Introduction

DeFi Options have become a highly sought-after product. However, compared to centralized counterparties, DeFi remains a small incumbent lacking liquidity, which limits options trading, issues a tokenomics audit can uncover early. This Options series aims to provide an overview of the current Options DeFi space and compare different protocols, with a focus on how they work rather than their potential as an investment vehicle. For teams shipping to mainnet, combining Solidity audits and a dApp audit reduces both code and frontend risk, and assessing cross-protocol exposures via an ecosystem risk assessment adds another layer of protection.

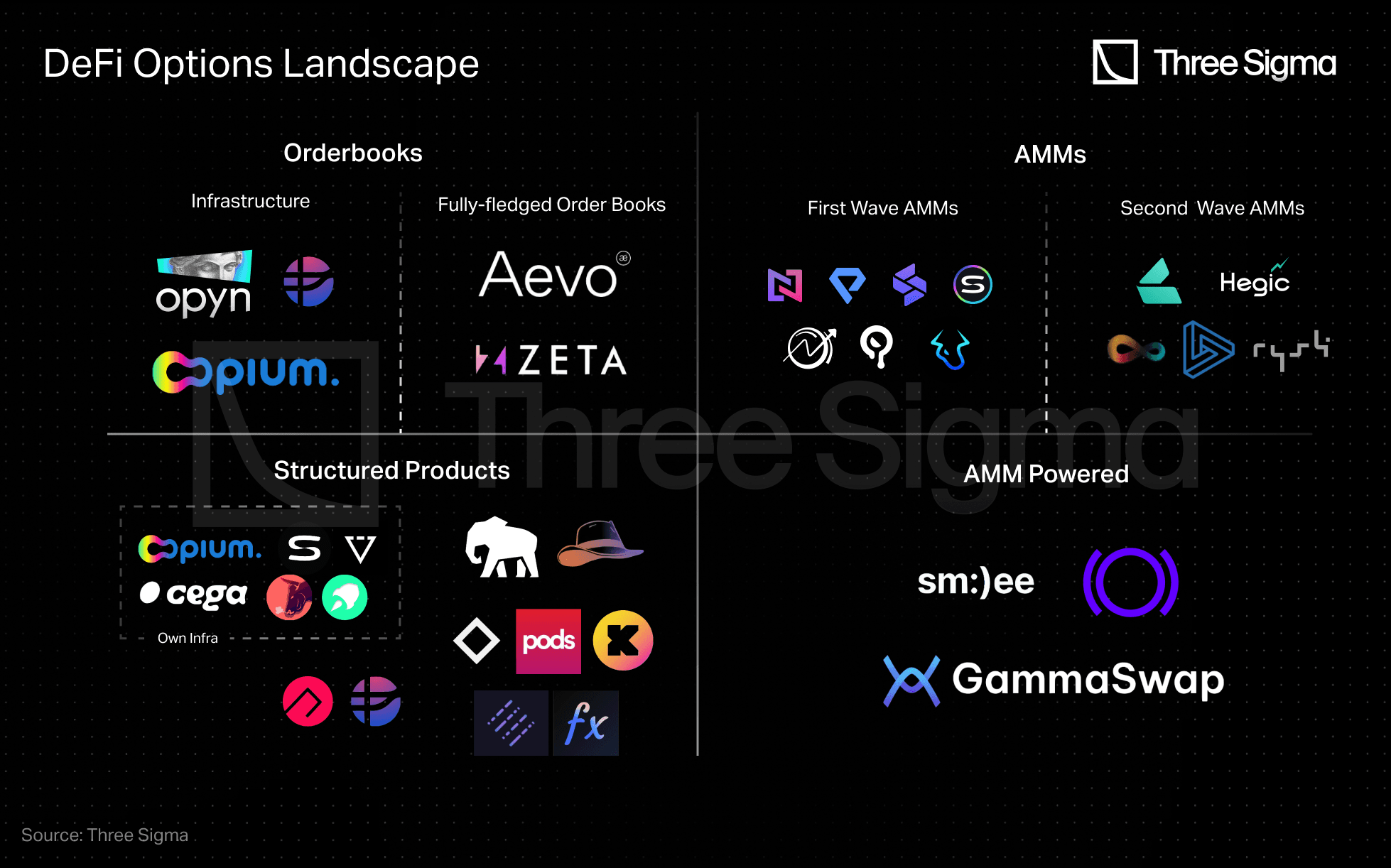

This initial report will classify the existing protocols into four groups: Orderbooks, AMMs, Structured Products, and AMM Powered. It will explore the protocols’ inner workings from a high-level to a detailed view.

This Option Series takes an in-depth look at the following 34 protocols:

- AEVO, Cally, Cega, Deri, DoPeX, Friktion, GammaSwap, Hegic, JonesDAO, Katana, Knox Vaults, Lyra, Oddz, Opium, Opyn, Panoptic, PODS, Polynomial, Polysynth (now Olive), Premia, Primitive, PsyFi, PsyOptions, Ribbon, RYSK, Siren, Smilee, StakeDAO, Synquote, Thales, ThetaNuts, Ntropika, IVX and Zeta.

We considered but excluded 16 other protocols from our analysis because they stopped operating, changed their focus, or had no publicly available information.

- Auctus, Arrows Market, Buffer Finance, Charm.fi, Dexilion, Everest DAO, Exotic Markets, FinNexus, Kibo Finance, Lien, Phoneix Finance, Risq, Shield, Toros.Finance, Valorem, and Whiteheart. During the writing of this article, Friktion was officially sunset.

Recap on Options

In this section you can find a brief introduction to options. If you're already familiar with it, you can skip this part.

Options give buyers the right, but not the obligation, to buy or sell the underlying asset at the strike price by expiration. Options buyers pay a premium to the seller for taking on the obligation to buy or sell the underlying asset.

A Call Option gives the buyer the right to buy the underlying asset, while a Put Option gives the buyer the right to sell the underlying asset.

Options have different exercise terms:

- European options can only be exercised or settled at the expiration date.

- American options can be exercised anytime before expiration.

- Bermudian options can be exercised at specific pre-expiration dates. It's also important to know how options are settled.

At expiration, asset-settled options deliver or exchange the underlying asset, while cash-settled options use cash or stablecoins.

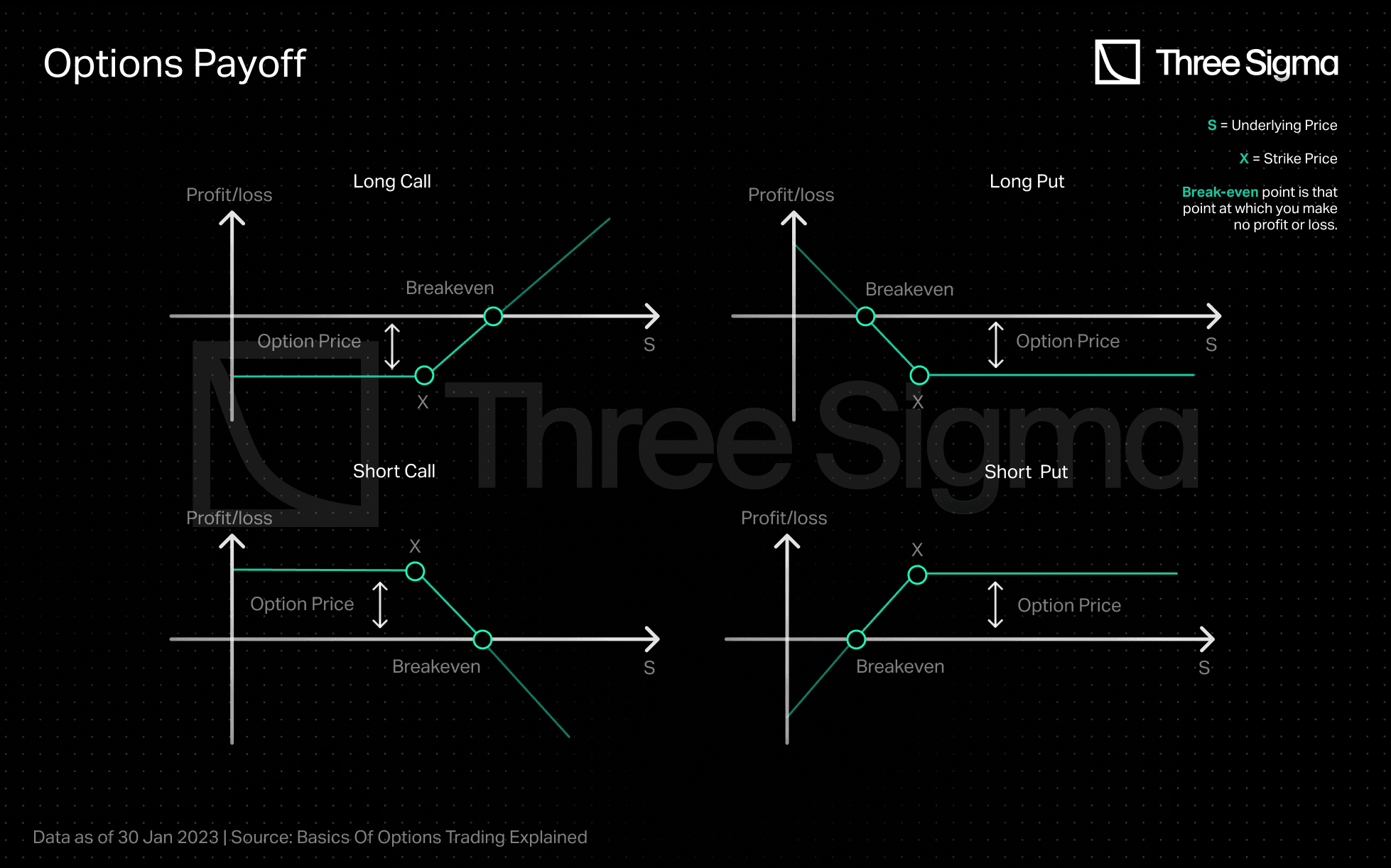

Option writers are “short” and buyers are “long”. Their payoffs are as follows:

Source: https://blog.quantinsti.com/basics-options-trading/.

The premium is based on the option’s likelihood of paying off for buyers. This probability is influenced by both the strike price and the current asset price. Generally, higher likelihood means higher premium. For example, buying a 1-week call option when ETH is $1500 with a $800 strike price would have a high premium due to the low likelihood of ETH dropping below $800. The opposite also applies, if the probability of ETH being over $3000 in a week is low, the option buyer will pay a small premium.

Classification of Options Protocols

In this section, we will explore the different types of options protocols and how they differ from one another.

