DeFi Money Markets 2024: How Trustless Lending and Borrowing Drive Financial Innovation

Introduction

This article aims to provide an overview of the current DeFi Money Market space and compare different protocols, with a focus on how they work rather than their potential as an investment vehicle.

By examining a diverse range of models and protocols, we aim to highlight how lending and borrowing work in a trustless environment. This exploration will provide insights into the mechanisms that drive liquidity, risk management, and innovation in the DeFi landscape.

We covered the following protocols: AAVE, Compound, Maple Finance, Solend, Spark, Curve, Llamalend, Dolomite, Gearbox, Sentiment, Notional, Wildcat Finance, Union Finance, Fluid, Kamino Finance, Radiant Capital, Scallop, ZeroLend, LayerBank, Benqi, Avalon, Idle, Rari Capital (Fuse Pools), Euler, Ajna Finance, Myso Finance, Morpho, Goldfinch, Centrifuge, Venus.

What are Money Markets?

Money Markets allow users to lend and borrow assets, providing liquidity and the ability to manage capital efficiently. In traditional finance (TradFi), Money Markets commonly use financial instruments such as treasury bills, certificates of deposit, and commercial paper. Each offers institutions and individuals different options to address their short-term liquidity needs and provide safe returns.

In DeFi, money markets operate similarly but emphasize over-collateralized positions. Here, borrowers must provide collateral that exceeds the loan amount, a safeguard due to crypto's volatility and the anonymity of DeFi.

Over-collateralization provides lenders with security: if the borrower defaults, the lender can recover their funds through the collateral.

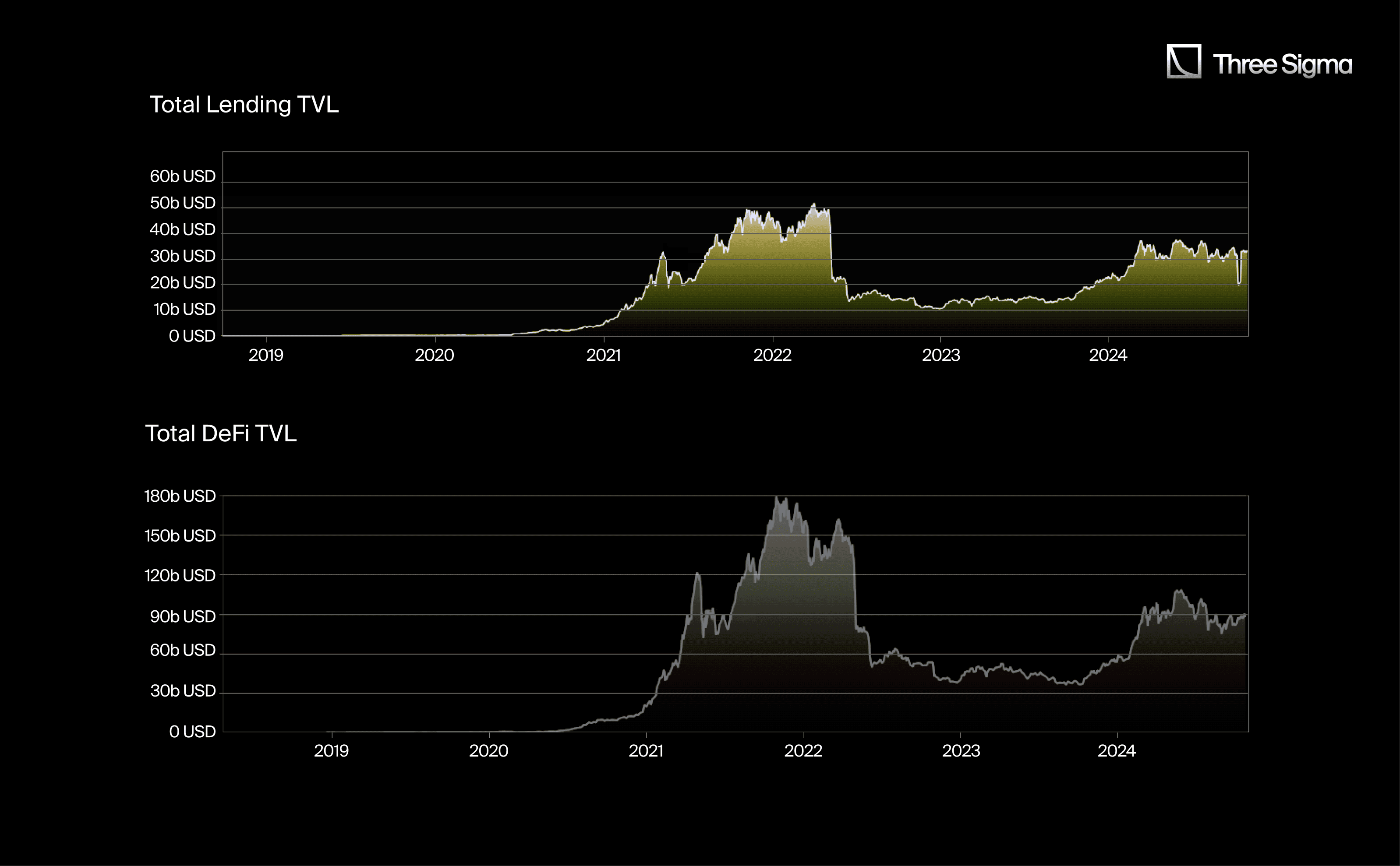

As of October 23, 2024, the total TVL in the DeFi lending market is about $33 billion, making it the second-largest sector in DeFi, just behind staking, according to DeFiLlama. Most top DeFi lending protocols use overcollateralized models, with 8 out of the top 10 protocols implementing it. In contrast, TradFi is much larger; for example, the total outstanding U.S. commercial paper grew to approximately $1.23 trillion in 2024.

Over-collateralized lending

Over-collateralized lending is the most common type used by protocols. These money market protocols allow lenders to earn yields on their collateral, while borrowers take out over-collateralized loans and pay interest, which becomes the lenders' yield.

As DeFi money markets are meant to be decentralized and enable permissionless borrowing, this introduces the challenge of ensuring borrowers don’t simply vanish with the funds.

In this trustless environment, over-collateralization and liquidation mechanisms ensure that lenders can reclaim their funds if borrowers default. These systems rely solely on smart contracts, avoiding the need for off-chain complexities like credit scores, borrower reputation, KYCs, risk assessments, etc. As a result, undercollateralized lending remains a niche, holding only a small fraction of the market.

On overcollateralized protocols, borrowers can borrow funds in two distinct ways.

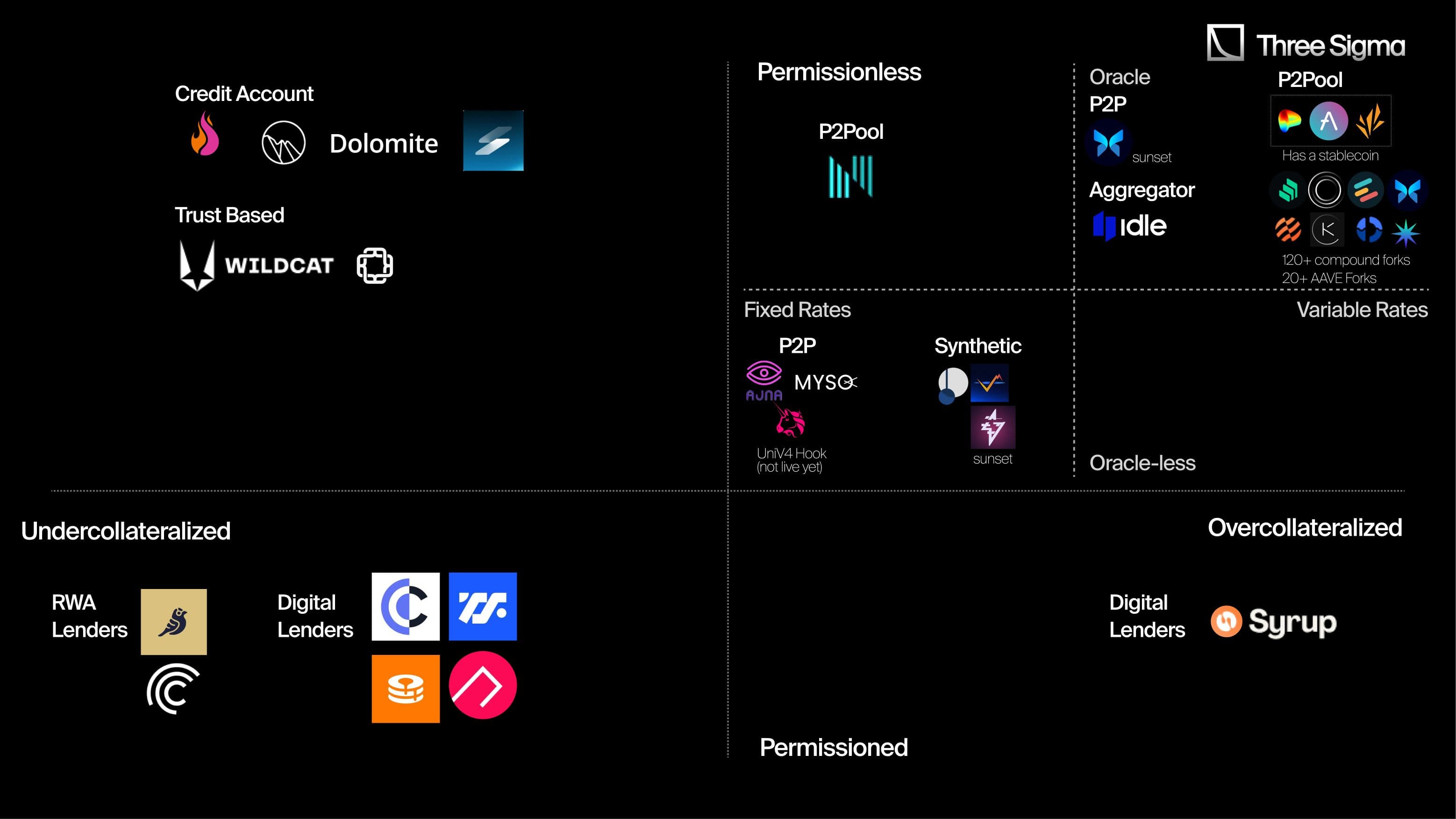

Peer-to-Pool (P2Pool)

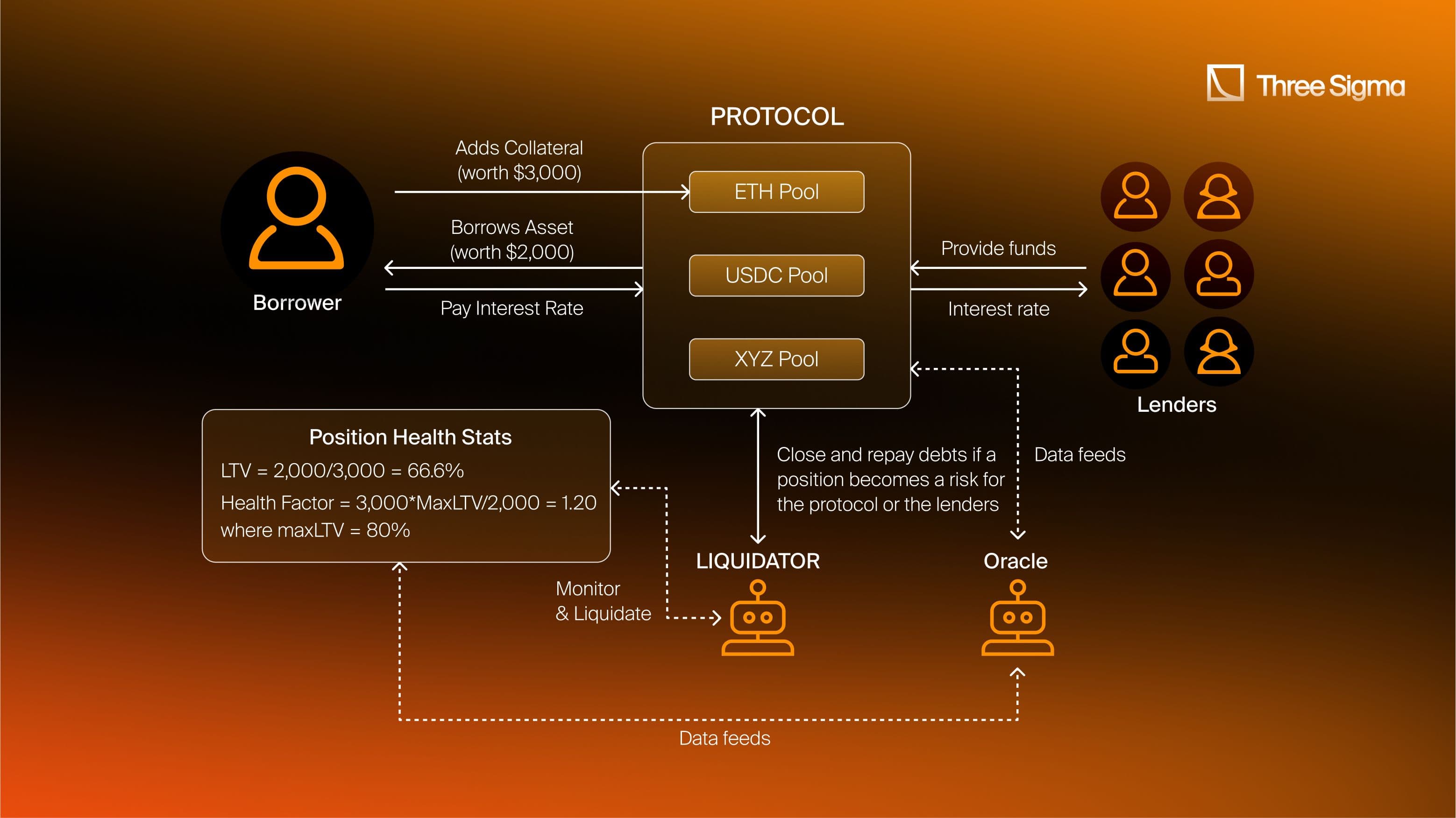

Pooled lending involves aggregating funds from multiple lenders into a common pool. Borrowers then draw from this pool, and the interest they pay is distributed proportionally to all lenders. This type of lending distributes risk across all the lenders in the pool while simultaneously increasing flexibility and liquidity.

