five assets. However, a very valid counterargument or question is whether most traders actually want to access markets beyond BTC and ETH. Trading volume data broken down by asset can be found here. A quick glance at the data shows that for Gains Network 50~70% of the volume was generated on BTC and ETH and for Kwenta around 40 to 80%. We chose to highlight these two as they have a wide range of markets available.

Protocol Breakdown

As we transition from the market overview in the previous section, the focus now turns to exploring the different parts into which protocols can be broken down. In this article, Liquidity Provision and Pricing are covered.

Liquidity Provision

We can broadly categorize them into two groups from the protocol’s perspectives:

- P2P Trading. So there’s no need to have liquidity locked in the platform (TVL=0).

- Liquidity Pools. Trading through AMMs, vAMMs, or Oracles.

The topics covered in this section are:

- Liquidity mechanisms in decentralized protocols. Who’s the counterparty of traders? - Role of liquidity providers and incentives - Balancing liquidity across different assets and markets

Order books

Plain and simple, makers and takers trade against each other. Protocols might incentivize the maker/taker flow.

For protocols, the complex task is how to match the makers’ and takers’ orders in a timely manner. For example, according to this report from May 2023 from the Deutsche Börse Group, participants react in less than 2770 nanoseconds. Could this be handled by a generalistic chain like Ethereum right now? The answer is no.

This forces protocols to either move off-chain or to a dApp forcing validators to also run the order book. It follows that liquidity providers are active agents interacting with other agents. There’s no real barrier stopping order books from listing shitcoins, beyond the fact that market makers won’t probably be market-making for HarryPotterObamaSonic10Inu.

Spot AMMs

Here, the liquidity to settle trades comes from AMMs like Uniswap. Nonetheless, the protocols themselves need to incentivize lenders to come, given that they’re the ones facilitating the leverage for traders. Sentiment and Gearbox, while allowing users to do more things, they’re also in this category. Liquidity providers are rather passive actors who “just” provide leverage.

Power Perpetuals

Power Perpetuals, like SQUEETH, consist of two participants. The ones who are long on ETH², thus long on convexity. And the ones short on ETH², thus short on convexity. It’s not possible to generalize the design, given that each protocol follows a different design. For example:

- In Opyn the short side mints the power perpetual with ETH as collateral. Long traders can only buy SQUEETH in the open market, in an AMM like Uniswap. So it follows that to profit, they also need to be able to sell.

- In Numoen it is the long side that mints the tokens, while LPs provide LP tokens as collateral—they lend out the LP tokens to traders.

- Deri uses a single liquidity pool as a counterparty for all derivatives, including power perpetuals. Therefore, while included here, their liquidity model is essentially the same as oracle-based protocols.

- Polynomial has not yet released its model, but the team indicated it will be using a liquidity pool in a different way than its competitors.

vAMMs

vAMMs utilize various approaches when it comes to liquidity provision

- Perpetual Protocol and those built following their model, like NftPerp. In theory, you don’t really need liquidity providers here, given that the vAMM mints virtual tokens, a counterparty is not needed. And what happens if there's no counterparty? That’s why on Perp v1—at least for some time—the team was one of the major LPs given they were market-making to facilitate the trades. Later on, liquidity providers were introduced, and while it would still be preferred to match longs to shorts, by introducing LPs, there’s a counterparty ensuring continuous liquidity. It follows that in this model, liquidity providers can be both passive, i.e., you provide liquidity, and traders figure it out, or more active, arb’ing prices and collecting funding fees.

- Increment follows a similar model to Perpetual Protocol, but instead of using Uniswap v3 model, it concentrates liquidity by leveraging Curve’s V2 math. Each pool in the protocol might use a different parametrization based on the volatility of the pooled asets.

- Rage Trade. Introduced the concept of “omnichain recycled liquidity.” What’s this? Recycled liquidity is a vault with an 80-20 split of the liquidity, where 80% of the liquidity is redeployed to provide liquidity on Curve, while the other 20% provides concentrated liquidity—thus powered by Uni v3—on Rage Trade. The virtual liquidity of the vAMM is backed by the 80-20 vault.

- InfinityPools. Achieves its liquidity by being built upon the Uniswap V3 concentrated liquidity concept. By rebalancing Uniswap-alike liquidity positions, it can achieve very substantial leverage without liquidation downside. For example, LP deposits $1000 worth of assets in an ETH/USDC pool in the 900-1000 range. A trader then would borrow that LP position and redeem all liquidity for 1 ETH (1ETH = $1000).