Source: Three Sigma

How to Choose a DeFi Options Venue (Decision Paths)

I need to hedge my spot risk.

Start with order-book style venues for precise strikes and expiries plus clearer execution control. If liquidity is thin or spreads are wide, consider structured products that automate short-vol strategies for smoother fills.

I want automated yield.

Look at structured products (DOV-style vaults) that package covered calls or puts. They simplify rolling and settlement, but always review utilization, weekly expiries, and redemption mechanics.

I’m trading volatility directionally.

Explore AMM-based defi options for fast entry and exit. Check whether the AMM lets you sell back before expiry and how pricing reacts to utilization or market-maker hedging activity.

Order books

Order books are marketplaces where buyers and sellers can place orders to buy or sell assets. The orders are recorded in a public "order book" displaying the prices that buyers are willing to pay and the prices that sellers are asking for. When a buyer and seller match on a price, the exchange executes the trade and removes the orders from the order book.

However, constantly checking orders on-chain to match them can cause scalability and latency issues, making on-chain order books too slow and expensive at the current state of blockchain technology. Nonetheless, some order books are only used as an infrastructure or settlement layer for options, creating options but not markets, resulting in options in order books being commonly traded OTC.

The five protocols that were considered as Order Books are AEVO, Opium, Opyn, PsyOption, and Zeta.

AMMs

AMMs use algorithms to let users buy or sell assets without setting a specific price. Instead, the price is calculated automatically by an algorithm based on supply and demand, and transactions are executed at the best available price.

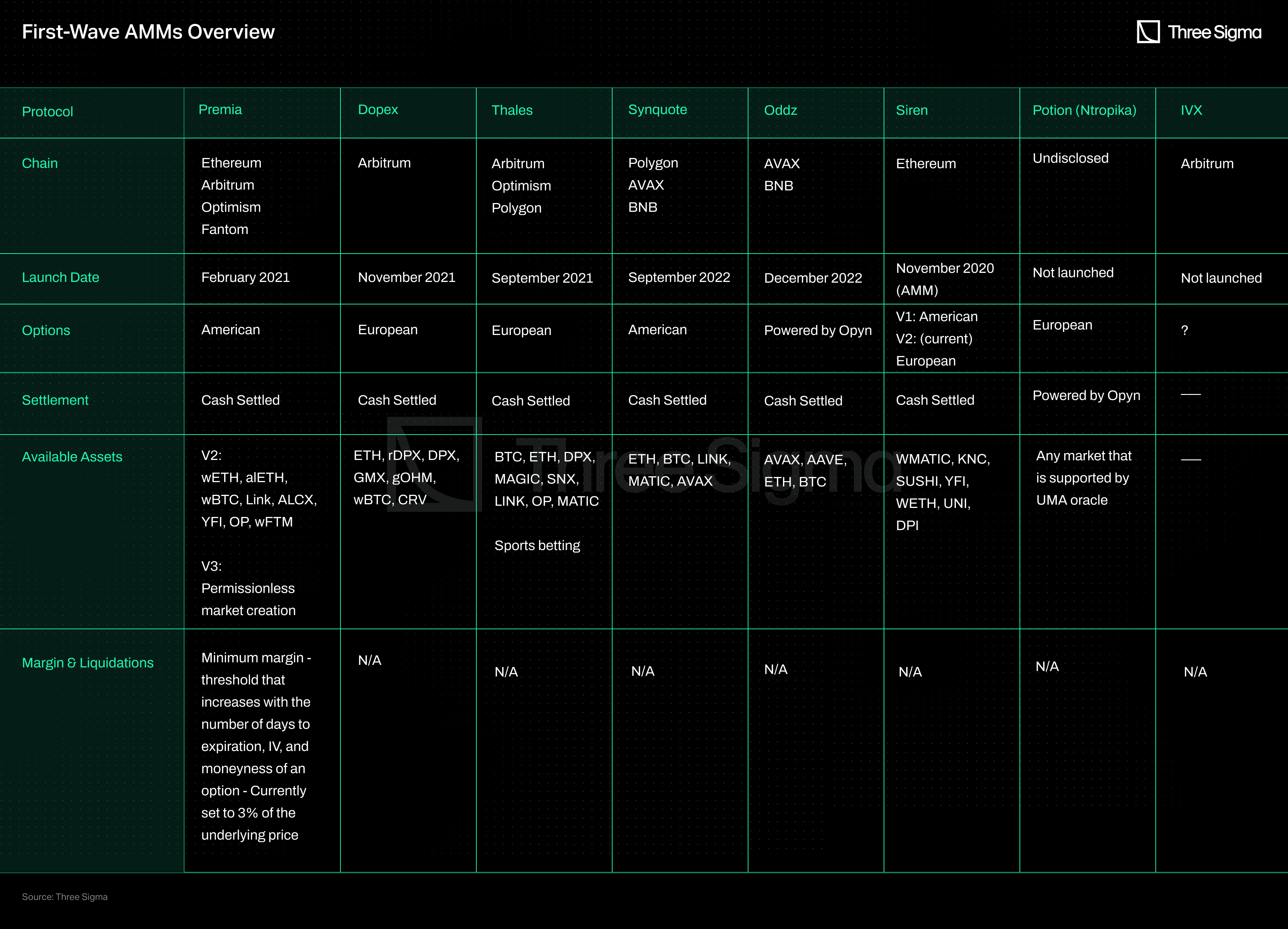

Following the success in DEX’s, AMM options have become a crowded space, and the active projects analyzed in this report are DoPeX, Deri, Hegic, Lyra, Oddz, Premia, RYSK, Siren, Synquote, Ntropika, IVX and Thales.

Structured Products

Structured products provide a customized investment strategy that may offer higher returns and lower risk. When specifically referring to DeFi options, structured products use options to automate investment strategies, often through option selling. This allows investors to deposit funds and have their investment strategy executed automatically without intermediaries or manual intervention.

The protocols that have been considered are Cally, Cega, Friktion, JonesDAO, Katana, KnoxVaults, Opium, PODS, Polynomial, Polysynth (now Olive), Primitive, PsyFi, Ribbon, Siren, StakeDAO, and ThetaNuts.

AMM Powered

In our opinion, these protocols should be considered a subcategory of options AMMs. These protocols are based on the idea that every AMM struggles to reach sufficient and sticky liquidity, and the ecosystem would be better served if Uniswap, or another DEX that uses an AMM, was used instead, since liquidity already exists there.

AMMs can be seen as a liquidity layer where the first primitive, DEX AMM, has been built, but other primitives like options or volatility DEXs with similar payout to options can be built on top.

To date, there are three protocols following this approach: Panoptic, Gammaswap, and Smilee.

A Comprehensive Look at Options Protocols

DeFi Options Order Books

In defi options, order-book venues mirror CEX mechanics while staying on-chain. DeFi orderbooks options protocols can be further labelled in two subcategories: Infrastructure and Fully-Fledged options DEXs.