Examples include AAVE and Compound on EVM or Kamino on Solana.

Aave (TVL: $19.24b)

AAVE is one of the most popular DeFi protocols around, allowing users to lend and borrow crypto. Lenders earn interest by depositing assets into specially created liquidity pools, while borrowers can use their crypto in overcollateralized positions to take out a loan.

One of Aave’s unique features is the ability to choose between stable or variable interest rates on loans, providing flexibility based on market conditions. Aave allows liquidators to use flash loans to liquidate undercollateralized loans.

With the latest improvements, Aave v3 introduced new features that improve its cross-chain capabilities and capital efficiency. Portal allows for seamless liquidity movement across different networks, and Efficiency Mode optimizes borrowing power when collateral and borrowed assets are price-correlated. Aave has also launched GHO, an overcollateralized decentralized stablecoin pegged to USD, with interest payments going directly into the protocol’s treasury.

Compound (TVL: $2.64b)

Compound is an algorithmic, autonomous interest rate protocol that enables the supply of assets as collateral to borrow the base asset, as well as earning interest by supplying the base asset.

Kamino Lend (TVL: $1.4b)

Kamino Lend is a P2Pool protocol that uses a unified liquidity market, offering higher leverage through 'eMode' for correlated assets like SOL. It tokenizes CLMM LP positions into fungible kTokens, enabling leveraged liquidity provisioning.

Risk management includes deposit/borrow caps, auto-deleveraging, and protected collateral options. Liquidations are dynamic, with partial liquidations and penalties starting at 2%, scaling with LTV, incentivizing efficient liquidations.

Peer-to-peer (P2P)

P2P lending is when individual lenders and borrowers make direct loans facilitated by the protocol. Lenders and borrowers can specify their loan parameters, suiting their risk preferences and potentially leading to more favorable interest rates for both parties.

However, the risk in such cases is transferred from the protocol to the lender. In cases of insolvency, the lender is the one who loses money. An example is Myso Finance:

Myso Finance (TVL: $0.6m)

In Myso, lenders create loan offers with custom parameters, such as the type of collateral and the token lent against it, which borrowers meet. In the event of a default, the lender gets access to their collateral.

However, it is possible that the value lent surpasses the value borrowed (since the borrowed asset and the collateral can be different assets). In this case, the borrower does not repay the loan, and the lender loses money. A buffer usually exists to reduce the likelihood of this occurring.

Enzyme Finance, source, recently acquired Myso.

While P2P lending can offer more favorable rates, it suffers from a major liquidity problem that affects its scalability. Loans need to be matched individually, whereas pooled lending protocols standardize this process using smart contracts, allowing for more efficient liquidity. Hence, protocols tend to focus on pooled lending. However, Morpho offers a mix of both.

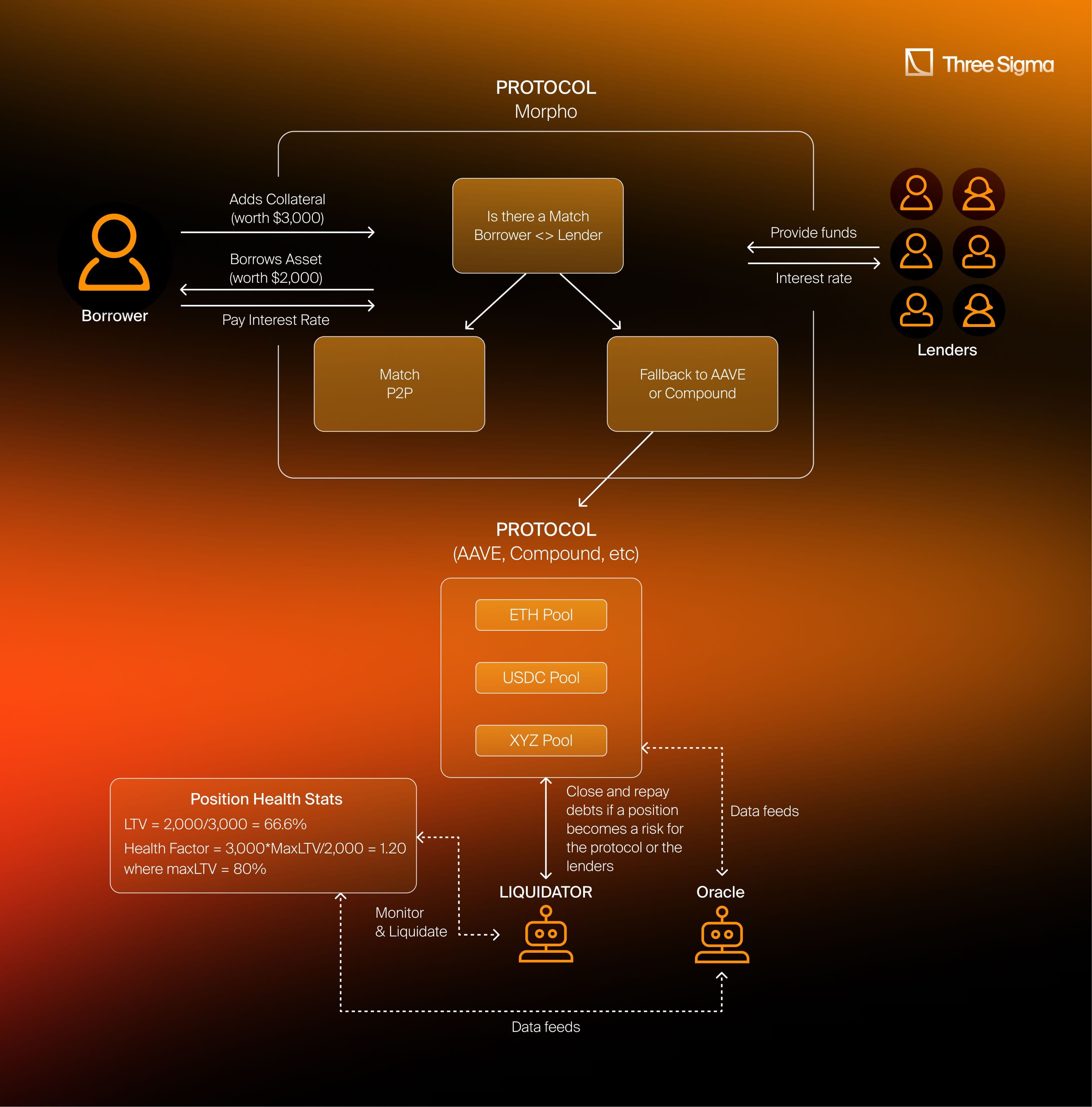

Morpho Optimizers (Sunset)

Morpho Optimizer was a peer-to-peer layer built on top of lending protocols like AAVE and Compound to enhance liquidity allocation. It functioned by autonomously allocating collateral either through direct peer-to-peer matching or, if no direct match was found, by utilizing the protocol’s standard lending pool.

This approach aimed to provide users with optimal interest rates—either matching borrowers directly for the best rates or falling back on the protocol’s pool rates when a P2P match was not possible.

Morpho has since shifted its focus to MorphoBlue (now simply Morpho) and MetaMorpho Vaults (now Morpho Vaults). These vaults operate within a permissionless system where designated risk curators—such as Gauntlet, MEV Capital, and Re7—are empowered to manage specific vaults. This setup allows curators to strategically optimize liquidity and yields across different assets based on their expertise and strategies.

Under-collateralized Lending

Undercollateralized loans are a type of borrowing where the borrower provides less collateral, or no collateral at all, than the amount of the loan they receive.

The TradFi credit-based model relies on trust to issue loans. Lenders assess the borrower’s trustworthiness, primarily through credit scores. A higher score means access to more capital. Credit scores are built from multiple factors, including income, assets, and repayment history, analyzed by creditors.

In crypto, the same trust-based assessment is harder to implement. The decentralized and often anonymous nature of crypto makes it impossible to conduct such analysis without centralization. This creates challenges for undercollateralized loan protocols, such as higher default risks, unattractive interest rates, and mandatory KYC checks.

Despite these hurdles, some protocols have managed to offer undercollateralized loans. These protocols generally fall into two categories: those that verify lenders off-chain through permissioned systems and those operating entirely on-chain.

Off-chain / Permissioned

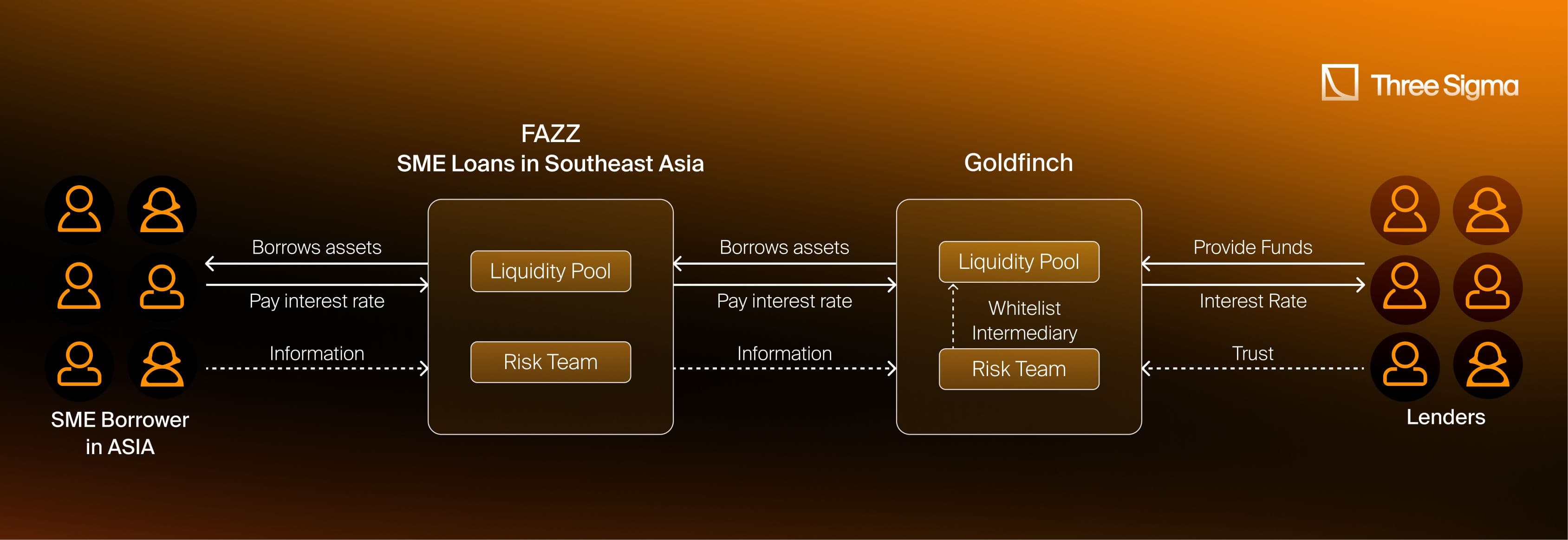

One one hand protocols such as Centrifuge and Goldfinch focus on Real-World-Assets (RWA) by lending to, for example, emerging country start-ups.

Goldfinch (TVL: $2.6m)

Goldfinch is a decentralized credit protocol allowing crypto borrowing without crypto collateral. Borrowers propose borrowing pools with specific terms, such as rates and repayment duration. Lenders can provide general liquidity as liquidity providers or lend in a specific borrow pool as backers. In the event of a default, the backer’s liquidity will be used first to pay the debt, followed by the liquidity providers. As such, backers receive a higher interest rate for this additional risk. The lenders can then pursue off-chain legal recourse to recoup their losses.

When losses are recouped, liquidity providers are paid first, followed by the backers. All involved parties are required to be verified by KYC and additionally, all borrowers and borrower pools need to be approved by auditors. The auditors combine KYC information and on-chain data to create a profile for borrowers, which affects your credit availability.

On the other hand, there are protocols that focus on digital assets lenders, such as Wintermute, Galaxy Digital, FalconX, Orthogonal Trading, etc. Those protocols are Maple, Ribbon Lend, TrustFi, Clearpool, and many others. This was a very hot vertical around 2022 with many protocols sunsetting after the collapse of Alameda and FTX.