- Drift V1. Drift used a virtual AMM—named dynamic virtual AMM DAMM—where the liquidity source was the LPs on Drift. The AMM implemented a set of parameters to fine-tune the market depth. Such as a price multiplier, fee pool, or tranches. More can be read about it here. The Drift V1 AMM is now part of Drift V2.

Hybrid: AMM + Order Book

A potential problem on order books is: what if there are no makers who show up to post bids/asks? For this reason, some protocols introduced a hybrid model between order books and AMM to ensure continuous liquidity.

- Drift v2 uses three different liquidity mechanisms. First, a Just-In-Time (JIT) dutch-auction, provided by market makers. This lasts around 5 seconds. Second, there’s a Limit Order Book, which only executes limit orders and is run by a network of keeper bots. Third, there’s a constant-product AMM—Drift V1 AMM—if no makers step in the previous two steps to ensure there’s constant liquidity for traders.

- Vertex uses a price/time priority algorithm, so orders will be executed based on the best price regardless of whether it's the AMM or a market maker making the price. The AMM essentially quotes bids and asks as it places discrete price levels to approximate xy=k on the order book.

- Syndr combines an off-chain order book with liquidity pools deployed on a L3 built on Arbitrum. The AMM will consolidate the liqudity provided by retail, while the order book is aimed for market makers to provide quotes.

Oracle-based. Synthetic.

Liquidity provision is fairly straightforward. A vault that acts as the counterparty for all trades. While the main LPs are providing liquidity passively, we can also identify active agents who aim to farm the funding rates. By doing so, they balance the OI of the platform, which in turn lets more trades happen.

The liquidity of the vaults can be provided with:

- USD-denominated stablecoins, like Avantis, Gains Network, Deri on zkSync, and Tigris Trade, where—depending on the protocol—a pool of DAI, USDC, or USDT backs all trades. Another differentiator for protocols is whether they’ve implemented a tranching mechanism like Avantis or not.

- Volatile asset. For example, Kwenta & others are built on top of Synthetix, where SNX stakers are the counterparty.

Oracle-based. Basket of Assets.

Same main idea as above, but instead of a single asset being the foundation, there are one or more baskets of assets

- Similar to the previous section, protocols can also have tranching mechanism—Level—or not—GMX, Pika, and MUX.

- While Angle is here, the feature was wound down due to the Euler hack. A brief summary of it is that Angle is the issuer of agEUR (Euro stablecoin). The collateral assets used to mint agEUR are used as counterparties for traders. So someone who brings 1 ETH gets 1000 agEUR, can long ETH and short the EUR and this makes the protocol neutral. This also allowed Angle to have perpetuals on forex, like agEUR/USDT pairs.

- A special mention here goes to Lexer Markets, who uses both a basket of assets and synthetic liquidity as liquidity.

Price Discovery

We can broadly classify protocols based on whether price discovery occurs within the protocol or outside of it and is subsequently broadcasted through an oracle.

The topics covered in this section are:

- Price discovery methods - Price slippage - Settlement

Order books

As order books facilitate P2P trading, where buyers’ bids and sellers’ asks interact, it creates a marketplace for price discovery and trade execution. The protocol allows traders to execute trades at any price, eliminating the need for an oracle in this setting.

Slippage exists as an order might be too large to be filled at a particular price and can also be read as there’s not enough liquidity at that level, so the order pushes the price to less favorable execution prices.

The settlement process in order book trading involves two agents, makers and takers. Makers place limit orders on the order book, while takers are traders who accept and execute existing orders from the order book. The settlement occurs when a taker's market order matches a maker's limit order, resulting in a trade.

Funding rates exist to balance long and short positions but also to keep the price of the derivative contract close to the underlying.

Spot AMMs

Price discovery takes place outside of the platform. As these protocols integrate into spot-AMMs or DEX aggregators, trades occur on Uniswap, Curve, etc. So the price discovery is bound to the number of venues that are integrated as well as the liquidity within those venues.

Oracles are important to Spot AMMs mostly to ensure the best price execution for their buyers and sellers. Oracles are also used to keep track of the health of their positions; more on this will be detailed in the risk section.

