Introduction

Tokens play a significant role in DeFi systems, and they differ in goals, value accrual mechanisms, and general integration in their ecosystem, which is core to tokenomics in defi. These digital assets serve as versatile tools, assuming roles as utility tokens for transactions and access, governance tokens for decision-making, or revenue-sharing tokens for community wealth distribution. Tokens operate across a diverse range of contexts within DeFi, from decentralized exchanges and lending platforms to the underlying infrastructure that drives it all, an overview of DeFi tokenomics.

In this article, we delve into the most relevant mechanisms driving tokenomics in DeFi, from liquidity mining and staking to vote escrow and revenue sharing models, showing tokenomics explained in practice.

In this research we included tokens from many protocols, illustrating DeFi tokenomics variations across designs and chains.

It is worth noting that this is not an exhaustive list of all DeFi tokens but rather a representative selection, focusing on those that introduce innovations or slight variations in token mechanisms.

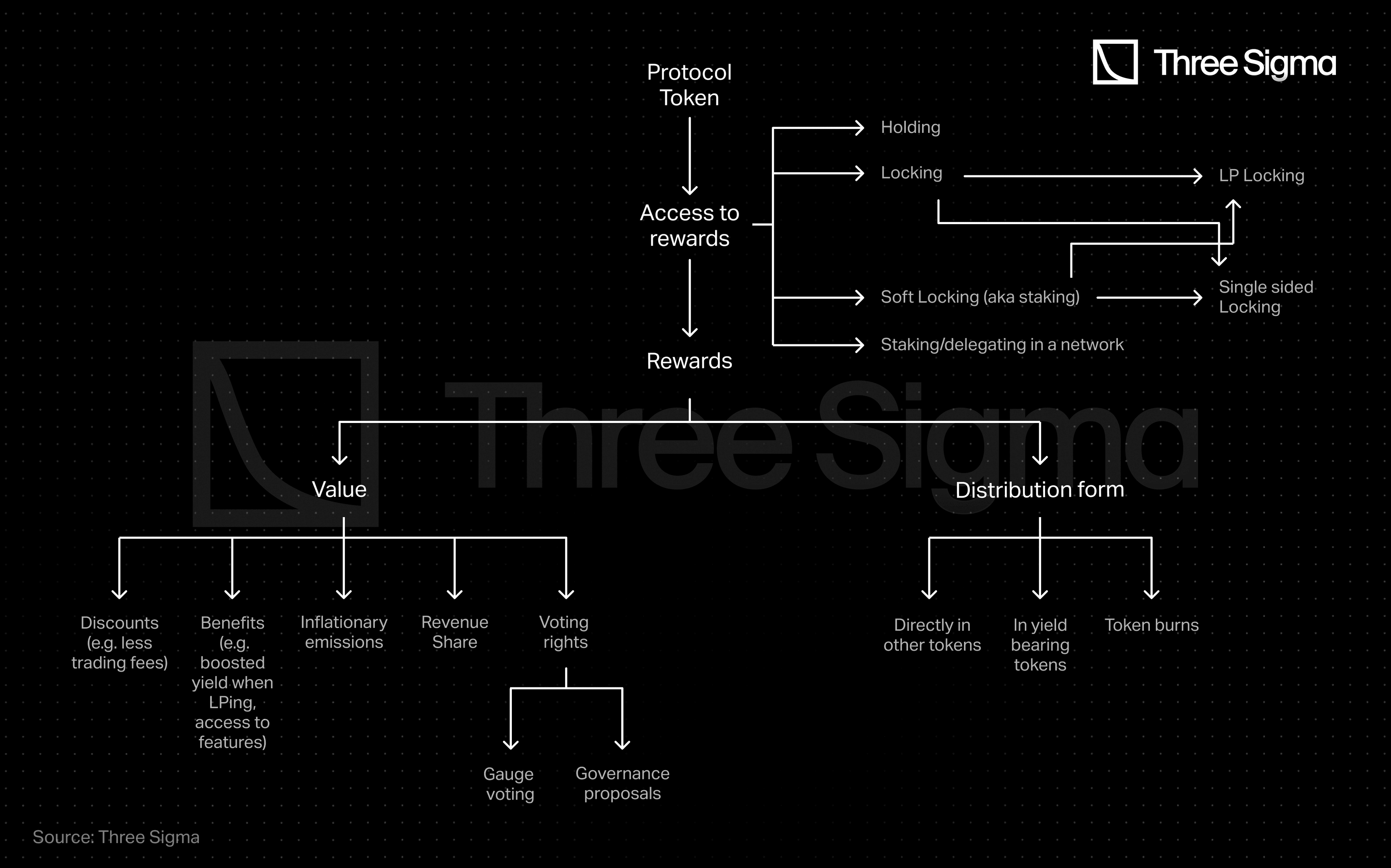

Our framework

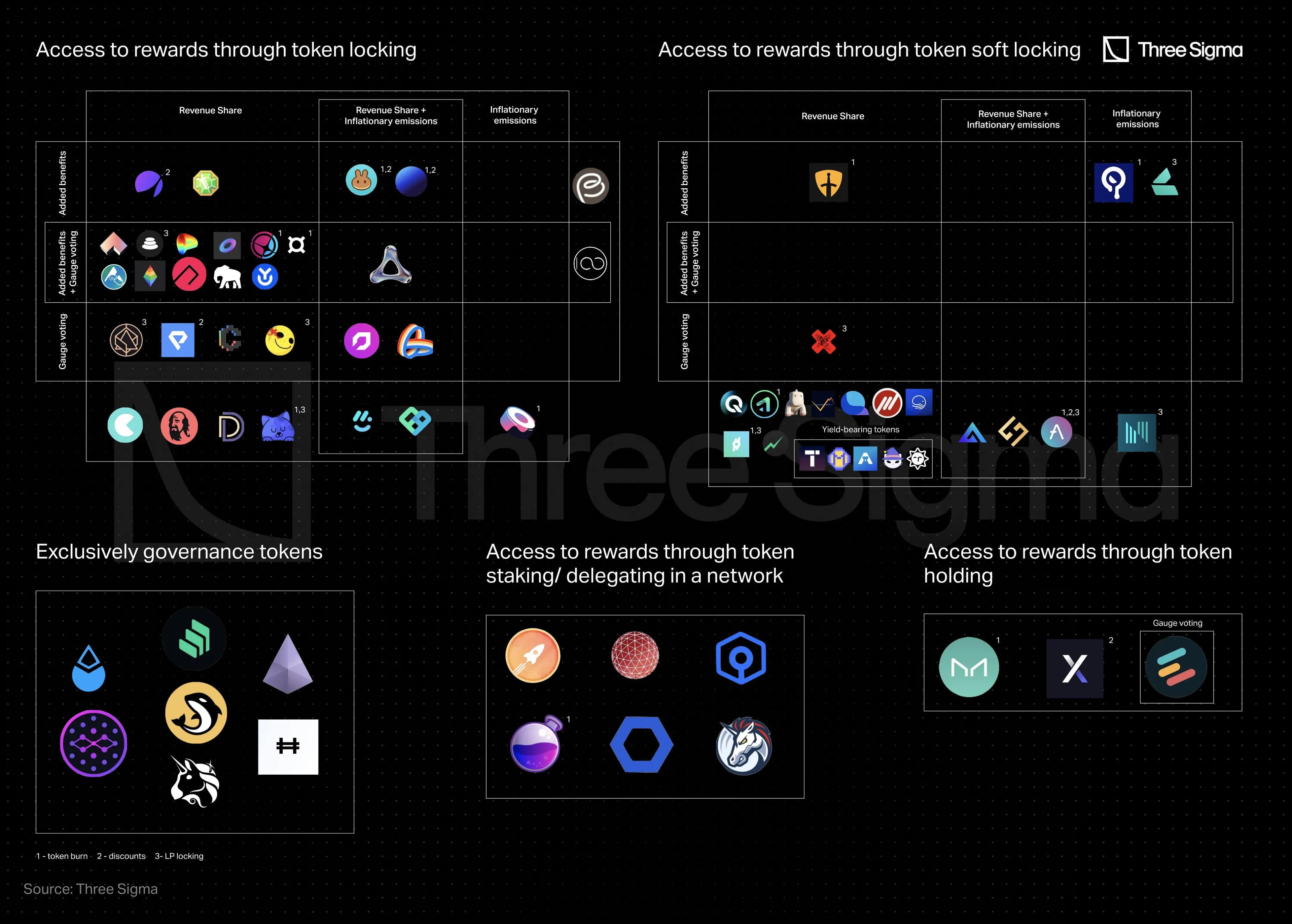

To explore the various roles tokens play in DeFi, we take a systematic approach. After examining many protocols, a prevailing trend is clear, most offer users a way to access rewards through tokens, which is tokenomics explained through incentives and governance. Reward distribution differs widely in tokenomics in DeFi. Some tokens are minted or transferred, others burn supply or generate yield bearing assets. Access can come from holding, soft locking, locking, or staking or delegating.