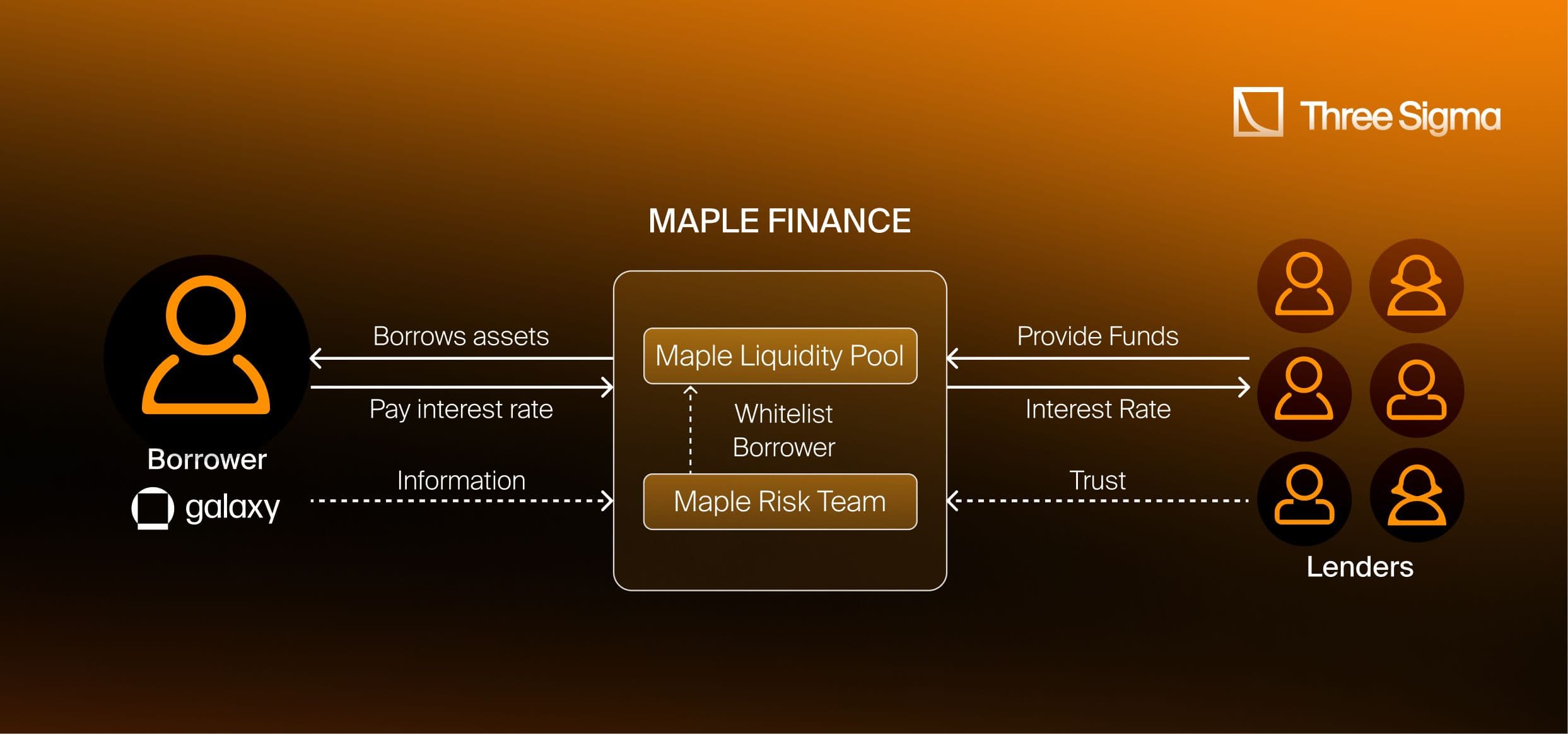

Maple Finance (TVL: $84.6m)

Maple Finance is a pool-based lending protocol that has a network of auditors responsible for vetting both potential borrowers and suppliers/lenders. To use the profile as either a borrower or lender, your wallet needs to go through a screening process. To work as an auditor, you would need to directly contact the team, as they hire only professionals for this aspect.

Lenders are allowed to deposit their capital into pools of auditors, and borrowers can submit loan requests in these pools. It is up to the auditor to conduct due diligence on the borrower and agree to terms with the borrower off-chain. If agreed, an on-chain request is made, and the loan is finalized.

The auditors have to stake a certain amount of capital, known as first-loss capital, to operate a pool. While the incentives for an auditor to successfully run a pool are the fees paid by the borrowers and lenders, in the case of a default, the bad debt is paid with the first-loss capital.

Maple also has Syrup, which is a fully collateralized lending solution for institutional borrowers.

Unfortunately, many under-collateralized protocols did not correctly judge their borrower’s credit, such as crypto firm Orthogonal Trading defaulting on a $36 million loan to Maple. Additionally, the collapse of 3AC, FTX, and more during the bear market sent massive shocks throughout the entire space, causing massive price fluctuations. This left a lot of bad debt and challenged the solvency of these protocols. Maple, for example, reduced their offering of under-collateralized pools, relying on over-collateralized positions instead for additional security.

However, these protocols are seeing a small resurgence due to the RWA sector gaining traction, with users being able to deposit and use these assets as collateral in protocols like Goldfinch.

On-chain / Permissionless

How can protocols be undercollateralized and permissionless? Wouldn't lenders run off with the funds?

Not quite.

In broad terms, protocols have two different choices. Use “credit accounts” or implement a “trust-based system”. And additionally, “flash loans”.

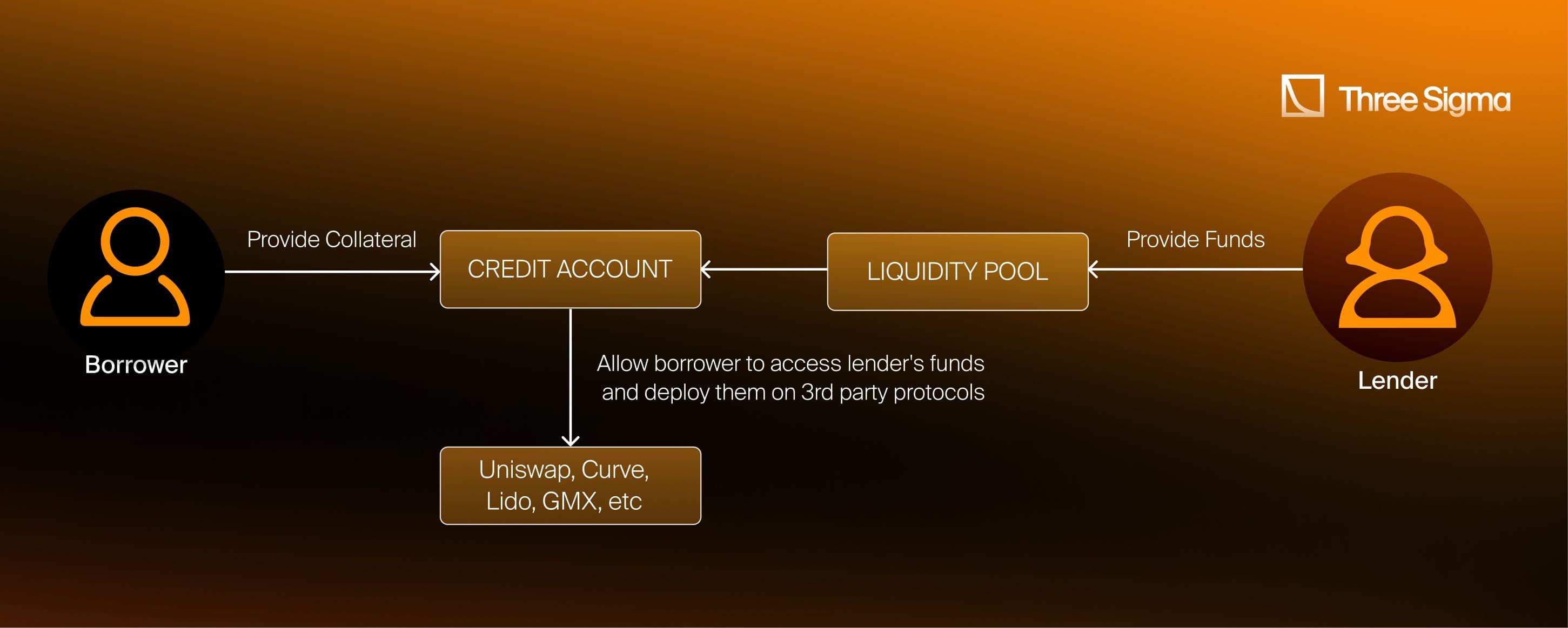

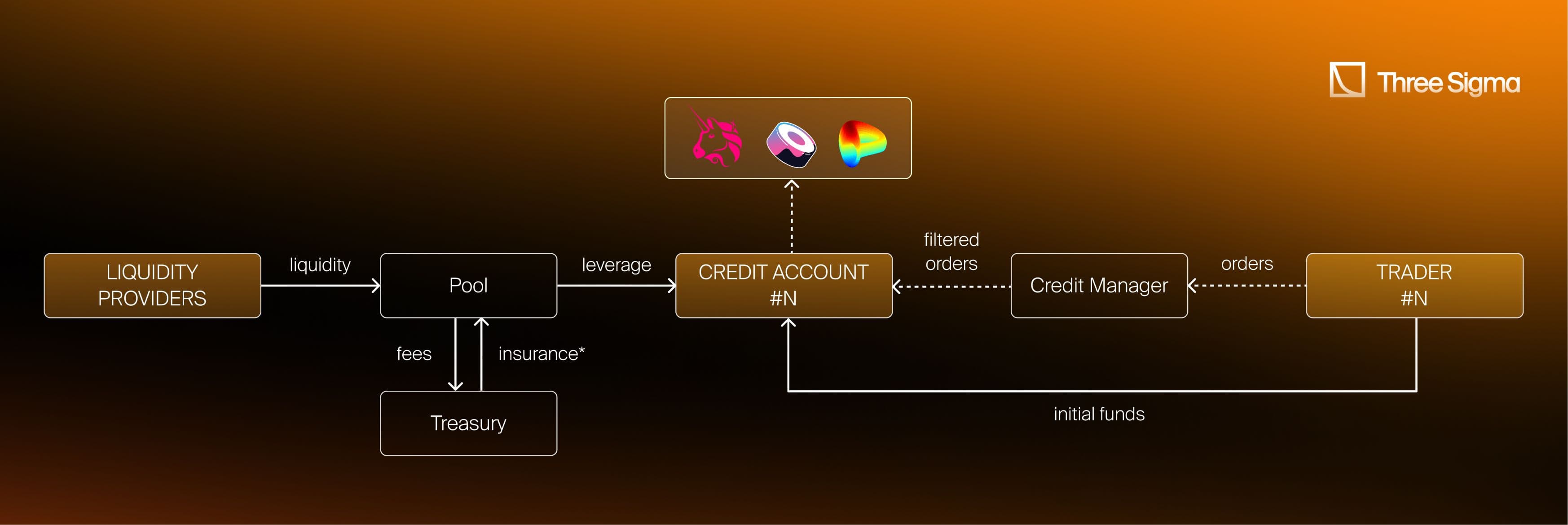

Credit Accounts

Protocols like Sentiment, Gearbox, and Dolomite allow access to leverage but limit actions to those pre-approved by the protocol. On Gearbox, for example, you can borrow ETH and redeposit it on Eigenlayer to farm rewards with leverage. Sentiment offers a similar approach, enabling leveraged positions on GLP (GMX LP).

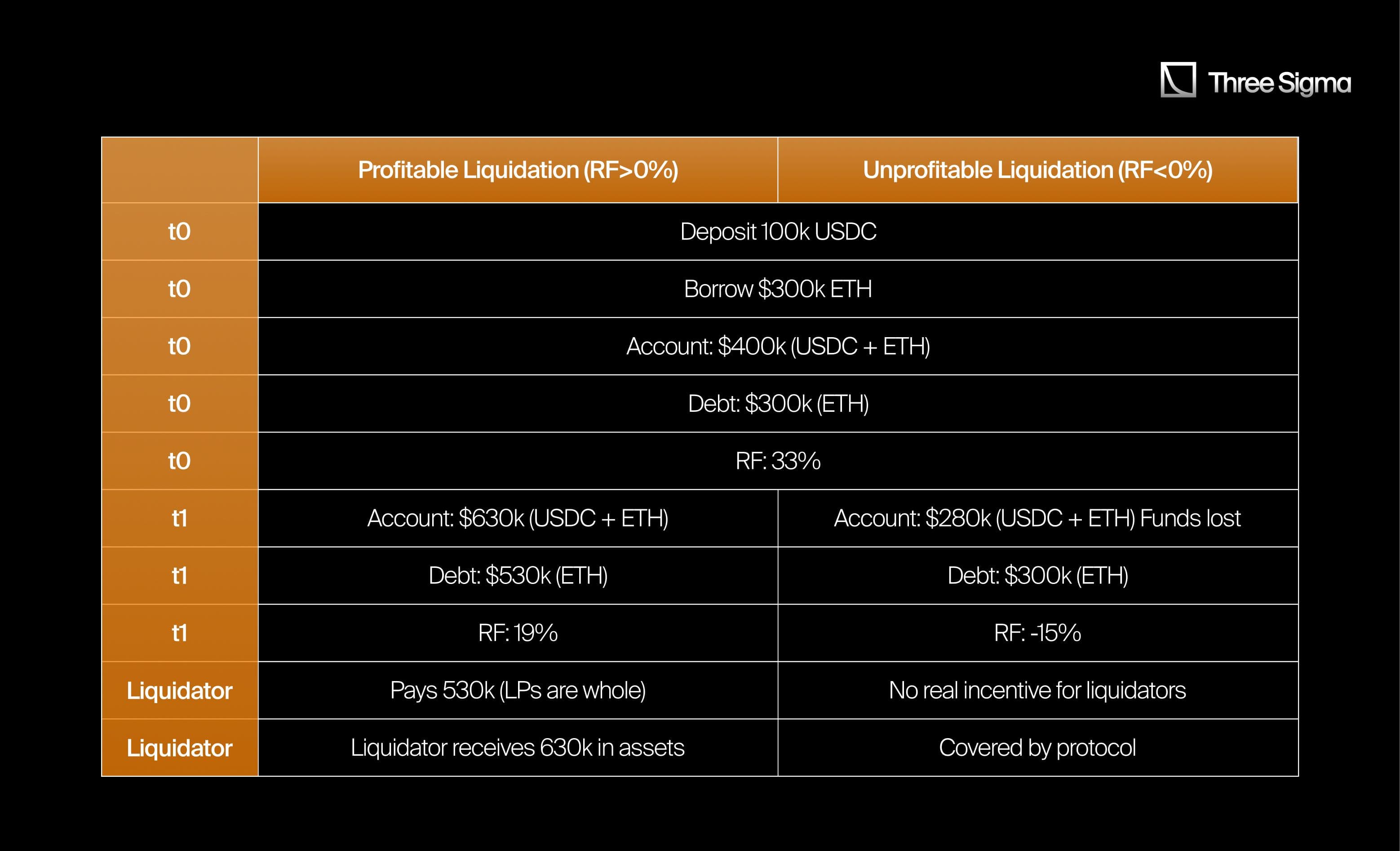

Despite being undercollateralized, these protocols maintain safety through liquidation mechanisms, ensuring that risks don’t spiral out of control and accounts end up very undercollateralized.

When an account is at risk of not having enough collateral to cover its debt, it can be liquidated, meaning that a liquidator steps in, pays off the debt, and takes the account’s assets as a reward.