DeFi Options Infrastructure

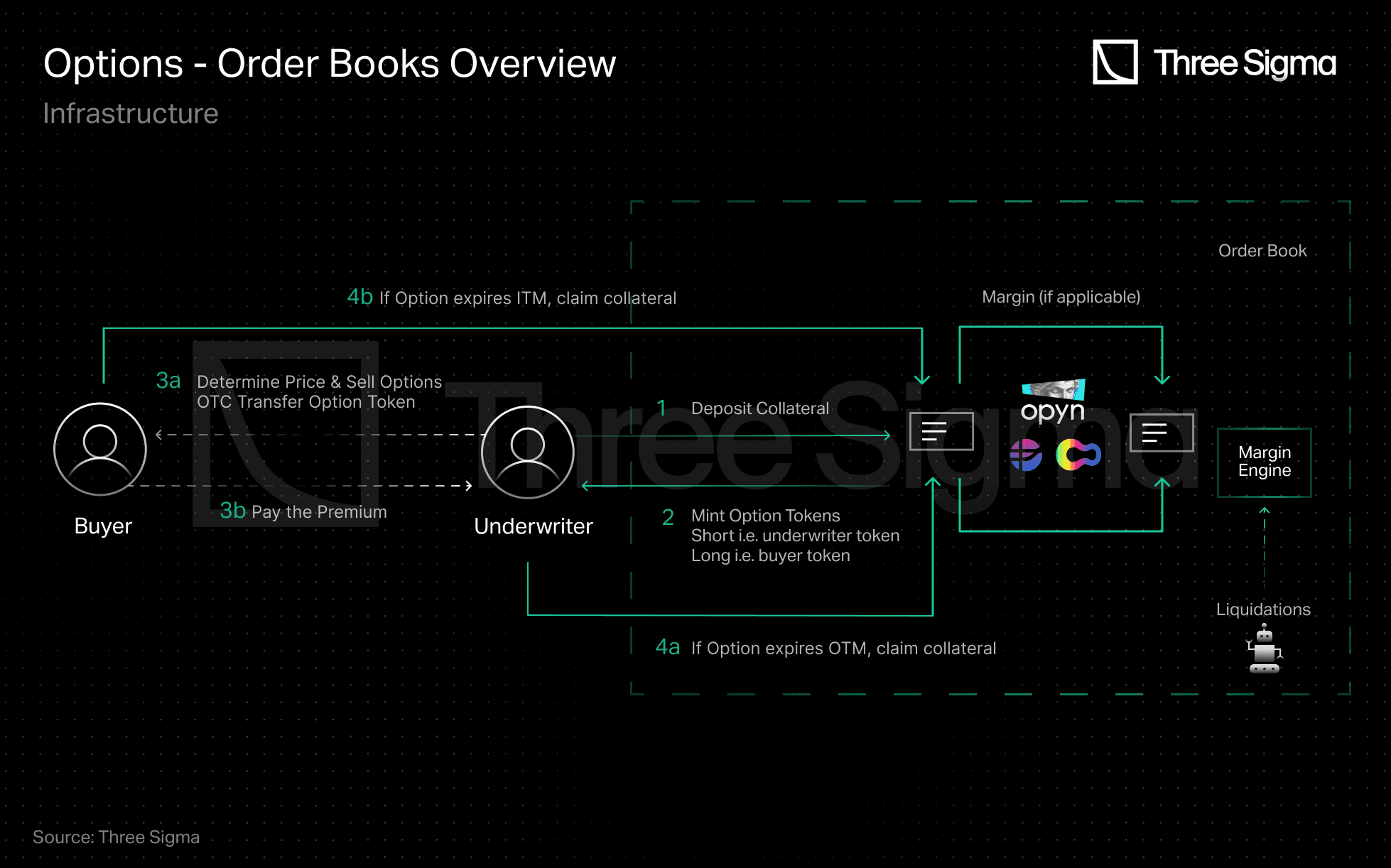

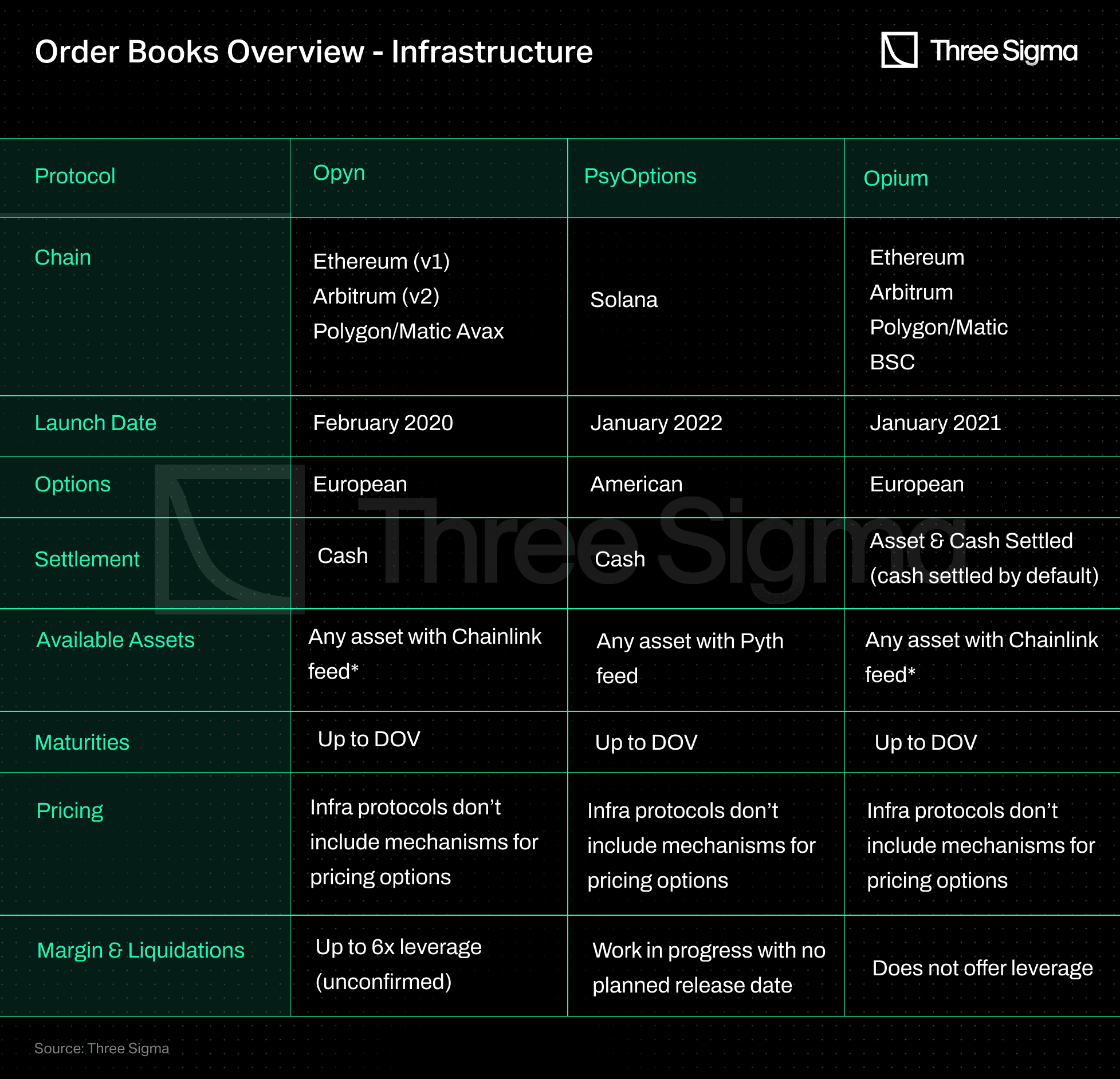

Opyn, PsyOptions, and Opium provide the underlying infrastructure for options trading, allowing other protocols to create, settle, and trade options contracts. These protocols are used by Market Makers, who act as options underwriters, and Decentralized Options Vaults (DOV) like Ribbon, use these protocols to price and sell the options created on the infrastructure layer.

The markets on these infrastructure protocols are usually permissionless, meaning anyone can create their own option market on top. Given the underwriters’ need to market and price the options themselves, they’re considered infrastructure.

The maturities are up to the protocols creating the options, with weekly maturities in DOVs being the most common for protocols like Ribbon or StakeDAO, therefore, most of the volume on the order books is on weeklies.

If the options expire ITM, a price feed like Chainlink, is used to determine the underlying asset price, and buyers need to manually redeem their tokens for the underlying (collateral). In case of price discrepancies, processes are in place to guarantee that all parties agree on the settlement price.

Individual traders face significant challenges in using infrastructure order books as the main vehicle for options trading. This is because they would need to market the options themselves, mint the options, set a reasonable price, and find buyers who are willing to pay that price.

Where * claims by the protocol, even though it might not be possible to do so through the UI.

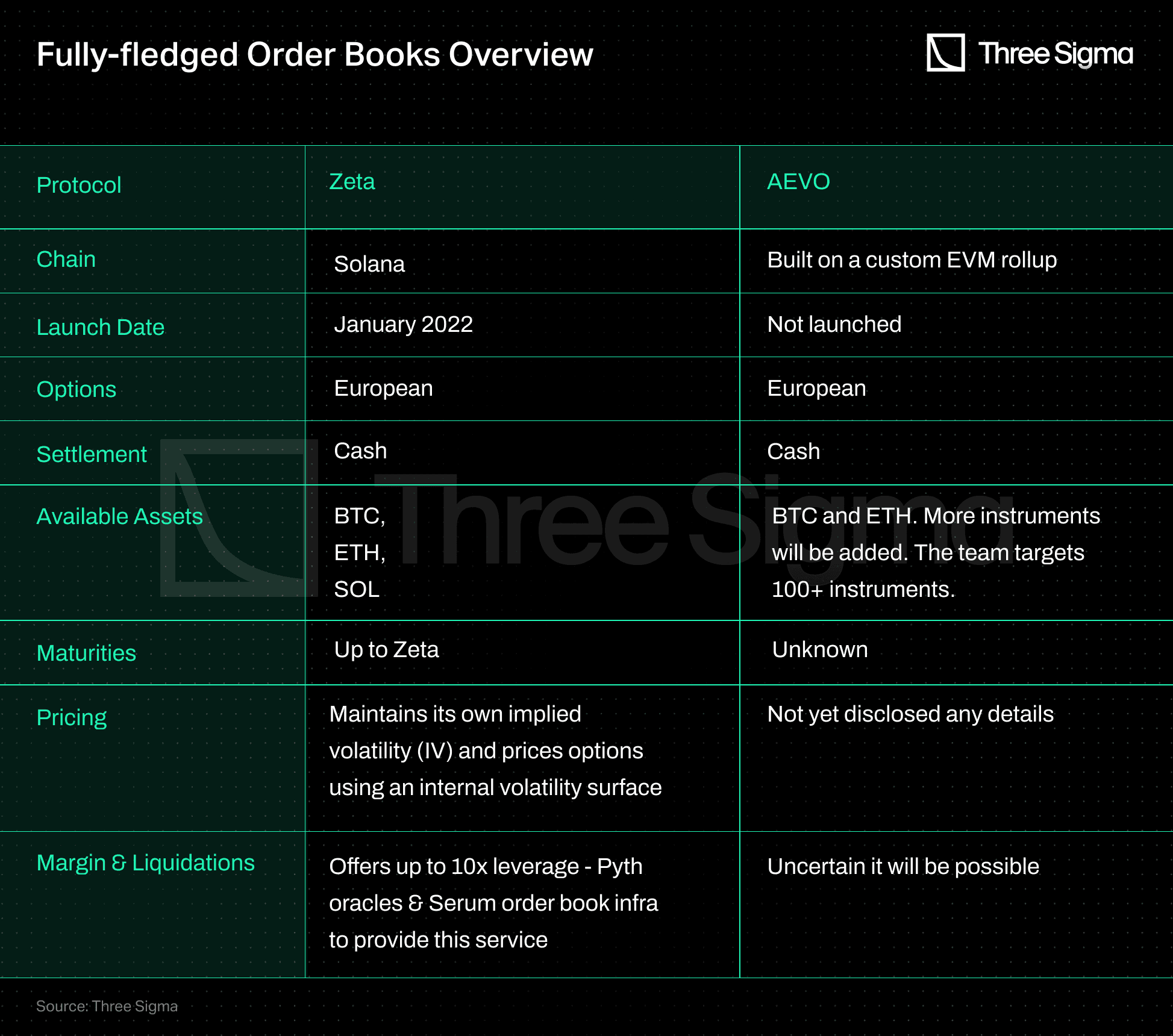

Fully-fledged Order Books

Fully-fledged options DEXs like Zeta Markets and AEVO provide a platform for trading options contracts that have already been created and priced, allowing Market Makers and other participants to trade options directly matching orders at specific prices without the need for an underlying infrastructure protocol.

At a high level it is expected for order book exchanges to work in a similar way:

- Investors place orders to buy or sell securities at specific prices and their orders are added to the order book.

- The order book shows the current market prices and quantities for all buy and sell orders.

- If two orders have matching prices, they can be paired and the transaction can be executed.

- The order book is constantly updated as new orders are placed and existing orders are matched and executed.

- Traders can use the information in the order book to identify potential trades and decide when to buy or sell securities.

- The order book is maintained by the exchange, and can be accessed by traders to view the current market state and to place their own orders.

Order Books Key Takeaways

Options traders use order books to trade at their desired prices. This requires a matching engine that can quickly scan the book and match orders, which can't be currently run on a blockchain. Its main benefit becomes its fatal problem in DeFi. Zeta circumvents this problem by operating its order book on Solana, which claims to check its order book up to two times per second. Efforts are being made to develop scalable and secure new infrastructure that will enable efficient on-chain order books.

Consequently, most order books only support option minting and settlement but not trading, which is typically done OTC through market makers auctions.

An alternative solution could be to follow the steps taken by dYdX, which took part of its order book off-chain, allowing users to trade perpetuals on-chain. Nonetheless, this introduces a level of blind trust in the system, as users must trust that the off-chain engine works as claimed.

DeFi Options AMMs

AMMs can be split into two categories based on their functionalities from the LP perpective. The first category includes AMMs that allow users to only buy options (long) from the AMM. The second category includes AMMs that hedge their exposure or redeploy collateral to increase yield. These models power most defi options trading today.