These locking mechanisms vary by protocol. We concentrate on three aspects to view DeFi tokenomics clearly, reward access, value, and distribution. Options should be tailored to each design and objective.

Instead of adopting unique terminology, we use a standardized approach for clarity and ease of comparison, a simple way to keep tokenomics explained consistently.

- Staking: within tokenomics in defi, refers to token staking in a network for decentralization.

- Locking: in defi tokenomics, a fixed term with no retrieval before the end without penalty.

- Soft Locking: describes token locking for an unknown duration, sometimes with a fee or cooldown, often called staking in tokenomics explained summaries.

- LP (Soft) Locking: same concept, specifically for LP tokens, common in tokenomics in defi.

Following our framework, the protocols included in this article fall in the following categories:

Access to rewards

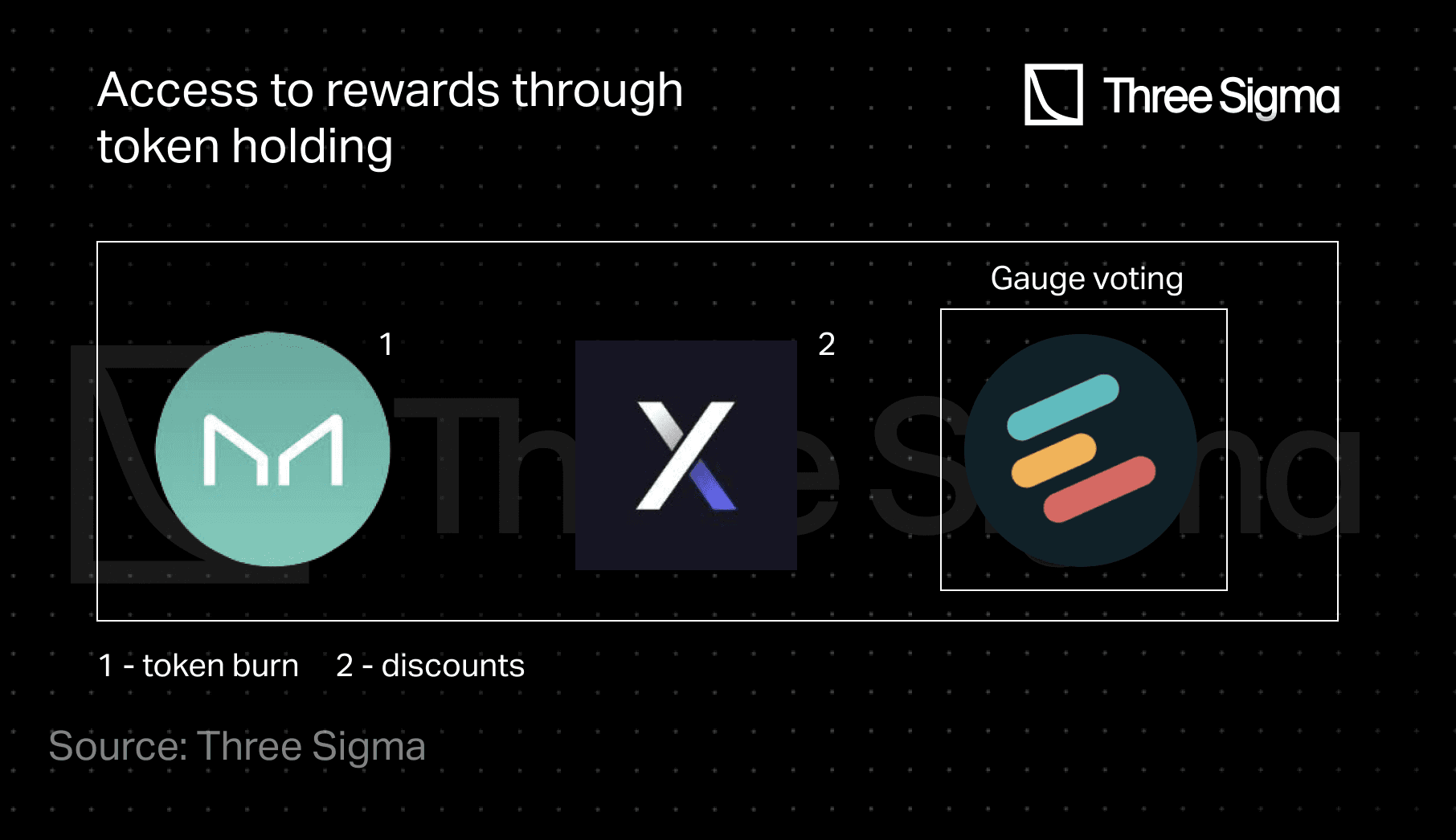

Access to rewards through holding

A handful of platforms, including Euler Finance, MakerDAO, and dYdX, have rewarded users for holding, a baseline in DeFi tokenomics.

dYdX, a prominent derivatives exchange, granted holders reduced trading fees. While $DYDX primarily functions as governance, token holders could stake in the Safety Module to enhance security, a classic tokenomics in defi pattern. Nevertheless, this fund ceased operations as of November 28, 2022.