At-risk accounts are liquidated by repaying their debts in exchange for all the assets in their account. If Collateral + Debt ≥ Borrowed, liquidators pay off the Debt and take the account’s assets as a reward.

If Collateral + Debt < Borrowed, it’s a bad situation. They claim they’ll get insurance from “Sherlock” and have a fund to cover these kinds of losses.

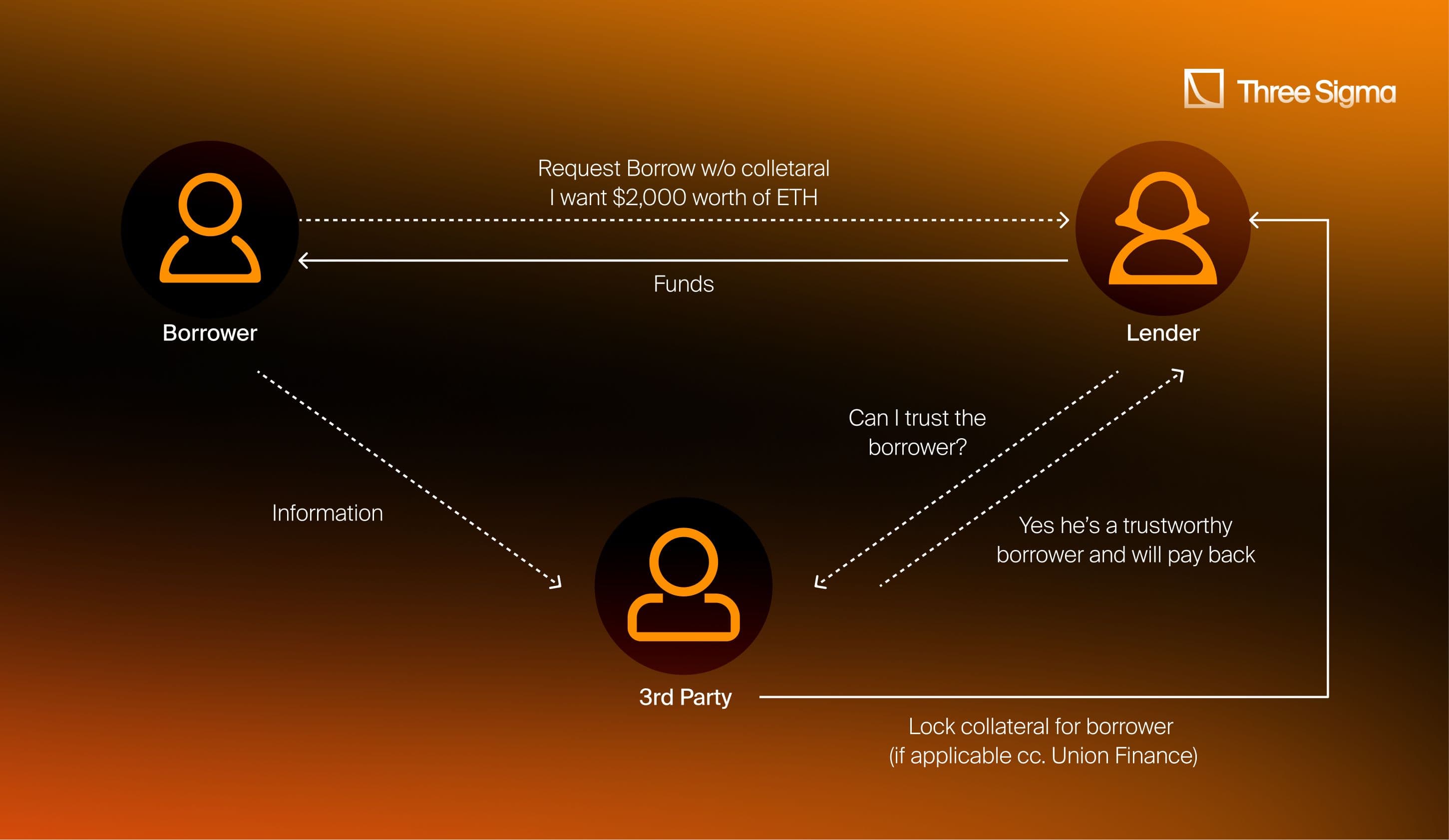

Trust Based Systems

Use a proprietary or third-party way to assess the creditworthiness of the lender.

For example, on Union Finance, you need someone else vouching for you as a trustworthy lender for you to be able to borrow.

Wildcat (not live yet)

Wildcat achieves undercollateralized loans by allowing borrowers to take loans with less than full collateral, supported by a dynamic, trust-based system. Borrowers initially have limited credit, but their credit capacity grows over time as they build a trustworthy repayment history.

Wildcat uses "backers" who provide overcollateralized support to manage risks, securing loans and ensuring the system's stability. This balance of trust, dynamic credit expansion, and third-party backers make Wildcat’s undercollateralized lending model possible.

Union Finance (TVL: $0.2m)

A decentralized, member-owned credit protocol on Ethereum. Members vouch for other addresses, enabling them to borrow without collateral. To be added as a member, at least one existing member must vouch for the new address.

This trust-based model reduces the entry barrier. Union V2 optimizes the system by requiring UNION tokens to be burned when adding new members, preventing spam, and managing system-wide costs. Union also allows unused deposits to be placed in third-party protocols like Compound to earn interest.

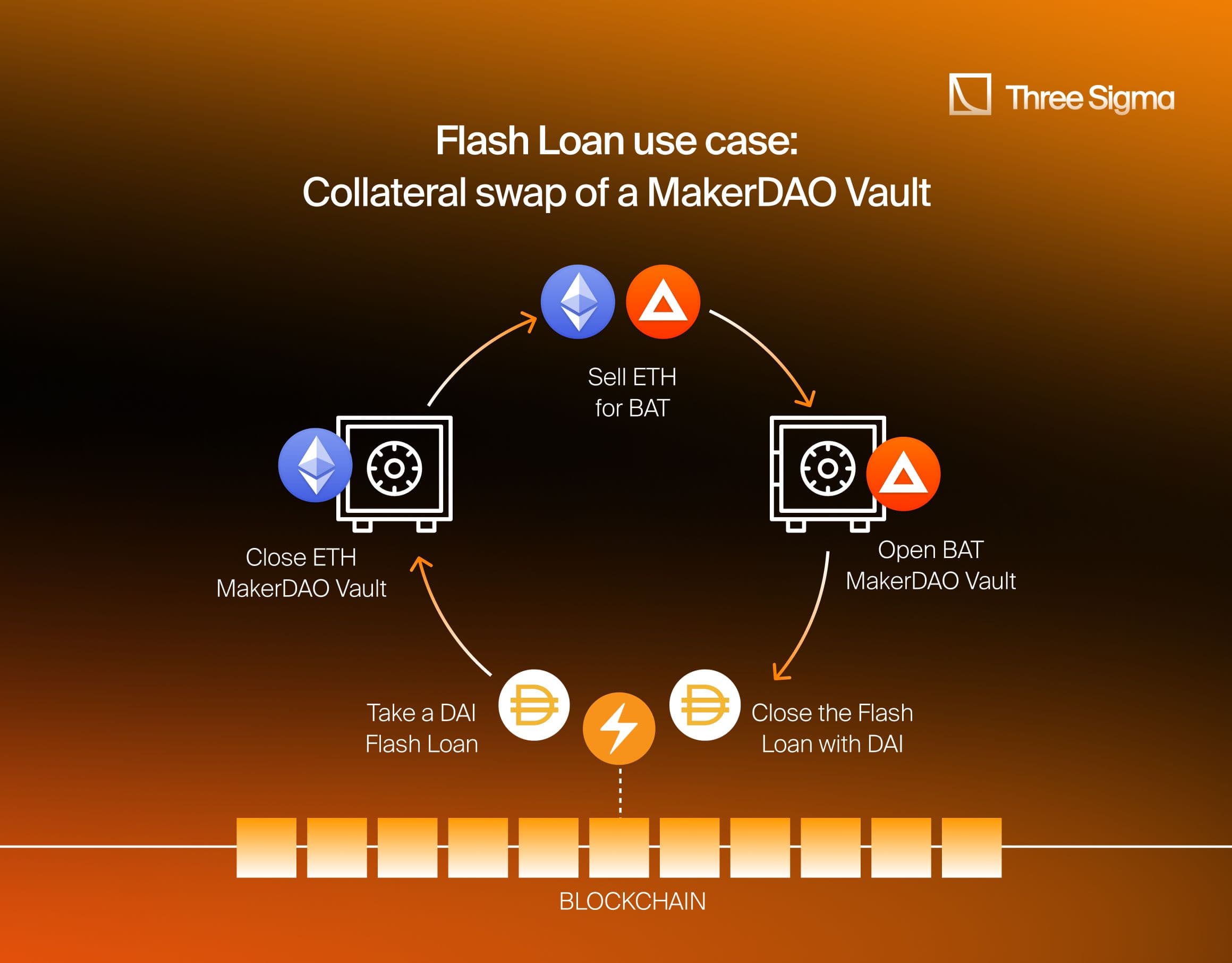

Atomic or flash loans

Use blockchain principles to borrow cryptocurrencies without providing any collateral upfront. To secure a crypto flash loan, the borrower must pay the lending protocol back in full within the same transaction block, plus gas fees. Failure to do so reverses the entire transaction, resulting in no bad debt.

The borrower needs to only pay a gas fee to access this type of loan, allowing for the borrowing of large amounts. It is a feature of AAVE but is unfortunately quite limited in its scope as the loan needs to be paid off in the same block. However, it is still useful, especially for arbitrage purposes and liquidating undercollateralized loans on time.

You can get flash loans through lending protocols such as Aave and Cream Finance, and also participate in flash loans via AMMs like dYdX, Uniswap V3, and Balancer.

Loan Characteristics

Assets

A loan uses assets for its principal and its collateral. How a lending protocol adds pools for assets depends on whether it operates on a Permission or Permissionless model.

Permissionless Pools

Permissionless pools are lending pools that can be created by anyone, specifically they do not need approval from the protocol’s DAO. Inherently, these protocols offer increased options for users to add liquidity, as an owner of any long-tail asset can open a pool to offer borrowing and supplying. Some examples are Rari, Ajna, and Euler.

Rari Capital (Sunset)

Rari Capital gained popularity for its Fuse Pools. Fuse enabled users to create permissionless, isolated lending and borrowing markets. Each market could have its own set of parameters, such as interest rate models, supported collateral, and liquidation thresholds. This allowed users to deploy customized lending pools without needing approval from the protocol, offering a high degree of flexibility and control.

In Fuse pools, borrowers and lenders could interact under terms they defined, selecting assets and risk profiles unique to each pool. For example, one pool might consist of stablecoins and conservative assets, while another could involve riskier assets like OHM. This was what made Rari so popular as users could get leverage on OHM. This isolated market structure ensured that issues in one pool would not affect others, reducing systemic risk.

Fuse pools were targeted by exploits due to vulnerabilities in their design, not once but twice, read more here and here.

Rari's core developers were high schoolers. After the second hack they were accused by the community of neglecting their responsibilities, and they struggled to manage the fallout effectively.

Euler V2 (TVL: $4.44m)

Euler V1 offered a permissionless platform where almost any token can be listed, as long as it is paired with WETH on Uniswap v3. Unfortunately, on March 13, 2023, Euler V1 experienced one of the largest DeFi hacks ever, losing over $195 million, Rekt.

Euler launched V2, which added the Euler Vault Kit (EVK). Using EVK, users can create customizable Edge vaults, which act as lending pools with fully customizable parameters.

Ajna Finance V2 (TVL: $4.16m)

Ajna Finance uses a non-custodial, permissionless system that operates without oracles or governance, ensuring a high degree of decentralization and autonomy. Since Ajna is non-custodial, the protocol does not have any solvency risk. Instead, the risk is shifted completely to the borrowers and lenders. Ajna allows for the creation of markets with specific collateral and loan assets, simplifying the process and enhancing user accessibility.

The platform supports a wide array of assets, including both fungible and non-fungible tokens (NFTs).

Save fka Solend (TVL: $280m)

Save is a decentralized lending and borrowing protocol built on Solana.

The protocol uses a multi-pool structure. The main pool holds most of the funds, while isolated pools are used for riskier assets. Users can create their permissionless pools on their terms. Pool creators earn 20% of origination fees generated in their pool, incentivizing the creation of new pools for various assets. Each pool has specific parameters controlling lending and borrowing rates, liquidation conditions, and usage limits.

Save implements a Recovery Mode during high volatility periods, allowing quick parameter adjustments to protect the protocol and its users. This mode may result in liquidations without the usual penalties. It uses various mechanisms to balance risk and reward, such as dynamic interest rates based on utilization and careful asset screening before inclusion in the main pool.

Permissioned Pools

Most protocols, such as AAVE and Compound, implement permission to deploy new pools (whitelist new assets) for borrowing and lending. This requires the governing DAO to vote on approving new lending pools or not, often with the help of third-party risk firms like Three Sigma, Gauntlet, or Chaos Labs.

This process is required because these protocols aggregate liquidity. Taking this approach means that all deposited token liquidity is concentrated into a single pool from where users can cross-margin their lending and borrowing. Aggregating liquidity into one large pool for all deposits results in higher utilization rates, and more capital efficiency.

On the other hand, this exposes liquidity providers to systemic risk, where if one token is exploited, the protocol might face insolvency challenges. Therefore, only tokens that have minimal market, contract, and counterparty risk are approved.