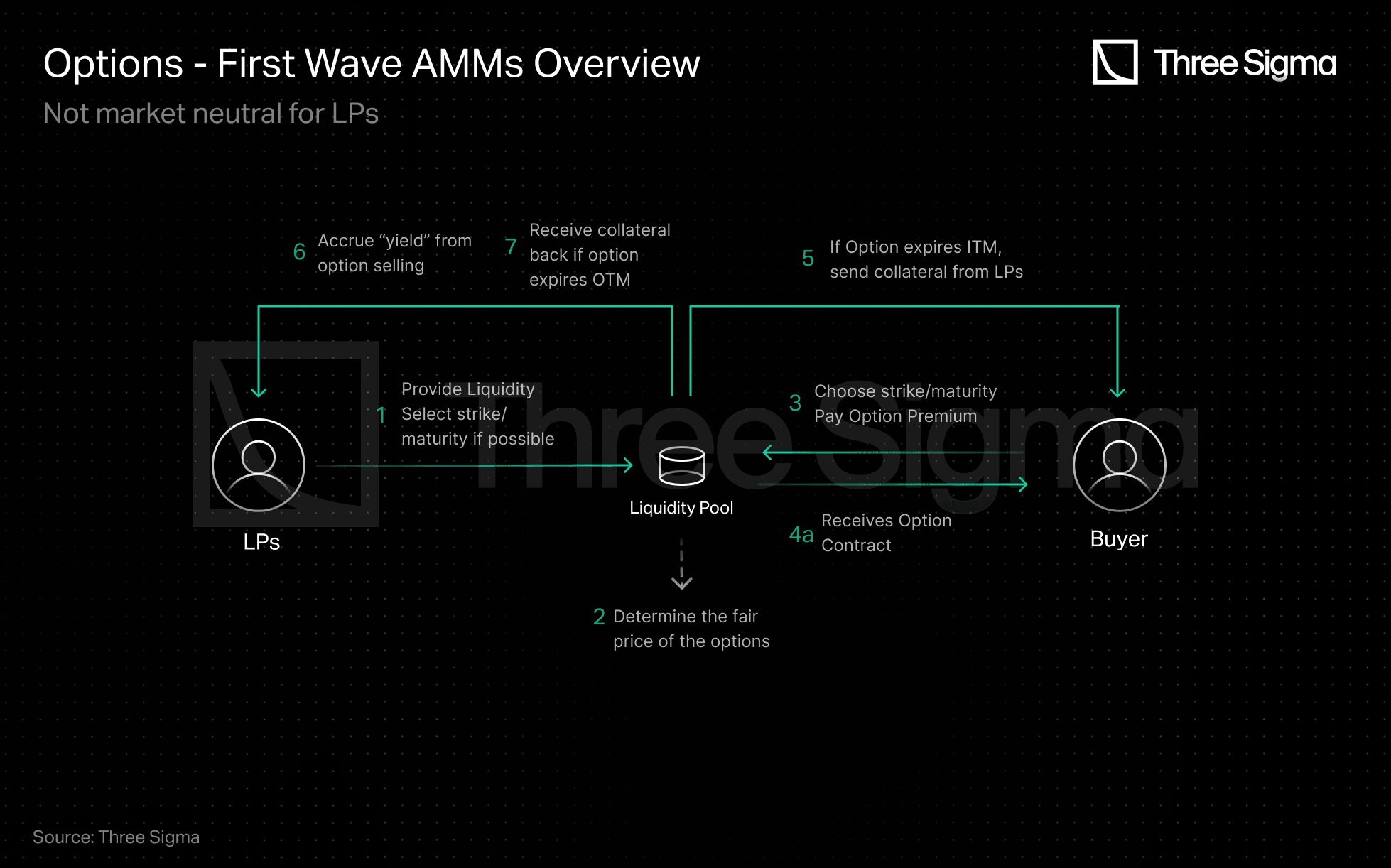

First-Wave DeFi Options AMMs

The first wave AMMs share some key characteristics:

- These platforms only allow users to buy options and not sell them back to the platform. As a result, options must be held until expiration or until exercise, in the case of American options.

- LPs are forced to always take the short side of the contract, meaning that they are obliged to sell options to users and thus be short on volatility.

- These platforms do not implement delta hedging, meaning that they do not adjust the number of options sold to maintain a constant delta.

Although it is not an absolute categorization, we can find under this umbrella protocols such as DoPeX, Premia (v2), Thales, Synquote, Oddz, Siren. For instance, Premia satisfies all the requirements of this category, but in some markets, buyers can sell options back to the AMM. Premia V3 offers liquidity providers more flexibility by allowing them to focus their liquidity on specific options and offers margin trading, but it still lacks delta hedging at the protocol level.