Euler Finance, operating within the lending sector of DeFi, entrusts EUL governance token holders with the authority to influence EUL liquidity incentives and guide the platform's direction. However, users have to stake their $EUL to participate in gauge voting, not actually reaping any direct rewards if they just hold.

The MKR token from MakerDAO serves a dual purpose. Firstly, it empowers MKR holders to actively partake in governance decisions, allowing them to shape the platform's future by voting on critical variables. Secondly, MKR serves as a protective measure for the protocol during periods of significant market volatility when loans become undercollateralized. In such cases, new MKR tokens can be minted and exchanged for DAI. Although MakerDAO lacks a distinct revenue mechanism, MKR holders indirectly benefitted from excess DAI generated through stability fees, as this surplus DAI could be used to acquire and burn $MRK tokens, reducing the supply. With the recently launched Smart Burn Engine, MKR tokens will be accumulated in the form of Univ2 LP tokens instead of being acquired and burned. Maker will periodically use DAI from the Surplus Buffer in order to acquire MKR tokens from the Univ2 DAI/MKR market. Acquired MKR tokens will then be matched with additional DAI sourced from the Surplus Buffer and supplied to the same market. In return, Maker will receive LP tokens and increase on-chain liquidity for MKR over time.

Several protocols employ buyback and burn that indirectly reward holders, another defi tokenomics lever.

Access to rewards through staking or delegating in a network

Some protocol tokens are used for staking or delegating for decentralization, enhancing security. Staking requires locking assets as collateral and engaging in network operations, a common element of tokenomics in defi. This aligns token holder interests with security and reliability, offering rewards with risk of loss for malicious behavior, trade offs often seen in defi tokenomics.

Among the protocols that employ this staking or delegating are Mars Protocol, Osmosis, 1inch Network, Ankr, Chainlink, and Rocket Pool, representative of tokenomics in defi across ecosystems.

Osmosis provides diverse staking options for OSMO token holders, including delegation to validators for network security. Delegators receive rewards from transaction fees based on their staked OSMO amount, with deductions for the chosen validator's commission. Stakers, both validators and delegators, earn 25% of newly released OSMO tokens for securing the network. Moreover, Osmosis offers Superfluid staking, enabling users to stake bonded LP tokens for OSMO pairs for a fixed period (currently 14 days). These tokens keep generating swap fees and liquidity mining incentives, while OSMO tokens gain staking rewards. In January, Osmosis introduced an automated internal liquidity arbitrage mechanism, accumulating revenue. Governance discussions are ongoing regarding potential uses of these funds, including the possibility of implementing a burn mechanism that could render OSMO deflationary. Mars Protocol, also part of the Cosmos ecosystem works in a similar way, where token holders can stake or delegate to play an essential role in securing the Mars Hub network, governing outpost features, and managing risk parameters.

The $1INCH token, the governance and utility token of the 1inch Network, holds its primary utility in Fusion mode. Resolvers stake and deposit 1INCH in a "feebank" contract to enable swap transactions. Users who delegate $1INCH for securing Fusion mode receive a share of the generated revenue. Once staked, tokens cannot be withdrawn without penalty until the designated lock period expires (default lock period is 2 years). Additionally, $1INCH holders possess voting rights in 1inch's DAO, enabling them to shape the platform's future.

Ankr's ANKR token is multifunctional, serving staking, governance, and payments roles in its ecosystem. Staking ANKR uniquely involves delegating to full nodes, not just validator nodes, allowing the community to actively choose reputable node providers. In return, stakers share node rewards and some slashing risk. This staking extends to over 18 blockchains. ANKR tokens also enable governance participation, where users vote on network proposals, shaping its future. Additionally, ANKR tokens are used for in-network payments.

Chainlink's native token, LINK, serves as the foundation for node operators, enabling individuals to stake LINK and become node operators. Users can also delegate LINK to other node operators, participating in network operations and sharing fee earnings. LINK tokens are used for payment in Chainlink's decentralized oracles, supporting the network's operations. Additionally, $LINK tokens are utilized to reward node operators offering essential services, including data retrieval, format conversion, off-chain computations, and ensuring uptime guarantees.

Rocket Pool is one of the major players in liquid staking derivatives (LSD), redefining Ethereum's PoS participation without the standard 32 ETH requirement. Rocket Pool introduces RPL, which provides insurance for network slashing, enhancing security. "Minipools" only need 8 or 16 ETH as a bond, with 24 or 16 ETH borrowed from the staking pool. RPL collateral acts as added insurance, reducing slashing risks. RPL token holders also possess governance rights and RPL tokens serve as payment for protocol fees, delivering a comprehensive toolkit in the Rocket Pool ecosystem.