Interest Rates

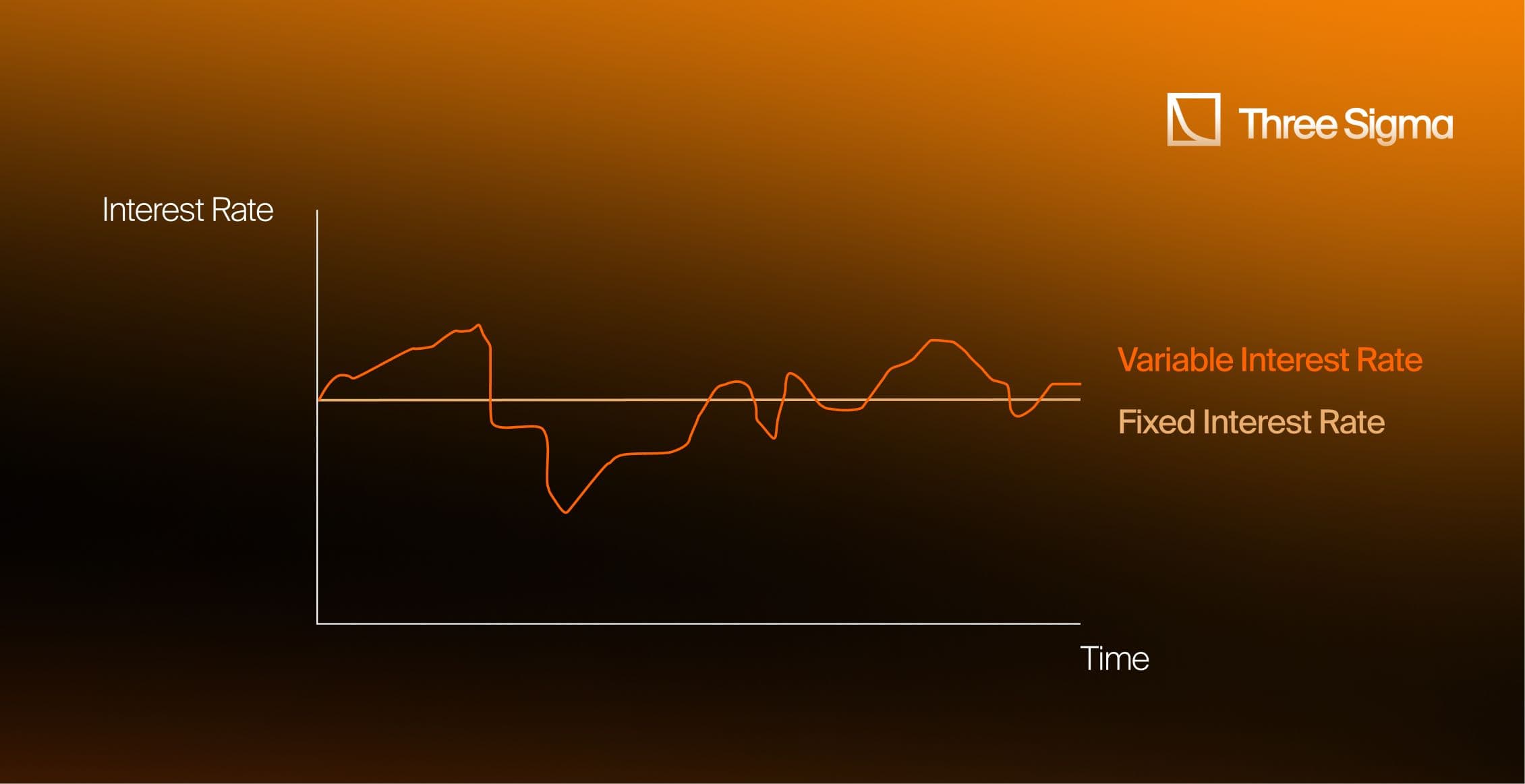

Interest rates determine the yield lenders earn and the payments borrowers make. Depending on the type of protocol, this interest rate is calculated differently, using either a fixed rate or a variable rate.

Fixed-Rate

A fixed rate is usually used in peer-to-peer protocols, where the lender and borrower agree on a specific rate for a defined time. At the expiration of the loan, the borrower can repay the debt plus interest to claim their collateral.

While fixed rates are used in pooled lending protocols, they are offered for only stable assets, such as stablecoins, and are subject to rebalances depending on their demand and supply. Fixed-rate loans are often used in yield-aggregating protocols, such as Notional.

Notional (TVL: $20m)

Notional is a Peer2Pool protocol. Where lenders can supply capital on the fixed terms pool, earning predictable interest rates, while borrowers take out loans at these rates for the same duration and same pre-defined maturities.

The protocol operates using fCash tokens, which represent claims to a fixed amount of currency at a future date. These tokens can either be held until maturity or traded in secondary markets, allowing users to manage their fixed-rate positions with greater flexibility. The ability to buy and sell fCash before the end of the term adds liquidity to the system, offering participants a way to adjust or exit their positions if needed while maintaining the structure of fixed-term agreements.

Another possibility is to lend on AAVE, or any other variable-rate protocol, and then use Pendle, IPOR, or Voltz to hedge against interest rate fluctuations by shorting the variable rate exposure. This strategy effectively converts your position into a fixed-rate loan. These protocols offer derivative markets for interest rates, allowing you to lock in a fixed rate or profit from interest rate volatility, depending on how you structure the position.

Pendle (TVL: $2.5b)

You can indirectly short interest rates on Pendle by trading future yield tokenized as Yield Tokenized Assets (YTs). This allows you to sell future interest from yield-bearing assets, which effectively gives you a way to hedge or speculate on interest rate movements. However, it is not a direct shorting of interest rates, but rather a way to sell expected yields on future income.

IPOR (TVL: $10.4m)

IPOR allows users to trade interest rate swaps, where they can take a position to "pay floating and receive fixed." This means that users can hedge or speculate on interest rate movements. If you expect rates to decrease, you can effectively "short" the floating rate by locking in a fixed rate while benefiting from falling rates on the variable side

Voltz (Reya) (Sunset)

The Voltz Protocol (now transitioning to Reya and focused on perpetuals) allowed users to trade interest rate swaps, giving them the option to exchange fixed and variable rates. This could involve taking a variable position to "short" interest rates if you expect them to decline. Voltz facilitated leveraged trading, making it easier to speculate on interest rate movements.

Voltz is being sunset in favor of new developments under Reya.

Creating a synthetic fixed-yield position requires managing it across multiple platforms, which increases risk by exposing users to additional protocols and introduces friction to the user experience. This process complicates the creation of synthetic fixed-rate borrowing, adding layers of complexity and potential vulnerabilities.

Variable Rate

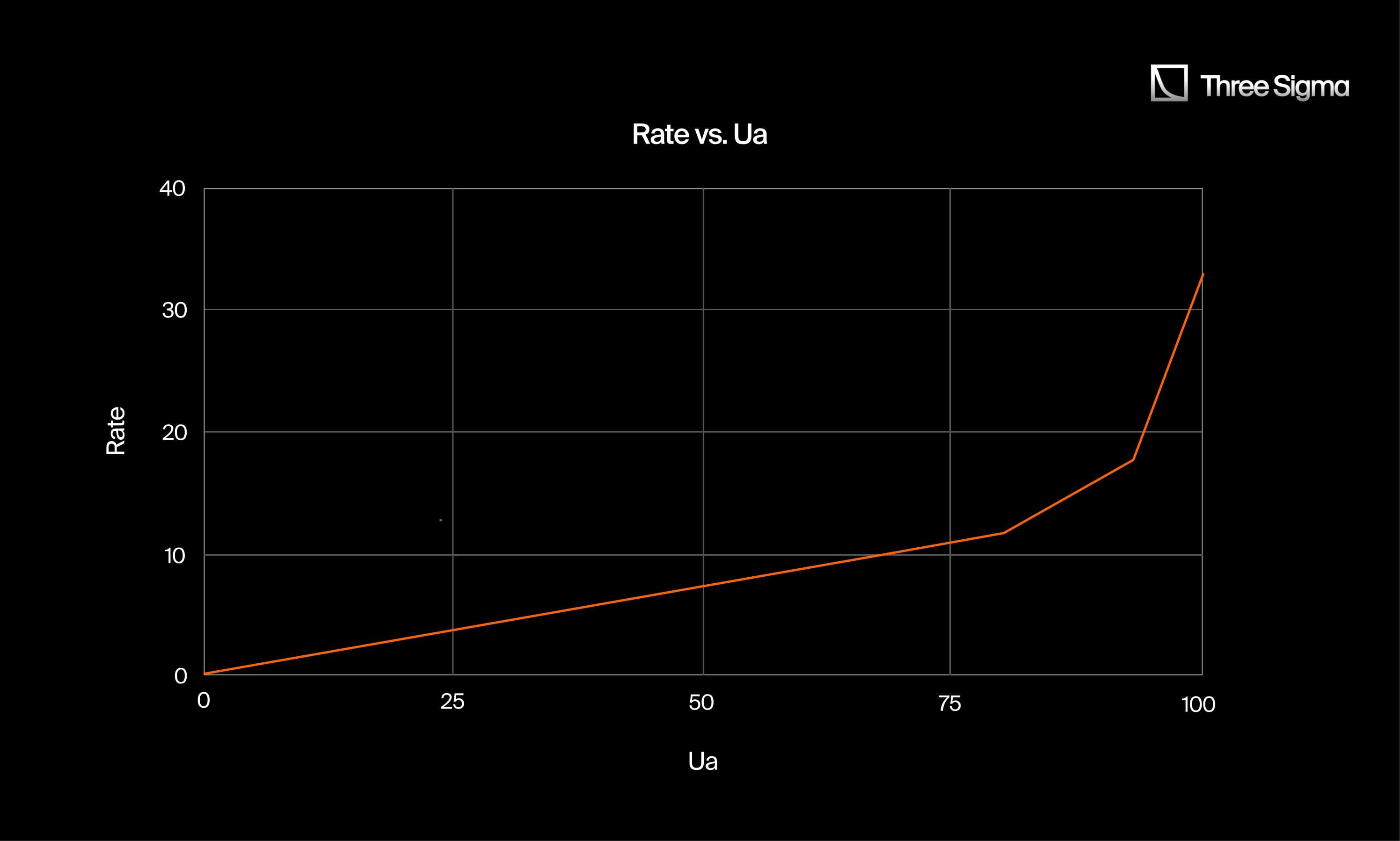

In pooled lending, where most liquidity resides, protocols use a variable interest rate that adjusts based on the utilization rate—the proportion of supplied funds that are loaned out. A higher utilization rate indicates that more capital is generating interest, enhancing revenue for both lenders and the protocol. This dynamic helps optimize returns and capital efficiency.

However, a 100% utilization rate poses significant liquidity risks, as all funds are tied up in loans, leaving no liquidity for withdrawals. This situation can lead to a bank run if lenders attempt to withdraw their funds but the protocol lacks liquidity to fulfill the requests.

To mitigate this risk, most protocols implement an interest rate curve with a threshold, known as the kink point. This is usually set around 60% to 80% of the utilization rate, depending on the asset. The rate remains relatively stable until the utilization rate approaches this point, after which it rises sharply to discourage excessive borrowing and attract more deposits.

The utilization rate serves as a key driver for adjusting interest rates. When demand for borrowing is high relative to available liquidity, the interest rate increases, encouraging lenders to supply more and borrowers to repay their loans. Conversely, a lower utilization rate results in lower interest rates, incentivizing more borrowing and increasing the rate of capital usage.

Protocols must carefully determine the ideal utilization rate for each asset by considering factors such as volatility, liquidity risk, and market capitalization. Higher-risk assets often have lower optimal utilization thresholds due to their liquidity needs and volatility, while stablecoins can support higher thresholds due to their price stability and high liquidity.

For example, on AAVE, the interest rate curve is defined by the following equations, which adjust rates based on whether the utilization rate is below or above the optimal point:

Which yields a curve similar to the one below.

Most protocols set variable interest rates as a function of utilization rate since it is simple to implement and effectively sets market rates. However, it relies on users acting rationally, and thus can either underestimate or overestimate user’s reactions to market events. Therefore, further protective measures are required.

Fluid (TVL: $426m)

Fluid protocol creates a unified liquidity layer, streamlining lending and borrowing processes. The Lend Protocol allows users to deposit assets into ERC-4626-compliant vaults, enabling long-term yield generation while interacting with the liquidity layer.

Fluid uses dynamic interest rates based on liquidity utilization, along with automated limits to manage risk. The built-in DEX supports smooth asset exchanges, ensuring liquidity flows efficiently across the protocol. The system is underpinned by a robust oracle that ensures accurate pricing for lending and risk management.

Maturity

A loan expires when it reaches its maturity date. There are two types of loan durations in crypto: perpetual and fixed-term.

Perpetual loans have no fixed end date, being held open until either the borrower pays off the principle of the loan or cannot maintain the position, i.e. their collateral can no longer cover the debt accumulated. Such a loan gives borrowers continuous access to capital and gives them the freedom to pay back the principal at their convenience. However, the borrower has to manage his position and debt regularly, or their collateral is at risk.

Fixed-term loans have a specific period during which they must be paid off. Otherwise, borrowers will automatically forfeit their collateral and will no longer be expected to pay the loan. Although these types of loans offer you less flexibility, they are predictable and offer a clear idea of how much debt you would accumulate. Flash loans are a subset of these loans, which have a fixed period of 1 block to repay the debt and gas fees. If the debt is unpaid, the transaction fails and the borrowed amount is returned.

The Synergy Between Money Markets and Stablecoins in DeFi Platforms

Many on-chain stablecoins effectively operate as money markets, relying on overcollateralised debt positions (CDP). This overlap explains why some money markets have expanded into stablecoins and, conversely, why stablecoins have ventured into money markets.

Although stablecoins aren't the primary focus here, it's worth noting some notable examples of this trend.

AAVE and GHO

AAVE’s stablecoin GHO allows users to mint stablecoins by locking up collateral within the AAVE protocol. Like its counterparts, GHO ensures overcollateralisation to maintain stability.

The peg to $1 is maintained by ensuring that users lock up collateral that exceeds the value of the GHO they mint. If the collateral falls in value or the debt ratio rises, the protocol can trigger liquidations to maintain solvency and the peg.

Spark and DAI (USDS)

Spark, an AAVE V3 fork, is backed by MakerDAO. It allows users to stake DAI as sDAI and earn returns through the DAI Savings Rate (DSR). This enhances DAI’s utility. Although rebranded as USDS, the original DAI branding remains more recognizable.