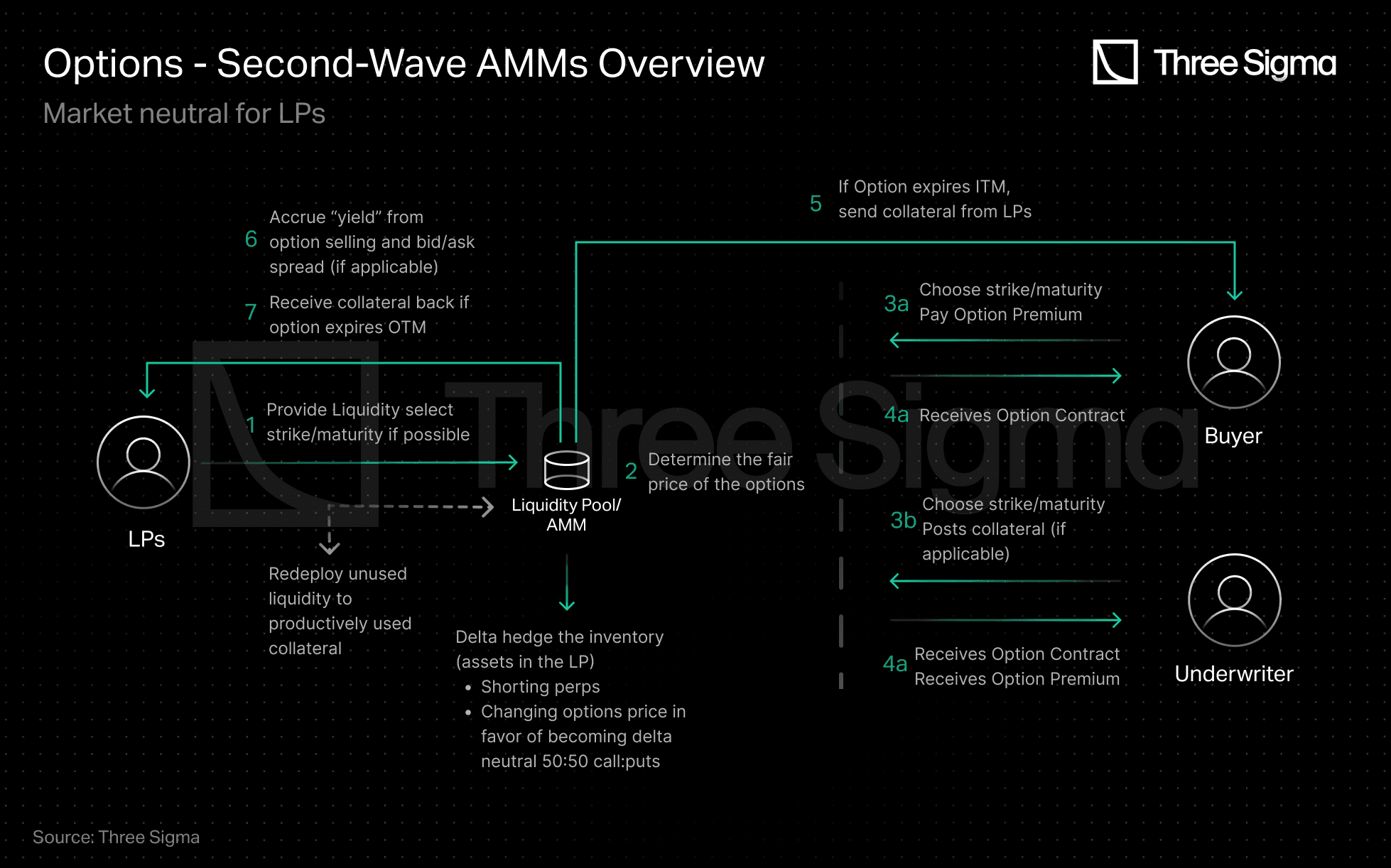

Second-Wave DeFi Options AMMs

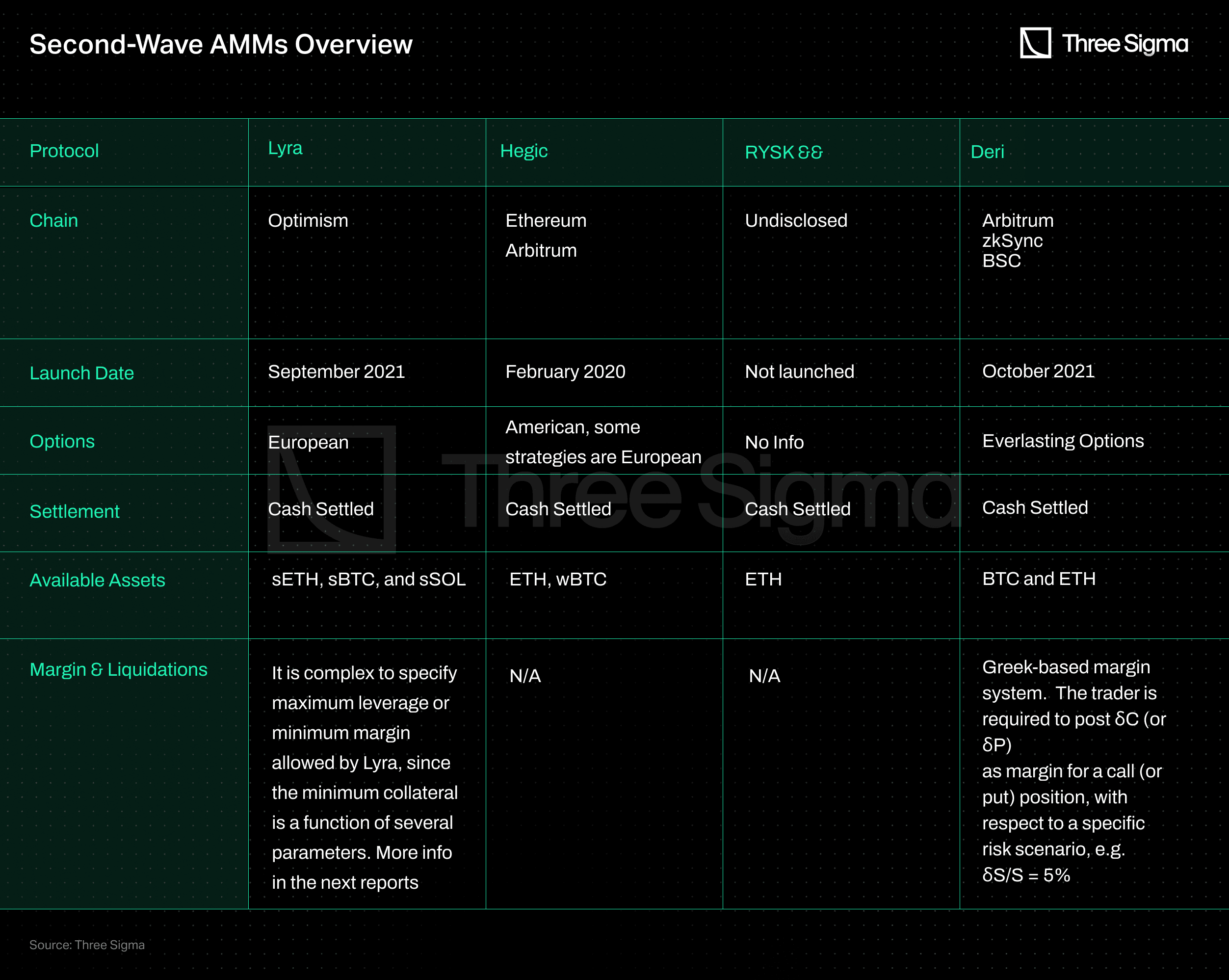

The Second-Wave protocols such as Lyra, Deri, Hegic, and Rysk are market-makers like AMMs.

Users can buy and sell options with LPs acting as the counterparty in both cases. This design has two main considerations. First, LPs can be either short or long into the options contracts, and they are not necessarily always short on volatility. Second, options traders can enter specific short positions against the AMM, making the UX more similar to what they are familiar with on order book CEX platforms.

These AMMs achieve delta neutrality by offering attractive options prices or perpetual contracts to encourage traders to take the unbalanced side. The goal is to create a market where LPs can manage their risk exposure while options traders can buy and sell options in a familiar way.

Source: Three Sigma Note: Not all protocols redeploy unused collateral or implement any strategy with idle funds

- Lyra strives for delta neutrality by having LPs provide sUSD to the pool. The AMM then sells 1x ATM sETH call with a -Δ0.5 delta, which traders can collateralize, adding +Δ1.0 delta to the pool. To hedge the +Δ0.5 exposure, the AMM shorts 0.5 sETH (-Δ0.5) on Synthetix. Lyra also implements a Vega hedge through a fee passed on to traders. The fee is only passed to traders when a trade increases the vega exposure of the AMM, but not when the exposure decreases as a result of a trade.

- Hegic mentioned that Molly delta hedges AMM positions, but no further information has been disclosed.

- Rysk aims to be pseudo-delta neutral by repricing options so that puts become more attractive when a call option is bought and vice versa, but the protocol is not live yet.

- Deri lets traders take both long and short position on the everlasting options. The AMM changes the option pricing based on its net position. When it is in the equilibrium state, the option mark price equals the theoretical price. Whenever there is a trade, it pushes the mark price toward the trading direction (i.e. a buying trade pushes the price up while a selling pushes it down). The price change due to the trade is proportional to the trade size. Additionally, LPs on Deri are also counterparties to perps, power-perps, and gamma swap.

AMM Key Takeaways

The key difference between 1st and 2nd wave AMMs is not which pricing model they use, but how they reach their pricing. Generally, AMM protocols adopt a market approach based on the supply and demand.

While referred to as 1st and 2nd wave AMMs, there are reasons why protocols choose one over the other:

- First-wave AMMs prioritize selling options for more premiums and avoid hedging because it is capital inefficient. More liquidity is preferred to sell as many options as possible.

- Second-wave AMMs hedge as LPs lack the capability to do so independently, assuming the potential losses of inventory exceed the premiums earned from selling options.

These AMMs passively provide liquidity, having it sit in the pool until a trade is executed. Trades can be settled faster than in order books, where the engine must constantly check the book, if the pool has enough liquidity. However, LPs cannot control the options they are writing and serving as counterparties to. Selling back positions to the AMM exposes traders to asset price fluctuations, volatility, and time decay. Additionally, options are non-linear products, making hedging difficult for LPs.

Furthermore, DeFi options require collateralization, reducing capital efficiency. Undercollateralized options require dependencies on liquidation mechanisms, liquidators, and oracles. Another challenge is the high cost of on-chain pricing that forces most protocols to rely on off-chain systems.

AMMs also face the risk of having an utilization ratio too high or too low, leading to yield dilution and underpriced or overpriced options where only a portion of the pool is used to generate premiums. To manage this risk, AMMs may need to adjust their algorithms or option prices to keep pool utilization within an acceptable range.

Risk Checklist: Before You Trade

- Oracle & settlement: What price source finalizes PnL and when is it read? Any fallback or delay risk?

- Liquidity & utilization: Do utilization spikes near expiry widen spreads or cause slippage on defi options?

Early exit: Can positions be sold back pre-expiry, or are they buy-and-hold until settlement?

- Off-chain components: If matching or quoting is off-chain, what transparency or assurances exist?

- Collateral path & liquidations: What assets are posted, how are margin calls handled, and is cross-/portfolio margin supported?

- Expiry operations: Are weeklies concentrated, is redemption manual or automatic, and what happens if oracles are late?