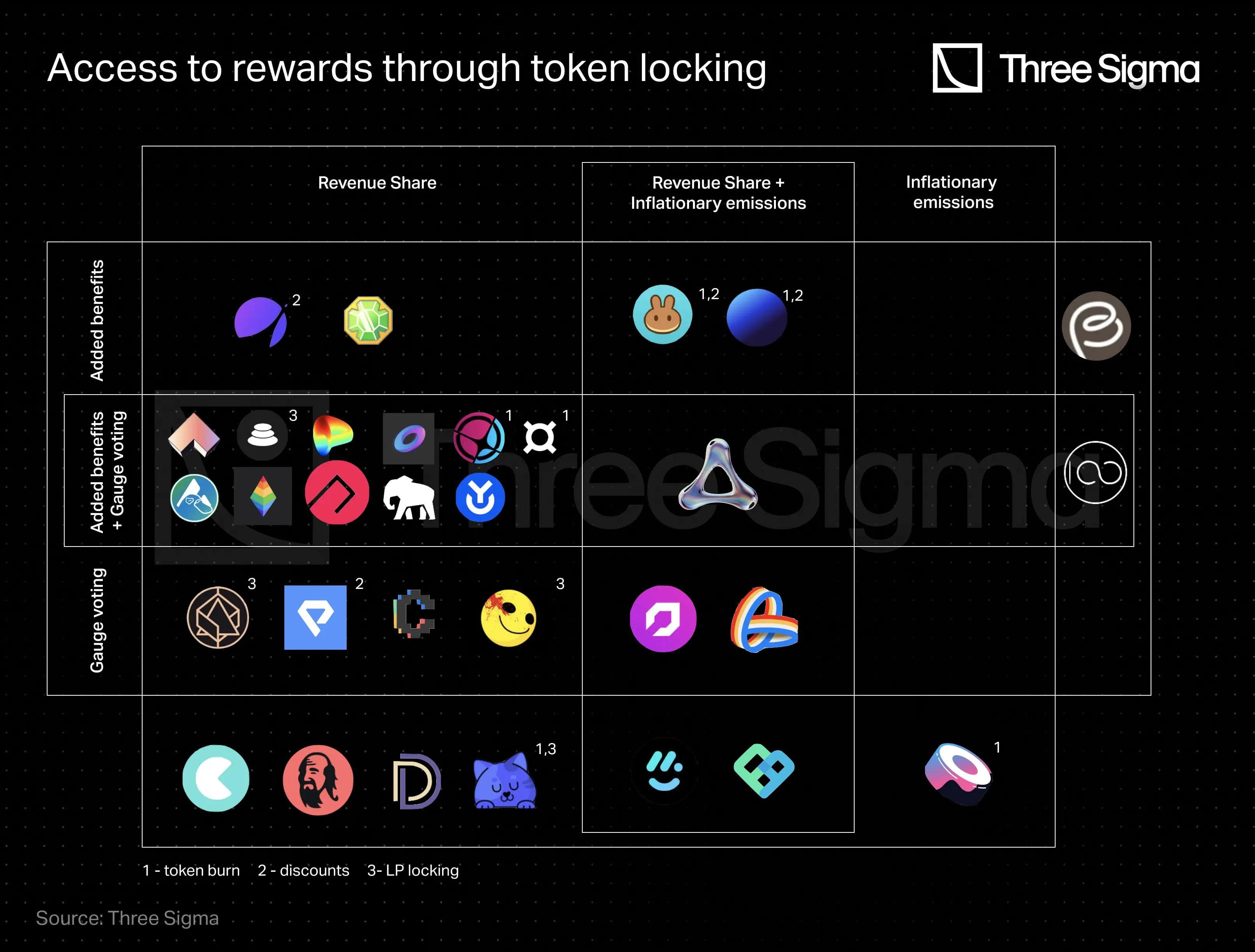

Access to rewards through locking

In DeFi's current landscape, token locking is a central mechanism for accessing protocol rewards, including revenue sharing, boosted APY, and inflationary emissions. There are mainly two forms: single-sided locking, where users lock the native protocol token, and LP locking, requiring liquidity provision with a token pair, typically consisting of the protocol's token and the blockchain's native token, and subsequent LP token locking.

A key aspect to this mechanism is selecting a lock time interval, binding users until it elapses. Some platforms offer extension options for increased rewards, while others allow early unlocking at a heavy reward cost, making it a strategic decision balancing risk and reward. Extended lock periods yield more rewards, like enhanced voting rights and increased protocol revenue shares. This links to commitment and risk mitigation: longer lock periods demonstrate confidence in the protocol, reciprocated with greater rewards.

One widely used locking method is the vote escrow model, pioneered by Curve Finance. When users lock their governance tokens, they receive veTokens, which grant voting rights but are typically non-tradeable. Though vote escrow solutions have grown in popularity among DeFi platforms, a number of issues have arisen that limit their effectiveness. Among these is the risk of centralization, which occurs when a few large holders gain governance control, as seen in the Curve Wars.

Hence, an increasing number of platforms and protocols are enhancing the vote-escrow concept to boost participation and align incentives across the ecosystem. While veTokens are typically non-transferable, some protocols permit token use for purposes like unlocking liquidity or accessing extra yields. Many DAOs now employ vote escrow solutions to manage user involvement and rewards.

In Curve DAO, users lock their CRV tokens to earn voting rights, with longer locks yielding more voting power. veCRV is non-transferable and can only be acquired by locking CRV, with a maximum lock time of four years. Initially, one CRV locked for four years equals one veCRV. $veCRV balance decreases linearly as the remaining unlock time shortens.

As previously mentioned, this model sparked a conflict over voting power, particularly regarding liquidity direction, which Convex led. To vote on Convex proposals, you must lock your $CVX tokens for a minimum of 16 weeks, and these tokens become inaccessible until 16 full epochs have passed.

Curve forks like Ellipsis Finance on the BNB Chain closely follow this pattern. EPX holders can lock their EPX for 1 to 52 weeks, and the longer they lock, the more $vlEPX they receive.

Hundred Finance, now ceasing to operate due to hacks to the protocol, adopted a similar vote escrow model to Curve, even as a lending protocol. Locking 1 HND for 4 years generated about 1 mveHND, and this balance decreased over time.

Perpetual Protocol, a perpetual futures trading platform, also employs this model. Locking PERP into vePERP increases governance voting power by up to 4x.

Numerous DeFi protocols have embraced derivatives of the vote escrow mechanism to incentivize user engagement and participation. Burrow employs a similar model to Curve's ve-token, offering BRRR holders the opportunity to engage in the BRRR locking program. Starlay Finance on Polkadot and Cream Finance across multiple chains introduce a similar concept, where token holders lock LAY and CREAM, respectively, to obtain veLAY and iceCREAM tokens. Frax Finance utilizes this model, with veFXS tokens granting governance voting power. Similarly, QiDao and Angle implement token locking for governance influence. In the options landscape, Premia and Ribbon Finance offer vxPREMIA and $veRBN tokens, respectively. StakeDAO, Yearn Finance, MUX Protocol, ApolloX, PancakeSwap, Planet, SushiSwap, Prisma Finance and DeFi Kingdoms also integrate variants of the vote escrow mechanism. These protocols vary in how they distribute rewards and the benefits they offer users, a topic we will delve into further in this article.

Additionally, Solidly Labs, Velodrome, and Thena are notable decentralized exchanges that have evolved from the foundations of Curve's vote escrow mechanism, incorporating unique tweaks in their incentive structures through the ve(3,3) mechanism.

Balancer brought an interesting variation to Curve’s model, where instead of locking the protocol’s liquidity mining reward token directly, an LP token is locked. Instead of locking up BAL, the liquidity token BPT, received for adding to the BAL WETH 80/20 pool must be locked to obtain $veBAL.

In their latest update, Alchemix also employs the LP locking variation of the vote escrow model. Staking is in the form of an 80% ALCX / 20% ETH Balancer Liquidity Pool Tokens to mint $veALCX.