DAI, a well-known overcollateralised stablecoin, maintains its peg through collateral deposits and liquidation mechanisms. When users deposit assets as collateral, they can mint DAI, but the value of the collateral must always exceed the amount of DAI in circulation. If the collateral's value falls too much, it is liquidated, ensuring that there is always sufficient backing.

Curve Lend and crvUSD

Curve’s isolated lending market, Llamalend, allows users to borrow or lend using crvUSD. Being isolated risk is contained within individual markets, further contributing to stability, and expanding the utility of crvUSD within Curve's ecosystem.

crvUSD is an overcollateralised stablecoin designed for borrowing and lending within Curve's isolated lending markets.

crvUSD maintains its $1 peg through a combination of collateralisation and liquidation processes similar to DAI. It uses a “self-correcting” algorithm to manage risk, dubbed the LLAMMA (Lending-Liquidating AMM Algorithm).

This system continuously rebalances collateral as the market value of the user’s assets fluctuates. Instead of waiting for a sharp drop in collateral value to trigger a liquidation, LLAMMA slowly sells the collateral and buys it back as prices recover, ensuring stability and avoiding sudden liquidations that could disrupt the peg.

Risk Management

Money markets are exposed to a wide variety of risks, such as price manipulations, over-exposure to a particular asset, and many more. These risks directly impact the solvency of the protocol and need to be mitigated to ensure stability. Most protocols use a health factor: a numerical representation of the safety of a user's collateralized assets against their borrowed assets. It is calculated based on the value of the collateral, the borrowed amount, and the liquidation threshold of the collateral.

LTV

The Loan-to-Value (LTV) ratio is a core element of risk management in money market protocols. It represents the relationship between the value of the loan and the value of the collateral. In essence, the LTV determines how much can be borrowed against the collateral provided.

LTV is typically expressed as a percentage. For example, an 80% LTV means that for every $100 of collateral, the borrower can take out up to $80 in loans. The closer the LTV is to 100%, the more leverage the borrower has but with a higher risk profile, as the loan is approaching the value of the collateral.

Risk-Based LTV Levels:

- Stable Assets (e.g., Stablecoins):

- LTV ratios for stable assets are generally higher because of their low volatility and predictable price movements.

- Stablecoins, for example, can support LTVs as high as 80% to 90% in some protocols, as their value is less likely to fluctuate significantly.

- An LTV of 80% would allow lenders to reach 5x leverage by looping (borrowing multiple times).

- Volatile Assets (e.g., Cryptocurrencies):

- For volatile assets like Bitcoin or Ethereum, the LTV ratio is lower—typically ranging between 50% and 70%—to account for their price volatility. Lower LTVs create a buffer for price swings and help manage risk in the face of sudden market drops.

- An LTV of 50% would allow lenders to reach 2x leverage by looping (borrowing multiple times).

LTV in Different Money Market Models:

- P2P: In P2P lending, the borrower and lender directly agree on the LTV, which may vary based on the assets and the parties’ risk appetite.

- Peer2Pool (e.g., AAVE, Compound): Here, the maximum LTV is set by the protocol based on the asset’s volatility, liquidity, and risk. For instance, stablecoins have higher maximum LTVs than volatile assets, which reflects their relative price stability.

Setting the right LTV ratios is critical for money markets. It’s their way to find the balance needed for capital efficiency and the need for security, ensuring that loans are adequately collateralized without exposing the system to undue risk.

Liquidations

Liquidation occurs when a loan becomes undercollateralized, and the borrower’s collateral is sold to repay the outstanding debt. This typically happens when the collateral decreases in value or the borrowed asset increases in value, causing the Loan-to-Value (LTV) ratio to exceed the allowed threshold. When liquidation occurs, the borrower loses part or all of their collateral, and the liquidator who repays the debt takes ownership of it.

Liquidations are typically permissionless, meaning anyone with sufficient capital can step in as a liquidator. Different protocols handle liquidations in various ways, but the most common method is the fixed liquidation discount model.

In cases where liquidations are permissioned, different levels of centralization come into play. For example, liquidations may be conducted via a stability pool, which, while not fully permissionless, allows anyone to contribute capital to the pool and indirectly participate. In more restrictive models, only whitelisted addresses are allowed to perform liquidations.

Fixed liquidation discount

Used by protocols like AAVE (V2, V3, and V4) and Compound V3, this method incentivizes liquidators by offering a discount on the collateral.

When a loan is liquidated, the protocol sells a portion (or all) of the borrower’s collateral to a liquidator at a discount, known as the liquidation bonus. The size of the discount varies by protocol and asset, and it acts as a reward for liquidators to cover undercollateralized loans quickly.

AAVE V2

- Liquidators could only liquidate 50% of a borrower’s position at a time. This system led to inefficiencies, particularly during volatile conditions or when gas fees were high, as it often required multiple liquidation events to resolve a single position.

- Liquidation threshold: Set around 80% LTV, but varies by asset.

- Liquidation bonus: Typically around 5-15%, depending on the collateral type. This bonus is the incentive given to liquidators for covering the undercollateralized debt.

AAVE V3

- Allowed for full liquidation of a position when the borrower’s Health Factor (HF) drops below 0.95. This mechanism reduces inefficiencies and minimizes the risk of bad debt, as liquidators can completely close an undercollateralized position in one transaction, rather than in stages.

- Liquidation threshold: Similar to V2, usually set around 80% LTV, but varies by asset.

- Liquidation bonus: Remains in the 5-15% range, depending on the collateral asset and the specific market conditions.

AAVE V4

- Liquidations are further optimized with the introduction of cross-chain liquidation capabilities, enabling liquidators to execute liquidations across multiple blockchains. This improves the availability and efficiency of liquidations, especially in multi-chain environments.

- Additionally, Isolation Mode ensures that high-risk or new assets are placed in isolated liquidity pools, preventing contagion from spreading across the entire protocol in case of collateral failure.

- Liquidation threshold: Also around 80% LTV, varying based on the asset and the risk profile.

- Liquidation bonus: Consistent with earlier versions, generally ranging from 5-15%, depending on the asset.

Compound V3

- Introduced a single-borrowing model, where users borrow against a single underlying asset, such as USDC, and use other assets as collateral. This approach simplifies liquidations by focusing on a single asset, improving the efficiency of collateral liquidation and reducing the risk of cascading liquidations.

- Liquidation threshold: Compound V3 typically sets its liquidation thresholds around 75-80% LTV, depending on the collateral and market volatility.

- Liquidation bonus: The fixed discount for liquidators is usually around 8%, providing liquidators with an incentive to quickly resolve undercollateralized positions while ensuring that the protocol remains solvent.

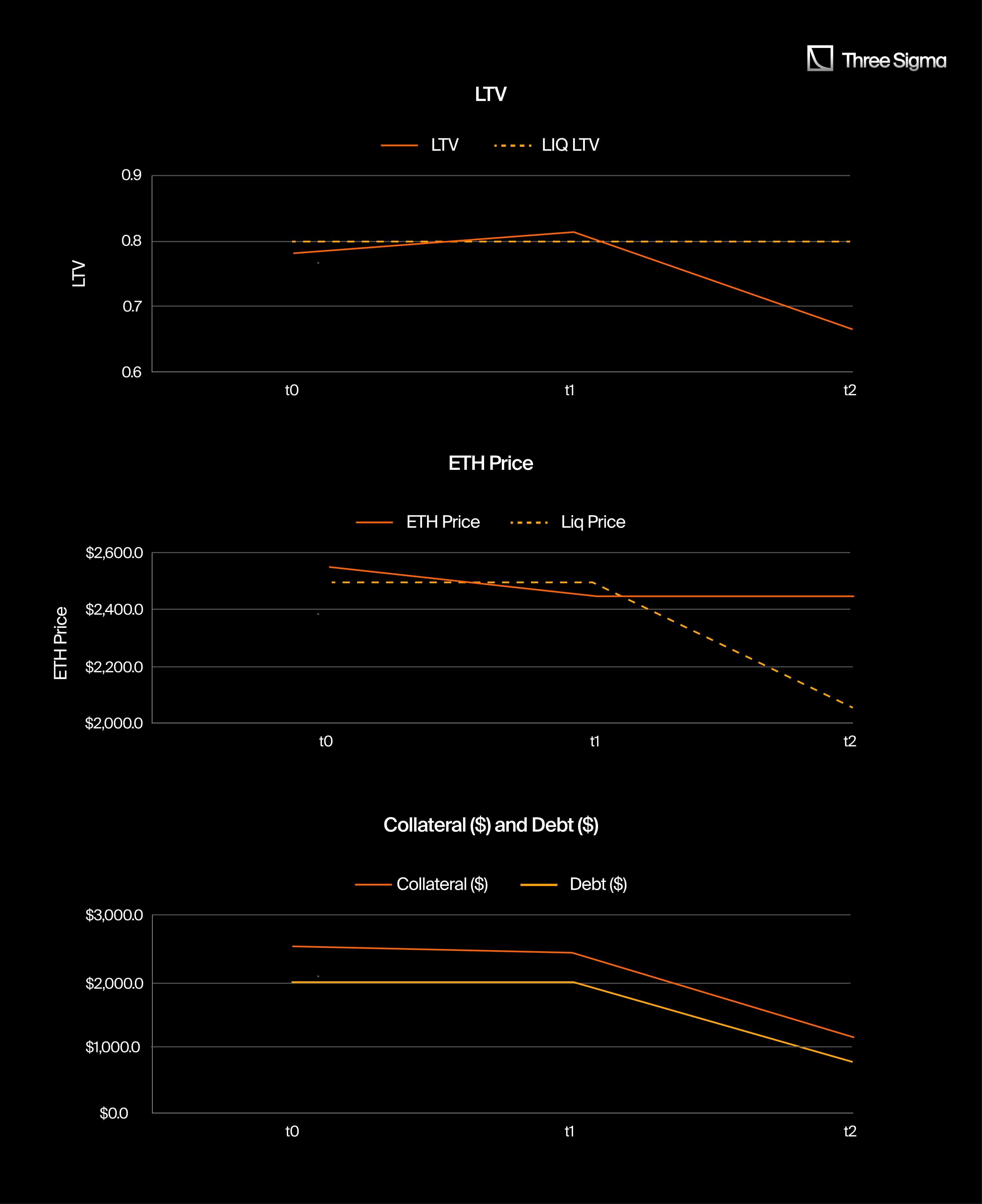

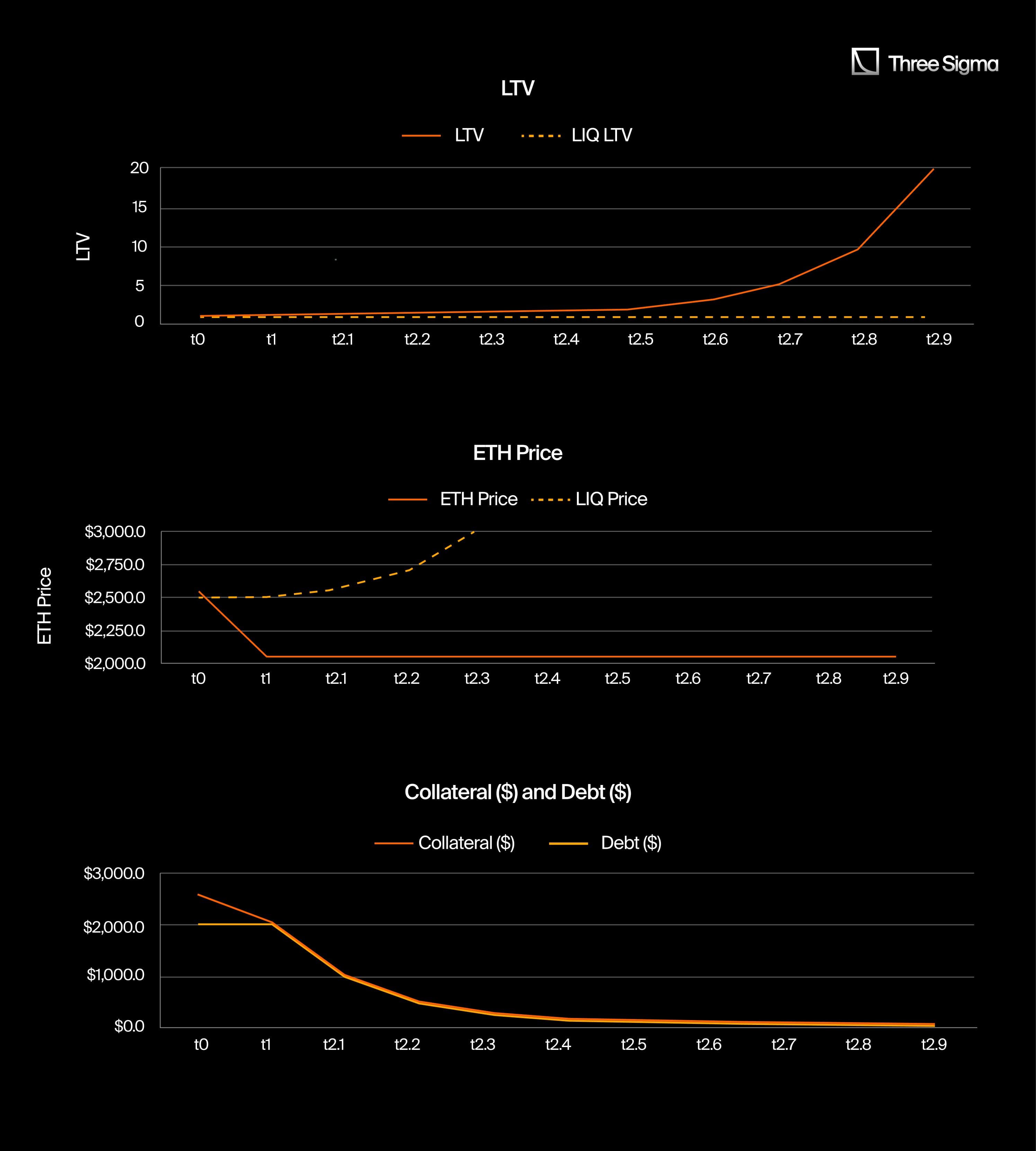

Example 1. Profitable Liquidation

- t0 (Initial State): A borrower deposits 1 ETH worth $2,550 and borrows 2,000 USDC.