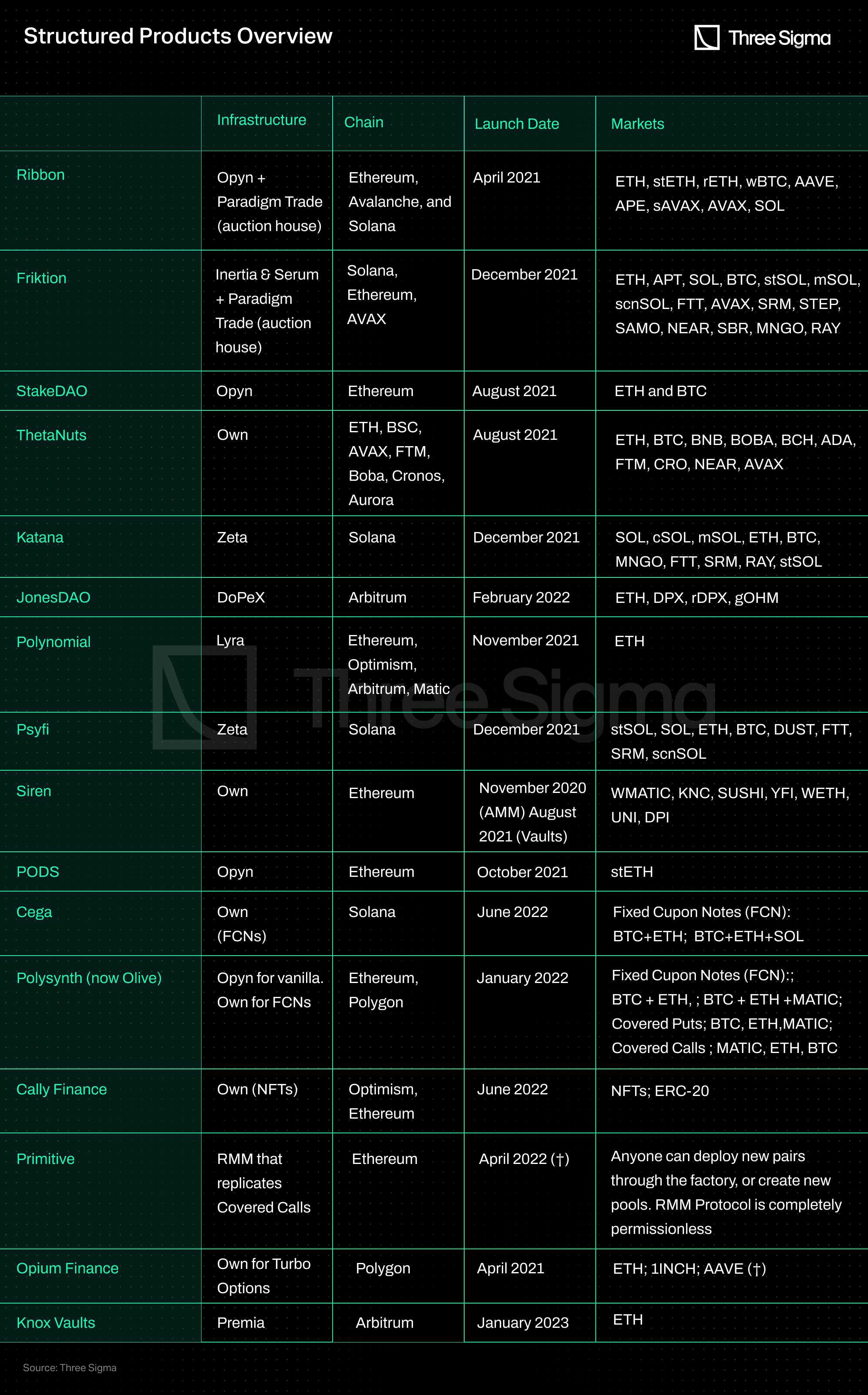

DeFi Options Structured Products

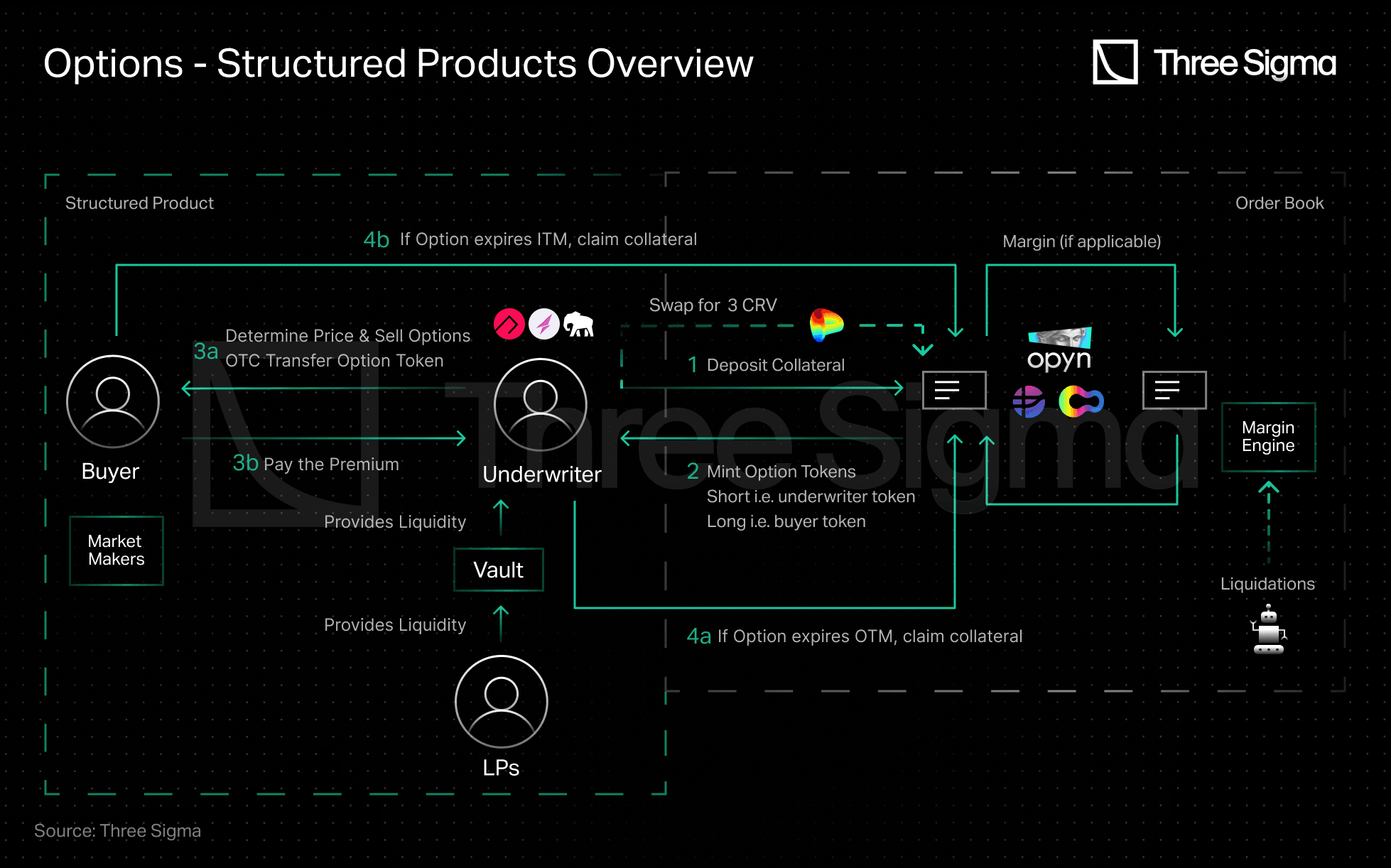

For passive exposure to defi options, structured products bundle strategies for depositors. After minting options, the most common process is to sell them to Market Makers through OTC auctions. This is done by projects such as Ribbon, Friktion, StakeDAO, ThetaNuts, Katana, and PsyFi, with some using third-party solutions like Ribbon with Opyn, and others having proprietary systems, like ThetaNuts. Some exotic structured products, such as Cega, have their own settlement layer as well. Another possibility for structured product vaults is to use an AMM such as Polynomial, JonesDAO, and Siren, which use Lyra, DoPeX, and their own AMM, respectively.

These protocols usually take the short side of the contract and use deep OTM options with a low chance of expiring ITM. For example, a delta of around 0.1 (meaning the option will increase by 0.1 for every 1-point increase in the underlying asset), implies that under the BSM model, there's only a 10% chance that the option will expire ITM, making it more likely for the protocols to profit when the option expires OTM.

Note: Protocols swapping the collateral for 3CRV just as an illustrative example of working collateral.

The two most commonly used options trading strategies are Covered Calls and Put Selling:

- Covered call: an investor holds a long position in an asset and also sells call options on that same asset. The goal is to generate additional income through the option premiums.

- Put selling: an investor sells put options without shorting the underlying asset. The goal is to generate income from the option premiums and potentially acquire the underlying asset at a discounted price.

One critical consideration is ensuring that all minted options can actually be sold. This is commonly overcome by a Dutch auction that sells all options to the highest bidder at a single price. However, this requires competitive auctions for each true market price to prevent arbitrage and avoid selling options below market prices.

In terms of leverage, the decisions are made by the structured product providers themselves. To the best of our knowledge, none of these products use leveraged strategies, likely due to targeting newer and less experienced participants.

The main split can be made based on whether projects use their own infrastructure or rely on a third-party for creating and settling options.

Where † = no longer active

Structured Products Key Takeaways

Ribbon is considered one of the most successful options products, as it managed to attract a large user base and a decent amount of capital. Its yield narrative and token incentives made it the first protocol to sell options systematically. Ribbon’s successfully managed to validate not only its business model but also that structured options products had demand for them in crypto, inspiring others to follow.

However, it is worth noting that most structured products rely on centralized and non-transparent auctions to sell and determine prices for their options, and often run the same strategies regardless of market conditions. While is not a flaw per se of the protocols themselves, puts the burden of choosing the right strategy on the users, which can be difficult for novice traders. It contrasts with the need for traders to have a strong market view when choosing a vault or strategy.

In future reports, we will dive into the performance of the options vaults over time. In the meantime, for more information on this topic, you can read here.

AMM-Powered DeFi Options

Implementing options on top of an AMM like Uniswap has the benefit of solving the liquidity and trader chicken-egg problem that hinders options market growth: lack of liquidity prevents onboarding traders, and lack of traders prevents onboarding LPs. This approach routes defi options flows through existing DEX liquidity.