The Y2K token is the cornerstone utility token in the Y2K Finance ecosystem, delivering a variety of benefits when locked to become vlY2K. Notably, vlY2K is represented as a locked Y2K $wETH 80/20 BPT.

Finally, UwU Lend presents a new lending network built on its own UWU coins. By combining UWU and ETH and providing liquidity on SushiSwap, customers get UWU-$ETH LP tokens, which can be locking within the dApp for a duration of eight weeks.

In token locking, a key feature is the promise of enhanced rewards such as voting rights as tokens stay locked longer. This encourages extended commitments and greater influence on protocol decisions. What sets protocols apart are the maximum lock periods, ranging from months to four years. Managing veTokens also differs; some use a linear decay model, gradually reducing voting power, as seen in Curve, Perpetual Protocol, Cream, Angle, Frax, and others. In contrast, some maintain governance influence even after the lock ends, as exemplified by Premia.

Various protocols, including SushiSwap, Premia, Ribbon, Yearn, ApolloX, DeFi Kingdoms and Prisma allow for the early unlocking of its tokens but with a punitive action that retains a portion of earned rewards or introduces a hefty penalty fee.

In summary, token locking rewards users with increased governance powers and other benefits, a topic we'll explore further in the article.

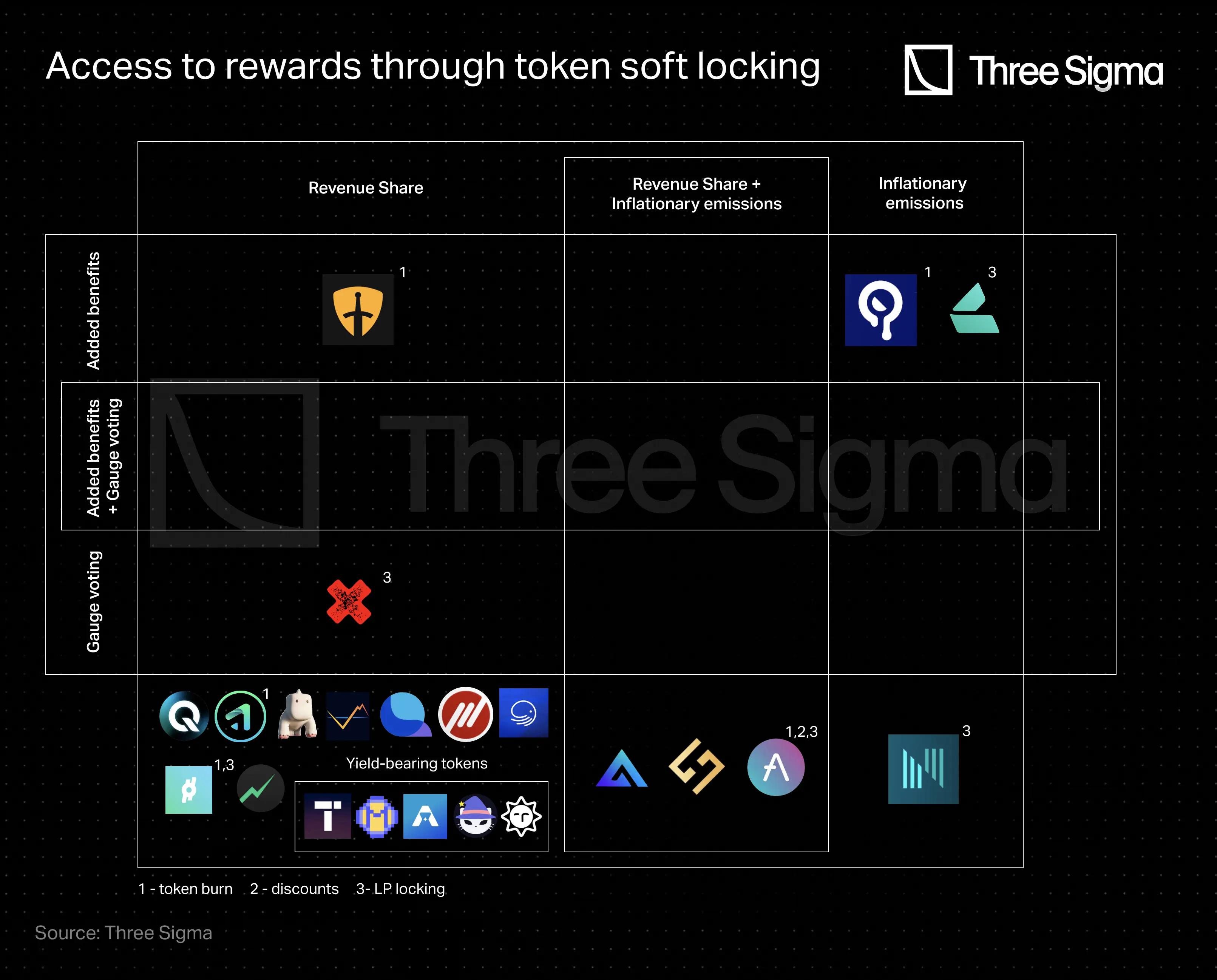

Access to rewards through soft locking

Soft locking, often referred to as staking, introduces a slightly different flavor to token locking. Unlike traditional token locks, users aren't tied to fixed predetermined periods; they can unlock at any time. To incentivize longer locks despite this, protocols often use strategies like vote escrow, where rewards increase with the lock's duration and allow immediate exit. Some protocols have cooldown periods during unlocking, or implement vesting schedules, discouraging frequent lock-unlock cycles. In some cases, unlocking fees are introduced to encourage stable and committed user participation while still providing flexibility.

Following the vote escrow approach, Benqi Finance, a lending and liquid staking protocol on Avalanche, distributes QI rewards through liquidity mining, which can then be staked for veQI. When QI is staked, veQI balance increases linearly over time to a maximum of 100 times the QI staked. When unstaking, all accrued $veQI is lost. Yeti Finance, an over-collateralized stablecoin protocol, employs a similar system.

Beethoven X, the first official fork of Balancer V2 built on Fantom and now available on Optimism, follows the same principle of accrued veTokens, albeit with the difference of having to lock BEETS/FTM 80/20 BPTs.

Three of the most popular derivatives exchanges, GMX, HMX and Gains Network, offer token stakers a lot of rewards incentivizing them to stake their tokens, however without importing veTokenomics.

Additional protocols like Astroport, Abracadabra, Tarot, and SpookySwap, allow their users to stake their tokens in return for yield-bearing tokens, which accrue value and may be used to redeem back the staked token plus any accrued rewards.

Camelot tried a different approach. xGRAIL is a non-transferable escrowed governance token that can be obtained by soft locking GRAIL directly, but requires a vesting period before it can be redeemed back for $GRAIL.