- LTV = 66.67% (2,000 USDC / $2,550 collateral).

- Liquidation Price: $2,500/1ETH

- Maximum LTV = 80%

- t1 (Market Decline): The price of ETH drops to $2,450

- This raises the LTV to 81.6%.

- Health Factor = 0.980 (below 1 triggers liquidation).

- t2 (Liquidation):

- The liquidator repays $1,225 USD

- In return, they receive 50% of the dollar value of the collateral + the liquidation bonus (5%), $1286.3 or 0.525 ETH

- The liquidator profits by $61.3 USD (the value of the liquidation bonus).

- New Values of the position:

- LTV 0.666

- Liquidation Price $2,039.5

Example 2. Unprofitable Liquidation

- t0 (Initial State): A borrower deposits 1 ETH worth $2,550 and borrows 2,000 USDC.

- LTV = 66.67% (2,000 USDC / $2,550 collateral).

- Liquidation Price: $2,500/1ETH

- Maximum LTV = 80%

- t1 (Market Decline): The price of ETH drops to $2,050

- This raises the LTV to 97.6%.

- Health Factor = 0.820 (below 1 trigger liquidation).

- t2 (Liquidations):

- The first liquidation reduces the outstanding debt from $2,000 to $973.8. However, despite this reduction, the LTV remains at 1.001, and the health factor is still at 0.824. The liquidator profits $51.3 from this initial liquidation.

- This triggers a downward spiral. Liquidators can repeatedly liquidate 50% of the remaining collateral plus a 5% liquidation bonus each time. This continues until further liquidations are no longer profitable due to gas costs exceeding the liquidation profits.

- After five rounds of liquidations, the liquidators' profit drops to approximately $2.6, while the remaining debt on the account is $94.8. The remaining collateral value decreases to $49.6, or 0.0024 ETH.

- The protocol then incurs bad debt, as the remaining collateral is no longer sufficient to cover the outstanding loan. This may require the protocol’s reserve funds to absorb the deficit.

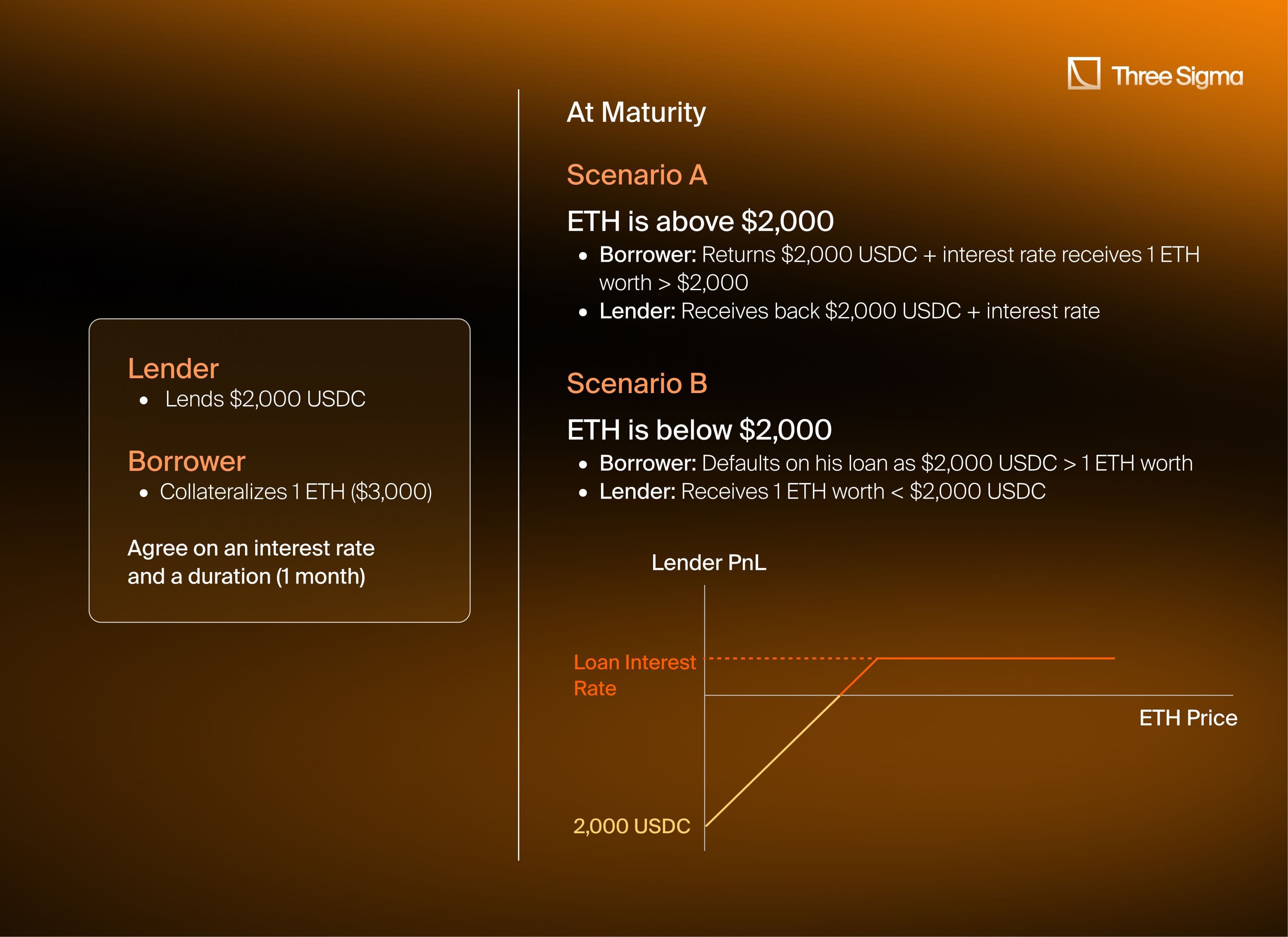

Zero-liquidation Loans

Zero-liquidation or no-liquidation loans are a different type of loan structure, where liquidations do not occur during the loan term. Instead, these loans are fixed-term and come with two options at maturity:

- The borrower can either repay the loan in full or,

- They can forfeit their collateral if they default.

In both cases, lenders are compensated, either through the return of the borrowed assets or by receiving the borrower’s collateral. Ajna and Myso are examples of protocols implementing zero-liquidation loans.

There is no risk of insolvency for the protocol since all risk is transferred to borrowers and lenders. Additionally, there’s no need for liquidators, eliminating external dependency and reducing operational risk for the protocol.

Example.

- A borrower locks 1 ETH as collateral for a fixed-term loan of 2,000 USDC.

- Upon loan maturity, they can either repay the 2,000 USDC plus interest or forfeit the 1 ETH.

- If the loan is not repaid, the protocol settles by distributing the collateral to the lenders, reducing the complexity of typical liquidation processes.

- The lender PnL resembles a naked shot put.

Dutch Auctions

A Dutch auction is a method where the collateral is initially offered with no discount (0%), and the discount gradually increases over time until a liquidator steps in to claim it, or the auction expires.

This process encourages liquidators to wait for a higher discount, which increases their profit potential but risks leaving positions undercollateralized for longer periods.

Example.

- t0 (Initial State): A borrower uses 1 ETH worth $3,000 to borrow 2,000 USDC.

- t1 (Market Decline): ETH drops to $2,300, triggering a liquidation.

- t2 (Auction Begins): The protocol starts the auction with 0% discount.

- The discount increases incrementally until a liquidator bids.

- Liquidator Bids: A liquidator may wait until the discount hits 10% (allowing them to buy $2,300 worth of ETH for $2,070), maximizing profit.

Stability Pools

Stability pools offer a mechanism that removes the need for external liquidators by utilizing the protocol’s internal liquidity to cover undercollateralized loans. When a loan's value drops below the liquidation threshold, the stability pool automatically repays the debt, with the borrower’s collateral being distributed proportionally among liquidity providers in the pool.

This approach provides several key advantages. Liquidations are instant, significantly reducing the risk of bad debt since positions are resolved immediately. Additionally, because the process is handled internally and doesn't rely on DEXs, there is no risk of price slippage. Finally, using internal liquidity for liquidations results in lower gas fees, making the process more cost-efficient compared to relying on external liquidators.

Oracles

Accurate and up-to-date price data is crucial for money market protocols, as it directly impacts key functions like liquidations and risk management.

To ensure loans remain adequately collateralized and to prevent systemic risk, protocols need reliable price information for all assets listed in their markets. These prices must also be resilient to short-term manipulation or exploits, as inaccuracies could lead to unintended liquidations or undercollateralized positions.

Oracles play a central role by bridging the gap between off-chain price data (typically from CEXs) and on-chain. This allows money market protocols to incorporate live data from the most liquid crypto markets, ensuring the prices used for liquidations are current and reliable. Without accurate price feeds, a protocol cannot properly calculate the LTV ratio, putting its solvency at risk.

Most protocols rely on Decentralized Oracle Networks (DONs) like ChainLink, Pyth, or Redstone to aggregate price data from multiple sources, such as centralized and decentralized exchanges. This multi-source approach ensures greater price accuracy and makes it difficult for malicious actors to manipulate prices.

The Mango Markets Hack

One of the most notorious examples of price manipulation occurred in Mango Markets in 2022, when an attacker exploited an oracle vulnerability to steal $117 million. The attacker artificially inflated the price of a low-liquidity token (MNGO) by manipulating its price on a thinly traded exchange.

They then used the inflated MNGO tokens as collateral to borrow large amounts of other assets. Once the price returned to normal, the protocol was left with undercollateralized loans, resulting in massive losses.

Some protocols, such as Ajna Finance and Myso, operate without oracles. WIAs discussed in the liquidation section, these protocols pass all price-related risks to the lenders. For example, in Myso's peer-to-peer marketplace, lenders offer loans based on their terms (including interest rates and collateral valuations), meaning that the protocol itself doesn’t need external price feeds or oracles. While this simplifies protocol operations, it also shifts the burden of risk management entirely onto users.

Isolated liquidity pools vs Aggregated Liquidity

Money market protocols manage liquidity through two main approaches: aggregated liquidity and isolated liquidity pools.

In an aggregated liquidity model, users can supply one asset as collateral and borrow multiple other assets from a unified pool. For example, on AAVE or Compound, a user might deposit ETH as collateral and borrow USDC, DAI, WBTC, or volatile assets like LINK or UNI. The protocol aggregates the collateral's value and calculates borrowing power based on the combined Loan-to-Value (LTV) ratio and risk factors.

While this allows users to maximize borrowing flexibility, it introduces systemic risk. A sharp drop in a volatile asset like LINK can trigger liquidations that impact all collateralized positions, even if the user’s stablecoin borrowings (like DAI) remain unaffected. This interconnectedness means that the protocol’s health depends on the overall volatility and liquidity of the assets in the pool.

Isolated liquidity pools separate collateral into individual markets. For instance, in Euler or Rari Capital’s Fuse, supplying ETH as collateral might only allow borrowing USDC and DAI from that specific pool. To borrow more volatile assets like LINK or WBTC, different collateral is needed in another pool.

This approach reduces contagion risk, as problems in one pool (e.g., LINK dropping sharply) don’t affect other pools. However, it can lead to fragmented liquidity, as users must manage multiple positions across different pools, reducing capital efficiency.

Aggregated liquidity (as seen in AAVE and Compound) provides flexibility and capital efficiency but with higher systemic risk due to asset interconnectivity. Isolated liquidity pools (used by Euler and Rari Capital) offer better risk containment by siloing assets, though this fragments liquidity and reduces flexibility.

Supply and Borrow Caps

Borrow caps allow the protocol to modulate how much of each asset can be borrowed, aiming to reduce insolvency risk. Riskier tokens will have a lower borrow cap, whereas safer tokens like stablecoins will have a higher borrow cap.

A supply cap limits how much of a certain asset can be supplied to the protocol. Not only does this reduce the protocol's exposure to just a single asset (diversification), but it also safeguards against potential exploits, like infinite mining and price oracle manipulation.

The biggest risk faced by lending protocols is insolvency caused by the accumulation of bad debt, which is why teams rely on a smart contract audit before scaling liquidity or listing new assets. This risk arises from three main areas:

- Smart Contract Risk: Bugs or flaws in smart contracts can be exploited, leading to severe and unexpected losses.

- Oracle Failure: Price manipulation or incorrect data from oracles during market volatility can trigger improper liquidations.

- Liquidation Risk: Failure to liquidate collateral assets effectively, especially those with low liquidity, can lead to a cascade of liquidations and a buildup of bad debt.

These risks can spiral out of control if protocols lack robust risk parameters and contingency plans. A key factor is managing Loan-to-Value (LTV) ratios effectively. If the LTV exceeds a safe threshold due to asset price drops or market volatility, liquidators are incentivized to step in and reduce the debt. However, in extreme cases, liquidators may not act quickly enough, leading to systemic issues.

Protocols like AAVE and Compound mitigate these risks by maintaining a reserve treasury funded by their native tokens, AAVE and COMP. This reserve acts as a buffer to cover bad debt during adverse market conditions. AAVE also has a recovery issuance mechanism to create and auction new AAVE tokens if reserves fall short, using the proceeds to stabilize the protocol.

AAVE has also introduced GHO staking, which serves as an additional safeguard against protocol shortfalls. GHO stakers earn yield on their staked assets, but in the event of a shortfall, up to 30% of their staked GHO can be slashed to cover the deficit, providing an extra layer of protection.

However, these mechanisms alone aren’t enough. Without well-thought-out risk parameters, protocols remain exposed to unpredictable market events. Markets are inherently volatile, with fat tails that can lead to unexpected failures. Protocols must have a strategic risk management framework that accounts for extreme scenarios, maintains diversified reserves, and implements robust liquidation parameters.

Protocols without comprehensive risk management frameworks are vulnerable to market shifts and tail risks that can lead to severe losses or insolvency. Hiring an expert team to design and monitor these risk parameters is essential to preventing catastrophic events.

That’s where we come in. We specialize in creating resilient systems to ensure protocols can withstand market turbulence and protect user funds.