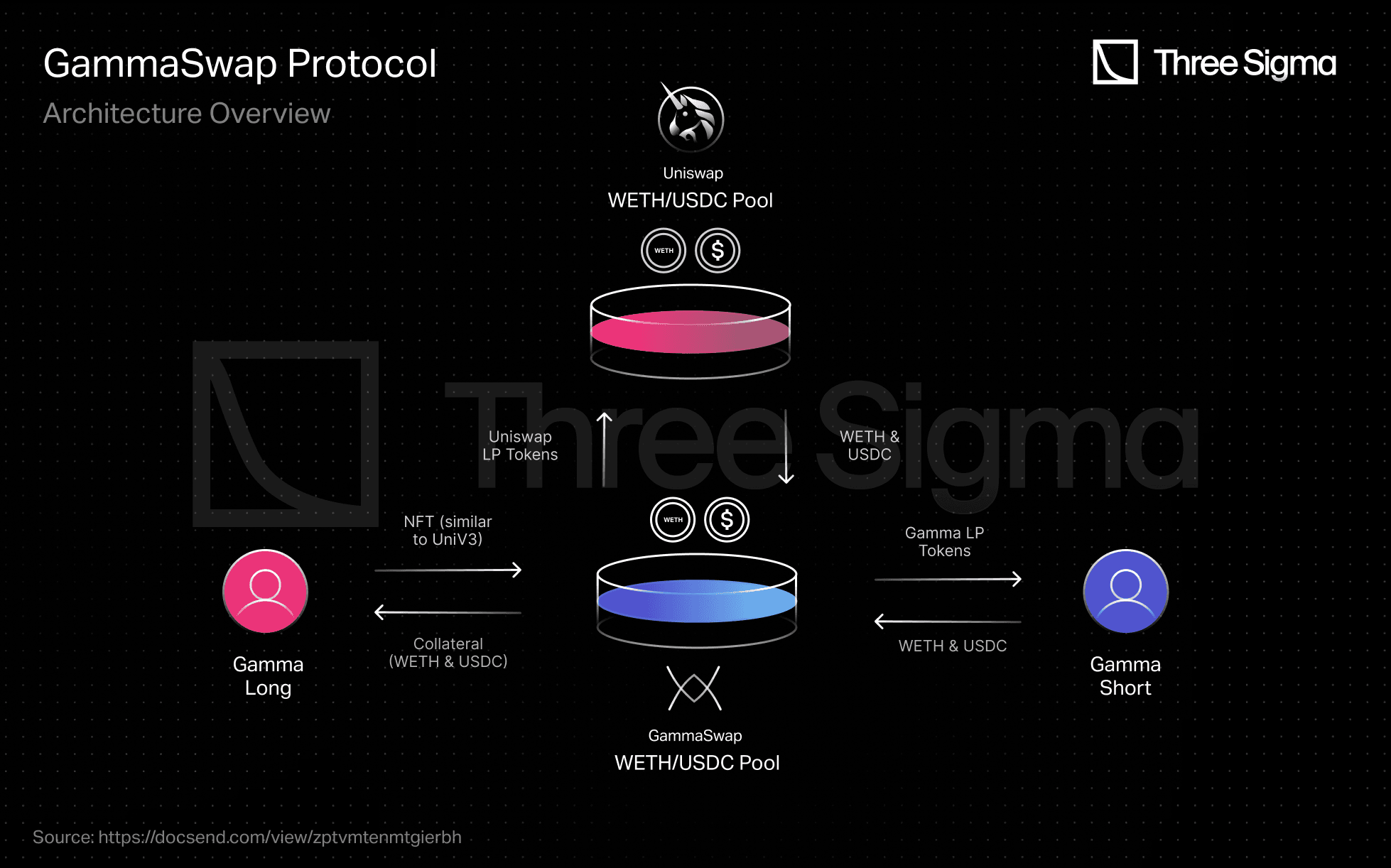

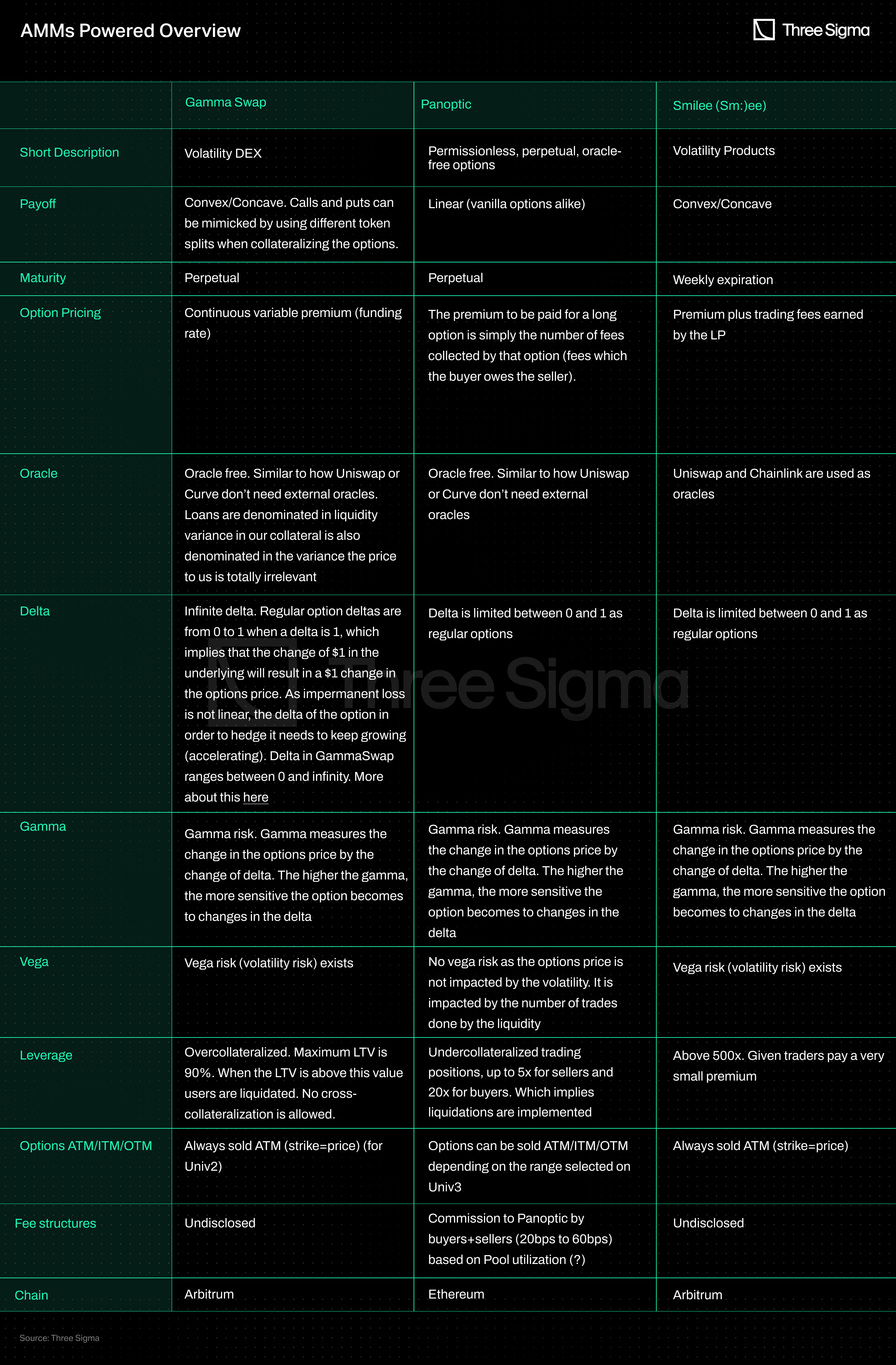

GammaSwap, Panoptic, and Smilee use Uniswap liquidity but have different features and capabilities:

- Gammaswap enables AMM LPs to hedge against impermanent loss. Its users can short volatility and profit from accrued trading fees, while long volatility traders pay a premium to the short side.

- Panoptic allows LPs to earn trading fees on Uniswap V3. It offers the same payoff structure as vanilla options and is likely to attract users from other options protocols.

- Smilee is similar to Gammaswap but operates through vaults rather than onboarding DEX AMM LPs. Long volatility traders pay a premium to the short side, while short volatility traders earn the premium plus trading fees.

The payoff structure is the key difference between them. GammaSwap and Smilee offer convex payoffs, while Panoptic provides almost linear payoffs. It remains to be seen which of these designs, if any, will emerge as the dominant model for DeFi Options.

GammaSwap

Source: https://docsend.com/view/zptvmtenmtgierbhWhere Uni LPs → short vol (short straddle). Risk Takers → long vol (long straddle)

In GammaSwap, Short users can deposit their assets - that form an LP - such as wETH and USDC. In turn, GammaSwap deposits wETH and USDC at Uniswap - or any another AMM - in the wETH/USDC pool. When “Gamma Long” users appear, they deposit wETH and USDC as collateral to borrow the Uniswap LP. The LP is then unwound and Gamma Long pays the trading fees that the LP would have earned if it still was on Uniswap and a borrowing fee (option premium).

Gamma Long users expect the impermanent loss experienced by the Uniswap LP to be greater than the trading fees and borrowing fees they need to pay back to profit. Conversely, the Gamma Short users expect low volatility and low impermanent loss, so that they can profit from the accrued trading fees. The borrowing rate earned is a way to incentivize Uniswap LPs to deposit through GammaSwap.

There are several scenarios under which users would use GammaSwap:

- AMM liquidity providers (gamma short) may use GammaSwap to hedge the risk of impermanent loss.

Then the counterparties could be but not only:

- Arbitrageurs who might be short on the pair that earns the most fees on Uniswap, while longing for the pairs that earns fewer fees, aiming to obtain a seemingly neutral position.

- The counterparty of Degenerate users looking for more convexity in their risk profile.

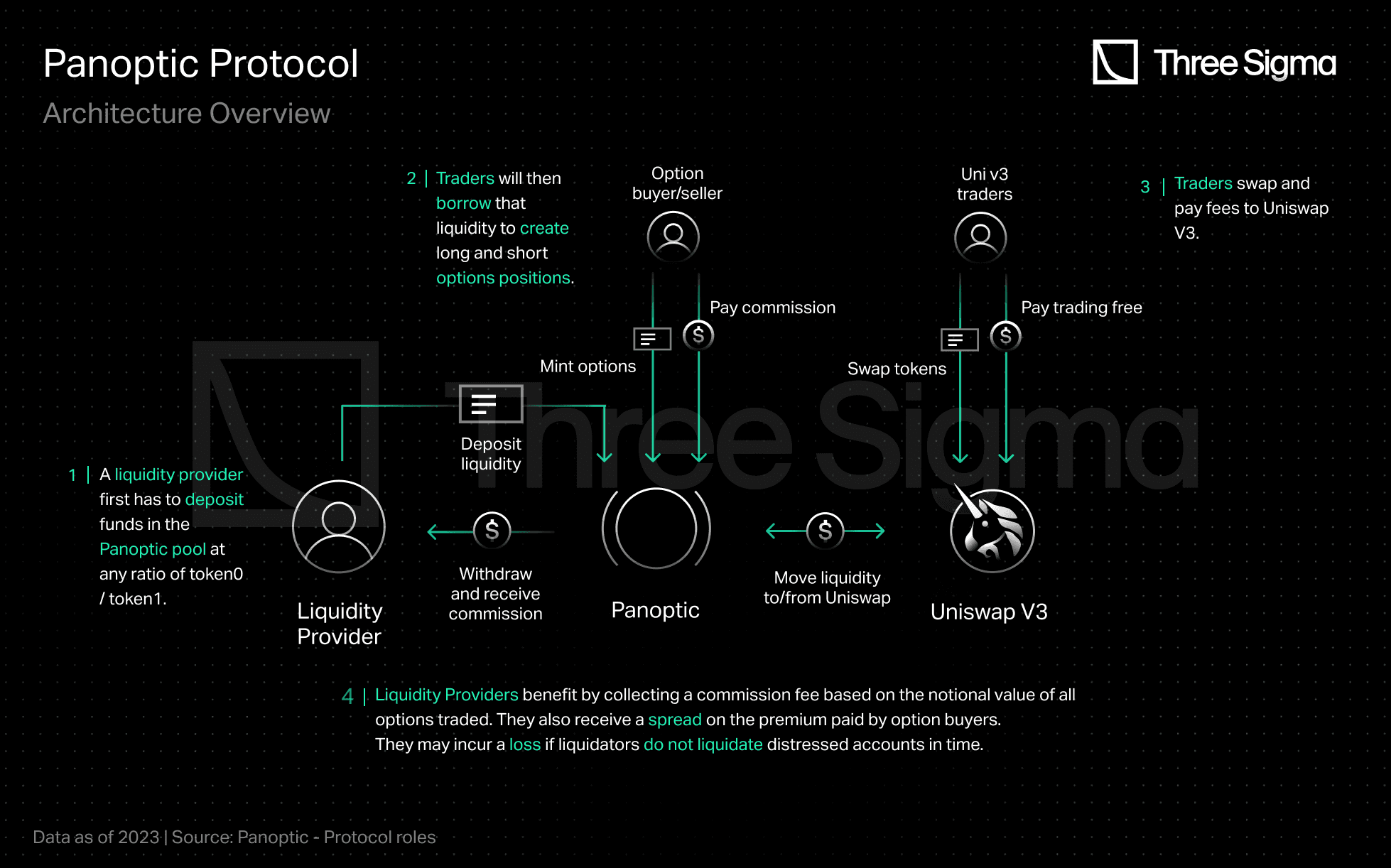

Panoptic

Source: https://docs-panoptic.vercel.app/docs/panoptic-protocol/protocol-roles

Panoptic allows LPs to deposit their liquidity which is then deposited in Uniswap V3. These LP are already Uniswap v3 or other CLMM LPs. As a result, LPs on Panoptic earn trading fees on Uniswap.

When an option buyer wants to trade, they pay a commission to mint the option and then a streaming option premium. Panoptic rearranges the liquidity to mimic an option payoff. The commission is paid by options buyers and sellers to Panoptic LPs, as they have the privilege of rearranging liquidity. The accrued trading fees of the position are considered the options premium.

Panoptic's traders are expected to be the same users that are currently using protocols such as centralized platforms like Deribit or decentralized ones like AMMs or on-chain order books, because the options payoff resembles vanilla options.