Furthermore, protocols like Liquity, Thales, XDeFi, IPOR and Moneta DAO, all make use of single-sided soft locking as a gateway to protocol rewards.

Just as Beethoven X, other protocols employ LP soft locking. Interestingly, many protocols leverage the LP staking mechanism to incentivize liquidity as insurance to protect the protocol against insolvency. Aave and Lyra are two protocols that support LP staking, as well as single-sided staking, to incentivize liquidity into their safety modules for protection against shortfalls. Users may deposit AAVE/ETH and WETH/LYRA LP tokens, respectively, in return for protocol rewards from the insurance pool. These tokenized positions can be redeemed at any time but have a cooldown period. On Notional, users soft lock NOTE/WETH Balancer LP tokens to receive sNOTE tokens. NOTE token holders can start an on-chain vote to access 50% of the assets stored in the $sNOTE pool for system recapitalization in the case of a collateral deficiency.

Similarly, users on the Reflexer protocol are responsible for keeping the protocol capitalized by soft locking FLX/ETH Uniswap v2 LP tokens.

Hegic, a battle-tested options trading protocol, uses the Stake & Cover model, where staked $HEGIC tokens cover the protocol’s net losses on selling options/strategies and earn net profits on all expired options/strategies. Like Aave and Lyra, staking is used not only to share rewards but also to add protection. The Hegic Stake & Cover (S&C) Pool participants receive 100% of net premiums earned (or losses accrued), which are distributed pro-rata among all stakers. Users can place a request to withdraw at any time and receive their funds at the end of each 30-day epoch.

Finally, a few protocols enable the possibility to choose between a soft and a hard lock.

dForce, a decentralized stablecoin protocol powered by an integrated DeFi matrix, introduced a hybrid model featuring both soft and hard locking. Locking into veDF allows user to earn more rewards than soft locking into sDF.

On Platypus Finance, a stableswap on Avalanche, users can acquire vePTP either by staking PTP or by locking PTP. By staking, users receive 0.014 vePTP every hour for every PTP staked (linear accrue). The maximum amount of vePTP a staker can receive is 180 times the amount of PTP staked, which takes about 18 months. By locking, the total amount of vePTP is given from the beginning.

Tectonic allows soft locking TONIC tokens as xTONIC. The Tectonic Protocol features a 10-day cooldown for withdrawals. It's similar to Tarot, but Tectonic allows its users to maximize their rewards by locking their $xTONIC tokens.

Rewards - incentives and benefits for stakeholders

Having explored methods for accessing DeFi rewards, let's now delve into the variety of incentives users gain for actions like holding, locking, or staking tokens. These encompass fee discounts, increased yields for liquidity providers, exclusive protocol features, revenue sharing, token emissions, and emission voting rights (gauge voting).

Discount on Protocol Fees

Various platforms offer discounts to users based on their token holdings and actions. For instance, Aave borrowers can reduce their rates by staking AAVE tokens, while Premia users with over 2.5 million vxPREMIA tokens get a 60% fee discount. On PancakeSwap, trading fees can be 5% lower when paid with CAKE tokens. Planet provides three tiers for yield-boosting discounts by staking GAMMA tokens. HEGIC token holders enjoy a 30% discount on hedge contracts. Staking APX tokens in the ApolloX DAO lowers trading fees.

Revenue Sharing

Revenue sharing can be a powerful incentive. Many protocols now distribute a portion of their revenue to users who stake or lock tokens, aligning their interests with the platform's success and rewarding contributions to network growth.

Most vote escrow protocols share revenue with stakeholders on a pro-rata basis. Protocols like Curve, Convex, Ellipsis, Platypus, PancakeSwap, DeFi Kingdoms, Planet, Prisma, MUX Protocol, Perpetual Protocol, Starlay, Cream, Frax, QiDAO, Angle, ApolloX, Uwu Lend, Premia, Ribbon, StakeDAO, Yearn, Balancer, Alchemix, Y2K, dForce, Solidly, Velodrome, and Thena all distribute a share of protocol revenue. Typically, about 50% of fees go to shareholders, but governance votes frequently update these distributions, underscoring the significance of voting power. Some exceptions in the vote escrow group are Hundred, Burrow and Sushiswap. Typically, protocol fees are pro-rata among stakeholders. Yet, a few protocols like Starlay, Solidly, Velodrome, and Thena distribute revenue based on stakeholder voting for specific gauges.

Regarding soft locking protocols, most incorporate revenue sharing. Some, like Beethoven X, Benqi, Yeti, and Platypus, which employ vote escrow systems, consider the lock duration and token amount as factors in determining stakeholder revenue shares.

In contrast, Aave, GMX, Gains, HMX, IPOR, Astroport, Camelot, Abracadabra, Tectonic, Tarot, SpookySwap, Liquity, Moneta DAO, Reflexer, XDeFi, and Hegic distribute revenue based only on the amount of staked tokens.

Certain protocols like Lyra, Thales and Notional do not share revenue, but provide users who soft lock and secure their platforms with inflationary emissions.

Inflationary emissions

Regarding inflationary emission, many protocols distribute their reserved community governance tokens to liquidity providers and active users as rewards for participating in the platform. While most protocols reserve token emissions for LPs, lenders, and yield farmers, some use them to reward stakeholders.

As previously mentioned, Lyra, Thales and Notional opt for inflationary emissions instead of revenue sharing. SushiSwap also canceled revenue sharing in its January 2023 tokenomics redesign.

In some cases, both revenue sharing and inflationary emissions go to stakeholders. Protocols like Solidly, Velodrome, and Thena, which implement the ve(3,3) rebasing tokenomics mechanism, follow this approach.

Additionally, Aave, Planet, MUX Protocol, PancakeSwap, and Perpetual Protocol provide emission-based rewards alongside revenue sharing.

Protocols such as GMX and HMX also reward stakers with escrowed GMX and HMX. For these tokens to become actual GMX or HMX, emissions must be vested for one year.

Gauge voting

Vote escrow gave rise to gauge voting, where farming smart contracts accept deposits and reward depositors with emission tokens. Gauge voting empowers stakeholders to influence emissions distribution, guiding the allocation of newly minted tokens in the ecosystem. This control over emissions plays a pivotal role in shaping protocol growth and direction.

Many protocols that adopted vote escrow enable gauge voting, including Curve, Convex, Ellipsis, Platypus, Hundred, Starley, Prisma, Frax, Angle, Premia, Ribbon, StakeDAO, Yearn, Balancer, Beethoven X, Alchemix, Y2K, Solidly, Velodrome, and Thena.

Contrarily, some protocols like Perpetual Protocol, Burrow, MUX Protocol, and QiDao do not utilize gauge voting.