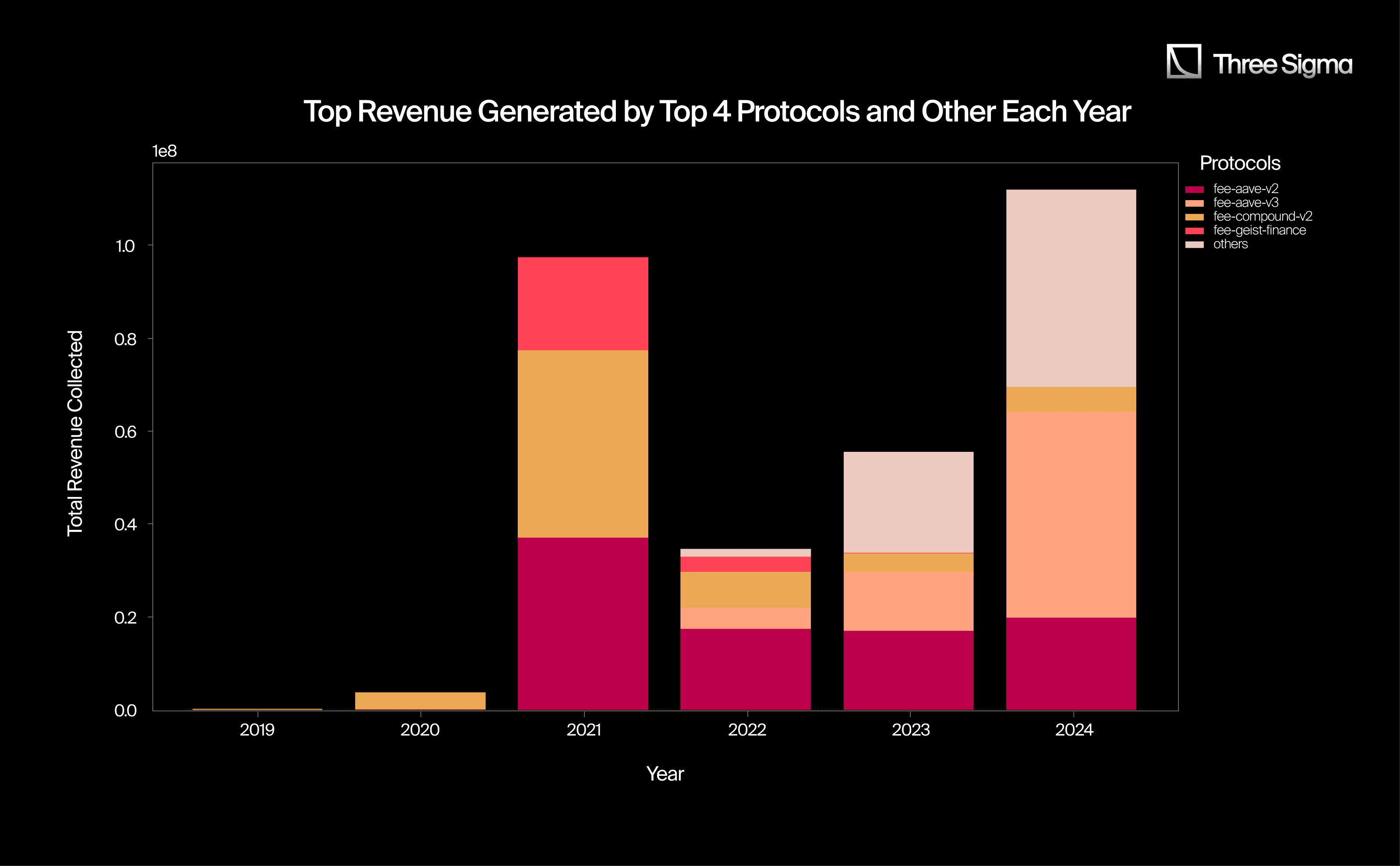

Revenue Generation

Money market protocols primarily generate revenue through the spread between fees paid by borrowers and fees received by lenders. Additional revenue streams include flash loan fees, and liquidation fees.

Let’s take a look at how these fees work and contribute to the revenue of leading protocols like AAVE, Compound, and other models like Radiant Capital.

AAVE’s Revenue Model

AAVE earns revenue from three key sources:

- Borrower Interest: This is the main revenue stream for AAVE. When users borrow assets, they pay interest, which is shared between the liquidity providers and the protocol. The majority of the revenue goes to liquidity providers as supply-side fees, with a smaller portion retained by the protocol.

- Flash Loan Fees: AAVE also charges fees for flash loans, which are loans that must be repaid within the same transaction block. Flash loan fees are split between the protocol and liquidity providers, and the fee percentages are adjustable through AAVE’s governance.

- Liquidation Fees: A percentage of the liquidation bonus (the reward given to liquidators) is collected as a fee. This ensures that the protocol captures a share of liquidation rewards.

In 2024, AAVE (V2+V3) generated $279million from user fees, with 76% ($214.7 million) going to liquidity providers and 24% ($64.3 million) retained by the protocol.

A portion of these earnings supports the Safety Module, a key reserve that guarantees the protocol’s solvency.

In 2023, AAVE spent $37.3 million on incentives resulting in a net revenue of $27.02 million.

Compound’s Revenue Model

Compound also earns revenue primarily from borrower interest. In 2024, Compound has generated so far $21.90 million from borrower fees, with 76% ($16.5 million) distributed to liquidity providers and $5.3 million retained by the protocol.

However, the protocol issued $8.1 million in token incentives, resulting in net negative earnings of -$2.9 million.

Radiant Capital

Radiant Capital generated $19.5 and $9.75 million in fees, in 2023 and 2024 respectively. With only around 25% being passed directly to lenders, $4.8 million and $2.3 million respectively. Did its treasury retain $22 million for the protocol? Not really as the majority of the revenue is diverted back to their token holders.

Other Protocols

While we’ve focused on specific cases, it’s important to acknowledge that many protocols face challenges where their operating expenses, primarily in the form of token incentives, exceed their generated revenue. This imbalance often undermines long-term sustainability.

A key use case for money markets is providing access to on-chain leverage, which has been particularly noticeable during periods of high market activity. During the bear market, fee revenue dropped significantly, but with market activity recovering, fee levels have yet to return to their 2021 highs, indicating a renewed demand for leverage but not as high as before.

Revenue of the top protocols:

Forks

Forks create similar or identical versions of existing protocols in ecosystems that lack robust equivalents.

When new L1s and L2s emerge, the first type of DeFi protocols to appear are often foundational ones, such as AMMs and Money Markets. These protocols act as the main engines for liquidity injection in the early stages of a chain's development.

From a user perspective, money markets like Compound or AAVE offer simpler experiences compared to CLAMMs like Uniswap V3, which face challenges like dynamic liquidity management, impermanent loss, and LVR. This simplicity contributes to their popularity for forks—AAVE and Compound, for instance, have around 20 and 120 forks respectively.

Moreover, devs deploy forks on target chains that are not yet covered by these larger protocols, giving new or smaller ecosystems a chance to establish their own native lending solutions.

Some of the most notable forks in terms of TVL are:

Avalon ($400m TVL)

The Avalon lending protocol provides borrowing and lending solutions for BTC and BTC LSDs. As a Liquidity Hub for BTC LSDFi and CeDeFi lending, Avalon integrates key elements from both centralized and decentralized finance. The protocol primarily operates on Bitlayer and CORE, offering a blend of services with on-chain transparency and security. Avalon Labs’ lending platform is built on an AAVE v2 fork, allowing for known and reliable services while ensuring institutional-grade security and flexible repayment options.

Benqi ($300m TVL)

As an AAVE V2 fork, BENQI is a non-custodial liquidity market protocol, built on Avalanche. The protocol enables users to effortlessly lend, borrow, and earn interest with their digital assets.

Layer bank ($300m TVL)

Based on CompV2, it is a permissionless on-chain bank designed to thrive across the omni-chain ecosystem, the protocol switched from a lending protocol on Linea to a omni-evm-chain protocol.

ZeroLend ($250m TVL)

A lending protocol built on L2s. Based on AAVEv3 and powered by Pyth and Chainlink. Mostly on LINEA.

Many of these forks aim to expand across chains, targeting underserved areas. TVL inflows are growing steadily, showing how forking established protocols attracts users across a broader DeFi ecosystem.

From looped leverage to cascading liquidations, DeFi money markets carry systemic risk. Our DeFi Ecosystem Strategic RD service helps you evaluate interest models, collateral ratios, and liquidation logic under real-world volatility.

Conclusions

In this article, we analyzed the fundamental aspects of DeFi money market protocols, focusing on the mechanisms that ensure solvency, manage risks, and generate revenue. By comparing protocols like AAVE, Compound, and others, we examined various models for lending and borrowing, such as over-collateralized loans, liquidations, risk management strategies, and revenue generation through interest spreads and fees.

The DeFi money market sector has experienced substantial growth, with top protocols like AAVE and Compound collectively managing billions in TVL. Lending protocols sit at approximately 70% of their all-time high TVL ($34b vs $51b), while for comparison DeFi sits at 50% of its all-time high (86b vs 172b).

This resilience reflects the sector's critical role in enabling on-chain capital efficiency. However, heightened competition from emerging protocols has led to 1) AAVE emerging as the most dominant on-chain lending platform and 2) an increasingly fragmented landscape, with a diversification of features and models across the lending stack.

We identified that protocols employing aggregated liquidity models, such as AAVE and Compound, excel in capital efficiency but expose participants to systemic risks tied to asset interconnectivity. In contrast, isolated liquidity models, like Euler and Rari Capital’s Fuse, limit systemic risk by segmenting markets, offering customization at the expense of liquidity fragmentation.

Key features such as liquidation systems (fixed discounts, Dutch auctions) and reliance on accurate oracles (e.g., Chainlink, Pyth) are critical for maintaining stability. Recent exploits, such as those involving Mango Markets and Cream Finance, underscore the necessity for rigorous risk controls and adaptive mechanisms.

As the money market landscape continues to evolve, protocols must balance capital efficiency with risk management. Expanding or diversifying product offerings, such as AAVE’s GHO staking and cross-chain liquidity solutions, show promise. However, these advancements must be supported by stringent risk parameters to mitigate tail risks.

For protocols to thrive, maintaining user trust through transparency, reliability, and sustainable growth is imperative, avoiding practices like excessive token burning that could undermine token value.

Understanding and implementing effective risk management strategies are crucial in this volatile and rapidly evolving sector. Proactive measures are essential to prevent systemic failures and to maximize long-term growth. As DeFi money markets mature, the integration of stablecoins with money market protocols will play a significant role in shaping the future of decentralized finance.

For those interested in exploring the intricacies of DeFi money markets further or optimizing protocol design, stay tuned to our upcoming articles. We will cover topics such as risk mitigation, cross-chain liquidity, and the integration of stablecoins within money markets, providing deeper insights and practical guidance.

Frequently Asked Questions (FAQ)

1. What are DeFi money markets, and how do they differ from traditional money markets?

DeFi money markets operate on blockchains, enabling trustless and permissionless lending and borrowing without intermediaries, whereas traditional money markets involve banks and financial institutions for similar services.

2. What does "over-collateralization" mean in DeFi lending?

Over-collateralization is when borrowers must deposit more collateral than the amount they borrow, ensuring that lenders can recover their funds even if the borrower defaults, due to the trustless and permissionless nature of DeFi lending.

3. What are the main risks associated with DeFi lending?

Key risks include smart contract vulnerabilities, oracle failures (inaccurate price feeds), liquidation risks due to volatility, and systemic risks in protocols with aggregated liquidity pools.

4. How does the Loan-to-Value (LTV) ratio affect DeFi borrowing?

The LTV ratio determines the maximum amount one can borrow against a given amount of collateral. Higher LTV ratios enable more borrowing but come with increased liquidation risk.

5. What is the difference between Peer-to-Pool (P2Pool) and Peer-to-Peer (P2P) lending models in DeFi?

In P2Pool, multiple lenders contribute funds to a common pool, from which borrowers can draw, while in P2P, lenders and borrowers interact directly, setting customized loan terms.

6. How do liquidations work in DeFi protocols?

Liquidations occur when a borrower's collateral value falls below a protocol-defined risk threshold, triggering the sale of collateral to repay the loan and keep the protocol solvent.

7. What are flash loans, and why are they popular in DeFi?

Flash loans are uncollateralized loans that must be repaid within the same transaction block. They are popular for arbitrage and liquidation opportunities in DeFi due to their instant nature.

8. How do DeFi protocols ensure accurate pricing for liquidations?

Most DeFi protocols use decentralized oracles like Chainlink and Pyth, which aggregate price data from various sources, ensuring accurate pricing for collateral and loan assets.

9. What are permissionless vs. permissioned pools in DeFi?

Permissionless pools allow anyone to create a lending market for an asset, while permissioned pools require approval from the protocol’s governance to list assets, adding security but limiting flexibility.

10. What are fixed-rate loans in DeFi, and how do they work?

Fixed-rate loans have an agreed-upon interest rate for the loan duration, offering borrowers predictability, unlike variable rates that change based on supply and demand in the pool.

11. Why do some DeFi protocols use stability pools for liquidations?

Stability pools provide internal liquidity to cover undercollateralized loans, offering instant liquidation without relying on external participants, which lowers gas costs and improves efficiency.

12. How do DeFi money markets generate revenue?

Protocols primarily earn from the interest rate spread between lending and borrowing, as well as from fees on flash loans, liquidations, and sometimes specific protocol fees or treasury funds.

13. How are money markets and stablecoins similar?

Both involve depositing collateral to borrow an asset: in money markets, users borrow various assets, while in stablecoin protocols, users lock up collateral to mint stablecoins.

Economic Security Lead

Pablo holds a Master's in management, having focused in finance, and with a thesis on DeFi, demonstrating his knowledge and expertise in this field. He has extensive experience in research and analysis of DeFi protocols, having worked as an analyst at Siemens and a DeFi researcher at Deep Tech Ventures. His background in finance, research and analysis skills are a valuable addition to our team.