Settlement occurs against (or with) the liquidity that is present on the AMMs where trades are being executed. However, it is important to note that two trades need to actually happen: when the position is opened, the asset is bought/sold on margin, and when the position is closed, the asset is then sold/bought on the market.

There is no funding fee because there’s no derivative price. However, in order to trade on margin, users must pay a borrowing rate to the lenders.

vAMMs

In very broad terms, we can group all vAMMs under the same umbrella, excluding InfinityPools. vAMMs will face slippage within their virtual liquidity reserves. Trades are settled against the assets used to mint the virtual liquidity.

- Perp Protocol, Rage Trade, Drift, and similar protocols based on Uniswap V3. The index price is tracked via oracles; for example, Chainlink is used in Rage Trade. The mark price is independently discovered via the open market for each particular perpetual contract. Each vAMM might implement different twists regarding how they manage to converge between the virtual (market) price and the index price. For example, Drift updates the quote asset reserves or the k-factor (xy=k).

- Infinity Pools. Built on top of the Uniswap V3 concept, by rebalancing the liquidity positions in their vAMM can achieve very substantial leverage without liquidation downside.

- A LP deposits $1000 worth of assets in an ETH/USDC pool in the 900-1000 range.

- The trader borrows and redeems all liquidity for 1 ETH (1ETH = $1000) and has $100 as collateral. This gives the following three scenarios based on the price of ETH.

- If 1 ETH > $1000 → Profit for the traders. The profit is the difference between ETH-Spot and $1000.

- If $1000 > 1 ETH > $900 → The trader account will be Collateral + 1 ETH. which, at any point in time, will be equal to or greater than $1000. The worst case being $901 in ETH + $99 in collateral.

- If 1 ETH < $900. The whole capital of the trader would be converted to ETH. There’s no “risk” for the LP, as if it were on Uniswap, their whole LP would be ETH. In this particular example, the trader would have 1.11 ETH collateral on its 1 ETH position.

Hybrid: AMM + Order Book

A mixture of an order book and an AMM.

- Drift V2 has a quite clear pricing approach. The trade is first priced by an auction, then by the order book, and lastly by the AMM.

- Vertex will use either the order book or the AMM to quote the users. At the moment, market makers quote tighter levels for the most part, but it's conceivable that the AMM quotes tighter markets if it scales significantly.

- On Syndr the AMM part is working similarly to a GMX/GLP pool, but will include a bid/ask spread.

Oracle-based. Synthetic & Basket of Assets.

These protocols use an oracle, hence the name, to determine the price at which the contract is trading. In turn, oracles determine the price of an asset through different methods, for example, just a TWAP of the Uniswap price (not great) or aggregating the price on most liquid CEXs (mostly Binance). To further illustrate this:

- Gains Network. Price is relayed by a network of bots—semi-permissioned, as bots need to hold an NFT to do so. Bots use Chainlink asset prices when executing Limit, Stop Limit, Take Profit, Stop Loss, and Liquidation orders.

- GMX. GMX v1 uses a combination of a custom price feed and CEXs like Binance, and Chainlink. If the fast price is older than 5 minutes, only the Chainlink price will be considered. For GMX v2 a new low-latency oracle by Chainlink is set to be implemented. The oracle keepers are run by the GMX team.

In terms of price slippage, there’s no real price slippage given trades are done against a pool based on an oracle. This can lead to some edge cases where a trader can long or short low liquidity assets without experiencing any price impact. However, some protocols introduce some workarounds to this topic, for example, introducing a synthetic slippage fee or a minimum price deviation required to close the position in profit.

The settlement is done against the assets provided by the liquidity providers of the pool. Ideally, longs and shorts would balance out—so that there’s no real delta exposure for the pool—and LPs would only profit from fees. As is not always the case, the liquidity in the pool is the counterparty of traders. This works great on choppy markets, given that traders lose money in the long run, but on one-directional markets (e.g. terra luna crash) it turns into a sketchy situation.

The funding fees are present, but not as a mechanism to balance the price out, but rather to balance the OI out. This is a typical risk-mitigation approach implemented by protocols. While a comprehensive examination of this topic is beyond the scope of this report, it will be explored in detail in the next article.

Power Perpetuals

Yet again, it’s complicated to generalize the design of power perpetuals given that each one of them has a different implementation. Additionally, some power perpetuals can be classified into other categories, like Deri; or have not yet made public their model, like Polynomial.