Additionally, Euler Finance lets EUL holders determine EUL liquidity incentives without requiring token locking a priori, although they need to soft lock in the gauges to exercise their power.

Added benefits

Protocols in DeFi often go beyond direct revenue sharing or token emissions, providing users with additional rewards and benefits.

Similar to gauge voting, many protocols following veTokenomics boost gauge emissions for users who also stake liquidity in a gauge. Notable examples include Curve Finance, Ellipsis, Platypus, Hundred, Prisma, Frax, Angle, Ribbon, StakeDAO, Yearn, Balancer, Solidly, and Starley.

Some protocols offer increased yields without gauge voting. Burrow boosts borrow and supply yields, PancakeSwap enhances yield farming on LP tokens, Lyra increases vault rewards for LPs, Thales raises emissions for active participants, Planet boost LP rewards, and ApolloX improves trading rewards.

Certain protocols take a personalized approach to benefits. For instance, Camelot offers a plug-in system where stakeholders choose their benefits from options like shared revenue, boosted yield farming emissions, or access to the Camelot Launchpad.

DeFi Kingdoms provides in-game power-ups as a unique benefit, while Osmosis offers superfluid staking, a method where LP tokens can be used for staking in the network to receive both rewards for securing the ecosystem and provide liquidity.

Governance token

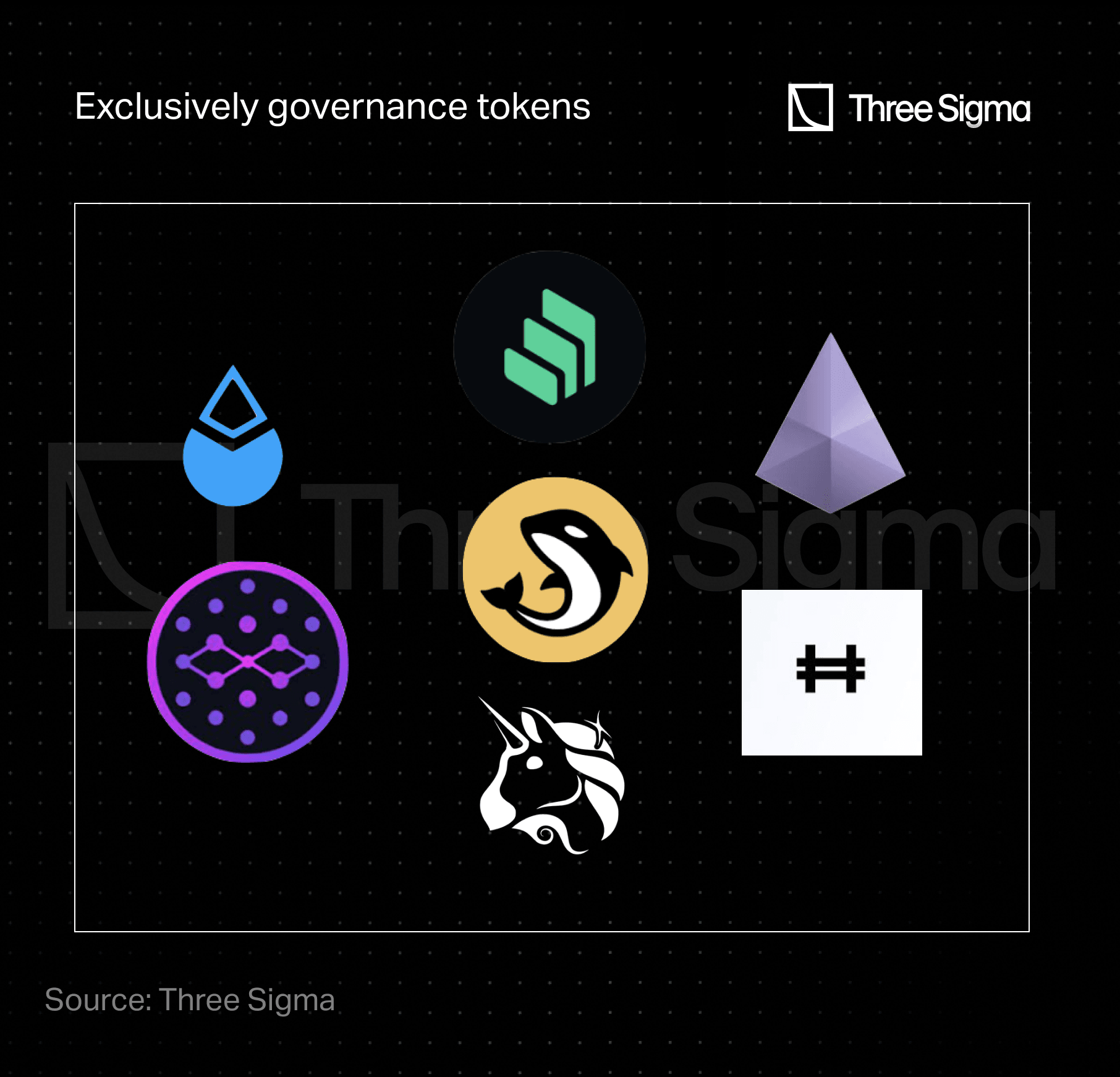

In some DeFi protocols, tokens may lack direct utility like revenue sharing but hold value through governance participation. Notable examples are COMP and UNI, where the primary value lies in governance. These tokens empower users to influence the protocol's direction, a valuable role in shaping a major DeFi platform. Protocol type seems to play an interesting role, with DEX governance tokens often being better evaluated, even with less value accrual mechanisms, than counterparties on other categories, that make up a smaller portion of DeFi's TVL. The potential for protocol success, token value appreciation or even the promise of future utility can be motivation enough to hold such governance tokens.

Consider LDO, which serves as a governance token for Lido. LDO holders can actively engage in decision-making by voting on key protocol parameters, thereby administering the large Lido DAO treasury. Similarly, Compound's COMP token is well-known in the lending industry, with COMP holders able to vote on governance proposals or delegate their tokens to trusted representatives. Uniswap's 3 billion USD. $UNI token, which serves as a governance token, has a market cap of more than $3 billion USD. UNI holders have the ability to vote, influence governance choices, and administer the $UNI community treasury, as well as determine protocol-wide fees.

Other protocols that did not create specific reward mechanisms around their token include Orca, a top decentralized exchange on the Solana network. Similarly, Synapse's SYN token is the second-largest cross-chain liquidity network, effectively integrating 18 different blockchain ecosystems. Hashflow's HFT token, which allows participation in the gamified DAO and governance platform of the multi-chain decentralized exchange. Finally, as one of the top six liquid staking platforms, StakeWise's $SWISE token, which is primarily focused on decentralized governance, plays an important role within the Ethereum ecosystem.