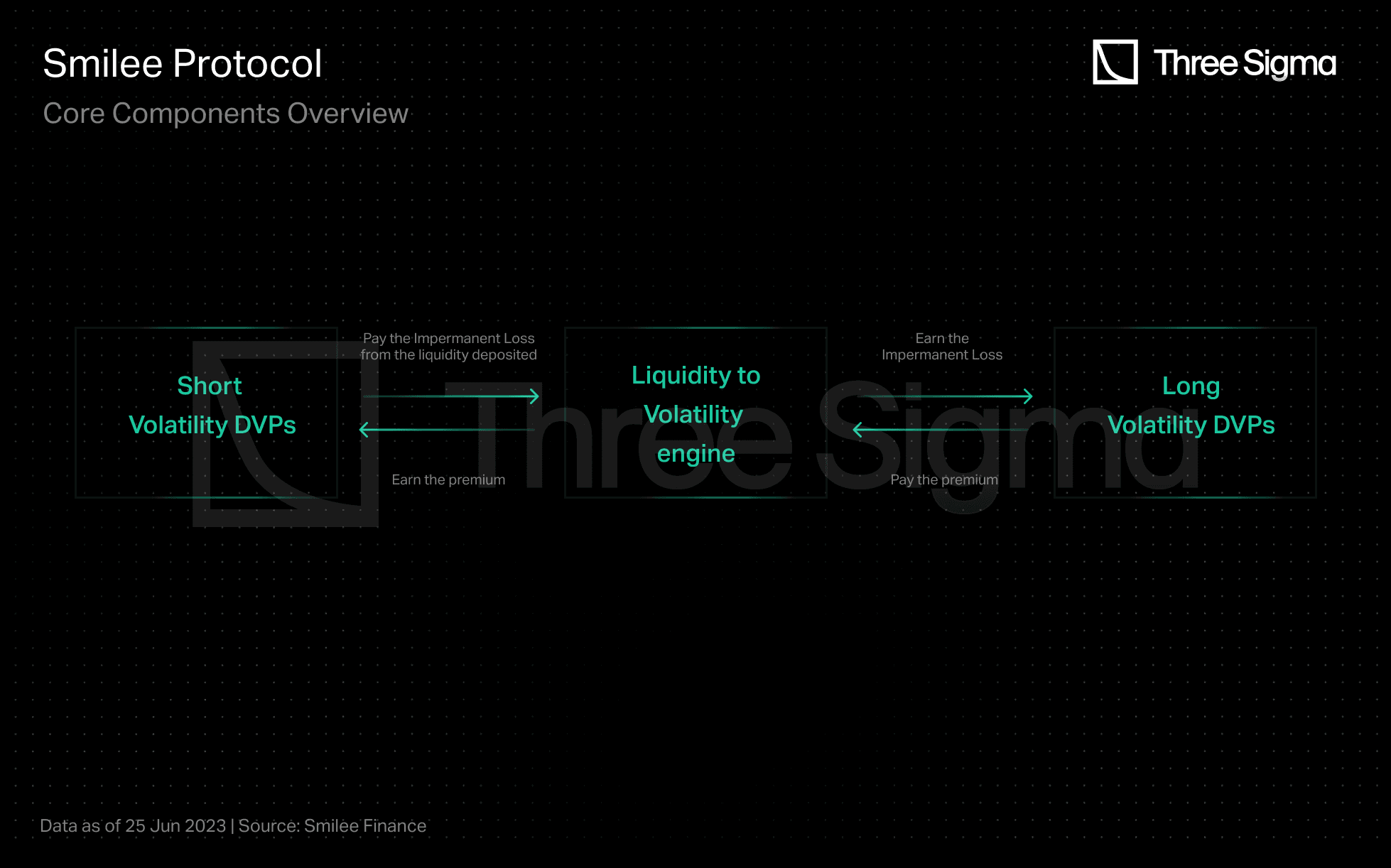

Smilee

Smilee offers a similar convex product as GammaSwap, but with key differences: it uses a vAMM to avoid the need for onboarding DEX AMM LPs, and Vaults, comparable to what we’ve seen in structured products.

Long volatility pays a premium to the short volatility side, with the long side earning the opposite payoff of impermanent loss and the short side experiencing it. Both long and short volatility traders use vaults, with the short side onboarding real LP tokens and denominated in the "Real Yield" vault.

A long volatility trader pays 20 USDC for 500x leverage on a 10,000 USDC exposure, with the payoff dependent on the volatility experienced. The short side earns the 20 USDC premium paid from the long side, plus trading fees, but always needs to pay the impermanent loss to the long side. To ensure impermanent loss/gains can be paid under any event, there's a cap on the total open interest on the long side bound to the amount of liquidity on the short side.

Margin & Liquidations

GammaSwap prevents leverage and cross-collateralization through overcollateralization and liquidates collateral if the position goes over 90% LTV ratio.

Panoptic provides up to 5x leverage, but liquidation may occur if position falls below a certain threshold.

Smilee offers synthetic margin access without liquidations, but has an open interest limit to ensure payoffs under all scenarios.

AMM Powered Key Takeaways

GammaSwap operates in a pool-2-peer manner that uses Uniswap or any AMM as a liquidity layer that. Its options have a convex payoff structure with delta values from 0 to infinity, and are always sold ATM. The platform is overcollateralized, resulting in a continuous variable premium (funding rate) and delta that is impacted by gamma and vega risk.

Panoptic has a more linear payoff structure with delta limited between 0 and 1 and no vega risk. Options can be sold ITM/OTM/ATM, and long option premiums are equal to fees collected each time the asset price crosses the strike price. Panoptic allows undercollateralized trading with leverage and liquidations, without cross-collateralization, and charges buyers and sellers based on pool utilization.

Smilee uses Uniswap and Chainlink as its oracles for determining the price of its underlying assets. Its options have weekly expiration and a convex/concave payoff structure with a delta between 0 and 1. Smilee offers leverage above 500x, and traders pay a small premium for this. Options are always sold ATM, and the fee structure is undisclosed.

In our perspective, all three protocols aim to solve the known liquidity issue by using Uniswap or another AMM. However, they will need to convince Uniswap LPs that their risk-adjusted returns are greater than depositing on Uniswap alone.

An important consideration for options traders is the role of volatility. Traditional options traders can purchase options in advance of potential news or catalysts that could cause volatility to increase, and then selling them when volatility spikes. However, this may not be possible with AMM protocols due to their current design.

Options protocols combine pricing, liquidity routing, payout math, and user behavior, no two models are alike. Our Smart Contract Audit service helps you navigate the risks of options AMMs, order books, and custom logic with confidence.

Conclusions

DeFi Options are far from being a serious competitor to its centralized counterparties due to limitations in terms of liquidity and UX.

Low liquidity and fragmented pools make it difficult to execute large trades. Additionally, there are not enough traders to offer economic incentives to LPs and attract liquidity to the market. This creates a chicken-egg problem where the lack of liquidity is worsened by its fragmentation, as these fragmented pools cannot handle large orders.

Furthermore, there are insufficient traders to offer economic incentives to liquidity providers (LPs) and attract liquidity to the market. As a result, this creates a chicken-and-egg problem, where the shortage of liquidity is aggravated by its fragmentation on DeFi platforms, as these fragmented liquidity pools cannot handle large orders.

Order books face scalability and latency issues due to the need for constantly checking the orders on-chain. As a result, the majority of these platforms primarily serve as a settlement layer for structured products that rely on OTC trading rather than on-chain execution.

AMMs have challenges for LPs such as inventory risk. Hedging may mitigate these risks, but it also limits liquidity available for trading and limits traders' access to liquidity.

Structured products allow for automated investment strategies and are a great tool for novice investors. However, the user must decide which strategy to use based on market conditions.

While the AMM-based options protocols sound promising, it remains to be seen if they will gain sufficient traction. The key challenge will be convincing AMM LPs to deposit capital in their protocol instead of Uniswap.

Potential improvements in the space could be:

- Cross-margining: similar to CEXs, allows traders to use their open positions as collateral to open additional positions and potentially increase profits, but it also increases risk as losses from one option can be used to cover the margin requirement for another. Some traders may still find the potential benefits of using available margins across multiple options to outweigh the increased risk.

- Onboard market makers to provide deep liquidity: This can be challenging in an adversarial market, as market makers may try to arbitrage and take advantage of the platform designs. One example of potential issues include arbitraging (toxic order flow) LPs of AMMs. Managing relationships with market makers and designing systems carefully is crucial.

- Undercollateralized trading: increase leverage to a better capital efficiency.

- Implement a liquidation engine that is straightforward to understand and does not rely on loosely defined parameters.

- Yield-bearing assets to be used as collateral. For example AAVE USDC (aUSDC), instead of just plain stablecoins, similar to using stETH instead of plain ETH.

In this article, we have explored the different options categories and their workings, explaining the pros and cons of the different approaches followed in the space. For the next article, we will delve into the different pricing approaches and tokenomics.

DeFi options remain early and capital-heavy. AMMs and structured vaults expand access, but introduce trade-offs in transparency and control. Focus on collateral, liquidations, utilization, and pricing to ship safely and consider an expert audit before launch. Read our DeFi Perpetuals guide next, plus liquidity incentives for options LPs.

FAQ

What are DeFi options?

DeFi options are on-chain contracts that give you the right, not the obligation, to buy or sell a crypto asset at a specific price before or at expiry. They’re used for hedging, yield, and directional bets.

How do order-book venues differ from AMM-based DeFi options?

Order books offer precise strikes/tenors and maker–taker pricing but rely on posted liquidity. AMMs offer faster entry/exit and routing through pools, though pricing can react to utilization and pool TVL.

What are “structured products” (DOVs) in DeFi options?

They package strategies like covered calls/puts into deposit-and-earn vaults that roll weekly. They simplify execution and settlement but concentrate short-vol risk and often rely on weekly expiries.

How is the settlement price determined at expiry?

Most venues use an oracle or reference index read at a specific timestamp. Always check the settlement source, timing, and any fallbacks in the venue docs before opening positions.

Can I exit a DeFi options position before expiry?

On order books, you can close by selling or offsetting the position if there’s liquidity. Some AMMs let you sell back to the pool pre-expiry; others are closer to “buy and hold” until settlement, verify this per venue.

What risks should I review before trading DeFi options?

Check oracle/settlement assumptions, liquidity and utilization around expiries, early-exit mechanics, off-chain matching/quoting dependencies, margin rules, and how redemptions work if oracles are delayed.

How do margin and collateral work across mechanisms?

Order books often support position-level or cross-margin; AMMs rely on pool-level constraints; structured products follow vault rules. Align margin style with your strategy and collateral availability.

Which chains are best for trading DeFi options?

L2 EVM chains often provide lower fees and faster confirmations; Solana offers high throughput and low latency. Consider gas, finality, wallet UX, and bridging timelines relative to your expiry schedule.

What metrics signal “healthy” DeFi options liquidity?

Look for consistent open interest, tight spreads, steady utilization (not spiking into expiry), and the ability to enter/exit size without moving price. Historical fill quality and redemption reliability also matter.

Sources & References

- Black, Fischer, and Myron Scholes. 1973. “The Pricing of Options and Corporate Liabilities.” Journal of Political Economy 81 (3): 637–54. https://doi.org/10.1086/260062.

- Augen, Jeffrey. Volatility Edge in Options Trading: New Technical Strategies for Investing in Unstable Markets, 2008.

- Documentation & Discords of the protocols included in the analysis.

Economic Security Lead

Pablo holds a Master's in management, having focused in finance, and with a thesis on DeFi, demonstrating his knowledge and expertise in this field. He has extensive experience in research and analysis of DeFi protocols, having worked as an analyst at Siemens and a DeFi researcher at Deep Tech Ventures. His background in finance, research and analysis skills are a valuable addition to our team.