However, we believe it is worth highlighting specific aspects of these cases; for example, in Squeeth:

- Index price: the Squeeth index price is ETH²

- Mark price: Mark is the current trading price of Squeeth

- Power Perpetuals rely on arbitrageurs to keep the index and mark prices close. But not only prices.

- Volatility: The market can over/underprice volatility. The funding rate will be too high/low.

- Price: Index to Mark price difference.

- Slippage happens when buying on the AMMs, which can be a bit problematic given that liquidity is generally not super high.

- Similar to AMMs in order to profit, traders need to both buy and sell in a pool, which, tied to the point above, can sometimes lead to not the greatest UX for traders.

Perps are simple on the surface, but complex under pressure. Our Smart Contract Audit service tests your margin engine, funding logic, liquidation paths, and oracle assumptions before users do.

Conclusions

In this article, we’ve provided a broad overview of the perpetuals market, including liquidity provision and the pricing of these contracts. For this report, we have examined over 60 different protocols.

Just by the sheer number of perp-protocols that have been deployed in the past 4 years, it is clear that there’s been substantial PMF for perpetuals, and that to some extent might have led to saturation in the market. An easy example to illustrate this is that the OI on BTC went from around 300k BTC ~$3b in 2020 to 450k BTC ~$13b by 2023.

Order books are most likely the best-fitted type for trading, hence why dYdX is currently the leader for perp-DEXs in terms of volume, with dYdX accounting for around 70% of DEX’s, while DEX’s only account for 2% of the total trading volume. To point out potential reasons why order books are what most market makers are used to, they allow flexibility for the makers (LPs) and more granular control over which prices traders are buying and selling. However, the technological constraints of today’s blockchains have led to protocols using other methods for liquidity bootstrapping.

AMMs and vAMMs were popular early during the DeFi cycle. Most of them have ended up following the route of Uniswap v3 (Concentrated Liquidity). AMMs ensure continuous liquidity for the participants—as long as liquidity exists—at the expense of potentially absorbing toxic order flow. New approaches to AMMs are used by InfinityPools and Predy where Uniswap LPs are used as liquidity sources.

In between order books and AMMs, there are two protocols—Drift and Vertex—that implement a hybrid approach to liquidity provisioning and pricing. By combining the models, they aim to bring the best of both worlds, allowing users to have granular control over their trades while using the AMM as a backup to ensure continuous liquidity.

On the other hand, oracle-based protocols need to rely on third-party infrastructure—oracles—to operate. On the bright side, this abstracts away the price discovery for its user base. Additionally, the ability for its users to trade without worrying about the depth of liquidity in a specific venue and the ease of providing liquidity—just adding liquidity to the pool—have contributed to the success of these protocols.

In future articles, we plan to delve deeper into the risk management strategies employed by perpetual protocols, their fee structures, and their integration within the broader DeFi Lego ecosystem. By examining these aspects, we aim to provide a comprehensive understanding of the ever-evolving landscape of perpetual futures exchanges.

References

Discords & Docs of mentioned protocols

- Drift Protocol. (2022, March 9). Deep Dive into Drift’s Dynamic vAMM (Part 1/3) - Drift Protocol - Medium. Medium. Link.

- Prospere, W. (2022, May 19). Squeeth Primer: a guide to understanding Opyn’s implementation of Squeeth. Medium. Link.

- Andrew². (2022, February 02). Opyn Discord. Link.

- RabbitX DeFi Perps Monitor. (2023, July 01). RabbitX DeFi Derivatives Exchange (DEX). Link.

- Shogun @Dune. (2023, July 01). Perpetual DEXs Insights (GMX, Perp, Kwenta, GNS). Link.

- CoinGlass. (2023, July 01). Bitcoin Open Interest. Link.

Further Reads:

- Ali. (2023, June 19). Derivatives Deep Dive pt.1: Perpetual Futures. Ali’s Research. Link.

- Teander, Dustin.(2023, February 10). Messari. Link.

Economic Security Lead

Pablo holds a Master's in management, having focused in finance, and with a thesis on DeFi, demonstrating his knowledge and expertise in this field. He has extensive experience in research and analysis of DeFi protocols, having worked as an analyst at Siemens and a DeFi researcher at Deep Tech Ventures. His background in finance, research and analysis skills are a valuable addition to our team.