Rewards distribution

Previously, we categorized protocol rewards into five main categories: discounts, additional benefits, voting rights, inflationary emissions, and protocol revenue sharing. While the first three reward types come inherently tied to their distribution methods, inflationary emissions and revenue sharing can take on various forms.

Inflationary emission rewards primarily take the shape of minting governance tokens, such as AAVE, LYRA, and SUSHI, among others. However, some protocols offer inflationary emissions in the form of yield-bearing tokens, where the number of original protocol tokens received upon redemption exceeds the amount minted with initially. These include Astroport, Abracadabra, Tarot, and SpookySwap. The appreciation in value of these yield-bearing tokens can stem not only from inflation but also from protocol revenue. Other protocols distribute revenue in its original form, such as fees paid in ETH. Alternatively, many protocols employ a buyback mechanism where they acquire their own token from external markets, increasing its value and subsequently redistributing it to stakeholders.

Many protocols opt for the buyback and redistribute mechanism such as Curve (CRV), Convex (cvxCRV), Perpetual Protocol (USDC), Cream (ycrvlB), Frax (FXS), QiDAO (QI), Angle (sanUSDC), Premia (USDC), Ribbon (ETH), StakeDAO (FRAX3CRV), Yearn (YFI), Balancer(bb-a-USD), Beethoven X (BEETS), Gains (DAI), HMX (USDC), IPOR (IPOR), Abracadabra (MIM), DeFi Kingdoms (JEWEL), PancakeSwap (CAKE), Planet (GAMMA).

Other protocols reward stakeholders directly in the accrued tokens such as GMX, Ellipsis, Platypus, Starlay, Solidly, Velodrome, Thena, and Liquity.

Furthermore, some protocol implement token burns. Instead of redistributing the protocol token that was bought back, part is burned in order to reduce the circulating supply increasing scarcity and, hopefully, price. By just holding the token, users receive protocol revenue indirectly, since the protocol used accrued rewards to remove those tokens from circulation.

A few protocols that conduct token burns are Aave, Gains, Camelot, Starlay, PancakeSwap, UwU Lend, Planet, MakerDao, Osmosis, SushiSwap, Reflexer, Frax, and Thales.

Good tokenomics don’t just distribute tokens, they create economic systems. Our DeFi Ecosystem Strategic RD service helps you align rewards, fees, inflation, and protocol design for long-term health.

Final thoughts

While the protocol category distribution covered in this article may not provide a fully representative picture of the entire DeFi landscape, several key insights can be drawn. Specifically, we have mentioned 14 lending, 20 decentralized exchange (DEX), 5 derivatives, 7 options, 5 liquid staking derivatives (LSD), 10 Collateralized Debt Position (CDP), and 9 additional protocols. Naturally, we have also taken into analysis protocols with similar characteristics, but refrained from explicitly mentioning them.

Decentralized exchanges tend to lean towards locking, particularly in the context of the vote escrow model, while lending and CDP platforms exhibit a preference for soft locking. Some CDP protocols still employ hard locks, though. The rationale behind this disparity can possibly be attributed to the greater demand for liquidity in DEXes compared to other protocols. Lending and CDP protocols typically strike a balance between liquidity supply and demand. When the demand for loans is high, there is often an adequate supply to meet it, as interest rates are adjusted accordingly. In contrast, DEX liquidity providers primarily earn trading fees, and competing with established DEXes can be challenging. Consequently, DEXes frequently resort to incentivizing through inflationary emissions, resorting to locking mechanisms to then manage the token supply. Soft locking is the more common approach in DeFi protocols in general, with notable exceptions in the top DEXes. This tendency is influenced not only by the protocol category but also by their age and reputation. Many leading DEXes today were among the first to launch. The decision to lock governance tokens in well-established protocols differs significantly from locking tokens in newer, often experimental, protocols.

Today, the majority of protocols utilizing locking mechanisms opt to reward users with shared revenue rather than relying on inflationary token emissions. This shift represents a significant improvement over the past few years, enabling protocols to consistently incentivize users to act in ways that benefit the community as a whole. It's the clearest method of aligning incentives, although its long-term viability remains uncertain due to regulatory considerations.

When it comes to distributing revenue, a common method employed, whether systematically or sporadically, is token burning. While a lot of aspects around these tokenomics mechanisms are intuitive, others are closely tied to time-to-market considerations and regulatory constraints. From an economic perspective, it seems more logical to buy back and redistribute tokens as deemed suitable, such as to those token holders who have a more significant role in the protocol. However, from a regulatory standpoint, buying back and burning tokens stands as the simplest way to return protocol revenue to token holders without it resembling a dividend distribution and potentially leading to token categorization as securities. Although this approach has been effective for some time, the future of this mechanism remains uncertain. Additionally, some protocols are highly influenced by the tokenomics endorsed at the time of their market entry or token updates. The emphasis on real yield and revenue sharing was a dominant narrative in DeFi, influenced not only by the protocols but also by broader market conditions. It's increasingly challenging to envision a token launching now with a four-year lock period gaining significant traction.

The vote escrow token model has evolved into the most comprehensive approach, encompassing not just token locking but also incorporating voting rights, incentive management, and revenue sharing.

Still, prominent protocols frequently grant voting powers through tokens without clearly defined mechanisms for value accrual. Although governance powers can hold significant value, this approach is not feasible for smaller or recently launched protocols. Even when these protocols rapidly gain adoption and contribute to the DeFi community, enduring the test of time remains the greatest challenge.

Although we have witnessed creative enhancements to tokens in this context, it is evident that the core concept revolves around various forms of token locks offering two or three types of rewards. Let's up our game and explore the potential for new token economies!

Final thoughts, tokenomics explained with examples, links to deeper reviews such as an Economic Audit and Mechanism Design Review can pressure test assumptions in tokenomics in DeFi.

Economic Modeler

Carolina is a data analyst with a Master’s degree in analysis and engineering of big data and a background in mathematics applied to economics and management. She has experience working on optimization problems, leveraging statistics to produce simulations and extract valuable insights. She joined Three Sigma with a continued passion for finding knowledge in data and an interest in improving the blockchain industry by contributing to its sustainable development. Outside of work, Carolina enjoys traveling and immersing herself in foreign environments.

Researcher

Tiago has a Bachelor's and Master's degree in aerospace engineering from Instituto Superior Técnico, which has honed his analytical skills and ability to tackle complex problems. This skillset makes him a perfect fit to study infrastructure, understand information theory, as well as researching cryptographic primitives such as zero-knowledge. Such expertise makes him a valuable contribution to the team, providing unique insights on how the space will evolve.